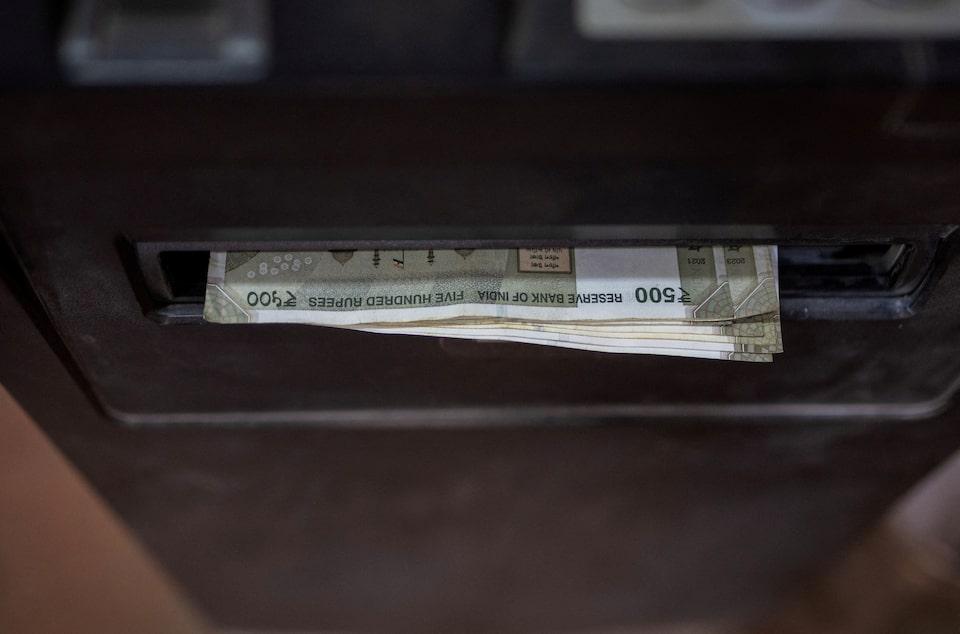

2025-09-11 03:00

MUMBAI, Sept 11 (Reuters) - The Indian rupee is expected to be largely range-bound on Thursday, with traders staying put amid muted momentum and in the lead up to key U.S. inflation data that could steer expectations for the Federal Reserve’s rate cut next week. The one-month non-deliverable forward pegged the rupee to open near 88.10, unchanged from Wednesday, with moves seen capped at 5–7 paisa on either side. Sign up here. "The rupee is basically stuck where it is, and the price action tells you it wants to stay that way," a Mumbai-based FX trader said. "The U.S. inflation data will decide the short-term direction for the dollar; however, I don’t think it can push the rupee too far away from 88," a Mumbai-based FX trader said. The rupee has been unable to sustain moves past the 88 level due to persistent dollar demand, likely driven by the U.S. tariff overhang, which has capped the upside. On the other hand, declines past 88 have lacked momentum, keeping the currency boxed in. While the rupee hit a record low of 88.36 last Friday, the price action has been broadly subdued since then with little follow-through. ASIA WEAK, FOCUS ON US INFLATION Asian currencies logged small losses on Thursday while the dollar index inched higher, with investors eyeing the consumer U.S. inflation data, due later in the day. A Reuters poll of economists expects August core inflation to rise 0.3% month-on-month. The inflation reading will land at a time when markets are fully pricing a 25-basis-point rate cut from the Federal Reserve next week amid worries over the labour market. Analysts say a larger move cannot be ruled out if the data backs it. "A benign inflation report could open the prospect of a 50 basis points cut," Chris Weston, head of research at Melbourne-based broker Pepperstone, said. KEY INDICATORS: ** One-month non-deliverable rupee forward at 88.22; onshore one-month forward premium at 12.5 paise ** Dollar index up at 97.84 ** Brent crude futures down 0% at $67.5 per barrel ** Ten-year U.S. note yield at 4.05% ** As per NSDL data, foreign investors bought a net $64.8 million worth of Indian shares on September 9 ** NSDL data shows foreign investors sold a net $47.5 million worth of Indian bonds on September 9 https://www.reuters.com/world/india/rupee-range-hold-with-us-inflation-test-horizon-2025-09-11/

2025-09-11 00:56

SAN SALVADOR, Sept 10 (Reuters) - El Salvado's Congress approved a law on Wednesday granting 10-year tax breaks to boost private investment in the geothermal energy. The law exempts import duties on equipment for geothermal plants and waives income taxes on energy production and emissions certificates. Authorities estimate the country has 600 megawatts of geothermal potential, with 100 MW to be developed by the state in the next five years. Sign up here. https://www.reuters.com/business/energy/el-salvador-approves-10-year-tax-breaks-attract-geothermal-investment-2025-09-11/

2025-09-11 00:39

Sept 10 (Reuters) - Union Pacific (UNP.N) , opens new tab CEO Jim Vena said on Wednesday he was confident that the railroad operator would receive a merger approval from the U.S. administration over its deal with Norfolk Southern (NSC.N) , opens new tab. In July, Union Pacific announced an $85 billion stock-and-cash acquisition of the smaller rival, which, if approved, would create the country's first coast-to-coast freight rail operator. Sign up here. Speaking at a Morgan Stanley Conference, Vena said he has met with senior people in the administration, who called the deal a "win for the country". "Do I think we're going to get it approved? The answer is yes", Vena added. The merger faces intense scrutiny from the Surface Transportation Board, which received a notice of intent from the companies on July 30, 2025. The companies plan to file a formal application by January 29 and are targeting an early-2027 close. Last month, the White House fired STB member Robert Primus, as part of a broader series of dismissals from independent agencies and commissions under President Donald Trump's administration. In a regulatory filing on Wednesday, the railroad, which primarily operates on the West Coast, said it expects $50 million in merger costs and has paused share repurchases while it awaits approval. https://www.reuters.com/sustainability/boards-policy-regulation/union-pacific-ceo-vena-says-norfolk-southern-merger-will-win-approval-2025-09-11/

2025-09-11 00:27

Sept 10 (Reuters) - Barrick Mining (ABX.TO) , opens new tab has agreed to sell its Hemlo gold mine in Canada to Carcetti Capital for up to $1.09 billion, the companies said on Wednesday. The deal includes $875 million in cash at closing, $50 million in shares of Carcetti, and up to $165 million in contingent payments linked to production and gold prices from 2027 over five years, the statement added. Sign up here. Carcetti said it will fund the acquisition through a mix of financing, including a $400 million gold stream with Wheaton Precious Metals (WPM.TO) , opens new tab, a $225 million loan underwritten by Scotiabank and about $415 million from a private placement. The deal is expected to close in the fourth quarter and will result in Carcetti Capital being renamed to Hemlo Mining Group. Earlier in August, Barrick topped quarterly profit estimates and raised its dividend despite taking a $1.04 billion charge tied to the loss of its mine in Mali, part of a wider effort to shed non-core assets and focus on its largest gold and copper operations. https://www.reuters.com/world/africa/barrick-sell-its-canadas-hemlo-mine-up-11-billion-2025-09-11/

2025-09-10 23:57

WASHINGTON, Sept 10 (Reuters) - U.S. financial regulators voted on Wednesday to disband two committees charged with monitoring financial risks brought on by climate change, ending a multi-year Biden administration effort to embed climate threats into financial regulations. The Financial Stability Oversight Council, a multi-regulator risk watchdog body chaired by Treasury Secretary Scott Bessent, rescinded the charters of its Climate-Related Financial Risk Committee and its Climate-Related Financial Risk Advisory Committee by voice vote without dissent or abstentions during a public session. Sign up here. The committees were set up by Bessent's Biden administration predecessor, Janet Yellen, who warned repeatedly that increasingly severe storms, wildfires and other climate events were causing large economic and financial impacts on the U.S. economy and could trigger destabilizing asset losses. Bessent said the dismantling was part of his "back to basics" approach to financial regulation, meant to remove burdensome rules and ease capital requirements for banks and other lenders to unlock more economic growth. "By rescinding these charters, the council can better focus its attention and resources on core financial stability issues and our efforts to promote economic growth and security while maintaining safety and soundness and protecting consumers," Bessent told the meeting. The move is another step in the dismantling of Biden's climate and energy policies, including unwinding federal support for clean energy projects, while slashing regulations to boost fossil fuel production. "The Trump administration is set to destroy key protections against the risks climate change poses to our economy," said Tracey Lewis, senior policy counsel at the Public Citizen non-profit group. "The committee's work on the financial impacts of climate disasters on housing, homeowners' insurance, and financial regulation play an important role in protecting the safety and soundness of the American financial system." A Treasury presentation also included FSOC's intention to review past guidance on designating non-bank institutions as systemically important financial institutions, a step that would subject them to greater oversight. https://www.reuters.com/legal/government/us-treasury-led-watchdog-dismantles-climate-advisory-panels-2025-09-10/

2025-09-10 23:39

Elliott takes between 4% and 5% stake in Kansai Electric, source says Wants Kansai Electric to sell non-core assets, boost shareholder returns Kansai Electric shares up 3.1% in Tokyo, outperforming wider market TOKYO, Sept 11 (Reuters) - Activist investor Elliott Management, a shareholder in Kansai Electric Power (9503.T) , opens new tab, said the Japanese utility could become a more attractive long-term investment by selling non-core assets and boosting profitability and shareholder returns. Elliott has become one of the top three shareholders of Kansai Electric, Japan's biggest nuclear power operator by reactors online, with a stake of between 4% and 5%, a person familiar with the matter said on Wednesday. Sign up here. In a statement issued from London on Wednesday, Elliott said it was looking forward to working with Kansai Electric's management and other key stakeholders to strengthen the company's core business. "By increasing shareholder returns, unlocking capital from its non-core assets and improving profitability, we believe the company can enhance its funding flexibility for future growth and bolster its appeal as a long-term investment proposition," its statement said. Elliott said it had a "significant" stake that made it one of Kansai Electric's biggest shareholders but did not disclose the size. In a statement to Reuters, Kansai Electric declined to comment on its engagement with individual shareholders. "As in the past, we will carefully communicate with shareholders through various opportunities," the company said. Kansai Electric shares were up 3.1% in afternoon trading in Tokyo, outperforming the overall Nikkei index (.N225) , opens new tab, which was 0.65% higher. Elliott wants Kansai Electric to boost its dividend to 100 yen per share from 60 yen per share and increase share buybacks by selling non-core assets, according to the source familiar with the matter, who was not authorised to speak publicly. Elliott has identified non-core assets at the company worth more than 2 trillion yen ($13.58 billion), including over 1 trillion yen of real estate as well as a stake in a construction firm, the source said. Elliott has been active in a push for Japanese companies to boost shareholder returns and corporate value, taking stakes in a range of companies including Tokyo Gas (9531.T) , opens new tab, Sumitomo Corp (8053.T) , opens new tab and Dai Nippon Printing (7912.T) , opens new tab. Apart from the energy business, Kansai Electric has assets in IT and real estate, among others, but it is targeting nuclear power as its main source of near-to-mid-term earnings growth. It plans to keep its dividend per share this fiscal year flat at 60 yen, despite a forecast 30% drop in profits to 295 billion yen. ($1 = 147.2800 yen) https://www.reuters.com/sustainability/sustainable-finance-reporting/elliott-says-kansai-electric-can-become-more-attractive-by-selling-non-core-2025-09-10/