2026-01-28 21:58

WASHINGTON, Jan 28 (Reuters) - The United States is handing over a tanker to Venezuela that it seized this month, two U.S. officials told Reuters on Wednesday, the first known instance in which President Donald Trump's administration has returned such a tanker. The United States has been carrying out a months-long effort to seize oil tankers linked to Venezuela - carrying out seven apprehensions since late last year. Sign up here. The officials, who were speaking on the condition of anonymity, said the tanker that is being handed to Venezuelan authorities was the Panama-flagged supertanker M/T Sophia. They did not say why the tanker was returned. The U.S. Coast Guard, which leads interdiction and seizure operations, did not immediately respond to a request for comment. The Sophia was interdicted on January 7 by the Coast Guard and U.S. military forces. At the time, the administration said the Sophia, which is under sanctions, was a "stateless, sanctioned dark fleet motor tanker." Trump has focused his foreign policy in Latin America on Venezuela, initially aiming to push Venezuelan President Nicolas Maduro from power. After failing to find a diplomatic solution, Trump ordered U.S. forces to fly into the country to grab him and his wife in a daring overnight raid on January 3. Since then, Trump has said the U.S. plans to control Venezuela's oil resources indefinitely as it seeks to rebuild the country's dilapidated oil industry in a $100 billion plan. https://www.reuters.com/world/americas/us-handing-over-seized-tanker-venezuela-officials-say-2026-01-28/

2026-01-28 21:26

TSX up 0.24% Bank of Canada holds rates, says hard to predict future moves U.S. Fed also holds rates Jan 28 (Reuters) - Canada's main stock index closed higher on Wednesday, helped by gains in material and energy stocks, as the index recovered from earlier losses following the Bank of Canada's comments on uncertainty around future policy decisions after it kept interest rates unchanged. The S&P/TSX Composite Index (.GSPTSE) , opens new tab closed up 79.67 points, or 0.24%, at 33,176.07. Sign up here. The gold-focused index (.SPTTGD) , opens new tab jumped 3%, as gold prices moved past $5,300 per ounce early in the day, triggered by a sell-off in the U.S. dollar even as U.S. President Donald Trump brushed off January's slide. The broader materials index (.GSPTTMT) , opens new tab, which includes metal miners, gained 1.9% as copper, aluminum and zinc also traded higher. The index reversed course as energy stocks (.SPTTEN) , opens new tab gained 1% with oil prices hovering around a four-month high, lifted by supply concerns due to the slow resumption of operations at Kazakhstan's Tengiz oil field and production disruptions in the U.S following a winter storm. The central bank's governor Tiff Macklem said the high level of geopolitical and trade uncertainty made it difficult to predict the timing and direction of the next rate change. The Bank of Canada's policy rate currently stands at 2.25%. "We're in, what I would describe as, uncomfortably in neutral. We don't know if they should shift up or down because the road is really windy and they don't know what's ahead," Ben Jang, portfolio manager at Nicola Wealth, said. Financial stocks (.SPTTFS) , opens new tab, which drove the main index lower earlier in the day, dropped 1%, while the rate-sensitive industrials sector (.GSPTTIN) , opens new tab fell 0.9%. In the United States, the Federal Reserve held interest rates steady, citing still-elevated inflation alongside solid economic growth, and giving little indication in its latest policy statement of when borrowing costs might fall again. The S&P 500 closed slightly lower and the Nasdaq advanced modestly as investor reactions were muted after the Federal Reserve kept interest rates unchanged as expected and gave little indication when borrowing costs might fall again. In other news, IT consulting firm CGI (GIBa.TO) , opens new tab sliding 3.9% after reporting first-quarter results. https://www.reuters.com/business/tsx-futures-edge-up-ahead-fed-boc-rate-calls-gold-rallies-2026-01-28/

2026-01-28 21:18

Citgo's U.S. refineries good match for Venezuelan crude Washington has denied Venezuelan crude to Citgo since 2019 Citgo purchased 500,000 barrel cargo of Venezuelan crude, sources say HOUSTON/NEW YORK, Jan 28 (Reuters) - U.S. refiner Citgo Petroleum has bought Venezuelan crude oil for the first time since 2019, when it severed ties with its parent, state-run oil firm Petroleos de Venezuela, two sources familiar with the matter told Reuters on Wednesday. The 830,000-barrel-per-day refiner, which is expected to be taken over by an affiliate of hedge fund Elliott Investment Management to pay Venezuela-linked creditors following a court-ordered auction, has the network in the U.S. that is most fit to process Venezuela's heavy sour oil. Sign up here. Citgo has been blocked from having access to Venezuelan barrels since 2019. The refiner severed ties with Caracas-headquartered PDVSA months after the re-election of President Nicolas Maduro, which the U.S. did not recognize. This month, Maduro was captured by U.S. forces, and a flagship $2 billion deal to supply Venezuelan oil to the U.S. and other markets was agreed shortly after by Washington and Caracas, which is now ruled by the government of interim President Delcy Rodriguez. Since then, trading houses have been marketing and exporting millions of barrels of Venezuelan oil. Citgo bought a cargo of about 500,000 barrels of Venezuelan heavy crude for February delivery from Trafigura, according to the sources, who requested anonymity to discuss confidential details. Trafigura declined to comment. Citgo did not respond to requests for comment. The deal marks a major milestone in U.S. efforts to normalize and potentially boost Venezuelan oil sales and revenue, which Washington took control of shortly after capturing Maduro. It is also key for Citgo, which in recent years has resorted to other Latin American heavy grades and to U.S. domestic crudes to fill the Venezuela void. Citgo, which operates the seventh-largest refining network in the U.S., was acquired by PDVSA in the 1980s to guarantee an outlet for Venezuelan oil in North America. The company was among the largest buyers of the South American country's crude until 2019, when Venezuela's entire energy sector was hit with U.S. sanctions to pressure Maduro. Citgo, the crown jewel of Venezuela's assets overseas, had also been a key supplier of refined products to Venezuela. Citgo had not been granted access to Venezuelan oil even when the sanctions were partially lifted in recent years, allowing other U.S. refiners to import cargoes through U.S. major Chevron (CVX.N) , opens new tab. U.S. government officials have said they fast-tracked the supply deals with trading houses Vitol and Trafigura, the first agreed after Maduro's capture, to help clear a massive accumulation of oil inventories caused by a U.S. naval blockade of the country that forced cuts in crude output. https://www.reuters.com/business/energy/citgo-buys-first-venezuelan-oil-cargo-since-ending-ties-with-venezuelan-parent-2026-01-28/

2026-01-28 21:01

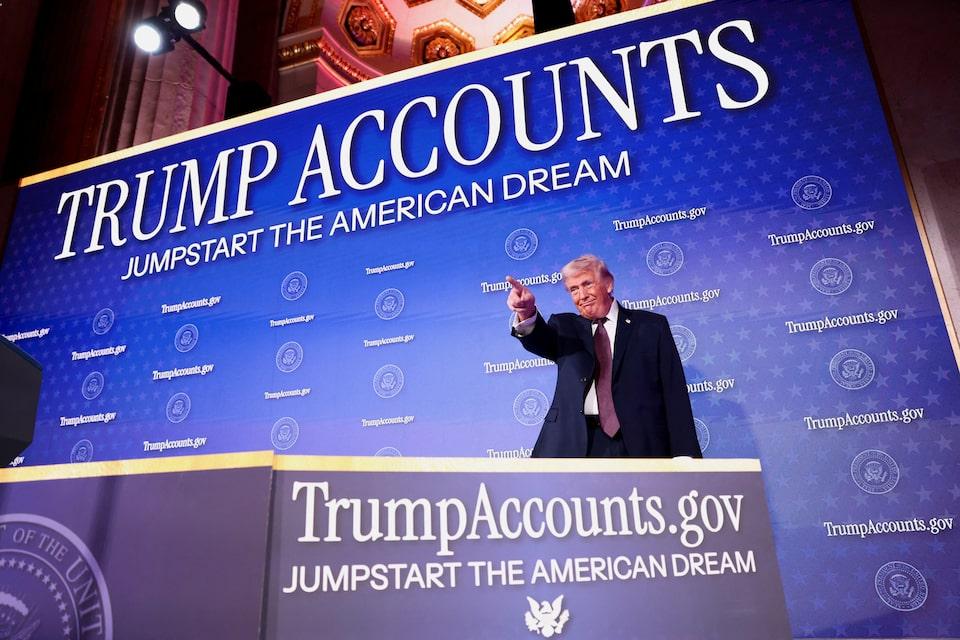

Trump says accounts are the most transformative policy of his administration Accounts to go live in July Government contributing to accounts for next three years WASHINGTON, Jan 28 (Reuters) - President Donald Trump on Wednesday rolled out his government-supported investment accounts for babies in the United States and urged American businesses to contribute to employees' family accounts. The White House is setting up these investment accounts for newborns in the next three years with initial government seed money. Trump and his Republican Party have been seeking to address voters' affordability concerns ahead of the November midterm elections. Sign up here. "Decades from now, I believe the Trump accounts will be remembered as one of the most transformative policy innovations of all time," Trump said at the Washington event, which welcomed many babies to underscore his administration's pro-family messaging. The accounts - named after Trump - were created last year under the president's One Big Beautiful Bill Act, his party's signature tax and spending legislation. The U.S. Treasury says it will deposit $1,000 into investment accounts for all children born between 2025 and 2028, with some 25 million families estimated to be eligible. The government will invest the money in low-cost index funds that grow tax-deferred. Income taxes are due upon withdrawal. The accounts officially come online on July 4 this year, and Treasury Secretary Scott Bessent said more than 500,000 families have already signed up. Trump said the accounts will be measured "not just in wealth created, it will be seen in young people buying houses that they could never have even dreamed of buying. It'll be seen in diplomas earned, companies founded, families formed, and more babies born." The White House is encouraging families to make additional contributions to these accounts, and some private investors have already contributed more, like the $6.25 billion investment by entrepreneur Michael Dell and his wife Susan. White House press secretary Karoline Leavitt said on Wednesday the accounts would address the lack of savings accounts for many American families. With no additional contributions, the administration expects the accounts to be worth $5,800 by the time the newborn babies turn 18. But if families contribute the maximum $5,000 each year, Leavitt said the account could accrue almost $1.1 million by the time the newborn turns 28. She did not share calculations to explain how the administration arrived at that amount. Financial analysts estimated that maxing out contributions would yield a portfolio of around $700,000 by age 28. The analysts compared the Trump accounts to retirement accounts, as the account converts into a traditional IRA at age 18, and also noted that taxes will need to be assessed at the time of withdrawal. Major companies in the U.S. - like Visa (V.N) , opens new tab and IBM (IBM.N) , opens new tab - have pledged contributions to their U.S. employees' accounts, and Trump called on "all employers" across the country to follow suit. Ahead of the midterm elections - when Republicans will be fighting to retain control of Congress - the Trump administration is pushing the accounts as a win for both Democrats and Republicans. Republicans view Trump as their best messenger on economic issues and count on him to win over skeptical voters, even though public opinion polling shows more Americans are souring on his handling of the economy. To help promote the accounts, the president invited rapper Nicki Minaj, who stood out in a white fur outfit amid a Washington crowd in dark suits, to the stage. "I am probably the president's number-one fan, and that's not going to change," Minaj said, adding that she would not be deterred by opponents of his policies. https://www.reuters.com/sustainability/society-equity/bessent-says-500000-have-signed-up-trump-accounts-more-donations-coming-2026-01-28/

2026-01-28 21:00

Indexes: Dow up 0.02%, S&P 500 down 0.01%, Nasdaq up 0.17% Fed keeps rates steady, cites stabilizing jobs market, high inflation Traders still bet first rate cut will be in June Texas Instruments, AT&T, Seagate shares rally after quarterly updates Reactions to after the bell Mag 7 earnings mixed Jan 28 (Reuters) - The Nasdaq rose slightly with a boost from chip stocks while the S&P 500 closed virtually unchanged on Wednesday as investor reactions were muted after the Federal Reserve kept interest rates unchanged as expected and gave little indication when borrowing costs might fall again. In its statement, the Fed cited still-elevated inflation alongside solid economic growth for its decision. The U.S. central bank said the job market has "shown some signs of stabilization" and removed language from its prior statement saying that downside risks to employment had risen. Sign up here. Investors had widely expected the central bank to keep rates unchanged at 3.5%–3.75% and it said that eight out of 10 policymakers had voted to hold rates steady. After the statement, traders boosted their bets that the Fed would cut short-term borrowing costs in June - but not before then. And in his closely monitored press conference, Fed Chair Jerome Powell was careful not to comment on future rate decisions, saying that the Fed would be data-dependent, but he told reporters that the upside risks to inflation and downside risks to employment have diminished. "Whether you were bullish or bearish going into the press conference you walked away feeling about the same," said Michael James, equity sales trader at Rosenblatt Securities. "Employment and inflation risks have downsized, but inflation overall remains stubborn. There hasn't been a meaningful enough change in the employment market to warrant the Fed doing something. There hasn't been a meaningful enough improvement in inflation to allow the Fed to be more aggressive with further cuts," James added. The Dow Jones Industrial Average (.DJI) , opens new tab rose 12.19 points, or 0.02%, to 49,015.60, the S&P 500 (.SPX) , opens new tab lost 0.57 points, or 0.01%, to 6,978.03 and the Nasdaq Composite (.IXIC) , opens new tab gained 40.35 points, or 0.17%, to 23,857.45. The benchmark S&P 500 index had briefly topped the 7,000 points milestone for the first time earlier in the day but couldn't hold its gains. Among the 11 major S&P 500 sectors the biggest decliners were real estate (.SPLRCR) , opens new tab, consumer staples (.SPLRCS) , opens new tab and healthcare (.SPXHC) , opens new tab. The biggest advances came in energy (.SPNY) , opens new tab, up 0.7% and technology (.SPLRCT) , opens new tab, up 0.6%. Technology's biggest index point contributions came from chip stocks with earnings reports in focus. The biggest boost was from AI chip leader Nvidia (NVDA.O) , opens new tab, up 1.6%, followed by Micron (MU.O) , opens new tab, which rose 6% and then Intel (INTC.O) , opens new tab, which jumped 11%. Earlier SK Hynix, a key Nvidia supplier, reported a record quarterly profit and ASML booked its highest ever fourth-quarter orders, igniting a tech rally from Europe to Asia. Texas Instruments(TXN.O) , opens new tab shares jumped 9.9% after the analog chipmaker forecast first-quarter revenue and profit above Wall Street estimates late on Tuesday. Seagate Technology(STX.O) , opens new tab shares finished up more than 19% after it forecast third-quarter revenue and profit above Wall Street expectations and its rival Western Digital (WDC.O) , opens new tab also rallied 10.7%. 'MAG 7' KICKS OFF EARNINGS After digesting the Fed update, investors then turned their attention to the kickoff of earnings from the so-called "Magnificent Seven" companies, which have driven the AI trade, powering markets to record levels. Meta (META.O) , opens new tab and Tesla (TSLA.O) , opens new tab shares gained nearly 4% and 3% respectively, in late trading after their reports were released following the market close. While Microsoft(MSFT.O) , opens new tab shares fell more than 3% after its report was released, shares in bellwether IBM (IBM.N) , opens new tab jumped 7% following its results. With lofty valuations driving rotation into undervalued areas of the market, the group's capital plans are being closely watched as investors question whether AI spending will drive returns. Elsewhere in earnings, shares in AT&T (T.N) , opens new tab rose after the U.S. carrier projected annual profit above market expectations. In industrials, however, Textron (TXT.N) , opens new tab shares sank 7.9% after it guided for a fiscal profit below estimates, while Otis (OTIS.N) , opens new tab stock slipped after its fourth-quarter revenue missed expectations. Declining issues outnumbered advancers by a 1.37-to-1 ratio on the NYSE where there were 593 new highs and 97 new lows. On the Nasdaq, 1,710 stocks rose and 3,029 fell as declining issues outnumbered advancers by a 1.77-to-1 ratio. The S&P 500 posted 38 new 52-week highs and 14 new lows while the Nasdaq Composite recorded 102 new highs and 125 new lows. On U.S. exchanges, 19.03 billion shares changed hands compared with the 18.29 billion 20-day moving average. https://www.reuters.com/business/us-stock-index-futures-rise-wall-street-braces-big-tech-earnings-2026-01-28/

2026-01-28 20:00

Senators urge protection for fully approved projects from political shifts Republicans criticize Trump's renewable energy project halts, support 'technology neutral' treatment of energy projects Democrats demand fair treatment for renewable energy in permitting reform WASHINGTON, Jan 28 (Reuters) - Republicans and Democrats on the Senate environment committee said on Wednesday that U.S. infrastructure project developers need assurances that fully approved projects will not be cancelled or stalled due to shifting political priorities. The statements from Republican senators were an apparent criticism of President Donald Trump's efforts to stymie renewable energy development, particularly his administration's halt on offshore wind projects that are fully permitted. Sign up here. The lawmakers spoke at a hearing about federal environmental review and permitting processes, which Congress has pledged to reform. "I feel strongly that no project should have to worry that it will be halted at the whim of an administration," Senator John Curtis, a Republican from Utah, said at the Senate Environment and Public Works Committee hearing. "We saw it in 2021 with Keystone XL Pipeline and we see it today with wind projects across the country." Another Republican, Senator Cynthia Lummis of Wyoming, also drew parallels between the Biden administration's Keystone oil pipeline cancellation and Trump's efforts to slow renewable energy. "What we do need is some certainty," Lummis said. Committee Chairman Shelley Moore Capito, a West Virginia Republican, said permitting legislation should be technology neutral. "Let's remove the politics from permitting once and for all," she said. Trump has used his second term to hinder the expansion of clean energy technologies that were a cornerstone of former President Joe Biden's climate and energy agendas. The House of Representatives passed legislation in December to streamline environmental reviews and speed permitting for large energy infrastructure projects, data centers and factories, which many lawmakers view as important to meeting rising U.S. power demand. The legislation now requires approval from the Senate, but some Democratic lawmakers oppose an amendment made to the bill that would preserve Trump's ability to block permitted offshore wind farms. Rhode Island Democratic Senator Sheldon Whitehouse said he and some other Senate Democrats cannot advance permitting reform unless Trump and his cabinet secretaries level the playing field for renewable energy. "We can add jobs and electrons, reduce emissions and waste, but it makes no sense to pass a bipartisan permitting reform that will be illegally butchered by a lawless executive branch, vindictively, irrationally and dishonestly," Whitehouse said. The Trump administration has argued renewables are expensive and less reliable than fossil fuels, and also says offshore wind farms can pose a national security threat by interfering with radar systems. https://www.reuters.com/legal/litigation/permitting-reform-dead-unless-trump-stops-attacks-renewables-democrat-senator-2026-01-28/