2025-09-10 07:38

BERLIN, Sept 10 (Reuters) - Germany is increasing purchases of Chinese goods in several price-sensitive categories as U.S. tariff moves roil global trade flows, according to a study by the Institute for Employment Research IAB seen by Reuters on Tuesday. During the October to June period, price- and calendar-adjusted figures show notable increases year-on-year in German imports from China, led by copper (+91%), apparel (+24%) and toys, games and sporting goods (+12%), according to IAB's analysis based on data from the German statistics office. Sign up here. "We have not yet been flooded with Chinese goods across the board," said Enzo Weber, head of the IAB research unit forecasts and macroeconomic analyses. "However, there are some product groups where noticeable effects can be seen." In the first seven months of 2025, imports from China rose by 10.5% to 97.6 billion euros, growing at more than twice the pace of total imports, which increased by 4.9% from January to July to around 796.6 billion euros. The import tilt toward China could intensify price competition in Germany and squeeze margins, especially in sectors where Chinese producers enjoy a structural cost advantage, economists warn in the study. https://www.reuters.com/world/china/chinese-goods-redirected-germany-because-us-tariffs-researchers-say-2025-09-10/

2025-09-10 07:34

JAKARTA, Sept 10 (Reuters) - Floods on Indonesia's holiday island of Bali have killed at least six people this week and blocked off major roads in the capital, officials said on Wednesday, disrupting a busy travel destination. Continuous heavy rains between Tuesday evening and Wednesday morning brought down two buildings in Bali's capital Denpasar, killing four people, said I Nyoman Sidakarya, the head of the island's search and rescue agency. Sign up here. Two more people have died and 85 have been evacuated in the region of Jembrana, Indonesia's disaster mitigation agency said on Wednesday. Flooding continued to hit Bali as of Wednesday, the agency chief Suharyanto told reporters. Access to the island's international airport near Denpasar was limited as only trucks could use the roads, Nyoman said. Videos on social media, which Reuters could not authenticate, show floods on major roads leading to complete gridlock. About 200 rescuers have been dispatched, Nyoman said. Heavy rain also led to flooding in Indonesia's East Nusa Tenggara where four people have been killed, the disaster mitigation agency said. https://www.reuters.com/business/environment/floods-indonesias-bali-kill-least-six-officials-say-2025-09-10/

2025-09-10 07:27

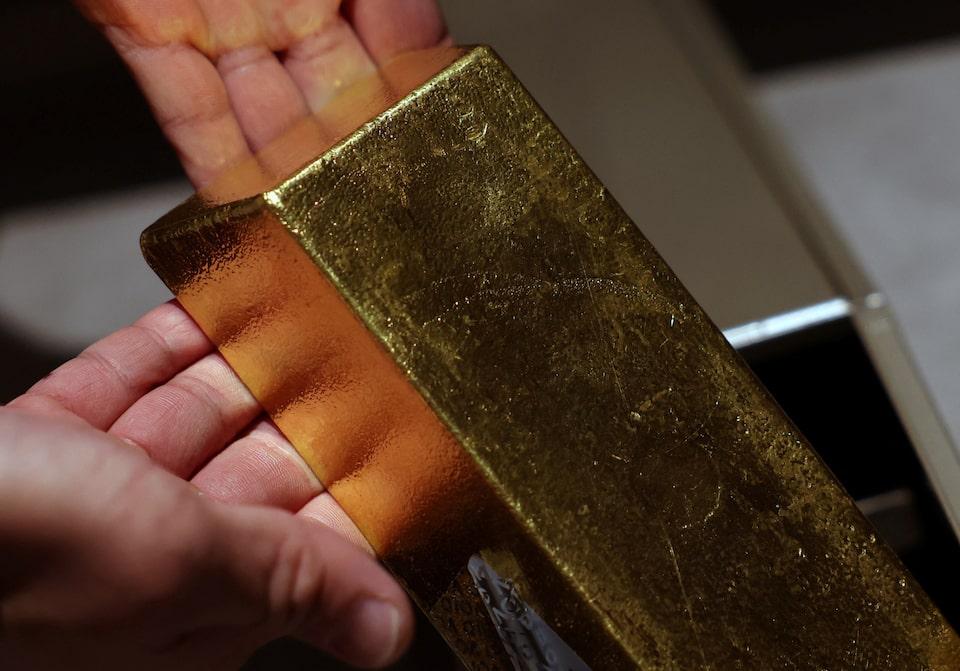

Sept 10 (Reuters) - ANZ Group on Wednesday raised its year-end gold price forecast to $3,800 per ounce and said prices could peak near $4,000 by June next year, citing robust investment demand for bullion. Spot gold hit a record high of $3,673.95 on Tuesday and gold is up 38% year-to-date, driven by a weaker dollar, strong central bank purchases, dovish monetary policies, and rising global uncertainty. Sign up here. Greenback-priced bullion, which yields no interest and is often considered as a safe-haven asset during periods of economic and geopolitical uncertainty, typically performs well in a low-interest-rate environment. The following is a list of the latest forecasts for 2025 and 2026 gold prices (in $ per ounce): *end-of-period forecasts https://www.reuters.com/markets/commodities/anz-raises-year-end-gold-forecast-3800-per-ounce-2025-04-03/

2025-09-10 07:24

BRUSSELS, Sept 10 (Reuters) - Austria lost a legal challenge against European Union rules that class nuclear energy and natural gas as climate-friendly investments on Wednesday, as Europe's second-highest court sided with the EU over the rules. In the case before the Court of Justice of the European Union's General Court, Austria's government had challenged the European Commission's decision to include gas and nuclear in the EU's "taxonomy" of investments that can be labelled and marketed as sustainable in Europe. Sign up here. The court sided with Brussels, in a ruling which said that the EU Commission "was entitled to take the view that certain economic activities in the nuclear energy and fossil gas sectors can, under certain conditions, contribute substantially to climate change mitigation and climate change adaptation." The EU's inclusion in 2022 of gas and nuclear in the taxonomy had exposed deep rifts between countries over which energy sources to use to meet climate change goals. Countries including Spain and Denmark had argued it was not credible to label gas, a CO2-emitting fossil fuel, as climate friendly. Poland and Bulgaria were among those who sought rules supporting investments in gas, to help them quit more-polluting coal. Austria's legal action, submitted to the EU's general court, had argued Brussels should annul the rules on grounds including that nuclear energy cannot meet a requirement to "do no significant harm" to the environment because of concerns about radioactive waste. Austrians widely oppose nuclear power and the country has never had an atomic plant. https://www.reuters.com/sustainability/climate-energy/austria-loses-legal-challenge-eus-green-gas-nuclear-rules-2025-09-10/

2025-09-10 07:19

Sept 10 (Reuters) - TotalEnergies (TTEF.PA) , opens new tab will take a 10% stake in a joint venture with liquefied natural gas producer NextDecade (NEXT.O) , opens new tab for a fourth liquefaction plant, known as a train, of the Rio Grande LNG project in Texas, it said on Wednesday. LNG developers are benefiting from a more favourable regulatory environment thanks to US President Donald Trump's decision to lift a moratorium on new export permits. Sign up here. On Tuesday, NextDecade reached a positive final investment decision on train 4, which is set to go live in 2030 and has an expected LNG production capacity of nearly 6 million tonnes per annum. The Rio Grande export facility is expected to hit total capacity of about 24 mtpa. "This project from which we will offtake 1.5 mtpa strengthens our LNG export capacity from the United States," said Stephane Michel, President of Gas, Renewables & Power at TotalEnergies. Additionally, TotalEnergies will also indirectly hold nearly 7% in Train 4 as a 17.1% shareholder of NextDecade, the company said in a statement. Train 4 will be financed with around 40% equity and 60% debt, according to TotalEnergies. https://www.reuters.com/business/energy/totalenergies-hold-10-interest-rio-grande-lng-train-4-project-2025-09-10/

2025-09-10 07:17

Anglo agrees $53 bln tie-up with Teck after spurning BHP Investors see BHP focused on building out own copper growth Bankers say much could change before deal closes MELBOURNE, Sept 10 (Reuters) - Top global miner BHP's focus on expanding its own copper assets while it undergoes leadership change means it is unlikely to gatecrash the planned $53 billion tie-up of Anglo American and Teck Resources, investors and bankers said on Wednesday. London-listed Anglo American (AAL.L) , opens new tab and Canada's Teck Resources (TECKb.TO) , opens new tab announced a merger on Tuesday, marking the sector's second-biggest tie-up ever, to forge a new global copper-focused heavyweight. Sign up here. The deal came just over a year after BHP scrapped a $49 billion bid for Anglo that in one mega acquisition would have beefed up the Australian miner's holding in the metal seen as essential to the energy transition. After being rebuffed by Anglo three times, BHP opted instead to double down on a series of smaller projects where it sees better value, a strategy that investors said has been consistent and suggests it is unlikely to make a move on Anglo or Teck. "Given BHP's message, 'We have moved on,' any move by BHP for either of the companies would come as a surprise," said Andy Forster, a portfolio manager at Argo Investments in Sydney, which holds BHP shares. In the past year, BHP instead spent $2 billion for a stake with Canada's Lundin (LUN.TO) , opens new tab in two Argentinian copper projects, including the Josemaria mine whose life was last month extended by six years. It has also pushed hard to eke out production gains at top copper mine Escondida in Chile. BHP declined to comment on whether it might spoil the Anglo-Teck deal but pointed Reuters to recent comments by its chief executive saying that M&A was just one lever of many for growth. "Frankly in current markets, it's hard to see the right combination of the commodities that we like, the asset quality that we like, at a price where we can still unlock attractive value for BHP shareholders,” CEO Mike Henry said on a results call in August. Despite its recent failure to offload its Australian coal assets, Anglo has worked hard to improve its share price from a year ago, one M&A banker said. "Both miners are in play now. Anglo's share price is up, they could probably put in a good defence like they did last time," he said. Shares in Anglo have jumped 20% since before BHP's bid in late April while BHP shares have dropped 8%. The deal was smart in that several factors were favourable to Canada in a way that would be difficult to replicate for other majors who might want to buy Teck, such as relocating the new company's headquarters to Canada, two people said. Among the conditions for approving BHP's merger with South Africa's Billiton in 2001, the Australian government mandated that the holding company be headquartered in Australia. Succession may be another stumbling block. BHP Chair Ross McEwan replaced Ken MacKenzie in March, after the latter's decade at the wheel, while CEO Henry is more than five years into a typical six-year term, meaning that BHP may be focused for now on replacing him rather than on big ticket M&A. But bankers aren't ruling out the possibility of BHP swooping in down the track, especially if the deal doesn't go to plan. "You'd have to have a serious think about it - the two most obvious targets in a nil premium deal," said an M&A banker not directly involved in the deal, which the parties expect to take 12 to 18 months to complete. "They have got time ... A deal doesn't have to be done tomorrow." https://www.reuters.com/world/americas/bhp-seen-unlikely-pounce-anglo-or-teck-it-eyes-organic-growth-2025-09-10/