2025-09-09 09:04

Stocks get lift from Fed easing expectations France political upheaval in focus, markets unrattled Investors weigh 50bp cut, look to U.S. CPI, PPI releases for clues Political turmoil in many countries complicates outlook for FX bond markets SINGAPORE/LONDON, Sept 9 (Reuters) - European stocks stayed in positive territory on Tuesday, with rising expectations of a rate cut from the U.S. Federal Reserve offsetting political uncertainty in France following the government's collapse. Europe's STOXX 600 index (.STOXX) , opens new tab was up 0.1% while Asian shares (.MIAPJ0000PUS) , opens new tab added 0.9%. French blue chips (.FCHI) , opens new tab were up 0.1%, while the country's government bonds were steady. Sign up here. S&P futures (.EScv1) , opens new tab ticked 0.1% higher and Nasdaq futures (.NQcv1) , opens new tab rose 0.2%, which would see the tech-focused index surpass a record high scaled in the previous session. French President Emmanuel Macron is seeking his fifth prime minister in less than two years after opposition parties united to kick out centre-right Prime Minister Francois Bayrou over his unpopular plans for budget tightening. Bayrou, handed a 364-194 defeat in a parliamentary confidence vote on Monday, will officially offer his resignation to Macron on Tuesday. The government's collapse was already largely priced in, and Macron has so far ruled out calls for a snap parliamentary or presidential election, which the far-right National Rally has called for. "If we were to avoid elections, clearly that would be more of a market positive than the alternative, though it doesn't do much to alter the rather perilous fiscal trajectory that France remains on," said Michael Brown, senior research strategist at Pepperstone. "It does remove a little bit of risk in the short-term, which is why markets are by and large shrugging all of that off this morning." French 10-year bonds came under modest pressure, pushing yields up around 1.7 basis points to 3.489%, broadly in line with the rest of the government debt market. "The tail risk is having a new presidential election before 2027 and a prime minister whose policies are not well received by financial markets," said Kevin Thozet, investment committee member at Carmignac. "Markets are saying the probability of this happening is very low, so no reason to panic." The euro hit a more than six-week high of $1.1756 and was last 0.1% lower on the day. FED IN FOCUS Breathing new life into the equities rally were expectations that the Fed will cut rates when it meets next week, following Friday's weak U.S. jobs report. While consumer and producer price inflation data are due in the week ahead, investors are betting that a 25-basis-point cut this month is a done deal, with focus now on whether the Fed could deliver a larger 50-bp move. The U.S. Labor Department will also report a preliminary revision estimate to the employment level for the 12 months through March later in the day. "They are likely to cut anywhere between half a million and 750,000 jobs off the payrolls count for the 12 months to March, if you get a figure like that it's only going to spur that dovish repricing a little bit further," said Pepperstone's Brown. Markets are now pricing in an over 11% chance the Fed could lower rates by 50bp this month, compared to zero a week ago, according to the CME FedWatch tool. Elsewhere, Japan's Nikkei (.N225) , opens new tab climbed past the key 44,000 mark for the first time, aided by a weaker yen and following the resignation of the country's Prime Minister Shigeru Ishiba, a fiscal hawk. U.S. tariffs on Japanese goods including cars and auto parts are set to be lowered by September 16, Japan's tariff negotiator Ryosei Akazawa said in an X post on Tuesday. POLITICAL TURMOIL Renewed uncertainty over the political landscape across various economies has rattled currency and bond markets in the past few sessions. Along with upheaval in France, investors are also mulling Ishiba's resignation in Japan, a heavy election defeat for Argentina President Javier Milei's ruling party in local elections and the abrupt replacement of Indonesia's finance minister. Still, losses across currencies were capped by a broadly weaker dollar, while most bond markets have since largely held steady. The yen was last 0.4% stronger at 146.90 per dollar, clawing back its losses from the previous session. The two-year U.S. Treasury yield , which typically reflects near-term rate expectations, languished near a five-month low at 3.513%. The benchmark 10-year yield rose 3 bps but was still near a five-month trough, last at 4.072%. In commodities, oil prices gained on Tuesday after OPEC+ decided to increase production by less than what market participants had anticipated. Brent crude futures were up 1.1% at $66.23 per barrel. Spot gold earlier touched a fresh record high of $3,659.1 an ounce, buoyed by expectations of imminent Fed cuts. https://www.reuters.com/world/china/global-markets-wrapup-2-2025-09-09/

2025-09-09 07:11

Brent and U.S. crude rise about 1% Threat of tighter sanctions on Russian oil also underpins market China to carry on stockpiling oil in 2026, Gunvor official says LONDON, Sept 9 (Reuters) - Oil extended gains on Tuesday, supported by the latest oil output hike from OPEC+ being smaller than anticipated, expectations that China will continue stockpiling oil and concerns over potential new sanctions on Russia. Eight members of the Organization of the Petroleum Exporting Countries and allies agreed on Sunday to raise production from October by 137,000 barrels per day, lower than the increases of about 550,000 bpd they made for September and August. Sign up here. Brent crude rose 53 cents, or 0.8%, to $66.55 a barrel by 1200 GMT, while U.S. West Texas Intermediate crude climbed 54 cents, or 0.9%, to $62.80. "Prices are holding up amid speculation that production will not rise by the amount the eight members have allowed themselves, and not least the fact China according to data has been buying around 0.5 million barrels per day towards stockpiling," said Ole Hansen of Saxo Bank. China's stockpiling of oil, which has helped soak up excess production this year, is likely to continue at a similar rate in 2026, the chief strategist for commodity trading house Gunvor said on Monday. Crude is also drawing support from the reduced amount of unused production capacity in OPEC+, said Giovanni Staunovo of UBS. A drop in spare capacity limits the group's ability to cover for sudden supply shocks and tends to support prices. "The realization that the October OPEC+ supply increase could be 60,000-70,000 barrels per day is one factor, the other is that OPEC+ spare capacity is much smaller than many thought," he said of the reasons for the rally. Speculation of more sanctions on Russia after the country's biggest air attack on Ukraine set fire to a government building in Kyiv also supported prices. U.S. President Donald Trump said he was ready to move to a second phase of restrictions. Further sanctions on Russia would diminish its oil supply to global markets, which could support higher oil prices. Also in focus is the expectation that the U.S. Federal Reserve, which meets next week, will cut interest rates. Lower rates reduce consumer borrowing costs and can boost economic growth and demand for oil. https://www.reuters.com/business/energy/oil-rises-modest-opec-output-hike-russia-supply-concern-2025-09-09/

2025-09-09 07:08

SINGAPORE, Sept 9 (Reuters) - Sentiment in the crude oil market has shifted to expecting prices to decline, with the debate at the industry's biggest gathering in Asia more about timing than direction. The topic of presentations and conversations at the annual APPEC conference is always dominated by the outlook for prices, and this week's event was no different. Sign up here. What has shifted is market sentiment and the least-sighted animal this year was a bull in a sea of bearish participants. While there are many factors that drive crude oil prices, the two that dominated APPEC were the decision by OPEC+ to keep unwinding production cuts and the risks to the global economy from the trade and geopolitical policies of U.S. President Donald Trump. The first is a supply factor and points to the now widespread market expectation that OPEC+ will continue to add barrels back as regaining market share is now more of a priority than defending price levels. The decision on September 7 by the eight members of OPEC+ undertaking voluntary production cuts to add back 137,000 barrels per day (bpd) of output from October was largely viewed as minor and unlikely to alter the market balance in itself. But what is seen as significant is the expectation that the producer group, which includes top exporters Saudi Arabia and Russia, will continue to increase output into the first half of 2026 and completely unwind the 1.65 million bpd of cuts from April 2023, having already ended an additional 2.2 million bpd from November 2023. It's unlikely that all of these barrels will find their way to the market, but with global demand growth forecasts coalescing at a maximum of 1 million bpd this year and next, it's still likely that OPEC+ will add back enough to swamp the increase in demand. The likelihood that non-OPEC oil output will also rise, especially from the Americas outside of the United States, is tilting the market consensus heavily towards a supply overhang in coming months. The demand side is also clouded with uncertainty, especially over the impact of the tariffs imposed by Trump on imports into the United States. Estimates of the impact of lifting the average tariff on goods imports from just over 2% to around 18% vary, but the consensus was overwhelmingly that these will act as a drag on growth, while boosting U.S. inflation, but likely lowering it elsewhere. HIDDEN BULLS? It was not all doom and gloom at APPEC, with some bullish factors getting an airing. But the bullish case relies on a few things going better than expected, and a few things getting worse. On the better side of the ledger, the world economy has sailed through the Trump barrage largely unscathed, with consumer sentiment and spending holding up in developed economies and developing economies able to continue to attract investment and trade. On the worse side, there would have to be heightened, and more successful, measures to reduce the flow of Russian crude to both India and China, the only major buyers left for oil sanctioned as part of efforts to end Moscow's war in Ukraine. More effective measures against Iranian and Venezuelan oil could also have an impact, and there is the ongoing risk of a flare-up in Middle East tensions given the conflict between Israel and Hamas. In some ways much of the risk premium in the crude market currently is largely dependent on what steps Trump decides to take. This is somewhat ironic as the one thing the otherwise inconsistent and unpredictable U.S. leader has been consistent on is that he wants lower oil prices. But it is caution over what he might do that is keeping a risk premium in the market, and helping to keep global benchmark Brent futures anchored around $65 a barrel. Another unknown is what tactics China's refiners are likely to adopt in coming months. They have been storing vast quantities of crude this year, with some estimates as high as 600,000 bpd, and their total storage is now estimated at between 1.2 billion and 1.4 billion barrels, which is well in excess of the 90 days of import cover recommended by the International Energy Agency. China has been building stockpiles largely on the back of discounted Russian barrels and a lower price trend for other grades in the second quarter of this year. But the Chinese may be swinging towards the view that oil should be priced more in a $50-$60 range currently, and may start to cut back on imports in order to encourage lower prices. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. https://www.reuters.com/markets/commodities/crude-oil-sentiment-swings-lower-prices-bearish-factors-mount-2025-09-09/

2025-09-09 06:54

Dollar falls to near seven-week low US 10-year Treasury yields slip to 5-month low Focus shifts to US CPI data on Thursday Palladium up more than 1% Sept 9 (Reuters) - Gold prices scaled a record peak on Tuesday, buoyed by a weaker U.S. dollar and a dip in bond yields, as growing expectations of a Federal Reserve rate cut this month lifted demand for the precious metal. Spot gold was up 0.2% at $3,642.09 per ounce, as of 0636 GMT, after hitting a record high of $3,659.10 earlier in the session. U.S. gold futures for December delivery edged 0.1% higher to $3,682.10. Sign up here. "We probably will see more upside in gold from here provided that the U.S. central bank delivers with regards to market expectations of seeing multiple rate cuts," KCM Trade Chief Market Analyst Tim Waterer said. U.S. job growth weakened sharply in August and the unemployment rate increased to a nearly four-year high of 4.3%, confirming that labour market conditions were softening and sealing the case for a Fed rate cut next week. Traders are pricing in an 89.4% chance of a 25-basis-point Fed rate cut at this month's meeting and a 10.6% probability of a jumbo 50-basis-point cut, per the CME Group's FedWatch tool. Lower interest rates pressure the dollar and bond yields, raising the appeal of the non-yielding bullion. The dollar index (.DXY) , opens new tab fell to an almost seven-week low against its rivals, making gold more attractive for other currency holders, while the benchmark U.S. 10-year Treasury yield dropped to a five-month low. Meanwhile, the European Central Bank is widely expected to hold rates at its meeting on Thursday. Investors are now awaiting the U.S. producer price data on Wednesday and consumer price data on Thursday for further clues into the Fed's policy path. "A potential short-term catalyst would be if U.S. inflation data comes in below expectations this week, which could see the Fed dial up their dovish levels at their September meeting and could hasten gold's ambitions of hitting the $3,700 level," Waterer said. Gold prices have gained 38% so far this year, following a 27% jump in 2024, bolstered by a soft dollar, strong central bank accumulation, dovish monetary settings and heightened global uncertainty. Elsewhere, spot silver was flat at $41.32 per ounce. Platinum gained 0.6% to $1,390.80 and palladium climbed 1.1% to $1,147.07. https://www.reuters.com/world/india/gold-extends-record-rally-fed-rate-outlook-dents-us-dollar-yields-2025-09-09/

2025-09-09 06:51

KUALA LUMPUR, Sept 9 (Reuters) - A security warning by Malaysian authorities for liquefied natural gas facilities was issued after an employee at state energy firm Petronas received a threat by phone to burn them down, a deputy premier said, according to state media. Petronas, or Petroliam Nasional Berhad, confirmed it was working with authorities after the National Security Council on Monday ordered LNG facilities in Sarawak to tighten security following an unspecified threat. Sign up here. The Bintulu complex is Petronas' flagship LNG facility, with an annual production capacity of 29.3 million metric tons. The government has tightened security at LNG facilities in Sarawak and Sabah after a Petronas employee at the company’s headquarters received threatening text messages, deputy premier Fadillah Yusof was quoted as saying. "I was informed that threatening text messages were received, originating from a phone number in Indonesia. However, who was behind it is still under police investigation," he said. Fadillah, according to Bernama, said a request was made in the text message and after receiving no response, the sender then threatened to burn LNG facilities. It did not say what the request was. "He asked for an answer but because there was no response, he threatened to burn our LNG - but who knows which one," he said. https://www.reuters.com/business/energy/malaysia-deputy-pm-says-petronas-received-threat-burn-lng-facilities-state-media-2025-09-09/

2025-09-09 06:24

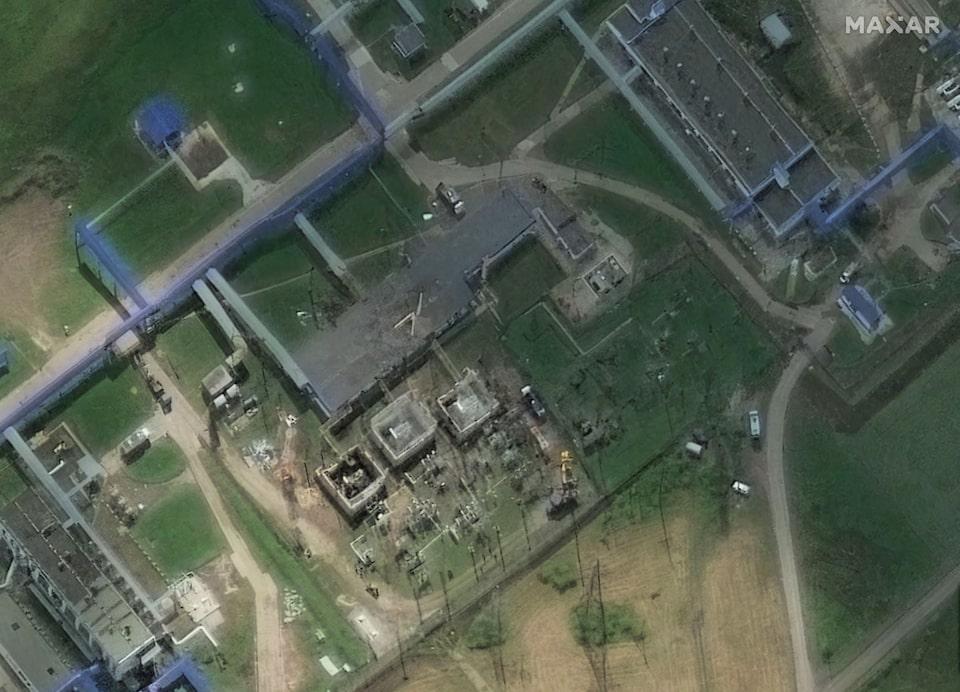

LONDON, Sept 9 (Reuters) - The recent wave of Ukrainian drone attacks on Russian oil refineries and export facilities could boost global refining profit margins – particularly those in the U.S. – just as the peak summer demand season fades. Ukrainian attacks have shut down facilities accounting for at least 17% of Russia's oil processing capacity, or 1.1 million barrels per day (bpd), according to Reuters' calculations. Other targeted infrastructure includes the Ust-Luga Baltic Sea oil export terminal and the Druzhba pipeline, which supplies Belarus, Slovakia and Hungary. Sign up here. These strikes mark a significant escalation in the three-and-a-half year conflict, with Kyiv now taking direct aim at the Kremlin's largest source of revenue while U.S. President Donald Trump seeks to broker a ceasefire deal. Russia and Ukraine had agreed in March to halt attacks on energy infrastructure after a barrage of Russian attacks. But Moscow has already broken this agreement, hitting a number of Ukrainian energy targets in recent weeks, including drone attacks on power facilities in the north and south of the country. Tensions escalated further this week when Russia launched its largest air offensive since the start of the war, hitting Ukraine’s main government building in Kyiv. DISRUPTED REFINERIES Ukraine’s strikes on Russia’s energy infrastructure are already having a meaningful impact on the world's second-largest exporter of crude oil, particularly its refining industry. Reduced domestic oil processing capacity has prompted Russia to increase its August crude oil exports from western ports by 200,000 bpd, or 11%, Reuters reported, because reduced domestic refining capacity means that increased volumes are available for export. The strikes also triggered gasoline shortages in parts of Russia, even after Moscow imposed a gasoline export ban for oil producers on July 28 to prevent supplies from falling too low during peak summer demand. The problem won’t be fixed any time soon. Repair work on damaged refineries could take weeks or longer, tightening fuel supplies domestically and internationally at a time when many of the world's refineries are entering seasonal maintenance ahead of winter. EXPANDING MARGINS Refineries worldwide have enjoyed strong profit margins this year, buoyed by robust diesel demand despite concerns about a potential slowdown in global economic activity stemming from the U.S. trade war. Supply has also been relatively stable, with closures of several European refineries offsetting new capacity additions in the Middle East, Mexico and Africa. Benchmark European diesel refining margins are $23.50 a barrel, roughly 40% higher than this time last year, LSEG data shows. But declining Russian diesel exports could apply downward pressure on global supply, further boosting refining margins, particularly for U.S. Gulf Coast refiners that export the majority of their product. Russian seaborne diesel exports declined in August to 744,000 bpd from 828,000 bpd in July, according to data from analytics company Kpler. That is only slightly lower than last year's 750,000 bpd in August exports, but the Ukrainian strikes mean volumes are likely to remain depressed. Reflecting expectations of tighter supply, the six-month forward spread for the ICE diesel contract has more than doubled since August 18 to about $50 a ton, LSEG data shows. MORE TURMOIL AHEAD? Before Moscow’s 2022 invasion of Ukraine, Europe was the largest buyer of Russian diesel, meeting 40% of its import needs and a quarter of its total consumption. The EU and Britain halted Russian fuel imports in 2023, turning instead to Middle Eastern and Indian refiners, some of which used Russian feedstock. However, in July, the EU adopted its 18th package of sanctions against Russia, which included a ban on imports of refined products made from Russian crude, which is set to kick in next year. The ban largely targets India, which has become the second-largest buyer of Russian crude behind China. India imported 1.9 million bpd in 2024, nearly 20% of total Russian crude exports, IEA data shows. Trump said on Sunday that he was ready to move towards a second phase of sanctions against Moscow, suggesting an increasingly aggressive posture. Sanctions could target Brazil’s purchases of Russian diesel, which could further disrupt global supplies. While the latest damage to Russian energy infrastructure is likely to complicate the supply outlook for refined products, it could provide a boost for refiners outside Russia, particularly those in the United States. (The opinions expressed here are those of the author, a columnist for Reuters) Enjoying this column? Check out Reuters Open Interest (ROI), , opens new tabyour essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis. Markets are moving faster than ever. ROI , opens new tab can help you keep up. Follow ROI on LinkedIn , opens new tab and X. , opens new tab https://www.reuters.com/markets/commodities/ukrainian-strikes-russian-oil-facilities-could-be-boon-us-refiners-2025-09-09/