2025-09-05 20:22

LUANDA/NEW YORK, Sept 5 (Reuters) - The International Monetary Fund cut Angola's economic growth forecast for 2025 to 2.1% from the previous 2.4% on the back of lower oil exports, the IMF said on Friday, and warned that risks have risen from last year with regard to the Southern African nation's capacity to pay its debts. The IMF said it is critical for Angola to limit its borrowing needs and cut expenses, while greater foreign exchange rate flexibility is also something the country must embrace. Sign up here. The statement follows an IMF board review of the findings of a staff assessment mission to Luanda in May, when the Fund had already cut Angola's growth outlook for this year from an initial 3%. "Angola has been hit by volatility in oil prices and sovereign spreads, and weaknesses in oil production in the first half of 2025, amplifying the impact of those shocks," the IMF said. Like other small, open African economies, oil-exporting Angola has faced challenges this year, when U.S. trade tariffs roiled financial markets. The IMF said Angola's capacity to repay debt remained "adequate" but warned that risks to that view have increased from last year. It cautioned Angola about following two potentially unsustainable financing options: too much domestic debt and costly short-term external debt. "Excessive reliance on domestic financing risks further increasing banks' sovereign exposure," the IMF said, while short-term solutions risk "accumulating onerous debt service, potentially undermining investor confidence, and ultimately delaying market access on more favorable terms." Angola had to pay $200 million in extra security to JPMorgan in April after the price of its bond that serves as collateral for a loan from the Wall Street lender dropped along with other frontier assets. It later got a refund of the cash when the price of that bond rebounded. The visit to Luanda by IMF officials in May was technically a Post Financing Assessment, which is reserved for nations with outstanding credit above their quotas that do not have an IMF-supported program or a staff-monitored program. Angola faces challenges from potentially lower prices of crude oil and tightening external financing conditions, the IMF said after the visit. Its government is also racing to cut the stock of oil-backed loans to China, in an effort to relieve pressure on its finances. https://www.reuters.com/sustainability/sustainable-finance-reporting/imf-cuts-angola-economic-growth-view-again-warns-about-excess-debt-2025-09-05/

2025-09-05 20:21

China extends canola probe to March 2026, citing case complexity Canada risks losing key canola market as China pivots to Australia Analyst suggests deal could resolve tariffs on vehicles and metals BEIJING, Sept 5 (Reuters) - China on Friday prolonged its probe into Canadian canola imports, buying six more months for negotiations that could ease a year-long trade dispute sparked by Ottawa's tariffs on Chinese electric vehicles. The Ministry of Commerce said the anti-dumping probe would now run until March 9, 2026, citing the complexity of the case, a statement showed. Sign up here. Beijing, the world's largest importer of canola, imposed preliminary duties of 75.8% on Canadian canola seed imports in August. A final ruling could result in a different rate, or overturn the decision. Canada's Agriculture Minister Heath MacDonald said in an interview his government is hopeful the Chinese move allows more time for the two sides to resolve trade tensions. "If there's a little more opportunity to have further dialogue, further communication, which we're doing with the appropriate people within the Chinese government, then it's a plus without a doubt," MacDonald said. The Canadian government announced new support for Canada's canola industry on Friday, with subsidies for domestic biofuels production, a pledge to improve biofuels regulations to encourage investment, and subsidized loans for canola growers. Canada's main canola industry organizations also said they were "hopeful" that the extension of the preliminary duties provides time for a longer-term solution. Canada, the world's largest exporter of canola, shipped almost C$5 billion ($3.63 billion) of canola products to China in 2024, about 80% of which were seed. The steep duties on canola seed, if they remain in place, would likely all but end those imports. China, which relies on Canada for nearly all of its canola seed supplies, also imposed tariffs on canola oil and meal in March. Canada, in turn, has imposed tariffs on Chinese steel and aluminum. Ottawa has grown increasingly anxious about losing a key customer, especially as China appears to be pivoting towards Australian supplies. Prime Minister Mark Carney's Parliamentary Secretary Kody Blois and Saskatchewan Premier Scott Moe are heading to China from September 6-9 to meet with Chinese officials and discuss trade issues. Saskatchewan is the prairie province that produces about half of Canada's canola, the majority of which is exported. In July, Reuters reported that Canberra is close to an agreement with Beijing that would allow Australian suppliers to ship five trial canola cargoes to China. The following month, Chinese state-run trading firm COFCO booked the first new-crop Australian canola, marking China's first imports from Australia since 2020. The Winnipeg ICE canola futures market initially rose on Friday after the China news broke, but a trader said some market participants might have been misinterpreting the headline as meaning China had suspended its duties, rather than extending the preliminary duties until March. ICE November canola settled down 0.55%. Canada's canola industry has been hoping for an early resolution to the canola duties and tariffs. https://www.reuters.com/business/energy/china-delays-final-ruling-canola-dispute-with-top-supplier-canada-2025-09-05/

2025-09-05 20:19

TSX ends up 0.5% at 29,050.63 For the week, the index adds 1.7% Materials group gains 2.6% as gold climbs Technology adds 2.4% Sept 5 (Reuters) - Canada's main stock index rose on Friday to another record high, led by gains for technology and gold mining shares, as disappointing U.S. and Canadian jobs data spurred investors to raise bets on interest rate cuts. The S&P/TSX composite index (.GSPTSE) , opens new tab ended up 134.74 points, or 0.5%, at 29,050.63, eclipsing Thursday's record closing high. Sign up here. It was the eighth-straight day of gains for the index, the longest daily winning streak since May. For the week, the index was up 1.7%. "Once again, weak data helped push rate cut expectations," said Angelo Kourkafas, senior global investment strategist at Edward Jones. "We saw a universal message across both the U.S. and Canada with employment numbers coming in weaker than expected ... It really cements the market expectations, first of all for the Fed that it is going to resume rate cuts in September, and for the Bank of Canada that the easing cycle is not over." Investors see a 90% chance the Bank of Canada will resume its easing campaign on September 17 after leaving its benchmark rate on hold at 2.75% since March, and are fully discounting a rate cut that same day by the Federal Reserve. Canada's economy shed 65,500 jobs in August, largely in part-time work, and the unemployment rate climbed to 7.1%. That's the highest level of unemployment since May 2016 excluding the pandemic. The S&P 500 ended lower, contributing to the TSX extending its outperformance this year compared to the U.S. benchmark. "I believe it is the commodity and metals exposure that continues to help the index," Kourkafas said. The materials group (.GSPTTMT) , opens new tab, which includes metal mining shares, added 2.6% as the price of gold rose to another all-time high. Technology (.SPTTTK) , opens new tab was up 2.4%, with shares of electronics company Celestica Inc (CLS.TO) , opens new tab jumping 9.9%. Energy was a drag, falling 1.7%. The price of oil settled 2.5% lower at $61.87 a barrel as expectations grew of higher supply. https://www.reuters.com/world/americas/tsx-adds-daily-winning-streak-weak-data-boosts-rate-cut-bets-2025-09-05/

2025-09-05 20:19

Sept 5 (Reuters) - Utility Southern Co's (SO.N) , opens new tab unit Georgia Power said on Friday it had received approval from the Georgia Public Service Commission for five new solar site power purchase agreements totaling 1,068 megawatts (MW). The new facilities support the company's Clean and Renewable Energy Subscription (CARES) 2023 program, allowing commercial and industrial customers to subscribe to renewable energy to enhance sustainability efforts. Sign up here. The approved projects will be constructed and maintained by third-party companies that won bids in the CARES 2023 Request for Proposal (RFP), which was approved in the 2022 Integrated Resource Plan (IRP) Final Order. The five solar facilities will be located across Georgia, including Mitchell County, Coffee County, Wilkinson County, Jefferson County and Laurens County. Georgia Power said the CARES 2025 RFP, also approved in the 2022 IRP Final Order, was recently issued with bids due in August. The request seeks utility-scale solar or solar-plus-storage proposals to meet a target of up to 2,000 MW of utility-scale solar. These utility-scale solar projects are expected to be fully operational as early as 2028, the company added. https://www.reuters.com/business/energy/georgia-power-receives-approval-1068-mw-new-solar-energy-projects-2025-09-05/

2025-09-05 20:08

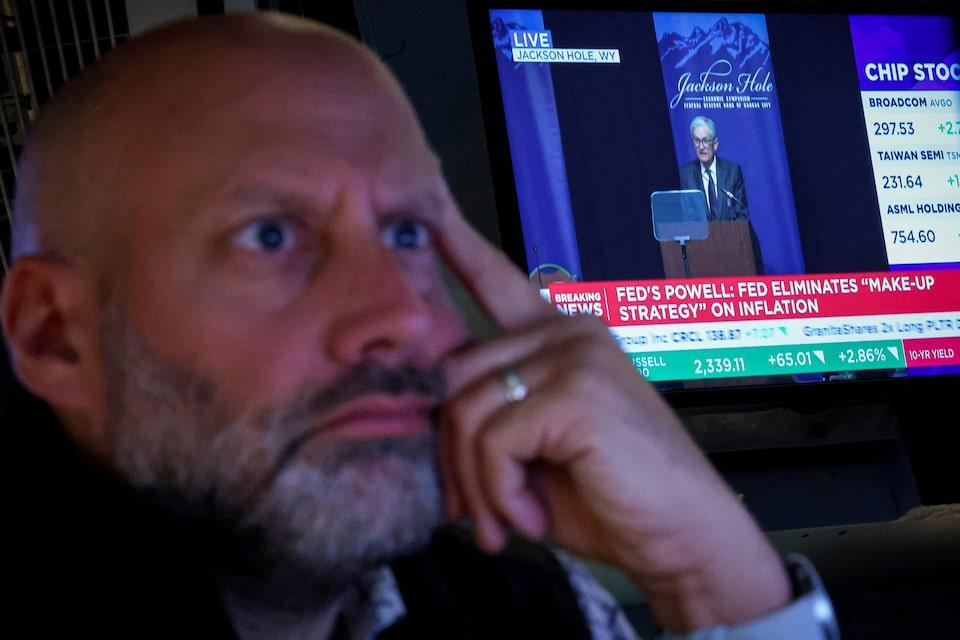

CPI data set for Thursday, PPI a day earlier Markets widely expect Fed rate cut at September 16-17 meeting Weak jobs report on Friday raises expectations for easing Tariff uncertainty re-emerges following court ruling NEW YORK, Sept 5 (Reuters) - A spate of inflation data confronts U.S. stock investors in the coming week as markets grapple with fresh uncertainty over tariffs and government bond yields, while equities hover at lofty valuations. The benchmark S&P 500 index (.SPX) , opens new tab closed at a record high on Thursday despite an uneven start to September, which has been the worst month for stocks on average over the past 35 years. Stocks were pulling back on Friday after the monthly U.S. employment report showed job growth weakened in August. Sign up here. "September has been known to see a wearing down of the sentiment picture," said Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments. At the same time, he said, "stocks aren't pricing in a lot of risks right now. They look fully valued." The monthly U.S. consumer price index on Thursday highlights next week's economic releases, with investors focused on signals from the inflation data about the prospects for interest rate cuts and the fallout from tariffs on prices. Following Federal Reserve Chair Jerome Powell's remarks late last month that flagged rising risks to employment, markets have been widely expecting the central bank to lower rates for the first time in nine months at its September 16-17 meeting. Investors bet on even more accelerated easing after the weak jobs report. Fed Funds futures were baking in a 90% chance of a quarter-point rate cut at the meeting, and a roughly 10% chance of a heftier half-percentage point cut, LSEG data as of Friday afternoon showed. Only a CPI number that comes in "egregiously higher" than estimates could dent assumptions of imminent monetary policy easing, said Art Hogan, chief market strategist at B Riley Wealth. About 70 basis points of easing, or nearly three standard cuts, are projected by December, according to the futures data. Recently, "the prospect of the Fed cutting has been the overwhelming factor driving equity sentiment to be more positive," Miskin said. "And so if that reverses, then it could be problematic for equities." Along with CPI, a Wednesday report on producer prices could also reveal impacts from import tariffs. Last month's PPI data showed U.S. producer prices increased by the most in three years in July as the costs of goods and services surged. Tariffs and their economic implications were the main risk facing markets earlier this year, but other factors such as questions over Fed independence and caution about the artificial intelligence trade have been more prominent recently. The issue returned to the fore this week after a U.S. appeals court ruled that most of President Donald Trump's tariffs are illegal. While the Trump administration has asked the U.S. Supreme Court to hear a bid to preserve the sweeping tariffs, the ruling injected fresh uncertainty for markets. "It felt as though the fog of trade war was clearing, and now we're just back into the thick of it," Hogan said. "And that doesn't help corporate America make decisions, consumers make decisions, and investors make decisions." The potential of lost tariff revenue exacerbating the U.S. fiscal deficit was one factor investors said may have driven long-dated U.S. government debt yields sharply higher at the start of the week, moves that also followed big jumps in yields in the UK and other regions. While long-dated yields globally have since calmed, their spikes were cited as contributing to stock weakness initially during the week. The 30-year U.S. Treasury yield this week hit 5% for the first time in over a month. That yield level has been "problematic" for risk appetite over the past few years, said Adam Turnquist, chief technical strategist for LPL Financial. The long-bond yield was last around 4.78%, with yields falling broadly on Friday after the jobs data. The S&P 500 was up about 10% so far in 2025, helped recently by a solid second-quarter earnings season. The S&P 500's price-to-earnings ratio climbed to 22.4 times, based on earnings estimates for the next 12 months, a valuation well above its long-term average of 15.9, according to LSEG Datastream. "Investors face ongoing threats from trade and tariff unknowns as well as potential economic releases ... that could ultimately challenge elevated stock valuations," Anthony Saglimbene, chief market strategist at Ameriprise Financial, wrote in a commentary. "That said, investors have been navigating those dynamics for months, and stocks have continued to grind higher." https://www.reuters.com/business/wall-st-week-ahead-inflation-data-looms-markets-stocks-hover-near-records-2025-09-05/

2025-09-05 20:01

WASHINGTON, Sept 5 (Reuters) - Energy Secretary Chris Wright said on Friday that he is not worried that any Russian sales of gas to China would harm U.S. exporters of the fuel. Russia and China gave their blessing earlier this week to a gas pipeline called Power of Siberia 2, underscoring Chinese President Xi Jinping's disregard for Western demands that he row back from a deepening partnership with Moscow. Sign up here. Wright touted the Trump administration's focus on rapidly expanding liquefied natural gas exports at an event at the Council on Foreign Relations on Friday. "I think in this administration, it'll become the single largest export of our country, because exports will double during this administration," he said. "This is a way to get European allies off Russian gas." Wright told reporters after the event that Russia has lost much more market share of gas exports from traditional customers in Europe than it's gaining in China. "I don't worry about that for U.S. energy exports," Wright said, about China's interest in Russian gas. "But we do worry about it more in that (President Donald Trump's) top agenda item is, end the killing in Ukraine, and so the pressure to try to reduce Russian revenue from selling energy, that's the issue." Trump, in his second administration, has put additional 25% tariffs on goods coming into the U.S. from India in response to the country's buying of Russian oil. Since coming back to office, Trump has not imposed direct sanctions on Russian energy entities. https://www.reuters.com/business/energy/russian-gas-sales-china-would-not-harm-us-energy-secretary-says-2025-09-05/