2025-12-08 05:52

China's trade surplus tops $1 trillion in first 11 months of 2025 November exports top expectations as non-US shipments lead amid high US tariffs Imports underperform, pointing to still-subdued domestic demand PMI surveys suggest exporters face challenging 2026 BEIJING, Dec 8 (Reuters) - China's trade surplus topped $1 trillion for the first time as manufacturers seeking to avoid President Donald Trump's tariffs shipped more to non-U.S. markets in November, with exports to Europe, Australia and Southeast Asia surging. Shipments to the United States dropped by close to one-third from the same month a year before. Sign up here. "The tariff cuts agreed under the U.S.-China trade truce didn't help to lift shipments to the U.S. last month, but overall export growth rebounded nonetheless," said Zichun Huang, China economist at Capital Economics. "We expect China's exports will remain resilient, with the country continuing to gain global market share next year." "The role of trade rerouting in offsetting the drag from U.S. tariffs still appears to be increasing," she added. Chinese exports overall grew 5.9% year-on-year in November, customs data on Monday showed, a reversal from October's 1.1% contraction, and beating a 3.8% forecast in a Reuters poll. Imports were up 1.9%, compared with a 1.0% uptick in October. Economists had expected a 3.0% increase. China's trade surplus was $111.68 billion in November, the highest since June and up from $90.07 billion recorded the previous month. That was above a forecast of $100.2 billion. The trade surplus for the 11 months of the year topped $1 trillion for the first time. China has stepped up efforts to diversify its export markets since Trump won November 2024's U.S. election, pursuing closer trade ties with Southeast Asia and the European Union. It has also leveraged Chinese firms' global footprint to establish new production hubs for low tariff access. Chinese shipments to the United States dropped 29% year-on-year in November, while exports to the European Union grew an annual 14.8%. Shipments to Australia surged 35.8%, and the fast-growing Southeast Asian economies took in 8.2% more goods over the same period. Tumbling exports to the U.S. came despite news that the world's two biggest economies had agreed to scale back some of their tariffs and a raft of other measures after Trump and Chinese President Xi Jinping met in South Korea on October 30. The average U.S. tariff on Chinese goods stands at 47.5%, well above the 40% threshold that economists say erodes Chinese exporters' profit margins. "Electronic machinery and semiconductors seem to be key (to higher exports)," said Dan Wang, China director at Eurasia Group. "There is a shortage in lower-grade chips and other electronics, which meant prices jumped, and Chinese companies going global have been importing all kinds of machinery and other inputs from China." KEY MEETINGS EYED AMID US-CHINA TRADE UNCERTAINTY China's yuan firmed on Monday, off the back of the stronger-than-expected export data, with investors also awaiting policy signals from key year-end meetings. The Politburo, a top decision-making body of the ruling Communist Party, pledged on Monday to take steps to expand domestic demand, a shift analysts say is crucial for weaning the $19 trillion economy away from reliance on exports. Top officials are also expected to convene for the annual Central Economic Work Conference in the coming days to set key targets and outline policy priorities for next year. Economists estimate that diminished access to the U.S. market since Trump returned to the White House has reduced China's export growth by roughly 2 percentage points, equivalent to around 0.3% of GDP. October's unexpected downturn, following an 8.3% surge the month prior, signalled that Chinese exporters' tactic of front-loading U.S.-bound shipments to beat Trump's tariffs had run its course. Although Chinese factory owners reported an improvement in new export orders in November, they were still in contraction, underscoring continued uncertainty for manufacturers as they struggle to replace demand in the absence of U.S. buyers. An official survey tracking broader factory activity showed that the sector contracted for an eighth consecutive month. DOMESTIC DEMAND STILL SOFT China's rare earth exports jumped 26.5% month-on-month in November, the first full month after Xi and Trump agreed to speed up shipment of the critical minerals from the world's largest refiner. The nation's soybean imports are also poised for their best-ever year, as Chinese buyers, who had shunned U.S. purchases for the majority of this year, stepped up purchases from American growers in addition to large purchases from Latin America. Overall, China's domestic demand remains soft due to a prolonged property downturn. That weakness was seen in a decline in imports of unwrought copper, a key material in construction and manufacturing. "China's pivot to establishing domestic demand as a key driver of growth will take time, but it’s essential for China to move into the next phase in its economic development," said Lynn Song, ING's chief economist for Greater China. https://www.reuters.com/world/asia-pacific/chinas-november-exports-top-expectations-imports-underperform-2025-12-08/

2025-12-08 05:35

JAKARTA, Dec 8 (Reuters) - Indonesia will from January 1 require natural resource exporters to deposit and hold all foreign currency earnings in state-owned banks, CNBC Indonesia reported on Monday, citing a government document. Under the current rules introduced in early January, exporters must for at least one year keep all proceeds from sales of natural resources like coal, palm oil and nickel within the Indonesian banking system, including privately-owned banks. Sign up here. The proceeds could be used for business operations if converted into rupiah, with authorities encouraging foreign exchange swaps if exporters were reluctant to convert. Under the new regulations, only a maximum of 50% of the proceeds can be converted into rupiah for operational use, down from 100% in the previous rules, CNBC Indonesia reported. Exporters could place their foreign currency deposits in foreign currency denominated government bonds that are issued on the domestic market, the news website said. Indonesia's finance and economic ministries, the president's office and the central bank did not immediately respond to request for comment. https://www.reuters.com/world/asia-pacific/indonesia-revise-retention-rules-export-earnings-new-year-cnbc-indonesia-2025-12-08/

2025-12-08 05:35

A look at the day ahead in European and global markets from Wayne Cole. Well, Fed decision week is finally upon us and it's shaping up to be one of the most vexed meetings in recent memory. Of 108 analysts polled by Reuters only 19 tipped a hold with the rest for an easing on Wednesday. Sign up here. Futures are 88% for a rate cut, as if trying to make it a fait accompli for policymakers who wouldn't dare disappoint such overwhelming pricing. Yet commentary from officials suggests at least two of the 12 voting Fed members will dissent against a cut, with more opposition possible from divided Fed policymakers, even as one Trump-appointed governor argues for a reduction of 50 basis points or more. The Federal Open Market Committee has not had three or more dissents at a meeting since 2019, and that has happened just nine times since 1990. Analysts note that as many as 9 of the full 19 members could use their "dot plot" forecasts to show they were against a December reduction. How Chair Powell chooses to frame all this in his media conference, and whether his focus will be on risks to employment or to inflation, will be a crunch moment for markets. Futures assume he will err on the hawkish side and imply only a 24% chance of a move in January. Further out is even more uncertain given President Trump is due to announce Powell's successor at any time and, as usual, is likely to favour loyalty over experience and expertise. It's not clear how the Treasury market would deal with such a nakedly political appointee to the most powerful central bank position in the world, but it's unlikely to bode well for the long end of the curve. Central banks in Canada, Switzerland and Australia also meet this week and all are poised to hold steady. The Swiss National Bank might like to ease again to offset the strength of its franc, but is already at 0% and reluctant to go negative. A run of hot economic data has led markets to abandon any hope of another easing from the Reserve Bank of Australia and even price in a rate hike for late 2026. All this has made for a cautious start on markets, with Wall Street futures up a fraction and European futures down as much. Asian shares are mostly in the green, led by a 1% gain for China after it reported a 5.9% rise in exports for November, topping forecasts and continuing to defy the drag from U.S. tariffs. The dollar is broadly softer, while Treasuries are hushed for the Fed countdown. Note JOLTS data are out tomorrow and could make more of a splash than usual given the payrolls report is now not due until December 16. Key developments that could influence markets on Monday: - Euro zone Sentix Index for December, Germany's industrial output for October - Appearances by Bank of England policymakers Alan Taylor and Clare Lombardelli. ECB Board Member Piero Cipollone also speaks - NY Fed 1-year Inflation Expectations https://www.reuters.com/world/china/global-markets-view-europe-2025-12-08/

2025-12-08 05:26

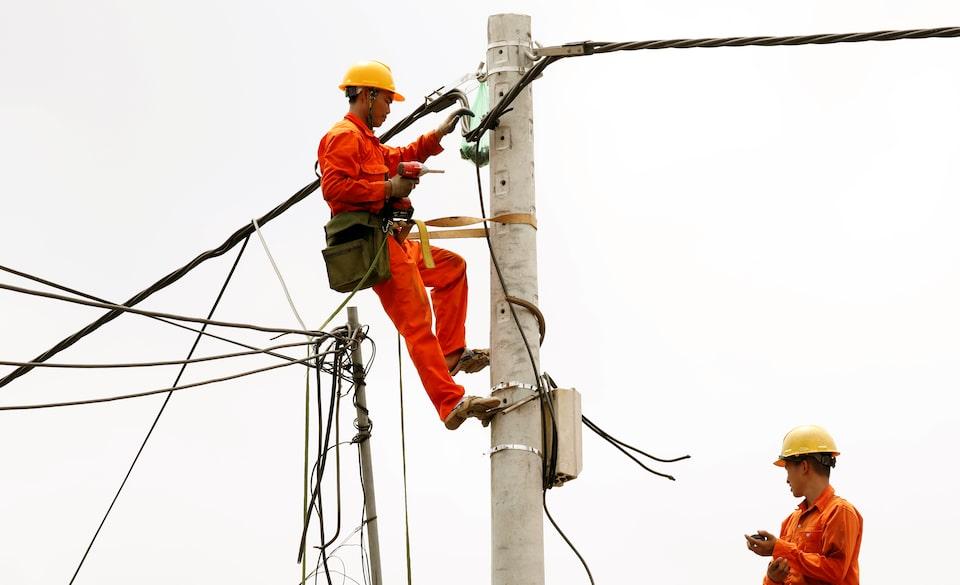

Timeline for Vietnam project too tight, Hanoi envoy says Ties already strained over petrol motorbike ban hurting Honda Demand surging from industry, expanding middle class Extreme weather events also threatening supply HANOI, Dec 8 (Reuters) - Japan has dropped out of plans to build a major nuclear power plant in Vietnam because the time frame is too tight, Japanese ambassador Naoki Ito told Reuters, potentially complicating Vietnam's long-term strategy to avoid new power shortages. Vietnam, home to large manufacturing operations for multinationals including Samsung and Apple, has faced major power blackouts as demand from its huge industrial sector and expanding middle class often outpaces supplies, strained by increasingly frequent extreme weather, such as droughts and typhoons. Sign up here. "The Japanese side is not in a position to implement the Ninh Thuan 2 project," the ambassador to Vietnam said, referring to a plant with a planned capacity of 2 to 3.2 gigawatts. The project is part of Vietnam's strategy to boost power generation capacity. Ninh Thuan 2 is scheduled to come online by 2035 alongside Ninh Thuan 1, a plant with the same capacity, according to the government's roadmap. Vietnam wants to increase electricity production from multiple sources, mostly renewables and gas, but projects have faced delays and uncertainty over regulatory and pricing issues. The announcement comes amid strains in usually close ties between Hanoi and Tokyo, including from a planned ban on petrol motorbikes in central Hanoi that has angered market-dominating Honda (7267.T) , opens new tab. A letter about the issue from Japan's embassy to Vietnamese authorities in September has still not been formally answered, Ito said, though he said that Vietnamese authorities might organise further consultations on the matter. RUSSIA, JAPAN WERE ORIGINAL PARTNERS Work on both nuclear plants in central Vietnam started in the early 2010s but was halted in 2016 when Hanoi suspended its nuclear power programme over safety and budget concerns. Russia had been awarded the Ninh Thuan 1 project, and Japan the second plant. After it resumed its nuclear energy programme last year, Vietnam asked Japan and Russia to implement the projects, Ito said, but that after meetings with Vietnamese officials, Japan decided in November that it would pull out as the deadline for completion was too close. Under the current timeline, Vietnam was expected to sign agreements with its international partners in September for Ninh Thuan 1 and in December for the second plant. Vietnam's industry ministry and state-owned energy firm Petrovietnam, which is the Vietnamese partner for Ninh Thuan 2, did not respond to requests for comment. A Vietnamese official said no agreement had yet been signed for Ninh Thuan 1 either. The Russian embassy in Vietnam and its Vietnamese partner for Ninh Thuan 1, state-owned grid operator EVN, did not comment. Japanese companies expressed little interest in the Vietnam project because they were focused on rebuilding skilled workforces disrupted by the Fukushima accident in 2011 that led to the temporary shutdown of Japan's nuclear power plants, said one person familiar with the discussions. They declined to be named as the information was not public. The ambassador said Japan was still exploring options for additional plants in Vietnam at a later stage, especially small modular reactors. French, South Korean and U.S. investors have expressed interest in the Ninh Thuan plants, multiple Vietnamese and foreign officials said. https://www.reuters.com/business/energy/japan-pulls-out-vietnam-nuclear-project-complicating-hanois-power-plans-2025-12-08/

2025-12-08 05:23

MUMBAI, Dec 8 (Reuters) - The Indian rupee ended weaker on Monday as a fall in local equities and marginal slip in Asian currencies weighed on the currency, while traders remained cautious on speculative positions as the rupee settles into a fresh trading range. The local currency closed at 90.07 per U.S. dollar, down 0.1% on the day. Sign up here. Likely portfolio outflows from local stocks troubled the rupee on the day, traders said, while a pick up in exporter hedging and intermittent dollar sales from state-run banks helped keep a lid on its decline. India's benchmark equity indexes, the BSE Sensex (.BSESN) , opens new tab and Nifty 50 (.NSEI) , opens new tab fell about 0.7% and 0.9%, respectively amid mixed price action in regional equities. Foreign investors have sold over $1 billion of local stocks on a net basis over December so far, putting the year-to-date outflows at nearly $18 billion. Both the rupee and equities have underperformed regional benchmarks this year. The rupee is down about 5% this year, making it the worst performing currency in Asia. The Nifty 50 has risen over 9%, but the gain pales in comparison to the 25% jump in MSCI's gauge of Asian stocks outside of Japan (.MIAPJ0000PUS) , opens new tab. While foreign brokerages have incrementally turned positive on the outlook for local stocks, analysts reckon that the pressure on the rupee is likely to persist unless there is a breakthrough in U.S.-India trade talks. A U.S. trade delegation is expected to visit New Delhi this week for talks, an Indian government source said last week. Asian currencies were mostly on the defensive, with the Indonesian rupiah leading losses in the region while the dollar index was steady at 98.98 as investors awaited the U.S. Federal Reserve's policy outcome on Wednesday. "The Fed could be a positive event risk for the dollar in that it seems hard for the Fed to validate the 90bp of easing priced into Fed Funds futures by early 2027," analysts at ING said in a note. The dollar index is down nearly 9% on the year so far. https://www.reuters.com/world/india/rupee-open-steady-outlook-fragile-after-fall-past-90-2025-12-08/

2025-12-08 04:56

JAKARTA, Dec 8 (Reuters) - Indonesia's Sumatra island will require 51.82 trillion rupiah ($3.11 billion) in reconstruction and recovery funds following a series of deadly floods, senior government officials said. The death toll from the cyclone-induced floods and landslides reached 950 as of Monday, with 274 people still missing, according to official data. The storms also killed about 200 people in southern Thailand and Malaysia. Sign up here. Suharyanto, head of Indonesia's disaster mitigation agency, said that the recovery funds needed across the three provinces of Aceh, North Sumatra, and West Sumatra may still increase as the agency continues to calculate how much damage has been done. Among the three provinces affected, Aceh needs the most funds, amounting to a total of 25.41 trillion rupiah, Suharyanto said at a cabinet meeting led by President Prabowo Subianto in Aceh province late on Sunday. North Sumatra and West Sumatra will require 12.88 trillion and 13.52 trillion rupiah respectively, he added. The reconstruction process will soon begin in some areas in North Sumatra and West Sumatra, which have recovered relatively well, he said. "So, areas that are already in better condition can start the reconstruction process. We will relocate people living in evacuation centres to temporary houses," Suharyanto said without providing a timeline. The temporary houses are 40 square-metre plywood structures built by the government for people affected by natural disasters. "In the next phase, they will be relocated into permanent houses, built by the housing ministry," he added. Responding to the initial estimated recovery cost, Prabowo said his calculations were "similar", without elaborating whether he will approve the spending or not. "The point is we have the capacity and we will do it meticulously and do our best to manage it," Prabowo said. Prabowo also said that conditions in some areas remained serious, with rice fields, dams and a large number of houses especially affected. "The local leaders reported that there are quite a number of houses that we must help rebuild," he said. "In some places, there are still challenges," he said, adding that the distribution of medication and clothes to the residents must also become a priority. ($1 = 16,680 rupiah) https://www.reuters.com/business/environment/indonesia-says-more-than-3-billion-recovery-funds-required-after-sumatra-floods-2025-12-08/