2024-05-08 11:45

FedEx Boeing 767 lands without front landing gear Pilot and crew evacuated, no casualties reported Boeing facing mounting pressure amid 737 MAX crisis Turkish authorities investigating the incident ISTANBUL, May 8 (Reuters) - A FedEx Airlines Boeing 767 (BA.N) New Tab, opens new tab cargo plane landed at Istanbul Airport on Wednesday without its front landing gear, a Turkish Transport Ministry official said, adding there were no casualties and authorities had launched an investigation. The aircraft, flying from Paris Charles de Gaulle Airport, informed the control tower in Istanbul that its landing gear had failed to open and touched down with guidance from the tower, managing to remain on the runway, a ministry statement said. Airport rescue and fire fighting teams were scrambled before landing, but no one was injured. The ministry gave no reason for the failure. The aircraft involved is a nearly 10-year-old Boeing 767 freighter, one of the most common cargo planes and based on the 767 passenger model dating back to the 1980s. An official from Turkey's transport ministry said its teams were conducting examinations at the scene as part of the ongoing investigation, but did not provide further details. Boeing referred queries to FedEX, which said in a statement it was coordinating with investigation authorities and would "provide additional information as it is available". Video footage obtained by Reuters showed sparks flying and some smoke as the front of the plane scraped along the runway before coming to a halt and being doused with firefighting foam. No fire appeared to have broken out. The video showed the pilots holding the plane's nose above the runway for several seconds after the main wheels had touched the ground, apparently executing the emergency drill for landing with a retracted nose gear that pilots train for, according to the SKYbrary aviation database. In June last year, a small 22-year-old Boeing 717 flown by Delta Airlines made a similar smooth landing without a nose gear in Charlotte, North Carolina, in an incident later blamed on a fractured component. The runway was temporarily closed to air traffic, but other runways at Istanbul airport were still operating normally, the airport operator IGA said. Manufacturers are not typically involved in the operation or maintenance of jets once they enter service, but Boeing has been under intense media and regulatory scrutiny following a series of incidents on its smaller 737. Sign up here. https://www.reuters.com/world/middle-east/boeing-cargo-plane-lands-istanbul-without-front-landing-gear-no-casualties-2024-05-08/

2024-05-08 11:43

BENGALURU, May 8 (Reuters) - India's Tata Power (TTPW.NS) New Tab, opens new tab reported a jump in fourth-quarter profit on Wednesday, helped by strong energy demand amid heatwaves and growing economic activity in the country. The company reported a consolidated net profit of 8.95 billion rupees ($107.2 million), up around 15% from last year. Analysts had said energy firms such as Tata Power, NTPC (NTPC.NS) New Tab, opens new tab and Power Grid (PGRD.NS) New Tab, opens new tab would likely announce consistent fourth-quarter earnings as the sector stood to gain from increasing thermal and renewable energy capacity. Searing heatwaves and an uptick in economic activity have resulted in India's electricity generation growing at an average of about 8% annually following the pandemic year of 2020/21, outpacing power demand growth in every major global economy. The company's transmission and distribution segment, which brings in the lion's share of revenue, grew 8.80% to 90.25 billion rupees, while its generation segment clocked in a growth of 68%. Overall revenue from operations climbed 27% to 158.47 billion rupees. The company also recommended a final dividend of 2 rupees per share for the financial year 2024. Its total expenses rose about 24% to 156.91 billion rupees, led mainly by a near two-fold surge in fuel costs. Shares of Tata Power closed lower at 0.3% on Wednesday ahead of results. The stock has climbed about 18% in the reporting quarter, outperforming a 16.6% rise in the Nifty Energy index (.NIFTYENR) New Tab, opens new tab. ($1 = 83.4941 Indian rupees) Sign up here. https://www.reuters.com/business/energy/indias-tata-power-posts-15-jump-q4-profit-robust-demand-2024-05-08/

2024-05-08 11:24

April 30 (Reuters) - (This April 30 story has been corrected to fix the spelling of Indigo's CEO in paragraph 7) A coin called TON has leapt in value in recent months, with investors betting its integration with messenger service Telegram could bring the cryptocurrency to the app's estimated 900 million users. Telegram endorsed TON in September last year, saying the blockchain and associated token would be its "official Web3 infrastructure". Earlier this month, TON said that Tether tokens could also be issued on its blockchain, allowing Telegram users to send the stablecoin to each other within the app. The TON token has surged, reaching as high as $7.63 on April 11, compared with around $2.21 a year earlier, according to CoinGecko data. With $18.3 billion in circulation, it's the 10th biggest cryptocurrency, coming after memecoin Dogecoin. The prospect of a "super app" or "everything app", uniting payments and shopping with social media or messaging services, has long been a holy grail for investors, who look to China's WeChat for inspiration. In the crypto world, it's sometimes called "SocialFi", short for social finance. Such ideas drove Elon Musk's 2022 acquisition of Twitter, now X. Binance, which helped fund the buyout, said it would explore how crypto could be used on the platform. Britain's Revolut, meanwhile, has approached it from the other direction, starting with a finance app then adding social functions on top. While the appeal of TON is part of broader interest in super apps, it has also been helped by an overall revival in altcoins, said Thomas Puech, CEO of digital asset hedge fund Indigo. "TON did outperform a lot of its peers as many people are buying into the project as interest in alts returned and thanks to the backing of Telegram," he said, adding that Indigo had traded the TON token. TON, short for "The Open Network", has a crypto wallet product within Telegram with more than 6 million monthly users. LIBRA FAILURE Efforts to bring crypto payments into social media have not so far succeeded on a wide scale. Facebook, now Meta, wound down its "Libra" cryptocurrency project after fierce opposition from regulators globally, who were concerned that it could harm financial stability and erode control over monetary policy. "The recent foray into crypto payments through Telegram introduces a new use case for the app, but its acceptance and adoption are still in the nascent stages," said PitchBook senior analyst Robert Le, who said there has been an increase in venture capital interest in SocialFi. "The main challenge is shifting user perceptions in non-Asian markets, where messaging apps are predominantly seen purely for communication rather than as multi-functional platforms." Such integrations present "regulatory, technical and security challenges", said Ram Gopal, a professor at Warwick Business School. "Regulators may be concerned about how these platforms comply with existing financial regulations," he said. "Ensuring users are protected from scams, fraud, and potential losses due to cryptocurrency volatility would be a critical concern for regulators," he added. HISTORY OF TON Telegram Messenger created TON's blockchain in 2018 and raised $1.7 billion by selling the associated cryptocurrency. But the project was hit by charges from the U.S. Securities and Exchange Commission, which said the token sale violated federal securities laws. As part of a 2020 settlement with the SEC, Telegram agreed to stop developing TON. It neither admitted to nor denied the SEC's allegations. A group of unrelated developers then continued to work on the project, picking up where Telegram left off, according to a history on TON's website. TON says it is decentralised, based on an open-source codebase, with no single controlling authority. There's a non-profit foundation behind it, registered in Zug in Switzerland. A spokesperson for TON said that Telegram and TON were distinctly separate entities. The TON Foundation's president is Steve Yun, the body's website says. Andrew Rogozov, former CEO of Russian social media site VK, is a founding member of the foundation, according to his LinkedIn profile. He appeared on stage with Telegram co-founder Pavel Durov and Tether CEO Paolo Ardoino at a conference in Dubai where the partnership to issue the stablecoin on the TON blockchain was announced. Sign up here. https://www.reuters.com/markets/currencies/cryptoverse-ton-takes-off-telegram-tie-up-2024-04-30/

2024-05-08 11:16

SINGAPORE, May 8 (Reuters) - Oil giant Shell said on Wednesday that it has agreed to sell its Bukom refinery in Singapore - one of the world's largest oil refining and trading centres - to a joint venture of Indonesian chemicals firm PT Chandra Asri and global trading house Glencore, culminating a process that began last year. Here are the key details and what's next: WHY IS SHELL SELLING ITS SINGAPORE "CROWN JEWEL" REFINERY? The sale of the complex, which opened in 1961, is part of CEO Wael Sawan's plan to reduce the company's carbon footprint and to focus on its most profitable businesses. Last year, Shell said it was conducting a strategic review of its Singapore assets. WHO ARE THE BUYERS? Chandra Asri is majority owner of the joint venture with Glencore, called CAPGC Pte. Ltd. (CAPGC). Chandra Asri operates Indonesia's sole naphtha cracker which can annually produce 900,000 tons of ethylene and 490,000 tons of propylene, which are basic raw materials that are processed into other petrochemicals. It is a joint venture between several Thai and Indonesian firms including Siam Cement Group, Thai Oil and PT Barito Pacific. Glencore is a Swiss-based producer and marketer of commodities such as copper, cobalt, zinc, nickel and ferroalloys. It markets aluminium and alumina and iron ore, and trades oil and fuel products. WHAT IS BEING SOLD? Shell's Bukom refinery complex includes several crude distillation units with total processing capacity of 237,000 barrels per day (bpd) and a 1 million-ton-per-year steam cracker. Its Jurong Island facility has a 800,000-tpy steam cracker and other derivative petrochemical units making products such as monoethylene glycol and styrene, which are key feedstocks for the polyester and plastic industries. The deal is set to close by year-end, pending regulatory approval. HOW WILL THE DEAL AFFECT REGIONAL TRADE IN CRUDE OIL AND REFINED PRODUCTS? Glencore will likely provide cashflow for Chandra Asri's procurement of crude oil feedstock for its Bukom operations and take refined fuel products such as gasoline, diesel and jet fuel either for its own contract deliveries or for spot sales, a source with direct knowledge of the matter said. "It's very typical for a trading house to provide trade finance to refiners and in return they get paid by cargoes. This way, a trading house can secure long-term stable product supply," said Beijing-based director of downstream consulting at S&P Global Commodity Insights Harry Liu. Glencore declined to comment. It is likely that the refinery will continue to process mostly sour crude as it is a "fairly complex refinery with a residual fluid catalytic cracker, a mild hydrocracker and a vacuum gas oil desulphurisation unit", unless the economics favour sweet crude, said FGE head of Asia refining Ivan Mathews. In the longer run, however, there could be a shift in focus from fuel production to chemicals instead because of economics. "The site produces about 60% transport fuels and about 14% chemicals. Given the long-term value add from chemicals, we could see a deeper shift from transport fuels to chemicals at the site. But this will depend on how discussions work out between Chandra Asri and Glencore," said Wood Mackenzie's research director Sushant Gupta. From the downstream portion, Chandra Asri is likely to take naphtha from the Bukom facility to feed its steam cracker, according to a source directly involved in the matter as well as analysts. "The ownership of Shell's refinery will give (Chandra Asri) additional flexibility in feedstock sourcing. Chandra Asri can also tap into Glencore's logistical capabilities to improve the synergy between the two manufacturing sites," said Wood Mackenzie principal analyst Catherine Tan. Chandra Asri may also opt to shelve an earlier cracker expansion at its Cilegon site, instead using the newly acquired Jurong Island site as its second complex, two sources familiar with the plant operations added. "While we are not expecting any immediate impact to supply/demand in the near to medium term as the deal will take some time to close, the deal will likely impact Chandra Asri’s plans for CAP2, which could be shelved," Tan said, referring to a second naphtha cracker. Chandra Asri did not immediately respond to a request for comment. WHICH OTHER REFINERIES STILL OPERATE IN SINGAPORE? ExxonMobil operates a 600,000-bpd refining site in Jurong Island and Tuas, while Singapore Refining Co has a 290,000-bpd refinery at Jurong Island. WHAT OTHER ASSETS DOES SHELL HAVE IN SINGAPORE? Shell says it owns "over 57" retail fuel stations in the city-state, and has stakes in two petrochemical plants, the Petrochemical Corp of Singapore (PCS) and the Polyolefin Company (TPC) Singapore. Sign up here. https://www.reuters.com/markets/deals/shells-singapore-refinery-sale-its-market-significance-2024-05-08/

2024-05-08 11:14

PM says Thailand facing drug addiction problem Move follows cannabis business boom in Thailand Cannabis should be for medical use only, PM says BANGKOK, May 8 (Reuters) - Thailand will re-list cannabis as a narcotic by year-end, its prime minister said on Tuesday, in a stunning U-turn just two years after becoming one of the first countries in Asia to decriminalise its recreational use. The moves comes despite rapid growth of a domestic retail sector for marijuana, with tens of thousands of shops and businesses springing up in Thailand in the past two years in an industry projected to be worth up to $1.2 billion by 2025. "I want the health ministry to amend the rules and re-list cannabis as a narcotic," Prime Minister Srettha Thavisin said on social media platform X. "The ministry should quickly issue a rule to allow its usage for health and medical purposes only." Cannabis was decriminalised for medical use in 2018 and recreational use in 2022 under a previous government, but critics say its liberalisation was rushed through, causing huge confusion about rules and regulations. Srettha's comments followed a meeting with agencies involved in narcotics suppression, where he vowed to take a tough stand on illicit drugs and ordered authorities to deliver results and show "clear progress" in the next 90 days. "Drugs is a problem that destroys the future of the country, many young people are addicted. We have to work fast, to confiscate assets (of drug dealers) and expand treatment," he said. He also asked authorities to redefine what constitutes drug possession under the law, from "small amount" to "one pill", to to enable tougher enforcement by authorities. Srettha's government had earlier said it wants to push out a cannabis law New Tab, opens new tab by year-end that would ban recreational marijuana and allow its use for medical and health purposes only. It was not immediately clear when cannabis will be re-listed as a narcotic or what processes must first take place. Prasitchai Nunual, secretary-general of Thailand's Cannabis Future Network, said re-criminalising cannabis would be a bad move for the economy and deal big blow to small businesses and consumers. "Many people have been growing cannabis and opening cannabis shops. These will have to close down," he told Reuters. "If scientific results show that cannabis is worse then alcohol and cigarettes then they can re-list it as a narcotic. If cannabis is less harmful, they should list cigarettes and alcohol as narcotics too." Sign up here. https://www.reuters.com/world/asia-pacific/thai-pm-says-cannabis-be-re-listed-narcotic-by-end-2024-2024-05-08/

2024-05-08 11:12

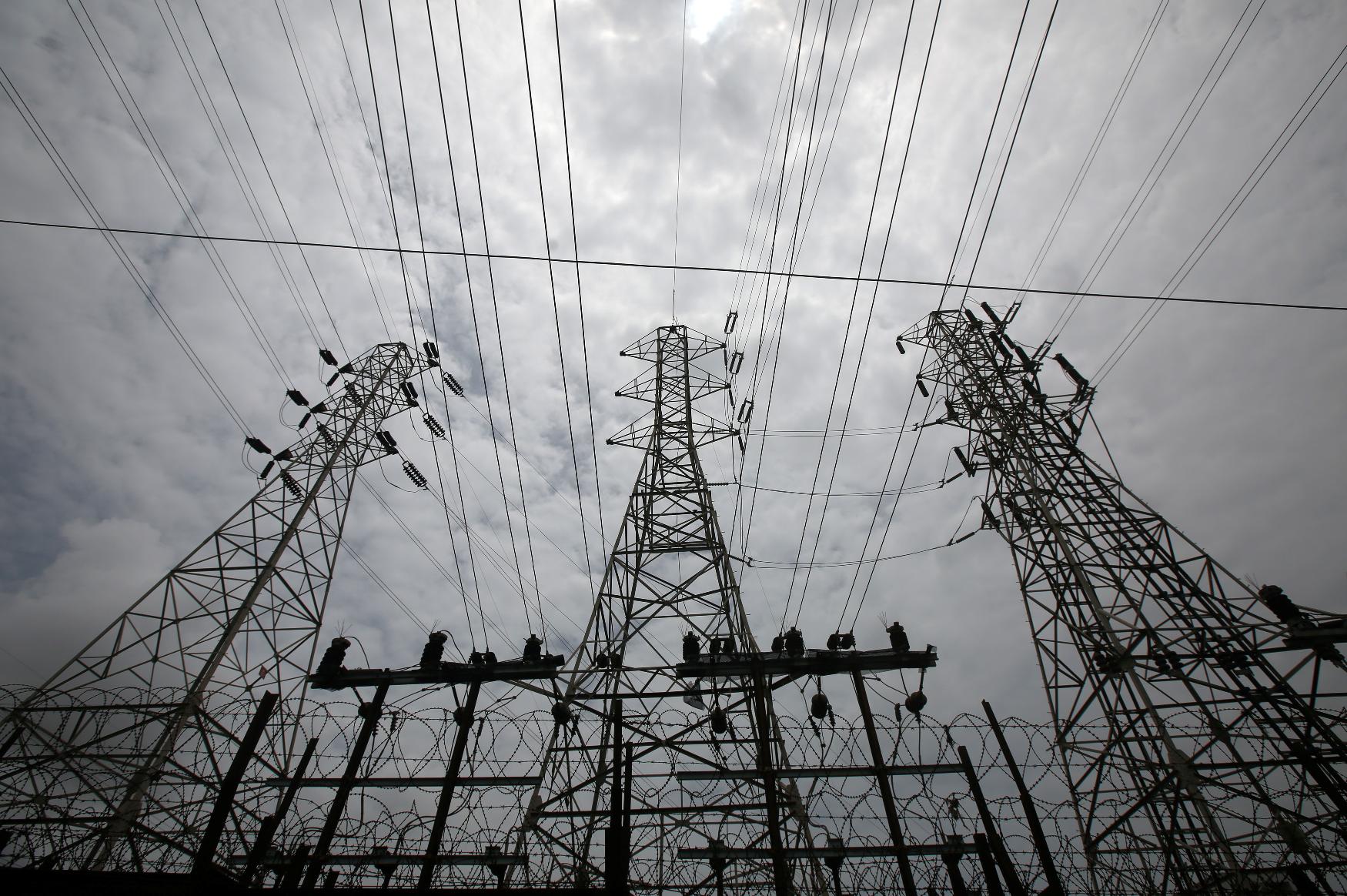

KYIV, May 8 (Reuters) - Russia launched a barrage of missiles and drones at Ukraine on Wednesday, hitting nearly a dozen energy infrastructure facilities across the country, in the latest in a string of attacks on the power sector over the past two months. Here is an overview of Ukraine's worsening energy situation since Russia's February 2022 full-scale invasion. DAMAGE Ukraine's energy system was badly damaged by a Russian air campaign in the war's first winter and only partially repaired. Russian forces renewed their assault on the grid on March 22, 2024, attacking thermal and hydro-electric power stations and the main power distribution substations. Ukraine lost about 80% of its thermal power generation and about 35% of its hydropower capacity during the renewed attacks, officials said. DTEK, Ukraine's largest private energy company which typically covers about a quarter of the nation's total energy needs, said the attacks had damaged five of its power plants and took out 80% of their capacity. Smaller, state-owned Centenergo said it lost all its generating capacity after the Trypilska coal-powered plant outside Kyiv, a major supplier for the Kyiv region and two central regions, was destroyed on April 11. Its other station was destroyed in March and another one is occupied. Officials say Russia has also attacked Ukrainian natural gas infrastructure, targeting underground storage facilities. Naftogaz said the state energy company's facilities had been attacked at least five times since March 2024. NUCLEAR Before Russia's invasion, Ukraine had one of Europe's largest electricity systems and was a net power exporter. In 2020, the installed capacity was about 54.5 GW and the mix was diversified. Now Ukraine has to rely increasingly on its three nuclear power plants, which produce about 60% of its electricity. Ukraine's six-reactor Zaporizhzhia, Europe's biggest such plant, was occupied by Russia at the start of its invasion. Thermal and hydro-electric power generation are needed to keep the levels of supply and consumption balanced during peak hours of energy consumption in the morning and evening. Ukraine is also developing renewable energy, hydro-electric power, solar, biogas and wind, which it sees as vital to creating a "decentralised" system that would be less vulnerable to Russian bombing. BLACKOUTS Russian attacks have forced authorities to impose rolling blackouts in multiple regions, but their full impact will likely be felt when seasonal energy consumption peaks at the height of summer and in winter. Power companies and officials are urging Ukrainians to minimise their power use and avoid using more than one electrical household appliance at a time, especially during peak evening hours. Ukraine consumed about 17-18 GW prior to the war, International Energy Agency data shows. No new data was available. Ukraine's second largest city, Kharkiv, the surrounding region and several other frontline regions in the east are already facing rolling blackouts because of a power shortfall. Analysts expect that to become larger in the summer as temperatures rise, which would in turn force the government to introduce broader blackouts in July and August. The colder autumn and winter months will worsen that shortfall. Energy Minister German Galuschenko has called on residents and businesses to start preparing and to purchase power generators and power banks. RESILIENCE The government rolled out hundreds of "invincibility" centres offering food, drinks and warmth to people left without power during the first winter of the war. As of April 2024, more than 13,000 centres were functioning across the country. The energy system has been connected to the European Union's united grid since the first weeks of Russia's invasion. Ukraine can import about 1,700 MW of electricity from Europe and relies on imports from its Western neighbours to balance its system during peak hours. Kyiv hopes to increase these volumes. Kyiv depends heavily on Western supplies of energy equipment and financial support to repairs its power system. Ukraine's government has set up a special fund to accumulate foreign funds to carry out repairs. Sign up here. https://www.reuters.com/world/europe/how-ukraine-is-keeping-lights-under-russian-fire-2024-05-08/