2024-05-02 14:04

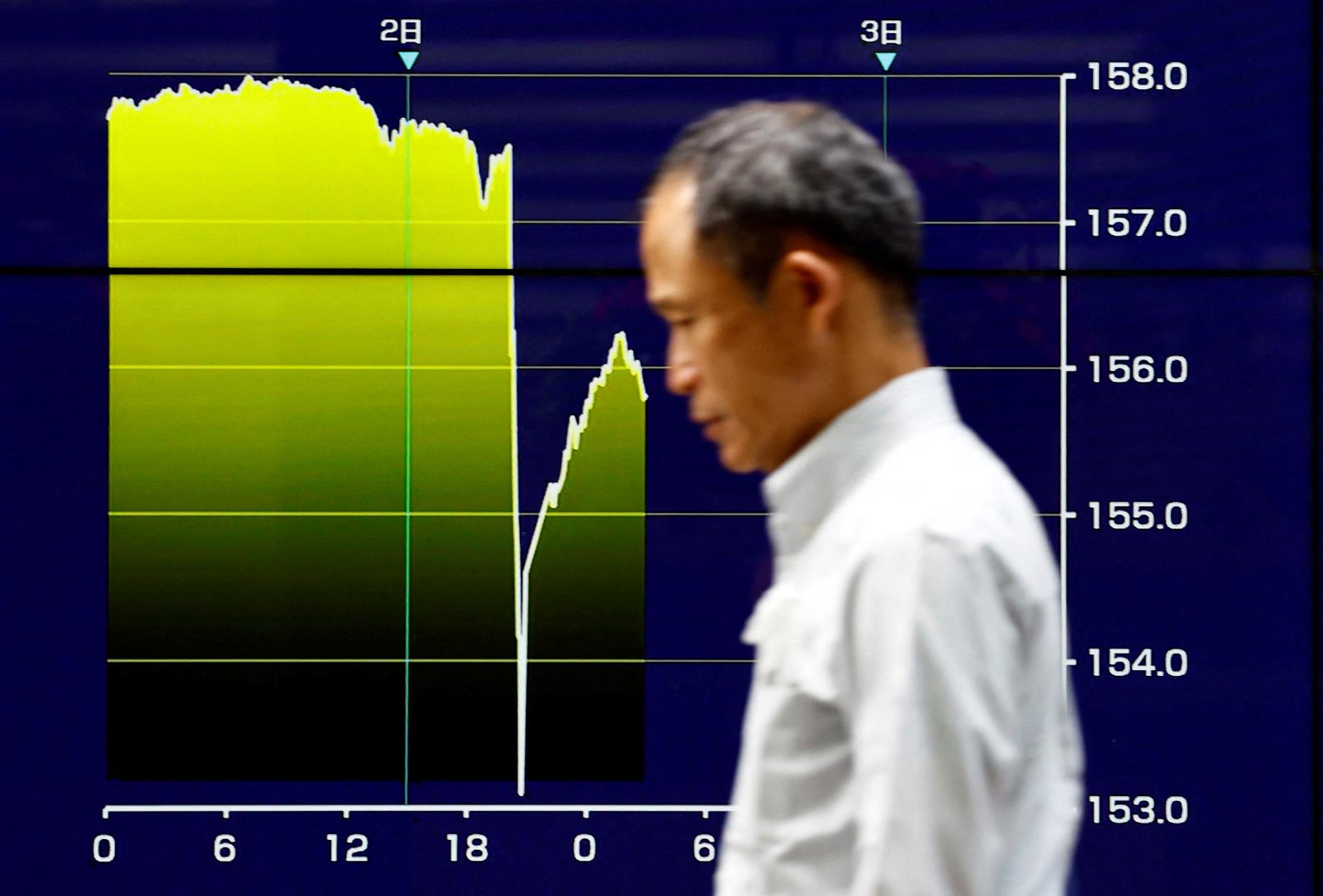

Markets on edge after suspected yen intervention this week Looming public holidays add to trader unease 160 seen as line in sand for the BOJ LONDON, May 2 (Reuters) - Japan's attempts to shore up its currency are putting trading desks across the globe on high alert and dealers are taking no chances ahead of a long weekend in London and Tokyo that might offer authorities another opportunity to bolster the frail yen. The Japanese currency, which is around its weakest since 1990, has witnessed its biggest weekly price swing since 2022, when the Bank of Japan bought the yen for the first time since 1998. Traders suspect the authorities stepped in on at least two days this week and data from the BOJ suggests Japanese officials may have spent almost $60 billion in doing so -- roughly what they spent on three bouts of intervention over September and October 2022. The blueprint for what they believe is intervention now includes operating in a near-vacuum of market liquidity, and a series of Japanese public holidays plus Monday's holiday in the UK - the world's biggest FX trading centre - could present a possible window. Monday's suspected intervention took place on a Japanese holiday and Wednesday's was late in New York. Currency intervention during quieter periods, can potentially have more impact, giving the BOJ more bang for its buck. Japanese authorities have repeatedly declined to comment. "We're (now) telling clients not to be surprised that these intervention efforts are coming at questionable times, this is multi-pronged and its meant to be opaque, as this is where they are going to have the biggest impact on overall market psychology," said Simon Harvey, head of FX analysis at Monex Europe, which advises companies and investors on currency management. Reuters spoke to a number of large investment banks and asset managers in London on their staffing plans for Monday. At least three said FX trading desks were staffed on public holidays to cover overseas markets but added it was usual to make adjustments if needed. REASON FOR UNEASE During Monday's Japanese holiday, the dollar hit a new 34-year high of 160.245 yen, before getting swatted back to a low of 154.40 by the time Europe opened. Excluding previous rounds of intervention, the dollar has only fallen that sharply on a handful of occasions in recent years. Late in the U.S. day on Wednesday, the dollar suddenly plunged 1% in five minutes, tumbling another 2% over another half an hour to the day's low. Spot yen trading volume on the EBS platform hit $77 billion on Monday, its highest since November 2016, CME Group data shows. The data also showed volume hit $42 billion on Wednesday and 78% of that was in a one-hour window late in New York. "The volatility has come in times of illiquidity, causing an increased sense of nervousness ahead of a few holidays between now and Monday," said one London-based trader, declining to be named. LOW RIDER The yen has weakened for over a decade, largely due to how low Japanese interest rates are compared to other large economies including the United States. In the last three years alone, the yen has lost around 35% of its value against the dollar , boosting Japanese exporters' competitiveness, but adding a hefty premium to the import bill. The yawning discount of Japanese rates versus U.S. ones encourages investors to stay positioned against the yen even with the risk of BOJ intervention. "Because of the wide rate differentials, speculators will still be on the other side of this trade," said Kaspar Hense, a senior portfolio manager at BlueBay Asset Management. In fact, in the week ended April 23, speculators held their biggest bearish bet on the yen in seven years in dollar terms, according to the U.S. markets regulator . Volatility in the yen, as measured by overnight options pricing, has shifted up a gear since the BOJ intervened in September 2022. Yen volatility has averaged around 9.4% since then, compared with an average of 7.8% over the last 13 years, according to LSEG data. Central banks and companies dislike currency volatility, as it complicates their risk-management efforts, while traders love how it can juice up their profits. But extreme volatility, such as that seen on Monday and Wednesday, has high stakes. "These are moves that typically take weeks, if not months, to play out, compressed into periods of a few minutes," said James Malcolm, head of FX strategy at UBS. "People's year, or careers, are made typically in the case of minutes and not days or months." Sign up here. https://www.reuters.com/markets/currencies/traders-prep-another-round-yen-whack-a-mole-2024-05-02/

2024-05-02 13:10

HOUSTON, May 2 (Reuters) - U.S. regulators gave the go-ahead on Thursday to Exxon Mobil's (XOM.N) New Tab, opens new tab $60 billion purchase of Pioneer Natural Resources (PXD.N) New Tab, opens new tab, but barred Pioneer's former CEO from Exxon's board on allegations he attempted to collude with OPEC to raise oil prices. Former Pioneer CEO Scott Sheffield coordinated efforts with U.S. shale oil producers to constrain their output and raise energy prices, the Federal Trade Commission said. Widely considered the dean of U.S. shale because of his long tenure and blunt comments on industry output and spending, Sheffield used his influence "to align oil production across the Permian Basin in West Texas and New Mexico with OPEC+," the FTC claimed. “Mr. Sheffield’s past conduct makes it crystal clear that he should be nowhere near Exxon’s boardroom," said Kyle Mach, deputy director of the FTC’s Bureau of Competition. When asked if the FTC would refer the collusion allegations to the U.S. Department of Justice for further investigation, a FTC spokesperson said: “The FTC has a responsibility to refer potentially criminal behavior and takes that obligation very seriously.” The DOJ did not reply to a request for comment. Pioneer said Sheffield had "neither the intent nor an effect of his communications to circumvent the laws and principles protecting market competition." The FTC's consent for the deal will come as a relief to other energy companies with mergers under antitrust reviews. But it drew criticism from lawmakers over the industry's concentration. Multibillion-dollar deals involving Chevron, Diamondback Energy, Occidental Petroleum, and Chesapeake Energy are before the FTC. "The American Big Oil oligopoly has for decades followed the lead of a foreign oil cartel to set high prices for consumers and reap mega-profits while destroying the planet," said Sen. Sheldon Whitehouse. "It is disappointing that FTC is making the same mistake they made 25 years ago when I warned about the Exxon and Mobil merger in 1999," added U.S. Senate Majority Leader Chuck Schumer. DEAL TO CLOSE FRIDAY Exxon plans to close the Pioneer purchase on Friday. The deal will make it the largest oil producer in the Permian Basin with more than 1.3 million barrels of oil equivalent per day (boepd). The oil giant said it will not add Sheffield to its board. It learned of the collusion allegations during the antitrust review, but the FTC investigation "raised no concerns with our business practices," a spokesperson said. Its shares rose a fraction to $116.24. The agreement frees Exxon to focus on a dispute with rival Chevron (CVX.N) New Tab, opens new tab over its proposed acquisition of Hess Corp (HES.N) New Tab, opens new tab, which owns a 30% stake in a prized Exxon joint venture in Guyana. Sheffield retired as Pioneer's CEO on Dec. 31, but continued to serve on its board and had been due to take a seat on Exxon's board when the acquisition deal closed. Pioneer said it was "surprised" by the FTC’s complaint but wanted the deal to close. Its former CEO's comments on the industry were "matters of public interest" and should not disqualify him from a board seat, a spokesperson said. Sheffield was a regular speaker at energy investor and industry conferences. His pronouncements on OPEC production cuts and oil price trends were widely quoted. The FTC complaint pointed to some of his remarks on the dangers of higher shale output as part of a "coordinated output reduction scheme" that threatened companies which did not restrain their production gains. The agency described the executive's 2020 call for the Texas Railroad Commission, the state's energy regulator, to consider mandating production cuts as uncompetitive behavior. Sheffield's urging of state cuts was consistent with then President Donald Trump's urging OPEC to pare output to save U.S. oil jobs. SHALE - OPEC TALKS The FTC says collaboration between OPEC and American oil firms would lead to production growth rates below what would typically be observed in a competitive market, sending energy prices up. Sheffield was among the executives who attended near-annual dinners with OPEC members at a Houston energy conference. The private get-togethers began late last decade with invitations to Sheffield and others by OPEC's late Secretary General Mohammed Barkindo. OPEC had failed to halt U.S. shale's rapid gains in market share, and its members were surprised at how quickly U.S. companies were able to recover after a punishing oil-price war that spanned 2014 through 2016. The war ended when OPEC curbed its production and prices rebounded. Attendees at the CERAWeek energy conference dinner included shale executives John Hess, Vicki Hollub, Rick Muncrief, and Domenic Dell'Osso. They would generally discuss the oil market, spare capacity, oil demand and shareholders' expectation for returns, some attendees have said. Sheffield told Reuters in a March 2023 interview on Saudi Aramco's interest in developing its shale reserves that his company had twice hosted officials and explained the company's operations and business practices. Aramco is the national oil company of OPEC kingpin Saudi Arabia. Sign up here. https://www.reuters.com/markets/deals/us-ftc-order-bans-exxon-mobil-pioneer-natural-resources-deal-2024-05-02/

2024-05-02 12:55

May 2 (Reuters) - Top U.S. oil and gas producer Exxon Mobil (XOM.N) New Tab, opens new tab has won the approval of the Federal Trade Commission (FTC) to close its deal for Pioneer Natural Resources (PXD.N) New Tab, opens new tab on the condition that former Pioneer CEO Scott Sheffield is kept off its board. The U.S. oil and gas industry went on a $250 billion buying spree in 2023 and the consolidation wave has continued into 2024. The mergers and acquisitions have drawn increased antitrust scrutiny, with the FTC reviewing multi-billion dollar deals, including those involving Chevron (CVX.N) New Tab, opens new tab, Diamondback Energy (FANG.O) New Tab, opens new tab, Occidental Petroleum (OXY.N) New Tab, opens new tab and Chesapeake Energy (CHK.O) New Tab, opens new tab. Here are the major deals in the global oil and gas sector since the 2000s: 2001 Chevron buys Texaco in a $39.5 billion deal and emerges as one of the largest energy firms in the world. 2002 Shareholders of Conoco and Phillips Petroleum, and the Federal Trade Commission approve an $18 billion merger between the companies and created the third-largest U.S. oil firm ConocoPhillips (COP.N) New Tab, opens new tab. 2005 Chevron agrees to buy California rival Unocal for about $16.4 billion after fighting off Italian oil group Eni (ENI.MI) New Tab, opens new tab, China's CNOOC and other rumored suitors. 2006 ConocoPhillips acquires Burlington Resources in a $35.6 billion deal and gains access to lucrative positions in North American gas-rich basins. 2007 Norway's Statoil buys the oil and gas assets of Norsk Hydro for $30 billion to create a new energy firm, Equinor (EQNR.OL) New Tab, opens new tab. 2010 Exxon Mobil acquires XTO Energy for about $30 billion in stock to bolster its position as a leading U.S. natural gas producer. 2012 Russia's state oil company Rosneft (ROSN.MM) New Tab, opens new tab buys TNK-BP from UK-based BP (BP.L) New Tab, opens new tab in a $55 billion deal. Kinder Morgan (KMI.N) New Tab, opens new tab finalizes a $21 billion deal to buy El Paso Corp, combining the two largest natural gas pipeline operators. 2014 Kinder Morgan buys all of its publicly traded units (Kinder Morgan Energy Partners LP, Kinder Morgan Inc with Kinder Morgan Management and El Paso Pipeline Partners) in a $70 billion deal. 2015 Shell (SHEL.L) New Tab, opens new tab (then Royal Dutch Shell) acquires British rival BG Group in a $70 billion deal. 2018 Marathon Petroleum (MPC.N) New Tab, opens new tab takes over rival Andeavor for $23 billion. 2019 Occidental Petroleum (OXY.N) New Tab, opens new tab acquires Anadarko Petroleum in a $38 billion deal. 2020 ConocoPhillips buys Concho Resources for $9.7 billion in 2020's top shale deal. Saudi Aramco (2222.SE) New Tab, opens new tab completes its purchase of a 70% stake in petrochemicals company Saudi Basic Industries for $69.1 billion. PipeChina takes over oil and gas pipelines, and storage facilities from PetroChina (601857.SS) New Tab, opens new tab and Sinopec in a deal valued at $55.9 billion. 2021 Norway's Aker BP (AKRBP.OL) New Tab, opens new tab buys Sweden's Lundin Energy in a $13.9 billion cash and stock deal to form Norway's second largest listed oil firm. BHP Group (BHP.AX) New Tab, opens new tab agrees to sell its petroleum business to Woodside in a merger to create an oil and gas producer worth $28 billion with growth assets in Australia and the Americas. 2023 Magellan Midstream Partners' unitholders vote in favor of its sale to larger rival ONEOK (OKE.N) New Tab, opens new tab for $18.8 billion, creating one of the largest U.S. energy pipeline companies. ExxonMobil agrees to buy Pioneer Natural Resources (PXD.N) New Tab, opens new tab in an all-stock deal valued at $59.5 billion that would make it the biggest producer in the largest U.S. oilfield and secure a decade of low-cost production. Chevron agrees to buy smaller rival Hess Corp (HES.N) New Tab, opens new tab in a $53 billion all-stock deal, putting the company head-to-head against rival ExxonMobil in two of the world's fastest growing oil basins - shale and Guyana. Occidental Petroleum (OXY.N) New Tab, opens new tab agrees to buy privately held CrownRock in a cash-and-stock deal valued at $12 billion, its biggest since the debt-laden acquisition of Anadarko Petroleum in 2019. 2024 Diamondback Energy (FANG.O) New Tab, opens new tab signs an agreement to acquire privately held rival Endeavor Energy Partners in a $26 billion cash-and-stock deal to boost its presence in the prolific Permian basin. Sign up here. https://www.reuters.com/legal/litigation/biggest-oil-gas-sector-deals-since-start-century-2023-10-11/

2024-05-02 12:31

BENGALURU, May 2 (Reuters) - A rallying U.S. dollar will stand resolute and may even trade more strongly than predicted in coming months if the policies of the Federal Reserve and other major central banks diverge, according to FX strategists polled by Reuters. Recovering from a lull in late-2023, the greenback has shrugged off forecasts for dollar weakness from strategists in Reuters polls over the past year with aplomb, and is already up 4.3% this year against a basket of major currencies (.DXY) New Tab, opens new tab. It is also more likely to trade higher than predicted rather than lower over the coming three months, according to a near-75% majority of forex strategists, 42 of 58, in an April 29-May 2 Reuters poll. "We remain steadfast in the belief a strong dollar is going to persist. A strong U.S. economy, evident in the activity numbers and stickier inflation, will make it difficult for the Fed to start cutting rates," said Paul Mackel, global head of FX research at HSBC. "As a result...the dollar will remain in pole position versus other major currencies in coming months," he added. Fed Chair Jerome Powell said on Wednesday after the central bank's most recent meeting that policymakers would "take longer than previously expected" to gain adequate confidence in inflation falling back to the 2% target, reinforcing remarks in a recent speech. Financial markets are now pricing in a 56% chance of a first rate cut of at least 25 basis points in September, but a greater 68% chance of a cut in November, according to CME FedWatch tool, in line with economists' predictions in a separate Reuters survey from two weeks ago, and down from six expected in January. That would lead to considerable policy divergence among the world's major central banks, which after raising rates in tandem to levels not seen for several decades to tackle runaway inflation, may start cutting at different times. The European Central Bank and the Bank of England are expected to cut rates earlier than the Fed, in June and August, respectively, according to separate Reuters surveys. Median forecasts from 80 currency strategists in the poll were for the euro to hold at its current $1.07-level until end-July and then gain only slightly to $1.08 in six months, down from the $1.10 predicted in last month's survey and the weakest forecast in Reuters polls so far this year. "We're really surprised at how (U.S.) inflation has evolved - I would have expected it to be at least a couple-tenths of a percent lower by now," said Steve Englander, head of G10 FX research at Standard Chartered. "The backing off of expectations of Fed rate cuts has made a real difference - (the current) episode of dollar strength seems to have more legs to it," he added. The Japanese yen , down about 10% for the year and marking a 34-year low of 160.03/$ earlier this week, recovered some of its losses on suspected intervention from Japanese authorities. It will strengthen only slightly to 152/$ by end-July, but then be one of the biggest gainers among major currencies and rise about 8% to 143.67/$ in 12 months, the survey showed. However, it was more likely the currency would trade weaker than predictions than stronger in three months, according to 13 of 18 respondents answering an additional question. "With U.S. yields heading higher and the dollar strengthening, what the Bank of Japan is really trying to do is buy time to slow the pace of (recent) weakness until fundamentals start to move in favour of a stronger yen," said Lee Hardman, senior currency analyst at MUFG. (For other stories from the May Reuters foreign exchange poll:) Sign up here. https://www.reuters.com/markets/us/greenback-strength-persist-delayed-fed-rate-cut-calls-2024-05-02/

2024-05-02 11:50

May 2 (Reuters) - Intercontinental Exchange (ICE.N) New Tab, opens new tab reported a rise in adjusted profit for the first quarter on Thursday as volumes hit a record on surge in energy markets trading. The conflict in the Middle East has resulted in a reshaping of the global commodities and energy markets, significantly raising volatility as investors assess the impact of shifting supply chains. Energy trading volumes surged a record 27% with gains across segments, including oil, gasoil as well as other crude and refined products. Natural gas average daily volumes jumped 34%, including record options. Trading across other markets was also robust with agriculture and metals climbing 11%, helped by a record 47% surge in cocoa trading volume. Prices of the commodity behind chocolate have soared to all-time highs as supply tightened after years of poor harvests. Total average daily volumes at ICE jumped 16% to hit a record in the first quarter. Consolidated net revenue rose 21% to $2.3 billion. While U.S. initial public offerings are expected to rebound this year as capital market volatility settles, the post-debut performance of newly listed companies has been uneven, prompting some caution from investors. Listings revenue fell 4% to $122 million. The company's flagship New York Stock Exchange hosted the IPOs of several high-profile companies in the first quarter, including social media firm Reddit (RDDT.N) New Tab, opens new tab and Wilson tennis racket maker Amer Sports (AS.N) New Tab, opens new tab. ICE's adjusted first-quarter net income rose to $852 million, or $1.48 per share compared with $791 million, or $1.41 per share, a year earlier. Sign up here. https://www.reuters.com/business/finance/nyse-parent-ices-profit-rises-record-surge-energy-market-volatility-2024-05-02/

2024-05-02 11:48

May 2 (Reuters) - Targa Resources (TRGP.N) New Tab, opens new tab beat Wall Street estimates for first-quarter core profit, as the pipeline operator benefitted from higher volumes of natural gas liquids (NGL) transported through its system. NGL pipeline transportation volumes were up nearly 34% in the January-March quarter compared to last year, while NGL sales rose about 22% to 1.23 million bbl/d in the quarter from a year earlier. Crude prices gained in the January-March quarter, as production curtailments from OPEC+, Russian refinery outages and the Middle East conflict raised concerns over supplies, helping oil and gas transportation firms like Targa Resources charge higher fees. The company said its pipeline transported higher volumes primarily through its systems in the Permian Basin. NGLs are hydrocarbon liquids like ethane, propane and butane among others which are used as fuels for heating, refrigeration and gasoline blending among others. Targa Resources said its revenue for the first quarter rose slightly to $4.56 billion, from $4.52 billion last year. The company reaffirmed its full-year adjusted core profit forecast of $3.7 billion to $3.9 billion, compared with analysts' estimates of $3.84 billion, according to LSEG data. On an adjusted basis, the Houston, Texas-based company's core profit was $966.2 million in the quarter ended March 31, compared with analysts' estimates of $937.95 million. Sign up here. https://www.reuters.com/business/energy/targa-resources-beats-first-quarter-core-profit-estimates-higher-transportation-2024-05-02/