2024-04-30 22:56

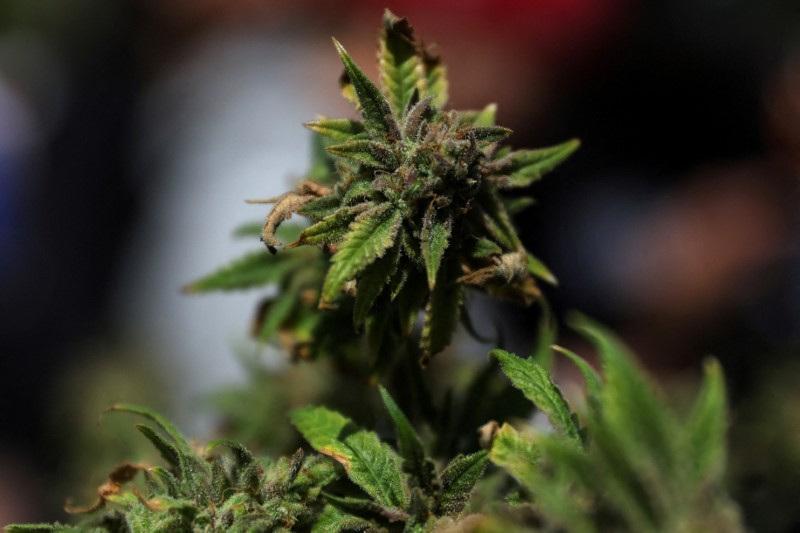

April 30 (Reuters) - The U.S. Justice Department is moving to make marijuana use a less serious federal crime with a proposal to reclassify the drug as on par with Tylenol with codeine, rather than heroin, according to sources. Here are some ways those changes will affect business. WHAT DOES RESCHEDULING ENTAIL? Under the Controlled Substances Act, marijuana is listed as a schedule one substance, meaning it has a high potential for abuse and no current accepted medical use. The Department of Justice, which oversees the Drug Enforcement Administration, recommended that cannabis be classified as a so-called schedule three drug, with a moderate to low potential for physical and psychological dependence. WHAT COMES NEXT? According to TD Cowen analysts, a review of the proposal by the Office of Management and Budget will probably last until late May or June. Then the proposal would be published in June or July in the Federal Register and a comment period held. DEA then must study the comments, and it also has to hold a hearing before an administrative judge. WHAT WOULD BE THE TAX IMPLICATIONS? One of the biggest benefits for cannabis firms would be that they would no longer be subject to Section 280E of the U.S. federal tax code. That provision prevents businesses dealing in schedule one and two controlled substances from claiming tax credits and deductions for business expenses. The tax change would put close to $3.5 billion of cash back into the sector, which will lower the overall cost of capital for the industry, and spark a flurry of M&A activity, said Katan Associates International founder Seth Yakatan. Sign up here. https://www.reuters.com/world/us/how-us-change-marijuana-would-help-cannabis-companies-2024-04-30/

2024-04-30 22:54

Amazon reports Q1 results Eli Lilly jumps after raising annual profit forecast GE Healthcare shrinks after Q1 revenue miss NEW YORK, April 30 (Reuters) - U.S. stocks ended lower on Tuesday as markets weighed economic data showing rising labor costs and deteriorating consumer confidence on the day of a key Federal Reserve policy meeting to decide the direction of interest rates. Data showed on Tuesday that U.S. labor costs rose by a more-than-expected 1.2% last quarter, indicating an uptick in wage pressures. A survey also found that U.S. consumer confidence worsened in April, dropping to its lowest level in more than 1-1/2 years. The reports came a day before the Federal Reserve Open Market Committee (FOMC) ends its two-day meeting, with investors widely expecting the central bank to leave interest rates unchanged. Most Magnificent Seven stocks finished lower, including Tesla (TSLA.O) New Tab, opens new tab, Alphabet (GOOGL.O) New Tab, opens new tab, Nvidia (NVDA.O) New Tab, opens new tab, Microsoft (MSFT.O) New Tab, opens new tab, and Amazon (AMZN.O) New Tab, opens new tab. "We're still in an environment where the knee-jerk reaction is to extrapolate any warmer data into firmer inflation and more hawkish reaction from the Fed," said Garrett Melson, portfolio strategist at Natixis Investment Managers in Boston. "But nothing has changed: growth is still strong, labor markets are holding up, and ultimately we're taking a little bit of breather in the disinflation process," Melson added. Money markets are pricing in just about 31 basis points (bps) of rate cuts this year, down from about 150 bps estimated at the start of 2024, according to LSEG data. According to preliminary data, the S&P 500 (.SPX) New Tab, opens new tab lost 79.92 points, or 1.56%, to end at 5,036.25 points, while the Nasdaq Composite (.IXIC) New Tab, opens new tab lost 325.26 points, or 2.00%, to 15,664.13. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab fell 574.08 points, or 1.47%, to 37,823.57. Shares of GE HealthCare(GEHC.O) New Tab, opens new tab shrank after its first-quarter revenue missed analyst estimates, 3M (MMM.N) New Tab, opens new tab gained after posting a better-than-expected quarterly profit. Drugmaker Eli Lilly (LLY.N) New Tab, opens new tab jumped after it raised its full-year profit forecast. PayPal(PYPL.O) New Tab, opens new tab rose after raising its full-year adjusted profit forecast. Of the 265 companies in the S&P 500 that have reported earnings to date for the first quarter, 79.2% have beat analyst estimates, compared with the long-term average of 67%, according to LSEG I/B/E/S data. (This story has been refiled to reflect that the Federal Reserve policy meeting is on Tuesday, in paragraph 1) Sign up here. https://www.reuters.com/markets/us/futures-drift-lower-focus-shifts-rate-verdict-2024-04-30/

2024-04-30 22:40

LITTLETON, Colorado, April 30 (Reuters) - The energy ministers of the Group of Seven (G7) major democracies vowed this week to end coal use in power generation within around a decade, marking a further high-profile pledge to accelerate the energy transition away from fossil fuels. Below is a breakdown of how this decision may impact global coal markets and power sector emissions: G7 MEMBER COAL USE The G7 member nations are Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, and collectively they are expected to account for around 44% of global gross domestic product in 2024, according to International Monetary Fund (IMF) data. As the G7 is made up of advanced economies, their power generation systems are generally more developed and less concentrated than the global average. For the G7 bloc as a whole, five separate sources of power account for 10% of more of their total electricity generation: hydro, nuclear, coal, natural gas and renewables. Globally, only hydro, gas and coal account for a 10% share or more of electricity generation. Coal was the fourth-largest source of electricity generation in the G7 in 2023, accounting for an average of 15% of the group's electricity last year, according to energy think tank Ember. That compares to 34% for natural gas, 18% from nuclear, 18% from renewables and 11% from hydro dams. The global average for coal-fired electricity generation in 2023 was 37%, or more than twice the G7 average. In absolute generation terms, the G7 nations produced 1,115 terawatt hours (TWh) of electricity from coal in 2023, compared to 10,093 TWh of electricity produced from coal globally. That 11% share of global coal-fired electricity output is down from a 26.5% share in 2013 and 44% in 2003, and reveals that G7 countries have already made deep cuts to coal use amid intensifying pressure to decarbonise power systems. G7 nations have made similarly steep reductions to their collective coal-fired emissions. In 2023, G7 nations discharged around 1.035 billion metric tons of carbon dioxide and equivalent gases from coal-fired generation, according to Ember, which is the lowest total on record. That tally represents a 10.8% share of the global total, and compares to 2.2 billion tons in 2013 and 2.6 billion in 2003. WIDE RANGE Among the G7 countries, there is wide variance in coal dependence. The least reliant on coal is France, which primarily uses nuclear power for electricity generation and sourced only a fraction of a percent from coal in 2023. The UK generated only around 1.1% of electricity from coal in 2023, while coal only accounted for 4.9% of electricity output in Italy and 5.6% in Canada. However, coal-fired plants generated around 29% of electricity in Japan, 25% in Germany and 16% in the U.S. last year, Ember data shows. That enduring reliance on coal to generate a double-digit share of electricity in three of the world's largest manufacturing economies reveals the G7 group still faces a significant challenge in fulfilling their collective pledge of eliminating the fuel from their power mix over the coming years. Indeed, statements accompanying the G7 pledge included caveats on the timing of the coal phase out in each country, providing wiggle room for Japan and Germany in particular to chart their own coal reduction courses within broader net zero emissions pathways. TRADE FLOW IMPACT In addition to the emissions impact, climate trackers will also be following the consequences of the G7 coal cuts on the international trade of thermal coal. Some of the G7 coal users, especially the U.S. and Germany, are largely self-sufficient in their coal needs due to large local coal mining industries that feed most of their power use needs. But Japan is almost entirely reliant on fuel imports, and as a result was the third-largest global importer of thermal coal in 2023, according to Kpler. Japan imported just over 110 million metric tons of thermal coal last year, compared to around 330 million tons imported by China and 170 million tons by India. If Japan complies with the G7 pledge to phase out coal use by the middle of the next decade, that will result in significant changes to global coal flows over that period, with repercussions for Japan's top current suppliers Australia, Indonesia, Russia and Canada. Some fast-growing economies elsewhere, including India, the Philippines and Vietnam, may snap up some of the reduced volumes bought by G7 nations over the near term. But in the longer run those and other nations plan to sharply increase clean power generation and cut back on fossil fuel use. That suggests the pledge made by the G7 to cut coal use over the next decade could be followed by other nations in due course, resulting in a more comprehensive reduction in coal use over the following decades. Sign up here. https://www.reuters.com/business/energy/emissions-trade-flows-impact-g7-coal-pledge-maguire-2024-04-30/

2024-04-30 22:11

SYDNEY, May 1 (Reuters) - Australian researchers have developed a chemical process that could produce sustainable aviation fuel from landfill gases as a way of cutting carbon emissions, they said on Wednesday. The global aviation industry seeks more sustainable aviation fuel (SAF) to meet a net-zero target on carbon emissions by 2050, but airlines lament lack of supply and a price that is three to five times more expensive than traditional jet fuel. The Sydney University scientists used non-thermal plasma technology that fires high-energy electrons in normal atmospheric conditions into methane and carbon dioxide emitted from landfills, causing carbon and hydrogen to bond. That process leads to production of sustainable aviation fuel, holding out hope for a net-zero aviation industry. "It redefines what we think of in terms of chemistry ... I think the impact is very significant," P.J. Cullen, of the university's school of chemical and biomolecular engineering, told Reuters. "In one sense, we have this idea that we're going to be capturing emissions that are coming from landfill. On the other, we have a sector that really needs a new technology in order to become more sustainable." All waste produced in Australia could be converted into energy, said Richard Kirkman, the Australia and New Zealand chief executive of waste management company Veolia. "That can supplement about 10% of Australia's energy supply," Kirkman told Reuters. Sign up here. https://www.reuters.com/business/environment/australian-researchers-eye-sustainable-aviation-fuel-landfill-gases-2024-04-30/

2024-04-30 21:52

April 30 (Reuters) - Shares of cannabis companies surged on Tuesday afternoon after the U.S. Department of Justice (DoJ) moved to reclassify marijuana as a less dangerous drug. U.S.-listed shares of Cronos Group , Tilray Brands (TLRY.O) New Tab, opens new tab and Canopy Growth rose between 14.9% and 67.7%, while ETF AdvisorShares Pure US Cannabis (MSOS.P) New Tab, opens new tab soared 24.8%. Canada-listed Green Thumb Industries (GTII.CD) New Tab, opens new tab and Trulieve Cannabis (TRUL.CD) New Tab, opens new tab were also up 26.6% and 37.3%, respectively. Cannabis firms are taxed under section 280E as a part of Schedule I drug, which disallows them from deducting normal business expenses from their profit, increasing tax burden for the companies. Reclassifying to Schedule III would eliminate this tax, helping towards their profitability. "This would result in meaningful cash benefits for operators and we estimate a cash benefit upwards of $150 mln," Alliance Global Partners analyst Aaron Grey said in a note. The proposal, which, if finalized, could potentially be the most significant shift in federal cannabis policy in 40 years, is being sent to the White House Office of Management and Budget for review and to finalize the rule-making process, sources told Reuters. The reclassification will not legalize marijuana outright for recreational use. Shares of U.S.-listed marijuana companies had similarly soared in 2019 after Canada legalized recreational marijuana use, but the rally collapsed the following year as underwhelming revenue numbers failed to justify their sky-high valuations. Sign up here. https://www.reuters.com/markets/us/pot-stocks-jump-us-doj-moves-reclassify-cannabis-less-dangerous-drug-2024-04-30/

2024-04-30 21:25

April 30 (Reuters) - Cadbury parent Mondelez International (MDLZ.O) New Tab, opens new tab beat market expectations for first-quarter sales and profit on Tuesday helped by steady demand for its pricey products such as chocolates and salted crackers, despite rising costs. Shares of the Chicago-based company were down 1% after the bell as it maintained its annual forecasts for organic net revenue growth and profit. "Mondelez benefited from the strength of its brands and its strong penetration in the snacking category in Q1," said Zak Stambor, senior analyst with eMarketer. While Mondelez International increased its prices by 6.3 percentage points in the quarter, its volumes fell 2.1 percentage points. Last month, peer Campbell Soup (CPB.N) New Tab, opens new tab also saw a dip in volumes owing to price hikes, despite beating quarterly sales and profit estimates on steady demand. As the Ritz cracker maker increased prices to counter rising input costs for labor and transport, it drove away the lower-income cohort that is already grappling with a rising cost of living. The Toblerone maker's volumes in Europe, a major revenue contributor, were down 3.5 percentage points, compared to a 3.3 percentage point rise seen in the last quarter. "While Mondelez has strong brands in resilient categories such as chocolate and biscuits, consumers will trade down if prices rise too high," Zak said. However, significant price hikes undertaken over the last few quarters helped the company expand its gross profit margin to 51.1% in the reported quarter, compared with a 37.3% rise in the last quarter. The firm posted net sales of $9.29 billion for the first quarter, beating analysts' average estimate of $9.16 billion, according to LSEG data. On an adjusted basis, Mondelez reported a profit of 95 cents per share for the quarter ended March 31, compared with analysts' estimate of 89 cents per share, according to LSEG data. Sign up here. https://www.reuters.com/business/retail-consumer/mondelez-international-beats-q1-sales-profit-estimates-2024-04-30/