2024-04-29 19:38

BUENOS AIRES, April 29 (Reuters) - Argentina's oilseed and maritime worker unions kicked off a strike on Monday to protest a labor reform bill backed by radical libertarian President Javier Milei, which lawmakers began debating earlier in the day. Argentina is one of the world's main exporters of processed soybeans and revenue from commodity exports are a major source of foreign currency needed to pay down debt and finance imports for the cash-strapped government amid a prolonged economic slide. The SOEA oilseed union operates in the Rosario area, home to most of the country's soybean processing plants and ports. The strike started just after lawmakers in Argentina's lower house of Congress began debate on two sweeping economic reform bills proposed by Milei that call for privatizations and tighter fiscal policy, as well as taxes on high salaries and a labor reform. Daniel Succi, the union's secretary general, said the strike will continue while the congressional session lasts. "Afterwards, we'll see; we'll evaluate," he said. Milei took power in December pledging to slash public spending and stave off hyperinflation, but his reform push has faced stiff resistance from center-left opponents. "We have a total stop of activity," Alejandro Vargas, a United Maritime Workers Union (SOMU) leader, told local television. The maritime union also called for demonstrations at Congress on Tuesday. The bills up for debate include provisions to lower the threshold for salaries subject to income tax, part of a slimmed-down version of an earlier Milei-backed package. Gustavo Idigoras, who heads Argentina's oilseeds and grains exporters chamber, said he agreed with the union's opposition to changes to the income tax, but expressed worry. "This industry pays very good salaries, so it's contradictory to paralyze it (with a strike), making those who provide these jobs lose money," said Idigoras. The lower house session is expected to be drawn out and could last until Tuesday. Sign up here. https://www.reuters.com/world/americas/argentina-oilseed-union-strikes-protest-milei-labor-reforms-2024-04-29/

2024-04-29 19:33

April 29 (Reuters) - Finnish refiner Neste (NESTE.HE) New Tab, opens new tab said on Monday its president and CEO Matti Lehmus would be stepping down and that the company was launching a hunt to find his replacement. Lehmus will continue as president and chief executive until his successor takes over, the firm said in a statement. Shares of Finland's Neste plummeted in February after the biofuels producer and oil refiner posted fourth-quarter operating profit below expectations and forecast a lower 2024 renewable products sales margin than last year's. Last November, Neste cut 400 jobs globally as it planned to save 50 million euros ($53.60 million) annually to prepare for increasing competition in renewable fuels. It also said it would merge its Renewable Aviation, Renewable Road Transportation and Renewable Polymers and Chemicals divisions into one and streamline its development portfolio. The refiner and biofuels producer has grown rapidly in recent years after investing early in the renewable fuels it makes from waste and residue. Industries and transport operators are increasingly seeking greener fuel alternatives to cut their emissions. But Neste's rapid growth came at the cost of complexities in its organisation as well as a large number of development projects, which Lehmus earlier said the firm needed to reassess. ($1 = 0.9329 euros) Sign up here. https://www.reuters.com/business/energy/oil-refiner-neste-says-ceo-matti-lehmus-will-be-stepping-down-2024-04-29/

2024-04-29 18:23

Canadian dollar gains 0.1% against the greenback Touches its strongest since April 10 at 1.3632 Price of U.S. oil falls 1.7% Canadian bond yields ease across the curve TORONTO, April 29 (Reuters) - The Canadian dollar edged up to a near three-week high against its U.S. counterpart on Monday as risk sentiment improved and ahead of monthly GDP data this week that could offer clues on the strength of the domestic economy. The loonie was trading 0.1% higher at 1.3656 to the U.S. dollar, or 73.23 U.S. cents, after earlier touching its strongest level since April 10 at 1.3632. "It has been a somewhat quiet start to the week, with firmer equity and bond markets underpinning risk sentiment and weighing on the USD more broadly," said George Davis, chief technical strategist at RBC Capital Markets. The U.S. dollar (.DXY) New Tab, opens new tab lost ground against a basket of major currencies as the yen rose sharply following possible intervention by Japanese authorities, while Wall Street's main indexes crept higher and U.S. Treasury yields eased for a second straight day. Investors were awaiting a Federal Reserve interest rate decision, due on Wednesday, as well as Tuesday's Canadian GDP data. Economists expect that Canada's economy grew 0.3% month-over-month in February, after advancing 0.6% in January. Speculators have reduced their bearish bets on the Canadian dollar, data from the U.S. Commodity Futures Trading Commission showed on Friday. As of April 23, net short positions had decreased to 76,450 contracts after hitting 82,815 in the prior week, the highest level in nearly seven years. The price of oil, one of Canada's major exports, fell as Israel-Hamas ceasefire talks in Cairo tempered fears of a wider Middle East conflict. U.S. crude oil futures were down 1.7% higher at $82.45 a barrel. Canadian government bond yields eased across the curve, tracking moves in U.S. Treasuries. The 10-year was down 5.9 basis points at 3.767%, after touching on Thursday a near six-month high at 3.891%. Sign up here. https://www.reuters.com/markets/currencies/canadian-dollar-posts-3-week-high-us-currency-retreats-2024-04-29/

2024-04-29 17:12

April 29 (Reuters) - Venezuela's use of digital currencies, expected to increase after the United States ordered a wind-down of oil deals with the sanctioned country by May 31, will require greater scrutiny by regulators and law enforcement, experts said on Monday. Venezuela's state oil company PDVSA plans to increase cryptocurrency transactions for its crude and fuel exports as the U.S. reimposes oil sanctions on the country, sources told Reuters earlier this month. It is unclear if payments in digital currency Tether by PDVSA will be targeted by Washington from June 1. Venezuelan opposition politician Leopoldo Lopez and expert Kristofer Doucette presented a report on Monday detailing transactions since Venezuelan President Nicolas Maduro took office. Democratic governments should counter his attempts "to exploit cryptocurrency for moving illicit proceeds into the international financial system," the report said. "Structures must be set up to combat this type of money laundering," said Doucette, national security leader at Chainalysis, a New York-based provider of research and software to governments, exchanges, banks and insurance firms to secure safe transactions with cryptocurrency. Technology for digital transactions is changing fast and transactions are rapidly growing in developing regions including Latin America and Africa benefiting people without access to the banking system. But some corrupt governments are moving faster, making it difficult to prevent fraud, the experts said. Doucette and Sigal Mandelker, a lawyer who previously worked at the U.S. Treasury Department, said during a conference organized by the Wilson Center in Washington that the U.S. administration is making efforts to increase regulation and encourage other countries to improve supervision. Sign up here. https://www.reuters.com/world/americas/experts-politicians-call-scrutiny-venezuelas-use-cryptocurrency-2024-04-29/

2024-04-29 16:28

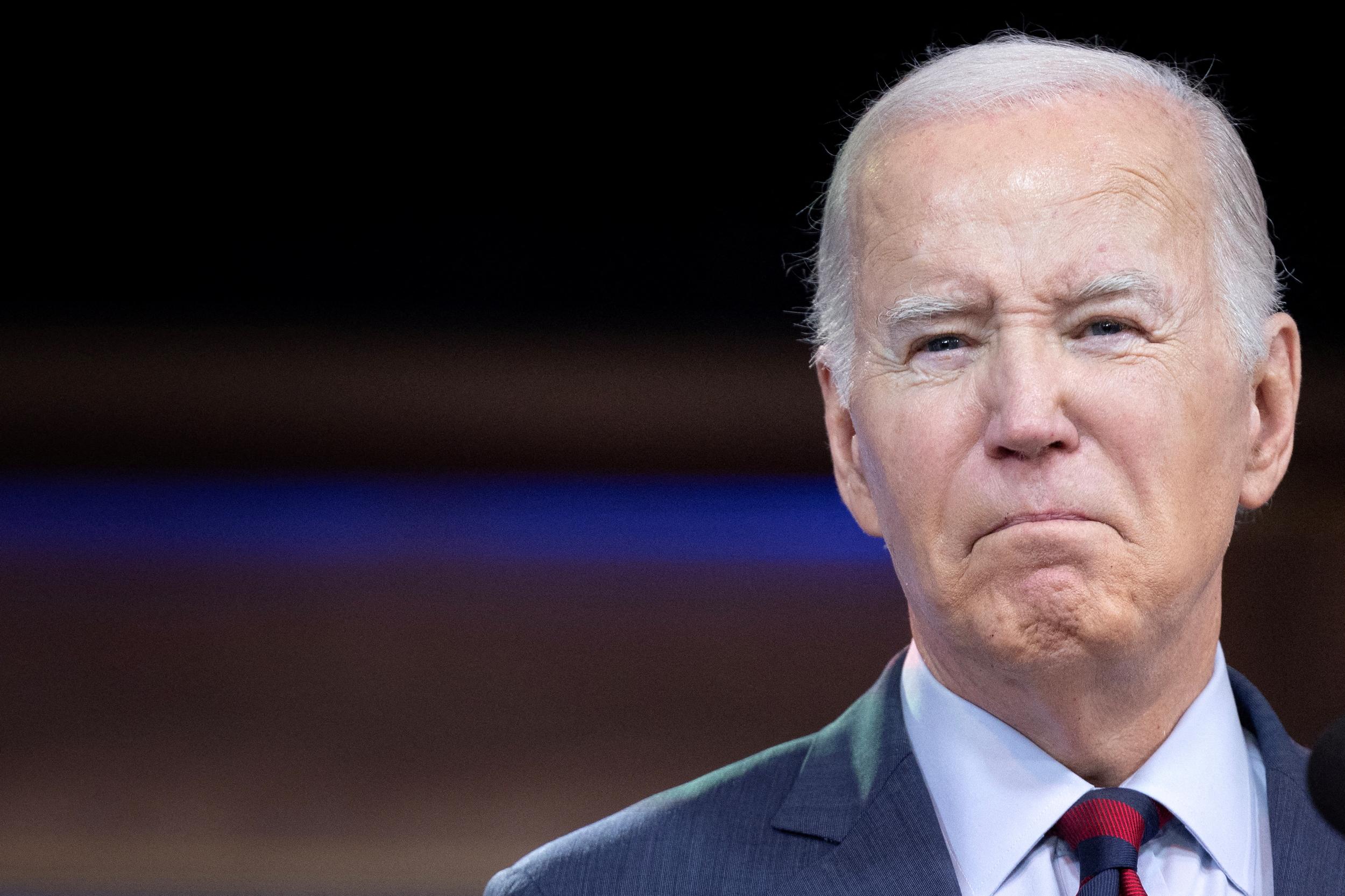

April 29 (Reuters) - Two lawmakers are pressing the Biden administration on the use of cryptocurrency to evade sanctions in Russia, Iran and North Korea, asking officials what additional authorities might be needed to prevent digital assets, such as stablecoin Tether from being used by sanctioned entities in Russia and elsewhere. WHY IT'S IMPORTANT The letter sent on Sunday by U.S. Senators, Democrat Elizabeth Warren and Republican Roger Marshall, to officials including Treasury Secretary Janet Yellen and Defense Secretary Lloyd Austin show increasing scrutiny on how cryptocurrencies could be used to circumvent sanctions. CONTEXT Warren and Marshall raised particular concern about the use of Tether, whose value is pegged to the U.S. dollar and designed to maintain a stable value. The Wall Street Journal reported earlier this month that Russian middlemen used Tether to evade Western sanctions in order to source weapons parts for drones and other military equipment. Reuters also reported this month that Venezuela's state-run oil company PDVSA plans to use Tether in its crude and fuel exports as the U.S. is set to reimpose oil sanctions on the country. KEY QUOTE "The national security threat posed by cryptocurrency requires a commensurate response by our country's defense community," Warren and Marshall said. They noted that even though Tether's preferred crypto trading platform Garantex has been sanctioned, "it is not clear if these actions have stopped the flow of funds through the platform." THE RESPONSE A Tether spokesperson said in a statement that every action with the cryptocurrency is online and traceable, and "every asset can be seized and every criminal can be caught." "We work with law enforcement to do exactly that. Tether respects the (Office of Foreign Assets Control and Specially Designated Nationals) list and collaborates with more than 120 law enforcement agencies from 40 different countries, including FBI, DOJ and the (U.S. Secret Service)," the spokesperson said. Sign up here. https://www.reuters.com/world/us/us-lawmakers-press-biden-administration-use-crypto-evade-sanctions-2024-04-29/

2024-04-29 15:41

LONDON, April 29 (Reuters) - Crypto company Tether has invested $200 million in Blackrock Neurotech, taking a majority stake in the U.S. brain implant company, Tether said in a statement on Monday. Blackrock Neurotech makes brain-to-computer interfaces, including neural implants which can allow people to control computers and prosthetic arms without moving, its website says. It has no relation to the asset manager BlackRock. The deal, which closed on Friday after several months of due diligence, values Blackrock Neurotech at around $350 million, making Tether its largest shareholder, Tether CEO Paolo Ardoino told Reuters. The $200 million from Tether will primarily fund the commercialization and roll-out of Blackrock Neurotech’s technology, which has been used with more than 40 individuals, Tether's statement said. In recent years, various device companies, including Elon Musk's Neuralink, have begun testing brain implants in humans. Tether issues a dollar-pegged cryptocurrency which has grown rapidly in recent years, hitting $100 billion in circulation in March. It says that the tokens are backed up by dollar-denominated reserves. Tether has made approximately $1.7 billion in venture capital investments to date, using funding from its profits, while leaving the reserves untouched, Ardoino said. Tether invests in sectors including sustainable energy, artificial intelligence and peer-to-peer technology, its website says. The arm which invested in Blackrock Neurotech is called "Tether Evo", and is "dedicated to propelling humanity into a future where technology and human capabilities merge in unprecedented ways" the website says. Blackrock Neurotech did not immediately respond to Reuters questions about the deal. Sign up here. https://www.reuters.com/technology/crypto-company-tether-invests-200-mln-brain-chip-maker-blackrock-neurotech-2024-04-29/