2024-04-25 22:09

April 25 (Reuters) - U.S. forest product firm Weyerhaeuser (WY.N) New Tab, opens new tab on Thursday beat estimates for first-quarter profit on increased demand for housing construction. Tight supply of existing homes in the United States pushed buyers to opt for newly made houses, helping forest product firms like Weyerhaeuser. The Seattle-based Weyerhaeuser's quarterly adjusted core profit from its real estate, energy & natural resources segment rose 5.6% to $94 million from a year ago, and was up 24.3% at $184 million from its wood products segment. The company reported an adjusted profit of 16 cents per share for the quarter ended March. 31, compared with analysts' average estimates of 15 cents per share, according to LSEG data. Weyerhaeuser owns or controls about 10.5 million acres of timberlands in the United States and manages additional timberlands under long-term licenses in Canada. It expects higher sales volumes, slightly lower log costs, and moderately lower unit manufacturing costs in the second quarter for lumber. The company reported quarterly revenue of $1.8 billion, a 4.5% fall from the previous year, missing estimates of $1.85 billion. Sign up here. https://www.reuters.com/business/weyerhaeuser-beats-quarterly-profit-estimates-high-real-estate-demand-2024-04-25/

2024-04-25 21:55

HOUSTON, April 25 (Reuters) - The second-largest U.S. liquefied natural gas (LNG) export facility has been running below 80% of its capacity due to technical problems, data from financial firm LSEG showed, denting U.S. exports. Since Jan. 15, Freeport LNG's Quintana, Texas, liquefaction plant has been operating without at least one of its three gas-processing trains. In the last two weeks, it has taken barely enough gas for one of its trains to fully operate. On Thursday, it took in 61 million cubic feet (mcf) of gas, compared to its capacity for 2.2 billion cubic feet per day (bcfd), LSEG data showed. A Freeport LNG spokesperson declined to comment. The company has blamed a January freeze for damage to its Train 3 motors, and in March said it had taken proactive steps to inspect and would take two other trains offline for servicing. "Future LNG projects will want to study what went wrong with Freeport's design," Ira Joseph, a senior research associate at Columbia University's Center on Global Energy Policy, said on social media site X. The plant's "lack of reliability is really sending Henry Hub (U.S. natural gas futures) for a wild ride," wrote Joseph. Henry Hub prices have fallen from $2.90 per million cubic feet (mmcf) on Jan. 16 to $1.63 per mmcf on Thursday. Freeport's operating woes were evident even before a 2022 fire knocked its facility offline for months and appear to have worsened after the plant returned to service last year, according to the LSEG data. In the 365 days up to the June 7, 2022, fire, Freeport's average utilization rate was 1.820 bcfd or 80% of its maximum 2.2 bcfd capacity. In the last 12 months that rate has fallen to an average of 1.625 bcfd or 72% of maximum flow rate. The Quintana plant has had the lowest gas utilization rate in the U.S., behind Venture Global LNG's Calcasieu Pass, Louisiana, plant with its 80% utilization rate while undergoing commissioning, the LSEG data shows. Other U.S. LNG plants are operating at an average 85-87% capacity, LSEG data shows. Sign up here. https://www.reuters.com/business/energy/demand-us-lng-booms-one-plant-struggles-stay-online-2024-04-25/

2024-04-25 21:47

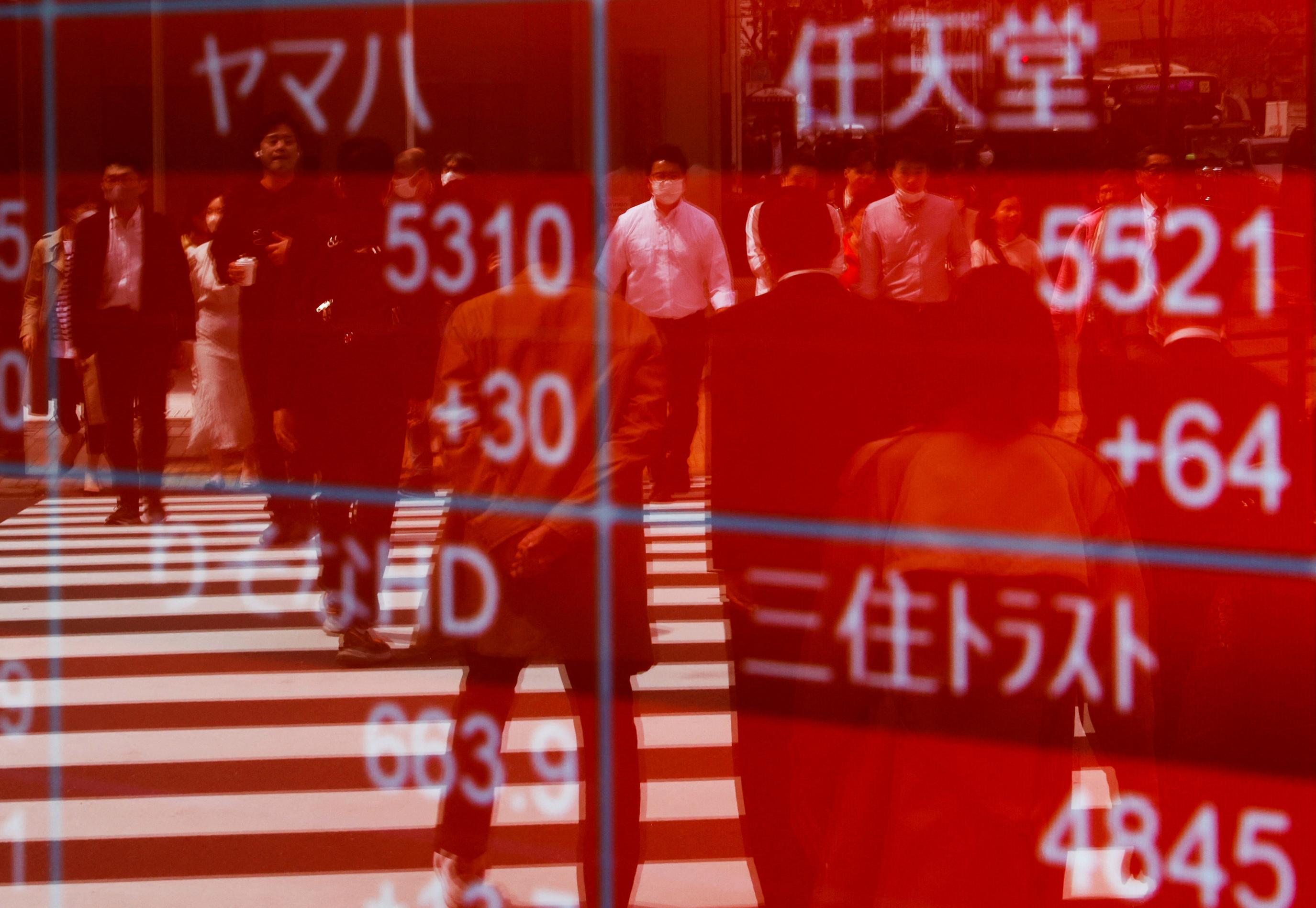

April 26 (Reuters) - A look at the day ahead in Asian markets. Asia's market spotlight on Friday falls on the Bank of Japan's policy announcement, as the cat-and-mouse game of when or if Tokyo intervenes in the currency market continues, and investors digest the latest U.S. mega tech earnings reports. The BOJ decision and guidance from Governor Kazuo Ueda top the regional calendar, which also includes Tokyo consumer price inflation for April, producer price inflation from Australia and industrial production from Singapore. Investor sentiment and overall risk appetite in early Asian trade on Friday will be determined in large part by the results from Microsoft, Alphabet and Intel reported after the closing bell on Wall Street on Thursday. Microsoft and Google parent Alphabet were resounding beats. Shares in Alphabet jumped as much as 14% and Microsoft 6% in after-hours trading, but Intel shares slumped as much as 7%. Risk appetite was dealt a heavy blow on Thursday by surprisingly high U.S. inflation and soft GDP growth numbers, and the leap in bond yields to new highs for the year will do little to improve the mood in Asia and across emerging markets. On the other hand, U.S. stocks on Thursday closed off their lows and after-hours earnings were mostly upbeat. If Asian stocks hold the line on Friday, they will register their best week since July last year. All eyes, however, are on Tokyo, where the BOJ is expected to keep its key interest rate on hold and project inflation to stay near its 2% target in coming years on prospects of steady wage gains. But the yen's slide to a fresh 34-year low against the dollar means Ueda will have to walk a delicate line in maintaining a steady, calibrated path to exiting ultra-easy policy while at the same time addressing the huge pressure bearing down on the currency. Erring too dovish risks pouring even more fuel on the current yen-selling flames, while an overly hawkish stance could threaten GDP growth and spark unwanted volatility in financial markets. One option policymakers are considering, according to Jiji news agency, is weighing up measures to reduce the central bank's government bond purchases. This would likely push down the BOJ's bond holdings, ushering in a phase of quantitative tightening, Jiji said. The yen goes into the BOJ decision at a 34-year low well below 155.00 per dollar and down 9% this year, Once again, it is on the defensive against other Asian currencies, much to the likely displeasure of policymakers in capitals across the continent. In an interview with Reuters on Thursday U.S. Treasury Secretary Janet Yellen sidestepped the issue of Japanese intervention, but said such instances should ideally be rare and only in response to excessive volatility. Here are key developments that could provide more direction to markets on Friday: - Bank of Japan policy announcement - Japan Tokyo inflation (April) - Australia PPI inflation (Q1) Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-04-25/

2024-04-25 21:44

April 25 (Reuters) - Internet services firm VeriSign (VRSN.O) New Tab, opens new tab reported a 5.5% rise in its first-quarter revenue on Thursday, helped by steady demand for domain name registrations as businesses beef up their online presence. More and more enterprises are nowadays choosing to build their presence on the internet with easy-to-remember domain names to capture a wider range of customers online. VeriSign is the sole registry for .com and .net domains and it operates two of the 13 global internet root servers. The company competes with Israeli-based Wix.com (WIX.O) New Tab, opens new tab and GoDaddy (GDDY.N) New Tab, opens new tab, which provide easy-to-use tools to build website and scale businesses. VeriSign posted revenue of $384 million for the quarter ended March 31, compared with $364 million a year ago. It reported quarterly profit of $1.92 per share, higher than the $1.70 per share a year ago. Sign up here. https://www.reuters.com/technology/verisigns-q1-revenue-rises-demand-internet-services-2024-04-25/

2024-04-25 21:14

Yellen: Q1 GDP data may be revised up; spending, investment strong Inflation to continue to ebb despite Q1 flare-up, Yellen says Yellen: tapping interest on Russian assets can win G7 support Yellen: currency market inverventions should be 'very rare' WASHINGTON, April 25 (Reuters) - U.S. Treasury Secretary Janet Yellen told Reuters on Thursday that U.S. economic growth was likely stronger than suggested by weaker-than-expected data on first-quarter output and said the Biden administration was keeping all options open to respond to threats from China's excess industrial capacity. In a wide-ranging Reuters Next interview, Yellen also said that a U.S. proposal for using the interest earnings from $300 billion in frozen Russian assets to aid Ukraine could win broad support from G7 allies. Yellen said U.S. GDP growth for the first quarter could be revised higher after more data is in hand and inflation will ease to more normal levels after a clutch of "peculiar" factors held the economy to its weakest showing in nearly two years. "The U.S. economy continues to perform very, very well," Yellen said in an interview with Reuters, responding to the Commerce Department's report showing that U.S. gross domestic product grew at a 1.6% annualized rate last quarter. That was below the 2.4% estimated by economists and less than half the pace in the fourth quarter of 2023 - thanks to substantial drags from trade and private inventories. The report also showed a worrisome surge in inflation, with the personal consumption expenditures (PCE) price index excluding food and energy rising at a 3.7% annual rate after a 2.0% pace in the fourth quarter of 2023. Yellen downplayed the inflation jump and said she did not see that as indicating that unemployment needed to increase or other areas of the economy needed to cool to return inflation to the Fed's 2% target. "The fundamentals here are in line with inflation continuing back down to normal levels," Yellen said. Fighting inflation remained President Joe Biden's top priority, Yellen said, highlighting his administration's efforts to reduce healthcare, energy and housing costs. But Biden, a Democrat, has struggled to translate U.S. economic strength into voter support ahead of the November presidential election. Republican challenger Donald Trump led Biden by seven percentage points in a recent Reuters/Ipsos poll when voters were asked which candidate would be better for the economy. "What I focus on most is the strength of consumer spending and investment spending," Yellen said. "Those two elements of final demand came in in line with last year's growth rate ... so this is the underlying strength of the U.S. economy that showed continuing robust strength." "The headline figure was off a little bit but for reasons that are peculiar and not really indicative of underlying strength," she added. Indeed, a number of private economists said the GDP data likely overstated any weakness in an economy that had grown at above the rate most see as its potential for nearly two years, despite aggressive interest rate hikes over that span by the U.S. Federal Reserve aimed at quashing inflation. Yellen said dollar strength has been another byproduct of U.S. growth and tight monetary policy. She acknowledged that this has put some pressure on other countries, but said currency interventions should occur only in "very rare and exceptional circumstances," when markets are disorderly with excessive volatility. She declined to comment on the Japanese yen's value when asked whether it was out of line with fundamentals. Last week, the U.S., Japan and South Korea agreed to consult closely on currencies, acknowledging concerns from Tokyo and Seoul over their currencies recent sharp declines against the dollar. CHINA OVERCAPACITY Yellen told Reuters no option was "off the table" for dealing with one threat to the U.S. economy - overproduction in China, which was hurting manufacturers in numerous countries. She said that while Chinese policymakers have acknowledged they have a problem with excess industrial capacity for electric vehicles, solar panels and other clean energy goods, they need to address it. The issue was "discussed intensively" last week at a U.S.-China meeting on the sidelines of the International Monetary Fund and World Bank spring meetings in Washington, she said. Asked about potential for new tariffs or other actions to protect U.S. producers from an expected flood of Chinese exports, Yellen said she would not eliminate any options as a possible response. She said Chinese overproduction threatens the viability of manufacturers in the U.S., Europe, Japan, Mexico and India but the problem won't be resolved "in a day or a week." "So it's important that China recognize the concern and begin to act to address it," Yellen said. "But we don't want our industry wiped out in the meantime, so I wouldn't want to take anything off the table." The Biden administration is completing a review of the "Section 301" unfair trade tariffs on Chinese imports imposed by former President Donald Trump in 2018, which U.S. officials have said could lead to higher tariffs on some products. Biden last week called for the review to triple the Section 301 duties on Chinese steel to 25%. U.S. Trade Representative Katherine Tai also told senators that the U.S. needed to take "early action, decisive action" to protect the fledgling American EV sector from Chinese imports. U.S. tariffs on Chinese vehicle imports are now about 27.5%, and few Chinese EVs are sold in the U.S. at the moment. RUSSIAN ASSET PLANS Yellen said that a proposal under discussion by finance ministers from the Group of Seven (G7) industrial democracies to harness earnings from frozen Russian central bank assets to aid Ukraine can be achieved without an outright confiscation of those assets, allaying the concerns of some countries. Yellen welcomed what she called a "very constructive step" taken by the European Union to segregate the proceeds from assets held by Brussels-based Euroclear and transfer them to Ukraine, noting future interest could also be pulled forward to back loans to Ukraine. "This is an approach that could be broadly supported by countries that are concerned about the seizure of assets, and some of the interest could be brought forward through, for example, a loan," Yellen said. Yellen said the approach was among several options being discussed by G7 countries ahead of a leaders summit in June, adding, "it certainly belongs on the list." The U.S. approach, led by deputy national security adviser Daleep Singh, is gaining momentum among the G7 nations, two officials from the group told Reuters earlier on Thursday. Most of the Russian assets held by Euroclear have now been converted to cash, Yellen told Reuters. G7 officials say the assets could generate around $5 billion a year in interest. Sign up here. https://www.reuters.com/markets/us/yellen-says-economy-performing-well-inflation-will-ebb-2024-04-25/

2024-04-25 20:54

KYIV, April 25 (Reuters) - Ukraine's agriculture minister tendered his resignation on Thursday as he faces criminal allegations for involvement in an illegal acquisition of state-owned land worth $7 million. Mykola Solsky, 44, has been at the centre of Ukraine's effort to keep its grain industry going as Russia's full-scale invasion has blocked Black Sea export routes, strewn fields with landmines and seen farmland occupied. Solsky denies the allegations against him that prosecutors say relate to events in 2017-2021, before he became agriculture minister in March 2022. A court is expected at 0500 GMT on Friday to determine whether to have him taken into custody. Prosecutors told a hearing on Thursday that the allegations against him were punishable by up to 12 years in jail. The National Anti-Corruption Bureau has said the allegations relate to a scheme to acquire state-owned land worth 291 million hryvnia ($7.35 million) and trying to obtain land worth 190 million hryvnia. Under the alleged scheme, the land was illegally taken from two state firms and transferred to war veterans on the condition they lease it to some private firms, prosecutors said. Solsky and his lawyer told the hearing on Thursday that he did not benefit from any such scheme. Solsky is the first known minister under President Volodymyr Zelenskiy to be named a suspect in a corruption case. His resignation will be reviewed at one of the next plenary sessions of Ukraine's parliament, Speaker Ruslan Stefanchuk said on the Telegram messaging app. "If the Verkhovna Rada (parliament) decides to accept my resignation, I will be grateful for such a decision, if it decides I should continue to work - I will continue to work," Solsky wrote on Telegram. Kyiv has applied to join the European Union, and Ukraine's agriculture minister will be heavily involved in negotiations to integrate the country's giant grain industry into the 27-member bloc. Several major agrarian associations issued statements voicing their support for the minister under whom who they said the ministry had worked "professionally and smoothly with agricultural producers". Zelenskiy has tried to project a zero tolerance line on corruption and last year replaced his defence minister after graft allegations pertaining to the defence ministry. Ukraine was among the world's leading grain and vegetable oil producers, but its output has sharply decreased due to the full-scale invasion that has buffeted the industry. During the war, Solsky has been on numerous travelling delegations tasked variously with trying to revive Black Sea grain exports, nurture exports via the Danube and ease a border blockade by protesting Polish truckers and farmers. Sign up here. https://www.reuters.com/world/europe/ukraines-farm-minister-resigns-amid-corruption-allegations-2024-04-25/