2024-04-25 06:49

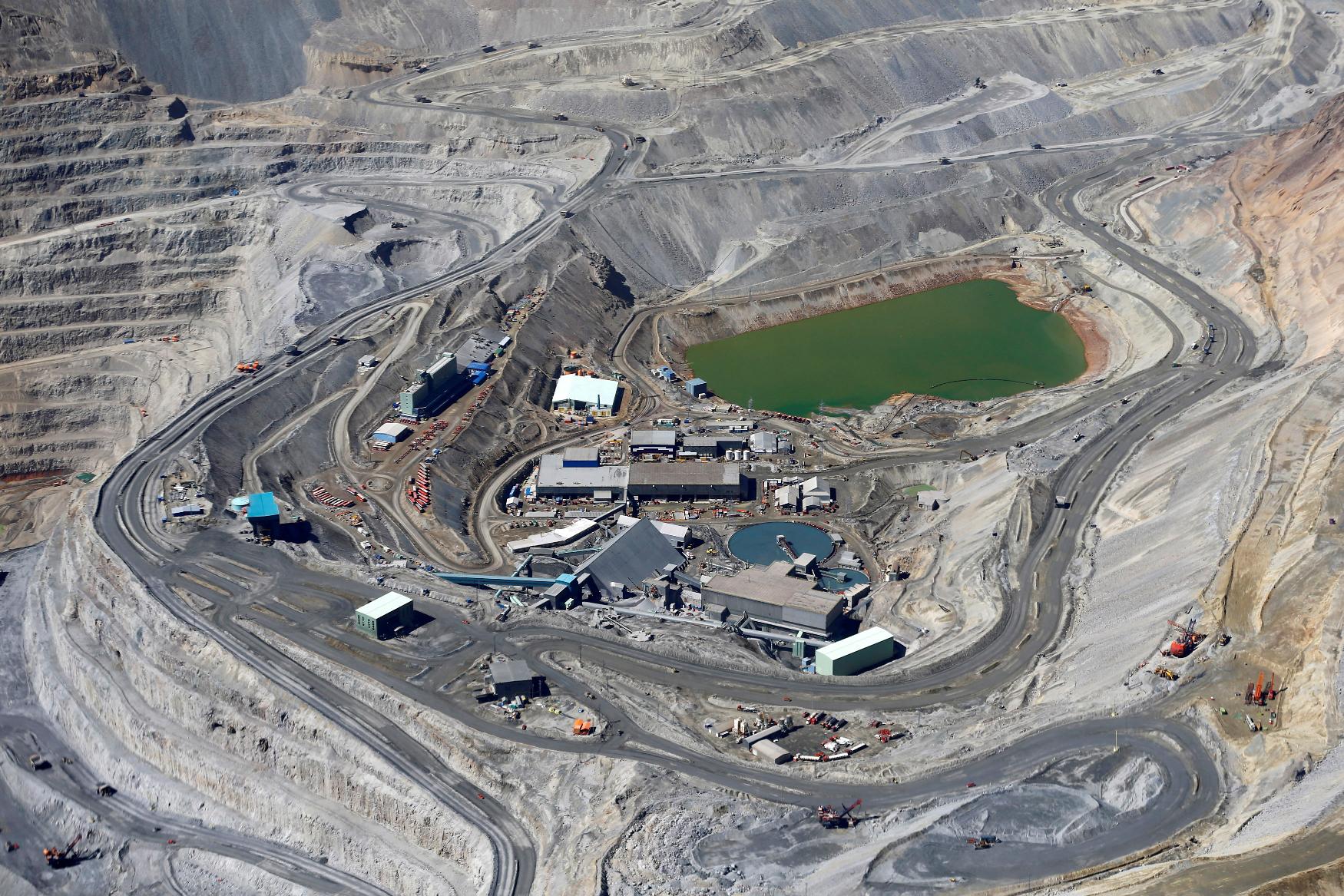

April 25 (Reuters) - BHP Group (BHP.AX) New Tab, opens new tab said it made an offer to buy London-listed miner Anglo American (AAL.L) New Tab, opens new tab, valuing its share capital at 31.1 billion pounds ($38.84 billion), a deal that would create the world's biggest copper miner with around 10% of global output. BHP, the world's largest listed miner, will offer Anglo American shareholders 25.08 pounds per share, including 4.86 pounds apiece in Anglo Platinum shares and 3.40 apiece in Kumba shares, it said in a statement on Thursday. Anglo American earlier in the day said it had received an unsolicited, non-binding and highly conditional combination proposal from BHP, which it was currently reviewing. If the deal goes through, it would give BHP access to more copper, one of the most sought-after metals for the clean energy transition, and potash, which are its key strategic commodities, as well as more coking coal in Australia. ($1 = 0.8006 pounds) Sign up here. https://www.reuters.com/markets/commodities/bhp-group-makes-388-bln-play-anglo-american-copper-focus-2024-04-25/

2024-04-25 06:34

JOHANNESBURG, April 25 (Reuters) - The South African rand rose on Thursday, after monthly domestic producer inflation came in as expected. At 1550 GMT, the rand traded at 19.0400 against the dollar , nearly 0.9% stronger than its previous close. The dollar was last trading down 0.11% against a basket of other major currencies. Statistics South Africa data showed producer inflation rose slightly to 4.6% year on year in March from 4.5% in February, in line with the expectations of analysts polled by Reuters. The central bank said this week that bringing consumer inflation back to the midpoint of its target range was likely to be a "bumpy and protracted" journey. The South African Reserve Bank has held its main interest rate at 8.25% (ZAREPO=ECI) New Tab, opens new tab since May 2023 to combat price pressures. On the stock market, the Top-40 (.JTOPI) New Tab, opens new tab index closed 0.2% lower while the broader all-share (.JALSH) New Tab, opens new tab index was down 0.25%. Anglo American Platinum (AMSJ.J) New Tab, opens new tab fell 9.48% after BHP Group (BHP.AX) New Tab, opens new tab bid $38.8 billion for its parent Anglo American (AAL.L) New Tab, opens new tab. Sign up here. https://www.reuters.com/markets/south-african-rand-little-changed-before-producer-inflation-data-2024-04-25/

2024-04-25 06:28

SINGAPORE/COLOMBO/NEW DELHI, April 25 (Reuters) - Chinese state energy giant Sinopec is pushing for greater access to Sri Lanka's market, where rival India is also seeking to expand its presence, as it looks to build its first fully-controlled overseas refinery, reflecting a change in the firm's global strategy to compensate for slowing demand growth at home. Sinopec, the world's largest oil refiner, is expected to complete a feasibility study by June for a plant at the Chinese-run Hambantota port, after winning Colombo's approval last November, two senior industry sources with direct knowledge of the matter told Reuters. While the China-based sources say the investment, which Colombo pegged at $4.5 billion as the country's largest-ever foreign investment, is commercially driven, neighbouring India is pushing a rival plan to build a fuel products pipeline to the island nation southeast of the subcontinent. Sinopec's effort to build a refinery with a more domestic orientation rather than the export-focused project sought by Sri Lanka, which has not previously been reported, puts it in direct competition with India's interests in expanding its role as an energy supplier to the country. New Delhi-run Indian Oil Corp is the No.2 fuel supplier to the country, after Sri Lankan government-owned Ceylon Petroleum Corp. India's foreign ministry and Indian Oil Corp did not respond to requests for comment. Sinopec, which has not publicly spelled out its strategy, is prioritising the Sri Lanka investment and another in Saudi Arabia under a newly launched investment arm, in an effort to leverage its expertise and deep pockets to expand globally as oil demand nears its peak in China as economic growth slows and electric vehicle adoption widens, the sources said. Sinopec's efforts mark a new trend in Chinese oil and gas investments abroad after mergers and acquisitions dried up to just $344 million in 2023, a fraction of the record $31 billion in 2012, according to LSEG data, following the 2014/15 oil price collapse and as Beijing tightened scrutiny over the finances of its national oil giants. Sinopec is working to finalise details including the plant's size and product configuration, while negotiating with Colombo over terms including greater access to the import-reliant Sri Lankan market, an element key for its final investment call, the sources said. The south Asian nation, grappling with a dearth of foreign exchange, has sought a refinery that would deliver 20% of its fuel domestically and export the rest to generate much-needed hard currency. Sri Lanka's power and energy minister, Kanchana Wijesekera, told Reuters on Friday that the government is sticking to that requirement. Sinopec, however, believes domestic sales would be more profitable, the two sources said, declining to be identified as the matter is not public. The company is considering either a 160,000 barrel per day (bpd) plant or two 100,000-bpd plants built in phases, which in either case would be geared towards gasoline and diesel fuel, the sources said. Sinopec declined comment. FULL CONTROL Sinopec sees Hambantota as among its top-priority projects, alongside a multi-billion-dollar plan to expand a refinery into a petrochemical complex at the Red Sea port of Yanbu in a joint venture with state-run Saudi Aramco, the two sources said. Compared to its half-owned, higher-cost Yanbu plant built a decade ago and designed to supply the U.S. market, Sinopec could fully leverage its expertise in refinery design, engineering and operation in the Hambantota venture and thus cap overall costs. Sinopec has in recent months sought more flexible terms for the project's domestic marketing share but Colombo has not budged. Sri Lanka's only existing refinery, the 38,000 bpd Sapugaskanda plant commissioned in 1969, supplies less than 30% of its fuel needs. Minister Kanchana told Reuters he expects Sinopec to sign an investment agreement by June. CHINA VS INDIA China and India are increasingly vying for influence in Sri Lanka. In 2022, India funnelled in about $4 billion of assistance during Sri Lanka's worst financial crisis in decades. Since last year, New Delhi has proposed various energy "connectivity" projects including a $1.2 billion subsea power line and a fuel pipeline linking India with Sri Lanka's Trincomalee port on the east coast, Sri Lanka Power and Energy Ministry Secretary Sulakshana Jayawardena said in late February. India is also deepening its involvement in Sri Lanka's power sector with solar projects and grid connectivity. "Their dependency on China is not there in energy supplies," said an Indian official directly aware of the pipeline discussions, declining to be identified because he is not authorised to speak with media on the subject. "That is a sector where we have a significant stake. That will increase with the pipeline," the Indian official said, adding that there has been significant progress on discussions for the multi-product pipeline, with the two sides seeking to formalise the arrangement "as soon as possible". China is a comparative latecomer to Sri Lanka but has since 2010 ploughed $6.7 billion into building the Hambantota port, highways and the country's only coal power plant in Norochcholai. At Hambantota, state-owned China Merchants Group owns 85% of port operator Hambantota International Port Group under a 99-year lease and earlier this year agreed a $392 million deal to build a logistics and storage hub in Colombo port under Beijing's sprawling Belt & Road Initiative. Last September, Sinopec started a fuel import and distribution business in Sri Lanka with 150 petrol stations, sourcing fuel mostly from Singapore, which Colombo expected to save the government about $500 million in foreign exchange over the next two years. Sign up here. https://www.reuters.com/markets/commodities/chinas-sinopec-charts-global-expansion-with-refinery-rival-indias-backyard-2024-04-25/

2024-04-25 06:11

ZURICH, April 25 (Reuters) - The Swiss National Bank (SNBN.S) New Tab, opens new tab posted on Thursday a record quarterly profit of 58.8 billion Swiss francs ($64.34 billion) for the first quarter, driven by the weakening franc and booming equity markets. The result for the central bank compared with a profit of 26.9 billion francs a year earlier and beat forecasts from economists at UBS, who had expected a profit of 40 billion to 50 billion Swiss francs. It also far exceeded the SNB's previous highest quarterly profit of 38.9 billion francs from the second quarter of 2020. During the quarter, the SNB made a profit of 52.4 billion from its foreign currency positions, helped by rising global stock markets at the start of the year, with the MSCI World Price Index (.MIWO00000PUS) New Tab, opens new tab up 10% in the first quarter. The central bank owns roughly 170 billion francs worth of stocks, including stakes in Google owner Alphabet (GOOGL.O) New Tab, opens new tab, Apple (AAPL.O) New Tab, opens new tab and Starbucks (SBUX.O) New Tab, opens new tab as part of its massive pile of foreign currency investments. The weakening franc, which lost around 5% against the euro and 7.5% against the dollar in the first quarter, also boosted the franc value of the SNB's foreign holdings. Overall exchange rate-related gains came to 38 billion francs. The SNB made a valuation gain of 8.9 billion francs from its gold holdings, as prices of the precious metal surged 15% during the quarter amid concerns about tensions in the Middle East. The profits were dampened by a loss of 2.4 billion francs on the SNB's franc positions, mainly from the interest paid on the sight deposit accounts it holds for commercial banks. "This was a very strong quarter for the SNB, with equities markets doing very well, but the biggest driver was the weakening of the Swiss franc," said UBS economist Alessandro Bee. Bee cautioned the results should not be seen as an indicator for large profits in the coming quarters. "With such benign markets you don't normally see a rise in the value of gold, while the dollar will probably weaken during the year, so the SNB won't get the currency gain in the future," he said. ($1 = 0.9139 Swiss francs) Sign up here. https://www.reuters.com/business/finance/swiss-national-bank-posts-record-profit-first-quarter-2024-04-25/

2024-04-25 06:10

MADRID, April 25 (Reuters) - Spain's Repsol (REP.MC) New Tab, opens new tab said on Thursday that first-quarter profit fell by a third - though that was less than expected - hurt by lower gas prices and a weaker performance from its refining and trading businesses. Quarterly adjusted profit fell to 1.27 billion euros ($1.4 billion), ahead of a company-provided average forecast from analysts of 1.19 billion euros. Net profit dropped 13% to 969 million euros. The company's shares were down 2.4% in morning trade. In February, Repsol outlined a plan to push ahead with diversifying into renewables from its traditional oil and gas core business. Like other big oil companies, it has pledged record returns despite a steep decline in profit from all-time highs in 2022, when oil and gas prices soared following Russia's invasion of Ukraine. Chief Executive Josu Jon Imaz said in a statement that the first quarter's results showed the company's three-year plan is solid. Its upstream division saw adjusted profit decline 6.8%, also hurt by the sale of its Canadian assets. In its industrial division, adjusted profit plunged 43% after refining margins returned to more normal levels compared to extremely high levels in the same quarter a year earlier. ($1 = 0.9337 euros) Sign up here. https://www.reuters.com/business/energy/repsols-q1-adjusted-profit-falls-slightly-tops-expectations-2024-04-25/

2024-04-25 06:03

BERLIN, April 25 (Reuters) - German consumer sentiment is set to rise in May on the back of households' brighter income expectations, continuing a path of recovery that has been slow-going due to uncertainty about the country's economic development, a survey showed on Thursday. The consumer sentiment index published jointly by GfK and the Nuremberg Institute for Market Decisions (NIM) rose to -24.2 heading into May from a slightly revised -27.3 in April. That reading, the third increase in a row, beat the expectations of analysts polled by Reuters of -26.0 and marks a two-year high, though sentiment still remains extremely low. Income expectations were a bright spot, climbing 12.2 points to 10.7, boosted by falling inflation and rising wages. "Our analyses indicate that income expectations are primarily based on real income development. And the signals here are definitely positive," said NIM consumer analyst Rolf Buerkl. The willingness to buy benefited only moderately from the jump in income expectations, rising 2.7 points to -12.6, as households put their money aside due to pronounced uncertainty about the economic development of Europe's biggest economy. NOTE - The survey period was from April 4-15, 2024. The consumer climate indicator forecasts the progress of real private consumption in the following month. An indicator reading above zero signals year-on-year growth in private consumption. A value below zero indicates a drop compared with the same period a year earlier. According to GfK, a one-point change in the indicator corresponds to a year-on-year change of 0.1% in private consumption. The "willingness to buy" indicator represents the balance between positive and negative responses to the question: "Do you think now is a good time to buy major items?" The income expectations sub-index reflects expectations about the development of household finances in the coming 12 months. The additional business cycle expectations index reflects respondents' assessment of the general economic situation over the next 12 months. Sign up here. https://www.reuters.com/markets/europe/income-optimism-boosts-german-consumer-sentiment-may-finds-gfk-2024-04-25/