2024-04-24 06:47

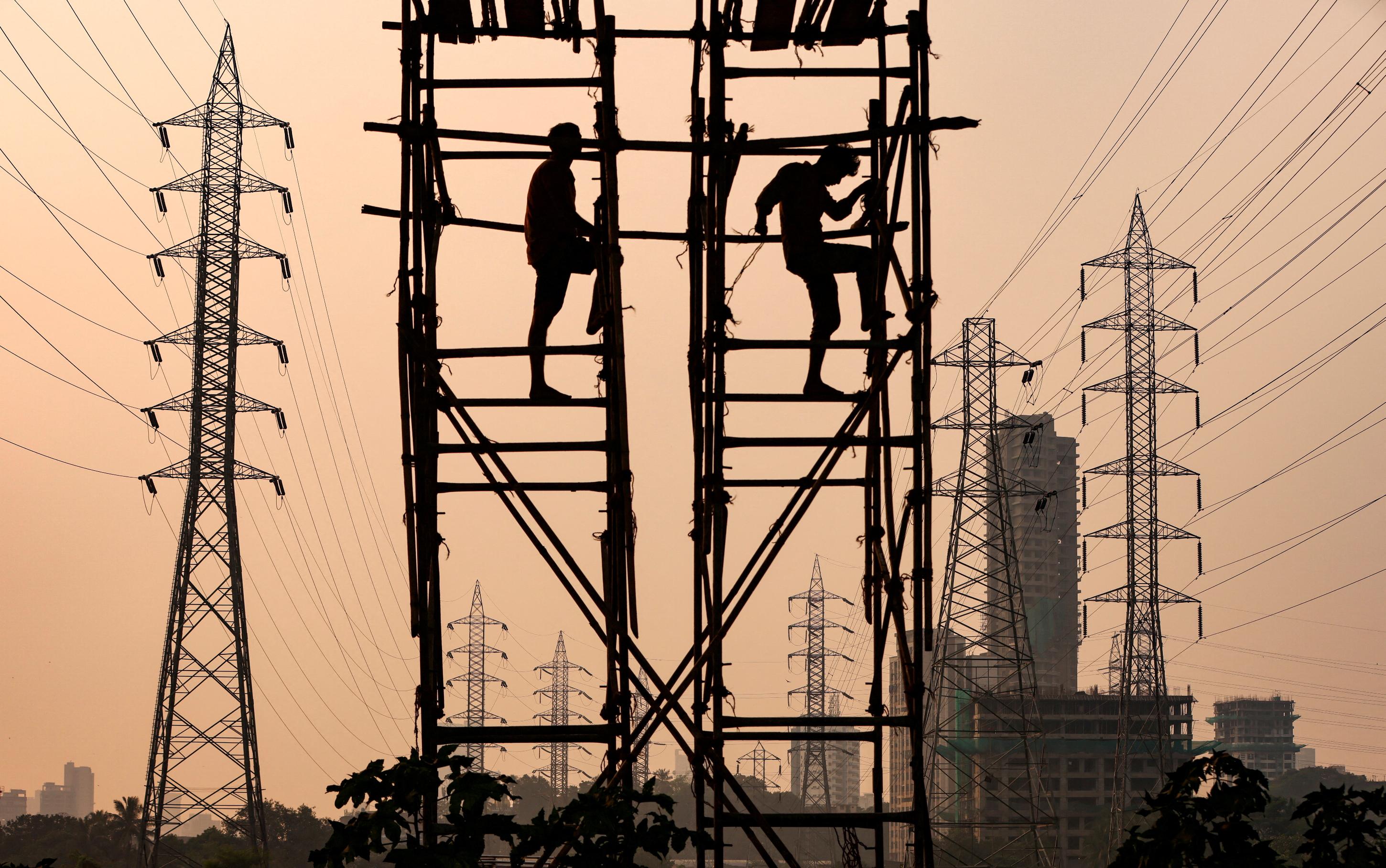

HYDERABAD, April 24 (Reuters) - Hitachi Energy is looking to open more global capability centers in India to expand local operations, amid growing energy demand and a push to scale up renewable energy generation in the country. Zurich-based Hitachi Energy, which makes transformers and large-scale power transmitters, operates a GCC in the country, where high power demand has led to the government ramping up generation, including in renewable energy. "We are looking at Hyderabad for our GCC.. and also looking at Pune. It might take six months to one year," said Venu Nuguri, the managing director and CEO of the company's India unit. The center could be in either or both cities depending on the demand, he said, without giving financial details of the investment. The new GCC - a low-cost, offshore facility - will work alongside Hitachi Energy India (HITN.NS) New Tab, opens new tab, but will be part of a separate non-listed Indian entity of Hitachi Energy in Switzerland, Nuguri said. India's government last year rolled out incentives for green energy transition, with an aim to have 500 GW of installed capacity through non-fossil fuel sources by 2030 New Tab, opens new tab. India's power consumption grew 8% in fiscal year 2023. The International Energy Agency estimates that India will add electricity demand roughly equivalent to the current consumption of the United Kingdom New Tab, opens new tab over the next three years. "To meet the projected demand, market needs to generate at least 3-4 times than what is being done. And accordingly, our order book will also grow two or three times, higher than market growth," Nuguri said. The company had an order backlog of 72 billion rupees ($864.7 million) as of fiscal year 2023, according to Nuguri. ($1 = 83.2690 Indian rupees) Sign up here. https://www.reuters.com/business/energy/hitachi-energy-eyes-expansion-india-amid-rising-power-demand-2024-04-24/

2024-04-24 06:44

U.S. crude inventories fall by 6.4 million barrels - EIA Goldman Sachs sees $90 per barrel ceiling on Brent U.S. business activity cooled to 4-month low in April NEW YORK, April 24 (Reuters) - Oil prices fell on Wednesday as worries over conflict in the Middle East eased and business activity in the United States slowed, although a fall in U.S. crude oil inventories put a floor on those losses. Brent crude futures fell 40 cents, or 0.45%, to settle at $88.02 a barrel, while U.S. West Texas Intermediate crude futures slipped 55 cents, or 0.66%, to $82.81. That reversed some of Brent's gains earlier in the week, buoyed by a weaker U.S. dollar. "It appears the fundamentals that we trade with are leaning towards a little settling down in the Middle East," said Tim Snyder, economist at Matador Economics. Perceived de-escalation between Iran and Israel could remove another $5-10 a barrel in coming months, Goldman Sachs analysts said in a note. These analysts estimated a $90 per barrel ceiling on Brent. U.S. crude stockpiles fell by 6.4 million barrels to 453.6 million barrels in the week ended April 19, the EIA said, compared with analysts' expectations in a Reuters poll for a 825,000-barrel rise.[EIA/s] The large crude draw was the result of very high crude exports, said UBS analyst Giovanni Staunovo. But it could be a one-off, he said, as preliminary tanker tracking data this week shows lower exports. U.S. business activity cooled in April to a four-month low, with S&P Global saying on Tuesday that its flash Composite PMI Output Index, which tracks the manufacturing and services sectors, fell to 50.9 this month from 52.1 in March. The U.S. central bank is expected to start lowering rates this year, which could bolster economic growth and, in turn, stimulate demand for oil. Elsewhere, Germany's business morale improved more than expected in April, according to a survey on Wednesday, boosting hopes that the worst may be over for Europe's biggest economy. Even as concerns about geopolitical tension in the Middle East eased, the Israel-Hamas conflict continues to rage with some of the heaviest shelling in weeks on Tuesday. Sources on Wednesday said Israel was preparing to evacuate Rafah ahead of a promised assault on the city. Sign up here. https://www.reuters.com/business/energy/oil-prices-inch-up-after-data-shows-unexpected-drop-us-crude-stocks-2024-04-24/

2024-04-24 06:34

OSLO, April 24 (Reuters) - Norwegian independent oil company Aker BP (AKRBP.OL) New Tab, opens new tab on Wednesday posted a higher-than-expected net profit for the first quarter as costs fell, and said its Tyrving field development could start production sooner than previously planned. The company, partly owned by BP (BP.L) New Tab, opens new tab, reported a net profit of $531 million for January-March, up from $187 million a year earlier, beating a $470 million forecast in a company-compiled poll New Tab, opens new tab of analysts. "Our oil and gas production increased while we maintained low costs and kept emissions in check," CEO Karl Johnny Hersvik said in a statement. Brokers DNB said the results beat was mainly driven by low-than-expected production costs, which were down to $6.1 per barrel produced from $7.2 in the first quarter of 2023. The costs were also below the company's 2024 full-year guidance of around $7 per barrel. Aker BP's Chief Financial Officer David Toenne told a call with reporters that the costs fell from a year ago due to lower power prices and maintenance, and were below the guidance partly due to the weaker Norwegian crown currency. Aker BP also said its Tyrving subsea development in the Alvheim area of the North Sea was "progressing towards an accelerated start-up" in the fourth quarter versus the beginning of 2025 previously. In January, environmentalists won a case at a lower court against the government for approving Aker BP's Tyrving and Yggdrasil projects, but a court of appeal has put on hold a suspension of further development until the case is heard. "With the court decision to defer the temporary injunction, the risks of the project schedules have been significantly reduced," the company said. Sign up here. https://www.reuters.com/markets/commodities/aker-bp-q1-beats-forecast-record-output-lower-cost-2024-04-24/

2024-04-24 06:30

MADRID, April 24 (Reuters) - Spanish utility Iberdrola (IBE.MC) New Tab, opens new tab on Wednesday raised its profit target for the year after a strong first quarter on the back of high renewable output in Spain and tariff increases in its network business in the U.S. and elsewhere. It now expects high single-digit profit growth this year, from previous guidance for growth of between 5% and 7%. First-quarter net profit rose to 2.76 billion euros ($2.95 billion) from 1.49 billion euros a year earlier, thanks to asset sales. Europe's largest utility by market cap is reaping the benefits of its strategic shift towards upgrading and expanding grids in the United States and elsewhere while taking a more selective approach to renewable energy. Last month it presented a $45 billion investment plan to build on this strategy, which it launched in 2022. Like Italian competitor Enel (ENEI.MI) New Tab, opens new tab, the Spanish firm is attracted by the stable and predictable returns offered by grids at a time when the renewable sector has been hit by high interest rates, rising debt costs and supply chain issues. Excluding one-offs such as a 1.2 billion euro gain in the quarter on the sale of some of Iberdrola's assets in Mexico, profit rose 28% and core earnings - before interest, taxes, depreciation, and amortization - 10%. Investment in the quarter reached a record 2.38 billion euros, of which 1.2 billion euros went to networks, mainly in the U.S. The company's network business benefited from improved tariffs in Britain, the U.S. and Brazil. Strong output at its hydroelectric plants pushed renewable energy production in its Spanish home market to a 10-year high, it said, while offshore wind capacity was added in France and the U.S. "We have started positively in the delivery of our strategic plan to 2026," Executive Chairman Ignacio Sanchez Galan said in a statement. The company will invest 12 billion euros this year after record spending in the first three months, he said. ($1 = 0.9345 euros) Sign up here. https://www.reuters.com/business/energy/spains-iberdrola-raises-profit-guidance-after-strong-q1-2024-04-24/

2024-04-24 06:17

LONDON, April 24 (Reuters) - Cut in June or not at all? The Bank of England is left parsing policy between a European Central Bank nailed on for cutting rates by mid-year and a U.S. Federal Reserve some feel may not be ready to ease at all in 2024. Not for the first time, the BoE finds itself somewhere in the middle of the North Atlantic trying to set its own course - possibly leaning stateside due to lagging UK disinflation but in the euro zone current when it comes to flagging economic activity. For much of the first quarter, financial markets conspicuously priced all three major central banks pulling their first rate cut triggers in tandem this summer - but a rift has opened up this month and timelines have scattered. BoE chief economist Huw Pill on Tuesday said the Bank could move policy independently of the Fed and the ECB, though he seemed non-committal on which it might be leaning closer to. It's left for markets to make up their own mind it seems. After a slightly confusing few days of 'BoE-speak' that had governor Andrew Bailey and his deputy Dave Ramsden late last week sounding dovish on hitting the BoE's inflation target and staying there, resident hawk Jonathan Haskel pushed back again on that on Tuesday and Pill seemed more cautious. As it stands, money markets currently fully price a first quarter-point BoE rate cut by its Aug. 1 meeting - with a roughly 50-50 chance of a move as soon as June 20. That timeline is still remarkably close to guesstimates about the ECB, which is more than fully priced to ease 25 basis points (bps) by July 18 - just two weeks before the favoured BoE date - and some two-thirds priced for an early move as soon as June. The Fed, on the other hand, is now not pencilled in to deliver until Sept. 18's policy meeting - with just a 50% chance that it moves as soon as July 31. Of course it's still not inconceivable that all three end up moving together in the fortnight between July 18 and Aug. 1. But where the gaps open up further is in implied year-end rates - where just 40 bps of cuts are now seen from the Fed, 55 bps from the BoE and almost 75 bps from the ECB. And that market pricing masks considerable divergence in views over the timing and the extent of future UK cuts. Barclays strategists now reckon the BoE will start to cut as soon as June and lop as much as 75 bps off its policy rate by year-end, even as it cut back expectations on the extent of the full easing cycle through next year by some 50 bps and put a tentative 'terminal rate' at 3.75%. Having last week pushed his forecast for a first UK cut out to June from May, Deutsche Bank's chief UK economist Sanjay Raja thinks there's 75 bps in the pipeline for this year - though sees deeper cuts through 2025 to as low as 3% in early 2026. MIND THE FX GAP On one level, much of the big post-pandemic spike and subsequent retreat of global inflation has largely been common to all major central banks due to energy and supply chain disruptions. Differences between them now stem more from the residual domestic factors related to labour markets and service sector inflation that characterise the so-called 'last mile'. But currency markets are starting to gyrate on those shifting views - and may also now play a role themselves. The BoE's trade-weighted sterling index dropped more than 1% this month as markets detected a twist in Threadneedle Street thinking. Given that the trade-weighted pound has appreciated 3% over the past year - and some 10% from the lows hit after the disastrous budget blowup by then Prime Minister Liz Truss in late 2022 - the BoE may feel comfortable sounding more dovish than the hardline Fed at this point. Barclays economists Jack Meaning and Abbas Khan point out that the early BoE rate hike in December 2021 - some three and seven months ahead of the Fed and ECB respectively - showed that it wasn't afraid of moving independently. The only barrier might be if moving alone seeded outsize exchange rate moves. But they added that Barclays' work showed a rate divergence of 100 bps would weaken sterling by a little over 2% overall - and that in turn would add only about 10-20 bps to headline UK inflation. "We do not consider this sufficient to change the path for UK policy." And yet if sterling is a factor - should the BoE lean towards one or other of the two big central banks? On the face of it, Britain's greater overall trade linkages with Europe despite the Brexit fracture might suggest sticking closer to the earlier ECB path. After all, almost 50% of all UK imports still come from the European Union and more than 40% of all exports still head there. The wrinkle is dollar-denominated energy and commodities and other internationally-invoiced trade, however. Data from the government's customs and excise New Tab, opens new tab office, for example, shows some 37% of total EU and non-EU imports to the UK are invoiced in dollars - more than those invoiced in sterling and almost twice those invoiced in euros. And more than 40% of total UK exports are invoiced in dollars - three times the share invoiced in euros. There are many moving parts in all that of course. But if sterling moves do become a concern, it's not all that obvious which way to tilt between the dominant Western blocs and ploughing a middle furrow may well be the safest way to go. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/world/uk/boe-tries-sail-mid-ocean-policy-mike-dolan-2024-04-24/

2024-04-24 06:08

LITTLETON, Colorado, April 24 (Reuters) - Japan's utilities are on track to boost clean electricity output to the highest levels in several years in 2024, after recording a 12.4% rise in clean power output over the first two months from the same period in 2023. Clean electricity output during January and February totalled 52.67 terawatt hours (TWh) according to energy think tank Ember, the highest for that period in at least five years. Japan's power firms also cut fossil fuel-based generation over the opening two months of the year by 6% from the year before, to the lowest since 2019. As a result, clean power sources supplied 31.6% of Japan's electricity during the first two months of 2024, up from a 28% share at the same point in 2023. With Japan's peak solar and hydro output periods still ahead, utilities are in a position to potentially lift clean power generation even more in the coming months, likely to the highest levels since the country slashed nuclear output in the wake of the 2011 Fukushima accident. POWER DRIVERS During the first two months of 2024, solar power was the largest source of clean energy in Japan, generating just over 14 TWh of electricity. Nuclear reactors (13.3 TWh), hydro dams (10 TWh) and bioenergy plants (9.5 TWh) were the next largest clean sources, followed by wind farms (4 TWh), Ember data shows. All sources of clean generation posted increases over the same period in 2023, with nuclear, hydro and bioenergy sources registering double-digit growth. Over the same period, coal and gas-fired generation contracted by 2.3% and 5.5% respectively. CLEAN PEAK Clean generation levels look set to climb further over the coming months as solar output rises to its annual peak and hydro dams receive their largest monthly rain totals during Japan's summer. In 2022 and 2023, Japan's solar electricity generation levels increased by around 70% from the January-February average during the peak summer months of May through August. If that trend is followed again in 2024, this year's solar production should average around 11.75 TWh per month during May, June, July and August, and should account for around 15% of total electricity generation during those months. Hydro output has historically roughly doubled from January-February averages during the peak summer months to around 7.5-8.0 TWh a month, and so should also help further lift total clean electricity generation in the middle of this year. The summer months also mark the high point of Japan's total electricity demand needs, due to the widespread use of power-hungry air conditioners during the hottest times of year. However, to meet some of that additional round-the-clock consumption, utilities may be able to dial up production at nuclear reactors and bioenergy plants that can adjust baseload output levels as needed. Power firms will also likely deploy more coal and gas-fired electricity if demand levels consistently exceed clean energy supplies, which is often the case during the warmest months of the year. But with most clean sources of electricity likely to increase substantially from current levels during the summer, Japan's utilities may be able to limit any increase in fossil fuel-powered output, and thereby continue to build on the clean energy momentum already in evidence so far in 2024. Sign up here. https://www.reuters.com/business/energy/japan-set-clean-power-surge-2024-maguire-2024-04-24/