2024-04-22 22:20

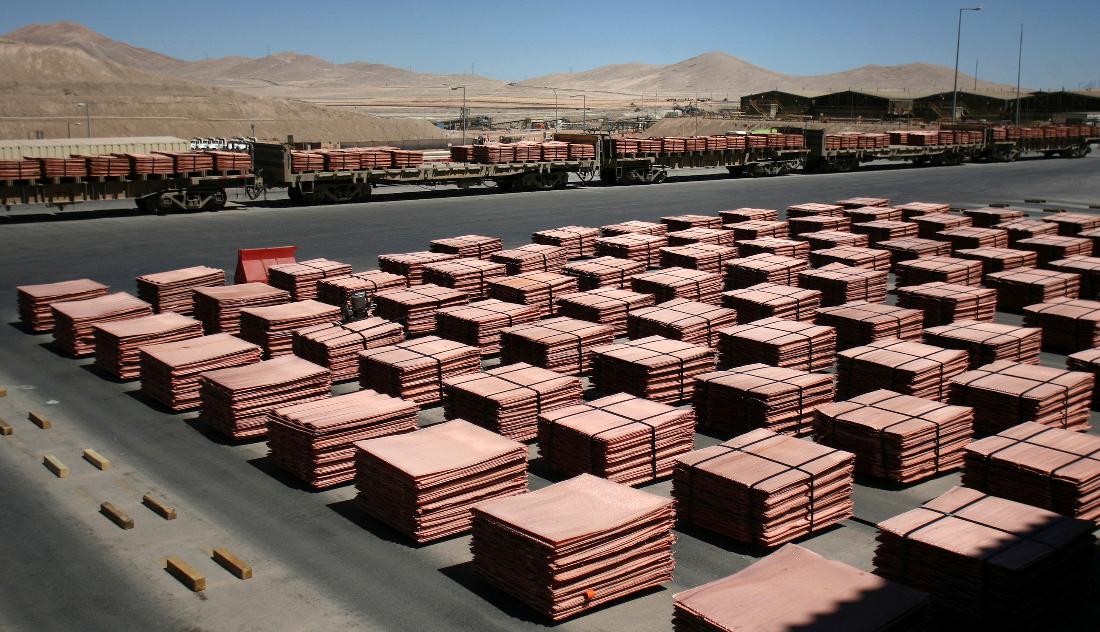

SANTIAGO, April 15 (Reuters) - Growing demand for copper along with supply constrictions could push prices higher than last year in 2024, the head of Chilean miner Antofagasta (ANTO.L) New Tab, opens new tab said. Speaking ahead of the World Copper Conference that begins on Monday, Antofagasta CEO Ivan Arriagada said an improving global economy plus the increasing need for the metal used in electric vehicles, solar panels and other elements key to the energy transition created a favorable scenario. "The trajectory we foresee is towards higher levels," he said in an interview last week, compared with last year's prices that he said were in the range of $3.80 to $3.85 per pound. Analysts have forecast a deficit from this year on signs that supply may not be as robust as previously thought after Panama ordered the closure of First Quantum's (FM.TO) New Tab, opens new tab 350,000-metric ton mine and producers Anglo American (AAL.L) New Tab, opens new tab and Vale Base Metals both lowered their guidance for 2024 and 2025. Arriagada also said boosting supply would be a challenge. Antofagasta, Chile's biggest copper miner after state-run Codelco, is aiming at organic growth through existing projects, although Arriagada said he did not rule out the possibility of acquisitions, as long as they are in the Americas. Antofagasta, which is listed on the London Stock Exchange, bought a 19% share in Peru's Buenaventura (BUENAVC1.LM) New Tab, opens new tab late last year, and two Antofagasta executives recently joined the Buenaventura board. The Peruvian company is looking at transitioning to copper production at some of its gold mines where reserves are diminishing, Arriagada said. In Chile, Antofagasta expects to increase production at its flagship Pelambres mine due to a new desalination plant, and begin operations at the Centinela concentrator in 2027, projects that Arriagada said will help lift production to about 900,000 metric tons from this year's outlook of 670,000 to 710,000 metric tons. "There could be more investments in the future that eventually help us have more production, but for now, this is our focus," Arriagada said, noting the importance of boosting production to mitigate the year-by-year deterioration of copper ore grade. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/chiles-antofagasta-ceo-foresees-higher-2024-copper-prices-plans-growth-home-2024-04-22/

2024-04-22 22:18

Nvidia rebounds after previous session selloff Cardinal Health falls on losing contracts with OptumRx Tesla down after price cuts in several markets Indexes end up: Dow 0.67%, S&P 0.87%, Nasdaq 1.11% NEW YORK, April 22 (Reuters) - Wall Street stocks ended higher on Monday following a market sell-off in previous sessions as investors eyed a busy week for quarterly results from key companies that would provide a glimpse of the U.S. economy's health. The benchmark S&P 500 (.SPX) New Tab, opens new tab and the Nasdaq (.IXIC) New Tab, opens new tab rebounded from a decline over the past six sessions which had been caused by investors re-evaluating their expectations on interest rate cuts in the wake of strong economic data, geopolitical tensions, persistent inflation and commentary from Federal Reserve officials. All 11 S&P 500 sectors closed higher, with technology (.SPLRCT) New Tab, opens new tab and financial stocks (.SPSY) New Tab, opens new tab leading gains. Markets were gearing up for quarterly results from megacap companies this week, including some of the so-called Magnificent Seven stocks such as Tesla (TSLA.O) New Tab, opens new tab, Meta Platforms (META.O) New Tab, opens new tab, Alphabet (GOOGL.O) New Tab, opens new tab and Microsoft (MSFT.O) New Tab, opens new tab. "I think it's just standard buy-on-the-dip after a 5% pullback that kind of wakes people up to put money to work," said Lamar Villere, portfolio manager at Villere & Co in New Orleans. "Investors are looking ahead to this week with hugely significant earnings coming out and with concerns about what the Fed is doing with pushing back any rate cuts," Villere added. Money markets are pricing in only about 41 basis points (bps) of rate cuts this year, down from about 150 bps seen at the beginning of the year, according to LSEG data. In addition to top corporate earnings, markets are also awaiting the release later this week of the March personal consumption expenditure (PCE) data - the Fed's preferred inflation gauge - to further ascertain the trajectory of monetary policy. Fed policymakers are in a media blackout period ahead of their policy meeting on May 1. The S&P 500 (.SPX) New Tab, opens new tab gained 43.37 points, or 0.87%, to 5,010.60 and the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 169.30 points, or 1.11%, to 15,451.31. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 253.58 points, or 0.67%, to 38,239.98. Megacap growth stocks ended higher, with gains in Alphabet, Amazon.com (AMZN.O) New Tab, opens new tab and Apple (AAPL.O) New Tab, opens new tab between 0.5% and 1.5%. Nvidia (NVDA.O) New Tab, opens new tab gained 4.4% to rebound from a 10% drop in the previous session. "This is predicated on positive technical expectations on tech earnings and traders not wanting to be short in front of it, and the PCE numbers later this week that people are somewhat sanguine about as well," said Thomas Hayes, chairman of hedge fund Great Hill Capital in New York. Tesla shares dropped 3.4% as the electric vehicle maker cut prices in a number of its major markets, including China and Germany, following price reductions in the United States. Cardinal Health (CAH.N) New Tab, opens new tab fell 5% after the drug distributor said its contracts with UnitedHealth Group's (UNH.N) New Tab, opens new tab OptumRx, one of its largest customers, will not be renewed when they expire at the end of June. Advancing issues outnumbered decliners by a 2.87-to-1 ratio on the NYSE. There were 49 new highs and 76 new lows on the NYSE. On the Nasdaq, 2,682 stocks rose and 1,499 fell as advancing issues outnumbered decliners by a 1.79-to-1 ratio. The S&P 500 posted 9 new 52-week highs and 4 new lows while the Nasdaq recorded 40 new highs and 184 new lows. Volume on U.S. exchanges was 10.33 billion shares, compared with the 11.03 billion average for the last 20 days. Sign up here. https://www.reuters.com/markets/us/futures-recover-after-friday-sell-off-mideast-tensions-ease-2024-04-22/

2024-04-22 22:15

SANTIAGO, April 15 (Reuters) - Chile's state-run copper miner Codelco is poised to improve production this year and begin to climb from its lowest dip in a quarter century, the head of Chilean copper studies center CESCO said ahead of a major industry conference that starts Monday. Codelco is aiming to produce between 1.325 million and 1.390 million metric tons of copper this year, a target that at best would see it lightly overtake its 2023 output of 1.325 million metric tons. That goal appeared realistic, said Jorge Cantallopts, head of the Center for Copper and Mining Studies (CESCO) in Chile, the world's top producer of the red metal. "We think that the level of production for this year will be better than the last one," he said in an interview on Friday. Output could rise at Codelco's Andina, Salvador and Chuquicamata mines, he noted, even as challenges continue for structural projects - mega projects designed to extend the life of key mines and compensate for a drop in ore grades. They include a $5 billion revamp of Chuquicamata, a project that Reuters found has suffered delays, collapses and construction difficulties. CESCO last year warned that the company, which represents about a quarter of Chile's copper output, could become insolvent if it didn't meet production promises. The center annually hosts CESCO Week alongside the CRU World Copper Conference, which make up the largest gathering of industry executives, investors and analysts. Driven by renewed interest in commodity assets, copper prices rallied 10% since the start of this year on London Metal Exchange. Copper prices also hit record high on Shanghai Futures Exchange (Shfe) and neared a two-year high of $4.34 per pound last Friday on Chicago Mercantile Exchange . When prices hit $4.50 per pound, it could start to hurt copper demand, Cantallopts said. Some signs are already showing. Copper inventory in China, the top consumer of the industrial metal, typically declined every April as factory activity picked up after Lunar New Year. But copper inventory is yet to retreat so far, remaining at multi-year high of close to 300,000 metric tons. Even so, if mined copper supply constraints held steady for the medium term, Cantallopts said, copper prices could reach $5.00 per pound. Although copper miners are increasingly turning to Africa for high-quality metal, Chile and neighboring Peru are better positioned for the long term and need to quicken efforts to boost supply, he said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/copper-output-chiles-codelco-set-rise-this-year-cesco-says-2024-04-22/

2024-04-22 21:58

April 23 (Reuters) - A look at the day ahead in Asian markets. Asian stocks should have a spring in their step on Tuesday after a positive start to the week locally and globally on Monday, supported by a recovery in tech shares, calm in fixed income markets, and a cooling in geopolitical tensions. Tuesday's economic calendar is pretty full, with purchasing managers index reports from Japan, Australia and India, consumer inflation from Singapore and Hong Kong, producer inflation from South Korea and industrial production from Taiwan all on deck. Currency traders remain on high alert for yen intervention with the dollar getting closer to 155.00 yen, although there is a question whether Tokyo will act so close to the Bank of Japan's two-day policy meeting that starts on Thursday. China's yuan remains on the defensive too, slipping to a five-month low against the dollar on Monday. Overall sentiment is fairly buoyant after the S&P 500 and Nasdaq rebounded on Monday, as tech clawed back some of last week's losses and Middle East tensions cooled. Investors now turn their attention to this week's earnings from some of these tech giants - Tesla, Meta Platforms, Alphabet and Microsoft announce their quarterly results this week, which will go a long way to determining the outlook for U.S. and global stocks in the months ahead. The 'FANG' index of mega U.S. tech stocks rose on Monday, snapping a six-day losing streak in which the index lost 10%. According to analysts at A.J. Bell, the 'Magnificent Seven' of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla lost $1.1 trillion of market cap in those six days. Shares in Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker, will be looking to bounce back from Monday's 1% fall. That followed a 6% slide on Friday after the company reported first quarter results. Official figures from Taipei on Monday showed that export orders rose less than expected in March, but the government was confident that surging demand for artificial intelligence applications will fuel future demand for the island's high-tech products. An air of caution still hangs over markets though. Financial conditions are the tightest this year, according to Goldman Sachs's financial conditions indices, driven almost entirely by rising long and short rates. The question now is how much higher will bond yields go? The two- and 10-year U.S. Treasury yields have both risen almost 100 basis points from recent lows, with the two-year yield nudging what many investors will consider an attractive and natural buying point of 5.00%. If yields level off, bond volatility is likely to subside, which in turn should help cool volatility in other markets. Implied U.S. equity volatility, which spiked to a six-month high on Friday, posted its biggest fall in six months on Monday. Relief, but maybe only briefly. Here are key developments that could provide more direction to markets on Tuesday: - Japan flash PMIs (April) - Singapore CPI (March) - Taiwan Industrial production (March) Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-04-22/

2024-04-22 21:45

WASHINGTON, April 22 (Reuters) - The Biden administration is expected to drop green hydrogen from its landmark plan to slash greenhouse gas emissions from the power sector, to reduce the risk of lawsuits if the nascent technology doesn’t reach commercial scale, according to three sources familiar with the matter. The move reflects skepticism within the U.S. government that the technology – in which hydrogen fuel is extracted from water using zero-emissions energy sources like wind and solar - will develop quickly enough to become a significant tool to decarbonize the electricity industry. The Environmental Protection Agency (EPA) will unveil its final rule as soon as Thursday, the sources said, marking a huge milestone in President Joe Biden’s strategy to fight climate change. The EPA did not respond to a request for comment. E&E News was first to report that the EPA was considering the change. The EPA’s initial power plant proposal had set standards that would push fossil fuel power plant operators to either also use super-low-emissions hydrogen to fuel their plants, or install carbon capture and sequestration (CCS) technology to siphon the CO2 from a plant’s smokestack. Dropping the use of hydrogen could strengthen the rule legally, the sources said. Opponents of the plan had warned that the technology may not be commercially viable when rules kick in in 2030 for gas plants and 2032 for coal plants. The power plant rule is among a raft of regulations the administration is seeking to finalize in the coming weeks to safeguard them from potential reversal under the Congressional Review Act should former President Donald Trump win the November election. The CRA allows a newly elected Congress to review and repeal laws that were recently created. The EPA last month narrowed the scope of the power plant regulation by removing existing gas plants from the standards, after pushback from utilities that called the initial proposal unworkable. Sign up here. https://www.reuters.com/sustainability/climate-energy/us-epa-expected-drop-hydrogen-power-plant-rule-sources-say-2024-04-22/

2024-04-22 21:29

PORT-AU-PRINCE, April 22 (Reuters) - Operations at Haiti's main fuel import terminal were suspended on Monday as armed men seized trucks and demanded the port be shut down, according to a source with information on the matter, likely exacerbating existing fuel shortages. The source said gangs had blocked off several roads leading to Varreux. "Fuel remains hard to find in Port-au-Prince, on and off," said a spokesperson from the U.N. World Food Programme, warning of long queues at gas stations. "We have stock at the moment, and continue to provide fuel to humanitarian partners working in Haiti," the spokesperson said. Armed gangs from the G9 alliance already blocked the Varreux terminal for nearly a month in October 2021, and again a year later for more than a month, halting most economic activities and prompting the government to call for a foreign intervention. With most businesses unable to maintain power without their diesel generators, under the previous blockades hospitals were forced to shut down, radio stations stopped programming, mobile antennas ran out of fuel and transport was brought to a halt. G9 leader Jimmy "Barbeque" Cherizier has said he wants unelected Prime Minister Ariel Henry to resign, but since Henry announced his intention to resign on March 11, he has spoken of a broader "revolution" against the elites and gang attacks in the capital have increased. He had also previously announced a broader alliance of gangs, known as Viv Ansanm (Living Together). Local media reported that Viv Ansanm gangs were fighting police around the National Palace on Monday. A transition council meant to usher in a new government is set to be sworn in at the palace, though a date has yet to be confirmed. Although the United Nations six months ago approved the intervention Henry had requested back in 2022, this has since been put on hold. Pending a new government, Henry remains nominally in charge though the government is largely absent. Meanwhile, the U.N. estimates hundreds of thousands are internally displaced - fleeing arson, kidnappings, indiscriminate killings and sexual violence - and millions are going hungry as gangs tighten their grip on the country. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/americas/haiti-fuel-terminal-operations-halted-gangs-seize-trucks-source-2024-04-22/