2024-04-17 21:33

WASHINGTON, April 17 (Reuters) - The U.S. must take "decisive" action to protect electric vehicles (EVs) from subsidized Chinese competition, U.S. Trade Representative Katherine Tai said on Wednesday as she completes a review of Trump-era China tariffs and considers President Joe Biden's call for higher tariffs on imports of Chinese steel. Tai told a U.S. Senate Finance Committee hearing that the U.S. needed to create a level playing field for U.S. workers and that Biden's call for higher "Section 301" tariffs on Chinese steel imports means that "we are in very, very advanced stages of our interagency work, and I expect that we will come to conclusion very soon." She said that China's "anti-competitive practices," including "enormous amounts of state support," had fostered overproduction of solar panels a decade ago that devastated U.S. producers. Tai said the U.S. was now facing a similar situation with EVs and the automotive sector, and leaving Chinese competition unchecked would cause the U.S. to lose the ability to produce those products. "So we have to take early action, decisive action and we have to be really clear about why we're taking the action," she said. "We are looking for a level playing field because the current playing field is not level, for all the talk about free trade." Tai added that the current dynamics in the global EV industry is a significant factor in the Biden administration's examination of its trade tools. USTR announced New Tab, opens new tab on Wednesday that it had opened a new unfair trade practices investigation into China's "acts, policies and practices" to dominate the maritime, logistics and shipbuilding sectors. The probe, which accepts a petition from five U.S. labor unions, will be conducted under Section 301 of the Trade Act of 1974, the same statute used by former President Donald Trump to impose tariffs on hundreds of billions of dollars of Chinese imports in 2018. Some senators have urged Tai to use the Section 301 tariff review, launched in September 2022, to take actions to impose higher tariffs on Chinese-made EVs. Tai told the panel that the completion of the review and any adjustments would be presented as a "complete package" and that she had a high degree of confidence it would be completed soon. Stay up to date with the latest news, trends and innovations that are driving the global automotive industry with the Reuters Auto File newsletter. Sign up here. https://www.reuters.com/business/autos-transportation/ustr-tai-calls-decisive-action-shield-ev-sector-china-2024-04-17/

2024-04-17 21:04

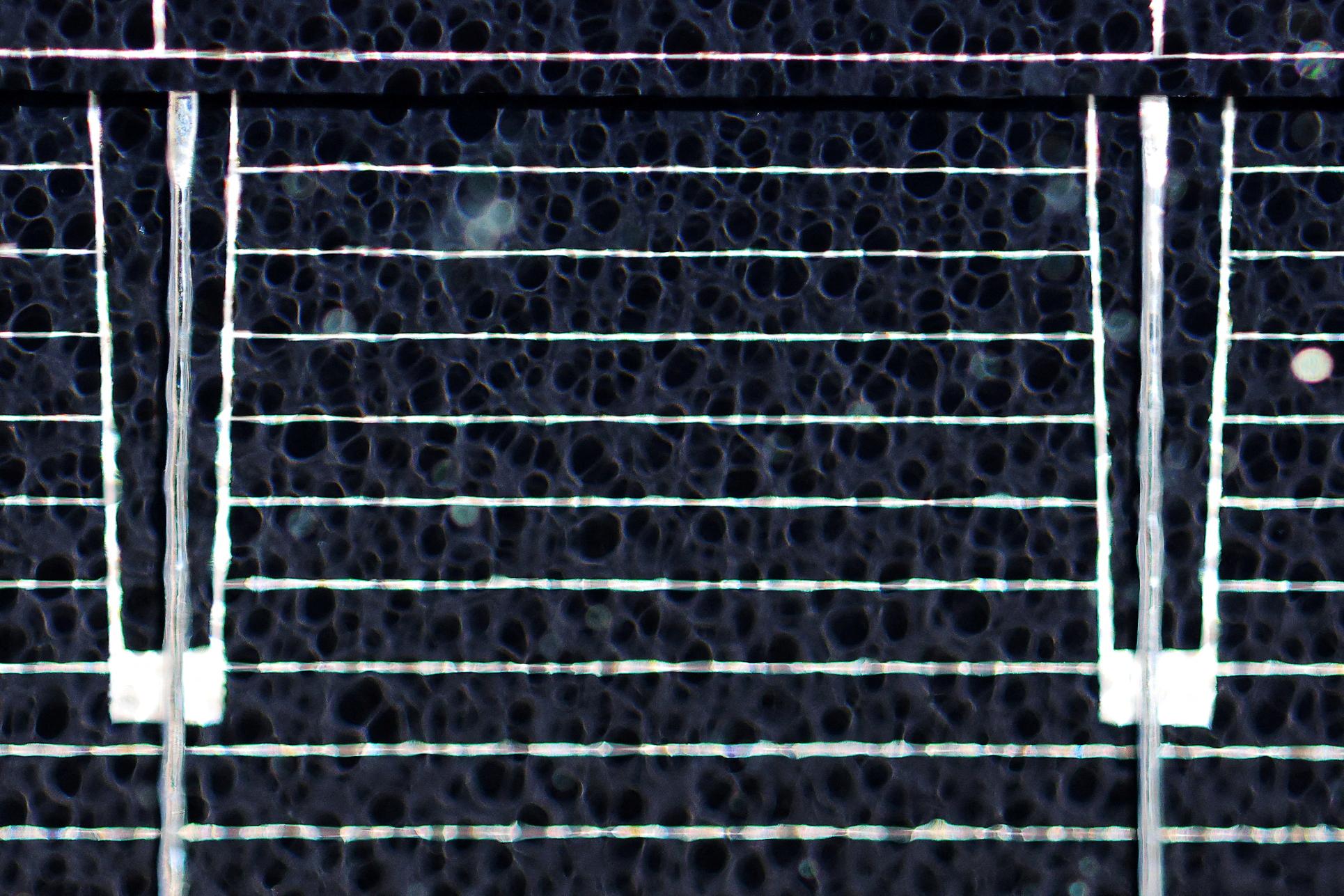

April 17 (Reuters) - The Biden administration is expected to grant a request by South Korea’s Hanwha Qcells to reverse a two-year-old trade exemption that has allowed imports of a dominant solar panel technology from China and other countries to avoid tariffs, two sources familiar with the White House plans said on Wednesday. The news sent shares of solar manufacturers including U.S.-based First Solar (FSLR.O) New Tab, opens new tab higher in afternoon trade. The Qcells request, which has not previously been reported, comes as the company is seeking to protect a pledged $2.5 billion expansion of its U.S. solar manufacturing presence against competition from cheaper Asian-made products. The solar division of Korean conglomerate Hanwha Corp (000880.KS) New Tab, opens new tab outlined the request in a formal petition to the U.S. Trade Representative on Feb. 23. It included letters of support from seven other companies with billions of dollars combined invested in U.S. solar factories. No decision has been made on the timeline of the expected reversal, the sources said. Duties on imports of bifacial panels, the main technology in utility-scale solar projects, would be a boon to the more than 40 solar equipment factories planned since U.S. President Joe Biden signed his landmark climate change law, the Inflation Reduction Act, in 2022. Those plants are critical to Biden's plan to fight climate change, revitalize American manufacturing and create millions of union jobs. Past trade remedies have sharply divided the U.S. solar industry, which is dominated by installers and developers who rely on cheap imports to keep their project costs low. The top U.S. solar trade group, the Solar Energy Industries Association (SEIA), lobbied for the bifacial exemption. In a statement, SEIA did not address the exemption directly but advocated for an increase in the amount of solar cells that can be imported tariff-free to help companies assembling American-made panels. "We hope the Administration is prepared to directly support increased domestic manufacturing of solar modules by raising the tariff rate quota on cells," said Stacy Ettinger, SEIA's senior vice president of supply chain and trade. Biden administration officials, including Treasury Secretary Janet Yellen and U.S. Trade Representative Katherine Tai, in recent weeks have said the U.S. is evaluating trade remedies to deal with threats posed by China's massive investment in factory capacity for clean energy goods. The solar panel issue goes to the core of one of Biden’s arguments for re-election: that his economic policies have begun transforming the U.S. energy economy while combating climate change. However, the pace of growth in the domestic solar panel manufacturing market has been cast into doubt by surging imports of cheap, Chinese panels. A bipartisan group of U.S. senators, led by the two Democrats from the critical election battleground state of Georgia, asked Biden earlier this year to toughen up tariffs on Chinese solar panels or face a glutted market just as clean-energy tax credits hit the market. Qcells, which has two factories in Georgia, is the largest U.S. producer of silicon-based solar products. In its petition, a copy of which was seen by Reuters, the company asked Biden to revoke an exemption of so-called bifacial panels from duties first imposed by Republican former President Donald Trump in 2018 and extended by Biden, a Democrat, in 2022. The tariffs on imported modules started at 30% and currently stand at 14.25%. They are due to expire in 2026. 'A LEVEL PLAYING FIELD' Most panel imports come from Southeast Asia but are made by Chinese companies there. The U.S. imposed duties on some panel makers for finishing their products in Cambodia, Malaysia, Thailand and Vietnam to avoid tariffs on Chinese-made goods. Biden waived those tariffs nearly two years ago, a policy that the White House said it will allow to expire in June. "We're continuing to look at all of our options to ensure that the historic investments spurred by the Inflation Reduction Act are successful," a White House official said. "Our companies and workers can compete with anyone, but they need a level playing field." Bifacial panels can generate electricity on both sides. The technology was nascent when the tariffs were first imposed but now accounts for 98% of imported modules, according to the petition. The action is needed, Qcells said in the petition, to preserve the many plans for new U.S. solar manufacturing capacity that have been unleashed by incentives contained in the IRA. "Despite these positive trends, there is growing evidence that negative market conditions caused by surging imports of bifacial modules are causing several companies to rethink their plans to invest in the U.S.," the petition said. Qcells' request is supported by seven other solar manufacturers with U.S. factories - First Solar, Heliene, Suniva, Silfab, Crossroads Solar, Mission Solar and Auxin Solar - according to the petition documents. First Solar shares closed nearly 3% higher at $178.01 on the Nasdaq. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/us-plans-restore-tariffs-dominant-solar-technology-sources-say-2024-04-17/

2024-04-17 20:59

BUENOS AIRES, April 17 (Reuters) - Automaker Stellantis (STLAM.MI) New Tab, opens new tab said on Wednesday it will pay $100 million to acquire 49.5% of 360 Energy Solar, one of Argentina's leading solar power producers, in a push towards making its plants more energy self-sufficient. Stellantis, which makes and sells Citroen, Fiat and Peugeot vehicles in the South American country, said in a statement the partners will develop additional solar plants, install large-scale solar storage systems and produce hydrogen energy. The investment will allow the automaker to boost renewable energy at its Ferreyra and El Palomar plants in the provinces of Cordoba and Buenos Aires, respectively, Stellantis said. Both facilities are powered by 360's La Rioja solar power plant. 360 Energy owns six photovoltaic plants in the provinces of San Juan, Catamarca and La Rioja, with an installed generating capacity of more than 250 megawatts. Get U.S. personal finance tips and insight straight to your inbox with the Reuters On the Money newsletter. Sign up here. https://www.reuters.com/markets/deals/stellantis-acquire-stake-argentina-solar-power-firm-green-energy-push-2024-04-17/

2024-04-17 20:46

CARACAS, April 17 (Reuters) - Venezuela is willing to continue doing business with foreign firms, including joint venture partners of state-run oil company PDVSA, even after the expiration of a broad U.S. license that had allowed it to freely export its crude, the country's oil minister said on Wednesday. Minister Pedro Tellechea told reporters the country expects the U.S. Treasury Department to reply to oil companies' requests for individual licenses for starting or continuing energy deals in Venezuela, and that a 45-day period set by Washington to wind down transactions will allow Venezuela to complete deals for expansions of oil areas and other projects. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/americas/venezuela-open-business-oil-sector-even-after-us-license-expiration-2024-04-17/

2024-04-17 20:45

April 17 (Reuters) - Pipeline and terminal operator Kinder Morgan (KMI.N) New Tab, opens new tab on Wednesday reaffirmed its annual profit outlook and said it expects demand for natural gas to grow substantially between now and 2030. The company, which operates about 79,000 miles of pipelines, said it is banking on growth in electric demand primarily driven by demand from new and expanding data centers, especially those required to support AI. Houston, Texas-based Kinder Morgan had said in January it continues to have a bullish outlook for natural gas demand due to demand from LNG export facilities and increased exports from Mexico. This comes at a time when natural gas (.NGc1) New Tab, opens new tab prices declined 20.4% in the first quarter of 2024 compared to a year earlier. "Increase in AI demand per management could lead to a 7-16 bcf/d increase in gas demand by 2030 adding another growth driver alongside US LNG exports" says Stephen Ellis, analyst at Morningstar. The company reaffirmed its 2024 profit forecast at $1.22 per share, which it had raised in January to reflect the acquisition of NextEra Energy Partners' (NEP.N) New Tab, opens new tab STX Midstream assets. Kinder Morgan also met the first-quarter profit estimates, helped by higher volumes in its natural gas pipelines segment. The natural gas pipeline segment saw a boost from higher margins realized on the company's storage assets and higher volumes on its gathering systems, with additional boost from the STX Midstream acquisition, it said. Adjusted core profit from the company's natural gas pipeline segment was $1.52 billion, versus $1.43 billion a year ago. "The interesting thing on the call is that KMI expects to carry lower levels of debt into the future, potentially getting higher ratings from credit agencies and better feedback from investors" said Bill Selesky, analyst at Argus Research. Kinder Morgan reported an adjusted profit of 34 cents per share for the January-to-March quarter, in line with the LSEG estimates, and approved a 2% increase to its quarterly dividend. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/kinder-morgan-meets-profit-estimates-strength-natural-gas-pipeline-segment-2024-04-17/

2024-04-17 20:28

TSX ends up 0.1% at 21,656.05 Materials, tech stocks lead gains CIBC raises PT on goeasy; shares climb Industrials fall 0.7% April 17 (Reuters) - Canada's main stock index ended higher on Wednesday as mining stocks rallied and investors looked ahead to quarterly earnings reports, but gains for the index were held in check after the federal budget proposed raising a tax on investment profits. The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) New Tab, opens new tab ended up 13.18 points, or 0.1%, at 21,656.05, after five straight days of declines. "There is some dip buying going on at the margins," said Elvis Picardo, a portfolio manager at Luft Financial, iA Private Wealth. "Mining stocks, we've seen the rebound after being sold off yesterday." The materials group (.GSPTTMT) New Tab, opens new tab, which includes metal miners and fertilizer companies, was up 0.8% as copper prices climbed. "The big question is whether Q1 earnings will be strong enough to provide the impetus for the markets to grind higher," Picardo said. Technology (.SPTTTK) New Tab, opens new tab was another bright spot, rising 0.6%, and heavily weighted financials (.SPTTFS) New Tab, opens new tab added 0.1%. It was helped by a gain of 6.3% for the shares of goeasy Ltd (GSY.TO) New Tab, opens new tab after CIBC raised its price target on the lender to C$200 from C$175. Canada's budget on Tuesday proposed raising the share of capital gains that is subject to taxation for wealthy individuals as well as for companies and trusts. The measure would come into effect on June 25. "There might be some selling on stocks that people have big gains in before the tax rate goes up. It could have an impact on the market", said Greg Taylor, a portfolio manager at Purpose Investments. Among the sectors that declined was industrials (.GSPTTIN) New Tab, opens new tab. It lost 0.7% and energy (.SPTTEN) New Tab, opens new tab was down 0.3% as oil settled 3.3% lower at $82.69 a barrel. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/tsx-futures-edge-higher-gold-strength-2024-04-17/