2024-04-17 12:35

FLORENCE, April 17 (Reuters) - The European Union is looking into whether to bring emissions removal credits into its carbon market, a move that could reopen the market to carbon credits in future years, a European Commission official said on Wednesday. The EU's carbon market is the bloc's main policy for reducing planet-warming greenhouse gas emissions, which it does by requiring power plants and factories to buy a permit covering each tonne of carbon dioxide they emit. Ruben Vermeeren, deputy head of the European Commission's EU carbon market unit, said Brussels was assessing whether carbon removal credits should be brought into the scheme in future years. "This is something we are starting to look at right now," he told a conference organised by the International Emissions Trading Association in Florence, Italy. The Commission has until 2026 to decide whether to propose rules adding removal credits to the market. Such credits represent the removal of carbon emissions, and can be generated by projects like planting new CO2-absorbing forests, or building technologies to extract CO2 from the atmosphere. Vermeeren said the options included adding removals to the existing carbon market, or forming a separate EU market for removal credits. Many companies "offset" their own greenhouse gas emissions by buying carbon credits, which represent the avoidance or removal of emissions. Unlike the EU's carbon market, which is obligatory for industries in Europe, companies' use of offset credits is voluntary. Scientists have said removing billions of tons of carbon dioxide from the atmosphere annually, by using nature or technology, will be necessary to limit global warming. But critics warn a reliance on removal credits could slow country and company efforts to cut their outright emissions. The EU has banned international carbon offsets from its emissions market since 2020, owing to concerns about cheap international credits with low environmental standards. It has since taken a strict stance on the use of carbon credits, which cannot be counted towards meeting the EU's 2030 emissions-cutting target. Vermeeren said potential benefits of adding removals to the EU carbon market include that it would provide a way for industries to address the final emissions they cannot eliminate. But he warned of the risk that promoting the use of offsets could deter companies from actually reducing their emissions. "Offsets cannot replace mitigation," he said. Get a look at the day ahead in European and global markets with the Morning Bid Europe newsletter. Sign up here. https://www.reuters.com/markets/europe/eu-considers-bringing-emissions-removal-credits-into-carbon-market-2024-04-17/

2024-04-17 12:26

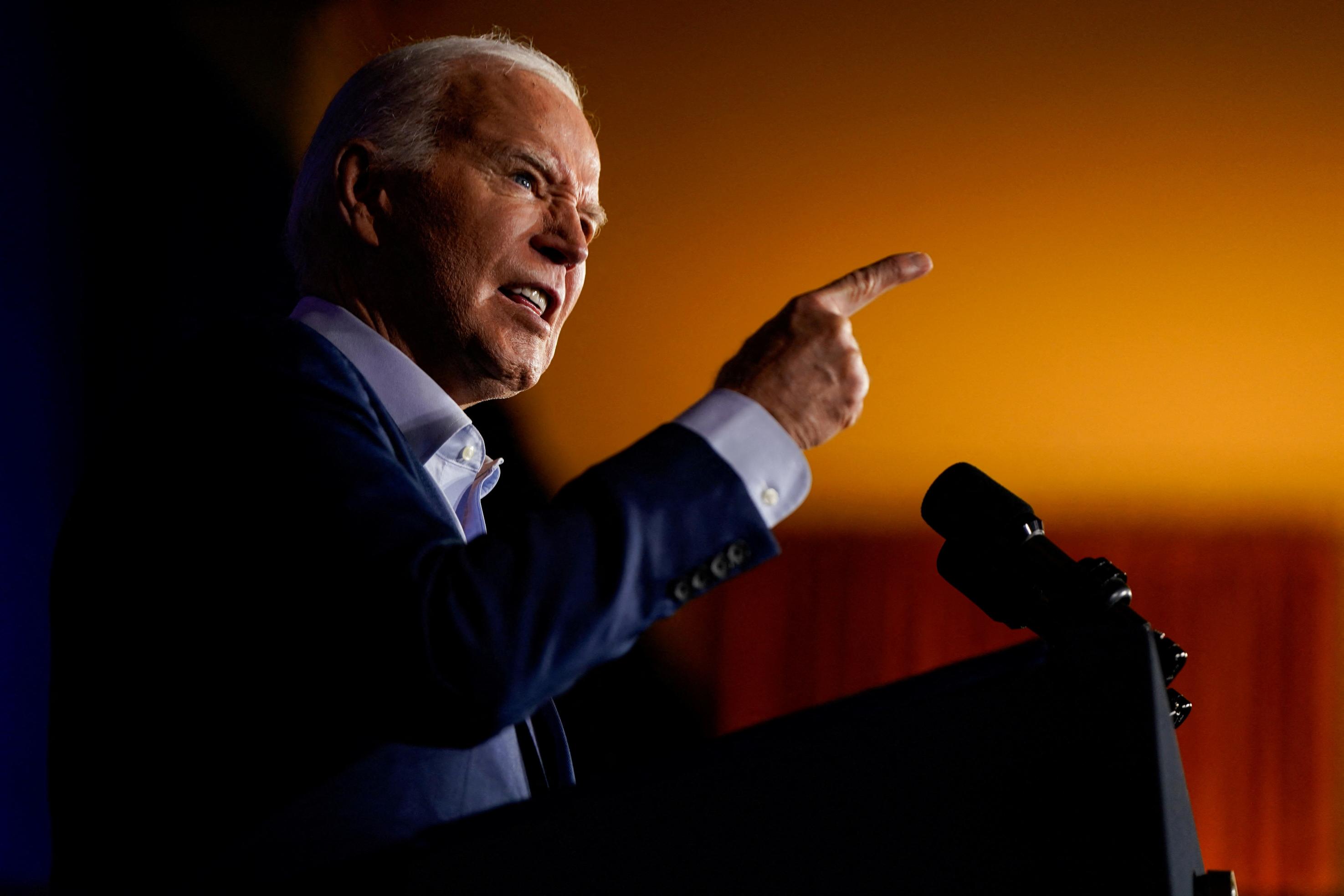

WASHINGTON, April 17 (Reuters) - U.S. President Joe Biden will call on Wednesday for sharply higher tariffs on Chinese metal products as part of a package of policies aimed at pleasing steelworkers in the swing state of Pennsylvania, at the risk of angering Beijing. In campaign stops in the "Steel City" of Pittsburgh, Biden is expected to propose raising to 25% the tariffs imposed by his predecessor Donald Trump on Chinese steel and aluminum products, according to an administration official. The products targeted currently face up to a 7.5% levy under a Trump-era policy under Section 301 of the U.S. trade law, under a review Biden ordered in 2022. The Biden administration is also pressuring neighboring Mexico to prohibit China from selling its metal products to the United States indirectly from there. At the same time, it is launching an investigation into Chinese trade practices across the shipbuilding, maritime and logistics sectors, which could lead to more tariffs. The measures, set to be unveiled as Biden visits the headquarters of the United Steelworkers union, will invite blowback from China at a time of already heightened tensions between the world's two biggest economies. Trump's imposition of tariffs during his 2017-2021 presidency prompted China's retaliation with its own levies. Pennsylvania is one of a half-dozen battleground states likely to decide the November election rematch between Biden and Trump. The economy ranks among voters' top concerns. Jared Bernstein, director of the White House Council of Economic Advisers, said on Wednesday the "targeted intervention" being considered by the Biden administration should not worsen persistently high inflation. "If we don't take action, we're putting at risk about one of our most critical sectors - what the president calls the backbone of the American economy, the bedrock of our national security - and that's domestic steel production," he told CNBC. KEY VOTING BLOC Biden and his Republican opponent have each courted union leaders and blue-collar workers in faded industrial hubs who comprise a significant voting bloc in Pennsylvania and Michigan, another swing state. The steelworkers union, which sought the measures Biden is now adopting, endorsed him last month. Biden handed the union another win when he came out last month against a proposed $14.9 billion bid by Japan's Nippon Steel (5401.T) New Tab, opens new tab to buy U.S. Steel Corp (X.N) New Tab, opens new tab. Both 2024 candidates have sharply departed from the pro-trade consensus that once reigned in Washington, capped by China's joining the World Trade Organization in 2001. Trump, who withdrew from the would-be Trans-Pacific Partnership trade deal in 2017, has proposed a 10% tariff on all imports if he returns to office. China was the seventh-largest exporter of steel to the U.S. in 2023, with shipments of 598,000 net tons, down 8.2% from 2022, according to U.S. Census Bureau data compiled by the American Iron and Steel Institute, an industry trade group. Canada was the top exporter to the U.S., with 6.9 million tons, followed by Mexico, with 4.2 million tons. Domestic steelmakers shipped 89.3 million net tons of steel in 2023, according to AISI data. Any new levies on steel and aluminum would be subject to the approval of Biden's appointed trade representative, Katherine Tai, at the completion of the review of the Trump-era tariffs. The new levies would come on top of 25% Section 232 national security tariffs also imposed by Trump on steel and aluminum products and product-specific anti-dumping and anti-subsidy duties that often reach into the triple-digit percentages. China's economy grew by a faster-than-expected 5.3% in the first quarter, data showed on Tuesday, as the country has turned to exports to shore up growth in the face of protracted weakness in the property sector and mounting local government debt. Beijing regards Trump-era tariffs as discriminatory. Officials said they expected Chinese exports to start flooding global markets, concerns raised by Biden Treasury Secretary Janet Yellen on a trip to the country last week. China exported 25.8 million tons of steel products in the first quarter, the highest for the period since 2016 and a rise of 30.7% year on year, Chinese customs data showed. "China cannot export its way to recovery," Biden's top economic policymaker, Lael Brainard, told reporters. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/biden-call-higher-tariffs-chinese-metals-steel-city-pittsburgh-2024-04-17/

2024-04-17 11:52

LONDON, April 17 (Reuters) - The 25 crew members of the MSC Aries, which was seized by Iran on April 13, are safe, shipping firm MSC said on Wednesday, adding that discussions with Iranian authorities are in progress to secure their earliest release. "We are also working with the Iranian authorities to have the cargo discharged," the Swiss headquartered company said in a statement. Iran's Revolutionary Guards seized the container vessel in the Strait of Hormuz days after Tehran vowed to retaliate for a suspected Israeli strike on its consulate in Damascus on April 1. Iran had said it could close the crucial shipping route. The International Transport Workers' Federation (ITF), the leading seafarers' union, said on Wednesday that their priority was the welfare and safety of the seafarers onboard. "I can confirm the ITF has been in touch with family of the crew on board MSC Aries – who have reported today they're safe and being treated reasonably," ITF inspectorate coordinator Steve Trowsdale told Reuters. "We continue to call on the Iranian authorities to urgently release the crew and the vessel." Portugal's foreign ministry summoned Iran's ambassador on Tuesday to condemn Saturday's attack on Israel by Tehran and to demand the immediate release of the Portuguese-flagged ship. Iran has also seized other vessels in international waters in recent years, heightening risks for merchant shipping in the area. The Advantage Sweet, Niovi and St Nikolas tankers, which were taken last year, were anchored in Iranian waters as of April 12, said Claire Jungman, chief of staff at U.S. advocacy group United Against Nuclear Iran, which tracks Iran-related tanker traffic via satellite data. Iran's foreign ministry said on Monday that the MSC Aries was seized for "violating maritime laws", adding that there was no doubt the vessel was linked to Israel. MSC leases the Aries from Gortal Shipping, an affiliate of Zodiac Maritime. Zodiac is partly owned by Israeli businessman Eyal Ofer. Recent attacks on merchant shipping in the Red Sea and the Gulf of Aden by Yemen's Iran-aligned Houthis have also affected the global maritime transport chain. The Houthis are still holding the Galaxy Leader commercial ship and its 25 crew after the militia's commandos boarded the vessel at sea on Nov. 19. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/middle-east/crew-ship-seized-by-iran-are-safe-operator-msc-says-2024-04-17/

2024-04-17 11:47

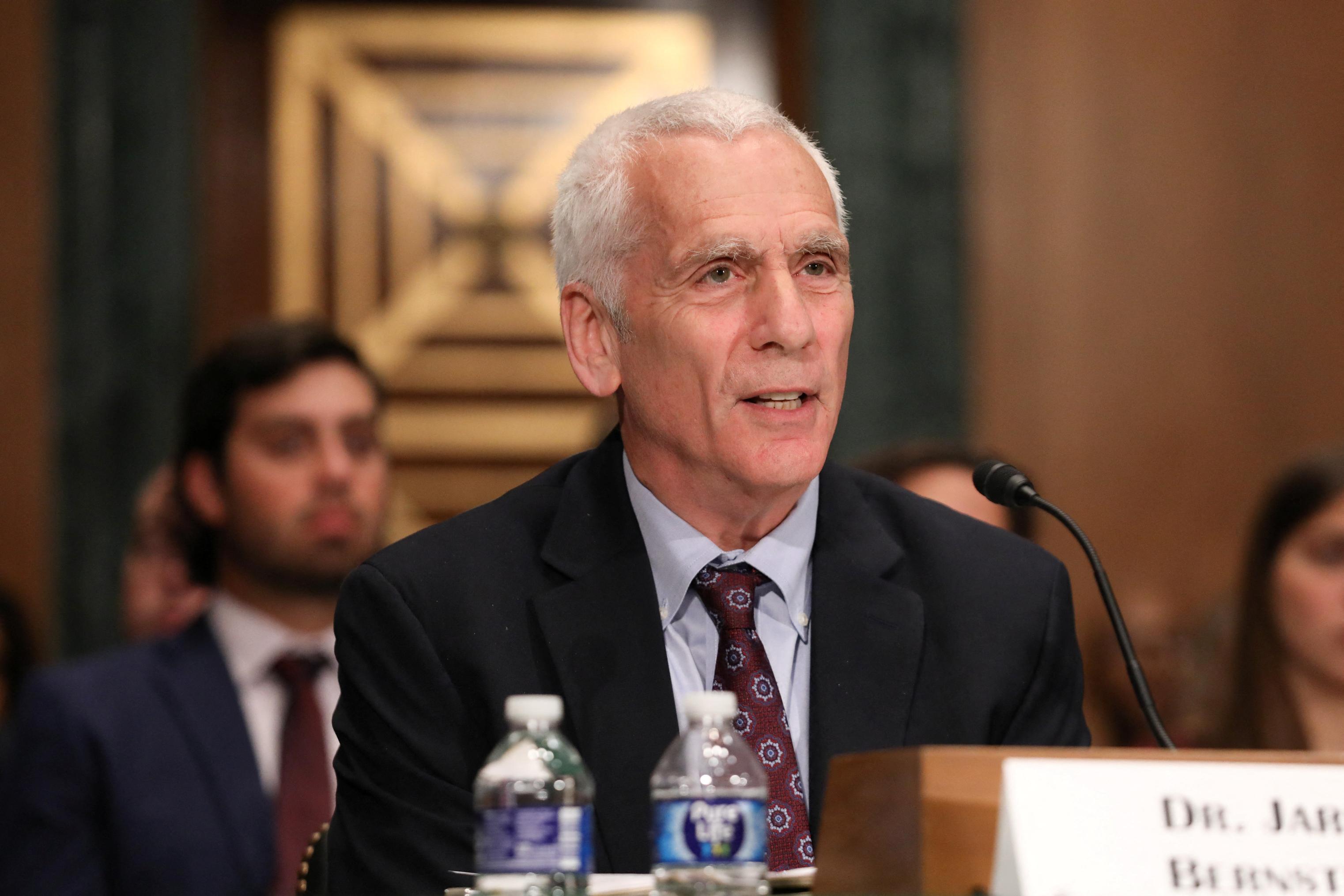

WASHINGTON, April 17 (Reuters) - Sharply higher tariffs on Chinese metal products being considered by the Biden administration would not affect U.S. inflation and are necessary for national security, White House economic adviser Jared Bernstein said on Wednesday. "If we don't take action, we're putting at risk about one of our most critical sectors -- what the president calls the backbone of the American economy, the bedrock of our national security -- and that's domestic steel production," the chairman of the White House Council of Economic Advisers told CNBC. U.S. President Joe Biden on Wednesday will call for sharply higher tariffs on Chinese steel and aluminum as part of a package of policies aimed at pleasing steelworkers in the swing state of Pennsylvania, at the risk of angering Beijing. Bernstein said such tariffs would not have a negative effect on the U.S. economy. "This is a targeted intervention that shouldn't have much impact at all on inflation," he said in an interview with CNBC. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/new-tariffs-chinese-metals-wont-impact-inflation-white-house-says-2024-04-17/

2024-04-17 11:43

MADRID, April 17 (Reuters) - Abu Dhabi's TAQA (TAQA.AD) New Tab, opens new tab is in discussions with the three largest shareholders of Spanish energy firm Naturgy (NTGY.MC) New Tab, opens new tab, it said on Wednesday, with a view to a possible full takeover bid for the company. Criteria, the main shareholder in lender Caixabank (CABK.MC) New Tab, opens new tab, owns a 26.7% stake in Naturgy, which has a current overall market value of 22 billion euros ($23.42 billion). Private equity firms CVC and GIP each own a further 20%, at a combined value of almost 9 billion euros. TAQA said it is in talks with the pair regarding the possible acquisition of the stakes. Spanish rules require a mandatory tender offer when a buyer wants to acquire more than 30% of a publicly traded company, which could lead to one of the largest European acquisitions by a UAE-based company. Thanks to the European Union's largest fleet of import terminals, Spain has become an important regional hub for liquefied natural gas (LNG) as the bloc pivots away from Russian pipeline gas supplies following Moscow's invasion of Ukraine. With Naturgy, TAQA - a power and water utility founded in 2005 - would acquire Spain's largest gas firm, with key contracts with Algeria and also a long-term contract to import some 3 billion cubic metres (bcm) of Russian LNG every year. It is also in talks with Criteria over a possible partnership agreement, it said, adding that no conclusion has yet been reached in the talks with any of the parties. There is no guarantee a deal will happen and, if it were to, under what terms, TAQA said, adding that it had not approached Naturgy directly. Any deal would need the approval of the Spanish government. Spain's economy ministry declined to comment. However, a government source said that TAQA's interest "shows Spain's international investment appeal". Naturgy, CVC and GIP declined to comment, as did Australian fund IFM which holds a 15% stake in Naturgy. Criteria declined to comment beyond a Tuesday statement where it said it was in discussions with an investor group. Naturgy's shares were up almost 6% by 1115 GMT. The company is also expanding its renewable energy business, reaching some 6.5 GW of installed capacity at the end of last year. Relationships between Madrid and Abu Dhabi were strengthened two years ago, when the two governments agreed to create a strategic partnership. TAQA operates in about 10 other countries besides the UAE. A unit of Abu Dhabi sovereign wealth fund ADQ owns just over 90% of the company. Gas accounted for over half of TAQA's production mix last year. ($1 = 0.9394 euros) Get U.S. personal finance tips and insight straight to your inbox with the Reuters On the Money newsletter. Sign up here. https://www.reuters.com/markets/deals/abu-dhabis-taqa-confirms-talks-with-spains-naturgy-shareholders-2024-04-17/

2024-04-17 11:09

X has been blocked since time of Feb. 8 election Rights activists: ban aims to stifle democratic accountability Ministry accuses X of failing to address its concerns Says ban was in 'interest of upholding national security' ISLAMABAD, April 17 (Reuters) - Pakistan's interior ministry said on Wednesday it had blocked access to social media platform X around the time of February's election on national security concerns, confirming a long-suspected shutdown. Users in Pakistan have reported problems using X, formerly known as Twitter, since mid-February, but the government had made no official announcement on the matter until now. The interior ministry mentioned the shutdown in a written submission to Islamabad High Court on Wednesday. Another court has told the government to reconsider the ban within a week, said Abdul Moiz Jafri, a petitioner and advocate. "It is very pertinent to mention here that the failure of Twitter/X to adhere to the lawful directives of the government of Pakistan and address concerns regarding the misuse of its platform necessitated the imposition of a ban," the ministry said in its court submission, which was seen by Reuters. It said X had been reluctant to resolve the issue. X did not immediately respond to a Reuters request for comment on Wednesday. "The decision to impose a ban on Twitter/X in Pakistan was made in the interest of upholding national security, maintaining public order, and preserving the integrity of our nation," the ministry report said. Access to X has remained limited since the Feb. 8 national election, which the party of jailed former prime minister Imran Khan says was rigged. KHAN'S PARTY IS BIG USER OF X Among Pakistan's political parties, Khan's party is the most prolific user of social media platforms, particularly after the country's traditional media began censoring news about the ex-cricket star and his party ahead of the polls. Khan has over 20 million followers on X, making him the most followed Pakistani. Khan says Pakistan's military was behind his ouster as prime minister in 2022 and that it helped his opponents form the current government, despite candidates backed by his party winning most seats in February's election. The military denies this charge. He remains in jail on a number of convictions, most of which came days before the election. Many government officials in Pakistan, notably Prime Minister Shehbaz Sharif, continue to use X - most likely through VPN software that bypasses the blocks. The decision to temporarily block X was taken after considering confidential reports from Pakistan's intelligence and security agencies, the ministry report said. It said "hostile elements operating on Twitter/X have nefarious intentions to create an environment of chaos and instability, with the ultimate goal of destabilising the country and plunging it into some form of anarchy". Rights groups and marketing advertisers have raised concerns. Digital rights activist Usama Khilji said the block on X seemed designed to hinder the democratic accountability which he said a platform with instant updates of real-time information enables, especially amid the allegations and evidence of rigging which surfaced following the election. Marketing consultant Saif Ali said: "It has become nearly impossible to convince Pakistani advertisers to invest in Twitter for brand communications, due to the platform being throttled by governmental authorities." The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/asia-pacific/pakistan-blocked-social-media-platform-x-over-national-security-ministry-says-2024-04-17/