2024-04-12 11:41

July 23 (Reuters) - Brokerages have raised their year-end targets for U.S. stocks benchmark S&P 500 (.SPX) , opens new tab, spurred by expectations of a "soft landing" for the economy and growing odds that the Federal Reserve will cut interest rates this year. Following are forecasts from some major banks on economic growth, inflation, and how they expect certain asset classes to perform: Forecasts for stocks, currencies and bonds: * UBS Global Research and UBS Global Wealth Management are distinct, independent divisions in UBS Group ---- U.S. INFLATION U.S. consumer prices fell for the first time in four years in June amid cheaper gasoline and moderating rents, firmly putting disinflation back on track and drawing the Federal Reserve another step closer to cutting interest rates in September. ----- Sign up here. https://www.reuters.com/markets/brokerages-lift-sp-500-target-hopes-soft-landing-rate-cuts-2024-07-15/

2024-04-12 11:38

Brussels expected to decide on possible tariffs this year Some of first public comments of European visit Solar panel experience scarred Europe Verona, Italy, April 12 (Reuters) - China's top trade official warned Brussels against protectionism on Friday, saying Beijing was puzzled by EU probes into green tech exports and the bloc's concerns they threaten the domestic solar panel, wind turbine and electric vehicle industries. Wang Wentao is travelling through Europe for discussions about the European Commission's investigation into whether China's electric vehicle (EV) industry has benefited from unfair subsidies. "We fail to understand how the EU commission carries the banner of sustainable and green development and then takes protectionist actions, thereby in effect generating more and more risks," Wang said in some of his first public comments during the European trip. Speaking at a trade and business conference in the northern city of Verona, he cited the European Union's investigations into Chinese electric cars, solar panels and wind turbines as examples. "We must oppose unilateralism and protectionism and protect the global supply chain," the minister said. Earlier this week, Wang was in France where he met French Finance Minister Bruno Le Maire. Also this week, Brussels launched a preliminary review of possible market distortions by Chinese wind turbine makers. The Commission could choose to prohibit transactions or disqualify bids in public tenders. In its EV investigation, the Commission is expected to decide whether to impose provisional duties by June 5. It would then publish an initial list of companies affected and decide on definitive duties by early November. PAINFUL MEMORIES European policymakers are keen to avoid a repeat of what happened with solar panels a decade ago when the EU took no action to curb Chinese imports and many European manufacturers collapsed. Addressing the Verona conference, Italy's Industry Minister Antonio Tajani, previously a European Commissioner, said the European Commission needed to prevent what he called "environmental dumping", a reference to selling green technology below the domestic price to gain market share. He also called for increased trade exchanges and investments between Italy and China. Italy seeks inward investment while Chinese carmakers, pursuing sales of their lower-cost, mostly electric, vehicles in the region are seeking to set up manufacturing sites in Europe. China's BYD has already announced plans to build a facility in Hungary, while rival Chery Auto might pick Spain or Italy for a similar investment. Tajani reiterated Italy was keen to find "new opportunities" for auto manufacturers investing in the country, besides Stellantis (STLAM.MI) New Tab, opens new tab, Italy's sole major automaker. Wang said China and Italy had to expand mutual investments. "We need to think of new opportunities to address growing bilateral investments, beyond traditional sectors," he said, citing "high-end manufacturing" as a possible area. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/china/china-puzzled-by-eu-probes-evs-solar-panels-wind-turbines-minister-says-2024-04-12/

2024-04-12 11:31

April 12 (Reuters) - A major battery plant near Los Angeles will be among the largest in the world when it comes online later this year, promising to shore up California's power grid during the peak summer season and help the state a meet ambitious climate goals. Calpine's billion-dollar Nova Power Bank, built on the site of a failed gas-fired power plant, will be able to power about 680,000 homes for up to four hours when charged. It could help boost California's renewable power industries which provide more than a third of the state's power needs. The 680-megawatt lithium-ion battery bank is big even for California, which boasts about 55% of the nation's power storage capacity, according to data from the U.S. Energy Information Administration. Calpine will bring online 620 MW of the bank in two phases this year starting in the summer and open the remaining 60 MW in 2025. Battery projects in the hundreds of megawatts are becoming more common. Such large systems exist or are under development in California, Florida, Australia, the United Kingdom and China. Calpine's new facility is part of a U.S. storage boom centered in California and Texas, two states with large and growing amounts of wind and solar energy. Storing power is considered vital to the expansion of renewable energy because it allows electricity generated when the sun is shining or wind is blowing to be used late in the day when consumers need it most. California was a pioneer in mandating that its utilities begin procuring energy storage more than a decade ago. The state is expected to need about 50 gigawatts of battery storage to meet its 2045 goal of getting all of its power from carbon-free sources, up from about 7 GW today. Calpine, best known in the state for its fleet of gas plants, has about 2,000 MW of battery capacity under development. Battery capacity has expanded dramatically in California since 2020, when rolling blackouts during a summer heatwave prompted state officials to launch an emergency procurement. Two years later, batteries provided valuable energy during a September heatwave, accounting for 2.4% of generation during evening hours, according to the state's grid operator, the California Independent System Operator. "This plant will help stabilize the grid, especially for reliability purposes," Emily Precht, Calpine strategic origination manager, said at a press conference to unveil the project in Menifee, California. "When people get home from work and they plug in their electric cars, turn on their dishwashers and air conditioners, there is a high demand for power, (but) not as much solar production. Having something that saves the power from the middle of the day (and) moves it to a higher demand period will help make the grid more resilient." New U.S. grid storage installations soared 98% last year, according to research firm Wood Mackenzie, which expects growth of 30% this year. Battery installations still must contend with permitting challenges and long interconnection queues that are slowing their expansion, Wood Mackenzie said. They also must contend with gas, which today still provides more than half of California's power needs. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/california-battery-plant-is-among-worlds-largest-power-storage-booms-2024-04-12/

2024-04-12 11:29

THE HAGUE, April 12 (Reuters) - Shell (SHEL.L) New Tab, opens new tab told a Dutch court on Friday that a European climate ruling against the Swiss government supported their appeal against a Dutch climate ruling because it confirmed that states and not courts should set the rules on emissions reductions. Friends of the Earth Netherlands, however, which brought the original Shell case, said the exact opposite. On the fourth and final day of its appeal against a landmark 2021 Dutch ruling ordering it to make much deeper greenhouse gas emission cuts than it planned, Shell's lawyer Daan Lunsingh Scheurleer said this week's European Court of Human Rights ruling in the Swiss case changed nothing in the Dutch one. But he said that in Shell's view, the ECHR decision that the Swiss government had violated the human rights of senior women by not doing enough to combat climate change confirmed Shell's point that emissions were an issue of state responsibility. "It does support Shell on the point that issuing a demand for emissions reductions for companies is not up to courts" but should be the domain of states, Lunsingh Scheurleer told judges. Friends of the Earth Netherlands replied that in fact the European ruling supported their side. "The European Court of Human Rights confirms that climate change is a human rights issue," lawyer Roger Cox said, adding that courts have a role to ensure companies respect human rights. In a landmark ruling that shocked the energy sector, a lower Dutch court in 2021 ordered Shell to reduce its planet warming carbon emissions by 45% by 2030 from 2019 levels. The order related not only to Shell's own emissions but also to those caused by the buyers and users of its products around the globe. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/climate-energy/shell-friends-earth-each-say-european-climate-ruling-backs-their-view-dutch-case-2024-04-12/

2024-04-12 11:27

April 12 (Reuters) - Exxon Mobil (XOM.N) New Tab, opens new tab has made a final investment decision for its sixth oil development project in offshore Guyana after receiving the required government and regulatory approvals, the company said on Friday. A consortium led by Exxon began crude output in Guyana in 2019, and has ramped up production to some 650,000 barrels per day (bpd) this year. The other members of the consortium are Hess Corp (HES.N) New Tab, opens new tab and CNOOC Ltd (0883.HK) New Tab, opens new tab. The latest project will bring the Exxon-led consortium's production capacity in Guyana to about 1.3 million bpd, Exxon said on Friday. Production at the $12.7 billion project, the sixth on the Stabroek block, is expected to begin in 2027. Exxon is currently also embroiled in a dispute for the Stabroek block with Hess and Chevron (CVX.N) New Tab, opens new tab. The dispute threatens to derail Chevron's $53 billion takeover of Hess, which has a 30% stake in Stabroek. Exxon says it has the right of first refusal for Hess's stake. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/exxon-mobil-moves-forward-with-sixth-offshore-project-guyana-2024-04-12/

2024-04-12 11:15

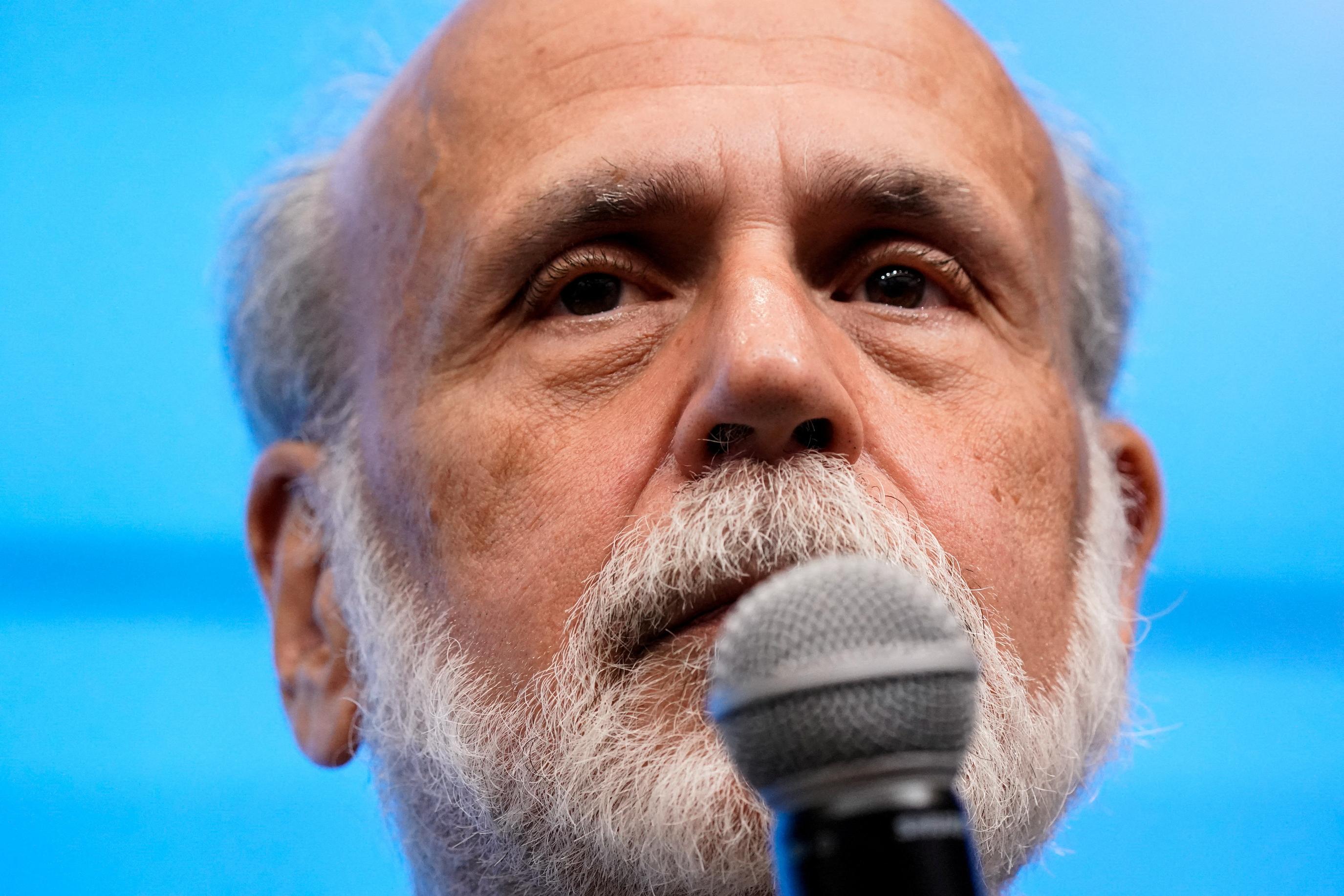

LONDON, April 12 (Reuters) - The Bank of England should scrap communication tools that it has used for a generation and upgrade "seriously out of date" technology to overhaul its approach to economic forecasting, former U.S. Federal Reserve chair Ben Bernanke said. After a surge in inflation to a 41-year high in 2022 which turned a spotlight on the BoE's inner workings, Bernanke released a report on Friday which advised the UK's central bank to publish more alternative scenarios for the economy. The Nobel prize-winning economist proposed that the BoE should rely less on market expectations of interest rate moves, among other measures to improve its forecasting. But he stopped short of recommending that the BoE publish its own forecast for where interest rates might head, saying this more radical option should be left for discussion. "While the accuracy of the BoE's forecasts has deteriorated significantly in the past few years, forecasting performance has worsened to a comparable degree in other central banks and among other UK forecasters," Bernanke concluded in the report, which was commissioned by the BoE's oversight body last year. British consumer price inflation surged above 11% in October 2022 after Russia's invasion of Ukraine caused a surge in European gas prices, compounding post-pandemic bottlenecks. Some politicians and economists criticised the BoE for only starting to raise interest rates in December 2021, when inflation was already above target. The BoE has said an earlier start would have made little difference. Bernanke described the BoE's failure to foresee the inflation surge as "probably inevitable" due to "unique circumstances". The biggest failure was in the BoE's forecasting systems which had "significant shortcomings" that made it hard for staff to produce alternative economic scenarios and needed "replacing, or, at a minimum, thoroughly revamping". Bernanke said the BoE should eliminate its long-standing "fan chart", which shows a range of possible future paths for inflation and growth based on a single set of assumptions. Instead, the BoE should give a more descriptive assessment of risks and publish alternative scenarios that show how the BoE might change interest rates if the economy did not develop as expected, and what impact these changes would have. Governor Andrew Bailey said work was underway to improve the BoE's data platforms over the next year or so and policymakers would set out further steps on communication by the end of 2024. "The Bernanke Review won't be a game-changer for how policy is conducted," Deutsche Bank chief UK economist Sanjay Raja said. "Any external changes will be gradual, with bigger changes likely to take place behind the scenes." NO 'DOT PLOT' Bernanke, who headed the Fed from 2006 to 2014, did not recommend that the BoE move closer to the U.S. central bank's "dot plot", where each rate-setter anonymously publishes their own forecasts for interest rates, growth and inflation. The BoE, unlike the Fed and the Swedish and Norwegian central banks, does not publish its own interest rate forecasts. Bernanke said there was a case for this "more aggressive approach" but it would be "highly consequential" and should be left for future debate. If the BoE did go down this route, it should produce a single rate projection, as Scandinavian banks do, rather than a Fed dot plot with individual policymaker views, he said. Some senior BoE officials have previously opposed rate forecasts, worrying they would be misinterpreted as a commitment rather than a best guess which was likely to change. Bernanke said this had not been his experience at the Fed, or a major problem for Sweden or Norway, though it did sometimes put pressure on policymakers in times of uncertainty. "The problem with rate projections is they force you to take a stand when perhaps you don't feel it is really appropriate," he told reporters. The BoE currently produces two sets of projections for inflation, growth and unemployment. One is based on interest rates staying unchanged, and the other on what financial markets think will happen to borrowing costs over the next three years - similar to the European Central Bank's approach. Investors often look at the BoE's forecast for inflation two years ahead to get a sense of whether the central bank thinks the market path for interest rates is too high or too low. Some former officials have said this can lock the central bank into making forecasts based on interest rate assumptions that policymakers sometimes themselves do not believe. Bernanke said the BoE should reduce the emphasis on forecasts based on market rate assumptions and be "exceptionally clear" when policymakers disagreed with them. Alternative scenarios, or explicit changes to the assumptions, could be a way to do this. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/uk/bank-england-must-fix-forecasts-technology-former-fed-chief-bernanke-says-2024-04-12/