2024-04-12 05:18

LONDON/BRUSSELS, April 12 (Reuters) - Governments and companies that are lax on climate action should be worried since this week's European human rights court ruling against the Swiss government improves the odds that other such cases could win at the top court, legal experts said. The climate case – one of three decided on Tuesday – was the first to be tested at Europe's regional human rights court. Earlier lawsuits filed over the last decade in courts around the world have mostly succeeded or failed at or below the national level. A win at the European Court of Human Rights (ECtHR) sets a precedent for courts across the region. Given similarities to arguments made by the Swiss women who won, it also has direct implications for seven other climate cases that the ECtHR had put on hold pending Tuesday's rulings, legal experts said. The two other cases decided on Tuesday were deemed inadmissible, and these failures may also impact pending cases. The Swiss case ruling on Tuesday - where the court ruled that the Swiss government had violated the human rights of more than 2,000 elderly women by failing to do enough to combat climate change - served as a reminder that even human rights courts are open to arguments that challenge commitments to tackling climate change, lawyers said. It's "going to have a significant impact on the other pending cases before the European Court," said Tom Cummins, partner at British multinational law firm Ashurst. There are seven lawsuits pending at the ECtHR that rest their argument on the same rights violation that the Swiss case successfully argued, including two that could hit the oil industry in Norway. Others challenge climate policies and pacts in Germany, Italy and dozens of other European states. Some focus on the specific harms they say government inaction has caused them, including one where a man with a medical condition is suing Austria because he suffers mobility issues when temperatures exceed 30 degree Celsius. "All of these cases rely on the same provisions and same legal theories around state and government responsibility," said lawyer Sam Hunter-Jones at non-profit law firm ClientEarth. CHILLING EFFECT Of the seven pending cases, two are against the Norwegian government. They argue that the country's decision in 2016 to grant oil exploration licenses in the Arctic violates human rights by further committing to the release of planet-warming emissions. A victory in either case could create "higher hurdles and costs for new exploration/extraction projects," said Laura Houët, partner and co-head of environmental, social and governance (ESG) issues at international law firm CMS. This could ultimately limit new oil and gas projects across Europe, she said. "Understanding what might happen with the Norwegian case, and others that are pending, is crucial," Houët said. Norway's climate minister, Andreas Bjelland Eriksen, said his government was reviewing the court's ruling against Switzerland. In 2022, Norway had asked the ECtHR to dismiss the Arctic oil lawsuit brought by NGOs, citing its role as a stable energy supplier amid the war in Ukraine. Equinor and Aker BP, Norway's two-largest petroleum producers, have both won exploration permits in the Barents Sea. Aker BP did not immediately respond to a request for comment. Equinor declined to comment. The International Association of Oil & Gas Producers said climate lawsuits were adding to a range of challenges facing Europe's industry, which include complex legislation and high energy costs. "When you add climate litigation and such rulings to the list, it probably doesn't help improve Europe's attractiveness for investors," a spokesperson for the industry group said. Plaintiffs in the cases against Norway said they felt buoyed by the ECtHR's ruling against the Swiss government, saying the verdict offered signs their cases too could win. The Swiss verdict should "send shivers through the international oil and gas industry," said Andrew Kroglund, who leads the Norwegian Grandparents' Climate Campaign, which filed one of the lawsuits. "We think that our case has been immensely strengthened," he said. The other case against Norway was filed by the non-profits Greenpeace Nordic and Young Friends of the Earth Norway. The head of Greenpeace Norway, Frode Pleym, expressed relief after Tuesday's verdicts, noting their case already had tested all national legal avenues. One of the two cases dismissed on Tuesday - a case brought by six Portuguese youth against 32 governments for their failure to rapidly cut emissions - was dismissed in part for not having done this. A third human rights case arguing that Germany's climate plans are inadequate is also based on the Swiss case, said Jürgen Resch of the non-profit Deutsche Umwelthilfe, which filed the suit on behalf of nine teenagers and adults. NEW HURDLES Not all climate litigants were cheered by Tuesday's rulings. The European court's dismissal of the Portuguese case suggested several other pending cases could falter for similar reasons. There are two lawsuits filed by Italian youths that target more than 30 governments, running the risk that they might be dismissed like the Portuguese youths' case for attempting to tackle so many jurisdictions, said climate litigation expert Joana Setzer at the London School of Economics. And in a pending case filed in 2022, five individuals are seeking to force Austria and 11 other European countries to withdraw from the international Energy Charter Treaty, which aims to protect energy investments including fossil fuel projects. The ECT secretariat did not respond to a request for comment. Lawyers involved in filing that case said they were concerned by the ECtHR taking issue with the fact that the Portuguese youth had not yet exhausted all legal avenues domestically. This may also be "relevant for our case," said lead lawyer Clementine Baldon. Though, "we can argue that domestic courts have no competence to challenge states' participation in an international treaty." The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/climate-verdict-swiss-women-warning-european-states-oil-industry-2024-04-12/

2024-04-12 04:51

A look at the day ahead in European and global markets from Kevin Buckland The question over which big central bank will be the last to cut rates took a major twist this week following dovish signals from the ECB's policy meeting and a U.S. CPI shock that's still reverberating in markets. The focus in Europe now falls on the UK, with the release of monthly GDP for February for the latest clues on when the Bank of England will move. BoE policymaker Megan Greene pushed back against punters betting the UK will cut before the Fed, arguing inflation in Britain was even stickier than it was in the U.S. Markets can look forward to potential policy hints from ECB officials including Pablo Hernandez de Cos, Luis de Guindos and Frank Elderson at various events over the course of the day, with the Fed's Jeffrey Schmid, Raphael Bostic and Mary Daly also on speaking duty. Currently, traders expect an ECB cut in June, a BoE easing in August, and a Fed reduction in September. The currency market reflects that shift, with the dollar sitting near multi-month high to both the euro and sterling . The yen , meanwhile, is clinging to the 34-year low against the greenback from Thursday, prompting another round of intervention warnings from Japan's finance minister. European equities look set to slump to another weekly decline, with the STOXX 600 (.STOXX) New Tab, opens new tab entering Friday down 0.4%, and a Wall Street-inspired rally unlikely considering Asia's lukewarm reception. Corporate news will become increasingly important for equity direction from today, with the big banks - including JPM, Wells Fargo and Citigroup - kicking off the U.S. earnings season. Big Tech's reporting season gets underway next week, with Netflix on Thursday. Key developments that could influence markets on Friday: -UK GDP (Feb) -Germany, France, Spain final CPI (Mar) -Earnings from JPM, Wells Fargo, Citi, BlackRock, State Street (This story has been refiled to fix a typo in paragraph 3) Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/global-markets-view-europe-2024-04-12/

2024-04-12 04:05

Gold hit record high of $2,400.35 per ounce China's March exports and imports shrank Vietnam to increase gold bar supplies to stabilise market April 12 (Reuters) - Safe-haven gold prices hit an all-time high on Friday on track for a fourth straight weekly gain as geopolitical risks in the Middle East and economic concerns about China spurred robust demand. Spot gold was up 0.9% at $2,395.66 per ounce as of 1100 GMT after hitting a record high of $2,400.35. Prices were up nearly 3% for the week. U.S. gold futures gained 1.8% to $2,414.30. There is potential for more upside in prices amid central bank purchases and as demand for safe-haven assets rise with growing anxiety among investors about geopolitical conflicts escalating, said Ricardo Evangelista, senior analyst at ActivTrades. Concern about "the Chinese economy feeds into worries about growth of the global economy and this also compounds the market sentiment of seeking safe-haven assets," he added. Iran has signalled to Washington that it will respond to Israel's attack on its Syrian embassy in a way that aims to avoid major escalation, Iranian sources said. Meanwhile, Vietnam's central bank said it will increase gold bar supplies to stabilise the market, while China's central bank added more gold to its reserves in March. Investors also kept a tab on data that showed China's March exports and imports shrank, highlighting the tough task facing policymakers as they try to bolster a shaky economic recovery. Elsewhere, Fed's Boston President Susan Collins said in an interview with Reuters that she is eyeing a couple of interest rate cuts this year. Spot silver rose 2% to $29.04 per ounce, hitting its highest levels since early 2021. Gold's strength appears to have filtered through to support silver prices, and industrial production figures released on Tuesday gave a further signal on industrial demand for silver, Frank Watson, market analyst at Kinesis Money, wrote in a note. Platinum rose 1.7% to $996.36 and palladium firmed 0.5% to $1,051.50. All three headed for weekly gains. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/gold-prices-hit-record-highs-safe-haven-demand-2024-04-12/

2024-04-12 00:54

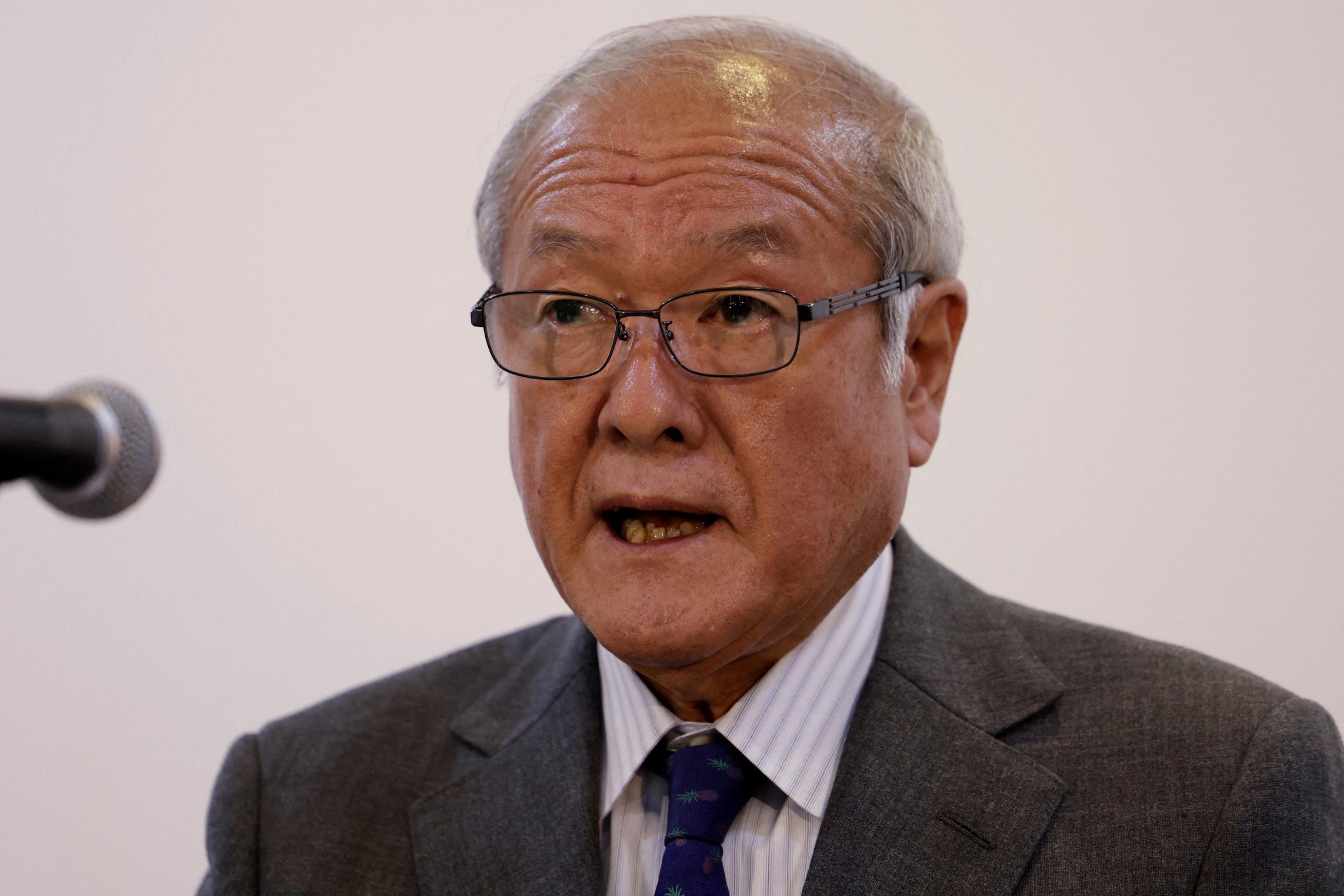

G20 finance chiefs may discuss currency moves next week Finance minister warns against excessive yen volatility Suzuki declines to say if Tokyo preparing to intervene Renewed yen slide complicates BOJ's rate hike path TOKYO, April 12 (Reuters) - Japanese Finance Minister Shunichi Suzuki said authorities were analysing not just recent yen declines but factors that are driving the moves, and repeated that Tokyo stood ready to respond to any excessive currency swings. Suzuki said finance leaders from the Group of 20 major economies, who will meet in Washington D.C. next week on the sidelines of the spring International Monetary Fund (IMF) gatherings, may discuss currency moves as part of topics for debate. While a weak yen brings some benefits and drawbacks to the economy, it can hurt consumers by pushing up inflation, he said. "I can't comment specifically on recent currency moves. But it's important for exchange rates to move stably reflecting fundamentals. Excessive volatility is undesirable," Suzuki said. "If there are excessive moves, we will respond appropriately without ruling out any options," he told a press conference on Friday. Suzuki said he was coordinating closely with top currency diplomat, Masato Kanda, to deal with yen moves, but declined to comment on whether they were preparing to intervene in the market to prop up the currency. Suzuki also did not escalate his warning to take "decisive action" against sharp yen declines, language he used shortly before Japan stepped into the currency market in 2022. The best-case scenario for authorities is to keep the market on alert for actual intervention to deter the yen from depreciating further, said Tsuyoshi Ueno, senior economist at NLI Research Institute. "If you keep saying taking 'decisive' action, it will lose its effectiveness," Ueno said. "There is a risk of causing friction when intervening, and it is not possible to intervene indefinitely." WIDENING YIELD GAP Suzuki said it was difficult to pin down the sole cause behind the current weakness in the yen, noting that several factors were at play including changes in monetary policy along with balance of payments, price trends, market sentiments and speculative moves. "In usual thinking, narrowing interest rate gaps would lead to a stronger yen", Suzuki said, when asked by an opposition lawmaker why the central bank's March decision to scale down accommodative policy was followed by yet another wave of currency depreciation. Fading expectations of a near-term U.S. interest rate cut have accelerated the dollar's ascent as markets focused on the starkly wide U.S.-Japan yield gap. The yen's slide against the dollar has brought intervention fears back as authorities in Tokyo have repeatedly warned over recent weeks that they would not rule out any steps to deal with excessive swings. After hitting a fresh 34-year high of 153.32 yen overnight, the dollar stood at 153.18 yen in Asia on Friday. The Japanese currency has tumbled almost 8% against the dollar since the beginning of the year With the G20 meeting coming up next week, the authorities may not see the necessity to rush to intervene beforehand since the yen has stuck around this level, said Mari Iwashita, chief market economist at Daiwa Securities. A weak yen has become a source of headache for Japanese policymakers because it inflates the cost of importing fuel and raw material, thereby hurting retailers and households. Household spending fell for a 12th straight month on February as many consumers have yet to see wage growth exceed the pace of inflation. A poll by think tank Japan Center for Economic Research, released on Wednesday, showed analysts expect Japan's economy to contract an annualised 0.54% in the first quarter due to weak consumption and output, before rebounding by 1.69%. The yen's renewed declines complicate the Bank of Japan's deliberations on the timing of a next interest rate hike, which analysts expect to happen sometime later this year. BOJ Governor Kazuo Ueda told parliament on Wednesday the central bank would not directly respond to currency moves in setting monetary policy. But he said the BOJ could respond if yen moves have a big impact on the economy and prices. Japan last intervened in the currency market in 2022, first in September and again in October, to prop up the yen. Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/japans-finance-minister-says-authorities-are-looking-factors-behind-yen-moves-2024-04-12/

2024-04-12 00:41

Concern of fewer U.S. rate cuts weighs IEA cuts 2024 demand growth view US drillers cut oil and gas rigs for fourth week in a row NEW YORK, April 12 (Reuters) - Oil rose around 1% on Friday on geopolitical tensions in the Middle East but posted a weekly loss on a bearish world oil demand growth forecast from the International Energy Agency (IEA) and worries about slower U.S. interest rate cuts. Brent crude futures settled up 71 cents at $90.45 a barrel, while U.S. West Texas Intermediate crude futures rose 64 cents to $85.66. For the week, Brent declined 0.8%, while WTI fell more than 1%. During the week, oil prices neared a six-month high on concern that Iran, the third-largest OPEC producer, might retaliate for a suspected Israeli warplane attack on Iran's embassy in Damascus on Monday. "The market's main focus is on whether Iran will retaliate against Israel," said Andrew Lipow, president of Lipow Oil Associates, with the fear of supply disruption associated with the events in the Middle East supporting prices. The U.S. expects an attack by Iran against Israel but one that would not be big enough to draw Washington into war, according to a U.S. official. Iranian sources said Tehran has signaled a response aimed at avoiding major escalation. Supply chain issues still carry the biggest risk premium as Iran maintains its threat to shut the Suez Canal, said Tim Snyder, economist at Matador Economics. The International Energy Agency cut its forecast for 2024 world oil demand growth to 1.2 million barrels per day (bpd). OPEC on Thursday said world oil demand will rise by 2.25 million barrels per day (bpd) in 2024. "For now the market is mostly in the OPEC 2.2 million bpd demand growth camp as opposed to the IEA's reduced 1.2 million bpd forecast," said Saxo Bank's Ole Hansen. Friday's gains erased the previous session's losses, which were dominated by stubborn U.S. inflation that dampened hopes for an interest rate cut as early as June. Higher interest rates can weaken economic growth and depress oil demand. U.S. energy firms this week cut the number of oil rigs operating for a fourth week in a row, energy services firm Baker Hughes (BKR.O) New Tab, opens new tab said in its closely followed report. The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November. Money managers raised their net long U.S. crude futures and options positions in the week to April 9, the U.S. Commodity Futures Trading Commission (CFTC) said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/oil-prices-head-back-up-middle-east-jitters-2024-04-12/

2024-04-12 00:23

SINGAPORE, April 12 (Reuters) - Singapore's central bank left its monetary policy unchanged on Friday, in line with expectations, as authorities looked for signs inflation in the city-state was moderating. The Monetary Authority of Singapore (MAS) said it will maintain the prevailing rate of appreciation of its exchange rate-based policy band known as the Nominal Effective Exchange Rate, or S$NEER. The width and the level at which the band is centred did not change. "Current monetary policy settings remain appropriate. The prevailing rate of appreciation of the policy band is needed to keep a restraining effect on imported inflation as well as domestic cost pressures, and is sufficient to ensure medium-term price stability," MAS said in a statement. Gross domestic product (GDP) rose 2.7% year-on-year in the first quarter of this year, according to advance estimates published by the trade ministry on Friday. A Reuters poll had estimated first quarter GDP growth at 2.9%. The central bank said it expects the economy to strengthen over 2024 and for inflation to "stay on its broadly moderating path and step down in Q4, before falling further into 2025". OCBC economist Selena Ling said it was "too premature to pull the trigger on easing when the view that core CPI will step down in 4Q24 into 2025 remains intact". Ling added that major central banks may be slightly hesitant to loosen monetary policy when recent inflation prints have been more buoyant and there is an uptick in crude oil prices. "The economy is cruising once again, while core inflation remains sticky," Maybank economist Chua Hak Bin said. "We see low odds of a move at the next MAS meeting in July. We expect the MAS to ease only in October, at the earliest." As a heavily trade-reliant economy, Singapore uses a unique method of managing monetary policy, tweaking the exchange rate of its dollar against a basket of currencies instead of domestic interest rates like most other countries. Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/singapore-central-bank-keeps-monetary-policy-unchanged-2024-04-12/