2024-04-10 21:12

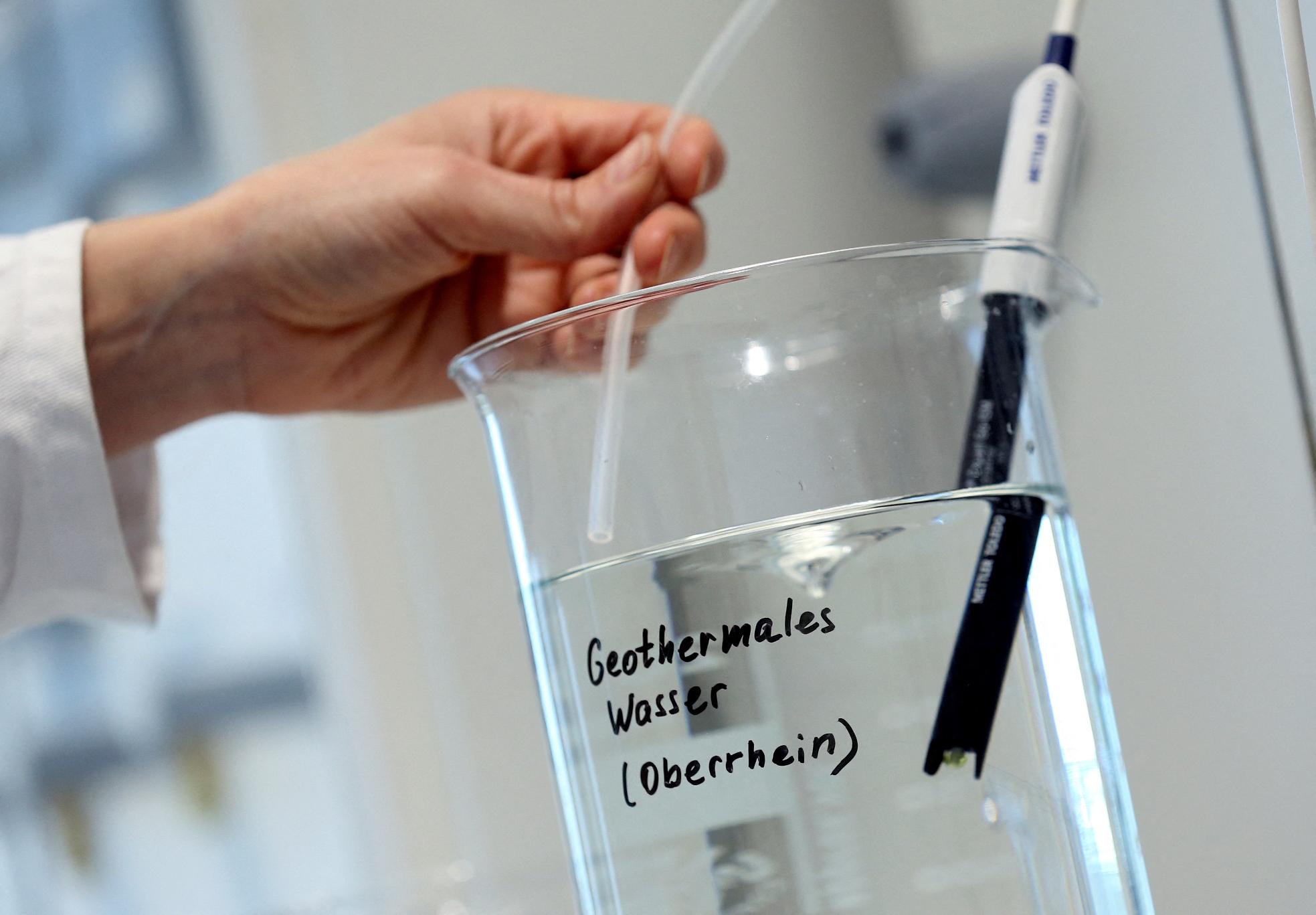

BERLIN, April 10 (Reuters) - Lithium supplier Vulcan Energy (VUL.AX) New Tab, opens new tab on Wednesday announced the start of production of the first lithium chloride at its extraction plant in Germany using geothermal energy, an essential step toward producing battery-grade lithium hydroxide. "To the best of our knowledge, it is the first locally produced resource, meaning that the lithium comes from Germany, from the resource underneath our feet," Vulcan Energy Chief Executive Cris Moreno told Reuters. Vulcan Energy has obtained licences for more than 1,000 kilometres of land in Germany's Upper Rhine Valley region to extract super-hot lithium-rich brine from underground reservoirs, using the heat to produce electricity and draw out lithium from the brine. The European Union has set targets to dig up, recycle and refine lithium, cobalt and other metals it needs for its green transition, but a shortage of new money, crippling energy costs and local opposition could put them beyond reach. The German government has created a 1.1 billion-euro investment fund to fortify the nation’s access to critical raw materials essential for high-tech and green projects, Vulcan Energy said in February. The company, which is listed both in Australia and Frankfurt, already has offtake agreements with automakers including Volkswagen (VOWG_p.DE) New Tab, opens new tab, Stellantis (STLAM.MI) New Tab, opens new tab and Renault (RENA.PA) New Tab, opens new tab. It said its Lithium Extraction Optimization Plant in Landau, Germany, showed strong early results, with lithium extraction efficiency consistently above 90%. The results, following three years of in-house piloting, replicate what Vulcan has seen in its lab and pilot plant operations, and are in line with its commercial plant expectations and Vulcan's financing model, the company added. Vulcan's lithium chloride output will be converted into battery-grade lithium hydroxide at the company's new conversion plant in Frankfurt in the second half of the year, Moreno said. The company is raising funds for its first large- scale industrial plant, with an expected annual output of 24,000 tonnes of lithium hydroxide, equivalent to 500,000 electric vehicles, to be commissioned by the end of 2026. "We're looking to close the financing in the next probably four to five months," Moreno added. In February, Vulcan Energy said it passed the preliminary examination of the European Investment Bank (EIB) for debt financing of up to 500 million euros ($537.15 million). ($1 = 0.9308 euro) The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/vulcan-energy-starts-its-first-lithium-chloride-production-germany-2024-04-10/

2024-04-10 20:49

April 10 (Reuters) - The U.S. Securities and Exchange Commission has notified of potential enforcement action against Uniswap Labs, the main developer behind one of the world's largest cryptocurrency exchanges, the company said in a blog New Tab, opens new tab post on Wednesday. The reason for the SEC's warning against Uniswap was not immediately clear from the blog post, but can be pegged to the regulator's campaign to apply U.S. securities law to the digital asset-related companies like Coinbase (COIN.O) New Tab, opens new tab. The SEC declined to comment on the post. The SEC's battle with Coinbase, the world's largest publicly traded cryptocurrency exchange, rests on one core debate: whether digital assets are investment contracts akin to stocks or bonds that should be regulated by the SEC. "Taking into account the SEC's ongoing lawsuits against Coinbase and others as well as their complete unwillingness to provide clarity or a path to registration to those operating lawfully within the U.S., we can only conclude that this is the latest political effort to target even the best actors building technology on blockchains," the blog post read. Uniswap is a crypto marketplace for decentralized finance or DeFi developers, traders and liquidity providers. DeFi is an open network and works on a peer-to-peer system, where transactions are not routed through a centralized system such as a bank or a brokerage. The Technology Roundup newsletter brings the latest news and trends straight to your inbox. Sign up here. https://www.reuters.com/technology/sec-warns-uniswap-labs-potential-enforcement-action-2024-04-10/

2024-04-10 20:00

MEXICO CITY/HOUSTON, April 10 (Reuters) - U.S. weekly imports of Mexican crude oil fell to the lowest on record in the early April, as Mexico's state energy company Pemex cut exports to supply more to its domestic refineries. The imports dropped to 209,000 barrels per day (bpd) in the week ended April 5, data from the U.S. Energy Information Administration (EIA) showed on Wednesday. The imports averaged about 733,000 bpd in 2023. The previous weekly low was 226,000 bpd in the last week of 2021. Reuters reported last week that Pemex requested its trading unit to cancel up to 436,000 bpd of crude exports for April and at least 330,000 bpd for May to retain supplies for its own refineries, including the newest, the Dos Bocas refinery. The Dos Bocas refinery in the southeastern state of Tabasco, which has been running behind schedule and over budget, is part of President Andres Manuel Lopez Obrador's strategy to wean the country off expensive gasoline and diesel imports. Pemex last month disclosed its crude production in February had fallen to the lowest level in 45 years. The cancellations in April include a 122,000 bpd reduction of Mexico's flagship Maya crude, prized by Gulf Coast refiners that typically run medium and heavy oil. A trader with direct knowledge of the matter said that while operational issues typically lead to significant variations in exports, the low export levels in April and May are likely to continue over the coming months, meaning U.S. refiners and traders will have to buy more barrels from the domestic market to compensate. U.S. refiners will also look for similar quality crude from Canada or Venezuela, two sources familiar with the market dynamics said. To offset the shortage, the U.S. imported 531,000 bpd of crude oil from Saudi Arabia last week, the highest in seven months. Total U.S. imports fell 184,000 bpd to 6.4 million bpd. Prices for heavier crude along the U.S. Gulf Coast have climbed in recent weeks, in part due to the fall in Mexican exports. Maya prices at the U.S. Gulf Coast climbed to about $78.80 per barrel on Wednesday, according to pricing data provider General Index New Tab, opens new tab. That was more than $1 higher than in the previous session and about $9 more than the average last year. Shippers are weighing repositioning tankers to serve other markets as Maya exports decline, a shipping industry source said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/us-imports-mexican-crude-lowest-record-eia-says-2024-04-10/

2024-04-10 19:19

NEW YORK, April 10 (Reuters) - U.S. electricity and gasoline prices increased sharply in March, with electricity up 0.9% and gasoline up 1.7%, leading the energy sector to far outpace broader inflation for the month, according to Bureau of Labor Statistics data released on Wednesday. Energy prices, which include electricity, gasoline, fuel oil and other power and oil-related goods and services, jumped by 1.1% last month compared to a 0.4% rise in the broader Consumer Price Index, BLS data showed. For the last 12 months, energy prices were up 2.1%, lower than the overall 3.5% inflation. Gasoline gained 1.3% for the past year, while electricity jumped 5%. Rapidly rising demand from data-intensive processing and manufacturing, coupled with lengthening delays to expand the country's electrical grids with renewable power supply and transmission lines, have accelerated the rise in the country's electric bills. Gasoline prices have been propelled by rising crude oil costs and slowing U.S. oil refining activity that has resulted in tightening fuel supplies. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/us-electricity-gasoline-prices-push-up-energy-sector-inflation-2024-04-10/

2024-04-10 19:16

Canadian dollar falls 0.8% against the greenback Touches its weakest since Nov. 24 at 1.3702 Bank of Canada keeps its policy rate at 5% Canada-U.S. 2-year spread hits a 13-month wide TORONTO, April 10 (Reuters) - The Canadian dollar weakened to a 4-1/2-month low against its U.S. counterpart on Wednesday as the combination of hot U.S. inflation data and a more dovish Bank of Canada led to a diverging outlook for U.S. and Canadian interest rates. The loonie was trading 0.8% lower at 1.3680 to the U.S. dollar, or 73.10 U.S. cents, after touching its weakest intraday level since Nov. 24 at 1.3702. The Canadian central bank kept its key interest rate unchanged at a near 23-year high of 5% but its governor, Tiff Macklem, said a cut in June was possible if a recent cooling trend in inflation is sustained. Still, money markets dialed back expectations for a June rate cut to roughly 50% from 80% before the release of U.S. data showing consumer prices rising more than expected to 3.5% in the 12 months through March. Canada's latest inflation report showed consumer prices easing to an annual rate of 2.8%, its slowest pace since June. "Set against a more inflationary U.S. economy that shouldn't see the Fed cut before September, the BoC's dovish stance should let rate differentials to widen further moving forward," said Simon Harvey, head of FX analysis for Monex Europe and Monex Canada. The U.S. dollar (.DXY) New Tab, opens new tab rose across the board after the U.S. inflation data pushed out the expected timing of a first rate cut by the Federal Reserve to September from June. Canadian government bond yields rose sharply across the curve, tracking moves in U.S. Treasuries. The 2-year was up 16.5 basis points at 4.356%, while the gap between it and the U.S. equivalent traded about 2 basis points wider to 61.5 basis points in favor of the U.S. note. That was the biggest gap since March 2023. Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/c-hits-4-12-month-low-us-canadian-rate-outlooks-diverge-2024-04-10/

2024-04-10 19:07

April 10 (Reuters) - Prospects for a first Federal Reserve interest-rate cut before the end of summer -- or even at all this year -- took a body blow on Wednesday with another U.S. inflation report that cast into stark relief the stickiness of price pressures across the U.S. economy. After months of centering on June for the start of Fed policy easing, traders' bets are now squarely on the Fed's mid-September meeting for an initial rate reduction, after a third straight stronger-than-expected reading on consumer inflation sent financial markets into a fast retreat. And the chance that the Fed won't cut rates at all this year leapt from a barely measurable sub-1% a week ago to about 14% after Wednesday's inflation surprise. While that remains an outside view for now, it is increasingly discussed as a possibility among economists and some Fed officials themselves. Minutes from the Fed's March meeting, released on Wednesday, show policymakers were already disappointed by recent inflation readings before the latest report. At that time, the typical Fed policymaker still felt that three rate cuts this year would be appropriate, but momentum for less was already gaining steam. Atlanta Fed President Raphael Bostic for instance said he sees a single rate cut this year in the fourth quarter. "Given that the U.S. economy has been so robust and so strong and so resilient, I can't take off the possibility that rate cuts may even have to move further out," Bostic said in an interview with Yahoo Finance on Tuesday. Wednesday's report from the U.S. Department of Labor showed the consumer price index rose 3.5% year-on-year in March, an acceleration from the 3.2% rise in February. Core consumer price inflation, which strips out food and gas prices and is one measure economists use to gauge the stickiness of prices, rose 3.8% year on year, the same pace as in February. "This print isn't going to generate the additional confidence that officials were looking for," said Inflation Insights' Omair Sharif. "If they were disappointed in the January and February inflation prints, they'll be outright despondent after today's reading." U.S. President Joe Biden, who faces former president Donald Trump in a presidential election in November, acknowledged Wednesday that still-strong inflation likely means a delay to the Fed's rate cut plans, though he said he stands by his prediction that borrowing costs will drop this year. The yield on the benchmark 10-year Treasury note hit the psychologically important level of 4.5% after Wednesday's inflation report, its highest since November last year. Two and 10-year yields posted their biggest daily gains since March 2023 and September 2022, respectively. Fed officials including the influential Fed Governor Christopher Waller have said they needed more data to assess if stronger-than-expected inflation readings in January and February were only bumps in the road toward the Fed's 2% inflation goal. Traders are now betting the Fed will deliver a first quarter-point interest rate cut at its September 17-18 meeting, bringing the policy rate target to a 5%-5.25% range, and they see just one more rate cut by the end of the year. Three months ago, as inflation appeared to be receding much faster than expected, the Fed was seen cutting rates a total of five times this year. "The lack of moderation in inflation will undermine Fed officials’ confidence that inflation is on a sustainable course back to 2% and likely delays rate cuts to September at the earliest and could push off rate reductions to next year,” wrote Nationwide Chief Economist Kathy Bostjancic after the CPI report. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/markets/rates-bonds/fed-seen-waiting-until-september-cut-rates-2024-04-10/