2024-04-08 05:51

TOKYO, April 8 (Reuters) - Japanese authorities could intervene in the foreign exchange market to stem sharp falls in the yen “at any time” if its moves are excessive enough to warrant such action, a former top currency official in Japan told Reuters on Monday. Takehiko Nakao, who was vice finance minister for international affairs in 2011-2013, made his comment as the Japanese currency hovered near a 34-year low touched last month against the dollar. "The yen has weakened severely against the dollar," Nakao said, citing the IMF's gauge of real effective currency rates and the so-called Big Mac index designed to compare the purchasing power of currencies to buy hamburgers worldwide. The weak yen weighs significantly on household real incomes and consumption, even though it boosts real-estate and stock prices, Nakao said. "It's undesirable,” Nakao said, referring to the yen's fall of about 30% against the dollar since 2022. The yen was last trading at around 151.70 . It hit a 34-year low of 151.97 in March. Japan last intervened in October 2022 when the yen weakened to the upper range of 151-152 yen. Japanese officials have warned against "speculators" trying to sell off the yen, saying that they would not rule out any measures to respond flexibly to excessive currency moves. When he was Japan's currency tsar, Nakao led intervention operations by buying dollars to keep the yen from strengthening beyond a record high of just above 75 yen. "It would be easier to get understanding from other countries when Japan intervenes to shore up the yen, rather than to weaken it to gain export competitiveness," Nakao said. "If you look at the yen's level and its underlying move with signs of speculation, it wouldn’t surprise me if authorities intervened any time,” he said. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/japan/former-japan-fx-tsar-says-yen-weakening-could-trigger-intervention-any-time-2024-04-08/

2024-04-08 05:37

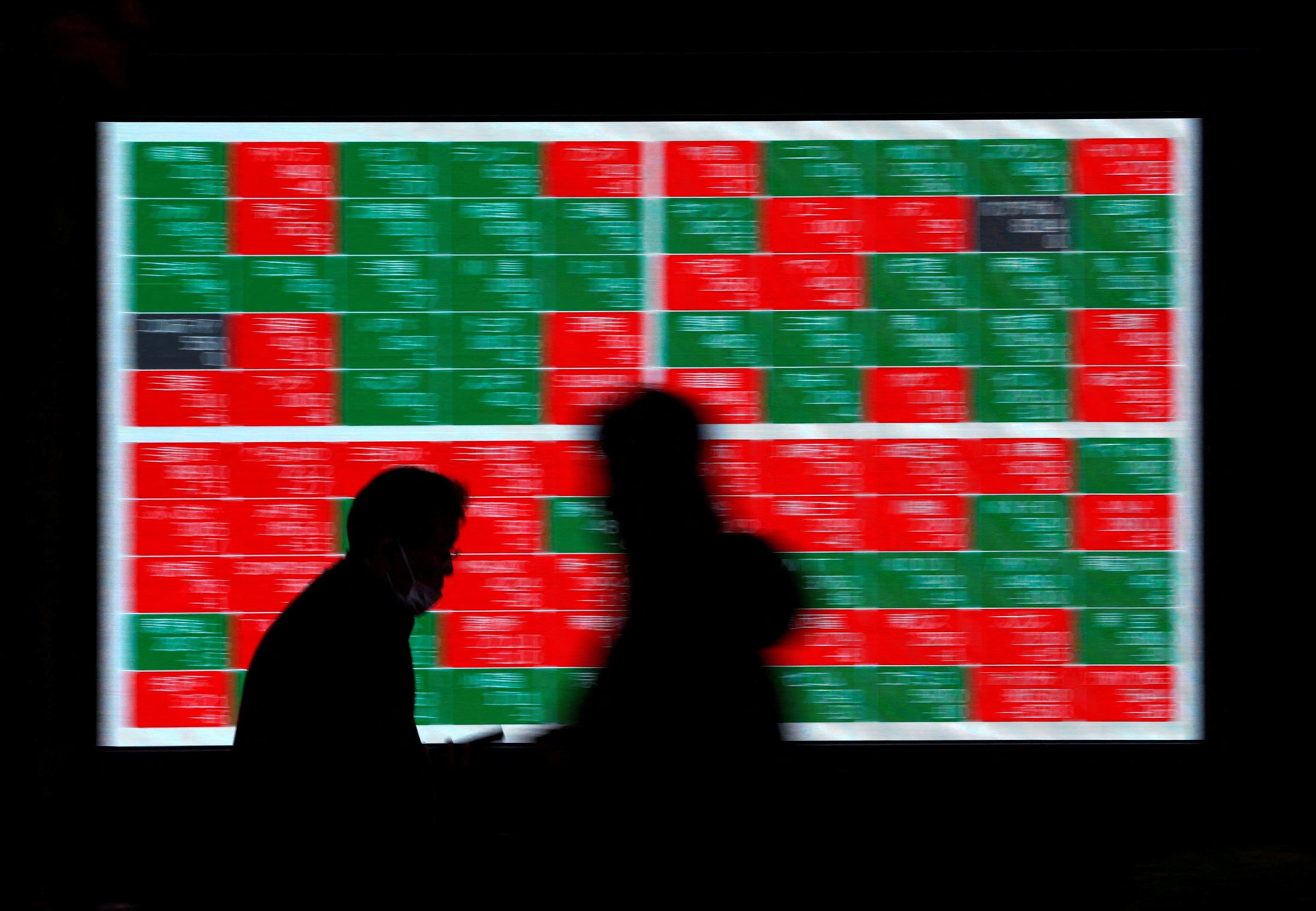

NEW YORK/LONDON, April 8 (Reuters) - A global equity index rose slightly on Monday while Wall Street stocks were muted as U.S. bond yields hit their highest levels since late November and investor optimism about the outlook for Federal Reserve interest rate cuts waned. The dollar index slid as investors focused on U.S. inflation data due later this week, while the yen dipped to near 34-year lows, with traders remaining alert for any potential action from Japanese authorities to support the weakening currency.. Oil prices fell on Monday on a renewed push for a Middle East ceasefire. However, a Hamas official said no progress had been made on Gaza ceasefire talks in Cairo while Israeli Prime Minister Benjamin Netanyahu said a date was set for an invasion of Rafah, the enclave's last refuge for displaced Palestinians. Stock markets had made a slow start to the second quarter as the risk of a broader conflict in the Middle East had pushed up oil prices to their highest level since October. Also, a much stronger-than-expected U.S. jobs report on Friday after solid manufacturing data caused investors to temper bets on a Federal Reserve rate cut in June. However, Chicago Federal Reserve President Austan Goolsbee said on Monday that the Fed must weigh how much longer it can maintain its current interest rate stance without it damaging the economy. "People are catching their breath from the underwhelming performance last week. Even with the bounce in markets on Friday, there was more damage done than constructive price action to markets overall," said Michael James, managing director of equity trading at Wedbush Securities in Los Angeles. Also on investors' minds was the upcoming earnings season, which kicks off on Friday with reports from some of the largest U.S. banks, according to Wedbush's James. "There's elevated anxiety going into the start of earnings season for those in the bullish camp. We need to see some decent prints and raised guidance," said James. On Wall Street, the Dow Jones Industrial Average (.DJI) , opens new tab fell 11.24 points, or 0.03%, to 38,892.80, the S&P 500 (.SPX) , opens new tab lost 1.95 points, or 0.04%, to 5,202.39 and the Nasdaq Composite (.IXIC) , opens new tab gained 5.44 points, or 0.03%, to 16,253.96. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab rose 1.60 points, or 0.21%, to 778.11. Earlier in Europe the STOXX 600 (.STOXX) , opens new tab index had closed up 0.47%. Along with earnings, investor focus this week was also on the U.S. consumer price index (CPI) report due out on Wednesday. And while millions of people in North America looked upward to witness a rare solar eclipse, trading volume on Wall Street was quiet with about 9.55 billion shares changing hands compared with the 11.53 billion average for the last 20 sessions. "It's probably a better day to watch the eclipse than it is to trade stocks," said Jay Hatfield, CEO and portfolio manager at InfraCap in New York. "I don't think anybody wants to really reposition one way or the other ahead of CPI." U.S. Treasury yields moved higher on Monday as fixed income investors lowered their expectations for how deeply the Fed will be able to cut interest rates this year after the jobs report. The yield on benchmark U.S. 10-year notes rose 4.6 basis points to 4.424%, from 4.378% late on Friday while the 30-year bond yield rose 2.3 basis points to 4.5548%. The 2-year note yield, which typically moves in step with interest rate expectations, rose 6.3 basis points to 4.7949%, from 4.732% late on Friday. In currencies, the dollar index fell 0.2% at 104.15, with the euro up 0.2% at $1.0857. Against the Japanese yen , the dollar strengthened 0.16% at 151.85. In energy markets, oil settled above its session lows but still lost ground for the day. U.S. crude settled down 0.55% at $86.43 a barrel while Brent LCOc1 settled at $90.38 per barrel, down 0.87% on the day. Meanwhile, gold prices hit a record high for a seventh straight session on Monday, fuelled by central bank purchases and geopolitical tensions, while strong economic data failed to dull bullion's allure. Spot gold added 0.37% to $2,338.29 an ounce. U.S. gold futures gained 0.58% to $2,339.10 an ounce. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-04-08/

2024-04-08 05:33

April 8 (Reuters) - The world's top energy trader Vitol made a net profit of $13 billion in 2023, the Financial Times said on Monday citing people with knowledge of the company's results. This is down from a record $15 billion net profit the Swiss trader made in 2022, according to a non-public balance sheet reviewed by Reuters. Vitol does not disclose its net profit. The Geneva-based firm's 2023 revenue fell to $400 billion, a drop of more than 20% from the previous year as oil and gas prices weakened following price spikes in 2022, when Western powers imposed sanctions on Russia over its invasion of Ukraine. Vitol said in March that it saw a tight global oil products market as the Red Sea crisis and the rerouting of Russian products had caused record volumes of oil products to be held on tankers at sea. Rival commodities trader Trafigura posted a record net profit of about $7.4 billion for 2023, up 5% from a year earlier. Vitol did not immediately respond to a Reuters request for comment. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/vitol-posts-13-bln-profit-2023-ft-reports-2024-04-08/

2024-04-08 05:22

TAIPEI, April 8 (Reuters) - Buildings shook briefly during an earthquake in Taiwan's capital Taipei on Monday. Taiwan has been rocked by hundreds of aftershocks following a 7.2 magnitude earthquake which hit the east of the island on Wednesday, killing at least 13 people. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/asia-pacific/buildings-shake-briefly-earthquake-rattles-taiwan-2024-04-08/

2024-04-08 05:21

Japan real wages fall; yen softer Focus on U.S. inflation data; March CPI seen up 0.3% U.S. rate futures now expect just two rate cuts this year ECB policy meeting this week also in spotlight Bitcoin hits three-week high NEW YORK, April 8 (Reuters) - The dollar slid on Monday as investors focused on U.S. inflation data due later this week, while the yen dipped to near 34-year lows, with traders remaining alert for any potential action from Japanese authorities to support the weakening currency. The greenback fluctuated last week as traders digested a mixed bag of economic data amid a slowdown in services growth followed by unexpectedly strong hiring numbers that prompted the market to pare bets on Federal Reserve rate cuts this year. The dollar index - which tracks the greenback against six other major currencies - was last down 0.2% at 104.12, while U.S. Treasury yields, which reflect interest rate move expectations, pushed higher. Against the yen, the dollar firmed 0.1% to 151.76 , within striking distance of the 34-year peak hit in late March. The yen's weakness came in the wake of data showing Japanese workers' real wages fell in February for a 23rd consecutive month, suggesting higher prices weighed on consumers' spending appetite. Inflation-adjusted real wages, a barometer of consumer purchasing power, fell 1.3% in February from a year earlier, data from Japan's Labour ministry showed. It followed a revised decline of 1.1% in January. Japanese Prime Minister Fumio Kishida said on Friday authorities will use "all available means" to deal with excessive yen falls, stressing Tokyo's readiness to intervene in the market to prop up the currency. "Broadly expect more jawboning from Japanese officials. I would not be surprised if the Bank of Japan does not intervene at 152 and the market snaps higher a little bit and then they come in and surprise us" said Amo Sahota, executive director at FX consulting firm Klarity FX in San Francisco. "So the BOJ could say: we'll let it (dollar/yen) run up a little more. Have you all exhausted yourself now? Here's a lesson for you. So the BOJ could take that approach. For now, though, 152 is capping dollar/yen." BOJ Governor Kazuo Ueda addressed the country's parliament on Monday, but gave little away on monetary policy and said he had succeeded in adopting a simpler policy framework. In the United States, the main focus is on consumer price inflation for March due on Wednesday. Economists expect the headline consumer price index (CPI) to have risen 0.3 on a monthly basis, compared with 0.4% in February, according to a Reuters poll. Core CPI is also seen rising 0.3% for the month of March. Ahead of the CPI data and after a strong jobs report last Friday, the U.S. rate futures market has reduced the odds of a June rate cut to 49%, down from 58% a week ago, the CME's FedWatch tool showed. The market has also pared back expectations for the number of rate cuts this year to two, from three to four a few weeks ago, according to LSEG's rate probability app. Chicago Fed President Austan Goolsbee on Monday acknowledged that the U.S. economy remains strong, but wondered how long the Fed can keep monetary policy restrictive. In an interview with Chicago radio station WBEZ, Goolsbee, who is not a voter this year on the Federal Open Market Committee, said "if you're there too long, the unemployment rate is going to start going up." The currency market though showed little reaction to his comments. In the euro zone, currency investors will be looking to the European Central Bank's (ECB) policy meeting on Thursday. The euro was last up 0.2% at $1.089, while sterling last changed hands at $1.2660, up 0.2%. The base case for the ECB is to hold rates this week and possibly reinforce the possibility of a cut in June. But while the ECB is increasingly confident that inflation is heading back to its 2% target, it has remained vague about further easing. In cryptocurrencies, bitcoin was up 6.3% at $71,953 after hitting a three-week high of 72,732.59 earlier in the session. Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/light-wind-dollars-sails-after-bumper-us-payrolls-2024-04-08/

2024-04-08 04:33

A look at the day ahead in European and global markets from Ankur Banerjee European markets are gearing up for a steady start to the week with the ECB widely expected to stand pat on rates but possibly hint at when rate cuts would likely begin, while investors will parse through the latest reading of the U.S. inflation report. Markets will also get a chance to assess U.S. PPI data and the minutes of the Fed's March meeting, while UK GDP data is due at the end of the week. Fed speakers including John Williams, Mary Daly and Raphael Bostic are also due to speak in the week. Investors see almost no chance of a cut on April 11 when the European Central Bank meet but have fully priced in a move for June, followed by another two or three cuts later this year. That makes the comments from officials as well as the tone of the statement the point of interest for traders. Futures indicate European bourses are due for a steady open, with the focus on the continent-wide STOXX 600 (.STOXX) , opens new tab. The index touched a two week low on Friday. Ahead of the ECB, however, investors will have to contend with the latest U.S. consumer price index (CPI) report scheduled for April 10, which is expected to show core inflation slowing to 3.7% in March from 3.8% the prior month. The data will hopefully help provide some answers to a question that has dogged traders this year: when will the Federal Reserve start its interest rate cutting cycle? What was once pencilled in for March, moved to June and is now slowly being pushed to July or even September in the wake of yet another blockbuster U.S. jobs report, making the inflation report the next all-important data for the markets. Investors may also be getting accustomed to the idea that a strong U.S. economy is not a bad thing after all. Elevated U.S. Treasury yields have boosted the dollar but shares have perked up as well, though whether this investor enthusiasm for risk assets in the face of the renewed higher-for-longer U.S. rates narrative persists remains to be seen. Also, helping risk appetite was a media report that talks on a truce in the Gaza conflict are making progress in Cairo and all parties have agreed on basic points. Key developments that could influence markets on Monday: Economic events: Germany trade balance, industrial output, industrial production, export and import for Feb Get a look at the day ahead in European and global markets with the Morning Bid Europe newsletter. Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-04-08/