2024-04-04 10:23

NEW DELHI, April 4 (Reuters) - The United States has not asked India to cut Russian oil imports as the goal of sanctions and the G7-imposed $60 per barrel price cap is to have stable global oil supplies while hitting Moscow's revenue, an American treasury official said on Thursday. India has emerged as one of the top buyers of Russian sea-borne oil since Western nations imposed sanctions and halted purchases in response to Moscow's invasion of Ukraine in February 2022. "It is important to us to keep the oil supply on the market. But what we want to do is limit Putin's profit from it," Eric Van Nostrand, the U.S. Treasury's assistant secretary for economic policy said in New Delhi, referring to Russian President Vladimir Putin. Nostrand said that buyers can purchase Russian oil at deeper discounts outside of the price cap mechanism, if they do not use Western services like insurance and broking, thus limiting Moscow's sales avenues. "They (Russia) have to sell oil for less," he said. The sanctions are intended to limit the options available to Russia to three: sell its oil under the price cap, offer deeper discounts to buyers if they circumvent Western services, or shut its oil wells, Nostrand added. The price cap imposed by the Group of Seven (G7) wealthy nations, the European Union and Australia bans the use of Western maritime services such as insurance, flagging the transportation when tankers carry Russian oil priced at or above $60 a barrel. Anna Morris, acting assistant secretary for terror financing at the U.S. Treasury said that G7 nations had the option to review the price cap depending on market conditions or other factors. As part of its wide-ranging sanction mechanism against Russian oil trade, the United States in February imposed sanctions on Russian state run shipper Sovcomflot (SCF)and 14 of its crude oil tankers involved in Russian oil transportation. Morris said that SCF vessels that have been identified in the recent rounds of sanctions "certainly carry with them the sanctions risk... the 14 vessels in particular that have been named are sanctioned vessels". The U.S. officials are in India this week meeting with government officials and business leaders to discuss cooperation on anti-money laundering, countering the financing of terrorism, and implementation of the price cap. Asked about the sale to Western nations of refined products produced from Russian oil, Morris said that would not breach the sanctions. "Once Russian oil is refined, from a technical perspective it is no longer Russian oil. If it is refined in a country and then sent forward, from a sanctions perspective that is an import from the country of purchase it is not an import from Russia." Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/us-has-not-asked-india-cut-russian-oil-purchases-american-official-says-2024-04-04/

2024-04-04 10:08

LITTLETON, Colorado, April 4 (Reuters) - Coal is on course to overtake natural gas as the primary source of electricity in Bangladesh, worsening regional emissions and complicating global efforts to cut use of high-polluting fossil fuels. Bangladesh power firms more than doubled coal-fired electricity generation in 2023 from 2022 to a record 17 terawatt hours (TWh), data from energy think tank Ember shows. Over the same period, natural gas-fired electricity output increased by just 4.7% to 47.44 TWh. The sharp jump in coal use relative to natural gas use resulted in a large swing in the country's electricity generation mix, with coal accounting for a record 21.1% share of total generation, up from just 7% two years before. The share of natural gas-fired output fell to around 59% in 2023 from 66% in 2021 and 76.4% in 2019. If utilities keep increasing coal-fired generation at a faster pace than gas-fired output, coal could emerge as the primary source of electricity in Bangladesh within the current decade, undermining worldwide efforts to cut coal use. UNDER PRESSURE Bangladesh, among the world's largest clothing producers and exporters, has experienced sharp growth in energy demand from its population and businesses. The country has garment factories that consume power around the clock, and overall energy use also has climbed along with economic growth. Real gross domestic product (GDP) growth in Bangladesh has averaged 6.2% over the past five years, more than twice the global average, according to the International Monetary Fund. The county's power suppliers have struggled to keep up, resulting in regular power outages last year. To avoid similar setbacks in 2024, authorities have directed electrical power generators to use more coal, and have approved record large coal imports. The country already receives regular thermal coal supplies by truck and train from neighbour India, but in 2023 also boosted seaborne imports by 47% to a record 12.7 million metric tons, according to ship tracking data compiled by Kpler. Bangladesh's average annual seaborne imports from 2017 to 2021 were 6.8 million tons, so the jump to close to 13 million tons last year helped lift the country to 12th on the list of global thermal coal importers in 2023, from 14th in 2022. With several nations taking steps to steadily reduce coal-fired power generation and imports, Bangladesh will likely rise further in coal import rankings. EMISSIONS IMPACT Coal-fired generation has pushed Bangladesh power sector emissions to record highs: just under 60 million tons of carbon dioxide emissions in 2023, up from 58.3 million tons in 2022, according to Ember. That emissions load was roughly a 24% rise from 2019. The carbon intensity of electricity generation has also climbed. Roughly 741,500 tons of carbon dioxide was emitted to generate each kilowatt hour of electricity produced in 2023, up from 723,200 tons in 2022 when coal use was roughly half of the levels seen in 2023. Coal-fired generation is still rising, with 2.11 TWh of electricity generated from coal in January, up sharply from 0.83 TWh a year earlier. Imports of thermal coal are also rising, with seaborne purchases through March totalling just over 3 million tons, up from around 2.5 million tons during the same period in 2023. If Bangladesh's coal use and imports remain strong, 2024 will likely set a record for both coal-fired generation and emissions. It could potentially offset any declines seen elsewhere in terms of coal consumption and pollution, with Bangladesh emerging as a hub for coal demand even as much of the rest of the world turns its back on the fuel. The opinions expressed here are those of the author, a columnist for Reuters. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/bangladesh-power-system-gets-dirtier-rapid-coal-use-growth-maguire-2024-04-04/

2024-04-04 10:03

April 4 (Reuters) - A look at the day ahead in U.S. and global markets by Harry Robertson Data Jerome Powell wants, and data Jerome Powell shall get. The Federal Reserve chair on Wednesday continued to play a familiar tune. "Given the strength of the economy and progress on inflation so far, we have time to let the incoming data guide our decisions on policy," he said in a speech at Stanford University. Thursday brings new numbers on weekly jobless claims for Powell and his colleagues to chew on. Economists think the number will come in at 214,000, up slightly from the week before but in line with the average over the last six months - and hardly commensurate with a faltering labor market. Then Friday brings the big one: March's nonfarm payroll employment data could cause markets to lurch. Analysts polled by Reuters think 200,000 jobs were added in March, a relatively big drop from 275,000 in February. But recent U.S. data has tended to come in hotter than anticipated. Wednesday did deliver a sign of a potential crack in the U.S. economy's armour, however. The Institute for Supply Management's gauge of the service sector came in much weaker than expected, with a measure of price growth hitting a four-year low. The ISM reading dented the dollar , which ground lower and ended the session down 0.5%, although the 10-year Treasury yield remains lodged at around its highest since November. In FX markets, where volatility has cratered, the focus remains on whether Japan will step in to prop up the yen, which is trading around its lowest in 34 years. The S&P 500 (.SPX) , opens new tab rose slightly on Wednesday but stayed around 1% below last week's record high after a wobbly start to the second quarter. Futures point to a slight gain when trading opens. European stocks (.STOXX) , opens new tab were up slightly on Thursday, while oil traded at a five-month high. A divergence is finally starting to show in investors' rate cut expectations, as Europe's economy lags behind the U.S. Traders now see fewer than 70 basis points of cuts from the Fed by December, but expect nearly 90 from the European Central Bank. Euro zone inflation dropped to 2.4% in March, data showed on Wednesday, lower than expected and tantalisingly close to the ECB's 2% target. In Switzerland, inflation is running at just 1%, figures showed on Thursday. U.S. March consumer price inflation data is due next week, with inflation at 3.2% in February. Five Fed officials, including Philly's Patrick Harker and Cleveland's Loretta Mester, are due to speak on Thursday, after Atlanta's Raphael Bostic suggested a rate cut might not come until the fourth quarter on Wednesday. Key developments that should provide more direction to U.S. markets later on Thursday: * U.S. initial weekly jobless claims data * U.S. trade balance data * ECB minutes from March 7 meeting * Fed speakers: Harker, Barkin, Goolsbee, Kashkari, Mester Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-04-04/

2024-04-04 10:01

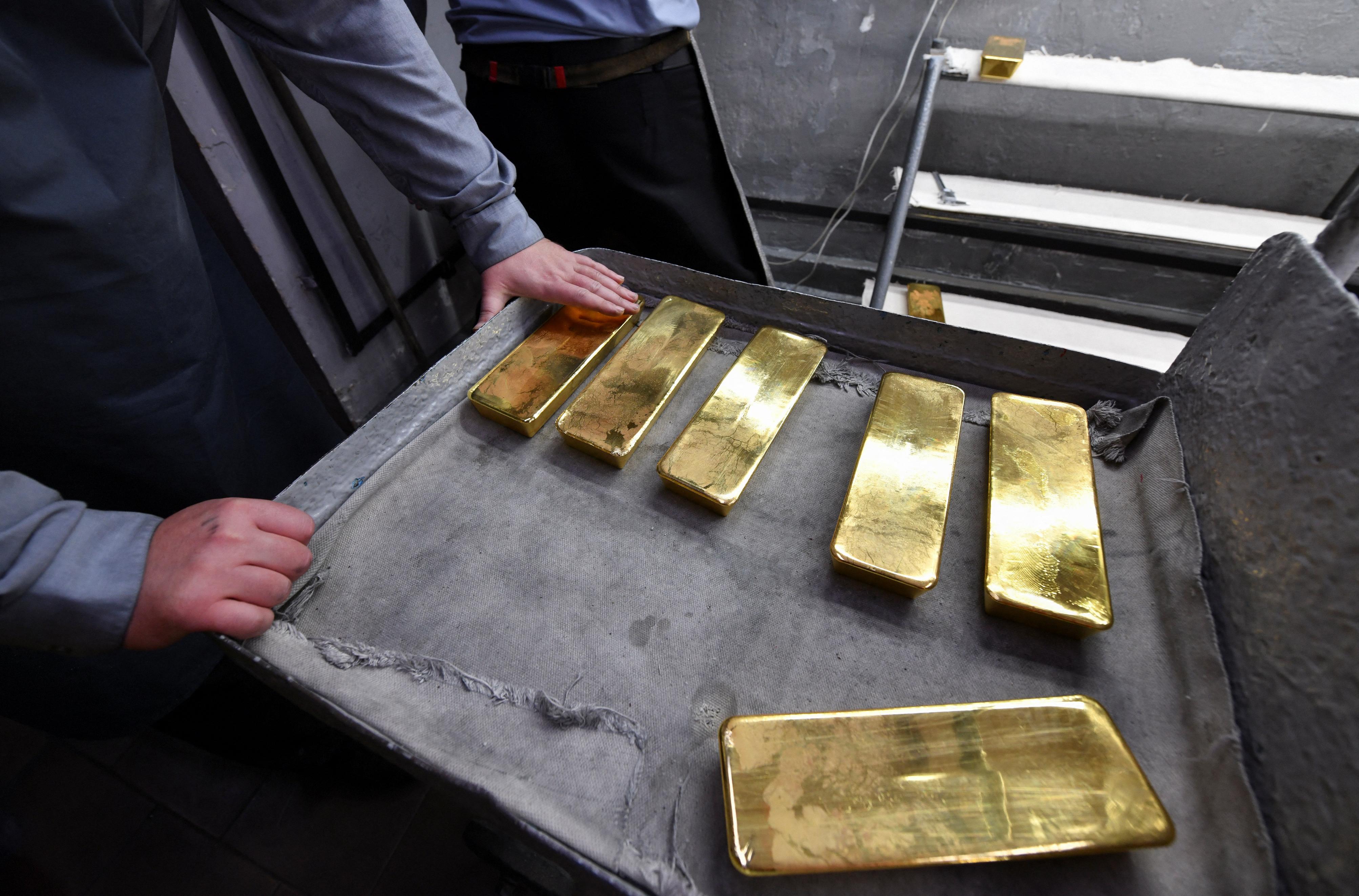

US weekly jobless claims increase more than expected Gold hits record high at $2,304.09/ounce Silver hits its highest since mid-2021 All eyes are on US non-farm payrolls report on Friday April 4 (Reuters) - Gold prices took a breather on Thursday after hitting an all-time high earlier in the session on expectations for lower U.S. interest rates this year, as investors await more clarity on the timing of the cuts. Spot gold was steady at $2,300.49 per ounce as of 2:50 p.m. EDT (1850 GMT) after hitting a record high of $2,304.09 earlier in the day. U.S. gold futures settled 0.2% lower at $2,308.5. "It's a continuation of the idea... propagated by the Powell speech the other day that the Federal Reserve is getting set to cut rates," said Bart Melek, head of commodity strategies at TD Securities. "That typically is a very accretive thing for gold, particularly since it looks like they (the Fed) are quite prepared to reduce interest rates at a time where inflation is going to be significantly above their 2% target." Fed officials including U.S. central bank chief Jerome Powell on Wednesday continued focusing on the need for more debate and data before interest rates are cut, a move financial markets expect to occur in June. Data showed the number of Americans filing new claims for unemployment benefits increased more than expected last week as labor market conditions gradually ease. Focus now shifts to U.S. March non-farm payrolls due on Friday which could shed more light on the timing of the Fed's first rate cut. Strong central bank buying and safe-haven inflows amid growing geopolitical tensions have boosted demand for gold, helping to drive the price up more than 25% since October. "It's heavily overbought and needs to correct to blow some of the froth. Fed cuts are priced in, in my view," said StoneX analyst Rhona O'Connell. Elsewhere, spot silver was flat at $27.22 per ounce after hitting its highest since June 2021. Platinum rose 0.3% to $939.65, and palladium gained 1.6% to $1,029.91. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/gold-continues-record-rally-after-fed-comments-us-data-focus-2024-04-04/

2024-04-04 07:54

SINGAPORE, April 4 (Reuters) - The world added less than half of the new renewable energy capacity needed to meet its climate goals last year, with rising energy demand and weak grid infrastructure slowing the shift from fossil fuels, a leading think tank said on Thursday. Global renewable capacity additions increased by 36% last year to reach around 473 gigawatts (GW), breaking the record for the 22nd consecutive year, said the Paris-based REN21, a research group that includes national governments and industry associations among its members. But it fell far short of the 1,000 GW per year required to meet the world's climate commitments, the group said in its annual outlook report. "The reality is that energy demand has increased at the same time, especially in China, India and other developing economies," said Rana Adib, REN21's Executive Secretary. REN21 said the renewables sector was being held back by a lack of investment in grid infrastructure, with an estimated 3,000 GW of projects still awaiting grid connections last year. More effort was also needed to boost energy efficiency and phase out fossil fuel subsidies, which in G20 countries alone stood at a record $1.3 trillion in 2022, it added. Providing financial support for developing countries to build renewable capacity also remains a major challenge, with financing costs sometimes as high as 20%, five times higher than those in richer nations, Adib said. "The cost of capital has greatly increased globally, but increased in a disproportionately high way in developing economies," she said, adding that development finance was also falling short, accounting for only 1.4% of total global renewable investment last year. Total global renewable investment reached $623 billion last year, up 8.1% compared to a year earlier, but an estimated $1.3 trillion is required every year to meet climate targets. At COP28 climate talks last December, countries pledged to triple global renewable energy capacity and double energy efficiency by 2030, but Adib said setting targets was not enough. "We have the technology - 80% of CO2 emissions can be abated with existing technology - but we need the political will," she said. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/climate-energy/renewables-growth-still-lags-climate-targets-think-tank-says-2024-04-04/

2024-04-04 07:50

Lukoil refinery struggles to repair gasoline unit U.S. firm UOP says not helping Lukoil All Russian refineries use Western technology, software Ukrainian drones damage dozens of Russian plants MOSCOW/LONDON, April 4 (Reuters) - When engineers at Russian oil firm Lukoil (LKOH.MM) , opens new tab discovered a turbine had broken at their largest refinery on January 4, they quickly realised the problem was far from trivial. There was only one company that knew how to repair the gasoline-producing unit at the NORSI refinery, located on the Volga River, some 430 km (270 miles) east of Moscow. The problem was that the company is American, according to five sources familiar with the incident. The firm, petroleum engineering multinational UOP, had withdrawn from Russia after the country invaded Ukraine in February 2022. "They (the engineers) rushed around to find spare parts and they couldn't find anything," said a source close to Lukoil, who asked not to be named because he is not allowed to speak to the media. "Then the whole unit just stopped." Four other sources said the unit - a catalytic cracker used to convert heavier hydrocarbons into gasoline - has been out of production since January and it was not clear when it could be repaired due to a lack of expertise inside Russia. The KK-1 unit is one of only two catalytic crackers at the plant. As a result, the NORSI refinery - the fourth-biggest in Russia - has cut gasoline production by 40%, according to two of the sources. Lukoil did not respond to requests for comment for this story. The Lukoil refinery is an example of wider problems in Russia's energy sector where some oil firms are struggling in the face of Western sanctions to repair their refineries, built with the help of U.S. and European engineering firms, according to at least 10 Russian industry sources. The difficulties have been exacerbated by Ukrainian drone attacks that have struck at least a dozen Russian refineries this year, the industry sources said. The attacks forced Russian refineries to shut in some 14% of capacity in the first quarter, according to Reuters calculations. "If the stream of drones continues at this rate and Russian air defences don't improve, Ukraine will be able to cut Russian refining runs quicker than Russian firms will be able to repair them," said Sergey Vakulenko, an expert on Russia's energy industry and non-resident fellow at the Carnegie Endowment for International Peace, an international affairs think tank. Russia's top energy official, Deputy Prime Minister Alexander Novak, said last week that the damaged NORSI facilities should resume operations within a month or two, as Russian firms were working to produce the spare parts needed. read more He also said other Russian refineries have boosted production after the drone attacks and there was no shortage on the local fuel market. Russia's energy ministry did not respond to a request for comment. Minister Nikolai Shulginov said on Wednesday all refineries would be fixed by June, without providing further details. The NORSI refinery, near the city of Nizhny Novgorod, has a capacity of 405,000 metric tons a month of gasoline or 11% of Russia's total. The current outage would cost Lukoil nearly $100 million in lost revenues a month, based on an average Russian gasoline price of $587 per metric ton, according to Reuters' calculations. Honeywell International Inc , the parent company for UOP, said in a statement to Reuters it had not provided any equipment, parts, products or services to the refinery at Nizhny Novgorod since February 2022, nor to the independently-managed Slavyansk ECO refinery. The Slavyansk refinery was hit by a Ukrainian drone attack on March 18 and caught fire briefly. read more "We are actively working to identify and interrupt any possible diversion of our products into Russia via third parties," Honeywell told Reuters by email. The company said it complies with all applicable export license requirements, sanctions laws and regulations. The United States and its allies have imposed sanctions on thousands of Russian targets since the invasion of Ukraine and around 1,000 companies have announced their departure from the country. Russia's export-focused $2.2-trillion economy has proved more resilient to two years of the unprecedented sanctions than either Moscow or the West anticipated. WAR OF ATTRITION Western companies such as UOP and Swiss engineering group ABB have supplied technology and software to all the 40 biggest refineries in Russia over the last two decades, according to more than 10 Russian industry sources. Each refinery has a combination of Russian and foreign equipment. ABB confirmed to Reuters it stopped taking new orders in Russia once the war broke out in February 2022, and has no plans to return to Russia once it has fulfilled its existing contractual obligations, a spokesperson said. The company did not provide details of those obligations. None of the five sources suggested the turbine failure in January at NORSI was a result of drone attacks. But the sources said the problems at the plant only became worse after NORSI was hit for the first time by Ukrainian drones in February when other pieces of equipment were damaged, putting additional strain on the entire refinery. As in the United States, the price of gasoline is a politically sensitive subject in Russia and authorities try to limit price rises. Recent measures included imposing a ban on gasoline exports for 6 months in February. Ukraine says it attacks Russian refineries because it wants to undermine the Kremlin's war machine by reducing state revenues and cutting fuel to the army. "Drones are tens, if not hundreds of times cheaper than the cost of repairs, which is important in a war of attrition," said Vakulenko, who was a former head of strategy at Russian energy major Gazprom Neft. He left the firm and Russia days after the start of the Ukraine war. Russia is the world's second-largest oil exporter. It has rerouted most of its crude and products exports to Asia and Africa since Western nations imposed sanctions on Moscow. Should Moscow face a steep decline in refinery output, it would be forced to cut fuel exports in favour of crude, according to more than 10 Russian oil traders. Russia supplies crude to just a few large buyers, such as China, India and Turkey, but its portfolio of fuels buyers is comparatively broader as it can ship to smaller consumers without large refining systems in Africa and South America. Russia's refining industry dates back to the 1940s, when the United States provided equipment under the lend-lease program during World War Two. After the collapse of the Soviet Union, Russian oil firms invested tens of billions of dollars in upgrades with the help of firms such as UOP and ABB. UOP helped upgrade Norsi and Slavyansk ECO refineries. It did not specify which other Russian refineries it has serviced, in response to Reuters' questions. The United States has imposed sanctions on companies around the world, including in Turkey, to prevent the transfer of technology to Russia. Countries under Western sanctions such as Russia and Iran have long managed to find loopholes to obtain spare parts for Western-made equipment such as planes or cars. But refining equipment is much rarer and more specialized; Western firms have tightened checks to prevent Russia from importing spare parts via third countries, one of the five sources said. Two of the sources said Lukoil had asked Chinese companies to repair the KK-1 unit at Norsi. The sources didn't name the Chinese companies. Lukoil declined to comment when asked if it had approached China. "China has got the technology. But very often it would mean a full costly replacement of the unit rather than a normal, cheap, regular repair," one of the sources said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/us-sanctions-hamper-russian-efforts-repair-refineries-sources-say-2024-04-04/