2024-04-03 15:46

NAIROBI, April 3 (Reuters) - Kenya's central bank held its benchmark lending rate (KECBIR=ECI) , opens new tab at 13.0% on Wednesday, its monetary policy committee (MPC) said, to allow inflation to continue declining to the desired level. The decision follows rate hikes in December and February that were aimed at stabilising the exchange rate and helping stubborn inflation to start falling. "The MPC noted that its previous measures have lowered inflation, addressed the exchange rate pressures, and anchored inflationary expectations," the committee said. The Kenyan shilling has stabilised against the dollar after the government successfully raised $1.5 billion from international markets in February to partially buy back another bond that is maturing in June. Inflation, which had remained on the higher side of the government's preferred band of 2.5-7.5% for months, fell to 5.7% last month. "The current monetary policy stance will ensure that overall inflation continues to decline towards the 5.0 percent mid-point of the target range," the MPC said. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/africa/kenyas-central-bank-holds-main-lending-rate-130-2024-04-03/

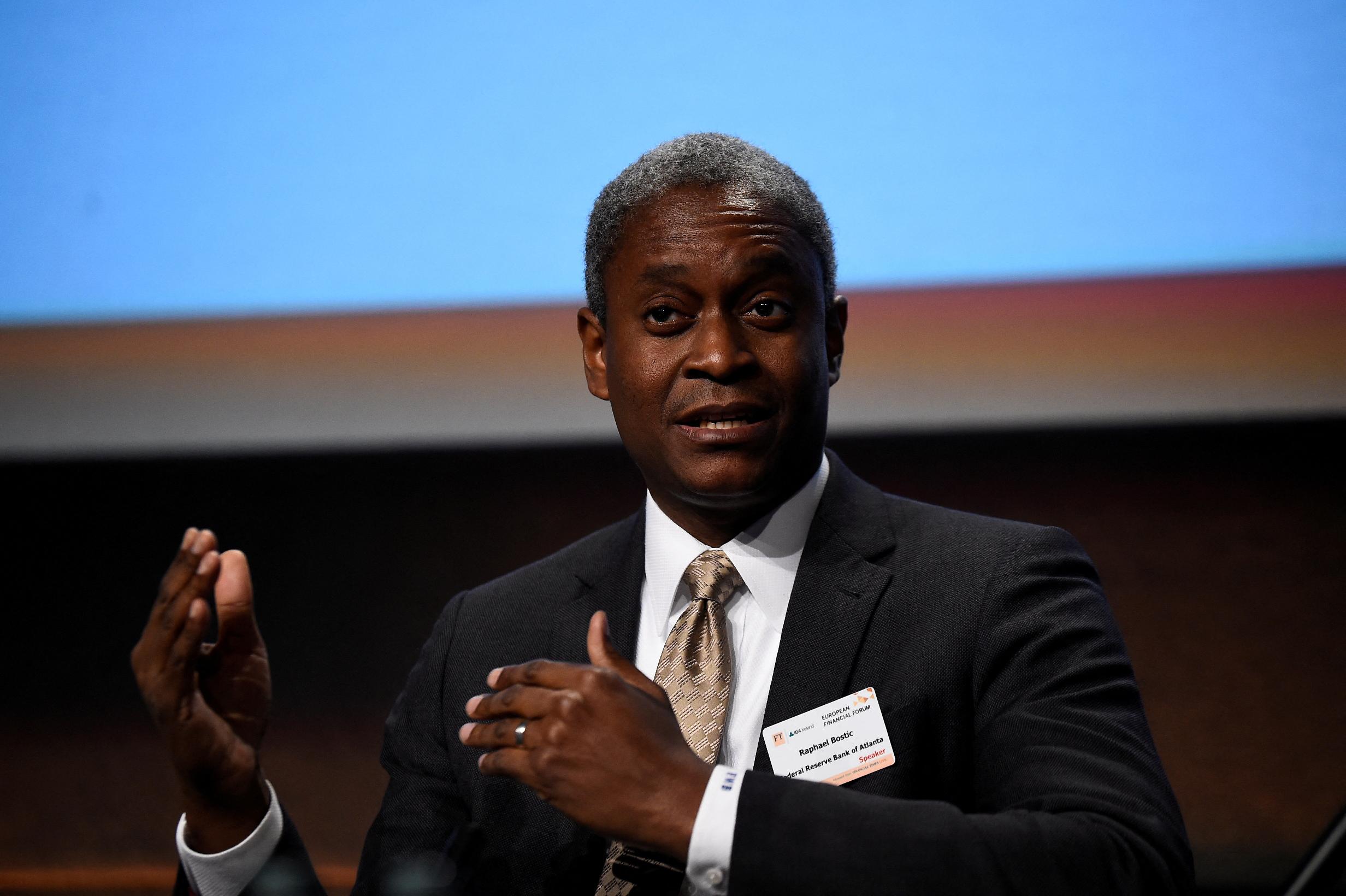

2024-04-03 13:58

April 3 (Reuters) - The Federal Reserve should not cut its benchmark interest rate until the end of this year, Atlanta Fed President Raphael Bostic said on Wednesday, as he maintained his view that the U.S. central bank should reduce borrowing costs only once over the course of 2024. "We've seen inflation kind of become much more bumpy," Bostic said in an interview with broadcaster CNBC. "If the economy evolves as I expect and that's going to be seeing continued robustness in GDP and employment, and a slow decline in inflation over the course of the year, I think it will be appropriate for us to start moving down at the end of this year, the fourth quarter." The Fed held rates steady in the 5.25% to 5.5% range last month, with most policymakers still expecting at least three rate cuts this year, but its new projections reflected slower progress on inflation and continued robust economic growth and employment. Two other Fed policymakers in separate appearances yesterday maintained their forecasts for three rate cuts. Fed Chair Jerome Powell is set to speak later on Wednesday. Bostic said that any weakening in the economy was incremental and once again highlighted his concerns that some secondary measures in the inflation numbers are much higher than they were before. "I've got to make sure those are not hiding some extra upward pricing pressure before I'm going to want to move our policy rate," Bostic noted. He now expects inflation to drop incrementally through 2024 and 2025 with the 2% target rate reached "sometime in early 2026." Inflation by the Fed's targeted measure was 2.5% in February, far below its mid-2022 peak of around 7% but still above the 2% goal, with progress slower so far this year than for much of last year. "If that trajectory slows down, in terms of inflation, then we are going to have to be more patient than I think many had expected," Bostic said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/business/finance/feds-bostic-says-first-rate-cut-should-come-q4-this-year-2024-04-03/

2024-04-03 12:24

HARARE, April 3 (Reuters) - President Emmerson Mnangagwa on Wednesday declared Zimbabwe's drought a national disaster and said the country needed more than $2 billion in aid to feed millions facing hunger. Mnangagwa's statement follows similar announcements by Zambia in late February and Malawi in March, as drought induced by the El Nino global weather pattern triggers a humanitarian crisis in southern Africa. More than 2.7 million people in Zimbabwe will go hungry this year, Mnangagwa told journalists at the state house in Harare, adding that 80% of the country had received poor rains. "Preliminary assessments show that Zimbabwe requires in excess of $2 billion towards various interventions we envisage in our national response," Mnangagwa said. He said the government would prioritise winter cropping to boost reserves, and work with the private sector to import grains. El Nino is a naturally occurring weather phenomenon associated with a disruption of wind patterns that means warmer ocean surface temperatures in the eastern and central Pacific. Most provinces in Zimbabwe have experienced crop failure since November, with hotter areas declaring grains such as maize a write-off. Humanitarian agencies including the World Food Programme, which fed 270,000 people between January and March in four districts, have described the hunger situation as "dire", calling on donors to provide more aid. The drought in southern Africa has reached crisis levels with Botswana and Angola to the west, and Mozambique and Madagascar to the east also facing hunger. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/africa/hunger-grips-southern-africa-zimbabwe-declares-drought-disaster-2024-04-03/

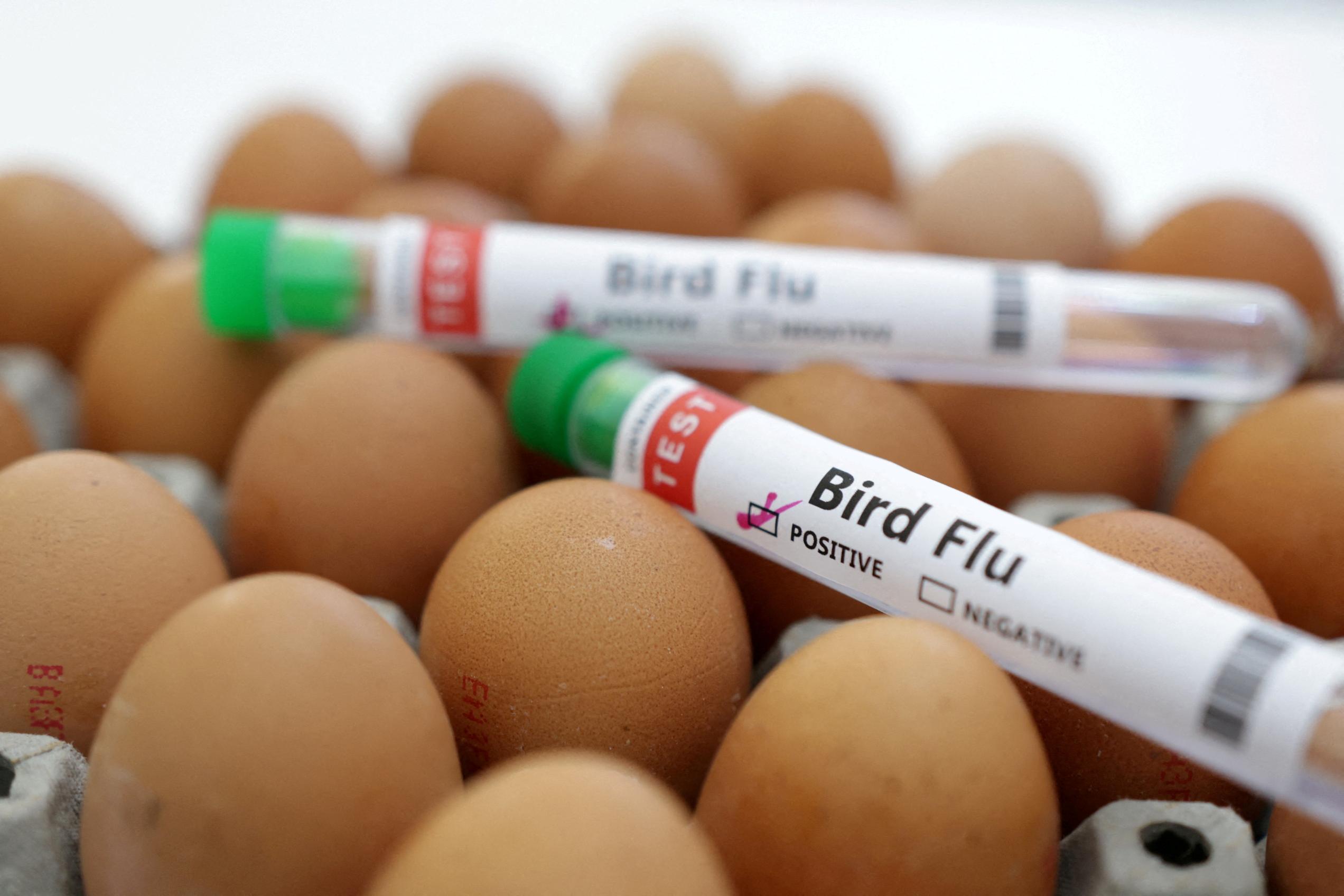

2024-04-03 12:19

PARIS, April 3 (Reuters) - The EU's Food Safety Agency (EFSA) warned on Wednesday of a large-scale bird flu pandemic if the virus becomes transmissible between people as humans lack immunity against the virus. This comes a day after Texas reported that the H5N1 strain of avian influenza, commonly known as bird flu, had been detected in a person who had contact with dairy cows presumed to be infected with the virus. The spread of bird flu is a concern for governments and the poultry industry due to the devastation it can cause to flocks, and a risk of human transmission. The number of bird flu outbreaks has been lower so far this season but it spread geographically, including to Antarctica, and to an increasing number of mammals, raising the risk of it evolving into a bigger threat to humans. To date there has been no sustained human-to-human transmission observed and bird flu transmission from infected animals to humans is rare. However, these viruses continue to evolve globally, and with the migration of wild birds, new strains carrying potential mutations for mammalian adaptation could be selected, EFSA said. "If avian A(H5N1) influenza viruses acquire the ability to spread efficiently among humans, large‐scale transmission could occur due to the lack of immune defences against H5 viruses in humans," EFSA said in a report. Some 887 cases of human infection with H5N1 avian influenza, were reported globally between January 2003 and Feb. 26 this year, the World Health Organisation (WHO) said in its latest report. Of these 462 were fatal, accounting for a rate of 52%. The majority of human cases were detected in people with unprotected exposure to sick or dead poultry, live poultry markets or a contaminated environment. Wild mammals could act as bridge hosts between wild birds, domestic animals and humans, EFSA said. Companion animals, such as cats living in households and with access to the outdoors, could also be a potential vehicle for transmission, it added. In addition to poultry and dairy cows reported in the United States, mammals hit by the virus include goats, cats, foxes, racoons, skunks, polar and grizzly bears and elephant seals. EFSA called for enhanced surveillance for humans and animals, ensuring access to rapid diagnostics, promoting collaboration between the animal and human sectors and implementing preventive measures such as vaccination. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/lack-immunity-raises-risk-bird-flu-pandemic-efsa-says-2024-04-03/

2024-04-03 12:00

Notes 'high conformity' with output cuts Panel welcomes Iraq, Kazakh pledges to achieve full compliance Next meeting set for June 1 LONDON/MOSCOW/DUBAI, April 3 (Reuters) - A meeting of top OPEC+ ministers kept oil supply policy unchanged and pressed some countries to increase compliance with output cuts, a decision that spurred international crude prices to their highest in five months at nearly $90 a barrel. A ministerial committee (JMMC) of the Organization of the Petroleum Exporting Countries and allies led by Russia, known as OPEC+, met online on Wednesday to review the market and members' implementation of output cuts. The JMMC brings together leading OPEC+ producers including Saudi Arabia, Russia and the United Arab Emirates. Oil has rallied this year, driven by tighter supply, attacks on Russian energy infrastructure and war in the Middle East. Brent crude settled on Wednesday at its highest level since October at $89.35 a barrel. "OPEC+ decided to stick with oil supply cuts for the first half of the year, keeping global markets tight and potentially sending prices higher," said Saxo Bank's Ole Hansen. OPEC+ members, led by Saudi Arabia and Russia, last month agreed to extend voluntary output cuts of 2.2 million barrels per day (bpd) until the end of June to support the market. In a statement following Wednesday's meeting, OPEC+ said some countries had promised to improve their adherence to targets. The panel welcomed pledges from Iraq and Kazakhstan to achieve full conformity as well as to compensate for overproduction, and Russia's announcement that its cuts in the second quarter will be based on production not exports, the statement said. "Participating countries with outstanding overproduced volumes for the months of January, February and March 2024 will submit their detailed compensation plans to the OPEC Secretariat by 30 April 2024," the statement said. Russian Deputy Prime Minister Alexander Novak said on Wednesday Russia was in full compliance with its commitments to reduce oil supplies as part of the OPEC+ deal. Data from S&P Commodity Insights, known as Platts, showed the group overproduced by a net 275,000 bpd in January and by 175,000 bpd in February. Platts is one of the secondary sources used by OPEC+ to assess its members' production. Gabon, Iraq and Kazakhstan were the main members that produced above their quotas for the two months, the survey said. Iraq last month promised to lower exports to make up for pumping above its OPEC target, a pledge that would cut shipments by 130,000 bpd from February. When the voluntary curbs expire at the end of June, the total cuts by OPEC+ are set to decline to 3.66 million bpd as agreed in earlier steps starting in 2022. The panel scheduled its next meeting for June 1, the same day as the next full OPEC+ meeting to decide policy. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/opec-ministers-keep-oil-output-policy-steady-sources-say-2024-04-03/

2024-04-03 11:53

LONDON, April 3 (Reuters) - Britain's financial regulators on Wednesday launched a public consultation on their new "sandbox" for trading digital securities in "real world situations" to keep up with rapid advances in technology. A "sandbox" allows the testing of new services in the market with real customers, but within a controlled regulatory environment. The Bank of England and Financial Conduct Authority said in joint proposals , opens new tab that within the sandbox, existing financial rules would be modified to enable companies to try out new technology, such as distributed ledger technology or blockchain that underpins cryptoassets, for trading and settling digitised bonds and stocks. The regulators are consulting on draft guidance on how firms would apply to operate within the sandbox, and scale up activities . "For the first time, they will be able to provide these services from a single legal entity," the BoE and FCA said. "The adoption of new technology in this area, if done safely, could lead to a technological transformation that will promote greater efficiency as well as greater resilience in the financial system in the long run." The new sandbox will last five years and could lead to a new permanent regulatory regime for securities settlement, whereby ownership of a stock or bond is swapped for cash. The consultation is open until May 29, with final guidance published in the summer. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/uk/bank-england-sets-out-conditions-digital-sandbox-2024-04-03/