2024-04-03 10:38

LONDON, April 3 (Reuters) - The pound held steady against the dollar and the euro on Wednesday, having rebounded from the seven-week lows against the U.S. currency it hit at the start of the week. Sterling was last at $1.2582 and 85.62 pence per euro with both pairs largely waiting for fresh catalysts to drive activity. Wednesday data showing euro zone inflation slowed to 2.4% in March failed to provide one. The British currency's moves against the dollar have been comparatively more dramatic, and the pound dropped to $1.254 on Monday matching Friday's level, the lowest since mid February. That was on the back of U.S. economic data that caused markets to pare back the amount of rate cuts they expect by the U.S. Federal Reserve this year, while bringing forward expectations of the first Bank of England rate cut. "For most of this year, the market has been comfortable with the assumption that the Bank of England would follow both the European Central Bank and the Fed in cutting rates," said Jane Foley, head of FX strategy at Rabobank. "It has now begun to revise that, and there are some expectations in the market that the Bank of England will cut in June - it's our forecast that they will go in August but June is out there - and, at the same time, the markets have begun to pushed back from June in terms of the Fed." "That in itself, is obviously something which could undermine cable," she said, using a common term for the sterling/dollar currency pair. U.S. jobs data, due Friday, will provide the latest information to shape expectations for the U.S. rate outlook. Markets currently are pricing a 62% chance of a June Fed rate cut, according to CME's Fedwatch tool, and roughly a similar chance of a cut then by the Bank of England, according LSEG data. Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/sterling-finds-some-stability-above-seven-week-lows-vs-dollar-2024-04-03/

2024-04-03 10:04

NEW YORK, April 3 (Reuters) - Hedge funds capped the first quarter with gains across different strategies, as a rally in stocks, some commodities and the dollar helped the industry weather a less shiny period for bonds, investors said. Fundamental equities long/short hedge funds were up 6.28% in the first quarter, while systematic long/short funds posted gains of 11%, according to a Goldman Sachs' prime brokerage report that tracks hedge funds globally. Long/short funds focused on technology rose 11.3% on average, it added. Light Street Capital Management's Mercury gained 35.3%, while Whale Rock Capital Management's long/short was up 23%, according to two sources. The S&P 500 (.SPX) , opens new tab advanced 9.09% in the quarter. Investors typically consider the hedge component that hedge funds should provide amid turmoils alongside performance at good times. "So far it has been a very good start to the year for hedge funds," said Ryan Lobdell, head of marketable alternatives at Meketa, adding that portfolio managers have increased exposure to rallying assets. "There has been an increase in the trendiness of equities and commodities." Stocks rallied in the first quarter mainly on the outlook that interest rates have reached a peak. The quarterly results follow a year of positive performance. Hedge funds posted gains of 8.12% last year, far behind the 24% gain posted by the S&P 500 (.SPX) , opens new tab. This year, the rally has broadened beyond the so-called Magnificent Seven – Alphabet (GOOGL.O) , opens new tab, Amazon.com (AMZN.O) , opens new tab, Apple (AAPL.O) , opens new tab, Meta Platforms (META.O) , opens new tab, Microsoft (MSFT.O) , opens new tab, Nvidia (NVDA.O) , opens new tab and Tesla (TSLA.O) -- to sectors such as energy, financials and industrials. "With greater market breadth and increased dispersion, it’s generally easier to find shorts that aren’t just moving up in price along with everything else," said Anders Hall, chief investment officer at Vanderbilt University. Portfolio managers have also juiced up returns with an extra dose of leverage , opens new tab in portfolios, investors said. Among strategies that worked: Record commodities prices for copper, gold and cocoa helped strategies such as CTAs (commodity trading advisers) and macro hedge funds, investors said. Bearish bets on European power markets and milling wheat yielded gains of 8.6% for AQR's Helix strategy. Multi-strategy hedge funds, which trade multiple assets in different ways, have also had a good start. After lagging rivals last year, Schonfeld's flagship fund Strategic Partners ended the quarter with a 6.2% gain, a source said. Citadel had a positive performance in all its funds strategies, with the flagship Wellington up 5.75%, according to a separate source. Exposure to emerging markets has also paid off for some. Macro hedge fund Discovery posted a 17% net gain, a source said, driven by long positions in Latin America and short bets in China. A more tepid corner of the market for performance was fixed income, as U.S. Treasuries yields have risen on the outlook that the Federal Reserve will take longer to cut rates. Citadel's Global Fixed Income fund rose 2.05%, underperforming the firm's other three funds, a source said. "Global fixed income was particularly challenging given increasing rates," said Hall. I'd consider a small gain to be a victory in many cases." Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/business/finance/hedge-funds-rally-q1-powered-by-gains-equities-2024-04-03/

2024-04-03 10:02

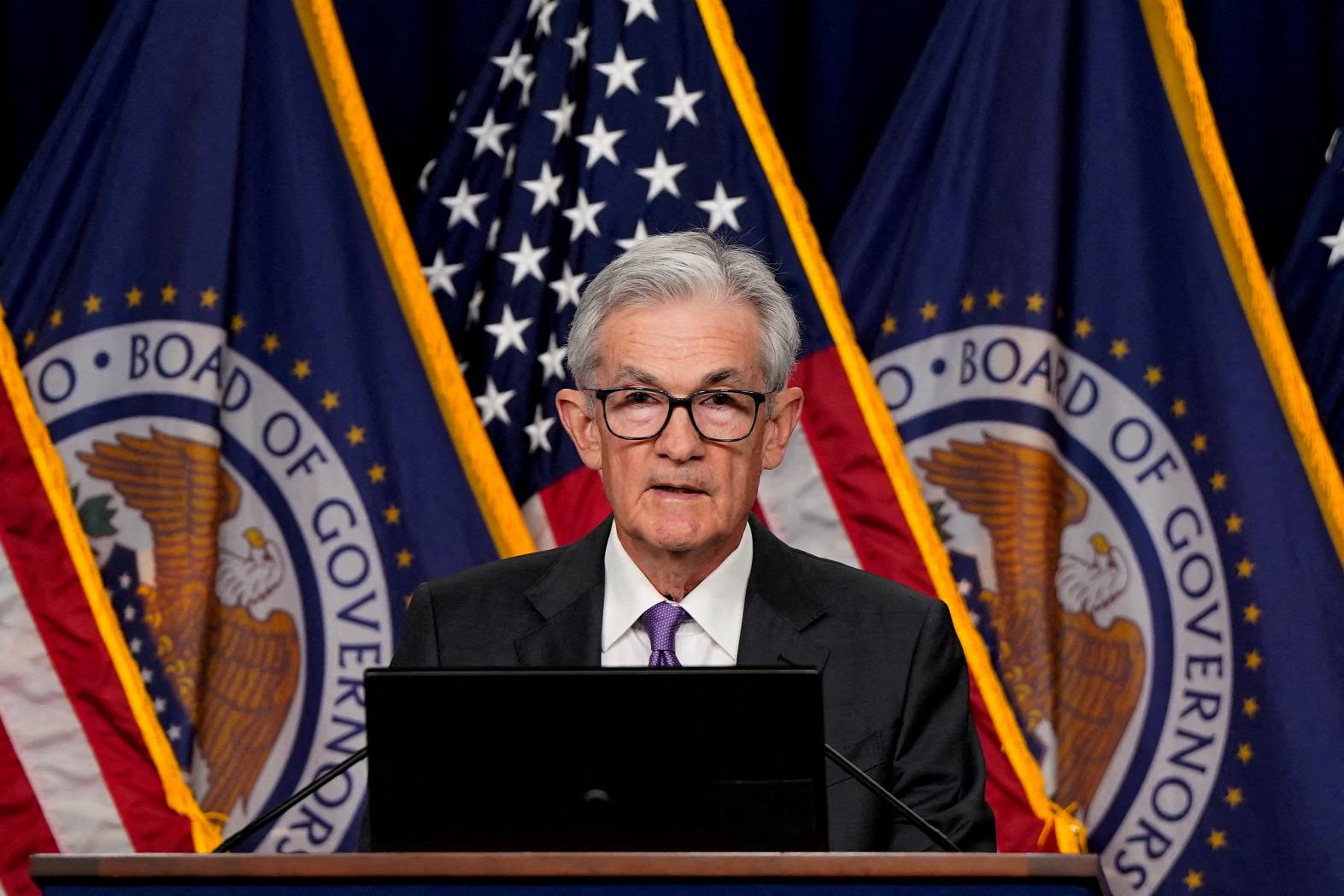

April 3 (Reuters) - A look at the day ahead in U.S. and global markets by Samuel Indyk The wobbly start for markets in the second quarter could worsen on Wednesday. Federal Reserve Chair Jerome Powell is due to deliver a speech, and markets are doubting whether the central bank will proceed with easing policy as early as June. Money market traders are at odds with the Fed - and most analysts - regarding the timing of the first interest rate cut and the scale of easing this year. Markets are still not fully pricing a cut until July, although they are banking on a roughly-65% chance of a cut in June. Meanwhile, they've also lowered their expectations for three cuts in 2024, but with inflation sticky and economic data strong, the Fed might be slowly coming around to that view themselves. "I think the bigger risk would be to begin reducing the funds rate too early," Federal Reserve Bank of Cleveland President Loretta Mester said on Tuesday, although she wouldn't rule out a June cut if upcoming inflation data met her forecasts for a further decline. Powell, in reference to Friday's personal consumption expenditures data, said the inflation reading was "along the lines of what we would like to see". His comments on Wednesday will be scrutinized for more clues on whether the June confab is the appropriate time to start loosening policy. The debate over the timing of the first rate cut has kept Treasury yields elevated, posing a threat to the equity rally that has made U.S. stocks increasingly expensive while hitting record highs. On Tuesday, the benchmark 10-year Treasury yield hit its highest level in four months, while the S&P 500 (.SPX) , opens new tab has slipped almost 1% to start the quarter. Investors will also be watching for the impact on supply chains after the strongest quake in 25 years hit Taiwan, disrupting the semiconductor sector in particular. "We believe this could lead to supply disruptions in the tech supply chain," Barclays analysts said in a note. Taiwan Semiconductor (2330.TW) , opens new tab, a major supplier to Apple (AAPL.O) , opens new tab and Nvidia (NVDA.O) , opens new tab, initially evacuated some fabrication plants, although later added that employees were returning to work. Its shares slipped 1.3% in Taipei. Elsewhere, data releases on Wednesday include the ADP's report of private-sector payrolls, a precursor to Friday's official nonfarm payrolls readout, and the ISM services index for March. Back to Wall Street and stock index futures are signalling another cautious start, with S&P and Nasdaq futures edging down. The dollar remains elevated, with the yen near 152, close to its weakest level in decades and keeping traders on edge for intervention from Japanese officials. Key developments that should provide more direction to U.S. markets later on Wednesday: * Fed's Powell, Bowman, Goolsbee, Barr and Kugler due to speak * ADP nonfarm private employment, ISM non-manufacturing * U.S. Treasury to auction four-month bills Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-04-03/

2024-04-03 09:04

MUMBAI, April 3 (Reuters) - Indian rupee's exchange-traded options went into a tizzy on Wednesday after brokers asked clients to submit proof of underlying exposure on their derivative contracts or unwind their existing positions, three market participants said. This came after brokers thought a central bank rule, to be effective on April 5, that exchange-traded rupee derivative transactions can be used only for hedging meant brokers had to collect proof of such exposure before allowing such trades. However, as Reuters exclusively reported, brokerages were doing so of their own volition and had not been instructed to do so by the central bank. The premium on out-of-the-money dollar/rupee put options expiring on April 26 soared up to 250%, despite spot dollar/rupee inching up 0.04% to 83.4200. Typically, the premium on put options should fall when spot prices rise, unless there is a change in volatility expectations. Further, the option premium on the 83.25 strike put was higher than on the 83.3750 strike put. A put option allows the buyer to sell dollar/rupee at the strike price on the expiry date. A right to sell at a lower strike price should cost less. "The liquidity in options is drying up, bid-ask prices are wider, leading to the anomalies (in premiums)," said Sajal Gupta, executive director and head of forex and commodities at Nuvama Institutional. "It's a very challenging situation out there." Out-of-the-money call options for the April 26 expiry climbed between 100% and 300%. "This is unprecedented. The forced unwinding of positions is leading to full-on panic," said a head at a large brokerage, declining to be named due to company orders to not speak to the media on any matter related to rupee currency derivatives. "We had, in a way, anticipated this and yesterday itself we were asking our clients to exit their positions." Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/turmoil-indias-exchange-traded-fx-options-forced-position-unwinding-2024-04-03/

2024-04-03 07:56

NEW DELHI, April 3 (Reuters) - Oil India (OILI.NS) , opens new tab plans to start its 180,000 barrels per day (bpd) Numaligarh refinery in the northeastern state of Assam by December 2025, its chairman Ranjit Rath said on Wednesday. The company will set up a trading desk as the refinery would process 110,000 bpd of imported crude, Rath said, adding that the remaining crude requirement would be met through local production. Oil India, which operates exploration and production assets mostly in the northeastern part of the country, would export refined fuels to Bangladesh from the Numaligarh refinery, he said. Oil India's production rose to a record 6.5 million ton oil equivalent (mtoe) last fiscal year from 6.36 mtoe in fiscal 2023, Rath said. The company is looking to further raise its output and would spend 135 billion rupees ($1.62 billion) in the current fiscal year, up from 115 billion rupees in the previous year, he said. Oil India aims to drill 61 wells this fiscal year compared to 45 in 2023/24, he added. ($1 = 83.4250 Indian rupees) Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/oil-india-plans-start-numaligarh-refinery-by-dec-2025-chairman-says-2024-04-03/

2024-04-03 07:56

MOSCOW, April 3 (Reuters) - Russia's general prosecutor's office has written to western countries, it said on Wednesday, asking them to respect international obligations to deliver justice as they investigate the Nord Stream blasts and "acts of terrorism" in Russia. Moscow has shown its frustration over the inconclusive nature of inquiries by some foreign powers into explosions in September 2022 on the pipelines designed to carry Russian gas to western Europe. Denmark dropped its investigation in February after Sweden closed its inquiry and handed evidence it had uncovered over to German investigators. Russia's general prosecutor said the letters were sent to Cyprus, France, Germany and the United States after Russian lawmakers and public figures asked for information about the investigation. It said it wanted to know about the possible involvement of individuals and organisations in setting up and funding some terrorism acts in Russia, as well as the Nord Stream blasts. It did not explicitly mention last month's attack on a Moscow concert hall when more than 140 people were killed. The Kremlin has linked it to Ukraine, while saying the attack was carried out by Islamists. Ukraine denies any role. Russia and the West, at loggerheads over Moscow's conflict with Ukraine, have accused each other over the pipeline blasts. Each has denied involvement and no one has taken responsibility. The Kremlin has called the situation regarding the investigations "close to absurd". The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/europe/russia-presses-answers-west-over-nord-stream-blasts-2024-04-03/