2024-04-02 23:55

SANTIAGO, April 2 (Reuters) - Chile's central bank cut its benchmark interest rate on Tuesday by 75 basis points to 6.50%, in a unanimous decision by its governing board, saying the rate would likely be reduced further. The cut is in line with forecasts in a traders' poll last week, which also predicted the bank will reduce the rate to 4.25% within 12 months. In a statement, the bank said it foresees further monetary policy rate cuts, with the size and timing of those moves taking into account the "evolution of the macroeconomic scenario and its implications for the trajectory of inflation." The bank's statement tweaked its forward guidance, removing language from its January statement that predicted the rate reaching its "neutral level" in the second half of 2024. The removal of the sentence "adds a hawkish flavor" to the bank's 75-basis-point cut, J.P. Morgan analyst Diego Pereira said in a note to clients. The South American nation's central bank raised interest rates from 0.50% in mid-2021 to a cycle-high of 11.25% in late 2022. The bank held at that rate before kicking off monetary easing in July as inflation began to cool. Chile's annual inflation peaked at 14.1% in August 2022 and came down to 3.9% at the end of 2023. It has since gone back up, reaching 4.5% in February. The central bank's board on Tuesday added that inflation expectations are aligned with its 3% target, and "rising inflation figures at the beginning of the year and higher imported cost pressures emphasize the need to continue closely monitoring its evolution." While Chile faced a sharp economic downturn in 2023 after a rapid post-pandemic recovery, the economy "has succeeded in closing the significant macroeconomic imbalances of previous years," the board said. Data published by the central bank on Monday showed Chile's economic activity index posted its largest year-on-year increase in almost two years in February. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/markets/rates-bonds/chile-central-bank-cuts-key-rate-65-sees-more-easing-2024-04-02/

2024-04-02 23:30

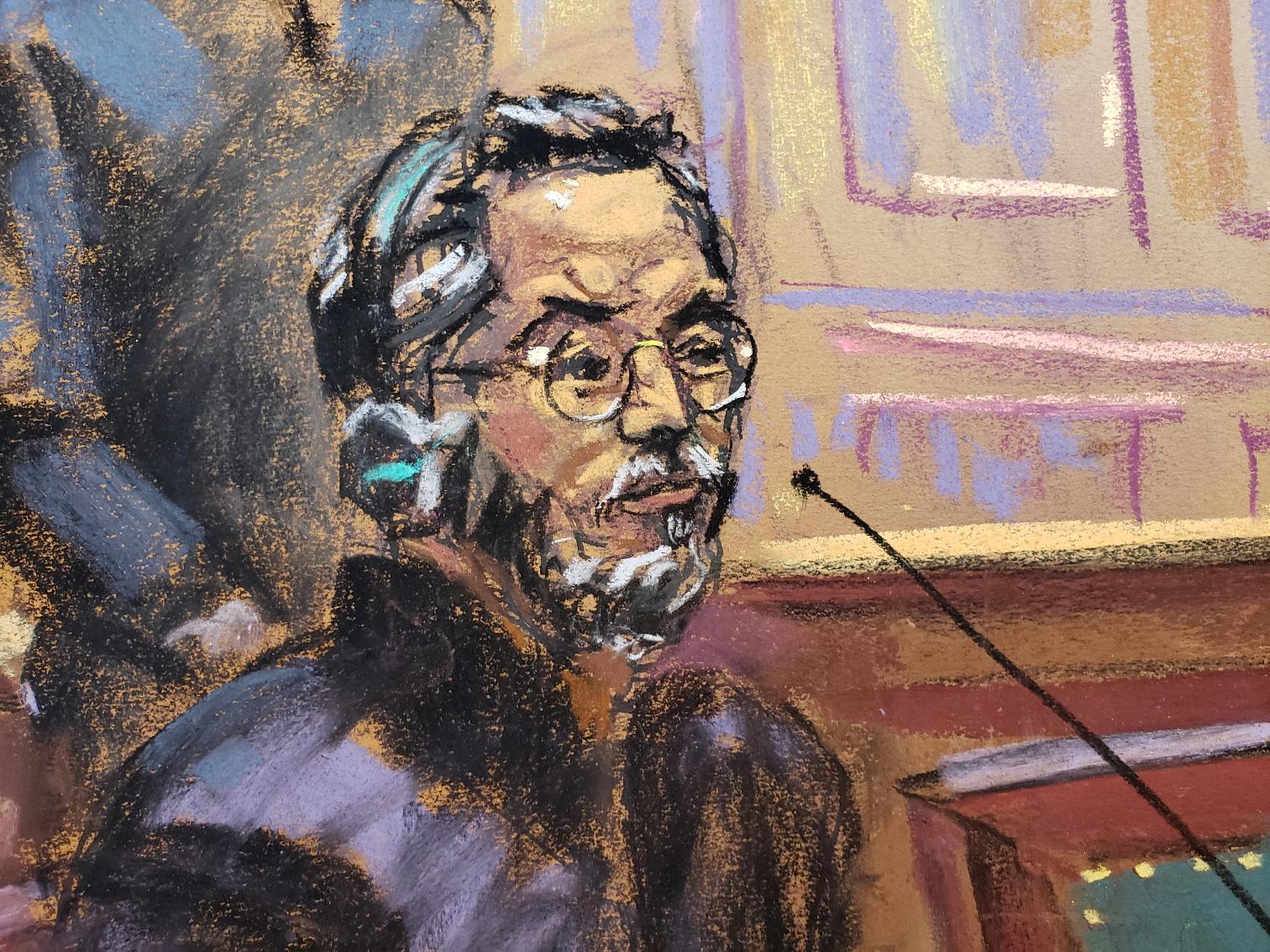

NEW YORK, April 2 (Reuters) - A U.S. judge on Tuesday rejected exiled Chinese businessman Guo Wengui's bid to dismiss an indictment accusing him of defrauding thousands of investors out of more than $1 billion. U.S. District Judge Analisa Torres in Manhattan said prosecutors sufficiently alleged that Guo engaged in a pattern of racketeering through four fraud schemes, and that proving it was a matter for trial. Lawyers for Guo did not immediately respond to requests for comment after business hours. Guo has pleaded not guilty to 12 criminal charges that including securities fraud, wire fraud, unlawful monetary transactions and conspiracy, including for money laundering. According to the indictment, Guo and his accomplices defrauded investors in a media company, cryptocurrency and other ventures. The indictment said Guo took advantage of his prolific online presence and hundreds of thousands of followers by promising outsized financial returns and other benefits. In reality, the scheme allowed the co-conspirators to enrich themselves and family members, and fund Guo's "extravagant lifestyle" the indictment said. Two co-defendants face related criminal charges, including one defendant charged with obstruction. Also known as Ho Wan Kwok and Miles Kwok, Guo is a critic of China's Communist Party and business associate of former U.S. President Donald Trump's onetime adviser Steve Bannon. Guo has been jailed in Brooklyn since his March 2023 arrest, with Torres and a federal appeals court rejecting his proposed $25 million bail package last year. Jury selection in his trial is scheduled to begin on May 20. Prosecutors also sought the forfeiture of various assets including bank accounts, a $37 million yacht, a New Jersey mansion, a Bugatti, a Lamborghini and a Rolls Royce. Guo filed for Chapter 11 bankruptcy protection in Connecticut in February 2022. That case was later combined with the bankruptcies of other companies he controlled. Torres has twice rejected Guo's bid to stay the bankruptcy proceedings. The case is U.S. v Kwok, U.S. District Court, Southern District of New York, No. 23-cr-00118. Jumpstart your morning with the latest legal news delivered straight to your inbox from The Daily Docket newsletter. Sign up here. https://www.reuters.com/legal/exiled-chinese-businessman-guo-wengui-must-face-us-fraud-indictment-2024-04-02/

2024-04-02 23:22

US health insurers fall after Medicare rates disappoint Tesla slides after Q1 deliveries miss Indexes: Dow down 1.00%, S&P 500 down 0.72%, Nasdaq down 0.95% NEW YORK, April 2 (Reuters) - U.S. stocks fell on Tuesday as investors weighed chances that the Federal Reserve could delay cutting interest rates, while Tesla shares dropped after the electric car maker posted fewer quarterly deliveries for the first time in nearly four years. Tesla's stock dropped 4.9%, one of the biggest drags on the S&P 500 and Nasdaq. Healthcare shares were also among the day's weakest performers. Shares of UnitedHealth (UNH.N) , opens new tab, CVS Health (CVS.N) , opens new tab and Humana (HUM.N) , opens new tab all fell sharply as the U.S. government kept reimbursement rates for providers of Medicare Advantage health plans unchanged. Investor caution grew as U.S. Treasury 10-year yields rose to their highest since late November. Recent solid U.S. economic reports have raised doubts about whether the Fed could deliver the three rate cuts outlined in its latest forecast. "The narrative of 'higher for longer' is coming back into play despite the fact that the Fed does see a rate cut sometime this year. So this has got the market worried," said Quincy Krosby, chief global strategist at LPL Financial in Charlotte, North Carolina. The Dow Jones Industrial Average (.DJI) , opens new tab fell 396.61 points, or 1%, to 39,170.24. The S&P 500 (.SPX) , opens new tab lost 37.96 points, or 0.72%, at 5,205.81 and the Nasdaq Composite (.IXIC) , opens new tab dropped 156.38 points, or 0.95%, to 16,240.45. The CBOE Volatility index (.VIX) , opens new tab, Wall Street's fear gauge, rose. "Healthy markets do need to pull back and most likely this is that pullback," Krosby said. The S&P 500 remains up about 9% for the year so far. Data on Tuesday showed new orders for U.S.-manufactured goods rebounded more than expected in February, while U.S. job openings held steady at higher levels. The market has pared back expectations for rate cuts to about two this year, from three a few weeks ago, according to LSEG's rate probability app. Fed officials who spoke on Tuesday reiterated that the U.S. central bank is in no rush to cut rates. San Francisco Fed President Mary Daly cited a "real risk" of cutting rates too soon and locking in too-high inflation. Fed Bank of Cleveland President Loretta Mester said she still expected the central bank to be able to cut rates this year, noting that the easing might kick off at its June policy meeting if economic data allows it. Investors are eagerly awaiting Friday's U.S. non-farm payrolls data. Among other stock decliners, Calvin Klein-parent PVH Corp's shares (PVH.N) , opens new tab tumbled 22.2% after the retailer forecast a roughly 11% drop in first-quarter revenue. Volume on U.S. exchanges totaled 11.12 billion shares, compared with the 11.87 billion average for the full session over the last 20 trading days. Declining issues outnumbered advancers on the NYSE by a 2.86-to-1 ratio; on Nasdaq, a 2.63-to-1 ratio favored decliners. The S&P 500 posted 24 new 52-week highs and four new lows; the Nasdaq Composite recorded 53 new highs and 124 new lows. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/futures-dip-health-insurers-slide-focus-data-fed-speakers-2024-04-02/

2024-04-02 22:38

LAGOS, April 2 (Reuters) - Nigeria's Dangote oil refinery started supplying petroleum products to the local market on Tuesday, a company executive and fuel marketing associations said, a major step in the country's quest for energy independence. The refinery, Africa's largest, was built on a peninsula on the outskirts of the commercial capital Lagos at a cost of $20 billion by the continent's richest man Aliko Dangote and was completed after several years of delays. It can refine up to 650,000 barrels per day (bpd) and will be the largest in Africa and Europe when it reaches full capacity this or next year. Dangote's group executive, Devakumar Edwin, confirmed shipping of diesel and jet fuel into the local market. "We have substantial quantities. Products are being evacuated both by sea and road. Ships are lining up one after another to load diesel and aviation jet fuel," Edwin told Reuters. "Ships load a minimum of 26 million litres, though we try to push for 37 million litres vessels, for ease of operations." Local oil marketers agreed a price of 1,225 naira ($0.96) per litre of diesel following a bulk purchase agreement, before putting their mark-up, said Abubakar Maigandi, head of the Independent Petroleum Marketers Association of Nigeria. The association's members control about 150,000 retail stations across Nigeria, Maigandi said. Another marketers' group, the Depots and Petroleum Products Marketers Association of Nigeria said its members were seeking letters of credit to buy petroleum products from Dangote. "Our members are discussing with banks and these talks have reached advanced stages, when we have our letters of credit, we will begin lifting products," Femi Adewole, the association's executive secretary said. The Dangote refinery is touted as the turning point to end Nigeria's reliance on imported petroleum products. Nigeria is Africa's most populous nation and its top oil producer, yet it imports almost all its fuel due to lack of refining capacity. (This story has been corrected to remove reference to marketers' group as 'smaller' in paragraph 9) Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/nigerias-oil-marketers-load-products-dangote-refinery-2024-04-02/

2024-04-02 21:58

April 3 (Reuters) - A look at the day ahead in Asian markets. The perfect storm of higher bond yields , opens new tab, corporate jitters and rising price pressures that hit Wall Street on Tuesday looks set to darken the Asian market landscape on Wednesday, as investors wonder whether this might be the start of a deeper correction. Asia's economic calendar has some top-tier releases in the shape of Chinese and Japanese service sector purchasing managers index data, but the market tone on Wednesday will probably be set by the latest tightening of global financial conditions. The 10-year U.S. Treasury yield hit 4.40% and Brent crude touched $89 a barrel on Tuesday - both the highest levels this year - and Tesla shares slumped 5% after the company announced the first fall in quarterly deliveries for nearly four years. The three main U.S. indexes shed 0.7% to 1.0%, and the S&P 500 clocked its biggest fall in a month. This doesn't bode well for Asia on Wednesday, but there is a 'glass half full' argument to be made. In some ways, Wall Street held up pretty well in light of the break out in yields, back up in implied rates and renewed talk of 'bond vigilantes' coming back to stalk the bond market. A decline of 1% or less, on the heels of a relentless rally culminating in last week's record highs, is small beer. Still, there are plenty reasons to be cautious. The threat of currency market intervention from Japanese authorities to support the beleaguered yen refuses to lift, as the yen continues to hover close to the 152.00 per dollar level. Recent moves in China's currency are also worth noting. The offshore yuan is creeping above the upper limit of the 2% band around the central bank's daily fixing rate. This comes ahead of U.S. Treasury Secretary Janet Yellen's return to China later this week for renewed dialogue with top officials in Beijing. China's 'unofficial' Caixin services PMI data on Wednesday rounds off a surprisingly strong set of PMI reports that has fueled hopes that the world's second largest economy is finally picking up momentum. Ironically, however, this renewed optimism, together with punchy U.S. manufacturing PMIs, has helped put upward pressure on global bond yields, which in turn has put downward pressure on stocks. World markets may be back in a 'good news is bad news' mindset. Alibaba shareholders may be asking themselves a similar question after the Chinese e-commerce giant said on Tuesday it conducted a $4.8 billion share buyback in the three months to March, its second biggest quarterly buyback ever. Hong Kong-listed shares rose 1%, but U.S.-listed shares fell 0.7%. Here are key developments that could provide more direction to markets on Wednesday: - China Caixin services PMI (March) - Japan services PMI (March) - Hong Kong retail sales (February) Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-04-02/

2024-04-02 21:14

April 2 (Reuters) - Duke Energy's (DUK.N) , opens new tab Florida segment (DEF) on Tuesday said it filed for new base rates, requesting nearly $820 million in revenue between 2025-2027 with the Florida Public Service Commission (FPSC), a cost which would be passed onto customers. DEF said the base rate aims to help the company increase efficiency, modernize the grid and invest in 14 new solar sites of 1,050 megawatts overall. Duke's Florida segment serves nearly 1.97 million people. With customer bills going into 2025 being lower on certain 2022 contracts expiring at the end of this year, the base rates would rise by 4% from 2025 through 2027: going up $16.48 in 2025, $2.73 in 2026 and $4.93 in 2027 on a 1,000-kilowatt bill. The company also flagged it plans to file a fuel and capacity rate request due to falling natural gas costs, which would lower customer bills by $5, in addition to a $11.29 decrease that began in January 2024. Natgas prices have fallen nearly 25% this year to their lowest since June 2020, as ample supply and storage, and low heating needs. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/duke-energy-florida-files-base-rate-hike-push-clean-energy-2024-04-02/