2024-04-01 19:34

Canadian dollar weakens 0.3% against the greenback BoC survey shows firms expect demand to stay subdued Factory sector moves closer to stabilizing in March 10-year yield rises 12.8 basis points to 3.595% TORONTO, April 1 (Reuters) - The Canadian dollar weakened against its U.S. counterpart on Monday as the greenback notched broad-based gains and a quarterly business survey from the Bank of Canada left the door open to interest rate cuts over the coming months. Fewer firms are planning for a recession in the coming 12 months but they expect demand to stay subdued over the next year, the BoC's Business Outlook Survey for the first quarter found. "It just reinforces that in Canada ... there's slack in the economy and weaker consumer demand. At the same time, inflation is starting to trend lower," said Aaron Hurd, senior portfolio manager in the currency group at State Street Global Advisors. "As the year progresses, that's more consistent with Bank of Canada easing." Investors expect the BoC to begin easing in June or July. Separate data showed that Canadian manufacturing activity moved closer in March to ending a lengthy period of contraction. The Canadian dollar was trading 0.3% lower at 1.3580 per U.S. dollar, or 73.64 U.S. cents, after trading in a range of 1.3516 to 1.3586. Speculators have raised their bearish bets on the Canadian dollar to the highest since December, data from the U.S. Commodity Futures Trading Commission showed on Friday. The U.S. dollar rallied against a basket of currencies as data showed U.S. manufacturing growing for the first time in 1-1/2 years in March. It follows data on Friday that showed strength in consumer spending alongside moderating inflation. "It just feeds that 'Goldilocks' U.S. scenario where the U.S. is still going to have superior growth, higher than the rest of the G10, higher than Canada, by a wide margin," Hurd said. The Canadian 10-year yield rose 12.8 basis points to 3.595%, tracking the move in U.S. Treasuries. Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/c-weakens-boc-survey-stays-consistent-with-rate-cuts-2024-04-01/

2024-04-01 16:51

ZURICH, April 1 (Reuters) - The Swiss National Bank (SNB) has to spend billions of dollars on foreign exchange to keep the Swiss franc from appreciating, according to a new working paper published by the central bank. Entitled "FX interventions as a form of unconventional monetary policy", the paper states that "(foreign exchange interventions) of approximately 27 billion francs are necessary to prevent the Swiss franc from appreciating by 1.1%." "The effect is stronger the longer the central bank can commit to keep its policy rate constant in response to the inflationary effect of the interventions," notes the paper authored by Tobias Cwik and Christoph Winter. The franc has for years been one of the world's strongest currencies. Through the early 2020s, the SNB spent heavily on forex to help prevent the safe haven currency from appreciating. However, as inflationary pressure built after the COVID-19 pandemic, in 2022 the SNB began selling forex to strengthen the franc in a bid to lessen the impact of imported inflation. With inflation now back within its target range of 0-2%, the bank last month cut its key interest rate for the first time in nine years, and has begun paring back foreign currency sales. ($1 = 0.9051 Swiss francs) Get a look at the day ahead in European and global markets with the Morning Bid Europe newsletter. Sign up here. https://www.reuters.com/markets/europe/snb-study-tallies-cost-intervention-curb-franc-gains-2024-04-01/

2024-04-01 16:15

By Promit Mukherjee and David Ljunggren OTTAWA, April 1 (Reuters) - Canadian firms are starting to see conditions improve after almost two years of deterioration but expect demand to stay subdued over the next year, the Bank of Canada (BoC) said on Monday in its first quarter survey. Fewer firms are planning for a recession in the coming 12 months and the number who expect to see inflation above 3% for the next two years has also fallen. And for the first time in four quarters, firms see future sales increasing. Analysts and economists say the survey - which contains some of the most recent data on the economy - will help them judge when the Bank of Canada might start cutting interest rates from their current 22-year high of 5%. The Bank, which has a 2% inflation target, says it might be able to start reducing rates this year but declines to give a timeline. Inflation hit an eight month low of 2.8% in February. The business outlook indicator - a broad gauge of how firms feel about their prospects - improved to -2.42 in the first quarter from -3.09 in the fourth quarter. "Firms reported that business conditions improved slightly in the first quarter. The uptick in sentiment follows nearly two years of deterioration and is reported widely across all regions, sectors and firm sizes," said the survey. Some 27% of firms expect Canada to be in a recession over the next year, down from 38% in the fourth quarter, while 40% thought inflation would stay above 3% for the next two years, down from 54%. The survey noted fewer firms planned to make unusually large or frequent price increases over the next 12 months. "Firms reported that demand remains weak overall. But there are some signs of returning optimism," said the survey, citing overall conditions, sales outlooks and employment intentions. February's inflation data and a rebound in gross domestic product in January are sending mixed signals to the market on how the impact of high rates on the economy. Wage growth, which the BoC singles out as one reason for sticky inflation, will be slower than it was in the past year, but is still likely to be high. Labor shortages continue to decline, the survey said. A separate central bank survey of consumer expectations showed Canadians believe inflation has slowed and do not expect more rate hikes this year. Money markets have trimmed their expectations of a June rate cut to around 64% from 70% last week and are fully pricing in a first 25 basis point cut in July. The Bank of Canada will release updated projections on April 10 along with the latest interest rate policy decision. ((Reuters Ottawa bureau, [email protected] , opens new tab)) Keywords: CANADA CENBANK/ Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/canadian-firms-see-outlook-starting-improve-says-central-bank-survey-2024-04-01/

2024-04-01 14:02

April 1 (Reuters) - India's National Stock Exchange of India Ltd and BSE Ltd on Monday issued circulars to brokers reaffirming the central bank's latest currency derivative rules, which traders fear will hurt volumes in the market. The rules were first issued by the Reserve Bank of India in a Jan. 5 circular and required exchange-traded rupee derivative transactions to have an underlying foreign exchange exposure. While a similar requirement existed earlier, it was not strictly enforced. According to the latest circular, stock exchanges can offer forex derivative contracts involving the rupee to users "for the purpose of hedging contracted exposure", starting April 5. Traders worry the new rule will hurt volumes as a small percentage of clients have actual forex exposure and many are speculators and arbitrageurs. "The brokers had communicated their worries to exchanges and regulators but there has been no change in regulatory stance," a person with direct knowledge of the matter said. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/india/india-cenbanks-new-fx-derivative-rules-unchanged-say-exchange-circulars-2024-04-01/

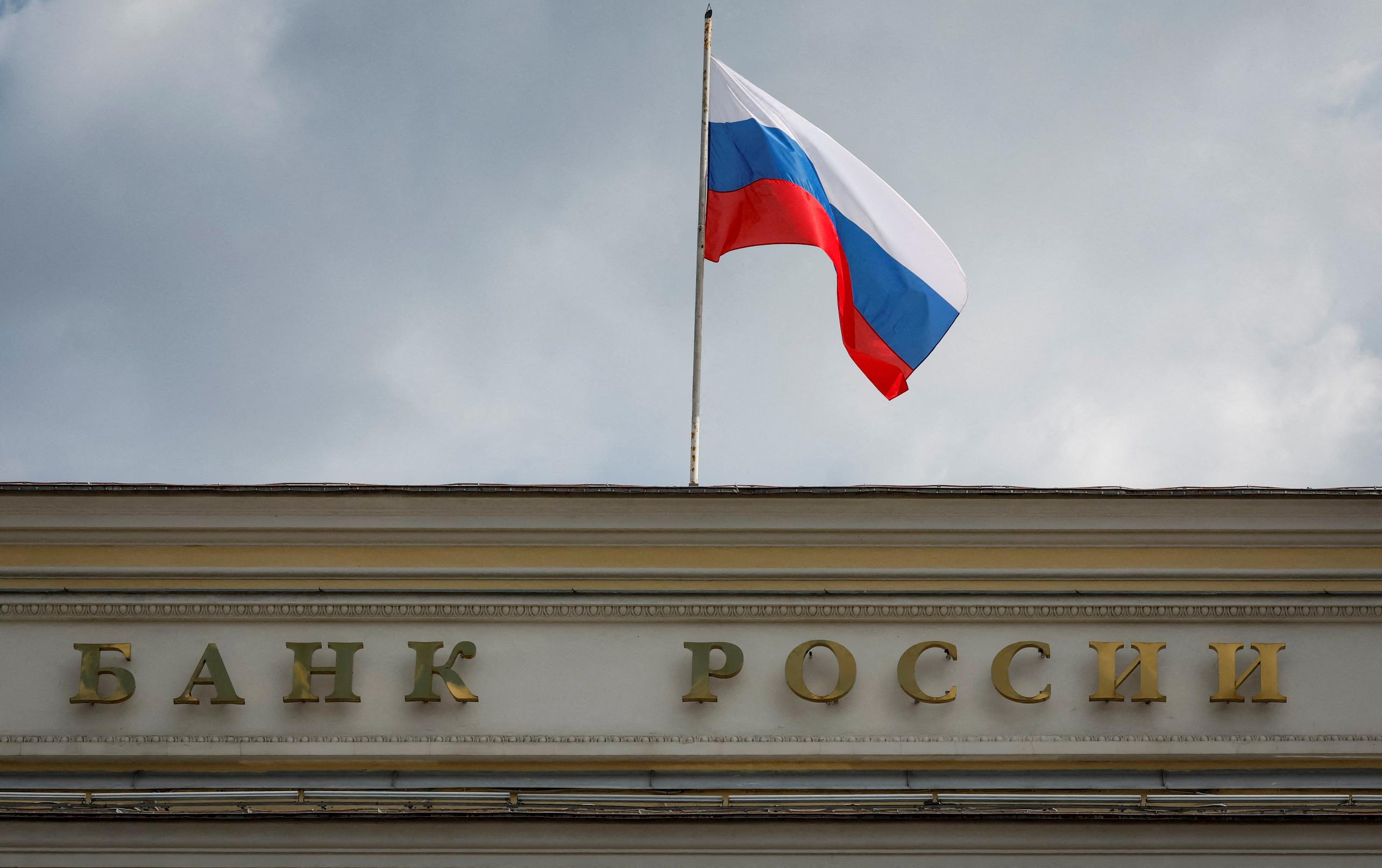

2024-04-01 13:08

MOSCOW, April 1 (Reuters) - Russia's central bank only considered keeping its key rate unchanged at 16% at the March meeting, as it believes the current decline in inflation pressure is less pronounced than that in late 2023, it said on Monday. According to the minutes of the March meeting published by the regulator, disinflation may require an additional rise in real rates and cutting rates too early could lead to a second wave of inflation that would be harder to combat. Get a look at the day ahead in European and global markets with the Morning Bid Europe newsletter. Sign up here. https://www.reuters.com/markets/europe/russian-central-bank-cutting-early-could-prompt-new-wave-inflation-2024-04-01/

2024-04-01 12:40

ORLANDO, Florida, April 1 (Reuters) - Looked at through a currency market lens, the verdict from hedge funds on the recent wave of major central bank policy meetings could not be clearer - don't bet against the mighty dollar. The latest Commodity Futures Trading Commission data show that speculators are going 'all in' on a stronger dollar, particularly against G10 currencies, and especially the Japanese yen and Swiss franc. Figures for the week through March 26 show that speculative CFTC accounts increased their net long dollar position against a range of G10 and emerging currencies to $13.5 billion, the highest since September 2022. The net long position against G10 currencies was even higher at $17.64 billion, a level not seen since July 2022. In both cases, most of the surge has come in the last few weeks during which time the Federal Reserve, European Central Bank, Bank of Japan and Swiss National Bank all held policy meetings. From a relative rates perspective, the dollar has emerged the victor. Fed policymakers lifted the median 'dot plot' and long-run neutral rate projections, the BOJ's historic rate hike was deemed to be 'dovish', the ECB could ease policy before the Fed, and the SNB was the first major central bank to cut rates. Even those who are more gloomy on the dollar's longer-term prospects recognize its relative attraction in the short term. "The bar remains high ... to boost the dollar substantially, but signs of continued economic resilience in the US could still keep the greenback on the front foot in the short term," Capital Economics senior economist Jonathan Peterson wrote last week. YEN, SWISSIE CARRY THAT WEIGHT Speculators appear to agree. In the week through March 26 they increased their net short yen position to 129,106 contracts, CFTC data show. That's close to the 132,000 contracts net short in February which was funds' biggest bet against the yen in over six years. A long position is essentially a bet that an asset will rise in value, and a short position is a wager its price will fall. Funds have increased their net short yen position in nine of the last 11 weeks, the two outliers being in the run up to the BOJ's historic rate hike in March. CFTC funds' short yen position is now worth $10.65 billion and the renewed bearishness is probably one of the reasons the Japanese currency last week hit a 34-year low against the dollar. CFTC data also show hedge funds grew their net short Swiss franc position in the latest week to the largest in almost five years. It now stands at 22,627 contracts, a bet worth more than $3 billion - both are the highest since June 2019. Funds also continued to reduce their net long euro position which now stands at 31,194 contracts, a $4.2 billion bet on the euro appreciating. Both are the smallest since September 2022. (The opinions expressed here are those of the author, a columnist for Reuters.) Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/long-dollar-bets-explode-funds-join-dots-mcgeever-2024-04-01/