2024-03-27 21:47

March 28 (Reuters) - A look at the day ahead in Asian markets. The yen dam has been breached, but hasn't burst. Not yet, anyway. The currency's brief slide on Wednesday to a new 34-year low near 152 per dollar triggered an emergency meeting of Japan's three main monetary authorities, suggesting direct intervention in the market to stop what they consider disorderly and speculative moves is imminent. Asian market focus on Thursday will be on whether Tokyo backs up its increasingly loud and frequent warnings with action. Finance Minister Shunichi Suzuki said authorities could take "decisive steps" - language he hasn't used since Japan last intervened in 2022. The dollar has pulled back towards 151.00 yen of its own accord, a move that will extend if hedge funds and speculators start covering their substantial short yen position. Tokyo's helping hand would accelerate it further. But currency traders appear relaxed or skeptical about intervention. Dollar/yen volatility ticked up only slightly on Wednesday, and is still around its lowest levels in two years. Analysts at HSBC note the dollar is not in the 'bubble-like state' of late 2022, so the risk is any action now would yield "very limited success." Analysts at Morgan Stanley say there is little incentive to intervene from a fundamental perspective - Japan's terms of trade have improved, the weak exchange rate has hugely boosted exporter revenues and rate differentials are still heavily against the yen. Joseph Wang, a former senior trader at the New York Fed, was more blunt: "Time for the authorities to put up or shut up. But honestly, my guess is intervention would be a waste and just buy a little time," he tweeted on Wednesday. Japan's officials may not fully welcome the yen's weakness, but equity investors do. The Nikkei is on the brink of new highs, up nearly 22% so far this year and on track for its best quarter since Q2 2009. Another 1.5% to the upside by the end of the week will seal the index's best quarterly performance on record. If Japanese stocks are on a roll, however, Chinese stocks are again threatening to roll over. The country's two main indexes slumped more than 1% on Wednesday, their steepest decline in a month and pushing them into the red for March. Authorities in Beijing may have welcomed Chinese industrial profits swinging back into positive territory, but they will not want to see stocks head back to their recent five-year lows and overseas investment dry up. In some respects, the keenest observers of whether Japan intervenes in the FX market are in Beijing. The yen is at its weakest level in more than 30 years against China's yuan, giving Japan a major competitive advantage over its rival. Here are key developments that could provide more direction to markets on Thursday: - Australia retail sales (February) - Thailand industrial production (February) - Bank of Japan summary of opinions from March 18 to 19 policy meeting Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/global-markets-view-asia-graphic-pix-2024-03-27/

2024-03-27 21:41

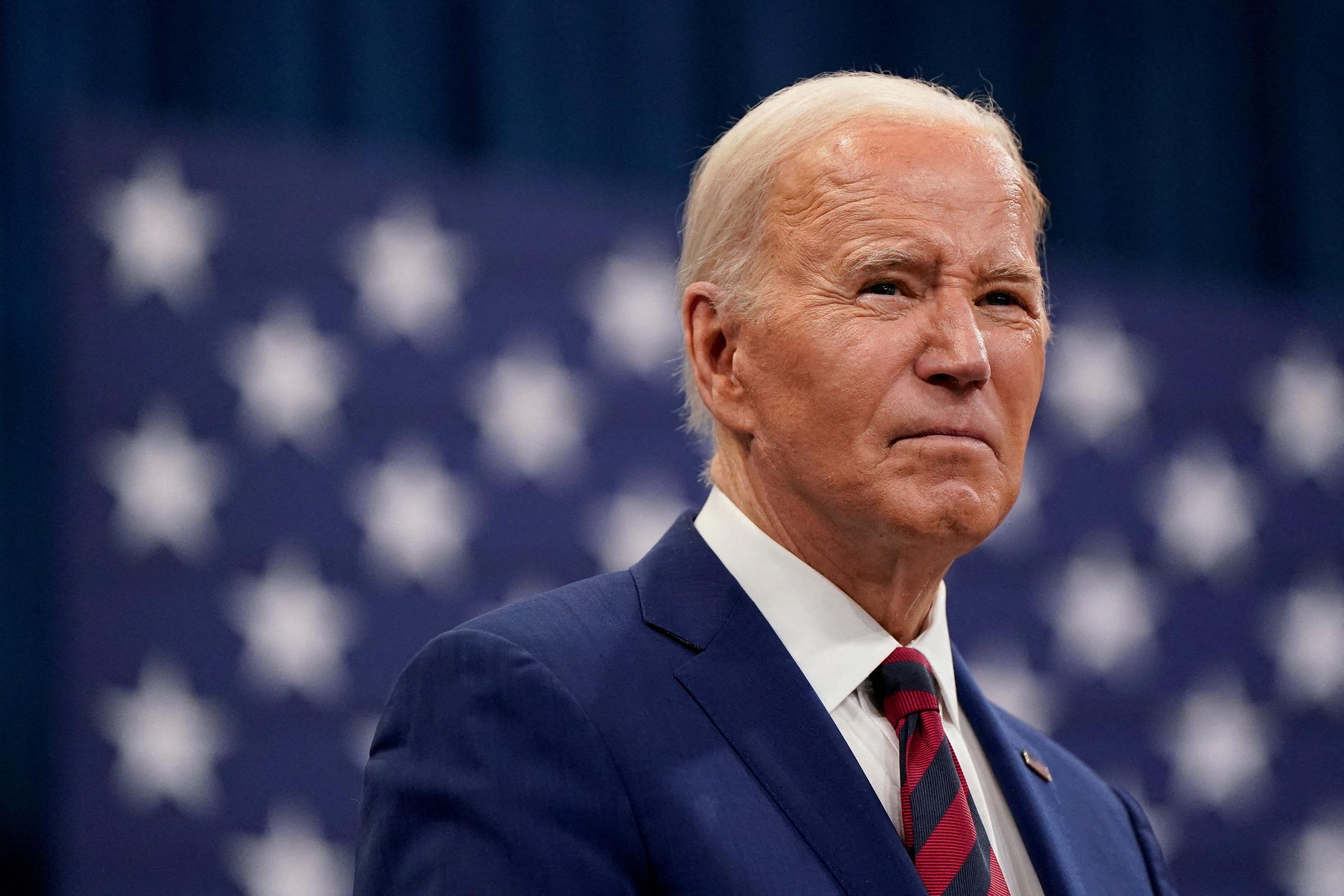

March 27 (Reuters) - The U.S. Department of Energy (DOE) said on Wednesday it would loan Holtec International $1.52 billion to help restart an 800MW nuclear power plant in Michigan that was shut down in 2022, potentially making it the first nuclear plant to be recommissioned in the United States. The conditional loan by the Energy Department's loan program office was authorized through passage of the Inflation Reduction Act in 2022. The loan is dependent on Holtec meeting several technical, legal, environmental, and financial conditions, according to the DOE loan office. The Biden administration has said that nuclear energy will play a key role in decarbonizing the country's power grid by 2035 and the entire economy by 2050. The re-started Palisades plant would avoid 4.47 million tonnes of CO2 emissions annually for a total of 111 million tonnes of CO2 emissions during its projected 25 years of operation. Florida-based Holtec said the plant would employ more than 600 workers, with about 45% of the workforce at the site coming from union labor once it's restarted. The company also plans to build what will be its first two small modular reactor (SMR) units at the site, which will not be part of the project that is eligible for the loan. NuScale's (SMR.N) , opens new tab SMR technology is the only one to have received design certification from the U.S. nuclear power regulator last year. But the company has faced cost and subscription issues and had to shelve one of its SMR projects. Holtec originally bought Palisades in 2022 from Entergy (ETR.N) , opens new tab to decommission the plant as it struggled to compete with natural gas-fired plants and renewable energy, but started looking into reopening the shut reactor. The company has also already signed long-term Power Purchase Agreements (PPAs) with electric co-ops Wolverine Power Cooperative and Hoosier Energy in Michigan, Illinois, and Indiana. Holtec is pursuing a reauthorization of the Palisades operating license with the Nuclear Regulatory Commission. Reuters in January reported that the company was in talks for the loan from the DOE for the plant. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/holtec-gets-152-bln-loan-us-restart-nuclear-power-plant-2024-03-27/

2024-03-27 21:36

March 27 (Reuters) - The Biden administration on Wednesday said it had finalized rules aimed at limiting methane leaks from oil and gas drilling on public lands. The policy complements efforts at other federal agencies to reduce emissions of methane, a potent greenhouse gas that tends to leak from drill sites and pipelines and contributes to climate change. Nearly a tenth of U.S. oil and gas production takes place on federal lands, primarily in Western states like New Mexico and Wyoming. The rules require oil and gas drillers to develop plans to detect leaks, make repairs and minimize waste. They must also pay royalties for natural gas lost through flaring or venting if those losses are considered to have been avoidable. The Interior Department said the rule would conserve billions of cubic feet of gas that otherwise might have been vented, flared or leaked, generating more than $50 million in additional royalty payments to the federal government each year. "This final rule, which updates 40-year-old regulations, furthers the Biden-Harris administration's goals to prevent waste, protect our environment, and ensure a fair return to American taxpayers," Interior Secretary Deb Haaland said in a statement. The new rules follow years of legal wrangling over methane regulations crafted by former President Barack Obama's administration. The regulation from Interior's Bureau of Land Management (BLM) focuses on waste prevention, an area over which it has legal authority. Oil and gas industry trade group American Petroleum Institute (API) said it was reviewing the rule to consider whether BLM had overstepped its authority. "API supports a smart regulatory framework for reducing methane emissions, but overlapping regulations and lack of coordination between policymakers could hinder progress, create unnecessary barriers to development on federal lands and result in regulatory incoherence," API vice president of upstream policy, Holly Hopkins, said in a statement. Environmental groups welcomed the new policy. "Taking action to limit methane waste on public lands offers a win-win-win for taxpayers, producers and communities harmed by this waste and associated pollution," Jon Goldstein, senior director of regulatory and legislative affairs at Environmental Defense Fund said in a statement. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/new-us-rules-seek-curb-leaks-oil-gas-drilling-public-lands-2024-03-27/

2024-03-27 20:59

March 27 (Reuters) - A combined Connecticut-Massachusetts-Rhode Island offshore wind solicitation on Wednesday attracted bids from at least four developers, including units of European energy firms Iberdrola (IBE.MC) , opens new tab and Orsted (ORSTED.CO) , opens new tab. The U.S. offshore wind industry is showing signs of a comeback this year, with several projects in various stages of development and construction, after a disastrous 2023 of developers cancelling contracts and taking roughly $9.1 billion in write-offs and impairments on projects. So far, Avangrid, Orsted, Vineyard Offshore and SouthCoast Wind have made proposals in the tri-state auction, which is expected to play a critical role in federal and state plans to decarbonize the power grid and help mitigate climate change. Avangrid, a member of the Iberdrola Group, submitted multiple proposals, including the 791-megawatt (MW) New England Wind 1 and the 1,080-MW New England Wind 2. If combined, the two projects could generate enough power to supply nearly 1 million homes. "Avangrid is ready to go," Avangrid CEO Pedro Azagra said in a press release, adding that construction could start on New England Wind 1 as early as next year. The company said New England Wind 1 could achieve commercial operations in 2029. In a separate bid, Orsted, the world's biggest offshore wind company, proposed the 1,184-megawatt Starboard Wind project, which could supply power to Connecticut and/or Rhode Island. Vineyard Offshore said it proposed the 1,200-megawatt (MW) Vineyard Wind 2, which would sit 29 miles (46.7 kilometers) south of Nantucket in Massachusetts. The project could start in 2031. Vineyard Offshore is held by funds managed by Copenhagen Infrastructure Partners. An additional project, called SouthCoast Wind, which is backed by a joint venture between EDP Energias de Portugal (EDP.LS) , opens new tab and Engie (ENGIE.PA) , opens new tab, was bid with few details about its size and scope. After contracts to sell offshore wind power to utilities in Massachusetts and Connecticut were scrapped due to rising costs from higher interest rates and supply chain problems, Massachusetts, Connecticut and Rhode Island agreed in October 2023 to jointly pursue offshore wind to help get more projects built. Some companies that canceled contracts to sell offshore wind power in the U.S. Northeast in 2023 have indicated they have projects ready to be bid in upcoming solicitations. Those include units of Avangrid, BP (BP.L) , opens new tab, EDP Energias de Portugal (EDP.LS) , opens new tab and Engie (ENGIE.PA) , opens new tab. Although Orsted has not canceled projects in New England, it has dropped contracts to sell offshore wind power in New York, New Jersey and Maryland over the past year. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/climate-energy/big-turnout-expected-new-england-offshore-wind-power-auction-2024-03-27/

2024-03-27 20:07

HOUSTON, March 27 (Reuters) - Citgo Petroleum (PDVSAC.UL), the Venezuela-owned oil refiner, is set to open a data room in coming days to provide operational and financial information to bidders under a court-ordered auction that could lead to new ownership, people familiar with the matter said on Wednesday. A U.S. federal court last year launched an auction of shares in a parent of the Houston-based refiner to satisfy $21.3 billion in judgments for Venezuela's past expropriations and debt defaults. The auction is due to wrap up this year and could put the seventh-largest U.S. refiner by processing volume in the hands of rivals or investors. Management presentations began this week and the formal data room will open at Citgo's headquarters, the people said. The meetings kicked off a 45-day second bidding round that will consider only binding offers. Citgo wants to restrict data room access to serious bidders and plans to press the issue this week with the court official organizing the auction, one of the people said. A Citgo spokesperson and a representative for the court official declined to comment. Investment bank Evercore Group, which is overseeing the auction's marketing, did not respond to requests for comment. The U.S. Marshals Service on Wednesday notified the court it had received creditors' writs of attachments, which would allow the court to establish a final list of those who can cash proceeds from the auction. The judge set a March 28 deadline for any objections to the writs. Citgo is Venezuela's foreign crown jewel with three U.S. refineries, pipelines, oil storage terminals and a retail distribution network that spans nearly half of the United States. It earned $2 billion last year. About 30 parties signed confidentiality agreements and received preliminary marketing information and a Citgo financial model as part of the first bidding round, and 12 submitted indications of interest in January, the court official leading the process, Robert Pincus, has said. That first round drew some creditors in the Delaware court case who wanted to place credit bids, using the value of their claims against Venezuela as part of their offer for the shares. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/refiner-citgo-set-open-data-room-bidders-tied-court-auction-2024-03-27/

2024-03-27 19:52

Canadian dollar gains 0.1% against the greenback Trades in a range of 1.3677 to 1.3712 Price of U.S. oil settles 1% higher Canadian bond yields ease across the curve TORONTO, June 27 (Reuters) - The Canadian dollar edged higher against its U.S. counterpart on Thursday as oil prices rose, but the move was limited ahead of U.S. inflation data and a domestic GDP report. The loonie was trading 0.1% higher at 1.3690 to the U.S. dollar, or 73.05 U.S. cents, after moving in a range of 1.3677 to 1.3712. Investors awaited the release on Friday of the U.S. personal consumption expenditures price index, the Federal Reserve's preferred inflation gauge, as well as Canadian GDP data for April. Economists forecast Canada's economy expanding by 0.3%. The data is unlikely to derail further interest rate cuts from the Bank of Canada, said Aaron Hurd, senior portfolio manager in the currency group at State Street Global Advisors, adding that the BoC has been clear that "there is room for things to recover and still have steady disinflation." Earlier this month, the BoC became the first G7 central bank to ease policy, lowering its benchmark rate by 25 basis points to 4.75%. Investors see a roughly 40% chance of another cut in July. "The U.S. still has higher rates, stronger growth, a little bit of a safe haven bid," Hurd said. "The divergence with the Bank of Canada and the Fed ... I still think that risks us to break up to 1.40." The price of oil, one of Canada's major exports, rose as supply disruption risks from rising geopolitical tensions in the Middle East helped to counter demand fears. U.S. crude oil futures settled 1% higher at $81.74 a barrel. Canadian government bond yields eased across the curve, tracking moves in U.S. Treasuries. The 10-year was down 1.8 basis points at 3.472% after earlier touching its highest level since June 10 at 3.522%. Sign up here. https://www.reuters.com/markets/currencies/canadian-dollar-edges-higher-ahead-domestic-gdp-data-2024-06-27/