2024-03-26 01:00

LONDON, March 25 (Reuters) - Investors have purchased oil at the fastest rate for more than four years, amid optimism that Saudi Arabia and its OPEC+ allies will continue to restrict production while an improving economic outlook boosts consumption. Ukraine’s drone attacks on oil refineries and export terminals in Russia, which threaten to disrupt production and exports of both crude and fuels, have turbocharged the shift in sentiment to more bullishness. Over the seven days ending on March 19, hedge funds and other money managers purchased the equivalent of 140 million barrels in the six most important futures and options contracts linked to petroleum prices. The buying was the fastest since December 2019, and among the ten fastest weeks since records began in 2013, according to position reports filed with exchanges and regulators. Chartbook: Oil and gas positions , opens new tab There were purchases almost across the board in NYMEX and ICE WTI (+57 million barrels), Brent (+55 million), European gas oil (+18 million) and U.S. gasoline (+10 million) but no change in U.S. diesel. In a sign of how bullish investors were becoming, most buying came from the creation of new long positions (+111 million barrels) with only a moderate amount of short covering (-30 million). The combined position across all six contracts had increased to 641 million barrels (61st percentile for all weeks since 2013), the highest for six months, and up from just 207 million (1st percentile) in the middle of December. Fund managers had become moderately bullish or at least neutral towards the entire petroleum complex for the first time in months. Inflation-adjusted crude oil prices were almost exactly in line with the long-term average since the start of the century. But many fund managers now expect production restraint and strong consumption will lift them into the upper half of the historic range in the next few months. U.S. NATURAL GAS In contrast to oil, portfolio investors remained bearish about U.S. gas, even though gas prices are close to their lowest level in real terms for more 30 years. Fund managers purchased the equivalent of 113 billion cubic feet (bcf) in the two major futures and options contracts linked to the price of gas at Henry Hub in Louisiana. Even so, the fund community still had a net short position of 449 bcf (20th percentile for all weeks since 2010) on March 19. Managers were more bearish about the outlook than a year ago, when they held a net long position of 75 bcf (35th percentile). Several major producers have already announced cuts to drilling and production that should eventually eliminate the excess inventories. El Nino conditions in the Pacific are also fading, which means winter 2024/25 is likely to be significantly colder than winter 2023/24. In the meantime, however, the run of mild weather has continued and the market is still struggling to bring inventories under control. Inventories had ballooned to 662 bcf (40% or +1.47 standard deviations) above the prior ten-year seasonal average on March 15, up from a surplus of just 64 bcf (2% or +0.24 standard deviations) on Oct. 1. Related columns: - Oil traders expect stocks to fall significantly after OPEC extends cuts (March 21, 2024) - Hedge fund optimism about diesel ebbs away (March 18, 2024) - Oil prices stall after funds complete short covering (March 11, 2024) - Oil prices rise as funds scale back bearish positions (March 4, 2024) John Kemp is a Reuters market analyst. The views expressed are his own. Follow his commentary on X https://twitter.com/JKempEnergy , opens new tab Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/oil-market-saw-frenzy-hedge-fund-buying-2024-03-25/

2024-03-26 00:07

March 25 (Reuters) - French President Emmanuel Macron said on Monday the government is seeking to designate new regulated gold mining zones in its South American territory of French Guiana to combat illegal mining and its environmental consequences. In an address from the territory ahead of a three-day trip to Brazil, Macron said France was considering drafting a plan within three months for areas with important gold reserves. Workers in these areas would be held to sustainable mining rules, Macron said, including an existing ban on mercury, a toxic metal small-scale and illegal miners use in extraction which leaks into rivers, oceans, forests and spreads to human populations. Illegal miners in the territory release around 1.3 kg of mercury for each kilogram (2.2 lb) of gold extracted, World Wide Fund for Nature (WWF) data showed. The program would bar illegal miners, many from neighboring countries, from entering these areas and limit their activities motivated by rising gold prices, Macron added. Gold, a safe-haven asset which tends to rise in times of geopolitical risk, has added over 10% in value from a year ago, nearing $70 per gram. Last year, Macron said an estimated five metric tons of gold had been extracted from the territory, most illegally, and 35 kg (0.04 tons) were seized by authorities. Macron said seized gold would now be sold to return funds to the territory, notably through projects linked to remedying the impacts of illegal mining. Macron said he is also looking to boost cooperation with Suriname and Brazil on breaking up illegal supply chains and improving military coordination, with the goal of finalizing a strategy by the 2025 United Nations Climate Change Conference. Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here. https://www.reuters.com/business/environment/frances-macron-looks-regulate-illegal-gold-mining-french-guiana-2024-03-26/

2024-03-26 00:04

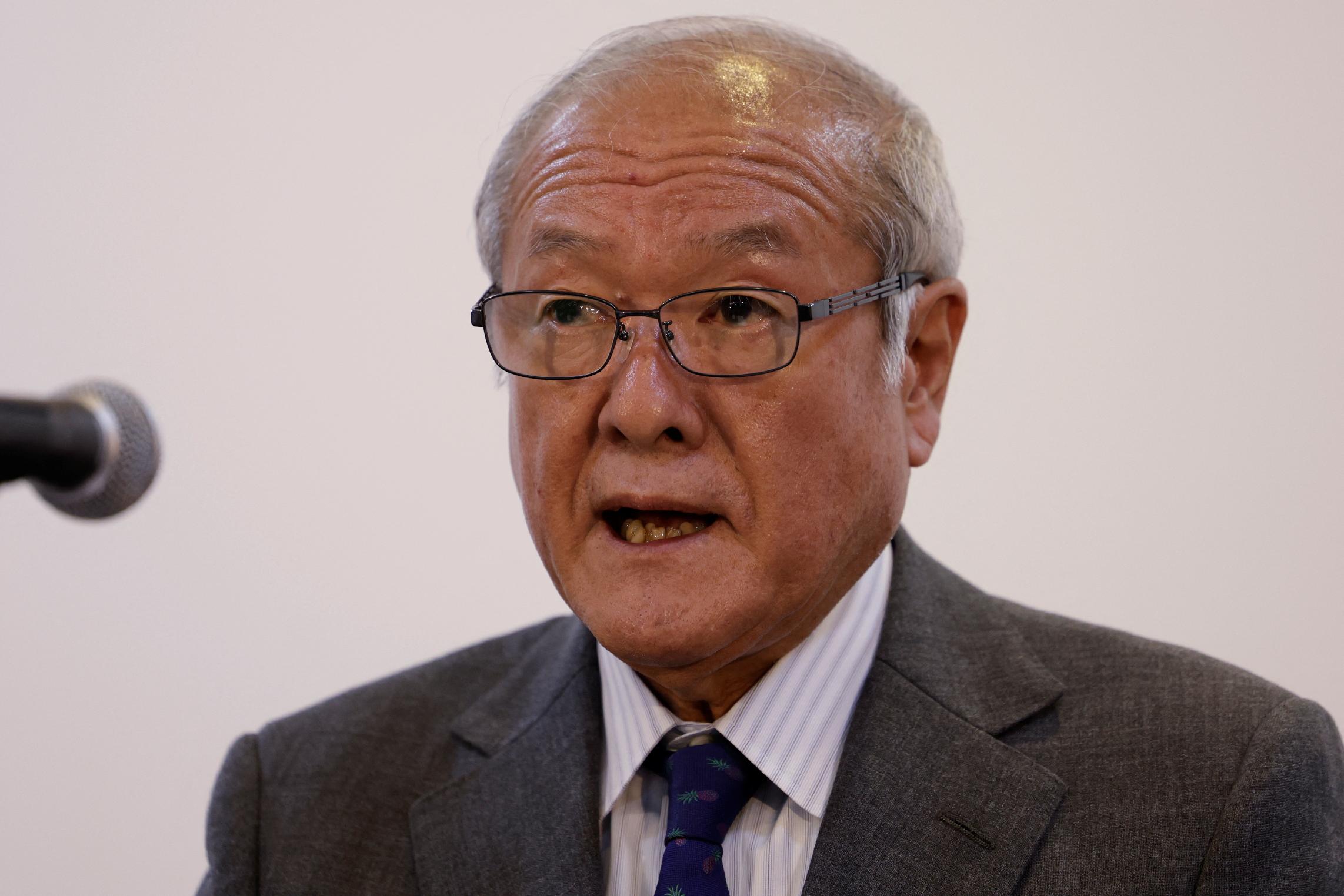

Persistent yen weakness stokes intervention worry Tokyo fires warning shot as dlr/yen nears danger zone Interest rate differentials remain stark, hurting yen Analysts see no return of strong yen for the time being TOKYO, March 26 (Reuters) - Japan would not rule out any measures to rein in weakness in the yen, finance minister Shunichi Suzuki said in the latest warning against speculators as the nation navigates a delicate period after last week's historic shift away from years of easy policy. Echoing concerns from Japan's top currency diplomat the previous day, Suzuki said on Tuesday that a weak yen has positive and negative effects on the economy but excess volatility raises uncertainty for business operations. This in turn could hurt the economy, the minister said, reinforcing Tokyo's focus on the velocity of market moves, rather than on specific currency levels. "Rapid currency moves are undesirable," Suzuki told reporters after a cabinet meeting. "It is important for currencies to move stably, reflecting economic fundamentals." The yen's sell-off picked up pace in the wake of last week's landmark decision by the Bank of Japan to end eight years of negative interest rates, ushering in a new era of tighter monetary policy in a nation where cheap money had been the norm for decades. The first rate hike in Japan since 2017, however, was well telegraphed to markets, triggering a slide in the yen in a classic 'sell-the-fact' trade. Crucially, yen bears have been emboldened by market expectations that the BOJ will raise rates only marginally in coming months, meaning Japanese-U.S. rate differentials will remain stark for a while longer. A weak yen boosts Japanese exporters' profits, but it also raises the costs of imports and squeezes households' wealth. Policymakers are particularly sensitive to factors threatening consumption as that would undo years of trying to create a virtuous cycle of demand-led price and economic growth. The dollar was off slightly against the yen in Tuesday afternoon trade, fetching 151.26 and facing great resistance near the 152 level due to the threat of intervention from Japanese authorities. The greenback is up about 7% on the yen since the start of the year. "It wouldn't surprise me if authorities intervene in the currency market if it breaks past 152 yen," said Makoto Noji, chief market strategist at SMBC Nikko Securities in Japan. Suzuki declined to comment on the possibility of Tokyo intervening to stem the yen weakness, but suggested the speed of the currency's fluctuations will be a factor in any decision to enter the market. "If I answer the question about currency intervention, it could have unintended effects on the market," Suzuki said, adding "if there's excessive moves, we will respond appropriately without ruling out any measures." Japan last intervened in the currency market in September and October 2022 to stem the yen's declines, initially when the dollar hit around 145 to the yen, and later in October when the U.S. currency surged to a 32-year high near 152 levels. "Behind the yen weakening lies not only speculators but also retail investors who have appetite for foreign stock markets," SMBC Nikko Securities' Noji said. "The government must be careful not to disturb such investment flows too much. That said, authorities may have no choice but to arrest the dollar's ascent towards 160 yen." Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/japan-finance-minister-says-he-wont-rule-out-any-steps-stem-weak-yen-2024-03-26/

2024-03-25 23:59

SYDNEY, March 26 (Reuters) - Australia's housing shortage may be driving prices higher but is locking out first-time homeowners and migrants needed to fill skills shortages across the country, the CEOs of Australia's three largest banks said on Tuesday. After years of ultra-low interest rates pushed home prices higher, Australia faces a long-term drop in the number of younger people buying homes, which could mean more people retiring in weaker financial positions, according to a 2023 government report. At a banking conference in Sydney, the heads of Commonwealth Bank (CBA.AX) , opens new tab, National Australia Bank (NAB.AX) , opens new tab and Westpac (WBC.AX) , opens new tab, Australia's top 3 lenders, blamed a housing supply shortage and urged local governments to speed up planning approvals. "For the younger cohort, I think it's really a significant problem," CBA CEO Matt Comyn told the AFR Banking Summit, when asked about a housing market with some of the worst affordability in the world by a measure of debt to income. Westpac CEO Peter King said that prices will go up when you have a supply-constrained market, but that the current home prices "from a societal perspective, it's too expensive". He, however, added he was "positive on the housing market" citing "the fundamentals of 'we need more houses developed'". NAB CEO Ross McEwan told the event the country needed migrants but "we've got to get the impediments out and get the tradies (tradespeople) in and get building". Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/westpac-ceo-says-he-is-positive-australias-housing-market-2024-03-25/

2024-03-25 23:03

March 25 (Reuters) - Adam Neumann has submitted a bid of more than $500 million to buy back WeWork, the office-sharing company he co-founded and propelled to a $47 billion valuation before it fell into bankruptcy, a person familiar with the matter told Reuters. It's not clear how Neumann is planning to line up financing for his bid, the source said, requesting anonymity as the discussions were confidential. Neumann raised WeWork to be the most valuable U.S. startup, worth $47 billion, before his pursuit of expansion at the expense of profit and revelations about his eccentric behavior led to his ouster in 2019 and derailed what would have been a major initial public offering. Last month, Reuters reported founder Neumann was trying to buy back the SoftBank-backed flexible workspace provider, which had filed for bankruptcy in November. "WeWork is an extraordinary company and it's no surprise we receive expressions of interest from third parties on a regular basis," WeWork said in a statement. "Our board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company," it added. WeWork said it remains focused on its restructuring efforts to "emerge from Chapter 11 in the second quarter as a financially strong and profitable company". Last month, Neumann's lawyers sent a letter to WeWork, saying he was exploring a joint bid for the company with Daniel Loeb's hedge fund Third Point and other investors. Third Point later told Reuters it had held "only preliminary conversations" with Neumann and his property company Flow and had not made any financial commitments. WeWork scrapped its IPO in 2019 after investors raised questions about its valuation and corporate governance arrangements that gave Neumann too much control. The company racked up losses on its long-term lease obligations as more people began working from home during the COVID-19 pandemic and demand for office space plunged. The Wall Street Journal first reported on Neumann's bid earlier on Monday. Get U.S. personal finance tips and insight straight to your inbox with the Reuters On the Money newsletter. Sign up here. https://www.reuters.com/markets/deals/adam-neumann-submits-over-500-mln-bid-buy-back-wework-wsj-reports-2024-03-25/

2024-03-25 22:16

CHICAGO, March 25 (Reuters) - Samples of milk collected from sick cattle in Kansas and Texas tested positive for avian flu, but the nation's milk supply is safe, the U.S. Department of Agriculture said on Monday. The detections in milk and a dairy cow show the wide reach of the virus, known as bird flu, which has been found in poultry flocks and mammals around the world. The USDA, along with the FDA and CDC, are investigating dairy cows in Kansas, Texas and New Mexico with symptoms including decreased milk production and low appetite, the USDA said. So far, "unpasteurized, clinical samples of milk" collected from two dairy farms in Kansas and one in Texas tested positive for highly pathogenic avian flu, the government said. A cattle swab test from another dairy in Texas also was positive. Based on findings from Texas, wild birds, which spread the virus globally, appear to have introduced the virus to cattle, the USDA said. Testing indicates the risk of human infection is low, according to the agency. The government said milk from sick cows is being diverted or destroyed so it does not enter the food supply. Pasteurization is required for milk entering interstate commerce, a process that kills bacteria and viruses such as flu, the USDA said. "At this stage, there is no concern about the safety of the commercial milk supply or that this circumstance poses a risk to consumer health," the agency said. It added there should be no impact on prices for milk or other dairy products. U.S. dairy industry groups urged importers not to ban or restrict shipments of U.S. dairy products because of the detections. Importers have limited purchases of U.S. poultry since the nation's worst-ever outbreak of the disease began in chicken and turkey flocks in 2022. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/us-detects-avian-flu-milk-says-dairy-supplies-are-safe-2024-03-25/