2024-03-21 23:25

HOUSTON, March 21 (Reuters) - Exxon Mobil (XOM.N) , opens new tab is ahead of schedule with its plan to double the size of its liquefied natural gas (LNG) portfolio to 40 million tons per annum (mtpa) by 2030 and will focus on selling its own gas rather than trading that of third parties, the company's LNG chief said on Thursday. Exxon is revamping its LNG trading strategy amid growing production of the fuel and as part of a wider corporate reorganization that began in 2022. The oil major is relatively small in LNG trading compared to TotalEnergies (TTEF.PA) , opens new tab and Shell PLC (SHEL.L) , opens new tab. Shell is one of the industry leaders and made $2.4 billion from trading LNG in the fourth quarter 2023. Unlike Shell and Total, Exxon plans to mainly trade its own gas, said Peter Clarke, Exxon senior vice president for global LNG. "Our portfolio is never going to look like Shell's, it's not going to look like Total's, we are targeting different aspects of the value chain," he told Reuters in an interview. Exxon said in 2020 it planned to double its LNG portfolio to 40 mtpa by decade-year, from 20 mtpa. It is now producing just short of 30 mtpa, he said. "We are well on track to achieve the objective we set ourselves back in 2020," Clarke said. "And we are slightly ahead of that." While Exxon could widen its trading portfolio by purchasing and marketing LNG from third parties, Clarke said, it considers margins in that business are small compared to the profits it can make on its own natural gas. For Exxon, there is more value in producing, liquefying and selling gas, he said. Long-term contracts still account for about 80% of the global LNG trade, he said. "The big component in LNG is obviously the commercialization of the LNG itself," Clarke said. "We want to have the leading LNG portfolio in the world in terms of its financial robustness and financial returns. I would say we're well on the way to doing it." Exxon's volumes will increase through the Golden Pass LNG project, where it has a 30% stake with QatarEnergies as a partner. That project has an estimated export capacity of around 18 mtpa and will produce its first LNG in 2025. The company said in a December presentation it expected to make a final investment decision for its PNG Papua LNG project in Papua New Guinea this year and begin engineering and design for a Mozambique project by year end. Clarke said the projects would help Exxon supply clients in Asia, where the company sees the most potential growth. "The market is expanding. And by 2050, 75% of global energy demand will be in Asia Pacific, so we are really focused in that area." The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/ceraweek-exxon-ahead-schedule-doubling-lng-portfolio-exec-says-2024-03-21/

2024-03-21 23:12

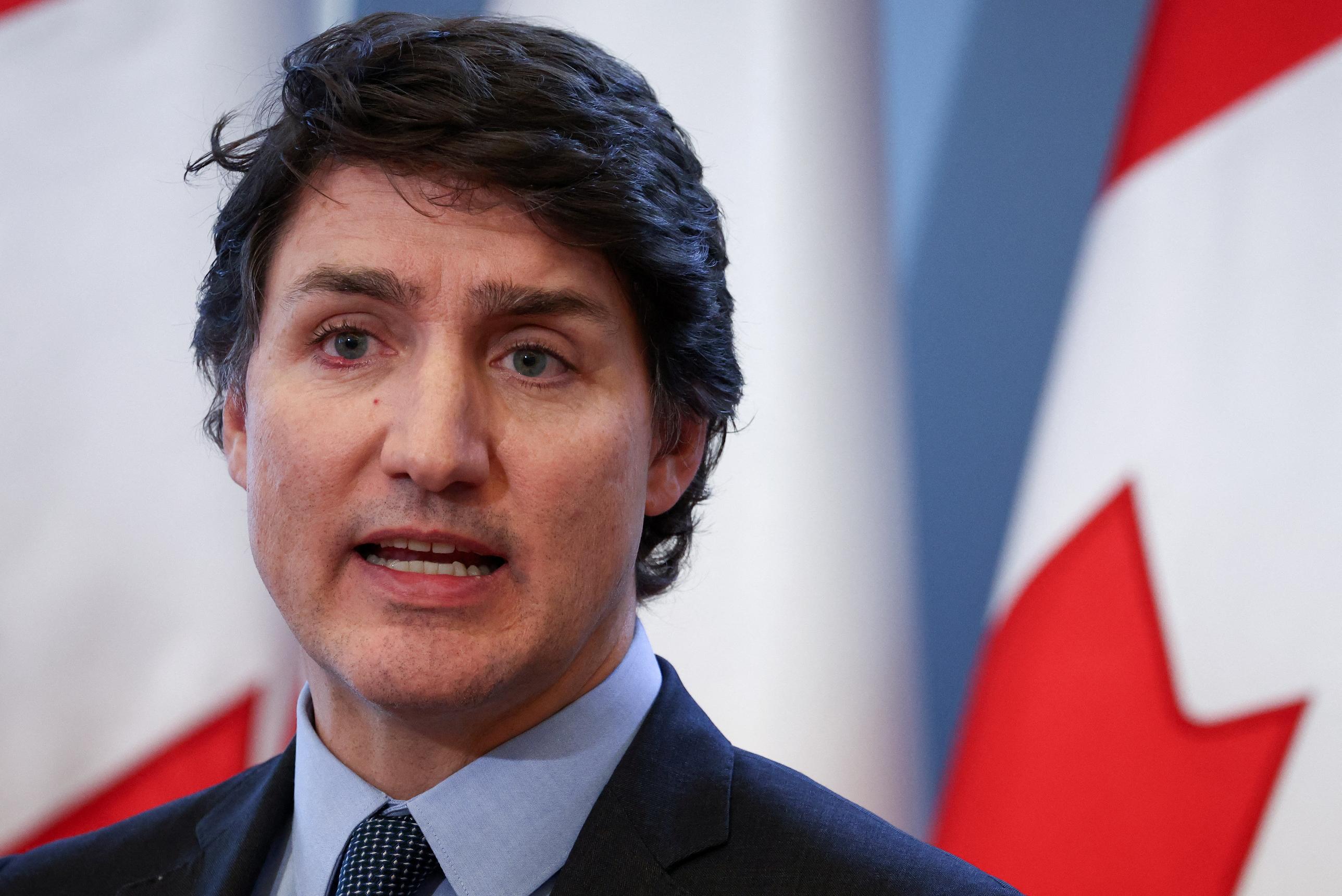

OTTAWA, March 21 (Reuters) - Prime Minister Justin Trudeau's Liberal government on Thursday survived a no-confidence motion brought by the opposition Conservative Party over Canada's carbon tax, which looks set to be a major issue in an election likely to be held next year. Legislators voted 204-116 to defeat the motion introduced by Conservative leader Pierre Poilievre, who says the tax imposes too great a cost on Canadians. Canada is aiming to cut emissions 40-45% below 2005 levels by 2030 and a steadily rising carbon price is a key part of the Liberals' climate plan. It is due to increase again on April 1 to C$80 ($59.13) a ton from C$65 a ton currently. Trudeau's signature climate policy was introduced in 2019, but it has been opposed by most Canadian provinces. Last year, the government offered a three-year carbon tax exemption for home heating oil and higher carbon tax rebates for people in rural areas, to bring relief amid soaring costs of living. The next federal election must be held by October 2025 and recent surveys of public opinion show the Conservatives will easily defeat the Liberals, who have been in office since November 2015. "Justin Trudeau has created the worst economic conditions since the great depression and Canadians have lost faith in his government," the Conservative party said in a statement. "Only Common Sense Conservatives will axe the tax and bring home lower prices for everyone," it added. The Liberals only have a minority of seats in the House of Commons elected chamber and rely on support from the smaller left-leaning New Democrats, who voted to back the government. The tax on fossil fuels is intended to accelerate a switch to clean energy. The government last month announced a new branding strategy to underscore that the policy means most people receive quarterly rebates. "Pierre Poilievre and his Conservatives just tried to cut hundreds of dollars from Canadian families and roll back Canada’s climate plan. We stopped them," the Liberal Party said in a tweet. ($1 = 1.3529 Canadian dollars) The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/americas/trudeau-government-survives-no-confidence-vote-over-canada-carbon-tax-rise-2024-03-21/

2024-03-21 22:54

Micron Technology surges after upbeat Q3 rev forecast Apple falls as DOJ sues company over antitrust laws Dow gets closer to 40,000 level Indexes up: Dow 0.68%, S&P 0.32%, Nasdaq 0.20% March 21 (Reuters) - Wall Street's three major stock indexes on Thursday registered record closing highs for the second day in a row after the Federal Reserve reassured investors about the prospects for rate cuts this year while chip stocks rallied after Micron Technology's upbeat forecast. The three major indexes had also hit fresh intra-day record highs earlier on Thursday and the Dow ended the day less than 1% away from the 40,000 for the first time. Shares in Micron Technology (MU.O) , opens new tab finished up more than 14% after hitting an all-time high following a surprise quarterly profit and its forecast of third-quarter revenue above estimates. Broadcom (AVGO.O) , opens new tab shares ended up 5.6% after TD Cowen upgraded its rating of the stock to "outperform". Shares in Nvidia (NVDA.O) , opens new tab were also a big boost as it added more than 1%while the Philadelphia Semiconductor index (.SOX) , opens new tab rallied 2.3%. U.S. stock indexes had also boasted record closing levels on Wednesday after U.S. central bankers kept borrowing costs unchanged and indicated they still expect to ease interest rates by three-quarters of a percentage point by the end of 2024. "Earnings results are keeping semiconductors as market leaders but more broadly a risk on mode has stemmed from the dovish Fed on Wednesday," said Matthew Miskin, Co-Chief Investment Strategist at John Hancock Investment Management. Fed Chair Jerome Powell said told reporters after the Fed's policy meeting on Wednesday that inflation reports "haven't really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road to 2%." But John Hancock's Miskin questioned whether the Fed is being overly optimistic about inflation and rate cuts. "They're opening to door to let inflation risk seep back into the market. It's not there yet but it's a risk that could come later this year," he said. In the meantime, however, economic data released earlier on Thursday added to investors' bullish moods. The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, while sales of previously owned homes increased by the most in a year in February, signs the economy remained on solid footing in the first quarter. "This economy continues to defy expectations and markets are loving every minute of it," said Miskin. The Dow Jones Industrial Average (.DJI) , opens new tab rose 269.24 points, or 0.68% , to 39,781.37, the S&P 500 (.SPX) , opens new tab gained 16.91 points, or 0.32%, to 5,241.53 and the Nasdaq Composite (.IXIC) , opens new tab gained 32.43 points, or 0.20%, to 16,401.84. Nine of the 11 major S&P 500 industry sectors were higher, with industrials (.SPLRCI) , opens new tab leading gains and finishing up 1%. The weakest sector was utilities (.SPLRCU) , opens new tab, which ended down 0.2%, followed by a 0.17% drop in communications services (.SPLRCL) , opens new tab, which saw its biggest drag from Alphabet (GOOGL.O) , opens new tab, down 0.8%. Goldman Sachs (GS.N) , opens new tab closed up 4.4%, leading gains in the Dow and in the rate sensitive bank sector. The S&P 500 bank sector (.SPXBK) , opens new tab added 1.7%. Apple (AAPL.O) , opens new tab bucked the market trend by closing down 4.1% after the U.S. Department of Justice sued the iPhone maker, the first major antitrust effort against the company by the Biden administration, alleging it monopolized smartphone markets. Shares in IT services provider Accenture tumbled 9% after it cut its fiscal-year 2024 revenue forecast, with economic uncertainty prompting its clients to cut consulting services spending. Reddit shares closed at $50.44 after it started trading on the New York Stock Exchange for the first time with at $47, which was 38% above its $34 initial public offer price. Advancing issues outnumbered decliners by a 2.34-to-1 ratio on the NYSE which showed 918 new highs and 56 new lows. On the Nasdaq Composite, 1,776 stocks rose and 1,400 fell as advancing issues outnumbered decliners by a 1.27-to-1 ratio. The S&P 500 posted 116 new 52-week highs and one new low while the Nasdaq recorded 365 new highs and 59 new lows. On U.S. exchanges 11.43 billion shares changed hands compared with the 12.39 billion moving average for the last 20 sessions. (This story has been corrected to say that nine sectors rose, not 10, and that utilities was the weakest sector, not communications services, in paragraph 14) Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/futures-gain-fed-sticks-rate-cut-projections-micron-rally-lifts-chipmakers-2024-03-21/

2024-03-21 22:42

WASHINGTON, March 21 (Reuters) - U.S. Treasury Secretary Janet Yellen said on Thursday she would welcome legislation that would rectify the conflict between federal and state laws on the sale and use of marijuana that is preventing cannabis firms from accessing the banking system. Asked at a U.S. House of Representatives Appropriations subcommittee hearing about the issue, which forces cannabis businesses to hold large amounts of cash, Yellen said: "I think it's a real problem and it would be desirable to have legislation that alleviated this problem." Republican Representative David Joyce said he had raised the same issue with former Treasury Secretary Steven Mnuchin five years ago and little has changed since then. Some 38 states have approved marijuana for medical use and 24 have approved its recreational use, but cannabis sales remain illegal at the national level. Most banks, concerned about running afoul of anti-money laundering laws, have shunned the business, forcing cannabis companies to deal in cash, which creates security risks for employees and hampers financing. Yellen also has previously said the issue is an impediment to collecting taxes from cannabis firms. "I think we would potentially welcome legislation in this area that would clarify for banks what their responsibilities are," Yellen said in response to Joyce's question about her position. "The fact that marijuana is outlawed by the federal government creates an impediment to (banks') willingness to provide banking services, services to cannabis firms, and it creates all the problems that you're familiar with," she said. Yellen did not specify provisions that she considered crucial for such legislation nor comment on a measure passed last year by the U.S. Senate Banking Committee that aims to expand the industry's access to traditional banking services. "I think legislation may be necessary to raise the comfort level that banks have in doing this business," she said. Democratic Representative Steny Hoyer said he would assist Yellen and Republican colleagues in passing such legislation because the current situation was putting businesses and employees at risk. "I am neither a user nor a suggester of using. The fact of the matter is every state that voted on it has made it legal. Every state," Hoyer said. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/yellen-would-welcome-us-legislation-aid-cannabis-banking-access-2024-03-21/

2024-03-21 22:27

HOUSTON, March 21 (Reuters) - Brazil is exploring ways to import natural gas from Argentina's massive Vaca Muerta formation, including the possible reversal of a pipeline now used for transporting Bolivian gas, as it looks to ease its gas deficit, Mines and Energy Minister Alexandre Silveira told Reuters on Thursday. Brazil has become Latin America's largest crude oil producer, but its gas output is insufficient to meet growing domestic demand, leading to increased imports of liquefied natural gas (LNG). Brazil historically relied on Bolivian gas, but the Andean country's dwindling output forced a supply contract renegotiation late last year to extend the timeframe for completing deliveries to state-controlled oil company Petrobras (PETR4.SA) , opens new tab, the company said. Dwindling Bolivian supplies have Argentina planning to cease imports through a gas line connecting the two countries later this year once a domestic pipeline is ready to bring gas to the country's north from the Vaca Muerta shale play, a formation that rivals the U.S. Permian basin. Brazil is encouraging Bolivia and Argentina to reverse the gas line flow so Vaca Muerta's gas can reach the region's North, a low-cost option that could better use the existing infrastructure. "That gas would be very important for them (Bolivia), for its energy security," said Silveira in an interview with Reuters on the sidelines of the CERAWeek conference, as it would help the Andean country offset declining reserves. Brazil also is looking at gas transportation alternatives involving Uruguay and Paraguay, while encouraging more domestic onshore gas production, Silveira said. As output from its prolific presalt region is set to plateau in the coming years, Brazil is looking at new frontiers for oil production, including the environmentally sensitive Equatorial Margin. "Brazil could be losing an opportunity" if it does not drill there, Silveira said. Petrobras' plans have been slowed due to the lack of environmental permits. Minister Silveira also is readying participation in the next OPEC+ meeting in June after the country last year announced it would join the group in January as an observer. Silveira plans to discuss energy transition during the meeting, he said, as Brazil tries to lead initiatives on tighter regulation of the transition and a global alliance for biofuels. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/ceraweek-brazil-exploring-ways-import-gas-argentinas-vaca-muerta-play-energy-2024-03-21/

2024-03-21 22:08

Stock ends trading at $50.44 per share IPO priced at top end of range March 21 (Reuters) - Social media platform Reddit's (RDDT.N) , opens new tab shares ended their first day of trading in New York up 48%, signaling that investor appetite for initial public offerings of promising yet loss-making companies could be returning. Reddit, which has not turned an annual profit since launching in 2005, lured investors by positioning its content as training grounds for artificial intelligence (AI) programs. Reuters reported last month that Reddit struck a data licensing deal with Google worth about $60 million a year. While Reddit still relies on advertising for the vast majority of its revenue, it touted AI in its IPO marketing roadshow as an area of growth. It also disclosed last week that the U.S. Federal Trade Commission is looking into its AI data licensing deals. "At the core we are a growth company. Achieving our mission means that we want to grow users and community," said Jen Wong, Chief Operations Officer at Reddit. Shares of the San Francisco-based company opened at $47 on the New York Stock Exchange on Thursday after pricing at $34 in the IPO, the top of the company's indicated price range. They ended trading at $50.44. The IPO valued Reddit at $6.4 billion, and the company and its selling shareholders raised $748 million. Reddit was valued at $10 billion in a private fundraising round in 2021, and the strong stock market reception indicated that the company may not have needed to curb its valuation expectations so much to get the IPO off the ground. Reddit's entry into public markets has been a long time coming. It confidentially filed for an IPO in December 2021, but a stock rout caused by Russia's war in Ukraine and the Federal Reserve's hiking of interest rates froze much of the IPO market and pushed it to delay. Josh White, assistant professor of finance at Vanderbilt University, said Reddit's IPO showed investors were willing to ignore the company's losses because of its potential growth - a trend not seen for at least three years. "We don't get many large tech IPOs. Those tend to be very popular because it's hard to buy that kind of growth," White said. RISKY RETAIL ALLOCATION Reddit's popularity rose to new heights during the "meme-stock" saga of 2021 in which a group of retail investors collaborated on its forum "wallstreetbets" to buy shares of highly shorted companies like GameStop (GME.N) , opens new tab. As part of its plan to reward users, Reddit has reserved 8% of the shares on offer for eligible users and moderators, certain board members, as well as friends and family members of employees and directors. It also offered some shares to retail investors through online brokerage platforms Robinhood (HOOD.O) , opens new tab, SoFi (SOFI.O) , opens new tab Morgan Stanley Wealth Management and Fidelity Brokerage Services. But the move is fraught with risks, analysts have said. Typically shut out of bidding in an IPO, retail traders eager to gain exposure to a newly-listed company buy shares only when they start trading. Allowing early access to the IPO could dampen some demand. Such buyers are also not under a lock-up period and could choose to sell when the stock starts trading, potentially increasing the price volatility. "I don't know one company which really benefits from allocating shares to their users," said Alan Vaksman, founding partner at investment firm Launchbay Capital. Stocktwits.com, the social media firm that analyses posts and message volumes on its platform related to a company's ticker symbol, showed retail sentiment for Reddit was "extremely bullish." But the discussion on Reddit's "wallstreetbets" forum was more mixed, with some users saying they would short the stock after it starts trading. CULTURAL PHENOMENON After its launch in 2005, Reddit became one of the cornerstones of social media culture. Its iconic logo - featuring an alien with an orange background - is one of the most recognized symbols on the internet. Its 100,000 online forums, dubbed "subreddits," allow conversations on topics ranging from "the sublime to the ridiculous, the trivial to the existential, the comic to the serious", according to co-founder and CEO Steve Huffman. Huffman himself turned to one of the subreddits for help to quit drinking, he wrote in his letter. Former U.S. President Barack Obama also did an "AMA" ("ask me anything"), internet lingo for an interview, with the site's users in 2012. But despite its cult-like status in the social media world, the company has failed to replicate the success of its bigger rivals Meta Platforms' (META.O) , opens new tab Facebook and Elon Musk's X. "The real news is going to be after the first earnings call - where are they headed, what are the results looking like, what changes are they going to make," said Reena Aggarwal, director of the Georgetown University Psaros Center for Financial Markets and Policy. Get U.S. personal finance tips and insight straight to your inbox with the Reuters On the Money newsletter. Sign up here. https://www.reuters.com/markets/deals/reddit-set-hotly-anticipated-debut-after-pricing-ipo-top-range-2024-03-21/