2024-03-21 12:52

LONDON, March 21 (Reuters) - Britain's economy is "moving in the right direction" for the Bank of England to start cutting interest rates, Governor Andrew Bailey said, as two of his colleagues dropped their vote a rate hike. The BoE's rate-setters voted 8-1 to keep borrowing costs at their 16-year high of 5.25% on Thursday, as the two officials who had previously called for higher rates changed their stance. Most economists polled by Reuters had expected one member of the Monetary Policy Committee to continue voting for an increase in Bank Rate. MARKET REACTION: FOREX: The pound fell against the euro and the dollar. It was last down 0.4% at $1.2734 versus $1.2749 earlier. BONDS: British government bond yields extended their fall, with rate-sensitive two-year yields down 10 bps at 4.12% compared to 4.14% just before the BoE statement. Interest-rate futures showed traders are pricing a roughly 70% chance the BoE will cut rates in June. STOCKS: UK stocks rallied, with the blue-chip FTSE 100 (.FTSE) , opens new tab hitting an intra-day high just after the BoE decision. It was last up 1.5% on the day. COMMENTS: RUTH GREGORY, DEPUTY CHIEF UK ECONOMIST AT CAPITAL ECONOMICS, LONDON: "Today’s communications suggest the MPC is gaining confidence that inflation will fall sustainably back to the 2.0% target. "That said, no-one joined Dhingra in voting for a 25-bp cut to 5.00%. And the MPC largely stuck to its hawkish guns in the policy statement, saying that key indicators of inflation persistence remain elevated and that policy will be “restrictive for sufficient long” and “restrictive for an extended period”. "We’re not sure this guidance tells us a great deal. It is the data that will decide when rates are cut." KALLUM PICKERING, SENIOR ECONOMIST, BERENBERG, LONDON: "Dovish hold: The BoE seems keen to validate market expectations for a summer interest rate cut and is emphasising that monetary policy will remain restrictive for some time, even as policymakers lower the bank rate due to the fact that the current bank rate of 5.25% is above the neutral rate - which is in the 3.5-4.0% range, in my view. "Policymakers are growing in confidence that they have mostly tamed inflation and now want to take steps to ease the monetary headwind on the economy – reaction function is shifting from taming inflation to supporting growth." JESSICA HINDS, DIRECTOR IN FITCH RATINGS ECONOMICS TEAM: "The recent improvements in the inflation and wage data resulted in the last remaining hawks on the MPC capitulating today, with both Catherine Mann and Jonathan Haskel dropping their vote for a further increase in Bank Rate." "But Governor Bailey signalled that the Bank was not yet on the cusp of cutting interest rates. The minutes also suggested a wide range of views about inflation persistence among the eight members voting for a hold today, with particular concerns about services inflation. We think it will take until August for the majority to join Swati Dhingra in voting for a cut." ANDREW JONES, PORTFOLIO MANAGER, JANUS HENDERSON, LONDON: "With inflation for February coming in roughly in line with expectations (core CPI at 4.5% versus 4.6% consensus) yesterday, it is not a surprise to see interest rates being held flat by the MPC today. "As it seems very likely that inflation will continue to move downwards over the next few months, we would still expect to see interest rate cuts in the middle of the year." "UK domestic stocks are currently valued very modestly in relation to their history, but as recent trading news from companies such as Wickes, DFS, Marshalls and Travis Perkins has shown, demand is currently weak. It is likely though when interest rates are cut, that stocks which are mostly exposed to the UK economy could well start to attract more interest again." FIONA CINCOTTA, MARKET STRATEGIST, CITY INDEX, LONDON: "That what’s really caught my eye - the two hikes last meeting have turned more neutral and looking to keep rates on hold." "Overall that must make for a less hawkish position from the central bank. And you can see the ship is turning towards that rate cut and that is what the pound has grasped on to. It’s definitely a much more concrete feeling that the next move is going to be a cut and it’s going to be coming, potentially, sooner than we thought, especially now that we don’t have those two hawkish votes. "What might offer the pound a bit of support against the euro and the U.S. dollar, as we go towards the next meeting is the fact that inflation is still stickier in the UK and also the services sector is still holding up strongly, service-sector inflation at 6.1% is still very sticky." COLIN ASHER, SENIOR ECONOMIST, MIZUHO BANK, LONDON: "The meeting unfolded more or less as expected. The shift in the vote is dovish but its not especially dovish, as in a cutting cycle its the doves rather than the hawks that drive things. The rest of the committee don't need Mann and Haskel to lower rates. "There don’t seem to be many cracks in the centre as yet – there were plenty of references to inflation persistence (and today’s PMI data don’t help on this front). "May seems to be off the table for rate cuts unless something bad happens. June is possible but we still see August as most likely at this point." SUSANNAH STREETER, HEAD OF MONEY AND MARKETS, HARGREAVES LANSDOWN, LONDON: "The Bank of England has adopted the same stance as the Fed yesterday and the ECB ... indicating that inflation is following the right path, but it’s still wary about the potential for prices to bubble up again. "Input costs are continuing to climb due to wage pressures and higher shipping fees, so companies are pushing up prices. So, it’s not surprising that caution remains the name of the game for the Bank. "Continued stubbornness in wage growth could tip a decision by the Bank of England towards August instead (of June), when a fuller monetary policy report is published." PHILIP SHAW, CHIEF ECONOMIST, INVESTEC, LONDON: "The decision to hold rates itself and the arguments which committee members are putting forward are no surprise. "If the shift in the dynamics on the committees is representative of the MPC (Monetary Policy Committee) as a whole, then we maintain our current view that the Bank of England will begin to cut rates in June." The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/markets/rates-bonds/view-bank-england-interest-rate-decision-2024-03-21/

2024-03-21 12:12

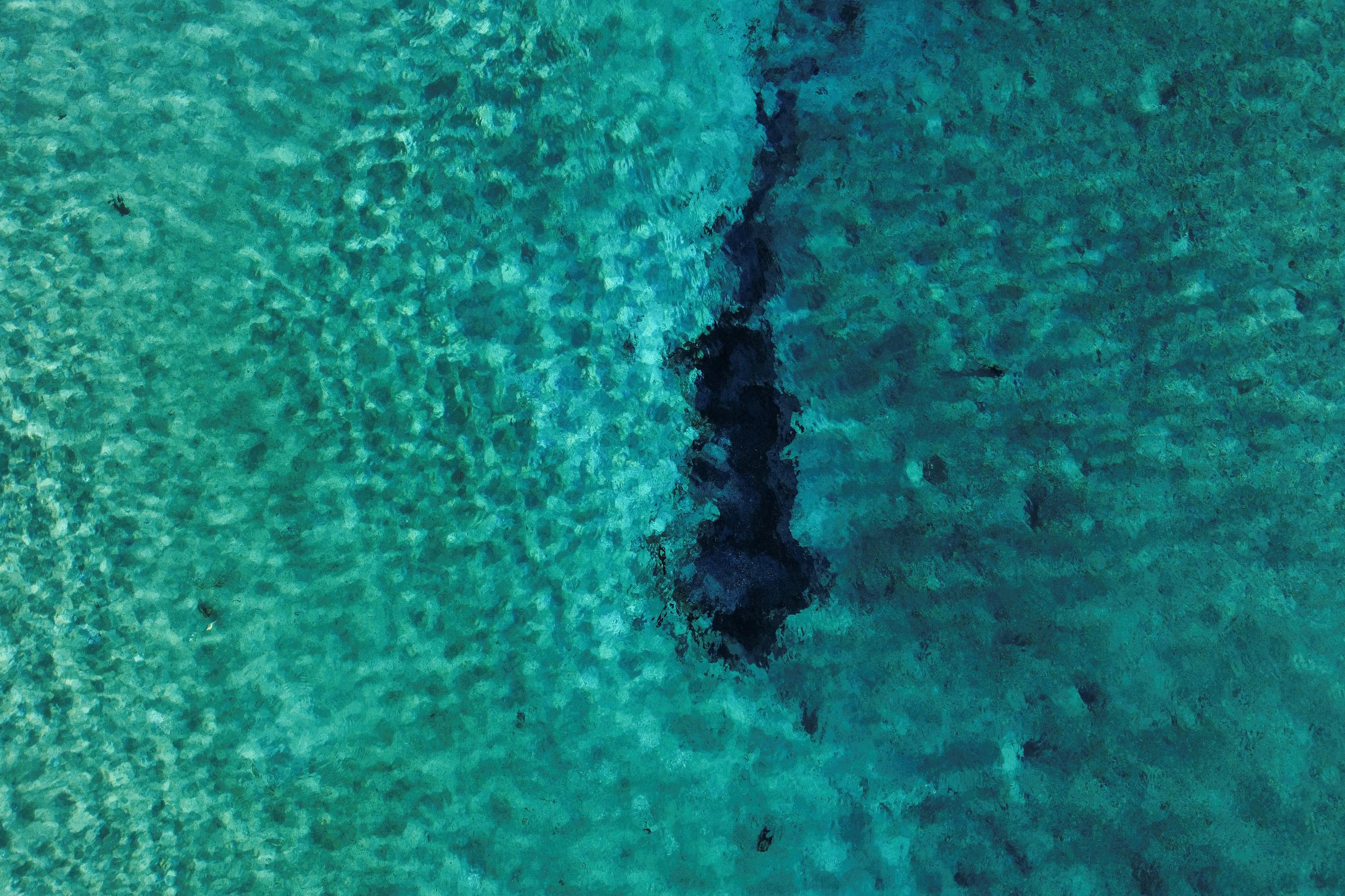

CUATRO CIENEGAS, Mexico, March 21 (Reuters) - Alfalfa plants sway under a thin veil of mist as towering irrigation equipment rolls above the crops, spraying the vast fields with water. It's an important agriculture product in Mexico's northern state of Coahuila, grown there for hundreds of years. Rich in fiber and protein, it's used to feed livestock in Latin America's second largest economy. But alfalfa crops and other agricultural activities are also sapping dry the ancient oasis of Cuatro Cienegas, the most important wetland in the Chihuahuan Desert and a geological anomaly that scientists say can help them understand the origin of Earth, climate change and the chances of life on Mars. The 170 cactus-ringed pools contain important species of fish, snails, turtles, bacteria and unique living rock structures that offer important clues to life on Earth millions of years ago. But since 1985, about 40% of surface pools and lagoons have been lost, the Mexican Institute of Water Technology estimated in a 2023 report. Water extractions from these bodies has increased at least 400% in 25 years, which the institute said is primarily due to an uptick in water concessions and water-reliant crops like alfalfa. Scientists warn that the area could suffer catastrophic damage without a recovery plan. Dairy farming in Mexico's main milk-producing region - the nearby city of Torreon - has since the beginning of the 20th century heavily relied on Cuatro Cienegas for water to feed wells used for as much as 6,000 hectares (14,825 acres) of fodder crops each year, according to the Mexican Institute of Water Technology. Ranches and crops run by large companies have diverted much of the supply, according to small-scale farmers like Mario Lopez, who has watched his own water access dwindle since he started growing alfalfa, corn and beans in 2008. "We all have the right (to water) but for the small landowners, the pace has slowed down over the years," said Lopez. "When I started here, there was plenty of water, and now there isn't." Lopez said his crops have scaled down to about six hectares due to the lack of water. "Cuatro Cienegas is at risk of disappearing," said Valeria Souza, a researcher at the Institute of Ecology at Mexico's National Autonomous University who focuses on sustainable agriculture models for desert settings. "It has survived two global freezes and five global extinctions, but it hasn't survived us 50 years," Souza said, adding that Cuatro Cienegas' unique characteristics reveal an understanding of whether other planets like Mars could be home to primitive life. Arnulfo Ramirez, who lives in a nearby community, said he made a deal with a large dairy company to sell his land under the condition the company would ensure his water access - but recently the water has not come. Instead, the community has to bring it in by truck, only if and when there is gasoline to do so. "We bring water to bath, to wash the dishes, for the animals," Ramirez said. "It's an enormous expense." Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here. https://www.reuters.com/business/environment/water-is-disappearing-mexicos-vital-desert-oasis-cuatro-cienegas-2024-03-21/

2024-03-21 12:10

LONDON, March 21 (Reuters) - Aquis Exchange (AQX.L) , opens new tab said it aims to be among Europe's top share trading venues within five years, as it reported higher annual earnings on Thursday. Aquis CEO Alasdair Haynes said Cboe, Euronext, LSEG and Deutsche Boerse accounted for roughly 10% each of share trading in the region, and that Aquis aimed to reach a similar level in three to five year's time. Aquis, which has share trading operations in London and Paris, had a pan-European share of 4.97% in December, rising to 5.46% in February this year. "I think in the medium term that shows that we have every opportunity of getting to above 10% and becoming a top three player," Haynes told Reuters. The company, which became a listed exchange in 2018, reported net revenue of 22.7 million pounds ($28.98 million) in 2023, up 13% on the prior year, with profit before tax of 5.2 million pounds, up 15%. The Mansion House Compact, which involved a group of pension funds committing to invest up to 5% of their funds in UK growth companies by 2030, including those listed on Aquis, is "at this point in time rhetoric rather than something that is going to change things", Haynes said. Haynes said education was needed to show investors that stocks, riskier than bonds favoured by pension funds, were an attractive option for creating wealth and a better bet for retail investors than bitcoin. Government and regulators have begun addressing this. "The debate has started. I think they are doing an excellent job, but these are tankers, they don't change quickly," Haynes said. "There's a massive education here that equities need to be made sexy again, it's simply that." The government has set out draft rules for Pisces, a new trading platform that would allow private companies to offer shares and encourage a public listing later on. LSEG is planning to launch such a platform, but Haynes said he was not convinced that Pisces was the right answer. "I won't give anything away, but there are other mechanisms that can be used, but we are certainly looking at that," Haynes said. ($1 = 0.7834 pounds) The Technology Roundup newsletter brings the latest news and trends straight to your inbox. Sign up here. https://www.reuters.com/technology/aquis-exchange-guns-10-european-share-trading-medium-term-2024-03-21/

2024-03-21 12:08

Surprise rate cut sends franc lower, boosts equities Lowered inflation forecast allow bank to cut rate Chairman gives no guidance on future moves Rate cut was first by SNB since 2015 ZURICH, March 21 (Reuters) - The Swiss National Bank cut its main interest rate by 25 basis points to 1.50% on Thursday, a surprise move which made it the first major central bank to dial back tighter monetary policy aimed at tackling inflation. The central bank, in the first rate decision since long-serving Chairman Thomas Jordan said he would step down in September, also cut its interest rate on sight deposits to 1.50%. The SNB's decision, its first rate cut in nine years, kicked off a busy day for central banks in Europe, with the Bank of England and Norwegian central bank also announcing their latest policy decisions. The Norges Bank kept its rates on hold and economists also expect no change from the Bank of England. The SNB move wrong-footed markets, sending the Swiss franc to an eight-month low against the euro and Swiss government bond yields , opens new tab tumbling, while boosting Zurich-listed shares. A majority of analysts polled by Reuters had expected the usually conservative SNB to keep rates on hold at 1.75% and wait at least another three months before moving. "SNB is the first central bank to declare victory over inflation," said Karsten Junius, chief economist at J.Safra Sarasin, who had expected a rate cut. The step follows a drop in Swiss inflation to 1.2% in February, the ninth month in succession that price rises have been within the SNB's 0-2% target range. "The easing of monetary policy has been made possible because the fight against inflation over the past two and a half years has been effective," Jordan told reporters, noting how Swiss inflation has held below 2% for several months. "According to our new forecast, inflation is also likely to remain in this range over the next few years." The SNB said it was taking into account the reduced inflationary pressure as well as the appreciation of the Swiss franc in real terms over the past year. The cut would support economic activity, it added. Before the decision, Swiss industry had urged the central bank to broaden its focus from fighting inflation to help them deal with the strong franc , opens new tab, which was eating into profits. Philipp Burckhardt, Fixed Income Strategist and Portfolio Manager at Lombard Odier IM, said Thursday's move was a logical consequence of current conditions and signalled more cuts ahead. "This is also an ideal farewell gift from Thomas Jordan, who can now clearly set the direction for his successor," he said. ECB, FED Asked what was it like for the SNB to go first with policy easing, Jordan said: "For us, it's not a question of whether we're the first or last, we make the decision at the moment when we're convinced that it's a good time to make that decision." He also rejected the notion the cut was a parting gift, and declined to be drawn into discussing whether there would be any further rate moves this year. "We give no forward guidance regarding our future interest rate decisions, but it's clear we will look at the inflation forecast in three months," he told a press conference. "If necessary, we will adjust monetary policy at that time." The European Central Bank is expected to make its first reduction in borrowing costs in June after it kept its interest rates on hold earlier this month. The U.S. Federal Reserve on Wednesday left its benchmark interest rate unchanged but retained its outlook for three cuts this year. Not all central banks are moving in the same direction. On Tuesday, the Bank of Japan ended eight years of negative interest rates with its first interest rate hike in 17 years and on Thursday central banks in Taiwan and Turkey surprised markets by raising rates, citing inflation concerns. Economists said the SNB's rate cut was a bold move given the central bank's usual caution. "The SNB's decision is a surprise, but was always a possibility because of the low inflation in Switzerland," said UBS economist Alessandro Bee. "It's a brave move to go before the ECB and Fed, although the SNB will not see it that way, and they probably believe the other central banks will also cut rates later this year." In its updated economic projections, the SNB dialled down its inflation forecasts, expecting it to average 1.4% in 2024, down from its December prediction for a rate of 1.9%. Inflation is expected to finish next year at 1.2%, down from 1.6% previously forecast. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/markets/rates-bonds/swiss-national-bank-surprises-with-interest-rate-cut-2024-03-21/

2024-03-21 12:06

March 21 (Reuters) - Borderless AI has raised $27 million in a funding round led by investment firm Susquehanna and Bernard Arnault's venture capital company, Aglaé Ventures, the artificial intelligence-powered human resource management platform said on Thursday. The fundraise underscores the frenzy that had helped the AI sector attract a major share of VC money last year in a largely subdued environment. AI-related startups attracted one out of every three dollars invested in the U.S. in 2023, according to data from PitchBook. The ease of operating technologies that can generate human-like responses to written prompts has also led to a surge in demand for AI applications. Toronto-based Borderless AI, which uses generative AI to automate onboarding and managing payments of team members, was founded by Willson Cross and Sean Aggarwal. Cross previously co-founded Canadian pet services platform GoFetch, while Aggarwal is the former chair and current lead independent director of the board at ride-sharing platform Lyft (LYFT.O) , opens new tab. The funds raised in the latest round will allow the company to expand into new markets and build upon its current AI product suite, CEO Cross said in an interview with Reuters. The company did not disclose its valuation after the fundraise. Borderless AI's model, called Alberni, can create employment contracts, analyze legal agreements and answer tax queries to help HR teams cut down costs and perform services quicker. Alberni is available in 170 languages and can solve complex problems and automate processes within 10 minutes, according to the company. "This isn't going to replace the people behind the HR function, but instead, the goal is to make their jobs easier, more seamless and more efficient," Cross added. The company's customers include dating and networking app Raya, global architecture firm MG2 and fintech startup Affiniti. The Technology Roundup newsletter brings the latest news and trends straight to your inbox. Sign up here. https://www.reuters.com/technology/borderless-ai-raises-27-mln-funding-backed-by-susquehanna-agla-ventures-2024-03-21/

2024-03-21 12:00

Lavrov: China and India will absorb any OPEC+ supply Lavrov: There is no shortage of buyers for Russian oil Russia says Saudi Arabia is pursuing its interests MOSCOW, March 21 (Reuters) - Russia said on Thursday that the United States was unlikely to agree to a Ukrainian proposal to lower the price cap on Russian oil to $30 a barrel because it would roil global energy markets and damage the U.S. economy. After Russia sent troops into Ukraine in 2022, the West sought to sink the Russian economy by imposing a myriad of sanctions and in 2022 slapped a $60 a barrel price cap on Russian oil , which is currently traded at around $68 per barrel. Before the cap was set, Ukrainian President Volodymyr Zelenskiy in November 2022 urged a limit between $30 and $40 per barrel. The $60 cap has so far been maintained despite fluctuations in the oil price and calls by some countries for a lower cap to further restrict Moscow's revenues. The United States has imposed sanctions on dozens of tankers suspected of carrying oil above the price cap agreed by G7, the EU and Australia. President Vladimir Putin says Russia's wartime economy -- which grew 3.6% last year -- has thrived despite the sanctions, and that Russia, the world's second largest oil exporter, has plenty of buyers for its oil. "The other day I read that Ukraine was trying to convince the United States to lower the cap price on Russian oil to $30 a barrel," Russian Foreign Minister Sergei Lavrov said in an interview published on the Foreign Ministry website. "This goes beyond all bounds." "It is significant that the United States is unlikely to go along with Ukraine," Lavrov said. He argued that such a lowering of the cap would have a serious impact on both the global oil market and on the U.S. economy. Russia has more than 5% of the world's proven oil reserves and about of quarter of the world's proven natural gas reserves while OPEC, led by Saudi Arabia, controls about 80% of the world's oil reserves, according to OPEC figures. SAUDI ARABIA Lavrov, Putin's foreign minister since 2004, said that the United States put immense pressure on the House of Saud in the 1980s to collapse the price of oil to weaken the Soviet Union. Asked about relations with Saudi Arabia, whose crown prince, Mohammed bin Salman, congratulated Putin on his election on and who has cooperated closely with Moscow as part of the OPEC+ group, Lavrov said Saudi had pursued its own policy. "I would not say that they have set a course away from the United States," Lavrov said. "They simply decided to pursue their national policy so that no one (from the left or the right, or from above or from below) should interfere with them, including, most of all, the United States." While Russia says it will never give in to the United States, which Putin casts as a declining empire fighting a proxy war with Russia in Ukraine, Russia's energy sector has faced serious challenges from the fallout of the war in Ukraine. Russia's Gazprom (GAZP.MM) , opens new tab has lost most of the European market - which Moscow spent about half a century slowly building after the Soviets forged gas pipelines westwards from Siberia in the early 1970s. Putin's bid to reorient Russia's vast energy exports eastwards faces massive hurdles - both the vast distances to Asian markets and the difficult negotiations with China about the price. "There will be no shortage of consumers. Take Africa - we have doubled the export of petroleum products there over the past year and a half," Lavrov said. He said China and India would be able to absorb oil supply from the OPEC+ group of leading oil producers. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/russia-says-ukraines-idea-30-oil-price-cap-beyond-all-bounds-2024-03-21/