2024-03-20 21:57

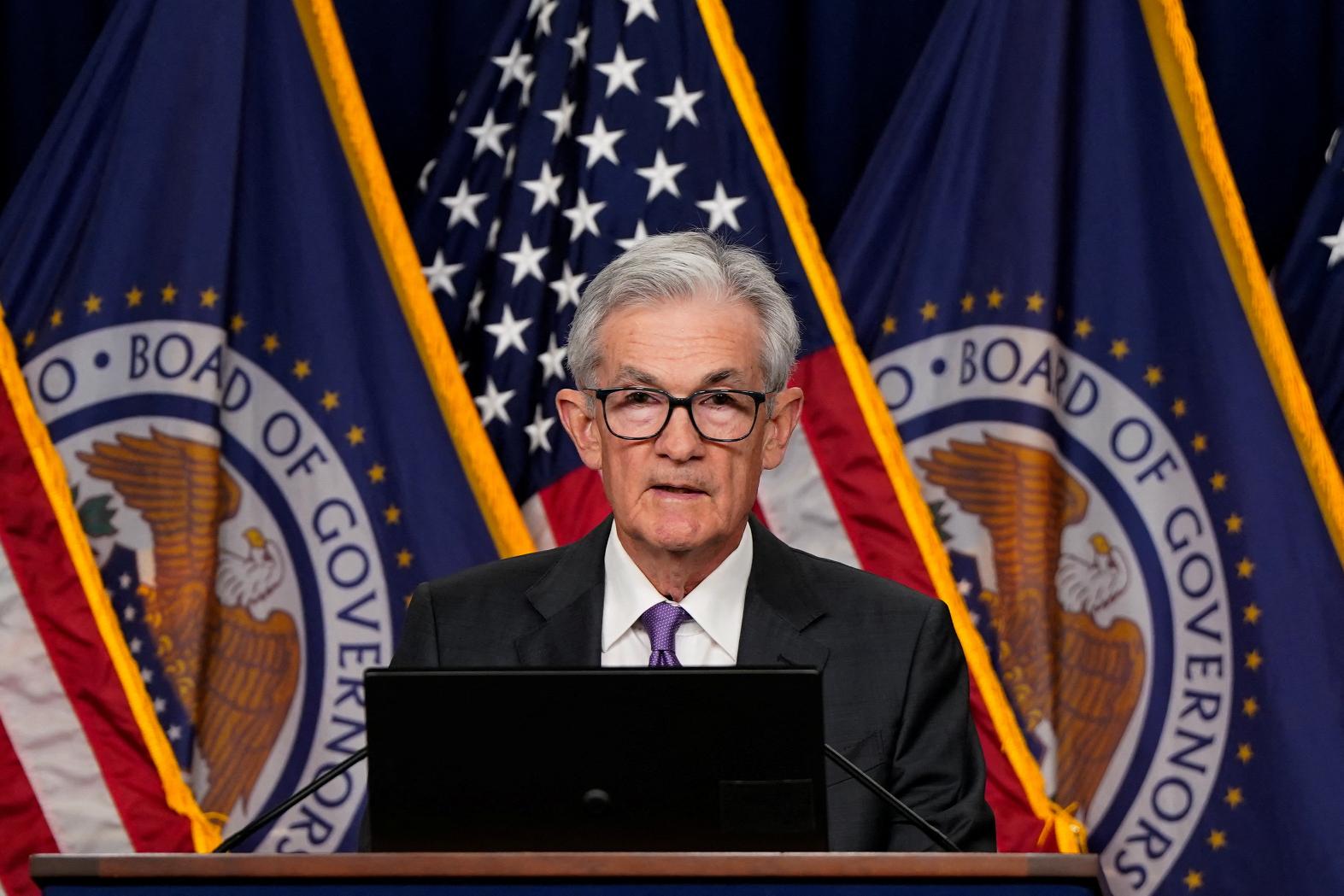

WASHINGTON, March 20 (Reuters) - Federal Reserve officials on Wednesday nudged up the level estimated for their target interest rate over the longer term, but central bank Chair Jerome Powell said that does not necessarily herald an era of consistently higher interest rates. Alongside maintaining the current target rate at 5.25%-5.50% and still penciling in three-quarters-of-a-percentage point of rate cuts this year, officials also raised their longer-run estimate of the fed funds rate to 2.6% from 2.5% in December's forecasts. That breaks above an estimate that had been in place for most of the last five years. Policymakers' longer-run estimate had fallen persistently over the years prior to the pandemic in what proved to be an extended stretch of very low interest rates and persistently weak inflation. But gradually, at least over the last year, views have been shifting. Seven policymakers now figure the long-run neutral rate is at least 2.9%, new projections released on Wednesday showed, versus just three a year ago. Powell, at a press conference after the rate meeting, said that while he does not anticipate a return to very low rates he was not yet sure that a new higher-rate regime was in the offing. “My instinct would be that rates will not go back down to the very low levels” that prevailed before the onset of the coronavirus pandemic in the spring of 2020, Powell said. But there’s “tremendous uncertainty” about where the longer-term rate will ultimately stand. Over recent months, in the Fed and among private sector economists, there’s been an active debate over whether the pre-pandemic era of very low rates has run its course. Some believe that period's stretch of very affordable borrowing costs will not return again amid changes in the economy and government finance that point to persistently more expensive credit. The shift to a higher longer-run forecast was not unexpected. Joe Brusuelas, chief economist of research firm RSM US LLP, said Fed forecasts point to an inflation-adjusted neutral rate of 0.4%, which he said was in-line with the December forecast outlook. But for Tani Fukui, director for global economic and market strategy at MetLife Investment Management, the change in the forecast was quite important. "One of the implications is they are not as tight as they think they are," she said, which might explain why the economy has not slowed as much as expected in the face of aggressive rate rises. She added the shift in forecast also means “they don't have to cut as much to get to an easing position.” Meanwhile, ING Chief International Economist James Knightley said in a note he sees that forecast climbing eventually to 3% due in large part to loose fiscal policy. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/amid-forecast-shift-feds-powell-flags-uncertainty-over-longer-run-outlook-2024-03-20/

2024-03-20 21:54

HOUSTON, March 20 (Reuters) - Rising oil tanker chartering rates due to global shipping disruption are forcing oil shippers to take on longer-term shipping charters, executives said this week at an energy conference in Houston. The global oil tanker fleet must now travel further to get crude to refineries and fuel to consumers. European sanctions have forced Russian exporters to send oil to Asia that would have otherwise gone to Europe. Attacks on vessels in the Red Sea have forced some shippers to sail around Africa. Low water levels in the Panama Canal have also led some vessels to take alternative routes. The detours have added up to three weeks sailing time to some routes, adding significantly to shipping costs and reducing vessel availability. Some ships are no longer available because they have joined the fleet carrying Russian oil or have been sanctioned. All of that has added up to 26% to tanker chartering rates in some cases. Insurance rates have skyrocketed for those shippers that still transit the Red Sea to save time. Chartering rates for an Aframax vessel, which can carry up to 800,000 barrels, have surged to about $49,500 per day from $39,000 a day five months ago, according to shipping data. "It's just kind of been a perfect storm," said Andrew Jamieson, co-head of Gunvor Group's chartering and shipping arm, Clearlake Shipping. "There are not enough vessels." To save money on ship chartering, Gunvor has taken on more longer-term charters on ships, he said. "The record time-chartering rates are a pain," Jamieson said. Time chartering contract allow companies to take a vessel for a given period of time rather than on a specific voyage between two location, protecting them from the cost of disruptions. Clearlake Shipping has entered into more long term deals as well, partly due to 50-60% volatility in 10 month-front contracts. Locking in time charter contract in advance are typically cheaper than nearer-term contracts and protects the company from volatility in price. "We don't like doing it, but we think rates are here to stay." The company has over 100 time-charter contracts now compared with a few prior to 2020, he added. Some operators also use hedges to lock in prices. Interest in forward freight agreements - futures contracts that allow participants to trade on an expected future level of freight rates - have risen in recent months, industry sources said. The coming expansion of Canada's Trans Mountain pipeline will add further demand to the tanker market. Vessels will be needed to take crude from the Pacific Coast terminal of the pipeline to refiners. Vessels avoiding the Red Sea have increased marine fuel consumption by 100,000 barrels per day and added 3% to the distance traveled by the global shipping fleet, Vitol CEO Russell Hardy said on Wednesday. To ease the shortage in the market, companies are also looking to build new vessels. About 100 Aframaxes are likely to enter the market in the next three years, while about 25 Very Large Crude Carriers will enter the market in 2027, Clearlake's Jamieson said. Most of the factors that have forced ships to sail longer routes are unlikely to change any time soon, said Geoff Houlton, a senior vice president at U.S. oil producer Occidental Petroleum (OXY.N) , opens new tab. A "chunk of these suboptimal trade flows" are probably here to stay, he said. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/ceraweek-shippers-turn-longer-term-leases-tanker-supply-tightens-2024-03-20/

2024-03-20 21:51

March 21 (Reuters) - A look at the day ahead in Asian markets. Asian markets open on Thursday in the slipstream of U.S. markets' positive reaction to the Federal Reserve's signal that interest rates will still be cut by 75 basis points this year, and not the 50 that many investors had been bracing for. Wall Street's three main indexes closed between 0.9% and 1.2% higher on Wednesday, Treasury yields , opens new tab fell and the dollar slipped, a mix that should point to early gains in Asia. This comes against a global backdrop of high asset prices, strong risk appetite and low volatility - global stocks are near record levels, FX vol is the lowest since September 2021, and U.S. high yield bond spreads are the tightest in over two years. Stacked up like that, however, maybe the upside is limited from here - the MSCI Asia ex-Japan index has shed around 2.5% in the past week. While the 2024 path for U.S. monetary policy is the biggest immediate driver for Asian markets, the regional economic calendar on Thursday is not without potential fireworks. Fourth-quarter GDP data from New Zealand, unemployment figures from Australia, trade numbers from Japan and a sprinkling of PMI reports are on tap too. Once again, all eyes will be on the yen, which remains on the slide following the Bank of Japan's historic rate hike and policy shift this week. The Japanese currency is its weakest ever against the offshore Chinese yuan, its lowest against the onshore yuan in over 30 years, a 16-year high against the euro and a whisker away from lows not seen against the dollar since 1990. The yen managed to claw back some of its losses late in U.S. trading on Wednesday as the dollar fell more broadly. Activity on Thursday promises to be frenetic as Asia takes its first opportunity to trade the Fed and BOJ. Rates futures markets are currently pricing in a first Fed rate cut in June, and unsurprisingly in light of the Fed's new projections, 75 bps of easing this year. Traders forecast the BOJ raising another 10 bps rates in September and again in December. Nikkei newspaper reported on Wednesday that the next hike is more likely to come in October. Elsewhere on Thursday New Zealand is expected to narrowly avoid recession with fourth quarter GDP seen rising 0.1%, following a surprise 0.3% contraction in the previous three-month period. The kiwi dollar has been a relatively poor performer against the U.S. dollar this year as traders bet that the Reserve Bank of New Zealand will cut rates by more than 100 bps this year. The first purchasing managers index (PMI) reports for March will also be released on Thursday in the shape of flash readings from Japan, Australia and India. Here are key developments that could provide more direction to markets on Thursday: - New Zealand GDP (Q4) - Australia unemployment (February) - Japan, Australia, India flash PMIs (March) Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-03-20/

2024-03-20 21:46

March 20 (Reuters) - Energy firm Shell (SHEL.L) , opens new tab said on Wednesday it had sold its 50% stake in SouthCoast Wind Energy, established to develop wind projects off the coast of Massachusetts, to its joint venture partner Ocean Winds North America for an undisclosed sum. Offshore wind developments faced a slowdown in 2023 as rising inflation, higher borrowing costs and supply chain snags led to a jump in costs. Renewable energy firm Orsted (ORSTED.CO) , opens new tab last year halted the development of two U.S. offshore wind projects and said related impairments had surged above $5 billion. Earlier this year, European energy firms Equinor (EQNR.OL) , opens new tab and BP (BP.L) , opens new tab terminated their agreement to sell power to New York state from their proposed Empire Wind 2 offshore wind farm. The SouthCoast Wind project was created in 2018 as a 50-50 joint venture to develop a proposed offshore wind farm with a capacity of about 2,400 megawatt (MW). Get U.S. personal finance tips and insight straight to your inbox with the Reuters On the Money newsletter. Sign up here. https://www.reuters.com/markets/deals/shell-sells-stake-southcoast-wind-energy-ocean-winds-north-america-2024-03-20/

2024-03-20 21:45

March 20 (Reuters) - The Biden administration on Wednesday proposed a second sale of offshore wind development rights in the Gulf of Mexico as soon as this year, despite lackluster interest in the region at an auction seven months ago. The Interior Department plans to offer four areas, a total of 410,060 acres, off the coasts of Louisiana and Texas and will accept public comments on the proposal for 60 days before deciding whether to proceed with the auction. If developed, the areas have the potential to power 1.2 million homes, the agency said. The announcement underscores the administration's determination to support the nascent U.S. offshore wind industry as part of President Joe Biden's climate change agenda. In the last year the industry has been plagued by rising costs tied to inflation, interest rates and supply chain constraints, forcing companies to write down assets and exit some projects. Interior has held a string of offshore wind auctions since 2022 for areas off the coasts of New York and New Jersey, the Carolinas and California that each brought in between $315 million and $4.4 billion in high bids. But a sale of three areas in the Gulf of Mexico last August attracted meager interest, with two of the leases receiving no bids at all. The third lease for an area off Louisiana sold for just $5.6 million. The Gulf's lower wind speeds, soft soils and hurricanes are considered challenges to the industry. The southeastern U.S. also has low power prices that could make it harder for higher-cost offshore wind to compete for electricity contracts. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/us-proposes-second-offshore-wind-auction-gulf-mexico-2024-03-20/

2024-03-20 21:45

NEW YORK, March 20 (Reuters) - The cryptocurrency industry, a new financial force in the 2024 U.S. election cycle, is surveying candidates for Congress on their views around the digital asset, as the political arm of the movement gains tens of thousands more followers and adds to its war chest. The survey from the Stand With Crypto Alliance, an advocacy group that aims to organize voters who own crypto and influence public opinion, is a way for a young industry like crypto to engage in political activity in lieu of trade organizations, said Olivia Buckley of OpenSecrets, a research group that tracks money in U.S. politics. Ultimately candidates who answer the survey in ways the industry deems positive may see support from groups that want to boost crypto-friendly candidates. Pro-crypto non-profits have been appearing in greater numbers over the past few years, Buckley said. "Crypto regulation at the federal level remains very much contested and murky, so seeing which candidates can garner support from the industry could be telling as far as what's to come in Congress," she added. Over a dozen candidates have already filled out the survey, including those from California, Alabama, Texas, Indiana and Maryland, according to Stand With Crypto, though the group declined to provide names. It plans to push the survey out to candidates of the 468 seats in Congress up for election in November, the group told Reuters. "It's for crypto advocates and the crypto community to understand where their policymakers, elected officials and candidates in federal races stand on the issue," said Nick Carr, chief strategist for Stand With Crypto. The survey, seen by Reuters, asks questions such as whether a candidate believes cryptocurrencies like Bitcoin will play a major role in technological innovation, and whether a candidate believes it is important for the U.S. to modernize the regulatory environment for crypto. It also asks whether a candidate would vote in favor of certain legislation, such as a bill introduced to the House of Representatives last year that would establish a regulatory framework for digital assets. Stand With Crypto's member count has grown to 370,000 as of Wednesday, up from 315,000 just before March 5's Super Tuesday contests, according to its website. The group was launched in part by Coinbase, an online platform for buying and selling crypto. Pro-crypto candidates are already receiving support from three new super PACs - Fairshake, Defend American Jobs and Protect Progress - that put millions of dollars towards Super Tuesday races. Collectively, the three super PACs have spent more than $21 million in independent expenditures this election cycle, according to OpenSecrets. Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here. https://www.reuters.com/world/us/crypto-industry-surveys-us-2024-candidates-looking-friendly-lawmakers-2024-03-20/