2024-03-20 07:32

March 20 (Reuters) - Glencore (GLEN.L) , opens new tab said Wednesday it aims to lower carbon dioxide equivalent emissions for its industrial assets by 25% by the end of 2030. The global miner and trader retained its emissions reduction targets of 15% and 50% by the end of 2026 and 2035, respectively, in its 2024-2026 Climate Action Transition Plan. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/glencore-aims-cut-industrial-assets-carbon-emissions-by-one-fourth-by-2030-2024-03-20/

2024-03-20 07:01

TOKYO, March 20 (Reuters) - A South Korean-flagged chemical tanker has capsized off the coast of Yamaguchi prefecture in western Japan, with operations to rescue the crew underway, public broadcaster NHK reported on Wednesday, citing the Coast Guard. The tanker, Keoyoung Sun, requested assistance after 0700 local time (2200 GMT), reporting the vessel was tilting over, and had 11 crew onboard with four people rescued so far, NHK reported. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/asia-pacific/skorean-flagged-tanker-capsizes-off-coast-japan-media-reports-2024-03-20/

2024-03-20 07:01

NEW DELHI, March 20 (Reuters) - Indian sponge iron producers have urged the government to impose duties on exports of low-grade iron ore to stave off shortages of the main raw material in the world's second-biggest crude steel producer. "We have urged the government that there is a shortage of iron ore, (so) please intervene and levy export duty," Rahul Mittal, chairman of the Sponge Iron Manufacturers Association, told Reuters in an interview. India, the world's biggest sponge iron producer, has about 336 sponge iron plants spread across the country. India produces around 50 million metric tons of sponge iron, which is mostly used by secondary steel producers as raw material. India's iron ore exports touched 32.2 million metric tons during the first nine months of the current fiscal year that began in April 2023 - worth $2.7 billion - from 9.5 million metric tons a year earlier. More than 90% of India's overall iron ore shipments go to neighbouring China. The surge in India's iron ore exports has rattled sponge iron producers who have complained about rising prices and falling supplies of the key ingredient in sponge iron making. Mittal said a sharp jump in iron ore exports has exacerbated shortages in recent months. But sponge iron producers have been raising concerns about supplies since the government in November 2022 scrapped higher export tax on low-grade iron ore lumps, fines and pellets, reversing the May 2022 decision, he said. The Federation of Indian Mineral Industries (FIMI), an industry body of mining companies, has asked the government not to impose curbs on iron ore exports. FIMI has argued that India ships out only low-grade iron ore, which is not widely consumed within the country. Countering FIMI's argument, Mittal said India's sponge iron producers use all grades of ore. "There are so many producers using low grades." India is expected to produce 51 million metric tons of sponge iron in the fiscal year to April 2024. Sponge iron output is expected to grow 15% in 2024/25, Mittal said, highlighting the rising requirement of iron ore by India's sponge iron producers. Most of India's sponge iron output is consumed within the country. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/indias-sponge-iron-producers-seek-duties-curb-iron-ore-exports-2024-03-20/

2024-03-20 06:53

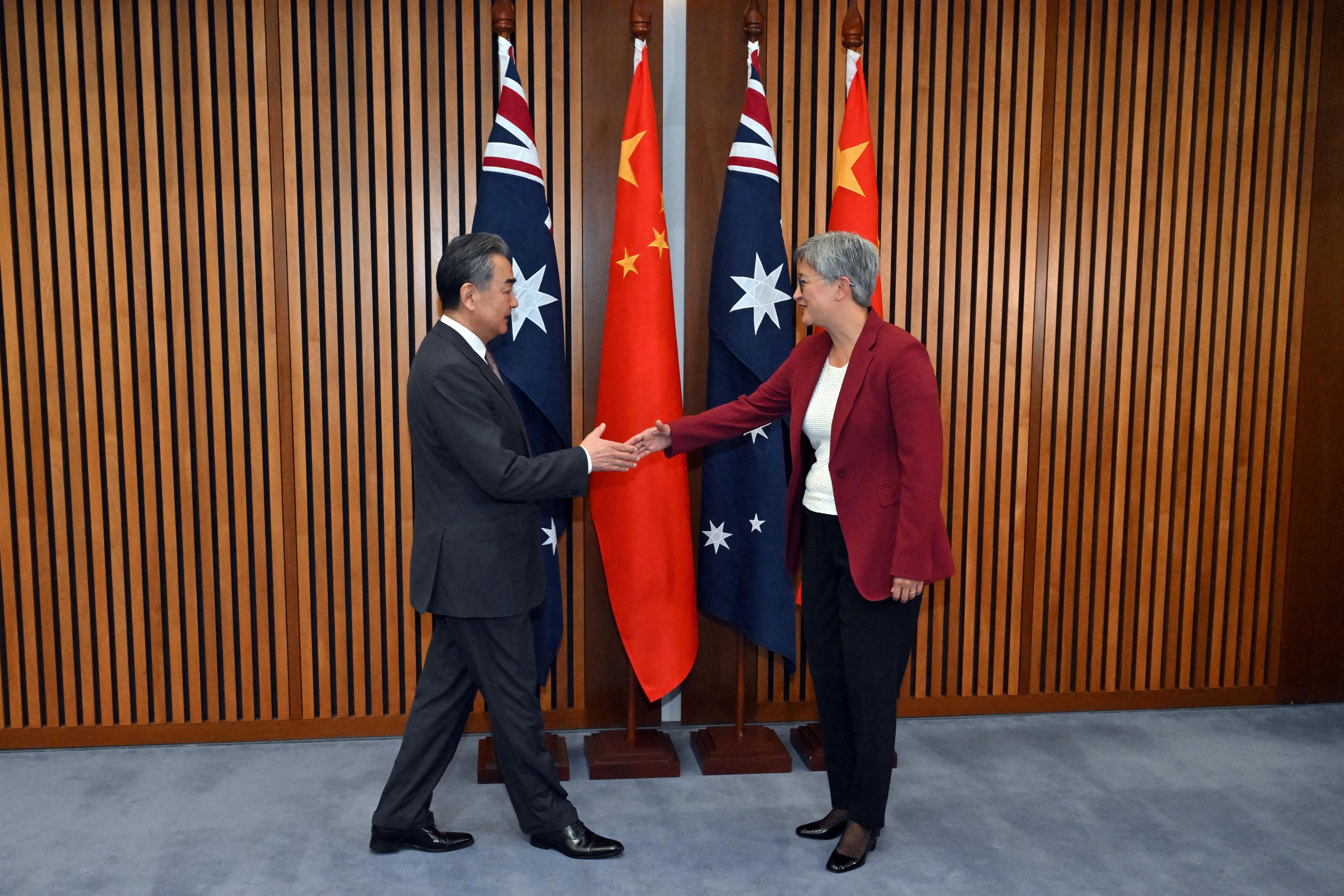

SYDNEY, March 20 (Reuters) - Australia will prepare for a visit by China's Premier Li Qiang this year, Foreign Minister Penny Wong said after meeting her Chinese counterpart Wang Yi in Canberra for talks she said covered human rights, tariffs, regional security and pandas. Australia and China, its largest trading partner, are rebuilding ties after a period of strained relations which hit a low in 2020 after Canberra called for an independent investigation into the origin of COVID-19. Beijing responded by imposing tariffs on billions of dollars worth of Australian commodity imports, most of which have been lifted since a change of government in Canberra two years ago. "I look forward to speaking frankly with you about Australians detained in China, human rights, maritime security and safety, as well as regional and international issues, such as the Pacific, Russia's invasion of Ukraine and the conflict in the Middle East," Wong said in her opening remarks. After the meeting, she addressed Chinese and Australian reporters and said the two nations would work to prepare for a visit by Li, emphasising the importance of face-to-face diplomacy to better understand each other. Australia and China would expand dialogue on the Pacific, and on climate and energy cooperation, Wong said. "I expressed our serious concern about unsafe conduct at sea, our desire for peace and stability across the Taiwan Strait and in our region," she said, a reference to friction with China's navy in the South China Sea. While Beijing has made an interim decision to remove Chinese tariffs on Australian wine - one of the commodities hit by import charges after 2020 - Wong said Australia also wanted blocks lifted on beef and lobster, and they had discussed nickel market volatility. Wong said she raised the case of Yang Hengjun, an Australian writer who was given a suspended death sentence by a Beijing court last month, and told Wang Australians were shocked by the sentence. In another sign diplomacy was back on track, Wong said it was likely two pandas on loan from China since 2009, and due to return this year, would have their stay in her home city of Adelaide extended. "We are on a good path there to continued panda presence," she told reporters after the meeting. 'MUTUAL RESPECT, COMMON GROUND' According to a Chinese foreign ministry statement, Wang said he hoped Australia will take measures to uphold the principles of the market economy and provide a non-discriminatory business environment for Chinese enterprises in Australia. Canberra screens foreign investment in key sectors for national security, including critical minerals, and has blocked some Chinese deals. He highlighted the need for independence, a likely reference to China's view that Australia's foreign policy is dominated by Canberra's strategic alliance with the United States, and said China-Australia relations are on the right track and should not go backward. A reference to Australia needing to have an independent foreign policy that appeared in the Chinese foreign ministry's first Chinese language statement did not appear in a longer version issued later. "The most fundamental thing is to insist on mutual respect, the most crucial thing is to insist on seeking common ground while reserving differences, the most important thing is to insist on mutual benefit and win-win situation, and the most valuable thing is to insist on independence and autonomy," he said according to the transcript. The last time a Chinese foreign minister visited Australia was in 2017 and Wang's visit signals a thaw in diplomatic ties. Wang also met with Prime Minister Anthony Albanese, and held a private meeting with 11 business, university and think tank representatives. The Australia China Business Council's national president David Olsson said afterwards said the discussion had reflected "a diverse range of views and voices from the Australian side, reflecting the conversations that are taking place in Australia about the future direction of the bilateral relationship". Rio Tinto(RIO.AX) , opens new tab iron ore chief Simon Trott said China was the biggest customer of Australia's iron ore, and ongoing stabilisation of ties had led to "increasingly positive dialogue between governments and business leaders of both countries". Wang will meet former Australian Prime Minister Paul Keating, a prominent supporter of China who has criticised Australia's AUKUS nuclear-powered submarine deal with the U.S., on Thursday. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/asia-pacific/chinas-top-diplomat-meets-australian-counterpart-canberra-2024-03-19/

2024-03-20 06:43

QUETTA, March 20 (Reuters) - Twelve miners were killed and eight rescued after an explosion in a coal mine in south-western Pakistan, officials said on Wednesday. "The rescue operation has been just completed," said Balochistan province's chief inspector of mines, Abdul Ghani Baloch, on Wednesday morning. He said that 20 miners had been inside the mine when a methane gas explosion took place overnight. He added that rescue teams recovered 12 bodies while the survivors had been taken to hospital. Coal deposits are found in the western areas of Pakistan that sit near the Afghan border and mine accidents are common, mainly due to gas build-ups. Mine workers have complained that a lack of safety gear and poor working conditions are the key causes of frequent accidents, labour union officials have said in the past. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/asia-pacific/explosion-pakistan-coal-mine-kills-12-miners-2024-03-20/

2024-03-20 06:29

NEW YORK, March 20 (Reuters) - The dollar weakened and the yen rebounded from near multi-decade lows on Wednesday after the Federal Reserve held interest rates steady as expected and policymakers still projected three U.S. rate cuts this year even as inflation remains elevated. The Fed's updated quarterly economic projections showed the personal consumption expenditures price index excluding food and energy rising at a 2.6% rate by year-end, compared to 2.4% in the projections the U.S. central bank issued in December. The new policy view also raised the outlook for the U.S. economy. Policymakers now see growth at 2.1% this year compared to 1.4% projected in December, while the unemployment rate is seen ending 2024 at 4%, versus 4.1% anticipated late last year. Fed Chair Jerome Powell said that even with unexpected strength in recent consumer price data, his outlook is that inflation is moving down gradually on a somewhat bumpy road. "Jay Powell is trying to tell everyone that nothing has changed in the short term, that he's still confident that inflation is going to proceed. That's his main message during the press conference," said Thierry Wizman, Macquarie’s global FX and interest rates strategist in New York. The dollar index , a measure of the U.S. currency against six major trading partners, eased 0.46%. The yen reversed an earlier decline as the U.S. currency fell 0.17% to 151.10 yen. Wizman said that the message that came out of the Fed's summary of economic projections is one of a stronger U.S. economy, both in the short and the long term. "There aren't too many ways you can reconcile that, unless what you're saying is that the reason that inflation is going to continue to come down is because we're going to see positive productivity trends, positive supply shocks." Earlier the yen had slumped to 151.82, a fresh four-month low against the dollar just hours before the Fed concluded a two-day policy meeting that came after the Bank of Japan (BOJ) on Tuesday raised interest rates for the first time in 17 years. Analysts said the yield differential between U.S. Treasuries and Japanese government bonds remained wide and would keep pressure on the yen as it trades near a multi-decade low of 151.94 to the dollar hit in October 2022. But the major central banks are largely moving in lockstep as they plan to cut interest rates to spur growth as economies slow and inflation keeps decelerating. "Nobody's expecting the BOJ to embark on a prolonged hiking cycle," said Bipan Rai, North America head of FX strategy at CIBC Capital Markets in Toronto. "You're still going to end up in a scenario where the rate differentials between the United States and Japan are going to look fairly wide." The yield on benchmark 10-year Treasury notes fell 2.1 basis points to 4.275%. Low Japanese rates have made the yen the funding currency of choice for carry trades, in which traders typically borrow a low-yielding currency to then sell and invest the proceeds in assets denominated in a higher-yielding one. Recent stronger-than-expected U.S. inflation reports have led traders to further reduce bets on Fed rate cuts this year, with markets now pricing in 81 basis points (bps) of easing by year end, or almost half expectations at the start of 2024. The euro rose 0.51% to $1.092. European Central Bank President Christine Lagarde said earlier on Wednesday that the ECB will continue to be data dependent and will not commit to a pre-set number of rate cuts even after it starts easing its monetary policy. Bitcoin was last up 6.4% at $65,860.00. Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/yen-flounders-near-four-month-low-fed-spotlight-2024-03-20/