2024-03-18 17:02

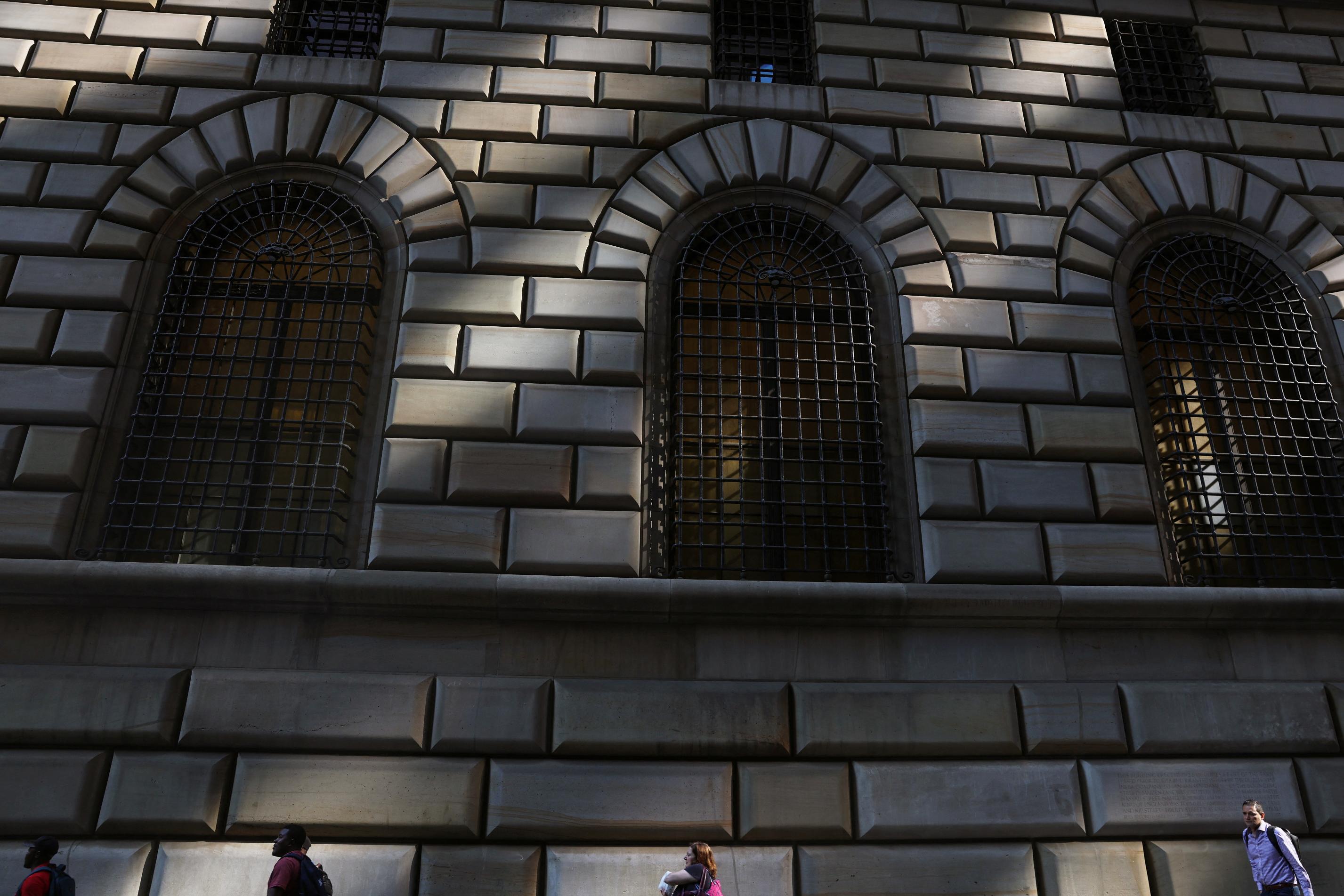

March 18 (Reuters) - Americans applied for mortgage credit in greater numbers over recent months even as they faced greater headwinds in getting those loans, new data from the Federal Reserve Bank of New York released Monday said. The bank’s report , opens new tab said that the overall application rate for credit increased to 43.4% in February, the highest reading since October 2022, from 42.5% in October and 40.3% last June. While application rates for auto loans and mortgage refinancing hit the lowest levels in the survey’s history, mortgage application rates rose to 5.6% of survey respondents in February, from 4.3% in October, the New York Fed said. The bank’s report found that those applying for credit faced better odds last month, with the overall rejection rate ebbing to 18.7% from 21.1% in October. Meanwhile, even as application rates increased for mortgages, rejection rates for that type of borrowing jumped to 22.5% in February from 13% the prior quarter. Application rates for other types of borrowing—auto loans, credit cards, mortgage refinancings--declined as of February relative to October, according to the bank. The findings came from the bank’s monthly Survey of Consumer Expectations, which is best known for its readings on the expected path of inflation. The rise in the applications rate for mortgages comes as that part of the economy continues to face decidedly hard times amid high borrowing costs. Two years ago the Fed embarked on an aggressive campaign of short-term interest rate rises that lifted rates from near zero levels to the current level of between 5.25% and 5.5%, as officials tightened policy to push down high levels of inflation. That policy shift sharply raised the cost of borrowing to buy a home, while also making most other forms of borrowing more expensive. But as inflation has come down, the Fed has been moving toward rate cuts, and that outlook has helped lower mortgage rates, making home borrowing appear more doable for some Americans. Last month, the New York Fed said overall borrowing levels rose modestly in the last three months of 2023, amid signs some Americans were facing challenges dealing with that debt. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/more-americans-tried-mortgage-loans-february-ny-fed-report-finds-2024-03-18/

2024-03-18 16:30

BUENOS AIRES, March 18 (Reuters) - Argentina's gross domestic product (GDP) is expected to have shrunk 1.5% year-on-year in the final quarter of 2023, the third straight annualized contraction, hit by declines in virtually all sectors of the economy, a Reuters poll found. The South American country likely contracted some 1.6% last year and is expected by analysts to shrink again this year, as new libertarian President Javier Milei battles to turn around high inflation and a deep deficit with tough austerity measures. The measures have helped boost the government's financial situation and shown signs of reining in prices, but have dampened economic activity, production and consumption. "We are in a stage where most of the sectors of the economy are deepening their contraction," said Pablo Besmedrisnik, economist and director of the consulting firm Invenomica, adding the hardest hit would be those associated with consumption. Primary and tradable sectors, such as farming and energy, would be the exception to a tough wider context, he said. "A contractionary fiscal policy, with fewer pesos in the market, relative prices that have not yet adjusted, and wages and pensions at rock bottom, mean that the fall in the level of activity is expected to deepen," he added. The analysts polled by Reuters estimated the economic contraction in the October-December quarter of between 1.1% to a maximum decline of 1.8%. Argentina, Latin America's third largest economy, saw the economy contract 0.8% year-on-year in the third quarter last year after a deep 5.0% slide in the second quarter. The official INDEC statistics agency is scheduled to release the official fourth-quarter data on Thursday. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/americas/argentina-economy-set-third-straight-year-on-year-contraction-q4-2024-03-18/

2024-03-18 15:48

NEW YORK, March 18 (Reuters) - U.S. stocks have climbed this year despite rising Treasury yields, but equities could become more sensitive if yields push higher from current levels, Morgan Stanley strategists said on Monday. Rising yields tend to pressure equity valuations, but this year "multiples have remained elevated in the face of rising rates," the Morgan Stanley equity strategists led by Michael Wilson said in a note. But the strategists said 4.35% for the 10-year U.S. Treasury yield was "an important level to watch for signs that stocks' rate sensitivity may increase." The 10-year yield was last at 4.32% on Monday morning. The bond market could become more volatile over the next few days, with policy decisions by the Federal Reserve and Bank of Japan. "We think a key question for this week is whether the direction of rates will begin to matter more for the valuations of large cap equities," the Morgan Stanley strategists said. The S&P 500's (.SPX) , opens new tab forward price-to-earnings ratio - a commonly used valuation metric - last stood at 20.5, near its highest level in about two years, according to LSEG Datastream. The benchmark index is up more than 8% so far in 2024. Higher yields increase the attractiveness of owning "risk-free" Treasuries for investors. That in turn can dull the luster of riskier equity cash flows and tends to pressure stock valuations. Small-cap stocks have been more negatively correlated to yields than large caps, "indicating small caps are likely to exhibit greater interest rate sensitivity than large caps on a move higher in rates," the Morgan Stanley strategists said. The strategists were also watching to see if the 10-year yield falls below its 200-day moving average, which was about 4.195%. "Should rates decisively fall back below the 200-day moving average, it could serve as support for equity valuations to remain elevated," Morgan Stanley wrote. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/us-yields-nearing-level-that-could-pressure-stocks-morgan-stanley-says-2024-03-18/

2024-03-18 15:32

ORLANDO, Florida, March 18 (Reuters) - Hedge funds have cut back their huge bet against the yen ahead of the Bank of Japan's policy decision on Tuesday, but not by much, suggesting they don't believe a landmark interest rate hike would do much to improve the currency's immediate fortunes. The BOJ is expected to deliver its first rate hike in 17 years on Tuesday, bringing the curtain down on eight years of negative interest rate policy (NIRP), and the latest move to end decades of deflation-fighting, accommodative policy. As historic as that would be, however, it probably won't move the dial much for currency traders unless it is followed up with further action, and unless the yen's yield gap with other currencies like the dollar shrinks significantly. More clarity on that will no doubt come from BOJ Governor Kazuo Ueda on Tuesday, and the U.S. Federal Reserve in its policy statement and Fed Chair Jerome Powell in his press conference on Wednesday. But until then, the jury is out and speculators are reluctant to buy into the view that Japan's first baby step into the world of policy normalization is a game-changer for the yen. The latest Commodity Futures Trading Commission data show that funds cut their net short yen position by 16,521 contracts to 102,322 contracts in the week ending March 12. That follows a reduction of almost 14,000 contracts in the prior week, marking the first time this year funds have scaled back their bearish yen bets two weeks in a row. A short position is essentially a wager that an asset's price will fall, and a long position is a bet it will rise. Hedge funds often take directional bets on currencies, hoping to get on the right side of long-term trends. These figures show that funds have cut their yen position by around 20% from what was the largest net short in more than six years at the end of February. At almost 133,000 contracts, it was one of the most bearish yen bets on record. In dollar terms, the latest position roughly equates to a $8.65 billion leveraged bet on the yen weakening. That's still large by historical standards, so there is room to reduce that further and put upward pressure on the yen. But that will need a catalyst. Given how historic a Japanese rate hike would be, it is reasonable to assume BOJ policymakers will want to proceed cautiously. The fact that only 25 basis points of tightening this year is priced into Japanese swaps attests to that. The U.S. rate outlook, meanwhile, appears to be moving in the dollar's favor. The amount of Fed policy rate easing expected by markets this year continues to be trimmed back, which helps explain why dollar/yen is closer to 150.00 than 145.00. Given how closely dollar/yen has correlated this year with the spread between two-year U.S. and Japanese yields, the yen might need a substantial narrowing in the spread to get any real momentum behind it. "Every delay in the market's expectation for the Fed to start the cutting cycle ended up with pressure on the yen and 10-year JGB (Japanese Government Bond) yields," analysts at Natixis wrote in a client note this past weekend. Morgan Stanley analysts note that a "soft landing" and only gradual U.S. rate cuts continue to be the market's default position, while expectations for the BOJ over the next 12 months haven't actually changed that much recently. "This in turn implies that the prospective US-Japan policy trajectory should be little changed, suggesting ... USD/JPY should continue to perform reasonably resiliently," they wrote on Sunday. The yen goes into the BOJ meeting as the worst-performing major currency this year. Funds are taking some chips off the table but are still betting that U.S.-Japan rate and yield spreads will stay wide, to the detriment of the yen. (The opinions expressed here are those of the author, a columnist for Reuters.) Keep up with the latest medical breakthroughs and healthcare trends with the Reuters Health Rounds newsletter. Sign up here. https://www.reuters.com/markets/currencies/funds-maintain-large-short-yen-position-ahead-boj-decision-mcgeever-2024-03-18/

2024-03-18 13:09

OTTAWA, March 18 (Reuters) - Canada, citing the need to shun Russian energy, on Monday signed an agreement with Germany that it said would accelerate work towards the commercial-scale trade of clean hydrogen fuel. The two nations inked a memorandum of understanding that commits them to backing transactions between Canadian hydrogen producers and Germany's industrial manufacturing and energy distribution sectors. "Canada is working with European allies to displace imports of Russian oil and gas and fight climate change with clean Canadian hydrogen. Canada can be a world-leading producer and exporter of clean hydrogen," the federal natural resources ministry said in a statement. In August 2022, Canadian Prime Minister Justin Trudeau and German Chancellor Olaf Scholz agreed to establish a transatlantic supply corridor while coordinating policies to attract investments in hydrogen projects. The deal envisaged Canadian exports to Germany starting in 2025. Hydrogen is a zero-carbon fuel best suited for powering large industrial machines, heavy vehicles and for heating. More than 80 low-carbon hydrogen production projects have been announced in Canada to date. Last year one of the first projects delayed its start by one year because the operator's European customers needed more time to develop special infrastructure to handle the product. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/climate-energy/canada-signs-hydrogen-deal-with-germany-cites-need-shun-russia-energy-2024-03-18/

2024-03-18 13:05

March 18 (Reuters) - Fisker (FSR.N) , opens new tab said on Monday it would pause production of its electric vehicles for six weeks and raise up to $150 million in funding by selling convertible notes after missing an interest payment, as the startup tries to navigate a cash crunch. The company added that none of its Ocean SUVs were produced in January, while its manufacturing partner Magna's (MG.TO) , opens new tab Austrian unit made about 1,000 vehicles between Feb. 1 and March 15. Fisker delivered about 1,300 vehicles in 2024 and the value of inventory of completed vehicles was more than $200 million, according to the company. The senior secured convertible notes will have a 10% original issue discount for gross proceeds of up to $150 million. The notes are being sold to CVI Investments, which is working through Heights Capital Management, and the Warsaw-based investment fund can convert the debt into equity in Fisker, the EV firm said in documents filed with the U.S. Securities and Exchange Commission. Fisker said it did not make the $8.4 million interest payment on March 15 for some convertible notes due 2026 despite having enough liquidity, as it wanted to take advantage of a 30-day grace period to talk to its investors about its capital structure. As of Friday, the company's balance of cash, cash equivalents and restricted cash was $120.9 million, down from $395.9 million at the end of last year. Fisker reiterated on Monday that it was in talks with a large automaker for a potential transaction, but did not name the company. Reuters reported earlier this month that Nissan (7201.T) , opens new tab was in advanced talks to invest in the company in a deal that could act as a financial lifeline for the cash-strapped EV startup. Earlier this year, Fisker started to transition its sales strategy from a direct-to-customer model to leaning on dealers to sell cars as it faced issues with distribution and servicing. The company flagged substantial doubt about its ability to continue as a going concern in February and paused investments in future projects until it secured a partnership with an automaker. Stay up to date with the latest news, trends and innovations that are driving the global automotive industry with the Reuters Auto File newsletter. Sign up here. https://www.reuters.com/business/autos-transportation/ev-startup-fisker-sell-up-1667-mln-senior-secured-convertible-notes-2024-03-18/