2024-03-14 23:40

March 14 (Reuters) - A major environmental group has sued to challenge new rules issued by the U.S. Securities and Exchange Commission requiring public companies to report climate-related risks, arguing they do not go far enough to protect investors. The Sierra Club and the Sierra Club Foundation filed the lawsuit on Wednesday in the U.S. Court of Appeals for the D.C. Circuit. The groups argue the SEC arbitrarily stripped the final version of the rules of requirements for companies to disclose information about their “Scope 3” emissions, which are indirect emissions by suppliers or customers. Those emissions disclosure requirements were included in an initial 2022 draft of the rules, which aim to standardize climate-related company disclosures. They were removed amid pressure and threats of legal action by industry groups and others. Republican-led states and industry groups have already filed several lawsuits seeking to block the rules, but the Sierra Club's case is the first to argue they are too weak. The Sierra Club in a statement said the organization and its members manage millions of dollars in investments, which they cannot adequately manage without complete information about climate risks. By failing to keep the more robust disclosure requirements in the rules approved this month, the SEC fell short of its responsibility under federal law to protect investors, the Sierra Club said. The lawsuit seeks to force the SEC to reconsider its decision to weaken the rules. An SEC spokesperson in a statement on Thursday said the agency will "vigorously" defend the climate disclosure rules in court. First proposed in 2022, the rules are part of Democratic President Joe Biden’s efforts to leverage federal agency rulemaking to address climate change threats. The rules require U.S.-listed companies to disclose greenhouse gas emissions, weather-related risks and how they are preparing for the transition to a low-carbon economy. They were approved by the SEC , opens new tab on March 6, and the first legal challenge seeking to block them was filed later that day. At least 25 Republican-led states including West Virginia, Texas and Ohio have so far challenged the rules in court, including in the 5th, 6th, 8th and 11th U.S. Circuit Courts of Appeals. Those states have argued, among other things, that the disclosure requirements amount to back-door environmental regulations that go beyond the SEC’s legal authority. Other challenges have also been filed by oilfield services companies and other energy industry groups. The U.S. Chamber of Commerce, the nation’s largest business lobbying group, and other business groups joined the challenges to the rules in court on Thursday. The SEC on Wednesday told the 5th Circuit in one of those cases that the rules "fit comfortably within" its longstanding authority to require the disclosure of information that is important to investors, and said they were adopted to provide "consistent, comparable and reliable information" about climate risks. Jumpstart your morning with the latest legal news delivered straight to your inbox from The Daily Docket newsletter. Sign up here. https://www.reuters.com/legal/sierra-club-sues-us-sec-weakening-climate-risk-disclosure-rules-2024-03-14/

2024-03-14 23:25

March 14 (Reuters) - The U.S. Chamber of Commerce said on Thursday it has filed a lawsuit against the U.S. Securities and Exchange Commission's new rules that require public companies to report climate-related risks. The business lobbying group joins a list of entities challenging the securities regulator over rules aimed to standardize climate-related company disclosures about greenhouse gas emissions, weather-related risks and how they are preparing for the transition to a low-carbon economy. "The final rule makes substantively harmful changes to 50 years of corporate governance precedent that will have implications well beyond this single rule," said Tom Quaadman, executive vice president, U.S. Chamber of Commerce Center for Capital Markets Competitiveness. "The Commission undertakes rulemaking consistent with its authorities and laws governing the administrative process and will vigorously defend the final climate risk disclosure rules in court," a SEC spokesperson said. The rules finalized earlier this month were substantially diluted but drew a mixed response. A major environmental group Sierra Club and Sierra Club Foundation filed a lawsuit on Wednesday in the U.S. Court of Appeals for the D.C. Circuit, arguing that the SEC arbitrarily stripped the final version of the rules. On the other hand, Republican-led states and industry groups have already filed several lawsuits seeking to block the rules, but the Sierra Club's case is the first to argue they are too weak. Jumpstart your morning with the latest legal news delivered straight to your inbox from The Daily Docket newsletter. Sign up here. https://www.reuters.com/legal/us-chamber-commerce-sues-sec-over-climate-risk-disclosure-rules-2024-03-14/

2024-03-14 23:08

LIMA, March 14 (Reuters) - Brazil is interested in exporting soy, corn and other products through Peru's China-controlled Chancay port, Peruvian Economy Minister Jose Arista said on Thursday, according to state news agency Andina. Brazilian Planning Minister Simone Tebet visited the port, still under construction, earlier this week and spoke with Arista about the possibility of using it as an export route, Andina reported. It would offer Brazilian exporters the opportunity to send goods by truck to the Peruvian port for shipping to Asia via the Pacific Ocean, cutting the transit time by about two weeks. Shipping from the port provides an alternative to the Panama Canal, where ships have encountered delays and logjams due to the impact of dry weather conditions on the canal's water levels. The Peruvian terminal, the first under Beijing's control in South America, will also serve as a crucial gateway for China to the region. Arista said Tebet plans to speak with Brazilian President Luiz Inacio Lula da Silva about the port's potential for Brazil and hopes to arrange a visit by Lula to meet with Peruvian President Dina Boluarte about enabling integration between the two countries through the port. Brazil's agriculture and planning ministries did not immediately respond to requests for comment. Brazil's planning ministry said on Monday in a statement before Tebet's visit that the Chancay port is part of a program its government has been developing to improve logistics integration with countries from South America. The port terminal, costing an initial $1.3 billion, is 70% completed, Andina reported. Majority owner Cosco Shipping Ports (1199.HK) , opens new tab has said the port is set to open at the end of this year. The port will open with four docks but could expand to up to 15, Andina said. Arista on Thursday confirmed the government in Lima is looking to create a special economic zone in the north of the capital to develop Chancay, in addition to creating a customs headquarters at the port. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/americas/brazil-eyes-exports-via-china-controlled-chancay-port-peruvian-minister-says-2024-03-14/

2024-03-14 21:54

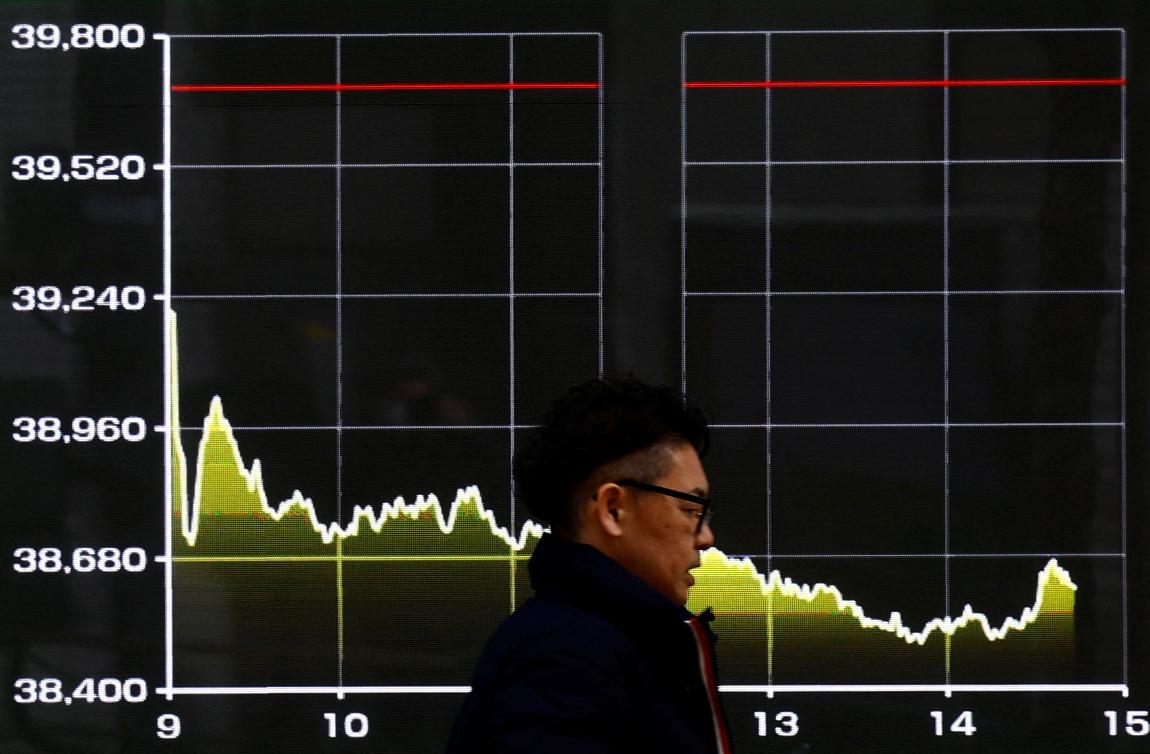

March 15 (Reuters) - A look at the day ahead in Asian markets. Asian markets are likely to come under downward pressure at the open on Friday, following the sharp rise in U.S. bond yields , opens new tab and the dollar the previous day on the back of yet another hotter-than-expected U.S. inflation report. Wall Street's late slide on Thursday - the S&P 500 and Nasdaq both shed 0.3% - could tempt investors to play safe ahead of the weekend and steer Asian equities away from what would be their seventh weekly rise in eight. The MSCI Asia ex-Japan index would need to avoid falling 0.5% or more to notch a weekly gain. Japan's Nikkei 225, on the other hand, goes into Friday's session down more than 2% on the week and on track for its worst week this year. The pullback in Japanese stocks should come as little surprise - the Nikkei hit a record high above 40,000 points last week and the Bank of Japan next week could deliver its first interest rate hike in 17 years. The Asia and Pacific economic calendar on Friday includes South Korean trade figures and import and export prices, New Zealand's manufacturing PMI for February, and Japan's 'tertiary index' gauge of conditions in the services sector. Japan watchers are also awaiting the findings of a preliminary survey of national wage round talks from labor union umbrella group Rengo. Sources have told Reuters that signs of strong wage growth could be the switch that flips the Bank of Japan's into raising rates next week. Japanese news agency Jiji reported on Thursday that the BOJ has started to make arrangements to end its negative interest rate policy next week. The main indicator though will probably be Chinese house prices for the month of February. They fell at an annual rate of 0.7% in January, the biggest decline in almost a year, and have been declining almost every month since April 2022. A turnaround in the embattled property sector is needed for the broader economy to get going again, and to convince investors that the market and economic nadir has passed. Curiously, China's economic surprises index this week rose to its highest level since October, begging the question: strong data, or lousy expectations to begin with? Maybe a bit of both. A reasonably bullish case, however, could be made for Asian risk assets on Friday. Even though the U.S. 10-year yield and dollar had their biggest rises in a month and Fed rate cut expectations were pared back, Wall Street only fell 0.3%. Chipmakers and tech stocks across the region could also get a boost from Apple supplier Foxconn saying on Thursday that it expects a significant rise in revenue driven by booming demand for artificial intelligence servers. Here are key developments that could provide more direction to markets on Friday: - China house prices (February) - Japan tertiary index (January) - New Zealand manufacturing PMI (February) Get a look at the day ahead in Asian and global markets with the Morning Bid Asia newsletter. Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-03-14/

2024-03-14 21:30

LIMA, March 14 (Reuters) - Peru's Congress has knocked down legislation that threatened to shut down thousands of small-scale mine operations, a move that comes after days of fierce protests from artisanal miners in the major gold producer and global No. 2 copper producing nation. In a plenary session on Wednesday night, the legislature annulled a government measure applied late last year that set a March 21 deadline for small-scale miners to present a valid mining contract or mining concession, otherwise they would be removed from a national program to formalize small mining operations. Peru has for years been trying to formalize small-scale gold miners, amid growing international pressure to shed light on the supply chain of the precious metal in South America's top producer. Tensions with big copper miners had also been rising. The legislation had also granted police more powers to act against small artisanal mines where there was evidence of illegal possession of explosives, amid reports by authorities of clashes and attacks by illegal miners that have left more than twenty people dead in the last two years. Victor Gobitz, president of the SNMPE union of formal private miners, said the ruling was a "disastrous spur of the moment decision" which he said would encourage mining crimes. He called on the government to "take note." Small-scale gold miners in Peru often operate unlawfully or with little oversight. They have been spreading into copper also as prices of the red metal have climbed. Peru produced 99.7 million fine grams of gold in 2023, 2.8% higher than the previous year. Artisan mines extract around 40% of the mineral, according to the government, while industry representatives claim that figure stands at 50%. "If this law is not repealed, we will go on strike and protest indefinitely," Maximo Becker, president of the National Confederation of Small Miners and Artisanal Miners of Peru (Confemin), told Reuters this week at a protest. The leader said that his union groups some 500,000 small-scale miners in the country, while about 85,000 are registered for the formalization program, known as REINFO. "REINFO has failed," said Gobitz, arguing the program helped many small miners to formalize but also allowed illegal miners to invade formal concessions. Gobitz is also chief executive of Antamina mining, Peru's second-largest copper producer controlled by Glencore (GLEN.L) , opens new tab, BHP (BHP.AX) , opens new tab, Teck (TECKb.TO) , opens new tab and Japan's Mitsubishi (8058.T) , opens new tab. Mining is key to Peru's economy, with 60% of the Andean nation's exports coming from the mining sector, mostly copper. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/americas/peru-congress-repeals-measure-fought-by-small-scale-gold-miners-2024-03-14/

2024-03-14 21:08

NEW YORK, March 14 (Reuters) - The United States' first utility-scale offshore wind farm entered service on Thursday 35 miles off the coast of Long Island, with the promise of generating enough power for about 70,000 homes at full capacity. The 12-turbine, 130-megawatt South Fork Wind project is a joint venture between Denmark's Orsted (ORSTED.CO) , opens new tab and New England-based electric utility Eversource (ES.N) , opens new tab. New York aims to reach 70% renewable energy by 2030 and to install nine gigawatts of offshore wind by 2035, and state Governor Kathy Hochul lauded the project as bringing it closer to those goals. "This is just the beginning of New York's offshore wind future," she said. But the startup comes up at a time the offshore wind business has been plagued by rising costs tied to inflation, interest rates and supply chain constraints, forcing companies to write down assets and exit projects. Eversource is one of a number of energy companies to recently announce it was exiting the offshore wind business. It plans to sell its stake in South Fork to Global Infrastructure Partners. The uncertainty over offshore wind could jeopardize plans by U.S. President Joe Biden and several states, including New York, to meet their goals to decarbonize the power grid in an effort to fight back climate change. Earlier this week, European energy firms Equinor (EQNR.OL) , opens new tab and BP (BP.L) , opens new tab terminated their agreement to sell power to New York state from their proposed Empire Wind 2 offshore wind farm, citing rising costs and logistical challenges. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/first-us-utility-scale-offshore-wind-farm-starts-operations-2024-03-14/