2024-03-14 20:56

HOUSTON, March 14 (Reuters) - BP PLC (BP.L) , opens new tab and Venezuela confirmed on Thursday they are in talks with Trinidad and Tobago government to develop a shared offshore gas field in the Caribbean. BP has been seeking to increase its natural gas production in Trinidad to feed into the local Atlantic LNG's liquefied natural gas export facility. BP's gas output has fallen in the last five years by almost 1 billion cubic feet per day (BCF/D) from over 2.2 bcf/d down to 1.2 bcf/d. "BP can confirm that it is in discussions with the government of Trinidad and Tobago and the Bolivarian Republic of Venezuela on the potential development of gas resources in the Manakin-Cocuina field," said BP in a statement on Thursday. Venezuela's state-run oil company PDVSA (PDVSA.UL) said on social media it is considering issuing a license for exploring and developing non-associated gas on its side of the shared field. Venezuela's government on Thursday posted a photograph of oil minister Pedro Tellechea meeting with BP's Trinidad President David Campbell and Trinidad's Energy Minister Stuart Young in Caracas. The Manakin-Cocuina field straddles both sides of the countries' borders and BP said the development talks are in keeping with an easing of U.S. sanctions against Venezuela. The fields were unitized in 2015 but talks on the development were stalled upon imposition of U.S. sanctions in 2019 against Venezuela, said BP. The field is estimated to contain just over 1 trillion cubic feet of natural gas. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/bp-talks-with-venezuela-trinidad-governments-develop-gas-field-2024-03-14/

2024-03-14 20:51

WASHINGTON, March 14 (Reuters) - The U.S. is seeking to buy 3 million barrels of oil for the Strategic Petroleum Reserve (SPR), as one storage site winds down maintenance that had tempered the pace of replenishing the stockpile, the U.S. Energy Department said on Thursday. The oil, if purchased, is expected to be delivered in August and September, the department said. The department issued a solicitation on Thursday of 1.5 million barrels for the Bayou Choctaw, Louisiana site that has undergone maintenance this year. Another solicitation for the same amount at Bayou Choctaw will be released on March 21, the department said. The SPR has a total of four sites on the coasts of the two states where pumps and other steel equipment are constantly exposed to moist, salty air. Life extension maintenance at the Bayou Choctaw and Bryan Mound, Texas sites this year had slowed the replenishment of the SPR after President Joe Biden's administration had conducted the largest-ever sale of 180 million barrels from the SPR in 2022. That sale was an effort to lower oil prices after Russia invaded Ukraine. The administration has wanted to buy back oil at $79 per barrel and if prices go higher, it could pose difficulties in buying back oil for the SPR. West Texas Intermediate (WTI)crude for April rose $1.54, or 1.9%, on Thursday to end at $81.26, its highest since early November. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/us-seeks-oil-emergency-reserve-two-sites-open-after-maintenance-2024-03-14/

2024-03-14 20:24

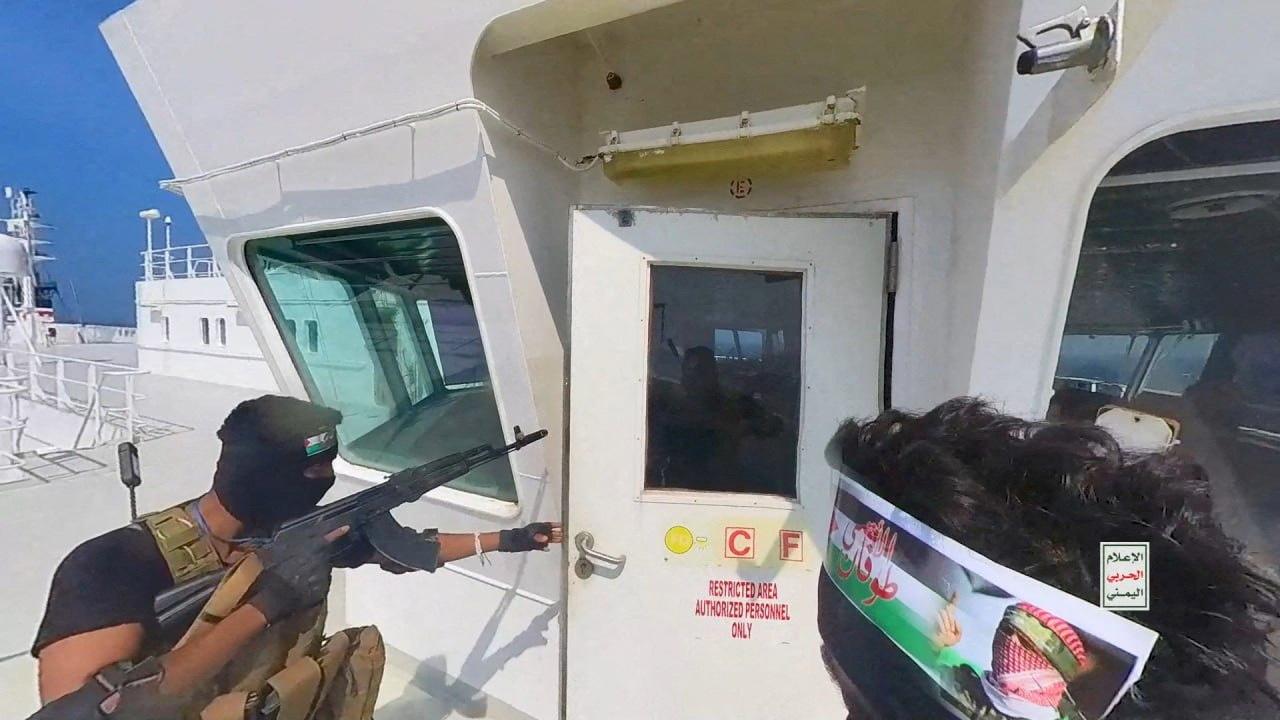

CAIRO, March 14 (Reuters) - The leader of Yemen's Houthis, Abdul Malik al-Houthi, said on Thursday the group's operations targeting vessels will escalate to prevent Israel-linked ships from passing through the Indian Ocean towards the Cape of Good Hope. "Our main battle is to prevent ships linked to the Israeli enemy from passing through not only the Arabian Sea, the Red Sea and the Gulf of Aden, but also the Indian Ocean towards the Cape of Good Hope. This is a major step and we have begun to implement our operations related to it," al-Houthi said in a televised speech. The Iran-aligned group has been attacking ships in the Red Sea and Gulf of Aden since November in what they say is a campaign of solidarity with Palestinians during Israel's war with Hamas in Gaza. Around 34 Houthi members have been killed since the group began the attacks, al-Houthi added. Months of Houthi attacks in the Red Sea have disrupted global shipping, forcing firms to re-route to longer and more expensive journeys around southern Africa, and stoked fears that the Israel-Hamas war could spread to destabilise the wider Middle East. The turmoil from Israel's war with the Palestinian Islamist group Hamas has spilled over to some extent into other parts of the Middle East. Apart from the Houthi attacks on vital shipping lanes, Lebanon's Iran-backed Hezbollah group has traded fire with Israel along the Israel-Lebanon border and pro-Iran Iraqi militia have attacked bases that host U.S. forces. The United States and Britain have launched strikes on Houthi targets in Yemen and redesignated the militia as a terrorist group. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/world/middle-east/leader-yemens-houthis-we-will-prevent-ships-passing-through-more-shipping-lanes-2024-03-14/

2024-03-14 20:19

WASHINGTON, March 14 (Reuters) - (This March 14 story has been refiled to correct the spelling of Cleveland-Cliffs CEO Lourenco Goncalves' surname in paragraph 9) U.S. Steel Corp (X.N) , opens new tab, which has agreed to be bought by Japan's Nippon Steel (5401.T) , opens new tab for $14.9 billion, must remain a domestically owned American firm, President Joe Biden said on Thursday - expressing explicit opposition to the deal for the first time. "U.S. Steel has been an iconic American steel company for more than a century, and it is vital for it to remain an American steel company that is domestically owned and operated," the president said in a statement. It was, however, not immediately clear whether Biden would use any U.S regulatory authorities to scuttle the deal. The Committee on Foreign Investment in the United States (CFIUS), a powerful panel that reviews foreign investments in U.S. companies, has the power to recommend the deal be blocked on national security grounds. The White House said in December that the proposed acquisition deserved "serious scrutiny" given U.S. Steel's core role in steel production that is critical to national security. Nippon Steel said in a statement on Thursday that the acquisition would deliver "clear benefits to U.S. Steel, union workers, the broader American steel industry, and American national security." "We are progressing through the regulatory review, including CFIUS, while trusting the rule-of-law, objectivity, and due process we expect from the U.S. Government. We are determined to see this through and complete the transaction," it said. The Japanese firm also said in an initial statement that there would be no layoffs and no plant closures until September 2026 under certain conditions but later re-issued its statement to say there would be no layoffs or plant closures as a result of the transaction. Shares of U.S. Steel sank again on Thursday and have tumbled 18% over two days to $38.26 on concerns that Biden would express his opposition. That's far below the proposed deal price of $55 per share. The company was not immediately available for comment. Separately, Cleveland-Cliffs (CLF.N) , opens new tab CEO Lourenco Goncalves said on Thursday he would consider another bid for United States Steel likely worth no more than $30 per share if the deal with Nippon Steel falls apart. Cleveland-Cliffs was among the bidders for U.S. Steel. U.S. opposition to the deal has the potential to overshadow an April 10 summit between Biden and Japanese Prime Minister Fumio Kishida aimed at boosting the long-standing security alliance between their countries in the face of growing Chinese influence. Biden, who is running for re-election this year and has courted unions as a key constituent of political support, also called United Steelworkers International President David McCall on Thursday. He reiterated that he has the "steelworkers' back," the White House said. McCall said Biden's statements should end debate about the deal. "Allowing one of our nation's largest steel manufacturers to be purchased by a foreign-owned corporation leaves us vulnerable when it comes to meeting both our defense and critical infrastructure needs," he said in a statement. CFIUS has met with the parties to discuss the deal, a person familiar with the matter said. The Treasury Department, which leads CFIUS, did not immediately respond to a request for comment, and the White House declined to comment on whether Biden planned to use its powers to block the deal. According to a January filing, Nippon Steel has committed to undertaking "all actions required" to obtain CFIUS clearance and to pay U.S. Steel a $565 million breakup fee if it fails to do so. Art Hogan, chief market strategist at B Riley Wealth in New York, said there were always complications when foreign companies look to buy U.S.-based corporations but Nippon Steel had an uphill battle in particular due to timing. "In an election year, it will be a heavy lift to get all the stakeholders comfortable with the acquisition of a U.S. manufacturing icon," Hogan added. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/biden-say-us-steel-must-remain-domestically-owned-operated-2024-03-14/

2024-03-14 20:07

WASHINGTON, March 14 (Reuters) - The U.S. export credit agency on Thursday voted to approve a $500 million loan guarantee for an oil and gas drilling project in Bahrain, testing a U.S. climate pledge to stop backing projects that expand the use of fossil fuels. The board of directors at the Export-Import Bank of the United States (EXIM) approved the project after voting last month to notify Congress about potentially supporting the expansion of an oil and gas field in the Middle Eastern country with over 400 new oil wells and 30 gas wells. While EXIM's loan to Bapco Energies would be out of step with the Biden administration's pledge to stop public financing of fossil fuel projects overseas, according to Democratic lawmakers opposed to the loan, as well as environmental activists, the agency said the project includes measures intended to reduce greenhouse gas emissions. Bapco had signed on to the COP28 Oil and Gas Decarbonization Charter, which commits it to achieve net-zero operations by 2050 and end routine flaring by 2030. "This transaction will support thousands of U.S. jobs and play a crucial role in ensuring Bapco Energies is able to achieve its climate goals of enhanced grid interconnectivity, more efficiency, decarbonization, and investments in large-scale solar projects," EXIM President and Chair Reta Jo Lewis said in a statement. In a letter , opens new tab to EXIM's board members on Tuesday, Democratic lawmakers had pushed for a rejection of the loan guarantee. "We urge you to take EXIM's mandate to consider the environmental impacts of projects seriously, and to start by disapproving new funding for oil and gas drilling in Bahrain," the lawmakers, led by U.S. Senator Jeff Merkley, said in the letter. The U.S. was one of more than 30 countries that joined a pledge to end public financing of fossil fuel projects overseas at the COP26 climate conference in Glasgow in 2021. But the U.S., through its export agencies, has approved eight fossil fuel projects totaling more than $2 billion since it made that pledge. An environmental group filed a complaint in December with the Organisation for Economic Co-operation and Development over EXIM's oil and gas financing deals. EXIM is also weighing support of fossil fuel projects in Papua New Guinea and Guyana, with votes due later this year. U.S. oil giant Exxon is developing one of the world's biggest oil discoveries in Guyana. The Reuters Daily Briefing newsletter provides all the news you need to start your day. Sign up here. https://www.reuters.com/sustainability/us-exim-bank-vote-bahrain-oil-project-testing-us-climate-pledge-2024-03-14/

2024-03-14 19:54

HOUSTON, March 14 (Reuters) - Liquefied natural gas (LNG) exporter Venture Global LNG on Thursday delivered to U.S. regulators a proposed protective order seeking to keep documents on the construction of a Louisiana export facility confidential. The request will test the Federal Energy Regulatory Commission's (FERC) willingness to back a call by Venture Global LNG's customers to require the company to disclose details on the plant's startup and repairs. Venture Global has said it would not make the information available unless ordered to do so. FERC had given Venture Global five days to provide the proposed order that sets out a process for any use of its privileged information. Customers, including BP (BP.L) , opens new tab, Shell (SHEL.L) , opens new tab, Edison (EDNn.MI) , opens new tab, Repsol (REP.MC) , opens new tab, Galp , Unipec and Orlen (PKN.WA) , opens new tab, filed with the regulator to comment on the extension, or objected to the lack of access to the documents, saying they could not evaluate its request without viewing them. They have in the past accused Venture Global of selling billions of dollars of LNG since 2022 that should have been supplied under long-term contracts to them. The Arlington, Virginia-based company has exported 257 pre-commercial cargoes at prices well above the rates that other exporters charged, Shell said in its request to deny the extension. The company sold its LNG at an average of $48.8 million per cargo, or $29 million more per cargo than if the LNG was sold at the average of other U.S. exporters' prices, Shell estimated, using U.S. Department of Energy data. Venture Global said in the past none of the companies had requested access to any confidential filings on its Calcasieu Pass facility, and it had not been required to provide a protective order. "As Calcasieu Pass will explain in a separate filing, it opposes those requests," it told the commission. The Reuters Power Up newsletter provides everything you need to know about the global energy industry. Sign up here. https://www.reuters.com/business/energy/venture-global-lng-asks-us-energy-regulator-keep-documents-confidential-2024-03-14/