2024-03-12 18:25

MILAN, March 12 (Reuters) - Automaker Toyota Motor Corp (7203.T) , opens new tab became the most shorted large-cap stock by hedge funds in the Asia Pacific region in February, overtaking Takeda Pharmaceutical (4502.T) , opens new tab, a report from treasury management and securities finance platform Hazeltree showed on Tuesday. A short trade is a bet on a company's stock price falling. U.S. electric carmaker Tesla (TSLA.O) , opens new tab remained the most shorted stock in the Americas, while luxury group LVMH (LVMH.PA) , opens new tab was No.1 in the Europe, Middle East and Africa (EMEA) region for the sixth consecutive month, according to the report covering 15,000 stocks on data from around 700 funds. Several newcomers joined the ranks of top large-cap shorts in the Americas, including AI server maker Super Micro Computer (SMCI.O) , opens new tab, media group Comcast Corp (CMCSA.O) , opens new tab, and banks Capital One Financial Corp (COF.N) , opens new tab and Wells Fargo (WFC.N) , opens new tab, the report said. Turning to mid-caps, train maker Alstom (ALSO.PA) , opens new tab and chipmaker Wolfspeed Inc (WOLF.N) , opens new tab remained the most shorted securities in EMEA and the Americas, respectively, it said. In the Asia Pacific, electronics company Ibiden Co Ltd (4062.T) , opens new tab was the top mid-cap short in February, overtaking computer maker Daifuku Co (6383.T) , opens new tab, it added. (This story has been corrected to fix the description of Hazeltree in paragraph 1) Stay up to date with the latest news, trends and innovations that are driving the global automotive industry with the Reuters Auto File newsletter. Sign up here. https://www.reuters.com/business/autos-transportation/toyota-becomes-asias-most-shorted-large-cap-stock-hazeltree-2024-03-12/

2024-03-12 17:49

March 12 (Reuters) - A second straight month of stronger-than-expected inflation has effectively shut the door on the possibility of a Federal Reserve interest-rate cut before June, and makes back-to-back reductions after that look increasingly less likely. Gasoline and shelter prices drove the February consumer price index up 3.2% , opens new tab versus a year earlier, an acceleration from January's 3.1% increase. Underlying core inflation, excluding gas and food prices, slowed less than economists had forecast, and on a three-month and six-month basis actually gained traction. Those continued price pressures will not change what Fed policymakers do next week, when they are universally expected to leave the policy rate in the 5.25%-5.5% range where it has been since last July. But it means too little data might exist by their April 30-May 1 meeting to give them confidence that inflation is durably on a path toward the Fed's 2% goal, analysts say. Even by June, there may be insufficient data to justify more than a couple of rate cuts all year. Tuesday's inflation report "is an ugly read that will do nothing to sooth nerves" at the Fed, wrote BMO economist Scott Anderson. "Clearly, restrictive monetary policy has not yet fully done its work and a patient and slightly hawkish Fed must remain in place for the monetary medicine to fully take effect." Core services inflation excluding rents, a measure to which Fed Chair Jerome Powell has said he pays close attention, rose 0.5% in February from a month earlier, and over the past three months is up on an annualized basis by 6.8%, compared with the 6.7% pace in January. Those sticky-hot readings will add to Fed caution on the inflation outlook, said Nationwide's Kathy Bostjancic. "While we thought a May cut was on the table, it is increasingly likely that the FOMC waits at least until June to start easing monetary policy," she said, referring to the Fed's policy-setting Federal Open Market Committee. Policymakers will release fresh quarterly projections at next week's meeting, and still-too-high inflation raises the possibility that those forecasts will signal just two quarter-point interest rate cuts this year, compared with the three seen in December. Just two of the 19 Fed policymakers would need to shift their rate-path views to deliver such a change. "Clearly the inflation data are running hotter than FOMC participants were generally thinking at the time of the December FOMC meeting," wrote economists at LHMeyer. Still, even if March projections show a majority of Fed policymakers see only two or fewer rate cuts this year, that "wouldn't necessarily preclude a first cut in June," they wrote. Traders of futures contracts that settle to the Fed's policy rate are pricing about a one-in-seven chance of a first rate cut in May, and a similar chance that the Fed will wait until July to reduce rates. They continue to see the main chance as June, pricing in about a 70% chance of a rate cut by then. After the inflation data, traders pared their view of how much the Fed will cut rates by year-end, with pricing showing they see four quarter-point rate cuts in all as only a bit more likely than just three. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/traders-keep-bets-june-first-fed-rate-cut-after-inflation-data-2024-03-12/

2024-03-12 17:19

March 12 (Reuters) - A former Tallgrass Energy board member and his friends will pay $2.2 million to settle insider trading charges related to a Blackstone-led (BX.N) , opens new tab $3.03 billion buyout offer for the oil pipeline operator in 2019, the U.S. SEC said on Tuesday. The U.S. Securities and Exchange Commission (SEC) announced the insider trading charges and the settlement in a statement. The SEC alleged that Roy Cook, a former board member of Tallgrass Energy, and four of his friends traded on nonpublic information before the Blackstone-led group's buyout offer was announced in August 2019. Tallgrass shares jumped 36% after the deal was made public. Cook and his friends agreed to pay a civil penalty and disgorge their "illicit trading profits" without admitting or denying the allegations, the SEC said. Terms of the Blackstone deal, which valued Tallgrass at $6.3 billion, were struck ahead of a collapse in energy prices in 2020 when global fuel demand plummeted due to COVID-19 pandemic-related business shutdowns. The deal closed at that valuation making it a rare case of a pre-market crash deal going ahead without a price cut. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/former-tallgrass-board-member-friends-settle-insider-trading-charges-2024-03-12/

2024-03-12 16:30

FRANKFURT, March 12 (Reuters) - The commercial real estate sector is "particularly vulnerable" to the recent rise in interest rates, resulting in more loans going unpaid, European Central Bank supervisor Claudia Buch said on Tuesday. "One sector which is particularly vulnerable to higher interest rates is commercial real estate," Buch said in a speech. "A little less than 4% of these loans were classified as non-performing – above the average...for loans overall." Get a look at the day ahead in European and global markets with the Morning Bid Europe newsletter. Sign up here. https://www.reuters.com/markets/europe/ecbs-buch-warns-again-about-commercial-property-2024-03-12/

2024-03-12 16:10

NEW YORK, March 12 (Reuters) - Goldman Sachs Asset Management, a unit of Goldman Sachs Group (GS.N) , opens new tab, aims to expand its private credit portfolio to $300 billion in five years from the current $130 billion, a senior executive said, laying out an aggressive expansion plan. "It's a huge opportunity," Marc Nachmann, Goldman's global head of asset and wealth management, told Reuters in an interview. Goldman's private credit aspirations are larger than those of its peers, including Morgan Stanley (MS.N) , opens new tab which aims to double its private credit portfolio to $50 billion in the medium term as it gathers funds from large investors. JPMorgan Chase (JPM.N) , opens new tab has earmarked at least $10 billion for private credit, and Wells Fargo (WFC.N) , opens new tab and Citigroup (C.N) , opens new tab have set up partnerships to get deeper into the market. Of the $40 billion to $50 billion Goldman plans to raise for alternative investments this year, at least a third will be dedicated to financing private credit strategies, he said. Non-bank lenders, or shadow banks, have expanded their lending in recent years as they faced fewer regulatory hurdles than traditional lenders. Wall Street banks have also joined forces with private equity giants and asset managers to expand their private credit businesses. Goldman Sachs has been active in private credit for almost three decades. The asset management arm has a variety of strategies for private credit for different tiers of investors in companies who get paid back depending on the type of debt or equity they hold, Nachmann said. ENGINE OF GROWTH Goldman Sachs has touted asset and wealth management as a growth area as it stepped back from an ill-fated foray into consumer banking. Its investment banking and trading division accounts for about 70% of the firm's revenue. Nachmann, a three-decade Goldman veteran, was put in charge of asset and wealth management after CEO David Solomon merged the businesses in 2022. Since then, Goldman Sachs Asset Management (GSAM) has lost some high-profile managers, including former chief investment officer Julian Salisbury, who joined investment firm Sixth Street. Katie Koch departed after two decades to become CEO of asset manager TCW Group. While staff turnover is expected when businesses are brought together, morale is still strong, Nachmann said. "People are very much focused on executing our strategy around the two big businesses and are very comfortable around the direction of the firm," he said. The bank is hiring across asset and wealth management, Nachmann said. RETURNS Nachmann aims to improve GSAM's return on equity to a mid-teens percentage in the medium term by trimming the bank's own investments held on its balance sheet, which have been a drag on returns. The legacy investments fell to $16.3 billion at the end of the fourth quarter 2023 from about $30 billion at the end of 2022, faster than an internal target. "We will keep selling down over the next three to four years," Nachmann said. "We will get to a place where it is not material from a financial impact." He also sees opportunities to increase the $1 trillion wealth management business, focusing on ultra-high-net-worth clients in overseas markets in Europe and Asia by adding advisers and boosting lending to private bank clients. Currently, 80% of Goldman's wealth business is in the U.S. "We believe we can double the business internationally over the next few years," he said. Goldman's lending in wealth management as a percentage of its wealth client assets is 3%, well below an average of 9% among its peers, according to a report by Autonomous Research. "We can do more there - lending to wealthy people is a good business," Nachmann said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/business/finance/goldman-sachs-seeks-expand-private-credit-portfolio-300-billion-five-years-2024-03-12/

2024-03-12 14:47

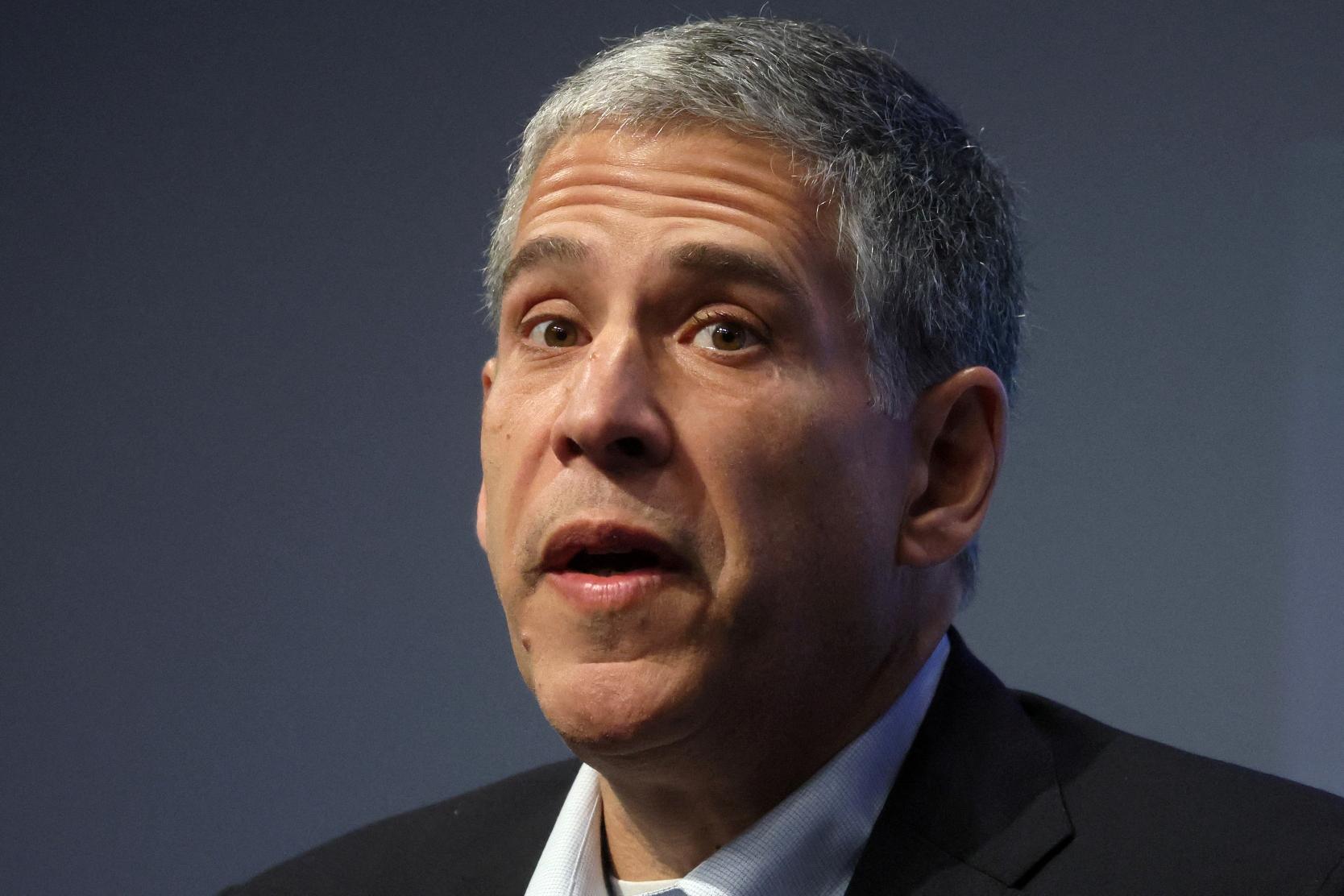

BOCA RATON, Florida/WASHINGTON, March 12 (Reuters) - The U.S. Commodity Futures Trading Commission plans to publish a draft rule by summer for comments about vertically integrated models in which a broker, a clearinghouse and an exchange are housed under a holding company, its chairman said Tuesday. The rule should address "the opportunity for there to be a vertically integrated stack, but also have sufficient amount of conditions that you would have the entity walled off from other entities," Chairman Rostin Behnam told journalists at the Futures International Association conference in Boca Raton, Florida. In December, the CFTC voted to approve a plan from the Chicago cryptocurrency derivatives exchange and brokerage Bitnomial to also act as its own registered clearinghouse. It marked the first time the commodities regulator had voted to allow a vertically integrated market structure. Behnam said integrated structures have become more common, so much so that the CFTC plans to publish a draft rule by summer, open for comments and then finalize it by this time next year. "It's changed from being a one-off to a trend. And when it became a trend, I made the decision, 'OK, this is going to demand or require a policy,'" the CFTC chairman said. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/commodities/us-cftc-publish-rule-vertically-integrated-models-by-summer-says-chair-2024-03-12/