2024-03-12 14:05

WASHINGTON, March 12 (Reuters) - A leading U.S. bank regulator said Tuesday that the government will be "open-minded" about making changes to a contentious plan to raise large bank capital requirements. Michael Hsu, the acting Comptroller of the Currency, said regulators are carefully considering numerous comments critical of the so-called "Basel III endgame" proposal, which the industry has decried as overly burdensome. At the same time, he defended robust capital requirements for the largest banks, saying it is critical to ensure they can withstand shocks. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/top-bank-regulator-says-agencies-open-minded-about-capital-hike-tweaks-2024-03-12/

2024-03-12 14:01

BENGALURU, March 12 (Reuters) - A key indicator of an oncoming recession implied by the U.S. bond market is no longer reliable, according to nearly two-thirds of strategists polled by Reuters. A persistent negative spread between 2-year and 10-year U.S. Treasury yields is a key input into many analysts' models as a reliable predictor of recession, having occurred in the lead-up to nearly all recessions since 1955. It offered a false signal just once during that time. The yield curve has been inverted for more than 20 months now - currently by 46 basis points - but most of the recent discussion in markets has been about the probability of no recession or even the risk of a re-acceleration in economic growth. Nearly two-thirds of strategists in a March 6-12 Reuters poll of bond market experts, 22 of 34, said the yield curve's predictive power is not what it once was. "I feel the inverted yield curve is just not as good an indicator as before," said Zhiwei Ren, portfolio manager at Penn Mutual Asset Management. "If you have these two things going on together - insatiable demand for the long-end from real money like pension funds and the Fed keeping front-end rates higher because of the resilience of the economy - the curve will stay inverted for a while." Since the 2007-2008 global financial crisis, the Federal Reserve has on multiple occasions conducted aggressive buying of Treasury securities as part of is stimulus program, meaning it owns a much larger proportion of the market in its own portfolio than it did before. Many observers have argued over recent years this ownership is distorting market pricing, although strategists interviewed to discuss the latest poll results did not mention suppressed yields via "quantitative easing" as a reason. "The difficulty this time is that the policy rate is more than double the fed (funds rate's) longer-run equilibrium, and it's the magnitude and speed of rate hikes that have contributed to the inversion," said Steve Major, global head of fixed income research at HSBC. In the meantime, financial markets have aggressively scaled back bets this year on when the Fed will first cut interest rates, from March to May and now to June. This has led several strategists to ramp up 12-month forecasts for the rate-sensitive 2-year Treasury note yield by a median 21 basis higher than one month ago to 3.68%. The benchmark 10-year Treasury note yield , currently at 4.10%, too was seen falling only a modest 19 basis points to 3.91% by the end of August, and to 3.75% in a year, according to 60 strategists polled. "Disinverting" the curve requires these short-term yields to fall much more sharply than longer-term ones, or for longer-term yields to rise. In addition to a decision on when to cut, the Fed will soon have to judge when to slow and then finally stop unloading some of the securities it purchased through its massive "quantitative tightening" program. Asked when the Fed would start slowing, or tapering, the pace of shrinkage of its balance sheet, 14 of 26 respondents said in June. Other responses ranged from March to December. Seventeen of 26 said the Fed would conclude its tapering program either in the first quarter of 2025 or later. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/inverted-yield-curve-no-longer-reliable-recession-flag-strategists-say-2024-03-12/

2024-03-12 13:59

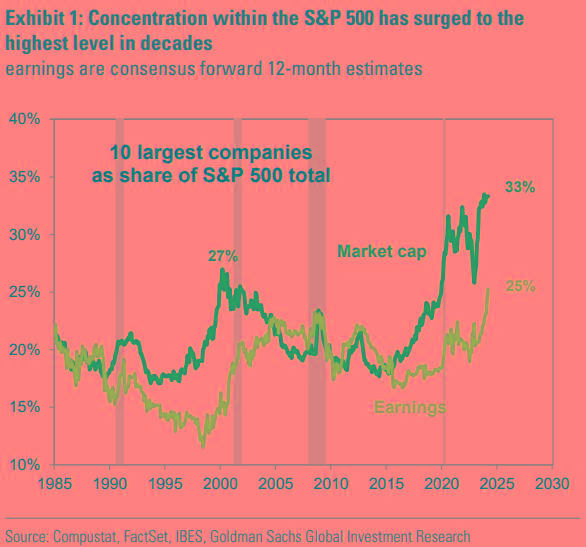

ORLANDO, Florida, March 13 (Reuters) - By some measures the U.S. stock market has not been this top-heavy in over 100 years and has just had one of its strongest rallies in decades, giving understandable rise to fears that a potentially large correction is imminent. History suggests these fears may be overdone. In the year following previous periods of extreme concentration, the S&P 500 (.SPX) , opens new tab rose more often than not, while rallies like the one just recorded over the past four months are always followed by 12 months of double-digit percentage returns. Of course, no two macro or market environments are the same. And if the post-2008 and post-pandemic world has taught investors anything, it is that past performance is definitely no guarantee of future outcomes. Still, they can provide useful guidance. Concentration within the U.S. equity market has not been this high in decades, with the 10 largest U.S. stocks now accounting for 33% of S&P 500 market cap. A narrower measure constructed by analysts at Goldman Sachs shows that market concentration has never been higher. S&P 500 returns in the 12 months after the 1973 and 2000 crashes fell 23% and 18%, respectively. But over seven periods of extreme concentration in the past century, including 1932, 1939, 1964, 2009 and 2020, average returns were 23% higher in the 12 months after. "Historical episodes of elevated concentration were followed by S&P 500 rallies more often than corrections," notes Ben Snider, senior strategist at Goldman Sachs. Comparisons with 2000 abound, but there are reasons to be optimistic. Snider calculates that the median valuation of today's top-10 stock is substantially lower than the comparable median in 2000, and the median top-10 market cap constituent is nearly three times more profitable than it was in 2000 or 1973. The average S&P 500 stock is also relatively cheap. Analysts at Truist Advisory Services estimate that the S&P 500 Equal Weight Index is trading at a 20% discount to the traditional S&P 500, which is dominated by these mega tech and growth companies. They say the equal-weighted index is showing signs of stabilizing after a period of underperformance, and reckon adding exposure to the equal-weighted index is one way to diversify within large caps. Smaller caps are trading at an even deeper discount and are now near "extreme undervaluation" territory. If earnings momentum picks up, this is another sector in prime position to share the load. SIT TIGHT Market concentration in itself is not a sufficient trigger for a large drawdown. Nor is a long and steep rally. By some measures, U.S. stocks are enjoying one of their strongest rallies in over 50 years and one of the strongest on record. The S&P 500 just rose 16 out of 18 weeks, a feat not achieved since 1971, gaining almost 25% in the process. A period of consolidation or a near-term pullback would almost be expected, and Nvidia (NVDA.O) , opens new tab losing more than 10% of its value since Friday may be the first sign that one is underway. Analysts at Deutsche Bank say there have been five other episodes since the World War Two where the S&P 500 rose 21.5% or more in four months. Four were when the economy was emerging from recession, and one was during the dotcom bubble. "So, you probably only need to worry if you think tech is in a bubble or if the recession has merely been postponed," wrote Deutsche's Jim Reid last week. "A relentless and aggressive rally is not in itself enough to justify a big correction." But what if investors do take fright and start selling? There is no template for what a drawdown looks like and history shows they come in all shapes and sizes. Recovery periods, the gap between the market's high-water mark and when it is next breached, vary wildly too. The largest drawdown was 1929-1932 when stocks plunged 79% in real terms and full recovery, including reinvested income, wasn't achieved until February 1945, more than 15 years later. The full drawdown and recovery from the dotcom crash of 52% in real terms lasted 7-1/2 years, while the market recovered its 35% real terms pandemic slump in 2020 within five months. Investors' drawdown tolerance depends not only on their risk tolerance but their investment horizon - economic, financial and political crises come and go, but in the long run stocks tend to rise. If you have the stomach and patience to ride out the volatility, sitting tight is perhaps the best policy. "The largest drawdowns, like 2008, 2020, or even 2022, were usually sparked by a major shock. But we would always caution against panic and selling, especially for longer-term clients like pensions, retirement accounts, endowments," said Olaolu Aganga, U.S. chief investment officer at Mercer. (The opinions expressed here are those of the author, a columnist for Reuters) Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/peak-us-stock-concentration-doesnt-mean-steep-drawdown-2024-03-12/

2024-03-12 13:27

March 12 (Reuters) - Digital asset manager Grayscale Investments on Tuesday filed for a spin-off of its spot bitcoin exchange-traded fund (ETF), the Grayscale Bitcoin Trust (GBTC) (GBTC.P) , opens new tab. The spin-off is part of a bid to offer investors lower-fee exposure to bitcoin, according to a person familiar with the matter. GBTC - which in January received approval to convert from a trust to an ETF - currently has higher fees than its peers, one of the key factors in drawing investors to rival ETFs, Reuters has reported. Grayscale filed to list shares of a new investment product, the Grayscale Bitcoin Mini Trust, which will receive a certain amount of bitcoin held by GBTC. In exchange, current GBTC shareholders will get stock in the Mini Trust, the company said. Since January, GBTC has seen capital outflows of $11.05 billion, according to data from crypto research firm BitMEX Research, even as bitcoin climbed to an all-time high and competitors recorded inflows over the same period. Grayscale is yet to determine the fees the Mini Trust will charge, according to the filing. Following the spin-off, both GBTC and the Mini Trust will operate independently, it said. The company's landmark victory in a legal fight with the Securities and Exchange Commission (SEC) led to the approval of spot bitcoin ETFs - investment vehicles that allow shareholders to gain exposure to bitcoin without directly holding it - in January. Since the approval, competitors BlackRock's iShares Bitcoin ETF (IBIT.O) , opens new tab and Fidelity Wise Origin Bitcoin Fund have recorded inflows of $10.59 billion and $6.37 billion, respectively. The ETF euphoria and hopes that the Federal Reserve will soon cut interest rates have propelled bitcoin, the world's biggest cryptocurrency, above $72,000. Bitcoin was last trading at $72,095, down 0.09% on the day. The Technology Roundup newsletter brings the latest news and trends straight to your inbox. Sign up here. https://www.reuters.com/technology/grayscale-pursues-spin-off-spot-bitcoin-etf-2024-03-12/

2024-03-12 13:24

NEW YORK, March 12 (Reuters) - U.S. consumer prices increased solidly in February amid higher costs for gasoline and shelter, suggesting some stickiness in inflation that could delay an anticipated June interest rate cut from Federal Reserve. The consumer price index (CPI) rose 0.4% last month after climbing 0.3% in January, the Labor Department said on Tuesday. Gasoline and shelter, which includes rents, contributed more than 60% to the monthly increase in the CPI. In the 12 months through February, the CPI increased 3.2%, after advancing 3.1% in January. Economists polled by Reuters had forecast the CPI gaining 0.4% on the month and increasing 3.1% year-on-year. read more MARKET REACTION: STOCKS: U.S. stock index futures extended a gain to up 0.45% BONDS: U.S. Treasury yields were mixed after the data, with 2-year note yield last a tick lower at 4.548%, and the 10-year yield up slightly at 4.112% FOREX: The dollar index added a bit and was 0.136% firmer COMMENTS: MELISSA BROWN, MANAGING DIRECTOR, APPLIED RESEARCH, SIMCORP, NEW YORK “Inflation was a little hotter than expected, particularly core inflation which is still significantly above the 2% target. The market seems to be shrugging it off which is a little surprising.” “We’ve got a trade-off. If the Fed has to cut aggressively it’s because the economy isn’t doing so well. So the flip side of that is that the economy is strong. We may still have inflation but .. maybe the market is a little more focused on the idea that a soft landing is looking less likely and that we’re looking at a no landing scenario where growth slows down but we wouldn’t see a recession.” “With rates higher than they’ve been in years we’ve still managed to have a strong economy. People could be realizing that higher than expected inflation isn’t hurting the economy and corporate profits … we seem to be pretty resilient to these numbers that are somewhat high.” PHILLIP COLMAR, GLOBAL STRATEGIST, MRB PARTNERS, NEW YORK “Sticky inflation seems to be very much intact at this point. “This is problematic for the bond market and the Fed’s view that inflation's ultimately coming down to that 2% target. “The underlying trend is suggesting that sticky inflation is the theme, which is problematic. The Fed was thinking that we would end up with subdued growth, that we build enough slack in the economy to bring down inflation. “But the output gap indicates there's no slack in the economy. That's not a good sign when you're not going to grow below trend and you have no slack in the economy, that signals sticking inflation.” EUGENIO ALEMAN, CHIEF ECONOMIST, RAYMOND JAMES, FLORIDA "Markets seem to be reacting well, it is not a big jump. The year over year rate for the core continues to move down, which means that things are improving, which is good news for the Federal Reserve. That is the reason why markets seem to be taking it in stride." "I think March’s inflation number is probably going to be much better. If core prices is prices continue to go down, even if the headline number doesn't come down as fast, they (Fed) can start moving, maybe by mid-year." KIM FORREST, CHIEF INVESTMENT OFFICER, BOKEH CAPITAL PARTNERS, PITTSBURGH "Came in a little hotter than anticipated and because this is the second month in a row, investors are going to take this as a trend, not just a data point." "The increase wasn't (that) extreme and these are preliminary numbers .. they're close enough to what was anticipated and I think investors are willing to give it another month." "If we listen to Jay Powell last week, he said he's data driven ... he did say that they feel this is the peak interest rate of this cycle and that is probably what's keeping a cap on investors' expectations today where they're not selling off and getting all freaked out." BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT, MENOMONEE FALLS, WISCONSIN “While energy and transportation services were hot, food, new vehicles, and medical care services were not. Depending on who you ask, this report isn’t too shocking. Powell’s super-core inflation decelerated from the super-hot January reading, so that’s reassuring. Inflation has been concentrated mostly in the South with that region’s inflation coming in at 3.7% while the Northeast has had inflation of 2.4%. The Fed wasn’t planning on cutting next week anyways, so this report doesn’t change the discussion they’ll have around the table.” ROBERT PAVLIK, SENIOR PORTFOLIO MANAGER, DAKOTA WEALTH, FAIRFIELD, CONNECTICUT "Inflation is still sticky. It's kind of what we've all been experiencing, higher prices not really coming down that much, but not really increasing that much either, just essentially being where they are and that's sort of the world we live in and the return to 2% inflation doesn't seem to be coming around any time soon. So, expectations of 2% inflation are really unrealistic." "We're on a glide path to a June rate cut and I don't think there's any kind of change to that yet. I'm still expecting three rate cuts sometime this year beginning in that June timeframe." RUSSELL PRICE, CHIEF ECONOMIST, AMERIPRISE FINANCIAL SERVICES INC, TROY, MICHIGAN “The inflation situation is going to likely drag out for several more months, thus possibly keeping the first Fed rate cut still on the sidelines for a bit longer than expected. “I was looking for June for the first rate cut to be the most likely and I still think that that might be the most likely. “We'll have to see another month or two of the data to see if we truly do get a deceleration in some of the core costs. It's still a wait and see situation. There are still components that are running hot that need to decelerate.” Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/sticky-feb-us-cpi-inflation-raises-questions-about-june-fed-cut-2024-03-12/

2024-03-12 13:08

Consumer prices increase 0.4% in February Gasoline, shelter account for over 60% of rise in CPI Core CPI gains 0.4%; up 3.8% on year-on-year basis WASHINGTON, March 12 (Reuters) - U.S. consumer prices increased solidly in February amid higher costs for gasoline and shelter, suggesting some stickiness in inflation that further diminishes the chances of a Federal Reserve interest rate cut before June. Despite the second straight month of firmer inflation readings reported by the Labor Department on Tuesday, the composition of the report remained consistent with a disinflationary trend. Inflation-weary Americans got some relief from their supermarket and medical bills. Though shelter costs helped to lift prices last month, housing inflation slowed after surging in January. Some economists said difficulties adjusting the data for price increases at the start of the year had injected a bit of "noise" into the CPI report. U.S. central bank officials, including Fed Chair Jerome Powell, have indicated they are in no rush to start lowering borrowing costs. The stubbornly higher cost of living is one of the key issues in the Nov. 5 U.S. presidential election. "We still believe the disinflation case is intact and that seasonal patterns at the start of the year have pushed inflation higher, but the Fed was looking for greater confidence that inflation was sustainably headed to 2%, and that confidence cannot be found in this report," said Conrad DeQuadros, senior economic advisor at Brean Capital. The consumer price index rose 0.4% last month after climbing 0.3% in January, the Labor Department's Bureau of Labor Statistics (BLS) said. Gasoline prices rebounded 3.8% after declining 3.3% in January. Shelter, which includes rents, rose 0.4% after advancing 0.6% in the prior month. These two categories contributed more than 60% to the monthly increase in the CPI. Food prices were unchanged after rising 0.4% in January amid decreases in the costs of dairy products, fruits and vegetables as well as nonalcoholic beverages. But prices for cereals and bakery products rose while meat, fish and eggs were slightly more expensive. In the 12 months through February, the CPI increased 3.2%, after advancing 3.1% in January. Economists polled by Reuters had forecast the CPI would gain 0.4% on the month and increase 3.1% on a year-on-year basis. The annual increase in consumer prices has slowed from a peak of 9.1% in June 2022, but progress has stalled in recent months. President Joe Biden used the report to drum up support for a $7.3 trillion budget unveiled on Monday. "We have more to do to lower costs and give the middle class a fair shot," Biden said in a statement. "The budget I put forward yesterday would take on Big Pharma to lower prescription drug costs." Financial markets continue to expect the Fed will cut rates in June. Since March 2022, the U.S central bank has raised its policy rate by 525 basis points to the current 5.25%-5.50% range. Stocks on Wall Street were trading higher on Tuesday. The dollar rose against a basket of currencies. U.S. Treasury prices fell. RESIDUAL SEASONALITY Inflation picked up in January, and was largely blamed on the price hikes by service providers at the beginning of the year, which economists said were not fully addressed by the model used by the government to strip out seasonal fluctuations from the data. There was also a jump in owners' equivalent rent (OER), a measure of the amount homeowners would pay to rent or would earn from renting their property, which diverged from rents. That was partly the result of some methodology changes by the government. The BLS last week held a webinar to discuss the underlying methodology related to the January OER and rent data. Excluding the volatile food and energy components, the CPI increased 0.4% in February after rising by the same margin in January. Shelter was also the main driver of the so-called core CPI. Rents increased 0.5% after gaining 0.4% in January. But OER climbed 0.4% after surging 0.6% in the prior month. The latest data suggested that the divergence between the rents and OER measures, which had raised concerns about the outlook for shelter inflation, was a one-off event. The cost of healthcare was unchanged after rising 0.5% in the prior month. Hospital services prices decreased 0.6%, but the cost of dental services increased 0.4%. Airline fares accelerated 3.6% while motor vehicle insurance cost 0.9% more. Services excluding energy increased 0.5% after shooting up 0.7% in January. The rise in the so-called super core services excluding shelter slowed to 0.5% from 0.8% in the prior month. Goods prices rebounded by 0.4% after falling 0.3% in January. They were boosted by increases in the prices of apparel. Used cars and trucks prices jumped 0.5%. Core goods prices rose 0.1%, the first increase since last May, after falling 0.3% in January. Economists were split on whether the goods disinflation trend that helped to lower inflation last year had run its course. "The Fed has said they need services inflation to moderate further in case goods deflation has ended. The February CPI report has this flavor," said Stephen Juneau, an economist at Bank of America Securities. "We read developments on February inflation as continuing to support our outlook for a rate cut cycle that starts in June." In the 12 months through February, the core CPI advanced 3.8%. That was the smallest year-on-year increase since May 2021 and followed a 3.9% rise in January. A separate report from the Atlanta Fed showed its sticky-price CPI, a weighted basket of items that change price relatively slowly, increased 4.0% on an annualized basis in February after rising 6.7% in January. The U.S. central bank tracks the personal consumption expenditures price indexes for its 2% inflation target. These measures are running at tamer rates than the CPI. Though job growth accelerated in February, the unemployment rate increased to a two-year high of 3.9% and annual wage inflation moderated a bit. Fewer workers are job-hopping, which over time could help to slow wage gains, the main driver of services inflation. Based on the CPI data, economists estimated that the core PCE price index rose 0.2% in February after increasing 0.4% in January. That would lower the increase in core inflation to 2.7% from 2.8% in January. "Good news is likely coming," said Ryan Sweet, chief U.S. economist at Oxford Economics. Get a look at the day ahead in U.S. and global markets with the Morning Bid U.S. newsletter. Sign up here. https://www.reuters.com/markets/us/gasoline-shelter-costs-lift-us-consumer-prices-february-2024-03-12/