2024-03-11 23:04

HOUSTON, March 11 (Reuters) - Chinese state-owned energy trader Unipec on Monday asked U.S. regulators for a chance to intervene in a request from liquefied natural gas (LNG) developer Venture Global LNG to extend the commissioning period for its Louisiana export project. The request comes amid an ongoing dispute between Venture Global and customers of its Calcasieu Pass, Louisiana, facility, who say they have lost billions of dollars in profit from undelivered cargoes under long-term contracts. Venture Global's long-term customers, including Unipec, have not received contracted cargoes of LNG because the plant has been in commissioning stage, in which it prepares for commercial operation, for almost two years. At the same time Venture Global has sold spot cargoes on the international market, raking in billions of dollars in revenue. BP (BP.L) , opens new tab, Shell (SHEL.L) , opens new tab, Repsol (REP.MC) , opens new tab, Edison (EDNn.MI) , opens new tab and Orlen (PKN.WA) , opens new tab earlier opposed an extension of the commissioning period or asked for an opportunity to view confidential documents on the plant's startup. Unipec said it missed a March 8 deadline to intervene and asked the Federal Energy Regulatory Commission (FERC) for additional time, citing an administrative oversight. It holds two contracts with Venture Global LNG. Venture Global LNG has said its contracts allow it to sell cargoes while the plant is being commissioned. FERC has stayed out of the controversy. On Friday, Shell asked regulators to deny Venture Global LNG's request for an extension, calling it moot because the facility has been operating above its capacity for more than a year while in the commissioning process. Arlington, Virginia-based Venture Global has exported 257 pre-commercial cargoes through December, 156 more than the six other LNG export facilities combined since 2016, Shell said in its filing to FERC. Last year, Venture Global sold its gas for an average of $48.8 million per cargo, or $29 million more per cargo than if the LNG was sold at the average of other U.S. exporters' prices, Shell estimated, using U.S. Department of Energy data. https://www.reuters.com/business/energy/chinas-unipec-wants-say-venture-global-lngs-extension-request-2024-03-11/

2024-03-11 22:08

NAPERVILLE, Illinois, March 11 (Reuters) - Ukraine, particularly in the last few months, has been exporting much more grain than anyone expected despite more than two years of war with neighboring Russia. This, combined with two bumper Russian wheat crops, has led to an enormous surplus of Black Sea grain shipments over the last two seasons compared with what was initially predicted, a surplus that could easily replace entire export programs of other top suppliers. Ukraine’s recent success has been limiting for traditional grain exporters like the United States, despite a boost in U.S. supplies versus last year. The U.S. Department of Agriculture on Friday raised Ukraine’s 2023-24 wheat exports for a fifth consecutive month and corn exports rose for a second straight month. Based on the estimate history, the expanding export pegs are linked with better-than-expected shipment performance and not bigger crops. Ukraine has been successfully operating its own Black Sea shipment corridor since August after Russia quit the original initiative in July, despite a significant number of Russian attacks on Ukrainian port infrastructure since then. Kyiv reported record February export volumes for all goods. GROWING BUT PROPORTIONAL TARGETS USDA’s combined 2023-24 export estimates for Ukraine corn and wheat have risen 35% (10.5 million metric tons) since August, though production is up just 9% (4.4 million tons). This is based on a return to near-normal export volumes versus output, suggesting Ukraine’s export system has somewhat re-regulated. Ukraine produces significantly more grain that it uses domestically, so much of it goes to exports, which is a huge moneymaker for the country. In the five marketing years prior to the war, Ukraine exported an average of 79% of its annual corn crop and 67% of wheat. Those shares fell far below normal in 2021-22, the first year of war disruption, then they surged well above typical levels in 2022-23 as shipments thrived but crops were much smaller. USDA’s 2023-24 corn and wheat estimates suggest respective export-to-output ratios of 83% and 68%, though they had been pegged as low as 68% and 49% within the last few months. Russia is set to export a post-Soviet era record 56% of its 2023-24 wheat crop, up from the five-year average of 48%. The United States is seen exporting just 39% of its wheat crop this year versus an average of 50%, reflecting its recent loss in global market share. TONS MORE GRAIN Across the recent two marketing years, major Black Sea grain exports are set to outperform original estimates by a combined 53 million tons (2.025 billion bushels). These days, that amounts to more than 2.5 years’ worth of wheat exports out of the United States, former top wheat supplier. That combined figure is derived by taking USDA’s initial projections for Ukraine corn and wheat and Russia wheat exports for both 2022-23 and 2023-24 and comparing them with the latest published figures. Doing the same for production shows original ideas over the two marketing years were 44 million tons (1.65 billion bushels) too low. The entire U.S. wheat harvest in 2023 totaled 49.3 million tons. One-third of the export surplus comes from Ukraine’s 2022-23 corn exports, which tripled from the original estimate. Bigger-than-expected production helped in Ukraine, as the last two corn and wheat crops combined were nearly 22 million tons better than first predicted, though Ukraine’s combined grain export potential was underestimated to a larger degree, by about 39 million tons. The opposite was true in Russia, as the last two wheat crops were a total 22 million tons larger than the initial pegs, though exports are seen larger by only 14 million tons. Grain and other agricultural exports are considerably more vital to Ukraine’s economy relative to Russia, hence Kyiv’s urgency to keep the critical deep-sea ports online. By value, corn, wheat and seed oils accounted for nearly 32% of Ukraine’s total calendar-year 2022 exports. Adding barley, sunflowerseed, soybeans and rapeseed brings the share to 41%, up from 31% in 2021. For Russia, the same commodities, which encompass the country’s largest non-chemical agricultural exports, accounted for between 2% and 4% of all exported value in 2021 and 2022. Karen Braun is a market analyst for Reuters. Views expressed above are her own. https://www.reuters.com/markets/commodities/black-sea-grain-exports-beating-early-market-ideas-by-substantial-degree-braun-2024-03-11/

2024-03-11 21:48

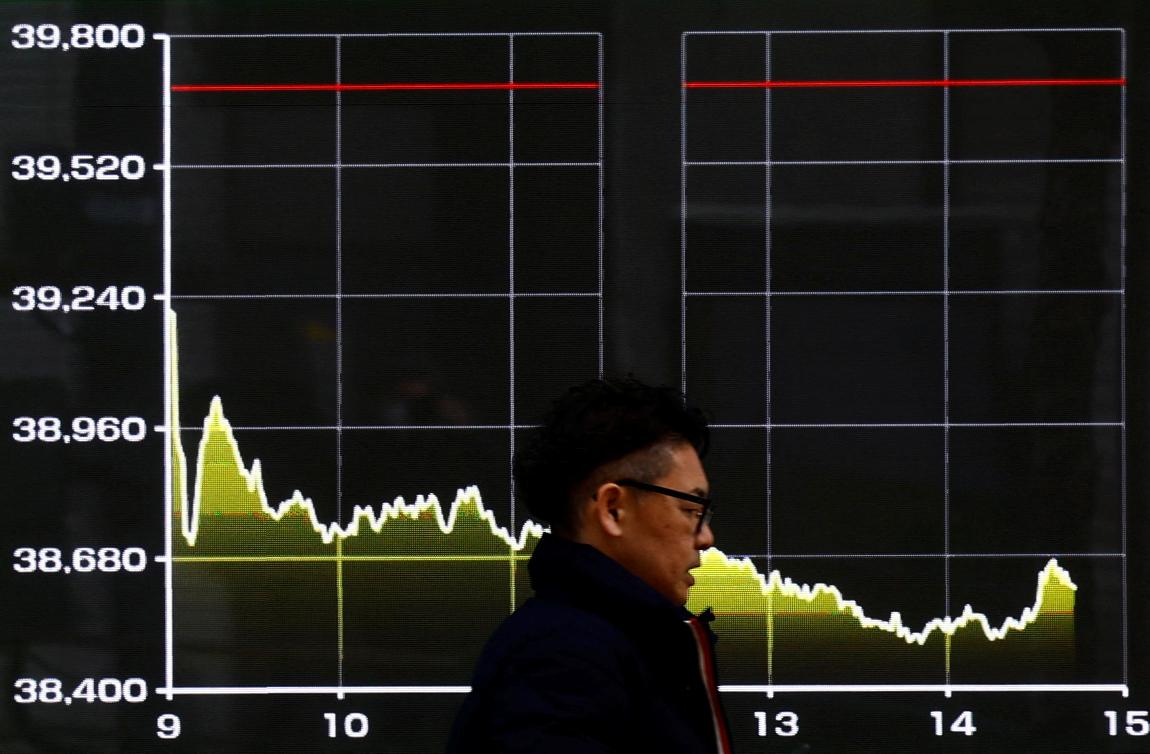

March 12 (Reuters) - A look at the day ahead in Asian markets. With global markets gently easing back from recent highs ahead of U.S. inflation data on Tuesday, Asian markets are unlikely to swing too far in either direction, although the Indian rupee and South Korean won could be exceptions to that rule. Indian inflation and Bank of Korea meeting minutes top the regional economic calendar on Tuesday, which also includes Philippine trade and Malaysian industrial production figures, and Australian business confidence. Japan's top financial diplomat Masato Kanda is scheduled to speak too and as one of the country's top voices on exchange rates, anything he says on the yen will be listened to attentively. The yen has recovered from historically low levels recently, back in line with what Kanda and others might consider 'fundamentals' - it rose 2% against the dollar last week, its biggest rise since July. This helped drive the Nikkei's 2.2% slide on Monday, its biggest loss since October. Having reached a record high above 40,000 points last week, Japan's benchmark index was always vulnerable to a correction. That may have more to run as speculation intensifies that the Bank of Japan is about to make a landmark shift away from its ultra-loose policy. The BOJ said it made no purchases of exchange-traded funds on Monday despite the slide in Japanese stocks, stoking that speculation even further. The broader correction in Asian equities on Monday was much shallower, however, thanks to a solid rise in China, and Wall Street's decline was mild too. That said, the Nasdaq was again the biggest decliner of the three major U.S. indices, and after sliding 5.5% on Friday market darling Nvidia fell another 2%. Is risk appetite beginning to crumble? Perhaps, although bitcoin smashing through $70,000 to a record high $72,910 on Monday would suggest otherwise. In China, authorities have asked banks to enhance financing support for state-backed China Vanke and called on creditors to consider private debt maturity extension, in a rare intervention from central government to help an embattled property firm. There's a long way to go but this news, exclusively reported by Reuters, could help bolster confidence that the property sector crisis has reached its nadir. Elsewhere in Asia on Tuesday, Indian inflation figures are expected to show annual inflation cooled in February to a four-month low of 5.0%. Despite the easing, inflation has remained above the 4% mid-point of the central bank's tolerance band of 2%-6% since September 2019. The rupee has been one of Asia's best-performing currencies this year, but from a low base - it is still languishing near its weakest ever levels against the dollar. Here are key developments that could provide more direction to markets on Tuesday: - India consumer inflation (February) - Bank of Korea minutes - U.S. consumer inflation (February) https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-03-11/

2024-03-11 21:36

March 11 (Reuters) - Advance Auto Parts (AAP.N) , opens new tab is appointing three new board members after hedge funds Third Point LLC and Saddle Point Management took positions in the automotive afterparts provider, the company said. The company will add executives with automotive supply chain and merchandising expertise to sit on its board which currently has nine members. The board refreshment comes only six months after the company picked Shane O'Kelly, a former U.S. Army captain who had held senior roles at Home Depot (HD.N) , opens new tab, to replace Tom Greco as chief executive. Armed with a mandate to turn the company around, O'Kelly arrived in September after Advance Auto Parts' stock tumbled last year and around the time S&P Global Ratings downgraded its debt to "junk." The company's financial performance and stock price also lagged behind rivals AutoZone (AZO.N) , opens new tab and O'Reilly Automotive (ORLY.O) , opens new tab. As part of the turnaround plan, Advance Auto Parts is in the process of trying to sell Worldpac, the wholesale distributor of original equipment automotive parts it acquired in 2014 when it bought General Parts International. Joining Advance Auto Parts' board immediately are: Brent Windom, who had been CEO of automotive refinish, industrial coatings and automotive aftermarket parts distributor Uni-Select; Gregory Smith, executive vice president at medical device company Medtronic (MDT.N) , opens new tab, and Thomas Seboldt, who spent much of his career at O'Reilly Automotive (ORLY.O) , opens new tab. Third Point, run by billionaire investor Daniel Loeb, and Saddle Point, run by former Pershing Square Capital Management partner Roy Katzovicz, teamed up on the investment last year after Saddle Point had begun researching the company in 2022, sources familiar with the matter told Reuters. The two firms now have under 5% in beneficial ownership in Advance Auto Parts. Both Third Point and Saddle Point have pursued an activist playbook with Loeb most recently threatening a proxy fight at Bath & Body Works (BBWI.N) , opens new tab last year. The two funds are now the first activists Advance Auto Parts has faced after Starboard Value took a position and the firm's chief investment officer, Jeffrey Smith, joined the board in 2015. He stepped down in 2020. Smith helped bring on director Eugene Lee, who had been chief executive officer of Darden Restaurants (DRI.N) , opens new tab, and became chairman of the board at Advance Auto Parts in 2020. https://www.reuters.com/business/autos-transportation/advance-auto-parts-add-three-board-members-activist-investors-take-stake-2024-03-11/

2024-03-11 21:13

CHICAGO, March 11 (Reuters) - Tyson Foods (TSN.N) , opens new tab will permanently close a pork plant in Perry, Iowa, the meatpacker said on Monday, eliminating jobs for about 1,200 workers. The company, which reaped big profits as meat prices soared during the COVID-19 pandemic, has since confronted a decline and slowing demand for some products. Tyson has announced the closures of six U.S. chicken plants in about the past year and also laid off corporate employees. The pork plant employed about 1,200 people in Perry, which has about 8,200 residents and is located near the state capital Des Moines, Mayor Dirk Cavanaugh said. "It's a big blow to the community," he said by phone. "It's our largest employer in the area. It's going to be tough to figure out what to do without them." Cavanaugh said the plant is set to close on June 28. Tyson did not respond to questions about the number of employees there but encouraged workers to apply for other jobs within the company. "While this decision was not easy, it emphasizes our focus to optimize the efficiency of our operations to best serve our customers," the company said. Tyson's pork business had an adjusted operating loss of $128 million in the fiscal year that ended on Sept. 30, down from income of $198 million in the previous year. Its sales volumes fell 2.2% while average prices slid 7.9%. The plant in Perry slaughters about 9,000 pigs per day, said Steve Meyer, chief livestock economist for Ever.Ag. That accounts for a little less than 2% of total U.S. pork production. In December, Smithfield Foods said it would end contracts with 26 hog farms in Utah, citing an industry oversupply of pork and weaker consumer demand. Smithfield in October said it would shut a pork plant in North Carolina, after previously confirming it would close 35 Missouri hog farm sites. https://www.reuters.com/markets/commodities/tyson-foods-close-iowa-pork-plant-with-1200-workers-2024-03-11/

2024-03-11 21:13

ADEN, Yemen, March 11 (Reuters) - Airstrikes attributed to a U.S.-British coalition hit port cities and small towns in western Yemen on Monday, killing at least 11 people and injuring 14 while defending commercial shipping, a spokesperson for Yemen's internationally recognized government told Reuters. At least 17 airstrikes were reported in the country, including in the principal port city of Hodeidah and at Ras Issa Port, according to Al Masirah, the main Houthi-run television news outlet. The strikes come just days after the first civilian fatalities and vessel loss since the Iran-aligned Houthis began attacking commercial shipping in November in solidarity with the Palestinians under attack by Israel. The strikes also coincide with the first day of the Islamic holy month of Ramadan, a period of fasting for Muslims. Despite reprisals from the U.S.-British coalition and other navies, the Houthis have escalated their campaign of attacks on commercial vessels in one of the world's busiest shipping lanes. The Houthis killed three crew of the Barbados-flagged, Greek-operated True Confidence on Wednesday in an attack off the port of Aden. That came days after the sinking of the cargo ship Rubymar, which went down about two weeks after being hit by a Houthi missile on Feb. 18. Many ships are now making the longer, more expensive trip around Africa's Cape of Good Hope to avoid the dangerous route through the Gulf of Aden and the Red Sea to the Suez Canal - sharply raising shipping costs. https://www.reuters.com/world/middle-east/us-british-forces-strike-houthi-targets-yemen-houthi-outlet-says-2024-03-11/