2024-03-08 01:08

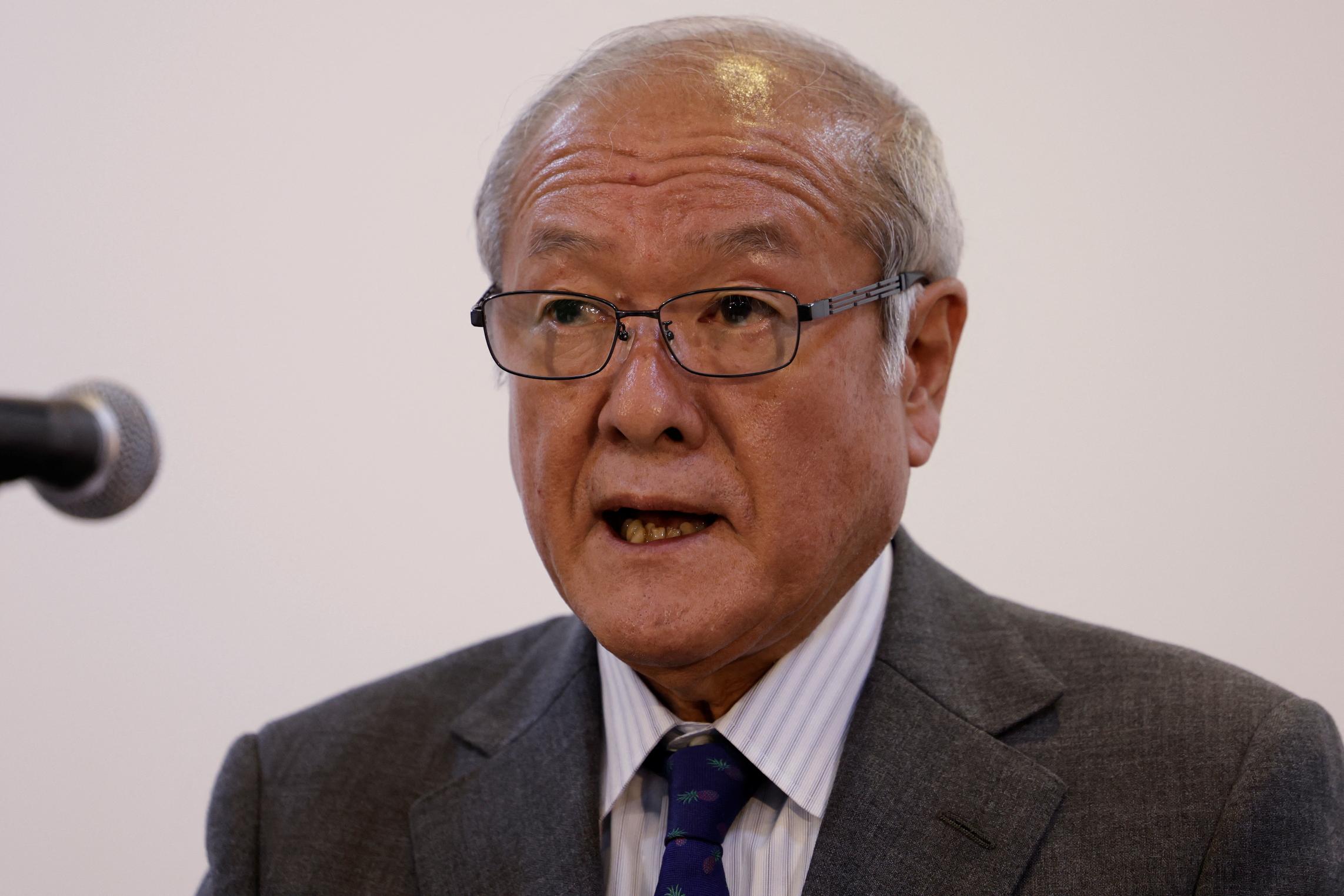

TOKYO, March 8 (Reuters) - Japanese Finance Minister Shunichi Suzuki said on Friday that the government would stick to its aim of balancing the primary budget by the fiscal year end in March 2026 and it's too early to refer to other measures as additional fiscal targets. Japan will strive to continue efforts to restore its tattered public finances so as to achieve the budget balancing while trying to bring down debt-to-GDP ratio in a stable manner, Suzuki told reporters after a cabinet meeting. https://www.reuters.com/world/asia-pacific/too-early-mention-additional-fiscal-targets-says-japan-finance-minister-suzuki-2024-03-08/

2024-03-08 00:09

March 7 (Reuters) - An error by S&P Dow Jones Indices may have contributed to volatility in shares of Morgan Stanley (MS.N) , opens new tab, Pfizer (PFE.N) , opens new tab, PNC Financial Services Group (PNC.N) , opens new tab and other stocks in recent days, traders said. At issue was a list of pending changes to the Dow Jones U.S. Dividend 100 Index (.DJUSDIV) , opens new tab that S&P Dow Jones Indices released late on March 1, naming 10 companies slated for addition to the index and two for deletion. The changes were to take effect on March 18. A total of 23 stocks were affected by the changes, according to trading desk notes obtained by Reuters. A S&P spokeperson said an unspecified error led to the wrong names being provided to clients. S&P Dow Jones issued a replacement pro forma list with a total of 11 additions and three deletions after the market's close on Tuesday. Morgan Stanley and PNC were among the companies that were to be added to the index on the original list. Their shares rose on Monday, but gave back those gains on Wednesday. By contrast, shares of Pfizer, which were slated for deletion on the initial list, fell on Monday but rose on Wednesday when the revisions were published and it was clear that it would remain in the index. Trading volumes for all three companies were 50% to 80% higher than their 90-day averages this week. Morgan Stanley and PNC declined to comment. Pfizer did not immediately respond to a request for comment. "This is not that common an occurrence," said Bryan Armour, an analyst at Morningstar who tracks exchange-traded funds. The error triggered a scramble on trading desks to help their own clients unwind trades made in anticipation of what proved to be incorrect upcoming changes, traders said. The Dow Jones U.S. Dividend 100 Index is designed to offer investors a benchmark composed of stocks in companies with strong fundamentals and a record of paying high dividends consistently. It is used by some index funds to build portfolios. Some traders also seek to buy on announcements of upcoming changes before they take effect and any asset management firms using it as a benchmark must adjust their own portfolios. https://www.reuters.com/markets/us/sp-index-error-may-have-sparked-turbulence-morgan-stanley-pfizer-shares-traders-2024-03-08/

2024-03-07 23:34

TORONTO, March 7 (Reuters) - Panama said on Wednesday it had asked First Quantum Minerals (FM.TO) , opens new tab to suspend a visitor program launched last month at the disputed Cobre Panama mine, saying the miner did not consult the government before starting the community relations initiative. The Canadian miner announced the program to help the Panamanian society to get a first-hand experience of what was happening at the site of the copper mine, according to a post from the company's Panama unit on social media platform X. "The ministry informed them (First Quantum) that these type of decisions, not only the visits but any other activity, needs to be previously consulted with the trade ministry or the appropriate entity," Jorge Rivera, Panama's Trade Minister said on Wednesday. First Quantum did not immediately respond to a request for comment. The Panama government and First Quantum are at odds over the future of the Cobre Panama mine, one of the newest and biggest copper mines in the world. The Central American nation ordered the shutdown of the mine late last year after public protests over environmental concerns. First Quantum said last month the community relations program was announced after an opinion poll by Gallup found that about half of those interviewed expressed interest in visiting the mine. The mine's activity represented about 5% of the country's gross domestic product, and Panama's GDP growth in 2024 is expected to slow to 2.5% from 7.5% due to its closure, according to the International Monetary Fund. Cobre Panama accounted for about 40% of First Quantum's 2023 revenue and the suspension has was wiped out about half of First Quantum's market value since the protests started, forcing the company to take a series of capital restructuring measures to manage its debt load. The company is seeking $20 billion from the Panama government through international arbitration. First Quantum shares fell 3.8% on Thursday, while the benchmark Canadian stock index (.GSPTSE) , opens new tab rose 0.9%. https://www.reuters.com/markets/commodities/panama-asks-first-quantum-suspend-visitor-program-disputed-copper-mine-2024-03-07/

2024-03-07 22:04

Q1 pretax loss 1.07 bln SEK vs 2.45 bln loss a year earlier CEO sees buoyant leisure travel, but costs a challenge STOCKHOLM, March 7 (Reuters) - High costs such as jet fuel remain a headwind for Scandinavian airline SAS (SAS.ST) , opens new tab, even as it sees leisure travel staying buoyant in 2024, its CEO told Reuters on Thursday, echoing the mixed picture painted by others in the sector. Anko van der Werff made the comments after SAS, which is grappling to exit bankruptcy protection, posted a narrower pretax loss for its fiscal first quarter. "We still see a rebound in long-haul travel, and corporate is still down versus 2019, but what remains strong is leisure," van der Werff said in an interview. A post-COVID travel boom is the big hope for SAS, which entered bankruptcy protection in 2022 after years of struggling with high costs were compounded by the pandemic plunge in demand. It plans to emerge from the process in the coming months with new owners that include Air France-KLM (AIRF.PA) , opens new tab. However, airport fees, fuel jet prices and maintenance costs still pose challenges. Rival Lufthansa (LHAG.DE) , opens new tab on Thursday also flagged the impact of high costs. Jet fuel prices, which have put a strain on the sector's finances for several quarters, were down in SAS's November-January first quarter, but van der Werff saw little cause for cheer. "It's still at about $83 right now, if you convert that with the low kronor then you are almost talking about an all-time high for us in fuel prices, so it's a challenge," he said. In January, SAS said it expected adjusted earnings before tax of between zero and 1.0 billion Swedish crowns ($97 million)for its 2024 financial year, with revenue exceeding 48 billion crowns. For its first quarter of November-January, the airline posted a pretax loss of 1.07 billion Swedish crowns versus a 2.45 billion loss a year earlier. Nordic rival Norwegian Air (NAS.OL) , opens new tab said in February it expected its profit to hit a new record in 2024, only a few years after the airline itself underwent a comprehensive financial restructuring. SAS's shares, which will become worthless after the bankruptcy proceedings are finished, were down nearly 22% at 0853 GMT. The company plans to delist shortly. ($1 = 10.2828 Swedish crowns) https://www.reuters.com/business/aerospace-defense/nordic-airline-sas-posts-smaller-q1-pretax-loss-2024-03-07/

2024-03-07 21:50

March 8 (Reuters) - A look at the day ahead in Asian markets. Trading in Asia on Friday is shaping up to be a battle between global market strength on one side, and local caution on the other, particularly surrounding the two regional powerhouses China and Japan. U.S., European and world stocks as measured by the MSCI All-Country index roared to record highs again on Thursday, spurred by - what else? - another surge in chip stocks. Hopes that the Fed and ECB could soon start cutting rates also boosted sentiment. New highs for the S&P 500 and Nasdaq, a weaker dollar and lower U.S. Treasury yields should be a positive cocktail for Asian stocks. The MSCI Asia ex-Japan index will have its seventh weekly rise in eight if it avoids a 1% decline on Friday. But concern over China's economy and deepening U.S.-Sino trade tensions are never far from the surface, and they bubbled up again on Thursday. In Japan, meanwhile, the Nikkei slumped 1% after the yen clocked its biggest rise of the year on mounting speculation that the Bank of Japan could end negative interest rates as soon as this month. The Nikkei has touched record highs recently so some profit-taking is to be expected. Similarly, U.S. futures market data show speculative short positions in the yen are the largest in six years, so a bout of short covering was always likely. Japan dominates the Asian economic calendar on Friday, with the latest household spending, bank lending, trade and current account data all scheduled for release. The news flow around China over the last 24 hours hasn't been particularly bullish for asset prices. S&P Global warned that China's credit rating could be cut if its economic recovery remains weak or is driven largely by extensive stimulus. S&P last downgraded China in 2017 but rival agency Moody's put Beijing on a downgrade warning in December. Beijing is fighting deflation, a property sector crash and slowing growth. The sums needed to turn all that around, as well as bail out indebted local governments, are extremely high. On the trade front, three U.S. Senate Democrats from auto manufacturing states on Thursday urged the Biden administration to hike import tariffs on Chinese electric vehicles, the latest push by lawmakers to protect the U.S. auto sector. With pressure growing on the White House to take further steps to prevent Chinese vehicle imports, the U.S. House Energy and Commerce committee approved legislation to vote on legislation giving China's ByteDance six months to divest from short video app TikTok or face a U.S. ban. This is the backdrop to IMF Managing Director Kristalina Georgieva and First Deputy Managing Director Gita Gopinath's planned visit to Beijing , opens new tab later this month to meet with Chinese authorities and attend economic conferences. Here are key developments that could provide more direction to markets on Friday: - Japan household spending (January) - Japan trade and current account (January) - Taiwan trade (February) https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-03-07/

2024-03-07 21:41

NEW YORK, March 7 (Reuters) - U.S. homebuying sentiment rose for a third consecutive month in February largely because a growing view among current homeowners that now is a good time to sell their house could bode well for a much-needed uptick in home listings. Fannie Mae’s Home Purchase Sentiment Index increased by 2.1 points in February to 72.8 from 70.7 in January, it said on Thursday. On a year-over-year basis, it rose by more than 25%. The share of consumers surveyed who said it is a good time to sell a home rose to 65% in February from 60% the month prior. That component was the largest contributor to the index's gain. "Consumer attitudes toward home-selling conditions increased markedly in February, with current homeowners, in particular, expressing greater optimism that it's a 'good time to sell,' a development that may foreshadow an upcoming increase in existing home listings," said Doug Duncan, Fannie Mae's senior vice president and chief economist. The inventory of homes for sale remains historically low as homebuilding has failed to keep pace with demand and many current homeowners are locked into lower-rate mortgages secured before interest costs started rising. That has kept many potential sellers from putting their homes on the market. While the improved seller sentiment foreshadows increased supply, buyer sentiment remained overwhelmingly negative, Duncan said, even as it ticked up slightly to 19% from 17% in January. With interest rates still high, mortgage payment affordability has weighed on would-be buyers, and the net outlook for mortgage rates falling 5 points on a month-over-month basis, the report said. "A decline in mortgage rates – and the resulting uptick in sentiment – would obviously bode well for the upcoming spring homebuying season, although affordability will likely remain a significant challenge for buyers, at least until there’s a meaningful addition to net supply," Duncan said. For the week ended March 7, the average rate on a 30-year fixed-rate home loan fell to 6.88% from 6.94% the week prior, snapping a streak of four weekly increases, according to Freddie Mac data. Rates have eased from two-decade highs near 8% seen in October, and 35% of consumers expect that trend to continue into 2024, Fannie Mae said. https://www.reuters.com/markets/us/us-homebuying-sentiment-up-owners-sense-good-time-sell-2024-03-07/