2024-03-07 21:39

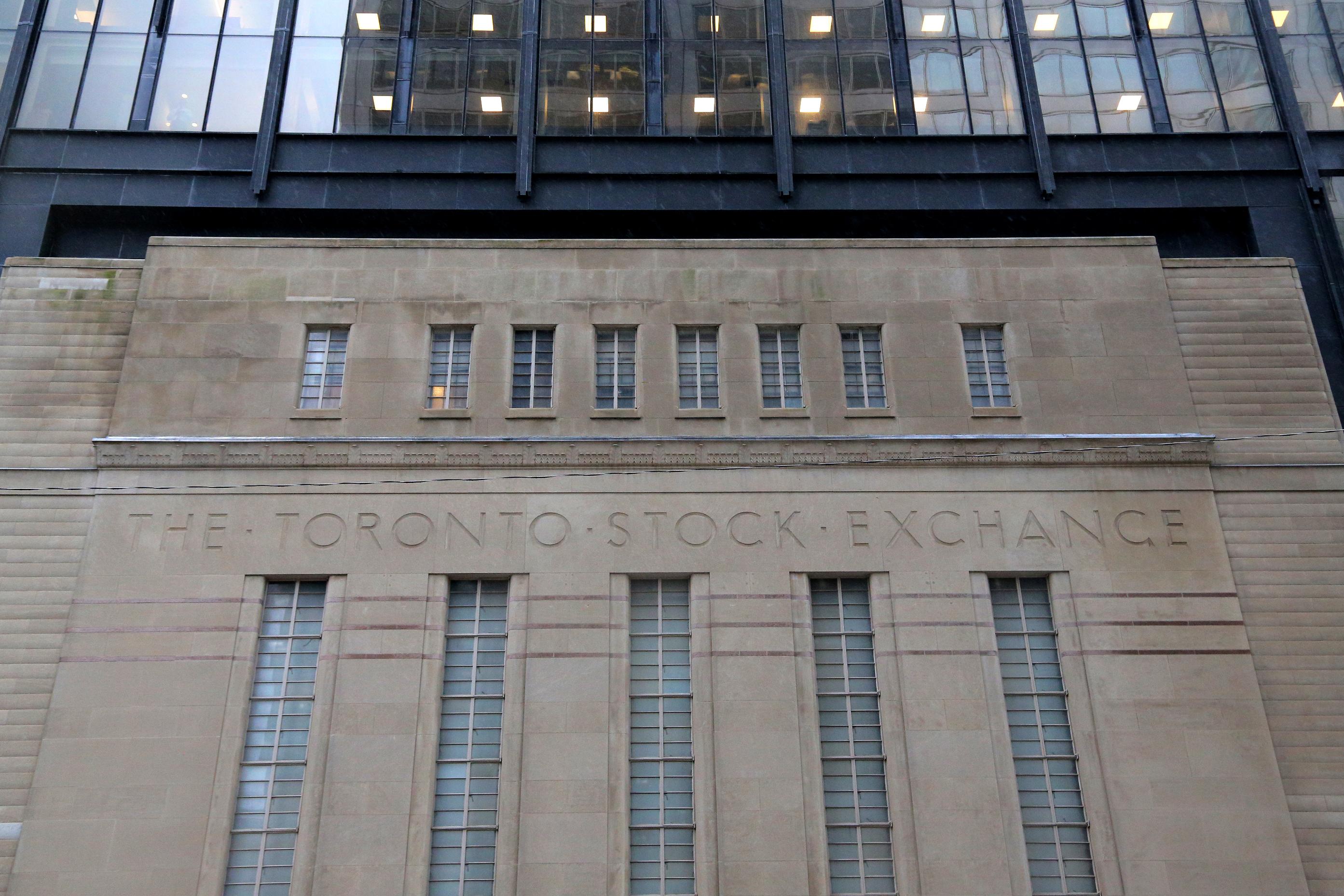

TSX ends up 0.9% at 21,794.56 Posts its highest close since April 2022 Tech sector rallies 2.5% Linamar jumps 11.4% after reporting earnings March 7 (Reuters) - Canada's main stock index climbed on Thursday to its highest level in nearly two years, helped by gains for technology and railroad shares, as investors cheered corporate earnings and the prospects of lower interest rates. The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) , opens new tab ended up 200.60 points, or 0.9%, at 21,794.56, its highest closing level since April 2022. Wall Street's main indexes also climbed as Federal Reserve Chair Jerome Powell said the U.S. central bank was "not far" from gaining the confidence it needs in falling inflation to begin cutting interest rates. "Interest rates, even though they are not coming down yet, central bankers are telegraphing to expect a rate cut probably later this year," said Lorne Steinberg, president of Lorne Steinberg Wealth Management. "That's bullish for the economy, so the rail stocks are doing well." Canadian Pacific Kansas City Ltd shares (CP.TO) , opens new tab rose 2.2% and Canadian National Rail Co (CNR.TO) , opens new tab was up 1.2%. Those moves helped lift the industrials sector by 0.9%, while technology added 2.5%. Descartes Systems Group Inc (DSG.TO) , opens new tab shares added 4.6% after the software company beat fourth-quarter revenue estimates and shares of Constellation Software Inc (CSU.TO) , opens new tab were up 4.5%. Investors also cheered the results of auto-parts manufacturer Linamar Corp (LNR.TO) , opens new tab. Its shares ended 11.4% higher. The materials sector, which includes precious and base metals miners and fertilizer companies, rose 1.2% as gold added to its record-setting rally. Eight of the TSX's 10 main sectors ended higher, with only consumer staples and energy losing ground. Oil settled 0.25% lower at $78.93 a barrel. https://www.reuters.com/markets/tsx-futures-indicate-upbeat-open-gold-shines-powell-testimony-focus-2024-03-07/

2024-03-07 21:38

WASHINGTON, March 7 (Reuters) - U.S. Senator John Fetterman, who famously trolled an election opponent's shopping for "crudite" in a discussion of high food prices, on Thursday tried to bring a dose of realism to an inflation debate likely to be a central issue in the upcoming presidential election. Food prices have risen, with a shock-to-the-pocketbook 20% run-up in the two years between January 2021 and January 2023, the fastest such surge on record and a likely GOP talking point heading into the presidential election campaign. But, noting a recent internet meme featuring outrage over an "$18 dollar cookie," Fetterman asked Federal Reserve Chair Jerome Powell for context during a hearing before the Senate Banking Committee. "Is that reflective of our economy?" the Pennsylvania Democrat asked. "I certainly hope not. I don't do much shopping these days, but that sounds like a pretty expensive cookie," Powell said, adding inflation "has been coming down sharply since the middle of last year." Indeed prices for food to prepare at home as of January were rising at just a 1.3% annual rate, in line with what has been typical in recent decades and a far cry from the breakout in food costs that occurred when global commodity markets and supply chains were roiled by the pandemic and the Russian war in Ukraine. And, as it happens, cookie prices have been falling year-over-year for the past two months, Consumer Price Index data shows. A HARD FEW YEARS There is no argument that inflation in the last three years has been extraordinary, with consumer prices rising as recently as June 2022 at a 9.1% annual rate, a level not seen since 1981. While the climb down to the current 3.1% rate has also been fast, Republicans highlight that the higher overall price level is here to stay. That's true. But it is pretty much always true -- it is unusual for the overall CPI to decline. It is also true that different components of CPI behave differently. Goods prices, in fact, have been falling, returning to a pre-pandemic pattern that helped keep overall inflation low. And yet, some of the relative price changes that happened during the pandemic don't just pose a hardship, they are arguably stark enough to alter how people behave. Perhaps the most notable example is housing. The median U.S. home price, at $417,000 at the end of 2023, was nearly 30% higher than at the start of the pandemic. Current high mortgage rates have created a doubly confounding situation -- first-time buyers are priced out, while current mortgage holders are incentivized to stay in place and not trade into a higher-rate loan. This is a point Republicans are likely to emphasize and which the Biden administration may try to address with new housing proposals. WILL MEMORIES BE SHORT? Inflation easing also means recent wage gains stretch farther, allowing some recovery of the purchasing power lost when prices surged. The rise in "real," or inflation-adjusted incomes, is something the Biden administration has emphasized. Whether that registers in improved sentiment, however, is another issue. As with inflation, the details matter. While some pandemic-era wage gains were larger for less well-paid jobs, lower-income households also devote a greater share of their incomes on basics like housing, food and gas, for which prices rose sharply. Economists and Fed officials have noted "stress" developing among those households. Even if the economy overall is seeing real wages rise, it doesn't mean every family is experiencing the same. https://www.reuters.com/markets/us/cookie-crumbles-election-year-inflation-debate-could-get-messy-2024-03-07/

2024-03-07 21:37

March 7 (Reuters) - TC Energy's (TRP.TO) , opens new tab Keystone oil pipeline resumed service on Thursday after going offline and temporarily restricting a major conduit of Canadian oil to the United States, which sent oil prices higher. The 622,000 barrel-per-day pipeline has been dogged by problems, including a 2022 spill in rural Kansas. TC said in a statement late afternoon that Keystone was safely operating after briefly suspending service as a precautionary measure. The Calgary, Alberta-based company said it had confirmed the pipeline's integrity and no oil was released. Earlier, TC notified shippers of the outage, citing operational issues but not offering specifics, one industry source said. The company did not say how much of the Keystone network was down or for how long. U.S. West Texas Intermediate oil turned positive after the trading session closed. When trading resumed, crude was up 0.4% at $79.22 per barrel. "With Keystone, we're seeing a pattern of these sporadic outages," said Rory Johnston, founder of the Commodity Context newsletter. "Western Canada is so often operating on a knife’s edge of crude egress capability." Keystone, stretching 4,850 km (3,000 miles), transports oil from Alberta to Nebraska, where it splits, with one arm running east to the Midwest and the other running south to the U.S. crude storage hub in Cushing, Oklahoma, and to the Gulf, where it is processed by refiners or exported. Last month, executive vice-president of liquids Bevin Wirzba told analysts on a quarterly call that TC had inspected 80% of the Keystone system during the year since the Kansas spill and found no potential issues with the pipeline's integrity. The main alternative to Keystone is Enbridge's (ENB.TO) , opens new tab Mainline, which is running in March at 25% apportionment for light oil and 20% apportionment for heavy oil. The discount on Western Canada Select (WCS) heavy crude for April delivery grew to as much as $16.30 per barrel in Alberta compared to West Texas Intermediate , from as little as $15.75, according to brokerage CalRock. At Cushing, WCS traded at a discount of $7.30 per barrel, shrinking 40 cents on the prospect of Canadian supplies becoming tighter at the hub, brokers said. The Keystone outage happened as shippers await completion of the Trans Mountain pipeline expansion, which will nearly triple capacity of a line moving oil from Alberta to the British Columbia coast, providing long-awaited relief to Canada's pipeline congestion. TC shares finished slightly higher in Toronto. Last year, TC said it planned to spin off its liquids business, including Keystone, to focus on transporting natural gas. The company has been selling assets to reduce debt. https://www.reuters.com/business/energy/tc-energys-keystone-oil-pipeline-offline-due-operational-issues-sources-say-2024-03-07/

2024-03-07 21:32

VIENNA, March 7 (Reuters) - The U.N. nuclear watchdog's Board of Governors voted on Thursday to demand Russia withdraw from Ukraine's Zaporizhzhia Nuclear Power Plant (ZNPP), in a resolution passed days after the two-year anniversary of the plant's capture by Russian troops. It was the board's fourth resolution condemning Russia's actions against Ukrainian nuclear facilities. The first was passed in March 2022, the day before Russia captured Europe's largest nuclear plant. The last was in November 2022. "Resolution has been adopted by the majority of votes," Ukraine's mission to the International Atomic Energy Agency said on X , opens new tab. The text adopted late on Thursday said the board called "for the urgent withdrawal of all unauthorized military and other unauthorized personnel from Ukraine's ZNPP and for the plant to be immediately returned to the full control of the competent Ukrainian authorities". The board also "reiterates its grave concern that the Russian Federation has not heeded the previous calls ... to withdraw its military and other personnel from the ZNPP", it said. The plant is near the front line in territory Moscow claims to have annexed from Ukraine. All six of its reactors are shut down, but it still needs constant power to keep fuel in those reactors cool and prevent a potentially catastrophic meltdown. At this week's quarterly meeting of the 35 member-state board, delegates have shown support for Ukraine by dressing in its national colours, blue and yellow, or displaying them with lanyards, ribbons or flowers. The IAEA, which has a small number of staff at Zaporizhzhia, says safety there remains precarious. In the past 18 months the plant has been cut off from external power eight times, forcing it to rely on diesel generators. Ukraine and Russia have blamed each other for shelling that has downed power lines. https://www.reuters.com/world/europe/iaea-board-calls-russia-leave-zaporizhzhia-two-years-2024-03-07/

2024-03-07 21:00

US weekly jobless claims unchanged S&P, Nasdaq, semiconductor index hit fresh record highs Indexes up: Dow 0.34%, S&P 1.03%, Nasdaq 1.51% March 7 (Reuters) - Wall Street charged ahead on Thursday, with the S&P 500 rising 1% to a record closing high while the Nasdaq composite finished up 1.5%, with the biggest boosts from technology and growth stocks on increasing investor optimism about prospects for Federal Reserve rate cuts this year. The Philadelphia Semiconductor index (.SOX) , opens new tab outperformed the broader market to finish up 3.36% at a record closing high as investors piled into chip companies, which they see as key beneficiaries to artificial intelligence related demand. In Washington, Fed Chair Jerome Powell told a U.S. Senate committee that the U.S. central bank is "not far" from being confident inflation is declining toward the 2% target, which would make rate cuts possible. His comments reinforced investor hopes for a first rate cut in June and boosted equity indexes that had faltered in the days leading up to his Congressional testimonies, which kicked off on Wednesday with an appearance before the U.S. House Financial Services Committee. Also the number of Americans filing new claims for unemployment benefits was unchanged as the labor market continued to ease, Labor Department data showed. This followed private payrolls, job openings, quit rate and unemployment claims data that gave investors a picture of a jobs market that was softening but still solid. Powell "essentially left rate cuts on the table for this year. That's what markets wanted to hear," said Anthony Saglimbene, Chief Market Strategist, Ameriprise Financial. "The market's also responding well to the employment data we've had so far this week," he said. "It adds to the narrative that we're starting to see employment slow but still solid." But Saglimbene noted investors will still anxiously monitor the nonfarm payrolls report on Friday for further details on the labor market. The Dow Jones Industrial Average (.DJI) , opens new tab rose 130.30 points, or 0.34%, to 38,791.35, the S&P 500 (.SPX) , opens new tab gained 52.60 points, or 1.03%, to 5,157.36. The Nasdaq Composite (.IXIC) , opens new tab hit an intraday record high and narrowly missed a closing record to end up 241.83 points, or 1.51%, at 16,273.38. "Everybody is waiting for something bad to happen but nothing bad has happened to the economy, markets, earnings and policy," said John Augustine, chief investment officer at Huntington Private Bank. "That's why we're building momentum." Nine the 11 major S&P 500 sectors rose, with communications services (.SPLRCL) , opens new tab and information technology stocks (.SPLRCT) , opens new tab jostling for position as the biggest gainer. Technology had the final say, ending up 1.89% followed by communications services with a 1.84% gain. Megacap growth stocks were major contributors to index gains including social media company Meta (META.O) , opens new tab, which added 3.2%, and AI chip darling Nvidia (NVDA.O) , opens new tab, which ended up 4.5%. Shares in lingerie retailer Victoria's Secret & Co (VSCO.N) , opens new tab fell sharply on a weak annual forecast, finishing down 29.7%. Kroger Co (KR.N) , opens new tab shares rallied 9.8% after the grocer forecast annual sales and profit above Wall Street estimates as it bet on higher demand for groceries at its stores, tighter cost control and strength in its private-label brands. Advancing issues outnumbered decliners by a 3.09-to-1 ratio on the NYSE where there were 736 new highs and 47 new lows. On the Nasdaq 2,592 stocks rose and 1,670 fell as advancing issues outnumbered decliners by about a 1.55-to-1 ratio. The S&P 500 posted 82 new 52-week highs and one new low while the Nasdaq recorded 331 new highs and 88 new lows. On U.S. exchanges 11.19 billion shares changed hands compared with the 12.06 billion moving average for the last 20 sessions. https://www.reuters.com/markets/us/nasdaq-sp-500-futures-inch-up-ahead-more-economic-data-powell-testimony-2024-03-07/

2024-03-07 20:59

March 7 (Reuters) - U.S. oil producer Hess (HES.N) , opens new tab said on Thursday it was reviewing the timeline for closing its takeover deal by Chevron (CVX.N) , opens new tab after oil major Exxon (XOM.N) , opens new tab signaled a potential counter offer for Hess's Guyana assets. Exxon on Wednesday filed a contract arbitration claim related to Hess' proposed sale of its Guyana oil properties and suggested it may counter Chevron's pending deal for the assets. The dispute between the top U.S. oil producers could end the Hess takeover deal, Chevron warned in a securities filing last month. If the deal falls part, Hess could be liable for a $1.7 billion breakup fee. The arbitration case seeks to preserve Exxon's right to evaluate making a bid for Hess' 30% stake in the giant Stabroek offshore oil block if Chevron proceeds with its proposed $53 billion purchase of Hess. "Exxon is currently in the process of closing the $60-billion acquisition of Pioneer Natural (PXD.N) , opens new tab ... plausible to think that moving toward arbitration could help delay the CVX-Hess transaction and allow Exxon to be in a position for another major deal with Hess thereafter," RBC Capital Markets analyst Biraj Borkhataria said. Chevron's acquisition of Hess has already been stalled by the U.S. Federal Trade Commission's request for additional information on the merger. That request pushed back any closing to at least the middle of this year and Exxon's claim could extend it further. Hess told , opens new tab employees that it disagreed with Exxon's interpretation of the agreement and was confident that its position will prevail in arbitration. https://www.reuters.com/markets/deals/hess-says-reviewing-timeline-closing-chevron-deal-2024-03-07/