2024-03-06 04:56

Weak household spending, auto disruption weighing on consumption Output plunge likely to prod BOJ to downgrade view on production BOJ likely to maintain forecast of moderate economic recovery Downgrades unlikely to affect timing of exit from stimulus TOKYO, March 6 (Reuters) - The Bank of Japan is expected to revise down its assessment on consumption and factory output this month, three people familiar with its thinking said, nodding to recent weak signs in the economy that underscore the fragile state of its recovery. While this could fuel worries about policy outlook, the sources said the BOJ was expected to maintain its forecast that the economy will continue recovering moderately, suggesting the revisions are unlikely to deter it from phasing out its massive monetary stimulus in March or April. "Consumption isn't very strong and output is falling due to the auto output disruptions," one source said. "But there's no change to the view Japan's economy is recovering moderately," the source added, a view echoed by the other two people. The sources spoke on condition of anonymity as they were not authorised to speak publicly. The board will discuss the economy's assessment and its outlook, as well as whether to tweak its ultra-loose policy, at its next meeting on March 18-19. The BOJ currently describes consumption as "rising moderately" and output as "moving sideways". The sources added that the weakness in consumption and output is likely to be temporary and would not derail Japan's recovery which will be propelled by robust corporate profits and expectations of continued wage gains. Big firms will settle negotiations on 2025 pay with unions on March 13, ahead of the BOJ meeting on March 18-19. Economists project wage hikes of about 3.9% on average, versus a 3.58% pay rise deal struck in 2023 that was the highest in three decades. BOJ Governor Kazuo Ueda has said the central bank will focus on the outcome of the wage negotiations, and whether firms will pass on rising labour costs by raising service prices, in deciding how soon it will phase out stimulus. "While real wages may not immediately turn positive, there's hope that this year's annual wage talks will yield solid results that would give consumption a sustained boost," Ueda told reporters last week when asked about the recent weak data. The BOJ typically focuses more on the outlook of the economy, rather than past data, in setting monetary policy. RECENT DATA Japan's economy slipped into recession in the fourth quarter on weak domestic demand, though recent data pointing to strong capital expenditure will likely lead to an upgrade when revised gross domestic product figures are published on March 11. Factory output fell 7.5% in January from the previous month, the biggest drop since May 2020, due largely to production stoppage at Toyota Motor's (7203.T) , opens new tab small-car unit Daihatsu. Household spending also dropped 2.5% in December from a year earlier, extending its decline for a 10th month, due to supply disruptions of cars and continued declines in real wages. Japan's government downgraded its view on the economy in February for the first time in three months on sluggish consumer spending, suggesting a bumpy path out of a recession. Sources have, however, told Reuters that the BOJ was on track to end its negative interest rate policy in coming months on signs companies will continue to offer bumper pay amid a tightening job market. With inflation exceeding its 2% target for well over a year and prospects of sustained wage growth, many market players expect the BOJ to end its negative interest rate policy by April. https://www.reuters.com/business/finance/boj-seen-revising-down-assessment-consumption-output-sources-say-2024-03-06/

2024-03-06 04:45

US crude inventories rise by less than expected last week -EIA US gasoline and distillate stocks fall more than expected -EIA US Fed's Powell says he expects rate cuts later this year NEW YORK, March 6 (Reuters) - Oil prices edged up about 1% on Wednesday on a smaller-than-expected build in U.S. crude inventories, a big withdrawal from distillate and gasoline stocks and remarks by the U.S. Federal Reserve chief that he still expects interest rate cuts this year. Lower interest rates could increase oil demand by boosting economic growth. Brent futures rose 92 cents, or 1.1%, to settle at $82.96 a barrel, while U.S. crude rose 98 cents, or 1.3%, to settle at $79.13. That put Brent up for the first time in five days. The U.S. Energy Information Administration (EIA) said energy firms added a smaller-than-expected 1.4 million barrels of crude into stockpiles during the week ended March 1, while distillate and gasoline inventories fell by much more than expected. For crude stocks, that compares with the 2.1-million barrel build analysts forecast in a Reuters poll and the 0.4-million barrel build shown in data from the American Petroleum Institute (API), an industry group. EIA/A , Energy firms also pulled 4.1 million barrels out of distillate stockpiles, which include diesel and heating oil, and 4.5 million barrels out of gasoline stockpiles last week. That compares with analysts forecasts for much smaller weekly withdrawals of 0.7 million barrels of distillates and 1.6 million barrels of gasoline. “The draw down in gasoline and distillates has the market’s attention. This is a wake up call that we have a very tight market,” Price Futures Group analyst Phil Flynn said. In remarks prepared for Congress, U.S. Federal Reserve Chair Jerome Powell said the central bank still expects to reduce its benchmark interest rate later this year, though policymakers still needed "greater confidence" in inflation's continued decline. Complicating the Fed's decision, however, were reports providing mixed signals. U.S. private payrolls increased slightly less than expected in February, bolstering the case for rate cuts, while data showing an uptick in U.S. economic activity from early January through late February supported the case for leaving rates unchanged. The U.S. dollar (.DXY) , opens new tab slipped to a one-month low against a basket of other currencies after Powell's comments. A weaker dollar can boost demand for oil by making the fuel cheaper for buyers using other currencies. AROUND THE WORLD China announced a 2024 economic growth target of around 5%, though the lack of big-ticket stimulus plans to bolster its struggling economy raised concerns of sluggish oil demand growth. The market "specifically was hoping to see further fiscal expansion to help meet the growth target," said Tony Sycamore, an analyst at IG in Sydney. Meanwhile, talks on a ceasefire and hostage exchange between Israel and Hamas were at an impasse as the humanitarian crisis in Gaza deepened and a merchant vessel was on fire after a fatal attack in the Red Sea. The disruption in oil tanker movements due to Red Sea attacks by the Iran-backed Houthi militia in Yemen, along with the latest OPEC+ supply cut extension, was causing supply tightness, especially in Asian markets. That tightness was apparent as Saudi Arabia, the world's biggest oil exporter, announced slightly higher prices for April crude sales to Asia, its biggest market. OPEC+ includes the Organization of the Petroleum Exporting Countries (OPEC) and its allies like Russia. https://www.reuters.com/business/energy/oil-fell-slightly-china-growth-worries-clash-with-output-cuts-2024-03-06/

2024-03-06 04:35

March 6 (Reuters) - Three people were missing and 18 wounded after a boiler room blast at the Shagonar power and heating plant in Russia's remote Tuva region, regional head Vladislav Khovalyg said on Wednesday. Six people were in grave condition, he said on the Telegram messaging app, and a fire that broke out at the facility had been brought under control and localised. No deaths have been reported and the cause of the accident was yet to be established, Khovalyg said. https://www.reuters.com/world/three-missing-after-boiler-room-blast-russias-tuva-region-2024-03-06/

2024-03-06 04:27

Central bank unlikely to cut rates soon as inflation still high Monetary authorities closely watching rice inflation BSP to review policy rates on April 4 MANILA, March 6 (Reuters) - The Philippines' central bank governor on Wednesday ruled out rate cuts anytime soon due to upside inflation risks and signalled that borrowing costs will remain higher for longer. Bangko Sentral ng Pilipinas governor Eli Remolona said the central bank wants to be certain inflation will settle comfortably within its 2%-4% target range. He said last month's data showed "it's still too soon to declare victory" over inflation. Annual inflation in February picked up for the first time in five months to 3.4% on higher food and transport costs. "It's on the edge, so I can't say that we're going to ease soon. I think it's unlikely that we will tighten some more. But we'll see what the data says," Remolona told a press briefing. The central bank chief said rice inflation, which rose to its highest in 15 years last month, was having an "outsized effect" on consumer price expectations. The BSP has kept interest rates at 6.50% for three straight meetings since late last year and will next review policy on April 4. It has raised rates by 450 basis points since May 2022, including an off-cycle move in October. "The main thing is still whether there are upside risks- supply side shocks- whether there's going to be more of them and whether they will cause second round effects," Remolona said. https://www.reuters.com/markets/asia/philippine-central-bank-governor-rules-out-easing-rates-soon-2024-03-06/

2024-03-06 03:35

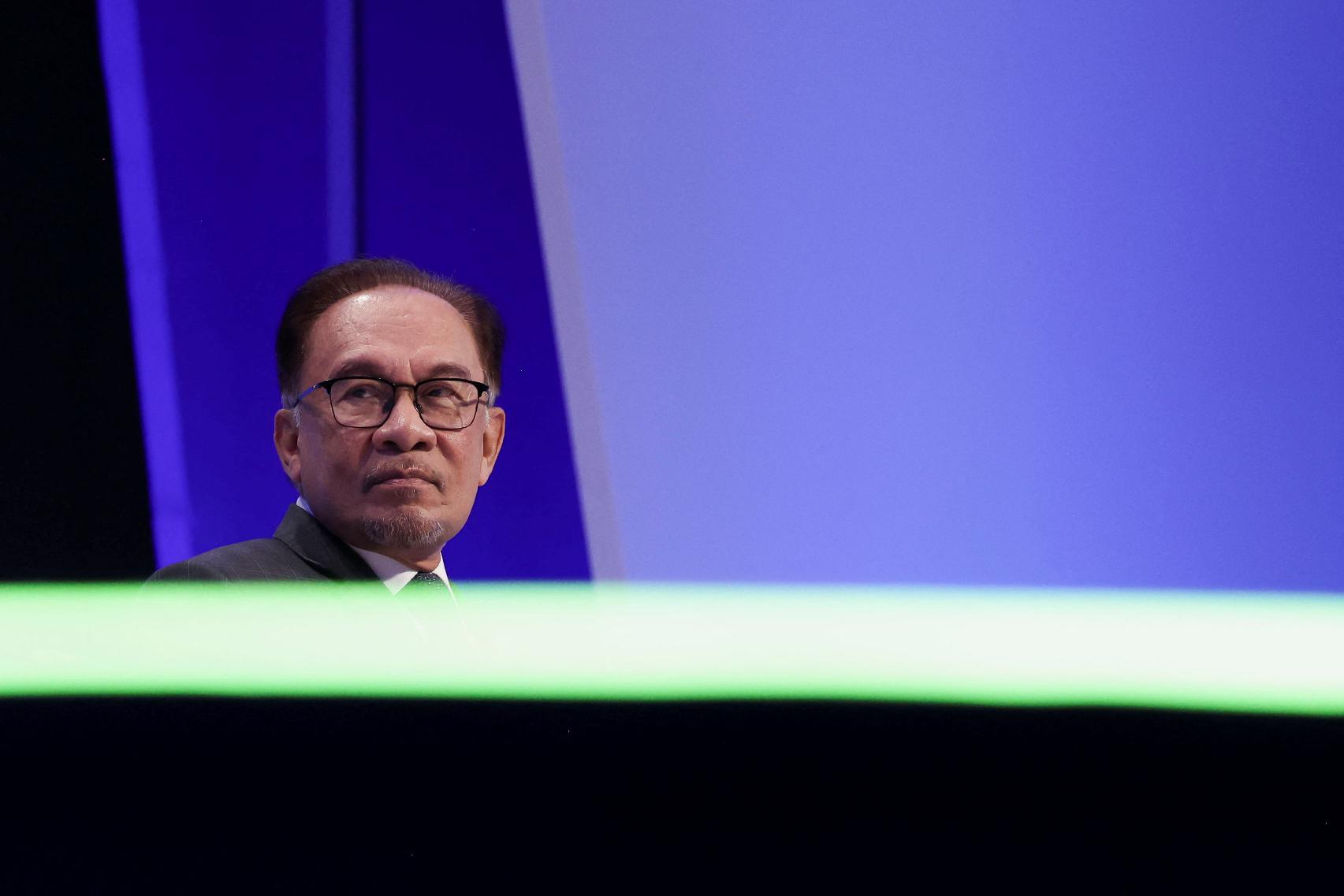

KUALA LUMPUR, March 6 (Reuters) - Malaysia is expecting Australian companies to invest up to 24.5 billion ringgit ($5.17 billion) in the country, state news agency Bernama reported on Wednesday, citing Prime Minister Anwar Ibrahim. Australian data centre operators AirTrunk and NextDC (NXT.AX) , opens new tab are planning to spend about 11 billion ringgit and 3 billion ringgit respectively, while miner Lynas Rare Earths (LYC.AX) , opens new tab was keen to expand its investments in Malaysia, Anwar told reporters during his visit to Australia this week, according to Bernama. No timeframe for the investments was given. The potential investments would create jobs for about 1,200 skilled workers in Malaysia, Anwar was quoted as saying. Separately, Malaysia's International Trade and Industry Minister Tengku Zafrul Aziz told broadcaster CNBC government officials had met with 20 Australian companies during the trip, with eight firms committing investments of about A$5.2 billion ($3.38 billion) so far. ($1 = 4.7370 ringgit) ($1 = 1.5366 Australian dollars) https://www.reuters.com/markets/asia/malaysia-expecting-australian-firms-invest-5-bln-reports-say-2024-03-06/

2024-03-06 02:55

MUMBAI, March 6 (Reuters) - The Indian rupee is expected to open little changed on Wednesday on a drop in U.S. Treasury yields and weak risk before Federal Reserve Chair Jerome Powell's testimony to lawmakers. Non-deliverable forwards indicate rupee will open barely changed from 82.8950 in the previous session. The S&P 500 Index had its worst day in three weeks on Tuesday while the 10-year U.S. Treasury yield dropped to a one-month low. The dollar index briefly dropped below 103.60 in the New York session. Asian currencies were mostly rangebound. "Count on a 3-4 paisa range today (for USD/INR). What direction Powell points to (on interest rates) will obviously be important," an FX trader at a bank said. "Having said that, we all know that the bar for making the rupee is pretty high." The rupee has been in a very narrow range for more than two weeks. Powell's testimony to the Senate Banking Committee will be eyed for indications of when the Fed is likely to begin cutting interest rates. Fed officials have repeatedly signalled that they are in no hurry to cut interest rates and Powell is expected to maintain that. "We expect him to lean hawkish and stick to the script he has been using since the January Fed meeting," ANZ said in a note. Recent inflation data - the US January consumer inflation reading was higher than expected - point to Powell holding the stance that the Fed will proceed cautiously on rate cuts. Ahead of Powell's testimony, data showed that the U.S. services industry grew in February. This follows the larger-than-expected contraction in U.S. manufacturing. KEY INDICATORS: ** One-month non-deliverable rupee forward at 82.94 ** Dollar index at 103.80 ** Brent crude futures up 0.1% at $82.1 per barrel ** Ten-year U.S. note yield at 4.16% ** As per NSDL data, foreign investors sold a net $1.4mln worth of Indian shares on Mar. 4 ** NSDL data shows foreign investors bought a net $69.7mln worth of Indian bonds on Mar. 4 https://www.reuters.com/markets/currencies/rupee-eyes-powells-testimony-cues-us-interest-rates-2024-03-06/