2024-03-05 17:20

Reports Q4 adjusted EPS of $2.98, above estimates Comparable sales decline but also beat LSEG forecasts Stock jumps 12%, has outperformed Walmart since 2019 CEO says launching Target Circle 360 membership on April 7 Target to open 300 new U.S. stores, remodel existing ones March 5 (Reuters) - Target (TGT.N) , opens new tab on Tuesday reported higher holiday-quarter earnings on a smaller-than-expected sales decline and predicted that annual comparable sales would come in largely above Wall Street expectations, sending its shares up 12%. The mass merchandiser is banking on same-day services, product launches and a new membership program to boost spending at its stores. Target plans to launch a membership feature called Target Circle 360 next month, which would offer shoppers unlimited same-day delivery, CEO Brian Cornell said on an earnings call. Target reported adjusted earnings of $2.98 per share in the fourth quarter, compared to $1.89 per share in the same period a year earlier. Analysts on average expected $2.42 per share, according to LSEG estimates. Total comparable sales in the November to January period fell 4.4% compared with the 4.6% decline analysts were expecting, in part due to a sales recovery on Target.com. Online sales fell 0.7% during the fourth quarter, an improvement from the 6% decline in the previous quarter. Robust Black Friday and Cyber Monday spending helped drive holiday-quarter sales, the company said, and shoppers gravitated to newly-launched collections such as Kendra Scott jewelry and its private-label Figmint line of kitchenware. Shoppers also responded to same-day pickup services, such as Drive-up, which made up more than 10% of total sales in the quarter, the company said. Over the next decade, Target expects to open more than 300 U.S. stores and remodel most of its 2,000 existing ones, the CEO added. CONSISTENT RESULTS "(The) biggest takeaway is now back-to-back strong quarters, which is exactly what the market wants to see out of Target - consistency, which is an adjective that has been elusive for the company over the past 2-3 years," said Dave Wagner, portfolio manager at Aptus Capital Advisors. Target Circle 360 program will be launched at a special membership price of $49 for five weeks starting April 7, allowing shoppers same-day delivery for orders over $35, Target said. The minimum order threshold was on par with Walmart's Walmart Plus program. The new loyalty program, along with Target's focus on rolling out new products and services would help reignite sales, traffic and market share gains in 2024, Cornell added. Target has already introduced "dealworthy", a new line of 400 products, stretching from apparel to beauty and electronics at prices starting under $1. "We spent most of last year, watching consumers shift their consumption patterns towards services versus goods. That consumption pattern seems to be normalizing back to a healthy balance of both goods and services this year," said Art Hogan, chief market strategist at B Riley Wealth. Target introduced its earnings outlook for 2024 of adjusted earnings between $8.60 to $9.60 per share. The midpoint of that range was largely in line with analysts' expectations of $9.14 per share, according to LSEG data. Annual comparable sales are expected to be in a range of flat to up 2% this year, compared to analysts' average expectations of a 0.86% rise. Gross margins in the fourth quarter ended Feb. 3 rose to 25.6%, from 22.7% a year earlier, aided by lower freight and supply-chain costs, healthy inventory and lower markdowns. https://www.reuters.com/business/retail-consumer/targets-earnings-surge-despite-holiday-sales-dip-sees-sales-recovery-2024-2024-03-05/

2024-03-05 16:45

Suspected arson attack shuts down electricity supplies Tesla plant to remain down for days Losses expected in the high hundreds of millions of euros Media publish letter by far-left group claiming responsibility Tesla shares down 3% BERLIN/FRANKFURT, March 5 (Reuters) - Tesla's (TSLA.O) , opens new tab European Gigafactory near Berlin has halted work until further notice after what CEO Elon Musk called an "extremely dumb" suspected arson attack nearby left it without power on Tuesday. The attack southeast of the German capital set an electricity pylon close to the site ablaze, but the fire did not spread to the Tesla facility - the U.S. electric vehicle maker's first manufacturing plant in Europe. It has however shuttered production at least until early next week, the company said. The outage will cost Tesla estimated losses in the high hundred of millions of euros, with 1,000 vehicles left unfinished on Tuesday alone. A company official was noncommittal on whether this would affect plans to double capacity at the site, but condemned what he saw as negative sentiment towards it. Emergency services have extinguished the blaze, and power to the surrounding communities has mostly been restored. Joerg Steinbach, the economy minister of Brandenburg, the German state where Tesla's plant is based, condemned the suspected attack as having "terrorist markings", and hitting tens of thousands of people. "This includes hospitals, homes for the elderly, where people may also be dependent on oxygen supply or similar, which is electricity-based," he said at a briefing outside the factory. The Tesla site, which employs around 12,500 people, was evacuated and most employees sent home. Tesla shares were down 3% at 1522 GMT. Local media published a letter purportedly from a far-left activist organisation called the Volcano Group that claimed responsibility for the incident, in a 2,500-word attack on Tesla and its billionaire CEO Musk. Police said they were aware of the letter, which was signed "Agua De Pau", the name of a volcanic mountain in the Azores, and said they were checking its authenticity. "These are either the dumbest eco-terrorists on Earth or they're puppets of those who don't have good environmental goals," Musk said on X. "Stopping production of electric vehicles, rather than fossil fuel vehicles, ist extrem dumm," he said, using the German for "extremely dumb". The attack was the latest setback for Tesla, which has had a bumpy ride in Europe of late, facing union pressure for collective bargaining agreements in the Nordics and supply disruptions as a result of attacks on shipping in the Red Sea. Germany has championed new big-ticket foreign investments at a time when Europe's largest economy is facing recession and grappling with higher inflation and weaker foreign demand. "If a left-wing extremist motive is confirmed, then this is further evidence that the left-wing extremist scene does not shy away from attacks on critical energy infrastructure," Interior Minister Nancy Faeser said. "The consequences can affect thousands of completely uninvolved people, as they do today. This shows enormous criminal energy." 'WE SABOTAGED TESLA' Police are investigating the possible arson attack in the area around the plant, which has been the focus of environmental protests since it was launched by Musk two years ago. "We are shocked by what happened today. It's the second direct attack on power supply to the factory and there was a third attack on the railway nearby. We are very concerned," said plant head Andre Thierig. He said the factory had managed to safely conduct an emergency shutdown, involving decanting molten aluminium from its smelters before it solidified. Brandenburg state has documented previous arson attacks by far-left activists, including at a Tesla power supply site at Gruenheide in May 2021. "We sabotaged Tesla," read the letter about Tuesday's incident, posted on website kontrapolis.info, describing the attack as a gift marking International Women's Day on March 8. "Tesla consumes earth, resources, people, workers, and in return spits out 6,000 SUVs, killer cars and monster trucks each week." Tesla's ambitions to expand its plant, which has a capacity to produce around 500,000 cars a year, hit a roadblock when local residents voted down a motion to fell trees to enlarge it. The U.S. EV maker wants to double the site's capacity to 100 gigawatt hours of battery production and 1 million cars per year, setting it up to dominate the European market. The plant's output ramp-up has slowed, though the carmaker produced 6,000 cars in a week for the first time in January. Steinbach said his government would reassess the current situation with regards to climate activists occupying the forest near the Tesla plant. The initiative, named "Tesla Stoppen", had struck a deal with the local government which assured them they would able to stay in the forest until mid-March on condition that they did not make fires or leave behind garbage, German media reported. Between 80 and 100 people were currently taking part in the action, a spokesperson for the protesters said, adding that they planned to stay there for several weeks. https://www.reuters.com/business/autos-transportation/tesla-plant-germany-without-power-after-suspected-arson-attack-bz-2024-03-05/

2024-03-05 16:45

New York, March 5 (Reuters) - Bitcoin hit a record high on Tuesday, fueled by investors pouring money into U.S. spot exchange-traded crypto products and the prospect that global interest rates may fall. The world's largest cryptocurrency hit a high of $69,202, topping November 2021's all-time peak of $68,999.99. Investor interest has increased since the Securities and Exchange Commission approved 11 spot bitcoin ETFs in late January. Bitcoin was recently down around 3.3% at $65,310. ZACH PANDL, HEAD OF RESEARCH AT GRAYSCALE INVESTMENTS, NEW YORK, NY “Although the proximate cause of the rally has been inflows into US-listed spot bitcoin ETFs, marginal demand ultimately reflects investor interest in bitcoin’s properties as an alternative ‘store of value’ and decentralized computing network.” “Active trader positioning in bitcoin now appears fairly long. Valuations for ether and most other tokens remain below their highs from the previous crypto cycle.” “If the macro markets backdrop remains favorable, we could see further increases in token valuations- but macro factors could also be a headwind.” ART HOGAN, CHIEF MARKET STRATEGIST, B RILEY WEALTH, NEW YORK “I think the adoption of the new spot bitcoin ETF clearly has been a slow process but continues to gain momentum and that likely drives that imbalance of supply and demand.” “Also, I think the people that are involved in bitcoin know that there is a halving process that happens at the end of April and that likely tamps down even more supply.” “But I think right now you're seeing basically a broader acceptance of bitcoin and the ease of use of ETFs driving demand (amid) what has always been a constrained supply and that's really highlighted this week in the parabolic move that we've seen.” LAITH KHALAF, HEAD OF INVESTMENT ANALYSIS, AJ BELL, MANCHESTER, UK (VIA EMAIL) “Bitcoin has today hit a record high as the tech-based market melt-up continues to gather pace. At times like these investors need to keep the ‘FOMO’ in check, especially when it comes to something as febrile as crypto. "This might not be the top of the current bull market in Bitcoin, but anyone buying in should be willing to accept the potential downside, especially if the crypto market eventually proves to be the emperor’s new clothes." "The Bank of International Settlements estimates that around three quarters of Bitcoin buyers between 2015-2022 were likely to have lost money, despite a huge rise in the price of the cryptocurrency, almost certainly because they got sucked in at precisely the wrong time." TAI WONG, INDEPENDENT METALS TRADER, NY "The primary driver behind bitcoin was the SEC approval of the spot bitcoin ETF and the significant inflows that have come in as a result. The surging stock markets and corresponding overall bullish sentiment has also helped." "After a brutal winter the crypto bulls are finally getting their time in the sun. The crypto rally feels a bit overextended to me and looking for a pullback. Another case though where you should only be flat or long because a short, especially leveraged, can get carried out and be ulimately right." BRIAN DOBSON, MANAGING DIRECTOR, CHARDAN CAPITAL MARKET "This is a near term event, but in the short term you have buying pressure from the ETF's driving Bitcoin higher. With companies there is also dilution concerns in some of these crypto oriented stocks that's capping near term performance but over time I would expect this to correct itself." MARK CONNORS, DIRECTOR OF RESEARCH, 3IQ, HOBOKEN, NJ “This is the first time an all time high was reached before the halving – that’s the number one takeaway for me when considering how this cycle could be different. The impact of the Jan. 10th approval of the (spot bitcoin ETFs) is still rippling through the system.” “Bitcoin demand is so much greater than in the past, so (demand) will be the primary driver of the price. The halving will have less of an impact because demand is so great, not just from ETFs but also from -- for example, soon, pension funds.” DAVID WAGNER, PORTFOLIO MANAGER, APTUS CAPITAL ADVISORS, CINCINNATI, OH "Bitcoin performing well is a sentiment indicator that a risk-on rally is occurring. Not only that, but the Russell 2000 outperforming Small Cap 600 is about as good of an indicator of investor sentiment towards speculation as the price of bitcoin has been. Both have been extreme indicators of speculative frenzy since mid January." "We've been fielding more questions from the field on Bitcoin, especially now that there are more efficient and cheaper ways to own bitcoin after the recent slew of ETF launches. In our exploration of the opportunity, we've pinpointed IBIT (iShares Bitcoin Trust) and FBTC (Fidelity Wise Origin Bitcoin Fund) as prominent Bitcoin-related ETFs, distinguished by their robust liquidity and appealing expense ratios.” “A notable differentiator for investors considering their options is that FBTC, unlike some counterparts, benefits from Fidelity's direct custody solution, avoiding the involvement of third-party custodians like Coinbase." PHILLIP COLMAR, GLOBAL STRATEGIST, MRB PARTNERS, NEW YORK “It’s a very speculative market. Recent new highs in equities, especially U.S. mega-caps, new highs in Bitcoin, new highs in gold, etc., is a clear message that the world is still flush with too much liquidity and does not need Fed rate cuts.” JAMIE COX, MANAGING PARTNER, HARRIS FINANCIAL GROUP, RICHMOND, VA “Crypto is becoming available to the masses through the bitcoin ETFs and you’re seeing demand for it right now that’s making the price go just vertical. It’s like California real estate on steroids. But I don’t think it says anything about investor sentiment overall because until there’s a better sense of when the Fed’s first rate cut is going to come you really don’t have that many options, which is why you’re seeing gold go up, tech go up, and short-term Treasuries get a bid.” SERGEY NAZAROV, CO-FOUNDER, CHAINLINK, SAN FRANCISCO, CA “Bitcoin's price often reaches new highs that are not just small bumps, but large leaps beyond the previous records. This suggests that we may be at the beginning of a new positive market cycle for Bitcoin. When Bitcoin's price surges, it attracts more capital to the ecosystem, which fuels innovation and development within the space.” STEVE SOSNICK, CHIEF STRATEGIST, INTERACTIVE BROKERS, GREENWICH, CT "Considering bitcoin's recent rocket ship rise and proximity to a record, a new high seemed all but inevitable and now its mission accomplished for crypto enthusiasts. Demand for the newly listed ETFs is the reason for the recent run-up according to conventional wisdom. However, activity at our firm shows much more interest in crypto related stocks like Coinbase and Marathon Digital rather than the ETFs themselves." "Bitcoin has essentially been going straight up for several days. It seemed like a push to the record. Once we got there its normal to see a little bit of profit taking when any asset becomes so extended." MATTHEW TUTTLE, CHIEF EXECUTIVE OFFICER, TUTTLE CAPITAL MANAGEMENT LLC, RIVERSIDE, CONNECTICUT "The spot ETFs are a game changer as they open up Bitcoin to a whole new group of investors that never would set up a bitcoin account somewhere." "Nothing goes up in a straight line, and Bitcoin is going to be volatile, but this makes it a viable asset class in my opinion and something that should be traded, or a small part of your portfolio for diversification." GEOFF KENDRICK, HEAD OF DIGITAL ASSETS RESEARCH, STANDARD CHARTERED "ETF inflows are now net USD7.5bn and open interest on exchanges (when you add futures and options together) have surpassed the previous 2021 highs." "I continue to think this is a one-off re-rating akin to what happened with gold after the gold ETFs were introduced in 2004. As a result I stick to my end 2025 $200k forecast." "US pension money is likely main driver of ETFs and retail money of exchange open interest." STUART COLE, CHIEF ECONOMIST, EQUITI CAPITAL, LONDON “Bitcoin - and indeed other crypto currencies are also performing better as well - are now seen as more legitimate investment destinations following the approval by US regulators of their inclusion in ETFs. So, they are now being used as an alternative to using gold when markets are looking to hedging against increased risks, higher interest rates etc. So no surprise I think that, when you see the gold price rallying, cryptos are doing the same.” NATHAN MCCAULEY, CEO AND CO-FOUNDER, ANCHORAGE DIGITAL, SAN FRANCISCO, CA “The Bitcoin all-time high marks a turning point for crypto. Traditional institutions were once sitting out; today, they are here in full force as the principal drivers of the crypto bull market. "If you want to know why institutions are here for the long term, just look at the underlying economics. Between the new ETFs and upcoming halving, demand for Bitcoin is rising while supply is diminishing." "The industry used the bear market to build a more mature market structure, bringing traditional investment vehicles—like SEC-regulated ETFs—to crypto." "Now, we are seeing exactly what happens when the market has safe, secure, and compliant access to the asset class—and institutions are just getting started.” ANTONI TRENCHEV, CO-FOUNDER, NEXO, ZUG, SWITZERLAND “Bitcoin recapturing its old high of $69,000 inspires a new set of superlatives for the oldest cryptocurrency that continues to divide opinion and conquer all comers with its returns. "Bitcoin has been propelled past its 2021 high by a bunch of ETFs that are squeezing supply and that means its trajectory looks set to continue towards $100,000 and beyond.” ALVIN TAN, HEAD OF ASIA FX STRATEGY, RBC CAPITAL MARKETS, SINGAPORE “One part of (bitcoin's rally) has to do with the generally positive sentiment on risk in general. You can see that in the all-time high in the S&P 500 and Nasdaq. The other part of it is definitely the institutionalization of interest in bitcoin through the ETFs that have been launched.” “Finally I think after quite a volatile two year period where there were a lot of scandals about crypto exchanges and crypto personalities, we haven’t had any of that for a few months, so we’re maybe seeing the dust settling on that.” “I’m not quite sure how one would value bitcoin, but certainly I think the rise in the last couple of months is quite extraordinary. I don’t really know if it’s going to continue at this speed." https://www.reuters.com/technology/view-bitcoin-rises-record-high-2024-03-05/

2024-03-05 15:52

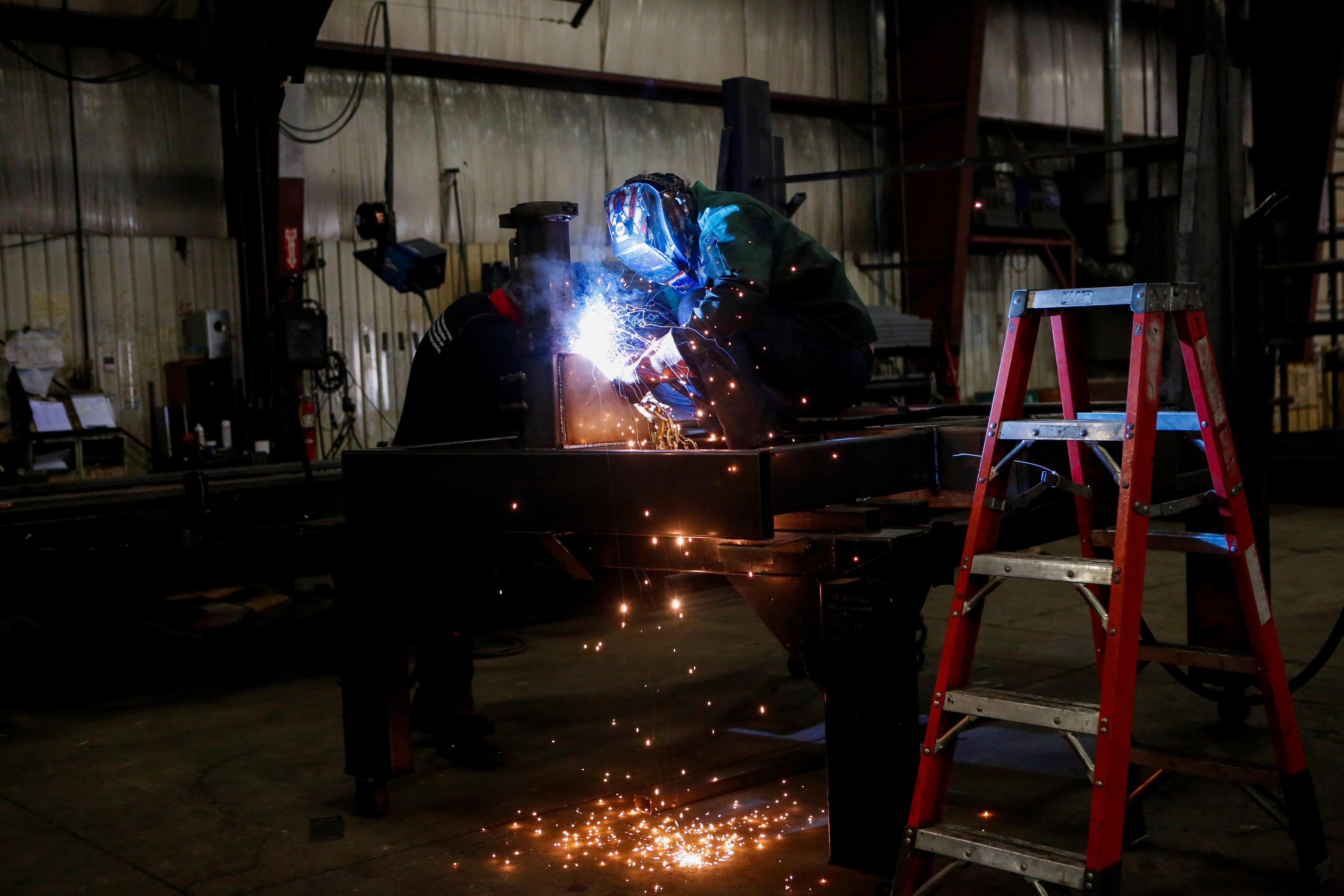

LONDON, March 5 (Reuters) - U.S. manufacturers are struggling to regain momentum as the sector tries to pull out of the prolonged but shallow downturn, with any help from lower interest rates delayed due to continuing inflation in the service sector. The desultory state of factory and freight activity has limited diesel consumption, postponed the anticipated depletion of fuel inventories, and caused refining margins to soften. The Institute for Supply Management (ISM)'s purchasing index slipped to 47.8 (18th percentile for all months since 1980) in February down from 49.1 (25th percentile) in January. The index has been below the 50-point threshold dividing expanding activity from a contraction for 16 months running since November 2022. The manufacturing downturn has been the most prolonged since the slowdown of 2000-2002 and before that 1981-1983. Both of those downturns were cycle-ending recessions rather than mid-cycle slowdowns, characterised by a far more severe contraction in activity. By contrast, in the current slowdown manufacturing output has declined less than 2%, according to data from the U.S. Federal Reserve. Chartbook: U.S. manufacturing and diesel , opens new tab The worst of the current downturn was over by the second and third quarters of 2023, but manufacturers have since struggled to regain momentum. The ISM production sub-index slipped to 48.4 (14th percentile) in February from 50.4 (22nd percentile) in January and was no higher than in July 2023. The new orders sub-index fell to 49.2 (20th percentile) in February from 52.5 (34th percentile) in January and was no better than September 2023. Manufacturers often find it hard to regain momentum after a mid-cycle "soft patch" – prompting the central bank to intervene by cutting interest rates. In this instance, however, rate reductions have been postponed by residual strength in services. Persistent inflation in the much larger and more labour-intensive services sector limits scope to provide relief for manufacturers. Makers of expensive items such as cars, furniture and computer equipment need lower interest rates to spur household and business spending and borrowing. But with service sector prices rising more than twice as fast as the central bank's flexible average inflation target, policymakers have limited scope to supply more stimulus. The central bank is confronted with a two-speed economy and cannot aid manufacturers without risking services overheating. DIESEL CONSUMPTION U.S. consumption of diesel and other distillate fuel oils has fallen in line with the shallow but prolonged slowdown in manufacturing and freight activity. There has been no sustained growth in distillate consumption since the middle of 2022 as the manufacturing sector has been stuck in the doldrums. Petroleum-derived diesel consumption has actually fallen because of the small but increasing market share captured by biodiesel and renewable diesel. The volume of petroleum-derived distillate fuel oil supplied to the domestic market (a proxy for consumption) was down to 3.6 million barrels per day (b/d) in December 2023. The volume slipped from 3.8 million b/d in December 2022 and 4.0 million b/d in December 2021, according to data from the U.S. Energy Information Administration. Over the same period, biodiesel and renewable diesel supplied increased to 0.3 million b/d from 0.2 million b/d in December 2022 and 0.16 million b/d in December 2021. Despite lacklustre consumption, distillate stocks remain well below the long-term average and have shown no sign of rebuilding. Extensive disruption of fuel manufacturing at BP's refinery at Whiting in Indiana following a site-wide power failure has added to the diesel shortage. U.S. petroleum-derived distillate inventories were 15 million barrels (-11% or -0.93 standard deviations) below the prior ten-year seasonal average on Feb. 26. The deficit had widened from 11 million barrels (-8% or -0.77 standard deviations) at the end of 2023, according to weekly figures from the Energy Information Administration. Distillate inventories are expected to tighten sharply once manufacturing and freight activity starts to accelerate again, putting strong upward pressure on fuel prices. But slack industrial activity and fuel demand has pushed the expected timeframe deeper into 2024 and caused fuel prices to fall. Prices for ultra-low sulphur diesel delivered in May 2024 are trading at a premium of around $31 per barrel over U.S. crude, but the premium has slid from almost $40 in early February. Related columns: - Persistent U.S. services inflation threatens soft landing (February 14, 2024) - Diesel prices primed to rise sharply in 2024 (February 6, 2024) - U.S. manufacturers poised for resumed growth, diesel shortage (February 2, 2024) John Kemp is a Reuters market analyst. The views expressed are his own. Follow his commentary on X https://twitter.com/JKempEnergy , opens new tab https://www.reuters.com/markets/us/us-manufacturers-struggle-grow-again-without-interest-rate-cuts-2024-03-05/

2024-03-05 15:43

WASHINGTON, March 5 (Reuters) - New orders for U.S.-manufactured goods dropped more than expected in January, pulled down by a sharp decline in bookings for commercial aircraft, but demand for computers and electronic products accelerated. Factory orders fell 3.6% after slipping 0.3% in December, the Commerce Department's Census Bureau said on Tuesday. Economists polled by Reuters had forecast orders declining 2.9%. They decreased 1.6% year-on-year in January. But there are signs that manufacturing, which accounts for 10.3% of the U.S. economy, is on the cusp of recovery after production eased in 2023 amid 525 basis points worth of interest rate hikes from the U.S. central bank since March 2022. A survey from the Institute for Supply Management last week showed manufacturers more upbeat about the outlook. Commercial aircraft orders plunged 58.9% in January after rising 1.0% in December. Boeing (BA.N) , opens new tab reported on its website that it had received only three orders for commercial aircraft in January, sharply down from 371 in December. The planemaker is under pressure after a cabin panel blew out on an Alaska Airlines jet mid-air in early January. The Federal Aviation Administration has barred Boeing from expanding production of its best-selling 737 MAX narrowbody planes to improve quality control. Orders for motor vehicle bodies, parts and trailers rose 0.7%. Overall transportation orders tumbled 16.2% after falling 0.6% in December. But orders for computers and electronic products shot up 1.3%. Electrical equipment, appliances, and components orders increased 0.9%. Orders for machinery slipped 0.3%. There were also declines in orders for primary metals and fabricated metal products. Shipments of manufactured goods fell 1.0%, while inventories dipped 0.1%. Unfilled orders at factories rose 0.2% after advancing 1.3% in the prior month. The government also reported that orders for non-defense capital goods excluding aircraft, which are seen as a measure of business spending plans on equipment, were unchanged in January instead of gaining 0.1% as estimated last month. Shipments of these so-called core capital goods increased 0.9% instead of 0.8% as previously reported. Nondefense capital goods orders plummeted 19.5% instead of 19.4% as initially estimated. Shipments of these goods dropped 3.0% as reported last week. These shipments go into the calculation of the business spending on equipment component in the gross domestic product report. Business spending on equipment has contracted for two straight months. https://www.reuters.com/markets/us/us-factory-orders-fall-more-than-expected-january-2024-03-05/

2024-03-05 15:42

WASHINGTON, March 5 (Reuters) - The hackers responsible for the breach at UnitedHealth Group (UNH.N) , opens new tab appear to have pulled a disappearing act on Tuesday, leaving their cybercriminal associates in the lurch and replacing their old website with a bogus statement from law enforcement. The U.S. insurer disclosed on Feb. 21 that Blackcat hacking gang - also known as ALPHV - had perpetrated a cyberattack on its technology unit Change Healthcare, causing disruptions across the U.S. healthcare system. A message posted to Blackcat's website said it had been impounded "as part of a coordinated law enforcement action" by U.S. authorities and other law enforcement agencies. Among the logos of non-American agencies involved were those of Europol and Britain's National Crime Agency. The FBI declined comment and Europol did not return messages, but a National Crime Agency spokesperson said: "I can confirm any recent disruption to ALPHV infrastructure is not a result of NCA activity." Blackcat has not responded to Reuters requests for comment in several days. Security experts said the law enforcement denial and other clues made it look like the hackers had simply decided to shut up shop. "This appears to be a classic exit scam," said researcher Will Thomas. In an exit scam, hackers pretend to be knocked out of commission only to quietly pocket their partners' money and start over under a new name. Thomas said Blackcat was already believed to be a rebrand of a previous hacker group dubbed DarkSide. "It would not be a surprise if they return once more in the not-too-distant future," he said. Even before the seizure notice, there were signs of something unusual following the intrusion at the tech unit of UnitedHealth, which has caused serious disruption across the United States. Last week Blackcat posted a message saying it had stolen millions of sensitive records from UnitedHealth, only to delete the claim without explanation. On Sunday, someone posting to a hacker forum alleged that the gang had cheated them out of their share of the $22 million ransom that UnitedHealth had allegedly paid to restore its systems. UnitedHealth had not commented on whether it paid a ransom, and did not return a message on Tuesday seeking comment. https://www.reuters.com/technology/cybersecurity/blackcat-ransomware-site-claims-it-was-seized-uk-law-enforcement-denies-being-2024-03-05/