2024-02-29 17:36

NEW YORK, Feb 29 (Reuters) - U.S. mortgage rates rose for a fourth-straight week, Freddie Mac reported on Thursday, reaching a two-month high and again becoming a factor impeding traffic among rate-sensitive prospective home buyers. The average rate on a 30-year fixed-rate mortgage ticked up to 6.94% for the week ended Feb. 29 from 6.90% the week prior, the report said. “The recent boomerang in rates has dampened already tentative homebuyer momentum as we approach the spring, a historically busy season for homebuying. While sales of newly built homes are trending in a positive direction, higher rates and elevated prices continue to pose affordability challenges that may leave potential homebuyers on the sidelines," said Sam Khater, Freddie Mac’s chief economist. The rate remains below two-decade highs near 8% reached in October. The Federal Reserve has held its benchmark policy rate unchanged since July, and rates tracked by Freddie Mac have held below 7% since December. High mortgage rates eroded buyer traffic last year as tight inventory and home price gains limited affordability. Home sales remain under pressure, with pending home sales retreating by 4.9% in January, according to National Association of Realtors data. https://www.reuters.com/markets/us/us-mortgage-rates-rise-fourth-straight-week-freddie-mac-says-2024-02-29/

2024-02-29 17:33

SAO PAULO, Feb 29 (Reuters) - U.S. Treasury Secretary Janet Yellen met Argentina Economy Minister Luis Caputo on Thursday, welcoming what she called "important steps" by the Milei government to restore fiscal sustainability, adjust the exchange rate and fight inflation. "There is no doubt that this has been, and will continue to be, a difficult economic transition period for the Argentine people," Yellen said in remarks prepared for her first meeting with Caputo. She said protecting the most vulnerable during the transition would be vitally important. Yellen, the latest in a string of U.S. officials to meet with senior Argentine officials since Argentine President Javier Milei took office, commended Caputo for his leadership. "The Milei administration has inherited a steep stabilization task but has already taken some important steps toward restoring fiscal sustainability, adjusting the exchange rate, and combating inflation," she said. Caputo told Yellen that Milei's government knew the reforms would be challenging, but said he was "very confident" that they would amount to "an inflection point" for his country. Yellen said she saw many areas for collaboration between the U.S. and Argentina on key issues on the agenda during this week's meeting of finance officials from the Group of 20 major economies. She said she expected an "active and constructive relationship" between the U.S. Treasury and Caputo's ministry. https://www.reuters.com/world/americas/yellen-says-argentina-moving-toward-fiscal-sustainability-2024-02-29/

2024-02-29 17:22

Feb 29 (Reuters) - Citigroup (C.N) , opens new tab will lay off 286 employees in New York, according to filings to the State Department of Labor, at a time the bank is carrying out its biggest overhaul in decades. Three separate notices dated earlier this week showed the layoffs would impact 239 employees from its primary banking subsidiary , opens new tab, 44 from its broker-dealer unit , opens new tab and three from its technology arm , opens new tab. Citigroup said in January it would cut 20,000 jobs over the next two years, while acknowledging a "clearly disappointing" quarter marred by one-off charges that resulted in a $1.8 billion loss. The lender is aiming to reduce its global workforce by roughly 8% through 2026, including layoffs from the reorganization, Chief Financial Officer Mark Mason told reporters at the time. CEO Jane Fraser announced the sweeping reorganization plan in September to simplify the bank's structure after divesting from non-core markets and focusing on profitable areas. https://www.reuters.com/business/citigroup-layoff-286-employees-new-york-filing-shows-2024-02-29/

2024-02-29 15:55

NEW YORK, Feb 29 (Reuters) - Pending U.S. home sales retreated in January, a report on Thursday showed, as buyers continue to struggle with still-high mortgage rates. The National Association of Realtors Pending Home Sales index fell 4.9% to 74.3. A poll by Reuters showed economists expected a 1.0% increase. The increase in pending sales in December was revised sharply lower to 5.7% from 8.3%, even as the index value for that month was revised higher, reflecting NAR revisions for 2023. “The job market is solid, and the country’s total wealth reached a record high due to stock market and home price gains,” said Lawrence Yun, chief economist at the NAR. “This combination of economic conditions is favorable for home buying. However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.” On a year-over-year basis, pending home sales fell 8.8% in January. In late 2023, contracts signed tumbled as higher mortgage rates limited prospective buyer traffic and discouraged homeowners from selling. The average rate on the 30-year fixed-rate mortgage has eased from two-decade highs near 8% in October, remaining below 7% since early December, according to Freddie Mac, after the Federal Reserve left its policy benchmark rate unchanged since July. On a monthly basis, the Midwest and South experienced the largest decline in pending sales in January, by a respective 7.6% and 7.3%. On a year-over-year basis, all regions posted a decrease in pending home sales. https://www.reuters.com/markets/us/us-pending-home-sales-fall-january-high-mortgage-rates-deter-buyers-2024-02-29/

2024-02-29 14:59

Fourth quarter GDP grows by 1%, beats estimates Economy likely expanded by 0.4% in January BoC to not rush with rate cuts, economists say OTTAWA, Feb 29 (Reuters) - The Canadian economy expanded at an annualized rate of 1.0% in the fourth quarter, exceeding expectations, data showed on Thursday, a result that should ease interest rate-cutting pressure on the central bank. Fourth-quarter gross domestic product (GDP) was higher than the Bank of Canada's (BoC's) expectation for zero growth and analysts' median forecast for an expansion of 0.8% growth. January GDP likely gained 0.4% from December, Statistics Canada said in a flash estimate. "Today's results, while mixed, would send a signal that there's no urgency to cut rates," said Doug Porter, chief economist at BMO Capital Markets. "It's not as if the economy is sinking... It's just very slowly but surely moving ahead." The Bank of Canada (BoC) has kept its key overnight rate at a 22-year high of 5% for the past four meetings as it strives to root out underlying inflation driven by shelter costs, food prices and wages. Canada's economy did better than G7 counterparts Japan and UK, which slipped into recession at the end of last year. Month-over-month, real GDP was essentially unchanged in December, missing a 0.2% growth forecast, Statscan said. Quarterly growth was fueled by a rise in exports as imports declined, Statscan said, adding that a decline in business investment was a moderating factor. Final domestic demand, composed of expenditures on final consumption and gross fixed capital formation, edged down 0.2% in the fourth quarter and outside of 2020, real GDP in 2023 rose at its slowest pace since 2016, StatsCan said. "Growth appears to have been driven largely by an easing of previous supply constraints... rather than necessarily an improvement in domestic demand," said Andrew Grantham, economist with CIBC. The current GDP data doesn't change his forecast for a first interest rate cut in June, he said. The BoC is expected to keep rates on hold at its next policy announcement on Wednesday. While high rates have helped cool inflation from 8.1% in June 2022 to 2.9% in January, it has gnawed at growth, building pressure on the central bank to start easing rates. In its monetary policy report last month, the BoC had forecast economic growth to stall in the fourth quarter and grow by an annualized 0.5% in the first quarter. It expects this year's growth to be 0.8%. Money markets see more than a 80% chance for a rate cut in June, and a 25-basis-point cut is fully priced in for July. The loonie clawed back its earlier losses to trade 0.1% higher at 1.3565 per U.S. dollar, or 73.72 U.S. cents. Bond yields for the two-year Canadian government bonds eased slightly from morning trade rose 0.8 basis points to 4.211% at 1433 GMT. Since the BoC's last rate announcement, data has been mixed with job growth exceeding expectations in January and inflation cooling faster than expected. At 2.9%, inflation is still running hotter than the bank's 2% target. In an advance estimate for January, Statscan said increases in educational services and health care and social assistance, were partially offset by decreases in mining, quarrying, and oil and gas extraction and transportation and warehousing sectors. https://www.reuters.com/world/americas/canadas-economy-tops-q4-growth-forecasts-another-rise-seen-jan-2024-02-29/

2024-02-29 14:18

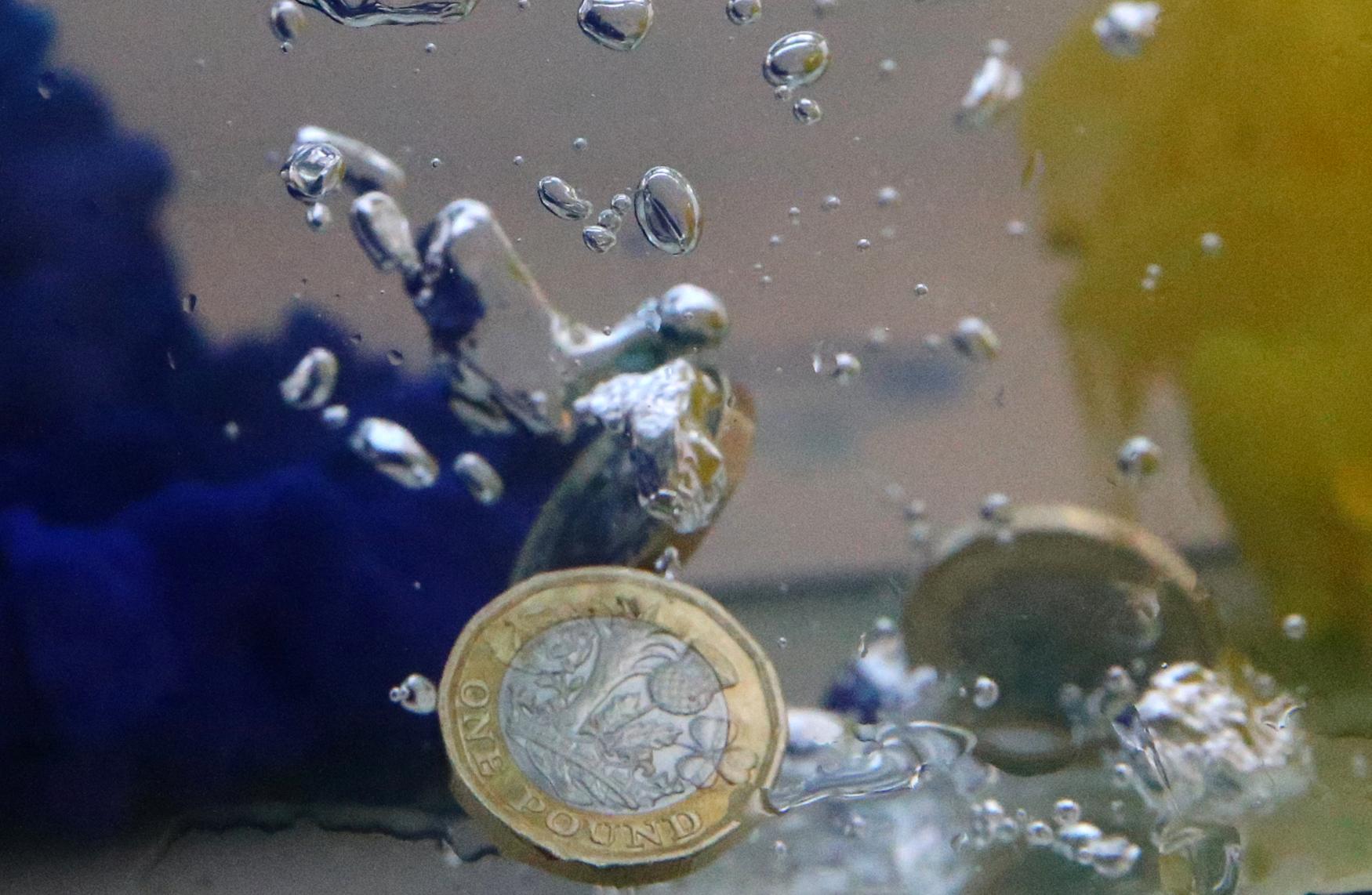

LONDON, Feb 29 (Reuters) - The pound was set for a small monthly decline against both the dollar and the euro on Thursday, on a busy day for inflation data elsewhere in the world, while investors in Britain's focus began turning to next week's budget. Sterling was last down 0.06% against the dollar at $1.2654 and heading for a monthly decline of 0.26%. It also softened on the day and the month versus the euro, which was up a fraction on Thursday at 85.66 pence and up 0.47% in February, albeit after a sharp fall at the start of the year. "The pound has been consolidating at higher levels this month after strengthening in January," said Lee Hardman senior FX strategist at MUFG in a note to clients. "We continue to hold a short EUR/GBP trade recommendation which is befitting from the higher yields on offer in the UK but has struggled to break below support at the 0.8500-level this month." The main event in world markets on Thursday was the release of U.S. PCE inflation, the Fed's preferred gauge, which showed U.S. prices picked up in January, but the annual increase in inflation was the smallest in nearly three years, keeping a June interest rate cut from the Federal Reserve on the table. The move was in line with expectations and did little to move currencies. Euro zone inflation dipped further this month, according to data also released on Thursday, strengthening the case for the European Central Bank to cut rates, though investors were nervous about changing ECB pricing too much ahead of the U.S. data. The crucial question for currency markets at present is when central banks are sufficiently confident that inflation is heading back towards their target that they cut rates, and which central banks do so first. Hardman said that was one way through which next week's budget could be transmitted to currency markets. British finance minister Jeremy Hunt is expected to cut taxes but is hemmed in by promises to tackle Britain's approximately 2.5 trillion pounds ($3.2 trillion) of debt. "While the size of the potential fiscal giveaway is unlikely to be sufficient to significantly alter the performance of the UK economy, it could discourage the BoE from delivering an earlier rate cut in May or June," Hardman wrote. https://www.reuters.com/markets/currencies/sterling-set-monthly-decline-dollar-euro-2024-02-29/