2024-02-28 12:22

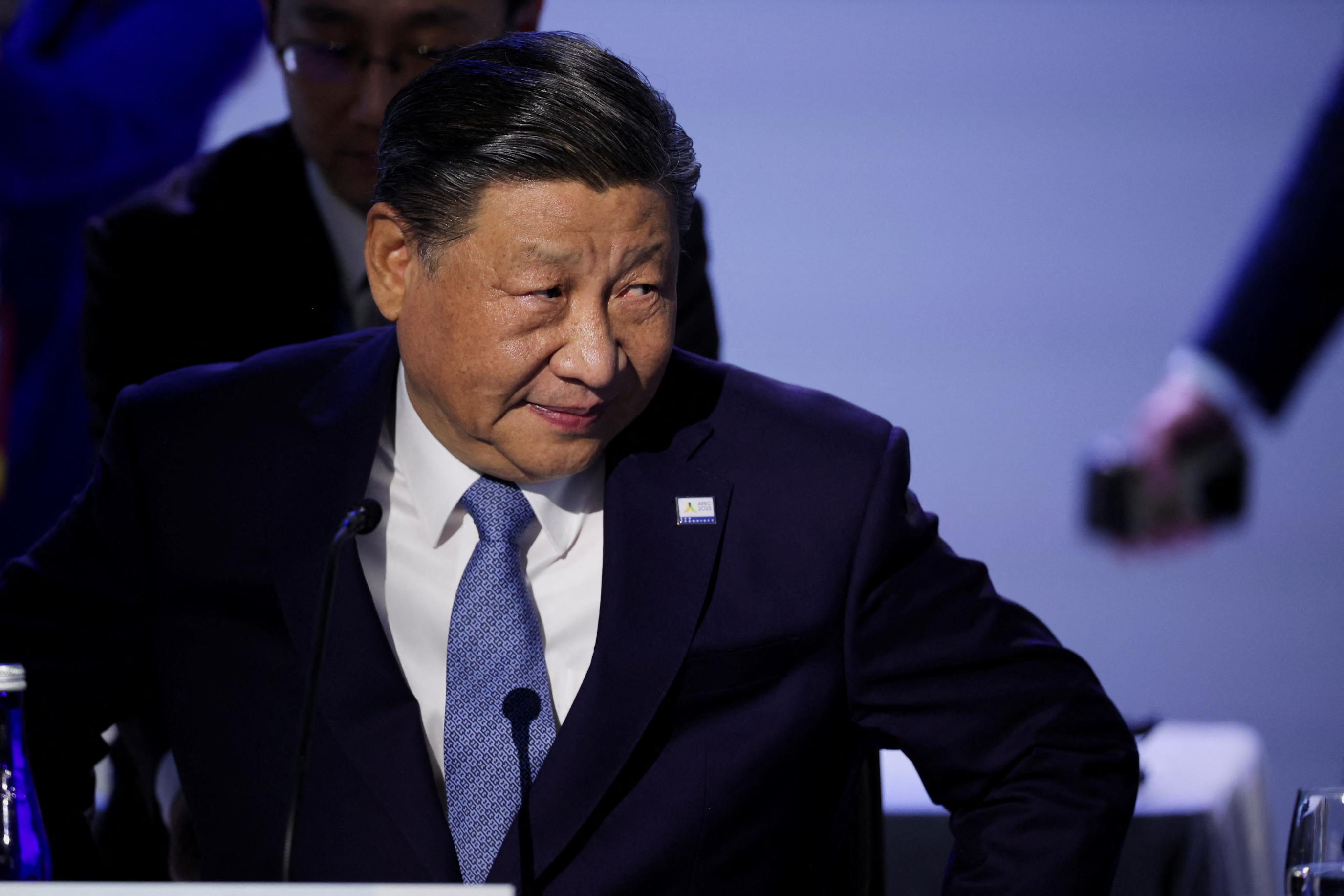

BEIJING, Feb 28 (Reuters) - Chinese President Xi Jinping promised to encourage Chinese firms to invest in minerals-rich but economically ailing Sierra Leone as part of Beijing's long-term drive to deepen economic and political ties with Africa. China has always regarded cooperation with African countries as a cornerstone of its foreign policy, Xi told visiting Sierre Leone President Julius Maada Bio in Beijing on Wednesday. Its relations with Sierra Leone are "a model of unity and cooperation" for other African states," Xi said. Bio, who is accompanied on his trip his finance and mining ministers, is hoping to attract more Chinese firms to the West African state and secure investment pledges to upgrade its poor infrastructure. China's engagement with African states is expected to take on a bigger focus in 2024 after the dismantling of stringent COVID-19 curbs and the re-opening its borders to the world. Since the start of 2023, it has elevated diplomatic ties with Ethiopia, Zambia, Benin, the Democratic Republic of Congo and Gabon in a continent whose natural resources have long been a draw. China is also keen to grow its geopolitical influence just as the United States seeks to deepen its ties with the continent. Xi told Bio China will support Africa's drive to industrialise and to modernise its agricultural sector. Chinese firms have invested $6.4 billion in Sierra Leone since 2010, data from the American Enterprise Institute think tank shows, predominantly in metals. In December, Sierra Leone signed a pact with China Road and Bridge Corporation to build an 8-km (5-mile) bridge crossing the river separating the capital Freetown from the country's main airport at an estimated cost of $1.5 billion. Freetown has struggled to convince foreign lenders that it could service any debt it might take on despite needing fresh funding to rebuild following an 11-year civil war that ended in 2002. Freetown owes Beijing around $78 million, or 2.5% of its public debt, International Monetary Fund data shows, ahead of South Korea, from which it has borrowed around $50 million, and India, which it owes $28 million. https://www.reuters.com/world/china-promises-investment-impoverished-sierra-leone-2024-02-28/

2024-02-28 12:07

WTO meets in Abu Dhabi to reach trade deals 'Deep divergences' on climate seen among countries Some seek rules on plastics, fossil fuel subsidies Others, like India, say no place for climate on WTO agenda ABU DHABI, Feb 28 (Reuters) - The World Trade Organization's chief is on a mission to put climate change at the heart of its work as part of an effort she is leading to get the watchdog to square up to some of the world's most pressing challenges. But at a biennial WTO meeting , opens new tab in Abu Dhabi where negotiators hope to fix new rules for global commerce, the sole paragraph in a 56-page draft agreement that explicitly addresses the topic is stuck in an annex - with an explanatory note referring to "deep divergences" among members. At first blush, it's hard for an outsider to tell what is so controversial since the section merely pledges to "promote cooperation on environmental aspects of trade" and mandates a WTO committee to offer recommendations by the next major meeting in two years. In a rare move, Director-General Ngozi Okonjo-Iweala has intervened to propose alternative language in the draft Abu Dhabi agreement and negotiations continue. A commitment to sustainable trade is in the WTO's 30-year- old founding document, with members aspiring to "protect and preserve the environment and to enhance the means for doing so". Yet, while it hosts brainstorming sessions among some groups of countries on climate change, it has no global negotiating stream on it. Okonjo-Iweala, who recently appointed a special adviser on climate change, wants to confront the view of some ecologists that free trade is part of the climate problem because it generates transport emissions and can help drive carbon-intensive economic growth. Instead, she argues the body can be part of the solution: by tackling fossil fuel subsidies, harmonising carbon price policies to prevent emissions merely being displaced to other countries or tackling import tariffs for low-carbon goods like electric cars, which tend to be higher than for combustion ones. But some countries, like India, say the issue has no place on an WTO agenda it wants confined to pure trade matters. "WTO should not negotiate rules on non-trade related subjects like climate change, gender, labor etc. Rather they should be addressed in respective intergovernmental organisations," said India's Commerce Minister Piyush Goyal, voicing a reticence felt by other developing countries. Meanwhile, some wealthier states would prefer to go it alone with their own policies, trade experts say. "They believe they have enough flexibilities under the rules as they are, and that a big multilateral negotiation on new rules would not be helpful, and could even constrain some of their future environmental measures," said Dmitry Grozoubinski, executive director of trade policy think tank, the Geneva Trade Platform. INTERNAL BATTLES The debate over the climate change paragraph illustrates the difficulties Okonjo-Iweala has sometimes faced in prioritising the topic within an organisation that is supposed to be led by its members – all 164 of whom must agree by consensus. Okonjo-Iweala, a former Nigerian finance minister, has warned about trade policy fragmentation if the WTO does not step in, citing the example of more than 70 existing carbon price schemes in the world. But a presentation by the WTO's Secretariat on a proposed global carbon price methodology last year in Geneva received a lukewarm reception, according to trade delegates who attended. Jean-Marie Paugam, WTO Deputy Director-General, acknowledged that there were "different visions" on carbon pricing but that a WTO-led task force was making progress on the topic. Overall, Okonjo-Iweala's ideas on the WTO's role in climate change have been well received, he said. "There is recognition of the DG's leadership in terms of trade and climate," he said. An area of hope is that, since 2020, groups of countries keen to make progress on environmental topics are discussing ideas such as new rules constraining fossil fuel subsidies or bans on trade in some plastic goods. "Now we are having a discussion on these issues, three years ago this would have been impossible," said Carolyn Deere Birkbeck, Executive Director of the Forum on Trade, Environment and the SDGs (Sustainable Development Goals). One day these talks known as "plurilaterals" may form the basis for broader negotiations on new rules binding for all countries, the trade experts say. "This work is really foundational to inform what the membership may wish to do at the WTO," said Canada's Trade Minister Mary Ng. If the second part of a deal on cutting subsidies that lead to overfishing is agreed in Abu Dhabi after more than 20 years of talks, this could spur more progress. Many developing states fear that countries' new policies in this area, such as the EU's carbon border tax, will place them at a trade disadvantage since they have fewer resources to decarbonise their industries. The EU has said the tax is in line with WTO rules, affecting both domestic and foreign producers. It has proactively engaged with partners and made presentations at the WTO to explain its policies, an EU spokesperson said. But for some, discussions around such tensions are exactly the right place for the WTO to start. "What we do not want is a new form of protectionism to arise. But these are things that can only be treated if you are at the table engaging in the give and take," said Kerrie Symmonds, minister of foreign affairs and trade for Barbados. "We believe strongly the WTO has the convening power to host these types of discussions and facilitate them." https://www.reuters.com/world/climate-change-confined-mere-annex-draft-wto-deal-2024-02-28/

2024-02-28 12:00

LITTLETON, Colorado, Feb 28 (Reuters) - China maintained its dominant grip on the export of solar panels and modules in 2023, boosting global shipments by over a third from 2022's totals, according to data compiled by energy think tank Ember. Total solar module exports by China, which accounts for roughly 80% of global solar exports, totalled roughly 220,000 megawatts (MW) of generation capacity in 2023, up by over 55,000 MW from 2022 as global markets seeking to boost clean energy generation snapped up components. But trade tensions with Europe over accusations that China has undercut rival producers of solar equipment led to a slight shift in the flows of module exports during 2023 as a whole. Asian countries saw the largest increase of all regions in solar module imports from China in 2023, growing by more than European nations for the first time since 2020. Europe remained the largest overall destination for Chinese solar modules overall, but the region's share of total Chinese solar exports dropped to 46.35% in 2023 from 55% in 2022. Asia had the second largest share, with 23%, while Latin America and the Caribbean had the third largest share with 14%. Africa and the Middle East both saw sharp climbs in module import capacity from China in 2023, and both regions climbed by roughly twice the combined capacity imported by Oceania and North America last year. COUNTRY HIGHLIGHTS In terms of individual countries, the Netherlands remained the largest single destination for China's solar modules for the second straight year in 2023, importing a record 47,156 megawatts. Brazil (21,009 MW), India (14,538 MW) and Spain (12,241 MW) were other major markets. In terms of annual growth rates, Saudi Arabia, South Africa, Malaysia and Pakistan all saw imports from China increase by well over 100% in 2023 from 2022's totals, and all joined the ranks of major markets for China panels and modules. Annual declines in solar imports from China were seen in Germany (-25%), Portugal (-54%) and Poland (-14%) as European lawmakers cracked down on cheap renewable equipment imports from China and threatened anti-dumping proceedings. United Arab Emirates also saw an annual contraction in module imports (-42%) in 2023, due to the completion of major utility scale projects and the introduction of feed-in tariffs which slowed the pace of new solar farm construction. GROWTH AREAS Offsetting the declines seen into certain European markets were import increases into Thailand, Brazil, Mexico, South Korea and Malaysia, which look set to remain high-growth markets for renewable energy components due to escalating clean energy momentum in those countries. Southern European nations also posted solid year-on-year gains in 2023, with Italy's imports growing by 64%, Turkey's by 219%, while Spain (+10%) and Greece (6%) also showed growth. Ongoing trade disputes kept the United States a conspicuously small market for Chinese modules given the overall size of U.S. economy, with U.S. purchases of 563 MW of components accounting for only 0.3% of total Chinese exports. However, even if trade spats continue to shrink China's share of the solar component markets in North America and Europe, fast-growing economies such as The Philippines, Vietnam, Thailand, Malaysia and South Africa look set to ensure the overall trajectory of China's solar module exports remains higher. https://www.reuters.com/markets/commodities/china-steers-solar-module-export-stream-towards-asia-2024-02-28/

2024-02-28 11:46

Feb 28 (Reuters) - Amazon (AMZN.O) , opens new tab aggregator Thrasio Holdings filed for Chapter 11 bankruptcy protection and received commitments for $90 million in new financing from existing shareholders, it said on Wednesday. Thrasio also entered into a restructuring agreement with some of its lenders to reduce debt of $495 million from its existing debt pile, it said in a statement. It listed its estimated assets in the range of $1 billion to $10 billion and estimated liabilities of $500 million to $1 billion, according to a document filed with the New Jersey bankruptcy court. Thrasio, which acquires third-party sellers on Amazon, said it will continue to operate its business normally and without interruption throughout the bankruptcy process. https://www.reuters.com/markets/deals/amazon-aggregator-thrasio-files-bankruptcy-2024-02-28/

2024-02-28 11:41

LONDON, Feb 28 (Reuters) - The British pound slipped against the stronger dollar, its first daily drop against the U.S. currency in seven trading days, with investors avoiding risks before key inflation data that could determine when central banks begin easing policy. Thursday brings the release of the U.S. personal consumption expenditures price index for January, the Federal Reserve's targeted measure of inflation, which investors were watching for clues on when it might cut interest rates. Analysts expect the PCE price index to moderate to 2.4% on an annual basis and the core measure to slow to 2.8%. "There is a tone of caution in the markets this morning ahead of the incoming high-impact U.S. data, which has guided sterling lower," said Kyle Chapman, FX markets analyst at Ballinger & Co. More volatile currencies, such as the pound, are generally more sensitive to risk sentiment in markets, while the dollar tends to benefit from safe-haven demand when markets are cautious. The pound was last at $1.2645 against the dollar, down 0.3% and on track for its biggest one-day drop in over three weeks. The dollar index , which measures its performance against six other currencies, including the pound, was up 0.3% at 104.11. "Looking at the broader perspective, it's tight ranges as markets wait for the inflation data," said Danske Bank FX and rates strategist Mohamad Al-Saraf. Germany, France and Spain publish their inflation figures on Thursday before euro area inflation as whole is released on Friday. But with little data out from Britain this week, some were already turning their attention to next week's Spring Budget, where some modest fiscal loosening before a possible election this year looks likely. Goldman Sachs economist James Moberly expects possible measures announced next week to boost British output by around 0.3% with half of the effect coming from increased supply and the remainder from higher demand relative to supply. "The modest change in the supply-demand balance at the margin reinforces our view that the BoE (Bank of England) will likely wait until June to cut Bank Rate," Moberly said in a note. Money market traders are betting that the BoE will begin easing policy from August, with only 56 basis points of rate cuts priced this year, implying around two quarter-point moves by the end of 2024. https://www.reuters.com/markets/currencies/sterling-rise-runs-out-steam-cautious-risk-picture-2024-02-28/

2024-02-28 11:36

LONDON, Feb 28 (Reuters) - Bitcoin hit $60,000 on Wednesday for the first time in more than two years, as a surge of capital into new U.S. spot bitcoin exchange-traded products fuelled a rally that has reached 42% this month, on track for its largest monthly gain since December 2020. Bitcoin was last up 8% at $61,272, its highest since November 2021, when it hit a record just below $70,000. It was also heading for its largest weekly gain in a year, up 18.5% since Feb. 21. Traders have poured into bitcoin ahead of April's halving event - a process designed to slow the release of the cryptocurrency. In addition, the prospect of the Federal Reserve delivering a series of rate cuts this year has fed investor appetite for higher-yielding or more volatile assets. "Bitcoin is being driven by the support of consistent inflows into the new spot ETFs and outlook for April's halving event and June's Fed interest rate cuts," said Ben Laidler, global markets strategist at retail investment platform eToro. Coinbase Global , the largest U.S. crypto exchange, said on Wednesday it was investigating an issue causing some users to see zero balance across their accounts. Coinbase CEO Brian Armstrong said , opens new tab in a separate post on X that the crypto exchange was dealing with a large surge in traffic. read more The value of all the bitcoin in circulation has topped $2 trillion this month for the first time in two years, according to crypto platform CoinGecko, while the price of the token itself has doubled in just four months. The bigger bitcoin exchange-traded funds (ETFs) have seen a definite pickup in interest this week. The three most popular, run by Grayscale , Fidelity and BlackRock (IBIT.O) , opens new tab, have seen trading volumes surge. On Monday and Tuesday, around 110 million shares in the biggest three changed hands, about 51% of the 215 million shares traded in the market's most valuable companies - Apple (AAPL.O) , opens new tab, Microsoft (MSFT.O) , opens new tab and Nvidia (NVDA.O) , opens new tab, according to LSEG data. Three weeks ago, this percentage was closer to 15%. "Essentially, we're seeing the ETF effect ahead of schedule ... We think it's reflective of advisors getting out there very quickly to start selling the ETFs to clients," said Joseph Edwards, head of research at Enigma Securities. LSEG data showed flows into the 10 largest spot bitcoin ETFs brought in $420 million on Tuesday alone, the most in almost two weeks. "If $60,000 doesn’t whet the appetite, consider that 70% of bitcoin supply has remained unmoved for a year, and the little that’s left is being hoovered up by the likes of BlackRock and Fidelity, just as rewards for miners are about to be slashed in half," said the cofounder of the Nexo crypto exchange, Antoni Trenchev. Crypto investor and software firm MicroStrategy (MSTR.O) , opens new tab this week disclosed it had recently bought about 3,000 bitcoin for $155 million, while social media platform Reddit said it had bought small amounts of bitcoin and ether. Meanwhile, the world's second biggest crypto currency, ether, , which underpins the ethereum blockchain network, rose 3.2% to $3,353, having hit another two-year high earlier in the day. Its price has risen 47% in February. Some investors are hoping U.S. regulators will approve applications for ETFs based on spot ether. Enigma Securities' Edwards said the rise felt reasonably well supported. "There certainly isn't a manic feeling to who's buying and why - ether gaining against the field also speaks to a more measured environment - but there's at least a little FOMO (fear of missing out) going on right now." https://www.reuters.com/technology/bitcoin-eyes-60000-biggest-monthly-rally-since-late-2020-2024-02-28/