2024-02-26 23:58

Feb 26 (Reuters) - Some U.S. residents will be going from wearing Bermuda shorts to snow pants in less than 24 hours, forecasters said on Monday, as a heat wave in the central plains and South gives way to weather more typical for this time of year. Temperatures on Monday in states like Nebraska and Iowa were seeing in the mid-70s Fahrenheit (low 20s Celsius), some 40 degrees F (22 degrees C) above averages for this time of year, while cities in the South, such as Dallas, Texas, sizzled in the mid-90s F (mid-30s C). This week's heat wave follows other unusual weather across the U.S. this winter - from "atmospheric river" rains in California that dumped a year's worth of rain in a matter of hours, to historic low levels of ice cover atop the Great Lakes. Forecasters said it was hard to pinpoint any single weather pattern to human-induced climate change, but extreme weather is becoming more frequent because of it. Scientists say the prevailing El Nino weather pattern is also contributing to the unusual weather. Joe Wegman, a meteorologist with the National Weather Service, said an unusual culprit is contributing to this week's heat wave. "Most of the eastern two-thirds of the country has had a relatively snow-less winter, so the ground is bare and dry," Wegman said. "So we're getting much warmer temperatures just due to solar radiation." That solar radiation is combining with warmer winds surging up from the Gulf of Mexico to push several locations to potential record high temperatures. Wegman said the heat wave will move quickly eastward across the U.S. and blow out to the Atlantic by Thursday. Some spots seeing unusually warm weather on Monday will get slammed by a cold front on Tuesday, Wegman said. He pointed to Grand Forks, North Dakota, where Monday's high was to be 55 F, followed by Tuesday highs of 9 F with a wind chill of -20 F (-29 C). Meanwhile, scientists with the U.S. National Oceanic and Atmospheric Administration's Great Lakes environmental research laboratory said ice cover on the lakes was at historic lows. Coverage ranged from 0% on Lake Erie to 10% on Lake Huron, according to the lab's data. Peak ice season for the Great Lakes happens in early March - so some recovery is still possible. Ice is a vital part of the Great Lakes' ecosystem. It provides a buffer against shoreline erosion due to the large waves common in winter, and protection for eggs laid by several fish species. Ice cover on the Great Lakes has been decreasing by 5% per decade because of warmer weather, the laboratory said in a report last week, for a 25% reduction from 1973 to 2023. https://www.reuters.com/world/us/central-us-seeing-wild-weather-with-heat-wave-then-deep-freeze-2024-02-26/

2024-02-26 23:48

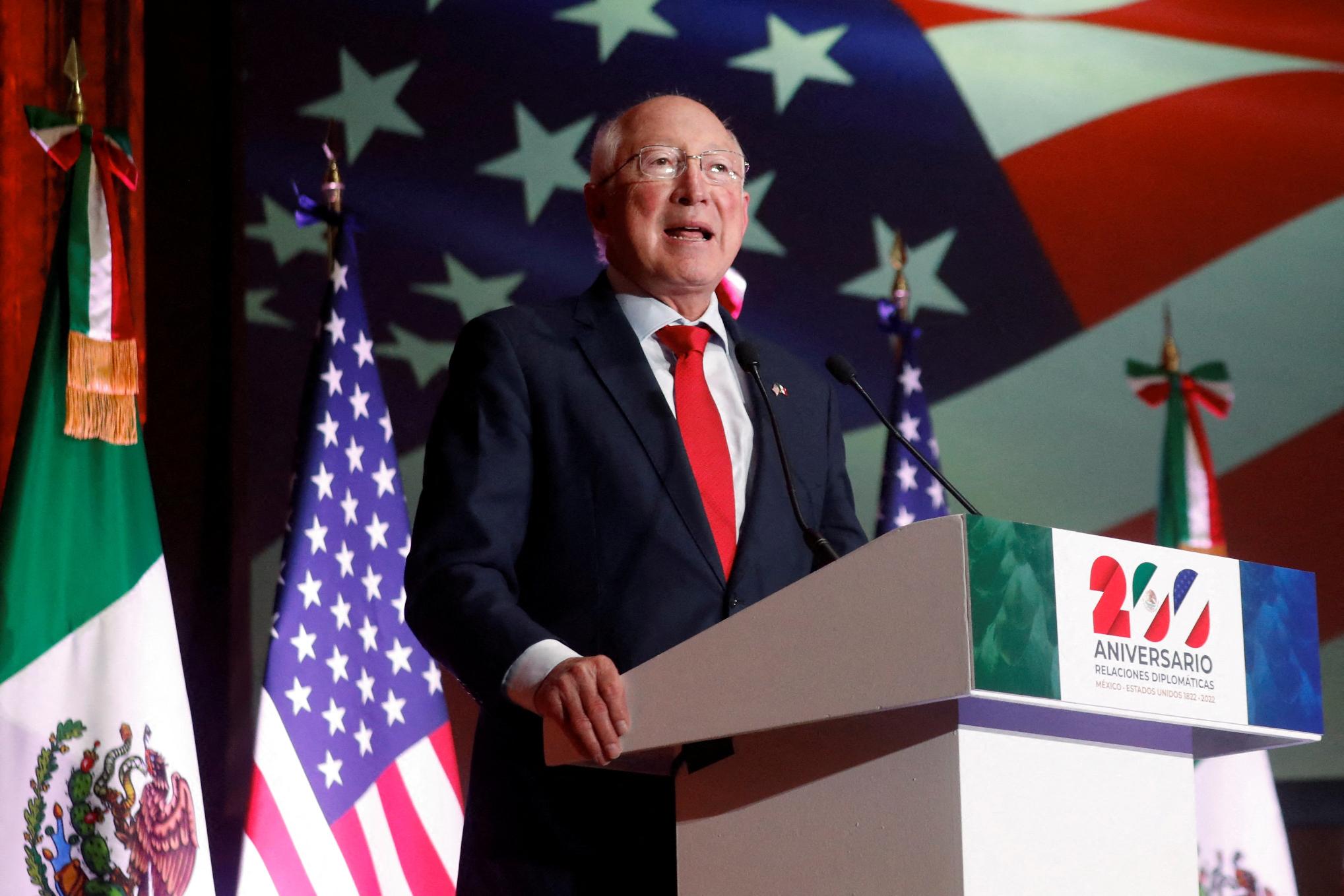

MEXICO CITY, Feb 26 (Reuters) - Mexican avocados grown on illegal orchards should not be exported to the United States, the largest importer of the popular staple used in guacamole, the U.S. ambassador to Mexico said Monday. In a visit to Michoacan, Mexico's main avocado-producing state, U.S. Ambassador Ken Salazar said there should be consequences if avocados were determined to be grown on illegal orchards. "They shouldn't have the opportunity to sell those avocados to the United States market," Salazar said in a joint news conference with Michoacan Governor Alfredo Ramirez, seen in a Facebook video shared by Ramirez. At least 30,000 hectares (74,130 acres) had been deforested in the state between 2018 and 2023, Ramirez said, with 817 illegal avocado orchards identified by the local government's Forest Guardian initiative. "Surely very soon the export protocol for avocados (from Mexico to the United States) will include a clause, an environmental guide that will have a direct reference to the Forest Guardian, from packaging based on the traceability of the product, to the orchard ... until it arrives for sale in the United States," Ramirez said. Mexico, the world's largest avocado exporter, sends 2.5 million metric tons abroad, according to data from its agriculture ministry. Four out of five avocados eaten in the United States are imported from Mexico, according to Climate Rights International (CRI), a nonprofit group that published research last year showing how avocados grown on deforested lands make their way to U.S. distributors and supermarkets. Michoacan state is the only place on earth where avocado trees bloom four times a year, instead of just once. The state's rich volcanic soil, healthy precipitation and ideal elevation for growing, make it a perfect location for avocado farming. The popularity of avocados and their lucrative market price has, however, led to unchecked illegal deforestation and water extraction in Michoacan, according to the CRI. Daniel Wilkinson, a senior adviser at CRI, called Salazar's announcement in Michoacan "remarkable." "If this commitment now translates into effective regulation, it could be a real game changer for local forests and communities," said Wilkinson. https://www.reuters.com/world/americas/mexican-avocados-grown-illegal-orchards-should-not-be-exported-us-ambassador-2024-02-26/

2024-02-26 23:30

Feb 26 (Reuters) - Utility firm AES (AES.N) , opens new tab on Monday forecast full-year 2024 profit above market estimates, backed by strong renewable project backlog. The Arlington, Virginia-based firm has been seeing a boom in its renewables unit, mirroring a global push to adopt cleaner methods of power generation. AES forecast adjusted profit in the range of $1.87 to $1.97 per share, the mid-point coming ahead of market estimates of $1.89 per share, according to LSEG data. The company said it expects to add 3.6 gigawatt of new projects in 2024 and forecast an adjusted core profit between $2.6 billion and $2.9 billion. AES said it expects to receive a rate case approval from the Indiana Utility Regulatory Commission by the middle of 2024. Rate case proceedings are used to determine the amount that customers need to pay for the electricity, natural gas, private water and steam services provided by regulated utilities. The company's net loss narrowed to $94 million for the quarter ended Dec. 31, from $903 million last year. https://www.reuters.com/business/energy/aes-forecasts-2024-profit-above-wall-street-estimates-renewable-strength-2024-02-26/

2024-02-26 23:24

Feb 26 (Reuters) - Human resources software provider Workday (WDAY.O) , opens new tab beat fourth-quarter profit estimates on Monday helped by strong demand for its cloud-based services, but reiterated its 2025 subscription revenue forecast citing macroeconomic concerns. Shares of the Pleasanton, California-based company fell more than 8% in extended trading. Tech companies facing an uncertain economy have started this year by announcing layoffs, which will impact companies like Workday that provide human capital and financial management services. Over 42,000 employees have been laid off from 170 tech companies so far this year, according to tracking website Layoffs.fyi. Workday reported adjusted profit per share of $1.57, compared with an estimate of $1.47, according to LSEG data. Peer Automatic Data Processing (ADP.O) , opens new tab also reported strong results last month, aided by steady payroll demand. Workday's revenue for the fourth quarter stood at $1.92 billion, in line with market expectations. The company said it would acquire AI-powered talent orchestration solutions HiredScore and expects the transaction to be completed in the first quarter of its fiscal year 2025. It reiterated its fiscal year 2025 subscription revenue guidance of $7.73 billion to $7.78 billion and said it expects macroeconomic conditions to persist. Subscription revenue for the quarter ended Jan. 31 rose about 18% to $1.76 billion. https://www.reuters.com/technology/workday-beats-quarterly-profit-estimates-expects-macro-concerns-continue-fiscal-2024-02-26/

2024-02-26 22:50

Exxon, CNOOC signal interest in buying Hess' Guyana operations Talks center on right of first refusal over Hess stake HOUSTON, Feb 26 (Reuters) - Exxon Mobil Corp (XOM.N) , opens new tab said on Monday it may preempt Chevron Corp's (CVX.N) , opens new tab acquisition of a 30% stake in a giant Guyana oil block, the centerpiece of its deal for Hess Corp (HES.N) , opens new tab. The companies are in talks on Exxon's claim it has a right to first refusal of any sale of the Stabroek block, a giant field off the coast of Guyana that contains at least 11 billion barrels of oil. The dispute between the top U.S. oil producers could end Chevron's $53 billion deal for Hess, Chevron warned in a securities filing. If the deal falls part, Hess could be liable for a $1.7 billion breakup fee. Hess shares fell more than 3% in late trading. Chevron fell almost 1%. Exxon said in a statement it wants to ensure it will "preserve our right to realize the significant value we’ve created and are entitled to in the Guyana asset," adding it is "working closely with the Guyanese government to ensure their rights and privileges." "You have to assume that Chevron made a business decision that Exxon wouldn't try to preempt," said Dan Pickering, chief investment officer at Pickering Energy Partners. The two companies are partners in projects elsewhere and the dispute signals how valuable the Guyana projects are to Exxon, he said. "It obviously means that 30% of Guyana is really valuable and maybe they think that Chevron is getting in too cheaply, Pickering said, adding "Right now, it feels like a food fight." Exxon operates all production in Guyana with a 45% stake in the consortium with Hess and China's CNOOC (0883.HK) , opens new tab as its minority partners. In October, Chevron proposed to buy Hess largely to obtain the Guyana stake. Chevron said it believes the talks "will result in an outcome that will not delay, impede or prevent the consummation of the merger." However, it also said the dispute could wind up in arbitration if the two sides cannot reach a settlement. "The right of first refusal provision is not applicable to the merger. We are fully committed to the transaction and do not believe the ROFR or these discussions will prevent its successful completion." Chevron and Hess said. A disruption of the deal terms would be a major blow to the U.S. second largest oil producer, which has been trying to expand production into lower cost fields in the Americas. Guyana has been trying to attract more large oil producers to dilute Exxon's dominance of the country's energy output. It recently held an offshore block auction that drew bids by TotalEnergies (TTEF.PA) , opens new tab, Petronas and Qatar Energy. The Hess acquisition has been stalled by the U.S. Federal Trade Commission's request for additional information on the merger. That request pushed back any closing to at least the middle of this year, and the Exxon claim could extend it further. The Exxon-led consortium has said it expects to triple Guyana's oil output to more than 1.2 million barrels of oil per day by 2027. https://www.reuters.com/business/energy/chevron-exxon-dispute-over-hess-stake-guyana-oil-block-2024-02-26/

2024-02-26 22:48

Feb 26 (Reuters) - Pipeline operator ONEOK (OKE.N) , opens new tab reported a 42% jump in fourth-quarter profit on Monday, as it transported higher volumes of natural gas and natural gas liquids. ONEOK, which has about 50,000-mile long network of pipelines, said its Rocky Mountain region natural gas liquids (NGL) raw feed throughput volumes rose by 20%, compared to last year. The company said it also saw a 17% rise in natural gas volumes processed. Pipeline operators have benefited from a sharp rise in U.S. liquefied natural gas (LNG) exports with 8.6 million metric tons leaving the country's terminals in December. ONEOK forecast 2024 net income in the range of $2.61 billion to $3.01 billion and said the forecast includes a full-year contribution from the refined products and crude segment. The company moved into transporting refined products and oil last year following its acquisition of rival Magellan Midstream in an $18.8 billion deal. Tulsa, Oklahoma-based ONEOK expects about $175 million in total realized annual cost and initial commercial synergy impacts in the first year after the Magellan acquisition. ONEOK reported net income of $688 million, or $1.18 per share, for the three months ended Dec. 31, compared with $485 million, or $1.08 per share, a year earlier. The company, which is the primary NGL transportation provider for the Williston and Powder River basins and Mid-Continent, said it expects 2024 capital expenditure in the range of $1.75 billion to $1.95 billion. https://www.reuters.com/business/energy/pipeline-firm-oneok-posts-higher-fourth-quarter-profit-strong-volumes-2024-02-26/