2024-02-23 22:27

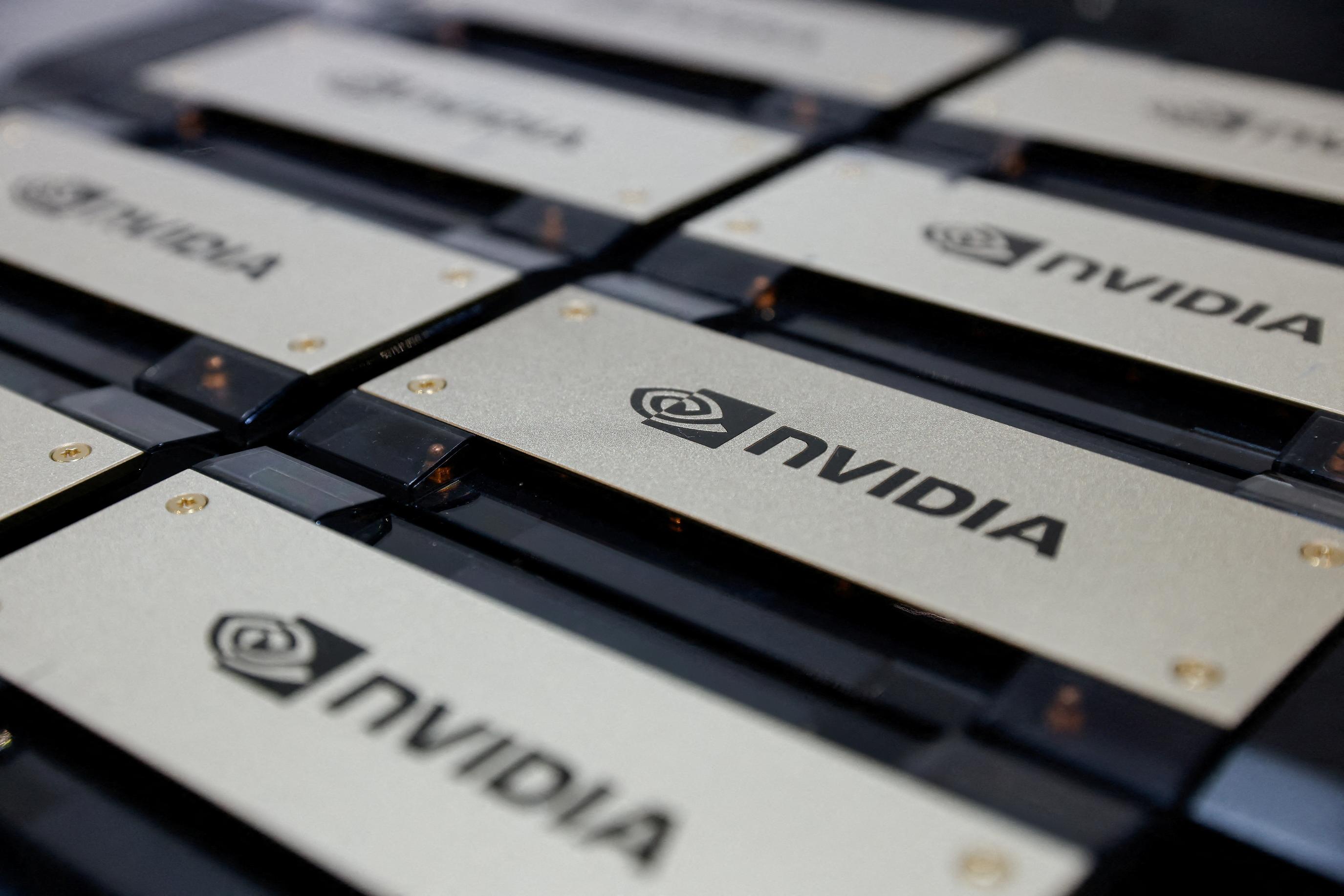

Feb 23 (Reuters) - A staggering rise in shares of chipmaker Nvidia (.NVDA.O) , opens new tab helped the SPDR S&P 500 ETF Trust become the first exchange traded fund to top $500 billion in assets, market participants said. The largest and most liquid fund tracking the Standard & Poor's 500 index topped $500 billion on Thursday, according to its issuer, State Street Global Advisors. It currently has about $502 billion in assets. A sizeable chunk of those gains came from the surge in Nvidia, whose heavy weighting in the S&P 500 gives it an outsized influence on the index’s moves. The stock’s shares have soared nearly 60% year-to-date, adding another 8.9% in the last week alone, thanks to a post-earnings surge on Thursday. “This is a result of Nvidia climbing to new highs rather than of fresh demand for the ETF,” said Todd Rosenbluth, chief ETF strategist at VettaFi. Nvidia, one of the so-called Magnificent Seven stocks that have helped drive markets higher this year, has a weighting of 4.5% in the S&P 500. The index is up 6.7% year-to-date. The company briefly hit $2 trillion in market value for the first time on Friday, riding on an insatiable demand for its chips that made the Silicon Valley firm the pioneer of the generative artificial intelligence boom. While the SPDR ETF continues to dominate trading volumes and liquidity and topped the list of ETFs with the largest inflows last year, two other broad market ETFs have emerged as challengers in recent years. Flows into both BlackRock Inc.'s (BLK.N) , opens new tab iShares Core S&P 500 ETF and the Vanguard S&P 500 ETF have grown at a faster rate over the last three years as a whole, data from LSEG showed. Together, the three ETFs now account for about $1.35 trillion of the $8.4 trillion of total assets invested in ETFs in the U.S. Rosenbluth noted. https://www.reuters.com/business/finance/spdr-sp-500-etf-tops-record-500-bln-assets-nvidia-soars-2024-02-23/

2024-02-23 22:04

WASHINGTON, Feb 23 (Reuters) - The United States on Friday imposed extensive sanctions against Russia, targeting more than 500 people and entities to mark the second anniversary of Moscow's invasion of Ukraine and retaliate for the death of Russian opposition leader Alexei Navalny. President Joe Biden said the measures aim to ensure Russian President Vladimir Putin "pays an even steeper price for his aggression abroad and repression at home." The sanctions targeted Russia's Mir payment system, financial institutions and its military industrial base, sanctions evasion, future energy production and other areas. They also hit prison officials the U.S. says are linked to Navalny's death. "Doesn't Washington realize that sanctions won't take us down?" Russia's ambassador to Washington, Anatoly Antonov, was quoted as saying on his embassy's channel on the Telegram messaging app. The United States later on Friday also imposed sanctions on Russia's leading tanker group, Sovcomflot, accusing it of being involved in violating the G7's price cap on Russian oil. Also targeted were 14 crude oil tankers in which it has an interest. "Sovcomflot as a whole, as a parent company, has been implicated in price cap violations in addition to deceptive activity," a senior Treasury official said. The Biden administration is seeking to continue supporting Ukraine as the country faces acute shortages of ammunition, with the approval of more U.S. military aid delayed for months in the U.S. Congress. The European Union, Britain and Canada also took action against Russia on Friday. The U.S. Treasury Department targeted nearly 300 people and entities, while the State Department hit over 250 people and entities and the Commerce Department added over 90 companies to the Entity List. The United States and its allies have imposed sanctions on thousands of Russian targets since Russia invaded neighboring Ukraine on Feb. 24, 2022. The war has seen tens of thousands killed and cities destroyed. However, Russia's export-focused $2.2-trillion economy has proved more resilient to two years of unprecedented sanctions than either Moscow or the West anticipated. "We must sustain our support for Ukraine even as we weaken Russia's war machine. It's critical that Congress steps up to join our allies around the world in giving Ukraine the means to defend itself," Treasury Secretary Janet Yellen said in a statement. Brian O'Toole, a former Treasury official, said the action, while involving a lot of names, was short on impact, because the majority of the entities targeted are Russian rather than foreign firms, and are easily replaceable as Moscow seeks to skirt sanctions. But former senior Treasury official Ben Harris said the magnitude of the sanctions imposed by the United States alone was formidable. U.S. Secretary of State Antony Blinken said Friday's move was Washington's largest number of designations in a single Russia action. PAYMENT SYSTEM Among the actions taken, the U.S. Treasury imposed sanctions on state-owned National Payment Card System, the operator of the Mir payment system. Mir payment cards have become more important since U.S. rivals suspended operations in Russia. It also targeted over a dozen Russian banks, investment firms, venture capital funds, and fintech companies. The United States also targeted Russia's future energy production and exports, taking further aim at the Arctic LNG 2 project in Siberia. In November, Washington imposed sanctions on a major entity involved in the massive project. On Friday, the State Department targeted Russia's Zvezda shipbuilding company, which it said is involved in the construction of up to 15 highly specialized LNG tankers intended for use in support of Arctic LNG 2 exports. The United States also imposed sanctions on entities based in China, Turkey, the United Arab Emirates, Kazakhstan and Liechtenstein over the evasion of Western sanctions on Russia and backfilling. The spokesperson for China's embassy in Washington, Liu Pengyu, called the sanctions against the Chinese firms "a typical move of economic coercion, unilateralism and bullying" by the United States. Washington has increasingly sought to crack down on Russia's circumvention of its measures. Peter Harrell, a former National Security Council official, said the moves sent a clear message that the U.S. is prepared to take action against circumvention. "I see this as kind of a valuable but incremental step that is within the strategy they've been deploying over the last two years," he said. The Biden administration also imposed new trade restrictions on 93 entities from Russia, China, Turkey, the United Arab Emirates and elsewhere for supporting Russia's war effort in Ukraine. The State Department also targeted three Russian Federal Penitentiary Service officials it accused of being connected to Navalny's death, including its deputy director who it said reportedly instructed prison staff to exert harsher treatment on Navalny. Navalny, 47, fell unconscious and died suddenly last week at the penal colony above the Arctic Circle, the prison service said. Biden has directly blamed Putin for Navalny's death. The U.S. action also targeted people involved in what the State Department called the forcible transfer or deportation of Ukrainian children. https://www.reuters.com/world/biden-announces-new-sanctions-vs-russia-two-years-into-ukraine-war-2024-02-23/

2024-02-23 21:48

Nvidia maintains upward march, briefly earning $2 tln valuation Warner Bros Discovery slides after big loss Block rallies as outlook tops earnings estimates For the week: Dow up 1.3%, S&P up 1.71%, Nasdaq up 1.43% Indexes on Friday: Dow up 0.16%, S&P up 0.03%, Nasdaq down 0.28% Feb 23 (Reuters) - The S&P 500 and Dow Jones Industrial Average eked out another closing record high on Friday, with all three Wall Street benchmarks scoring weekly gains, as artificial intelligence stocks had enough steam to keep the rally chugging along. AI poster child Nvidia (NVDA.O) , opens new tab advanced again, rising 0.4%, and briefly traded above $2 trillion in market valuation for the first time. Nvidia's gains on Thursday, the session after its blowout earnings, had propelled the chipmaker to add $277 billion in stock market value, Wall Street's largest ever daily gain. Despite a smaller advance on the final trading day of the week, its performance still dominated the market's attention. "Nvidia is one of the key companies, if not the key company, for driving the Nasdaq and S&P 500 higher," said Anthony Saglimbene, chief market strategist at Ameriprise. Saglimbene noted investors have been walking back expectations for Federal Reserve interest rate cuts, which otherwise could be a headwind for markets. But the performance of Nvidia and other Big Tech has pushed Fed worries into the background. "The concentration is so intense right now on Big Tech, in particular on Nvidia, that it's looking passed that," he said. Nvidia had pulled up other Big Tech and growth stocks in previous sessions, as investors traded the AI play. Some of these names gave up some gains on Friday, as Apple (AAPL.O) , opens new tab, Tesla (TSLA.O) , opens new tab and Meta Platforms (META.O) , opens new tab all fell between 0.4% and 2.8%. Shares of Super Micro Computer (SMCI.O) , opens new tab, another beneficiary of the AI rally, dropped 11.8% after the server component maker priced its convertible notes. The S&P 500 (.SPX) , opens new tab gained 1.77 points, or 0.03%, to end at 5,088.8 points, while the Nasdaq Composite (.IXIC) , opens new tab lost 44.80 points, or 0.28%, to 15,996.82. The Dow Jones Industrial Average (.DJI) , opens new tab rose 62.42 points, or 0.16%, to 39,131.53. A majority of the S&P sectors ended in positive territory. Among the best performers were utilities (.SPLRCU) , opens new tab, as well as materials (.SPLRCM) , opens new tab and industrials (.SPLRCI) , opens new tab. All three climbed between 0.5% and 0.7%. For the week, the S&P 500 climbed 1.7%, the Dow rose 1.3% and the Nasdaq finished 1.4% higher. Carvana (CVNA.N) , opens new tab surged 32.1% on Friday after reporting its first-ever annual profit, helped by its pact with bondholders to cut its outstanding debt by $1 billion. Among Friday's decliners, Warner Bros Discovery (WBD.O) , opens new tab shed 9.9% on reporting a bigger-than-expected quarterly loss, as the media conglomerate battled the fallout of the twin Hollywood strikes on content generation. Jack Dorsey-led Block (SQ.N) , opens new tab jumped 16.1% after the payments firm forecast adjusted core earnings for the current quarter above Wall Street estimates, betting on consumer resilience. The volume on U.S. exchanges was 10.64 billion shares, compared with the 11.6 billion average over the last 20 trading days. (This story has been refiled to fix a typo in the headline) https://www.reuters.com/markets/us/futures-take-breather-after-scorching-ai-led-rally-2024-02-23/

2024-02-23 21:28

WASHINGTON, Feb 23 (Reuters) - The U.S. has imposed sanctions on Russia's leading tanker group Sovcomflot (FLOT.MM) , opens new tab as Washington seeks to reduce Russia's revenues from oil sales it can use to support the invasion of Ukraine, the Treasury Department said on Friday. Russia is one of he world's top oil exporters and the sanctions were the latest in an effort by Western countries to add costs on the shipping of its crude oil and oil products while keeping the petroleum flowing to global markets. The Treasury's Office of Foreign Asset Control also designated 14 crude oil tankers vessels as property in which Sovcomflot has an interest. OFAC issued general licenses allowing the offloading of crude oil, or other cargoes, from the 14 vessels for 45 days, and allowing transactions with all other Sovcomflot tankers. "Sovcomflot as a whole, as a parent company, has been implicated in price cap violations in addition to deceptive activity," a senior Treasury official told reporters in a call. The sanctions freeze any U.S. assets of those targeted and generally bars Americans from dealing with them. The G7, the EU and Australia imposed a $60 per barrel price cap on Russian oil in late 2022. It bans the use of Western maritime services such as transport, insurance and financing for shipments of oil priced at or above the cap. "The designations today are basically intended to take some of their vehicles for doing that off the table, which is going to force them to invest more in spending, in creating new avenues for getting that oil out," the Treasury official said. The Western sanctions and the cap have forced some of Russian oil sales to rely on a so-called shadow fleet of aging tankers that ship consumers like India and China, much further than its traditional consumers in Europe. Treasury officials say those expenses reduce Moscow's revenues that it can use for war. The U.S. would not disclose what the specific violations Sovcomflot was accused of, the senior official said. The official, however, added that the authority used for these sanctions relates to operating in the Russian maritime sector, reflecting the company's work outside the price cap coalition. Earlier on Friday, Washington imposed wide-ranging sanctions against Russia, targeting more than 500 people and entities to mark the second anniversary of Moscow's invasion of Ukraine and retaliate for the death of Alexei Navalny, the Russian opposition leader. The Treasury began enforcing the price cap in October, and before Friday had sanctioned 27 tankers for violating the price cap. Many of those tankers have been anchored off ports since being sanctioned, shipping data has shown. Treasury said that the increased sanctions enforcement in recent months is forcing Russia to sell oil at a steeper discount to the international benchmark Brent crude, limiting Russia's revenue. The discount has widened to about $19 per barrel over the past month compared with $12 to $13 a barrel in October, it said. https://www.reuters.com/world/us-imposes-sanctions-russias-leading-tanker-group-sovcomflot-treasury-dept-2024-02-23/

2024-02-23 21:14

NEW YORK, Feb 23 (Reuters) - Strong corporate results have helped fuel the S&P 500’s climb to new highs this year, taking the focus away from the Federal Reserve’s tortuous path towards lower interest rates. As earnings season winds down, some investors believe monetary policy will jump back in the driver's seat. Nvidia Corp's (NVDA.O) , opens new tab blockbuster earnings results put an exclamation point on the fourth-quarter reporting period, as the AI darling's surging shares propelled the S&P 500 (.SPX) , opens new tab to fresh record highs in the past week. The benchmark index has gained over 6.7% so far this year. With the vast majority having reported, S&P 500 companies were on track to increase fourth-quarter earnings by 10% from the year-earlier period, according to LSEG IBES data, which would be the biggest rise since the first quarter of 2022. As the earnings glow fades in coming weeks, the spotlight could turn back to the macroeconomic picture. One pivotal factor could be the steady rise in bond yields, which has come on the heels of shrinking expectations for how much the Fed can ease monetary policy this year without reigniting inflation. "The market has been able to ignore the rise in yields because of the strong earnings," said Angelo Kourkafas, senior investment strategist at Edward Jones. "That focus on the path of rates and yields might come back into the forefront as we move past earnings season." Higher yields on Treasuries tend to pressure equity valuations as they increase the appeal of bonds over stocks while raising the cost of capital for companies and households. The benchmark 10-year Treasury yield, which moves inversely to bond prices, hit 4.35% earlier this week, its highest level since late November. While optimism on earnings and the economy has helped stocks shrug off the climb in yields, this could change if inflation data keeps coming in stickier than expected, forcing the Fed to further delay , opens new tab rate cuts. Futures tied to the Fed’s main policy rate on Friday showed investors pricing in around 80 basis points of Fed cuts this year, compared to 150 basis points they had priced in early January. An inflation test arrives Thursday, with the release of January's personal consumption expenditures price index, which the Fed tracks for its inflation targets. On a monthly basis, the PCE index is expected to increase 0.3%, according to a Reuters poll of economists, up from a 0.2% rise the prior month. "If inflation renews its downward trend, that is going to be helpful to interest rates and that can provide the next catalyst for an up move" in stocks, said Chuck Carlson, chief executive officer at Horizon Investment Services. At the same time, many investors believe AI fervor will continue driving stocks for the foreseeable future. Nvidia touched $2 trillion in market value for the first time on Friday, riding on an insatiable demand for its chips that made the Silicon Valley firm the pioneer of the generative artificial intelligence boom. “We believe retaining strategic exposure to the US large-cap technology sector is important, and the rise in tech stocks could go further still,” wrote analysts at UBS Global Wealth Management on Friday, adding that they believe generative AI “will prove to be the growth theme of the decade.” Next week will also bring other data including on consumer confidence and durable goods that will give a broader look into the state of the economy. A number of the companies due to report results in the coming week, including Lowe's (LOW.N) , opens new tab and Best Buy (BBY.N) , opens new tab, are retailers who will give insight into consumer spending. Jack Ablin, chief investment officer at Cresset Capital, is among the investors who see benefits if the economy continues walking a fine line to a so-called “soft landing,” in which the Fed is able to cool inflation without upending growth. "If we can get slowing growth, slowing inflation, create an environment that the Fed can start reducing interest rates... that should help the average stock," he said. https://www.reuters.com/markets/us/wall-st-week-ahead-soaring-us-stocks-could-take-cues-fed-earnings-wind-down-2024-02-23/

2024-02-23 21:12

SAO PAULO, Feb 23 (Reuters) - Brazilian miner Vale (VALE3.SA) , opens new tab does not see signs of environmental or social breach at two of its mines whose operating licenses were suspended this week, Vale Base Metals chair Mark Cutifani said on Friday. Speaking at a conference call about the miner's fourth-quarter results, the executive said an administrative issue could have led to the suspensions at the mines in Para state in northern Brazil, and that Vale would work with authorities to resolve the matter. The environmental secretary of Para state suspended environmental licenses for Vale's Onca Puma nickel mine and Sossego copper mine this week, flagging irregularities with an annual environment report and "non-compliance" on mining mitigation efforts that it said resulted in conflicts with local communities. Cutifani noted the furnace in Onca Puma had already been shut down and maintenance was scheduled for Sossego soon. Vale shares rose as much as 2.75% on Friday, a day after the company reported a 35% drop in fourth-quarter net profit due to more taxable income and a higher provision tied to a 2015 dam collapse in the Samarco joint venture with BHP (BHP.AX) , opens new tab. Vale executives told analysts the company expected to reach an agreement with authorities over the case in the first half of the year. The company's provision now stands at $4.21 billion. "There has been some progress recently," said Chief Financial Officer Gustavo Pimenta. Vale also said it plans to increase iron ore sales this year outside China, with demand expected to increase in Japan, Europe, India and Southeast Asia as supply tightens globally. https://www.reuters.com/sustainability/climate-energy/brazils-vale-sees-no-indication-environmental-breach-suspended-mines-2024-02-23/