2024-02-23 20:46

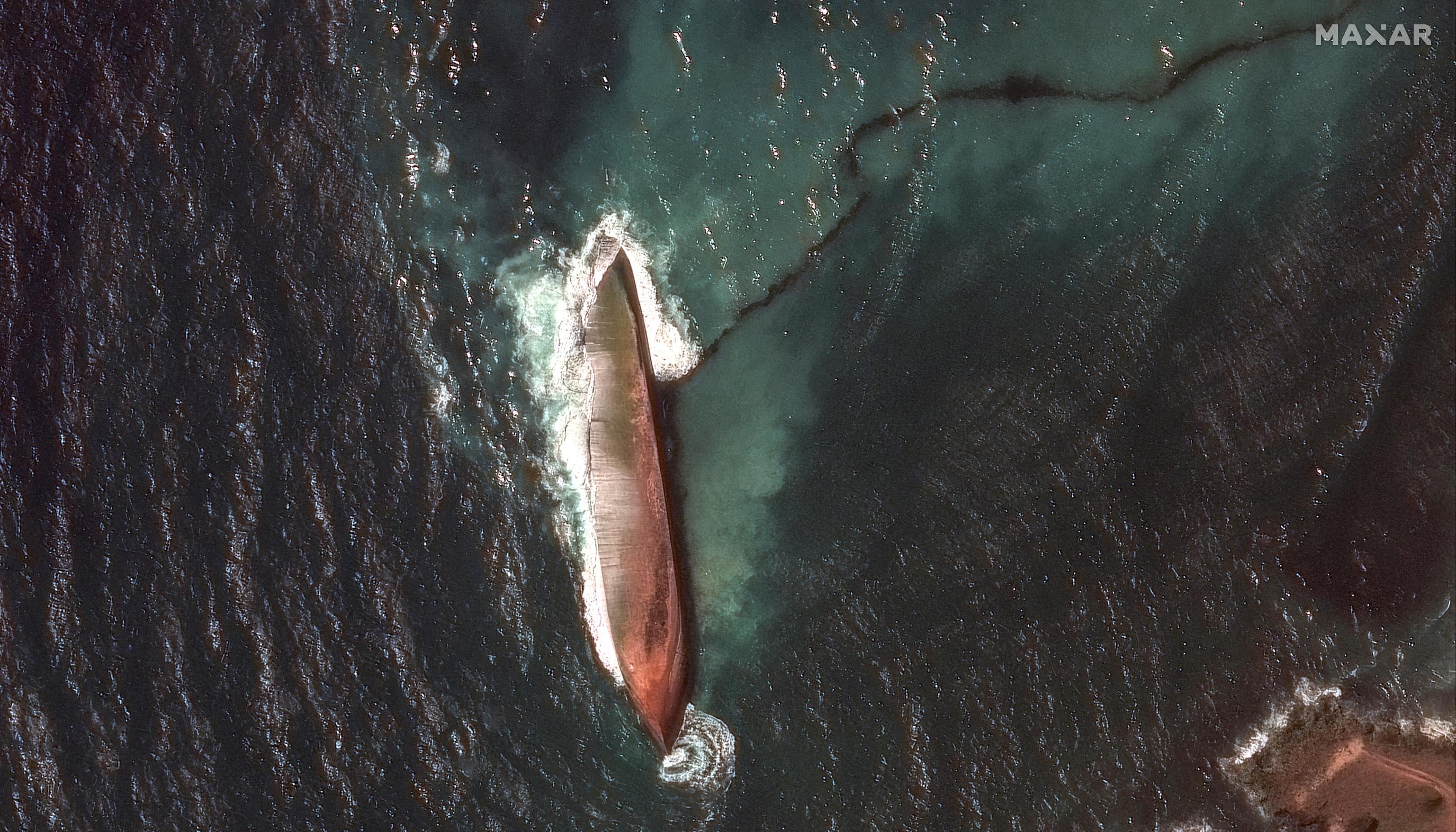

Feb 23 (Reuters) - Trinidad and Tobago's government on Friday confirmed the refined product leaking from a barge that struck a reef and overturned off the coast of Tobago was tested and determined to be a type of fuel oil. The leak, which remains unplugged and is spreading to the Caribbean Sea threatening several countries' coasts, was first spotted by Trinidad's Coast Guard on Feb. 7 after a barge towed by a tugboat capsized near Tobago's shore. "Analyses of the hydrocarbon discharge collected in Tobago indicates that the samples are characteristic of a refined oil," Trinidad's energy ministry said in a release, characterizing it as "intermediate fuel oil." Intermediate fuel oil can be used as a bunker fuel to power combustion engines. The pace at which the fuel is flowing from the barge has slowed considerably, Allan Stewart, the head of Tobago's emergency department, told Reuters. The fuel has been leaking for more than three weeks and has stained Tobago's coastline, affecting fishing and tourism, and has entered the waters off Grenada. "We are working hard to ensure the hydrocarbons do not get to the more sensitive southwest part of the island, where there are the popular tourist beaches," Stewart added. Containment booms are so far holding the spill. Tobago has been using skimmers and other equipment to mop-up the fuel, according to Stewart. The barge carried as much as 35,000 barrels of fuel oil, Tobago officials have said. The ship sailed from Panama and it was bound for Guyana, officials have said. But monitoring service TankerTrackers.com and investigative news outlet Bellingcat said after reviewing satellite photos that the vessels were near Venezuela's shore days before the spill was first reported in Tobago. "Imagery discovered by Bellingcat shows that the barge began leaking oil as early as February 3, immediately after leaving (Venezuela's) Pozuelos Bay, and that it appears to have capsized by the morning of February 6," it said this week. Venezuela has denied that the barge originated from the Bolivarian Republic. https://www.reuters.com/world/americas/trinidad-government-confirms-fuel-oil-is-leaking-off-tobagos-coast-2024-02-23/

2024-02-23 20:42

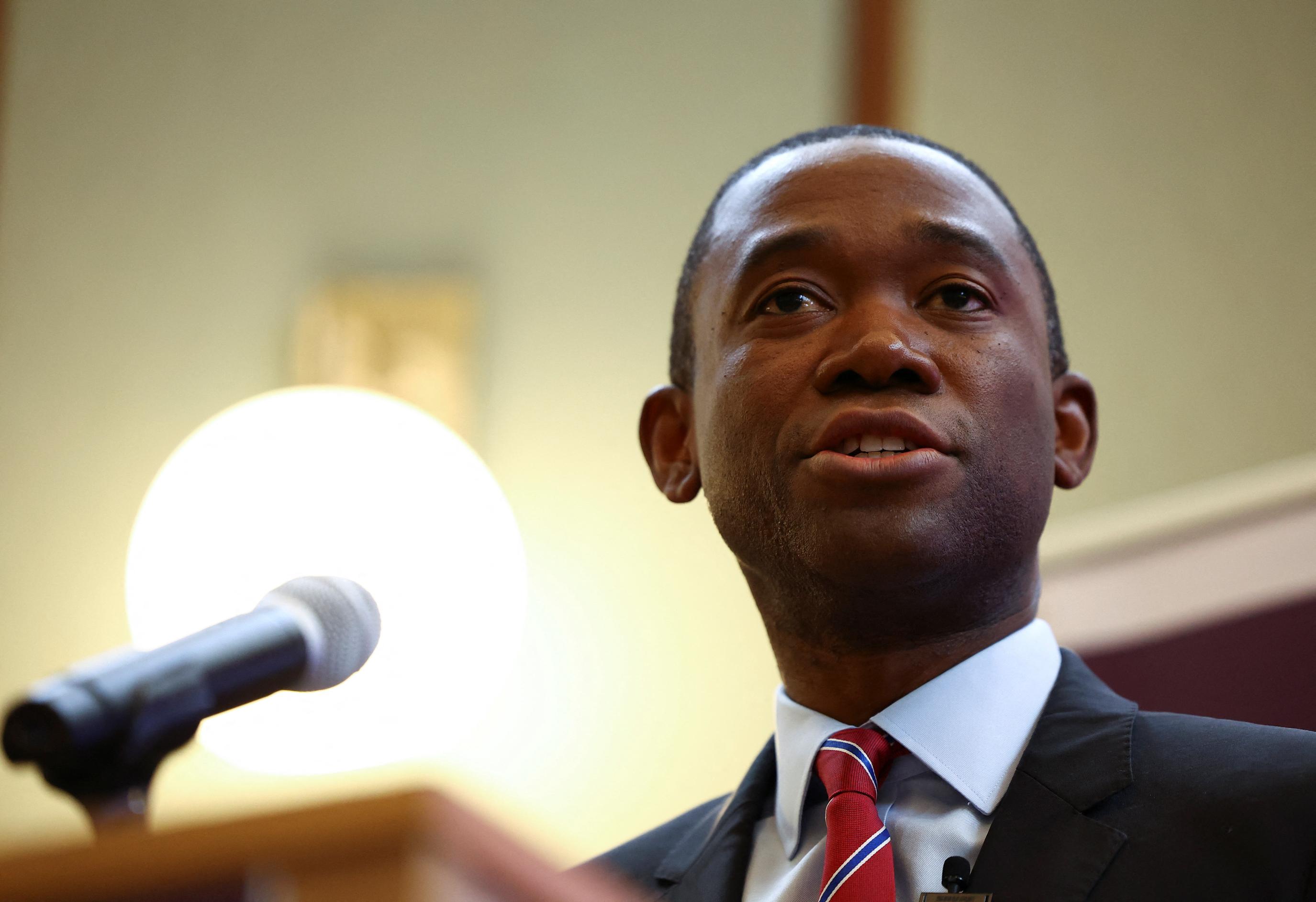

Feb 23 (Reuters) - A U.S. judge on Friday accepted Binance's guilty plea and more than $4.3 billion penalty for violating federal anti-money laundering and sanctions laws through lapses in internal controls at the world's largest cryptocurrency exchange. U.S. District Judge Richard Jones in Seattle approved the plea, which includes a $1.81 billion criminal fine and $2.51 billion of forfeiture, about an hour after the government proposed changes to Binance founder Changpeng Zhao's bond, drawing an objection from Zhao's lawyers. Binance's plea announced in November resolved a years-long probe that found the exchange had failed to report more than 100,000 suspicious transactions involving designated terrorist groups including Hamas, al Qaeda and the Islamic State of Iraq and Syria, or ISIS. Prosecutors said Binance's platform also supported the sale of child sexual abuse materials and was among the largest recipients of ransomware proceeds. In a statement on Friday, Binance said it accepted responsibility, has upgraded its anti-money laundering and "know-your-customer" protocols, and has made "significant progress" toward changes required under its plea agreement. Zhao has been free in the United States on a $175 million bond after also pleading guilty in November to money laundering violations. His plea included a $50 million fine and required that he step down as Binance chief executive. In a court filing, prosecutors said the proposed bond changes were meant to reflect Jones' orders that Zhao stay in the continental United States and under court officer supervision until his April 30 sentencing. The conditions include that Zhao provide three days notice of any travel plans, surrender his passports and maintain his current residence unless he gets approval for a change. Pretrial services officers are recommending that Zhao also be subjected to location monitoring. Prosecutors said they have discussed the changes with Zhao's lawyers several times, but that they "object to this motion as written." Zhao's lawyers did not immediately respond to requests for comment. The cases are U.S. v Binance Holdings Ltd, U.S. District Court, Western District of Washington, No. 23-cr-00178, and U.S. v. Zhao in the same court, No. 23-cr-00179. https://www.reuters.com/technology/judge-approves-binance-43-billion-guilty-plea-us-seeks-modify-founder-zhaos-bond-2024-02-23/

2024-02-23 20:22

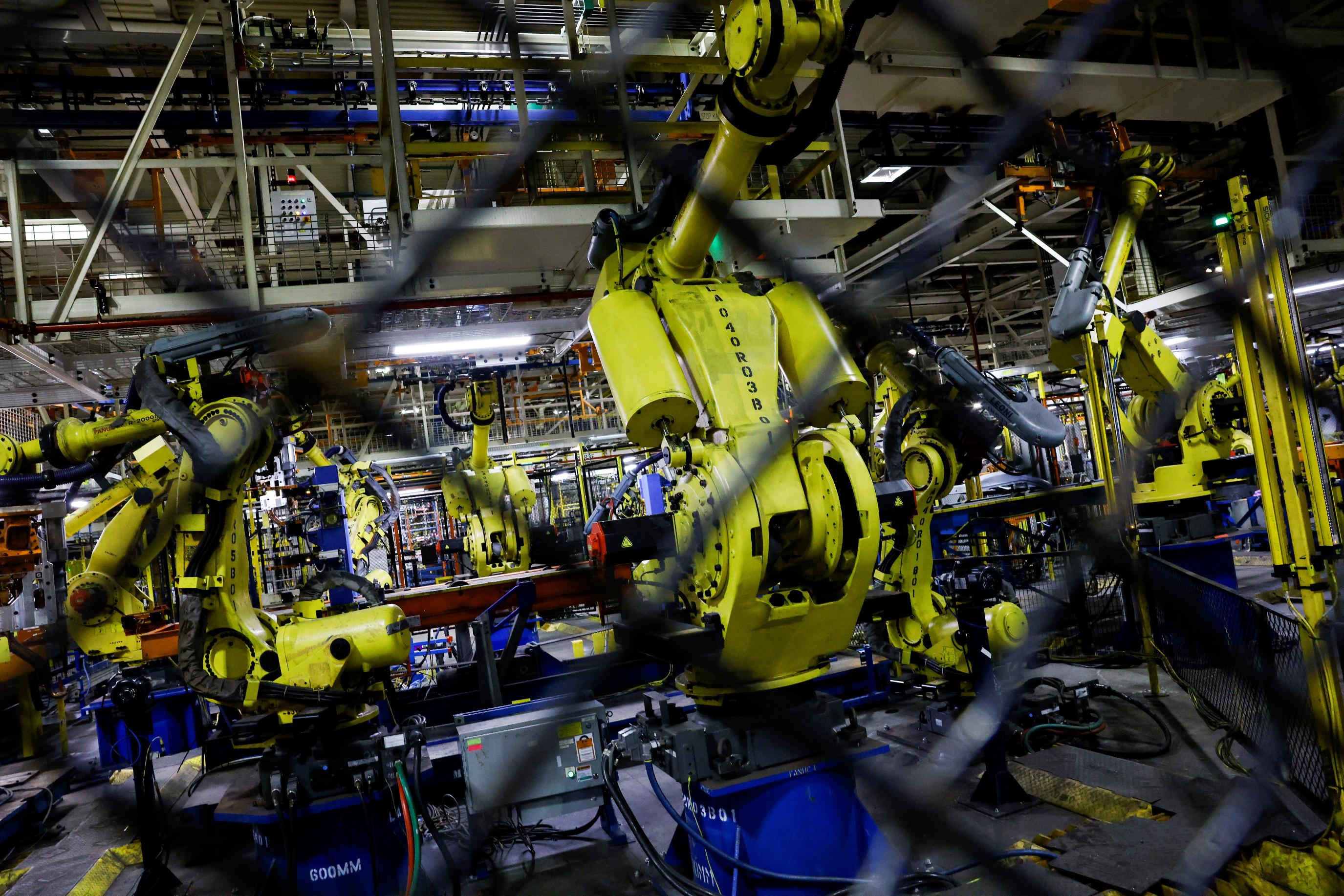

Feb 23 (Reuters) - Amazon.com (AMZN.O) , opens new tab founder Jeff Bezos, Nvidia (NVDA.O) , opens new tab and other big technology names are investing in startup Figure AI that develops human-like robots, Bloomberg News reported on Friday, citing people with knowledge of the situation. Figure AI, also backed by ChatGPT-maker OpenAI and Microsoft (MSFT.O) , opens new tab, is raising about $675 million in a funding round that carries a pre-money valuation of about $2 billion, according to the report. Bezos had committed $100 million through his firm Explore Investments LLC and Microsoft is investing $95 million, while Nvidia and an Amazon-affiliated fund are each providing $50 million, the report added. Investments in artificial intelligence startups have sparked after the launch of OpenAI's viral chatbot ChatGPT in November 2022, as investors sense an opportunity, betting on these startups that they might outpace bigger rivals. OpenAI, which at one point considered acquiring Figure, is investing $5 million, the report added. Backers include Intel's (INTC.O) , opens new tab venture capital arm, LG Innotek, Samsung's investment group, as well as venture firms Parkway Venture Capital and Align Ventures, the report added. ARK Venture Fund, Aliya Capital Partners and Tamarack are also among investors in the startup, according to the report. Amazon, Nvidia, Microsoft and Intel declined to comment, while other names mentioned in the report, including Figure AI, did not immediately respond to Reuters' requests for comment. Last year, Sunnyvale, California-based Figure, which develops general-purpose humanoid robots that could work in different environments and handle a variety of tasks from warehouses to retail, raised $70 million from investors led by Parkway Venture Capital in its first external round. https://www.reuters.com/technology/bezos-nvidia-join-openai-funding-humanoid-robot-startup-bloomberg-reports-2024-02-23/

2024-02-23 20:16

Feb 23 (Reuters) - U.S. companies borrowed 6% more to finance equipment investments in January compared to a year ago, industry body Equipment Leasing and Finance Association (ELFA) said on Friday. Companies signed up for new loans, leases and lines of credit worth $9.3 billion in January, down 26% sequentially. "It's especially encouraging to kick off in positive territory since equipment investment—the lifeblood of the equipment finance industry—is forecast to pick up in the second half of the year," ELFA President and CEO Leigh Lytle said. ELFA, which reports economic activity for over $1-trillion equipment finance sector, said credit approvals for U.S. companies in January came in at 76%, up from 75% the preceding month. The Washington-based company's non-profit affiliate, the Equipment Leasing & Finance Foundation, said its confidence index for February stood at 51.7, up from 48.6 for January. A reading above 50 indicates a positive business outlook. ELFA's leasing and finance index is based on a 25-member survey, including Bank of America (BAC.N) , opens new tab and financing units of Caterpillar (CAT.N) , opens new tab, Dell Technologies (DELL.N) , opens new tab, Siemens AG (SIEGn.DE) , opens new tab, Canon Inc (7751.T) , opens new tab and Volvo AB (VOLVb.ST) , opens new tab. https://www.reuters.com/markets/us/us-business-equipment-borrowings-up-6-january-elfa-says-2024-02-23/

2024-02-23 20:13

PARIS, Feb 23 (Reuters) - The EU should change conditions imposed on farmers to benefit from Common Agriculture Policy (CAP) funding, European Agriculture Commissioner Janusz Wojciechowski said in an interview with French newspapers of the Ebra group. His comments, to be published on Saturday, come after weeks of angry protests by farmers across Europe, who have taken to the streets to decry red tape, green regulations and high costs. "I propose today that we change our position on some of the cross-compliance rules which tend to limit agricultural production," Wojciechowski said in an interview with the group that owns nine regional titles across France, including L’Est Republicain and Le Progres. He specifically referred to rules regarding the conversion of arable land into permanent grassland, the ban on bare soil during sensitive periods, crop rotation, and fallowing, which he said farmers should no longer be obliged to follow to receive CAP funding. He said the rules "create a risk for EU food security". Wojciechowski also said he would favour an EU-wide price law, similar to France's Egalim law, designed to guarantee fair prices to farmers. "It will be necessary to include in this law the principle that it is prohibited to pay farmers a price lower than the cost of production," he said. In France, farmers were back on the streets of Paris on Friday, warning President Emmanuel Macron that he should expect a difficult welcome when he opens a major farm show on Saturday. There have also been protests in Belgium, the Netherlands, Poland, Spain and the Czech Republic. https://www.reuters.com/world/europe/eu-agriculture-commissioner-proposes-policy-shift-farmers-protest-2024-02-23/

2024-02-23 20:05

Feb 23 (Reuters) - U.S. Deputy Treasury Secretary Wally Adeyemo said on Friday that he is concerned about China's excess manufacturing capacity spilling over to the global economy, even if China's current economic woes are unlikely to slow U.S. growth in the near term. "I am not concerned about the headwinds from China having a large impact on the US economy," Adeyemo told a Council on Foreign Relations event in New York, referring to challenges from its property sector, an aging population and a worsening business climate for private firms. "The thing that I am fundamentally concerned about from China is excess capacity coming from China and hitting the global economy," Adeyemo said. China's heavily subsidized manufacturing capacity for electric vehicles, solar panels and other goods has followed industries such as steel and aluminum in producing more goods than China can consume, he added. "Fundamentally that overcapacity is going to go somewhere," Adeyemo said, adding that U.S. tariffs and tax credits for EVs and their batteries will help keep Chinese EVs out of the U.S. market and allow American firms to compete more fairly. "This is going to be a challenge for the global economy and it's something we are talking directly with the Chinese about," Adeyemo said. "They need to compete on a level playing field, not just with the United States, but with countries around the world." U.S. Treasury Secretary Janet Yellen is expected to raise her concerns about Chinese excess capacity with counterparts on the sidelines of a Group of 20 finance ministers meeting in Sao Paulo, Brazil, next week, a senior Biden administration official said. DOLLAR DOMINANCE Adeyemo, who presented a new round of U.S. sanctions on over 500 Russian-linked targets a day before the second anniversary of Russia's invasion of Ukraine, downplayed the potential for damage to the dollar's status as the world's reserve currency from such measures. He said it was important that sanctions be multilateral and targeted to maximize their effectiveness. "Fundamentally, my view about this question of whether the use of sanctions is going to lead to some challenges to the dollar, is that the thing that's going to matter to the dollar's role in the global economy isn't the strength of our economy." He said Biden administration policies, including investments in infrastructure, semiconductors and clean energy technologies, have made the U.S. a more attractive investment destination. "As long as we are able to continue to do that, I feel good about the fact that the dollar, America's financial system, is going to remain dominant in the world," Adeyemo said. https://www.reuters.com/markets/chinas-woes-wont-slow-us-economy-excess-capacity-concern-treasurys-adeyemo-2024-02-23/