2024-02-23 13:02

BRUSSELS, Feb 23 (Reuters) - Once considered a vital engine of the European Union, Germany is causing growing consternation in capitals across the bloc as disagreements in its ruling coalition spill over to thwart key EU policy goals. The internal German bickering and its European echoes are seen in Brussels as a symptom of something deeper: Germany's unresolved quest for a new economic model after the Ukraine war put an end to the cheap Russian gas and largely unfettered trade channels that fuelled its export-oriented industry for decades. "Much more than others in a phase of existential angst," one EU diplomat characterized Germany's condition. "They fear that the software itself is broken - and on top of that, you get the different logic from coalition members." When Social Democrat Olaf Scholz struck a coalition deal with the environmental Greens and economic liberals of the Free Democrats (FDP) in late 2021 it was clear the pact had a rocky way ahead, but few predicted their differences would emerge at the EU level. Since then, only the Greens have managed to roughly keep their popularity. Scholz's Social Democrats are down to 14-15% from almost 26% in the election and support for the smallest, the FDP, has more than halved to 3-5% - meaning it would not even get into parliament if elections were held now. "There is a causality there - precisely because the FDP are being snowed under domestically, they are looking for a way to raise their profile in carefully selected EU files to rally their electorate," a second EU diplomat said. German officials point to the constructive role Berlin has played in recent EU decisions to secure Ukraine aid or reform rules on budget deficits. But in other areas the differences have made it harder for the EU to implement its agenda, including its green deal. The impact became apparent last March, when Germany's FDP Transport Minister Volker Wissing at the last minute reneged on a deal Germany and other EU governments and lawmakers struck in 2022 to curb CO2 emissions from cars, shaking partners' confidence in Berlin. "Why would we want to do a deal with them if we cannot trust Germany will stick to it?" the EU diplomat said. Complicating matters further, a German constitutional court ruling last November blew a 60 billion euro hole in the German budget, in an embarrassment to FDP leader and German Finance Minister Christian Lindner. "That was the tipping point," a second senior EU diplomat said. "Now everything that has economic implications is extremely difficult." More recently, Germany's FDP-led transport ministry has again forced last minute changes to an EU law on curbing CO2 truck emissions, while labour ministry's objections contributed to the scuppering of an EU law that would boost gig workers' rights. Germany also helped sink an EU law that would require large companies to determine if their supply chains use forced labour or cause environmental damage. "If a result is bad, you have to be able to say no," German Justice Minister Marco Buschmann, a close ally of Lindner, told Spiegel magazine this week. "Just because an idea has been negotiated for a long time at EU level does not automatically mean it is good," he said. OPENING DOORS The German government had no immediate comment on EU concerns but a government source told Reuters that, while internal coalition disputes made Germany abstain in recent EU votes, it was far from being the only "blocker" of EU projects. For example, a long-mooted EU-Mercosur trade deal is on hold due to a variety of objections in European capitals. But while EU diplomats acknowledge that not only Germany is raising objections to various EU policies, they say its actions have opened the door for others to do the same. And crucially, it was the last minute changes that created uncertainty if deals would be respected. "You need to have trust in the agreements you make," Michael Bloss, a German Green lawmaker in the European Parliament, told Reuters. "It is difficult if one member state is creating chaos by not upholding agreements they have made before." Germany's size - which is reflected in its voting power - makes it difficult for the rest of the EU to work around it if it decided to block a piece of EU legislation. "It's getting worse and worse. We in the EU are paying the price for them not being able to manage their own coalition," a third EU diplomat said. Some officials pointed out however, that the FDP was effectively fighting for the votes of the German industry that is struggling to reinvent itself after higher energy prices robbed it of one key competitive advantage. Jeromin Zettelmeyer, the head of the Bruegel think-tank, noted that the FDP opposed German subsidies to energy for industry, a stance that should be welcomed by others in the EU who cannot afford such polices. "Germany is essentially torn between not favouring its own industry at the expense of the EU and at the same time preserving its economic model, which I would define as an industrial model," Zettelmeyer said. "It is a balancing act. The question is can you adapt the model rather than completely throw it out. It requires time and money. This is where the conflict of interest with the rest of the EU comes from." The European political calendar, including EU parliament elections due in June, does not help as politicians of all colours fear that a voter backlash to the EU's net-zero carbon economy goal will play into the hands of far-right populists in Germany and elsewhere. That, the German government source acknowledged, was one source of tensions within the coalition, adding: "we hope that after European election situation will get better." https://www.reuters.com/world/europe/frustration-grows-inside-eu-german-infighting-hurts-blocks-goals-2024-02-23/

2024-02-23 12:59

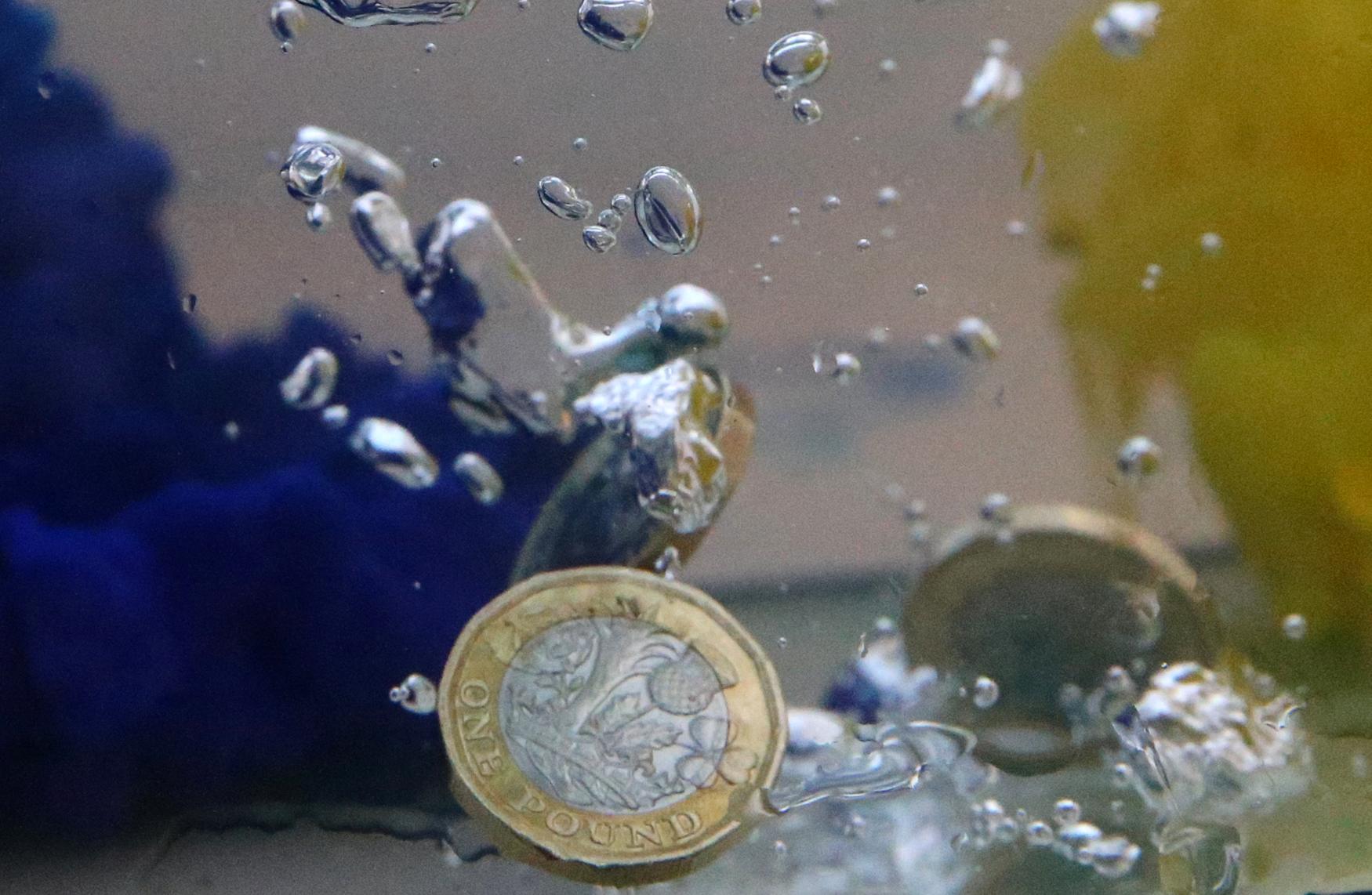

Feb 23 (Reuters) - Sterling was on track for its first weekly rise versus the dollar since mid-January on increasing risk appetite and some solid British economic data. Traders see the pound as a "risk currency" that moves in line with similar assets, most typically equities, and global shares capped a record-breaking week after U.S. chipmaker Nvidia's blockbuster earnings energised tech stocks. A survey showed strong growth for services firms and business optimism at a two-year high. But British consumer sentiment fell for the first time in four months in February. "The pound has consolidated at a higher level this morning, undeterred by an unexpected fall in GfK consumer confidence," said Kyle Chapman, forex analyst at Ballinger Group. "A global risk asset inflow keeps sterling buoyed despite a widening US yield advantage. FX has detached somewhat from rate spreads over the past few days," he added. Sterling was 0.1% higher versus the dollar but set to end the week up 0.54%, in its first rise since the week ending on Jan. 12. "The pound correlation with global equities has started to weaken but remains stronger than the U.S. dollar risk correlation and may prompt some pound strengthening if this risk appetite persists," said Derek Halpenny, head of research, global markets EMEA and international securities, at MUFG Bank. However, investors remained focused on the Bank of England policy path as higher rates would support the British currency. Analysts said recent data showed inflation pressures were likely to keep the BoE wary about cutting borrowing costs. While money markets are pricing a 25 basis points rate cut by the European Central Bank and the Federal Reserve, according to the CME FedWatch Tool, by June, they are discounting less than a 50% chance of such a move from the BoE. Analysts also flagged that BoE policymaker Megan Greene said on Thursday she wanted more evidence that inflation pressures were easing before voting to cut rates. Sterling rose 0.13% to 85.37 pence per euro and was on track to end the week up 0.15%. https://www.reuters.com/markets/currencies/sterling-set-first-weekly-rise-vs-dollar-since-mid-january-2024-02-23/

2024-02-23 12:54

PARIS, Feb 23 (Reuters) - French farmers were back on the streets of Paris on Friday, warning President Emmanuel Macron that he should expect a difficult welcome when he opens a major farm show on Saturday, amid anger over costs, red tape and green regulations. Dozens of tractors rolled into the French capital, loudly honking their horns. One tractor carried a sign that read: "Macron you're sowing the seeds for a storm - be careful of what you reap." Farmers have been protesting across Europe, calling for better income, less bureaucracy and denouncing unfair competition from cheap Ukrainian goods to help Kyiv's war effort. French farmers had earlier this month largely suspended protests that included blocking highways and dumping manure in front of public buildings after Prime Minister Gabriel Attal promised new measures worth 400 million euros ($432.56 million). But protests resumed this week to put pressure on the government to help them more and deliver on promises, ahead of the Paris farm show, a major event in France, which attracts around 600,000 visitors over nine days. "Some farmers will try to stop the president (Macron) from entering the trade fair. And if he does get in, they will disturb his walkabout," Jean Lefevre, who is a member of FNSEA, France's largest farming union, told Reuters. There will be tractors and some 2,000 farmers waiting for Macron at the fair, Lefevre said. Farmers' protests have spread across Europe, most recently in countries including Poland, Spain and the Czech Republic. The protests come as the far right, for whom farmers represent a growing constituency, is seen making gains in June's European Parliament elections. In another sign of how tense relations between farmers and the government still are in France, the head of FNSEA, Arnaud Rousseau, said that he would not take part in a big debate which Macron wants to hold at the farm fair on Saturday with farmers, food processors and retailers. "As I speak, the conditions for a dialogue are not met ... the tension is too great," Rousseau told BFM TV/RMC radio after he discovered that pro-environment activist group "Soulevements de la Terre" was among the guests at the debate. In an unusually detailed message on X, Macron's office later said that the activist group had not been invited and that they had announced it by mistake.($1 = 0.9247 euros) https://www.reuters.com/world/europe/french-farmers-prepare-tough-welcome-macron-farm-show-2024-02-23/

2024-02-23 12:49

LONDON, Feb 23 (Reuters) - A prominent Russian businessman can take his bid to pause an $850 million fraud lawsuit brought by two Russian banks to the United Kingdom's Supreme Court, his lawyers said in court filings on Friday. Boris Mints and his sons Dmitry, Alexander and Igor are being sued by National Bank Trust, which is 99% owned by the Central Bank of Russia, on behalf of Otkritie Bank, once Russia's largest private lender before it collapsed in 2017. Lawyers representing the Mints family – who deny the banks' fraud allegations – had said the lawsuit should be indefinitely put on hold because, if the banks win at trial, any damages could not be paid as Otkritie Bank is under British sanctions. Their application was rejected by the High Court in London in January 2023 and an appeal against that decision was dismissed in October. However, lawyers representing the Mints family said in court filings for a preliminary hearing that the UK Supreme Court had granted permission to appeal. Permission was granted last month but only became known publicly on Friday. "The timing of the appeal hearing is presently unknown, but it is expected to be listed for later this year," they said. The Mints' application to put the lawsuit on hold will be the first time the Supreme Court has considered Britain's sanctions regime in relation to Russia after its invasion of Ukraine. https://www.reuters.com/world/europe/russian-businessman-mints-can-take-sanctions-appeal-uk-supreme-court-2024-02-23/

2024-02-23 12:30

ZURICH, Feb 23 (Reuters) - Swiss solar panel maker Meyer Burger (MBTN.S) , opens new tab on Friday called an extraordinary meeting to approve a 200 million-250 million Swiss franc ($227 million-$284 million) rights issue to help plug a funding gap flagged earlier this year. Shares in the group slid more than 14% following the news, though they clawed back some of those losses over the course of the day, and by 1144 GMT were down 4.8%. The meeting is due to take place on March 18. The company said the German government has also approved an export guarantee for financing by a commercial bank for up to $95 million, and that it is applying for a loan of between $200 million-250 million from the U.S. Energy Department. The combination of the rights issue, the export credit guarantee and other loans are enough to close the financing gap of 450 million Swiss francs it mentioned in January, said Meyer Burger. One of Europe's last manufacturers of solar panels, Meyer Burger said the funds will finance the completion of its Colorado and Arizona manufacturing sites. It is also part of a larger plan to stop sustained losses in Europe and take advantage of the U.S. market, the company said. "A clearer focus on our U.S. business makes us independent of political decisions in Europe," CEO Gunter Erfurt said. Meyer Burger said that a lack of policy support measures to correct market distortions from oversupply and dumping on prices of solar modules meant it would also be halting production at its loss-making site in Germany's Freiberg in March. The company had threatened to close the plant, affecting around 500 employees, in January. A spokesperson for Germany's economy ministry said a number of conditions were attached to the export guarantee, including that the company maintained one of its other sites in the country. "How the company organises its sites is up to the company," added the spokesperson on Friday. ($1 = 0.8812 Swiss francs) https://www.reuters.com/business/energy/solar-panel-maker-meyer-burger-seeks-close-financing-hole-with-rights-issue-2024-02-23/

2024-02-23 12:05

BAGHDAD, Feb 23 (Reuters) - Iraq on Friday reopened its North Refinery in Baiji that was shut for a decade during the violence and chaos that followed the U.S.-led invasion in 2003 which made it nearly impossible to run one of the country's most vital energy complexes. The fall of Saddam Hussein was meant to bring stability and prosperity to major OPEC oil producer Iraq after years of economic mismanagement and military misadventures brought the country to its knees. Instead Iraqis suffered from an insurgency, a sectarian civil war and then the advent of Al Qaeda and later Islamic state which killed tens of thousands of people. The Baiji refinery complex was a high profile victim of the chaos, a focal point for fighting between security forces and militants for months on end. Al Qaeda had enough control over the Baiji area that it was able to intimidate refinery workers and hijack its refined products. It sold the products to neighbouring countries and used the profits to finance its insurgency. The refinery was shut in 2014 when Islamic State fighters seized it after taking over one third of the country's territory. Islamic State stole oil and petroleum products from areas it controlled in an effort to create a self-sustaining Islamic empire. It has a refining capacity of 150,000 barrels per day (bpd) after reopening, which would bring the total capacity of the Baiji refining complex to 290,000 bpd. Iraq aims to reach self-sufficiency in oil derivatives by mid-next year, Mohammed Shia al-Sudani said in the reopening ceremony. https://www.reuters.com/world/middle-east/iraq-reopens-north-refinery-baiji-closed-decade-2024-02-23/