2024-02-23 06:53

BASF to slash costs further by 1 billion euros in home market Predicts profit rebound, thanks to demand in rest of world More job cuts at Ludwigshafen HQ on the cards FRANKFURT, Feb 23 (Reuters) - Germany's BASF (BASFn.DE) , opens new tab will slash another 1 billion euros ($1.1 billion) in annual costs at its Ludwigshafen headquarters, citing weak demand and high energy costs in its home market, highlighting the country's economic woes. The annual cost savings will be reached by the end of 2026, affecting both production and administrative activities at its largest chemical complex, the German chemicals giant said in a statement on Friday. It also predicted that group earnings before interest, taxes, depreciation and amortisation (EBITDA), adjusted for one-offs, would rebound to between 8 billion and 8.6 billion euros in 2024. Last year, it fell 29% to 7.67 billion. CEO Martin Brudermueller, who will quit in April to become non-executive chairman of carmaker Mercedes-Benz (MBGn.DE) , opens new tab, cited high competitiveness of the group outside of Germany under challenging conditions. "On the other hand, the negative earnings at our Ludwigshafen site show the urgent need for further decisive actions here to enhance our competitiveness," he added. An economic downcycle at home is weighing on volumes affecting specialty chemicals and more basic petrochemicals known as its upstream business, the company said. This would lead to more job cuts that are being discussed with shop stewards. "Higher production costs due to structurally higher energy prices predominantly burden the upstream businesses." The German government this week cut its 2024 economic growth projection to 0.2%, from 1.3% previously, amid weak global demand, geopolitical uncertainty and persistently high inflation. High interest rates and cost inflation have in particular burdened the construction industry, hitting BASF chemicals that go into insulation slabs, among other uses. Major economic research institutes said in January that the 2024 outlook for the country's construction sector is grim, with spending by builders set to fall for the first time since the financial crisis. A year ago, BASF already laid out detailed plans to close sites, slash costs and shed about 2,600 jobs in Europe amid structurally weak demand there, affecting mainly Ludwigshafen. In October, the company ramped up cost cuts further to around 1.1 billion euros annually from the end of 2026, having previously targeted a 1 billion euro reduction. It will propose an annual dividend of 3.40 euros per share, unchanged from a year earlier, it said on Friday. ($1 = 0.9240 euros) https://www.reuters.com/business/basf-dials-up-cost-cuts-germany-flags-earnings-rebound-2024-02-23/

2024-02-23 06:43

Feb 23 (Reuters) - Talks relating to a planned $30 billion merger between the chemicals arms of Abu Dhabi National Oil Company (ADNOC) and Austrian oil and gas company OMV (OMVV.VI) , opens new tab have stalled over recent weeks, the Financial Times reported on Friday. The negotiations have paused to allow the parties to navigate a series of disagreements, which include the name of the merged unit in the final deal announcement, the report said, citing people familiar with the matter. It is still possible that talks will resume and a deal will eventually be reached, FT said. "We are in ongoing and open-ended negotiations and cannot comment further," OMV said in an emailed statement to Reuters. ADNOC did not immediately respond to a Reuters request for comment. Reuters previously reported that there are a number of points of conflict between the firms, including a provision for job guarantees in Austria, a requirement for a Vienna listing and an Austrian chairman of the new company. Last July, OMV entered into talks to merge petrochemicals group Borealis - which is owned by OMV and ADNOC in a 75:25 split - and Borouge (BOROUGE.AD) , opens new tab, which is listed in Abu Dhabi and 54:36 owned by ADNOC and Borealis. https://www.reuters.com/markets/deals/adnocs-30-bln-chemicals-deal-with-austrias-omv-stalls-ft-reports-2024-02-23/

2024-02-23 06:39

HANOI, Feb 23 (Reuters) - Vietnam aims to produce 100,000-500,000 metric tons of hydrogen a year by 2030 as part of its energy transition efforts, according to the country's hydrogen development strategy adopted earlier this month. The output would be raised to 10-20 million tons by 2050, including green hydrogen, according to a government document detailing the strategy reviewed by Reuters. The production, distribution and usage of hydrogen will help "meet the country's national targets for climate change, green growth and to meet its net zero target by 2050," the document said. Hydrogen is categorised 'green' when it is extracted from water using electrolysis powered by renewable energy and is seen as crucial to help decarbonise industry, though the technology is still expensive and at an early stage of development. The hydrogen output will partly replace natural gas and coal at power plants by 2030, the document said, adding that hydrogen will also be used for transport and for fertiliser, steel and cement production. By 2050, hydrogen will be responsible for 10% of the country's electricity generation, it added. Vietnam will mobilise both public and private funds for hydrogen production, including from green bond issuance and from Just Energy Transition Partnership (JETP), a financing scheme made up of equity investments, grants and concessionary loans from members of Group of Seven (G7), multilateral banks and private lenders. https://www.reuters.com/sustainability/climate-energy/vietnam-aims-produce-100000-500000-tons-hydrogen-year-by-2030-2024-02-23/

2024-02-23 06:29

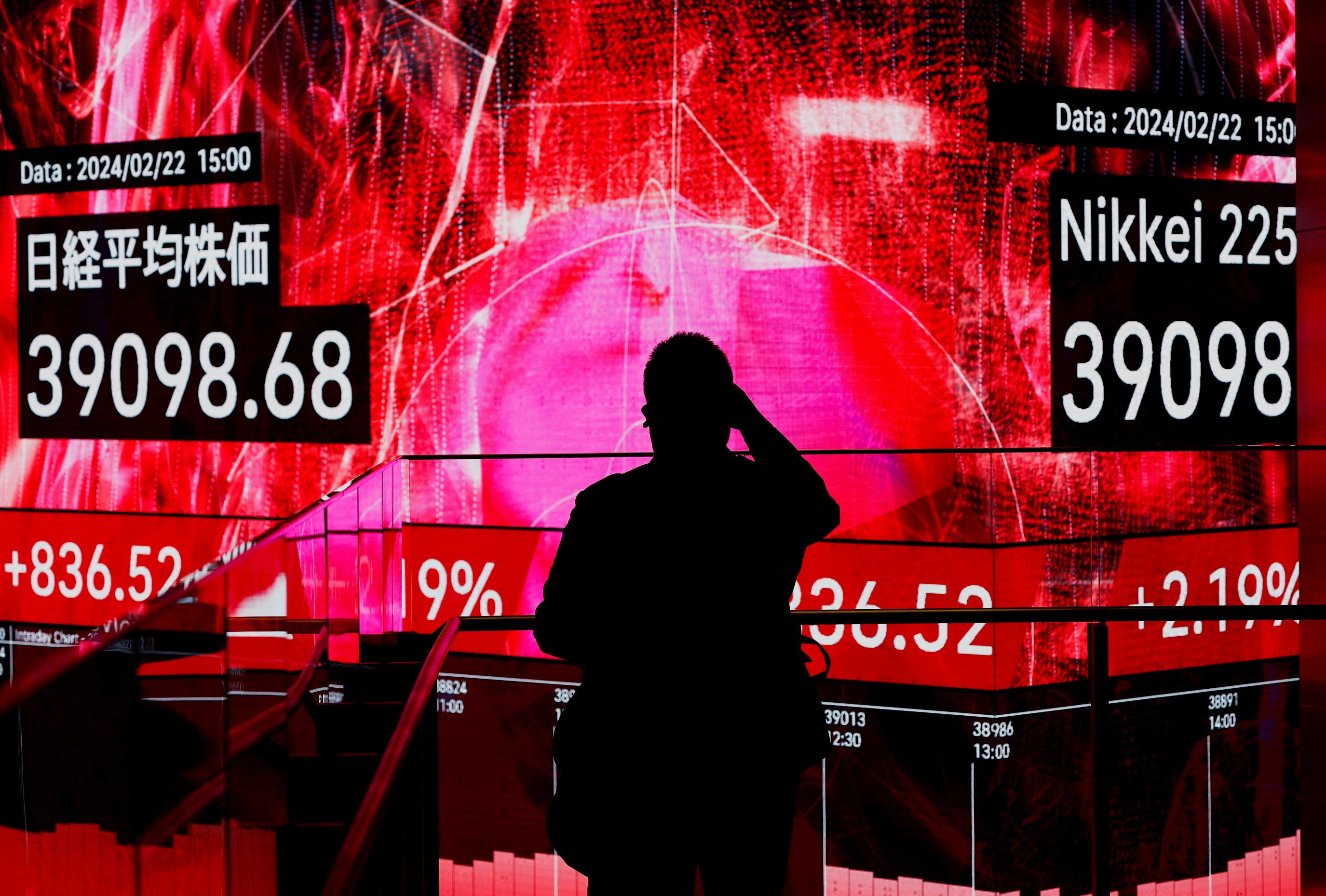

Nvidia crosses $2 trillion valuation, then slips AI drives optimism but rate cut outlook spurs uncertainty MSCI ACWI, STOXX 600, Dow, S&P 500 close at new highs Dollar heads for first weekly fall of 2024 NEW YORK, Feb 23 (Reuters) - A gauge of global equity markets lost steam on Friday but still set a new high amid optimism over Nvidia's potent results, while Treasury yields fell as the market bet that the Federal Reserve will not cut interest rates until at least June. Wall Street mostly extended gains as Nvidia briefly shot above $2 trillion in market value for the first time, driven by the AI frenzy that has gripped investors since the chipmaker's blockbuster quarterly earnings report two days earlier. Nvidia's (NVDA.O) , opens new tab shares jumped 4.9% to a high of $823.94, before paring gains to close up 0.4%. Investors worry valuations may be stretched after a rally that has lifted the S&P 500 more than 7% so far this year, but are optimistic about the profits companies may gain from artificial intelligence. "We don't see that much more upside from current levels," said Solita Marcelli, chief investment officer Americas at UBS Global Wealth Management in New York. "But we have to acknowledge that over the last year we have been consistently positively surprised by the enormous profit growth for some of the AI-leveraged companies," Marcelli told Reuters, adding that better-than-expected inflation could prompt the Fed to cut more than expected. Data that showed U.S. services sector growth picked up in January as new orders increased and employment rebounded to help equity markets advance, though a measure of input prices rising to an 11-month high added fodder to fears of sticky inflation. MSCI's all-country world index (.MIWD00000PUS) , opens new tab, a gauge of stock performance worldwide, closed up 0.1% after earlier hitting to a new intraday high. The combination of strong growth and inflation not yet slowing to the Fed's 2% target has led Fed officials to push back on rate cut expectations. The strength of the labor market has unequivocally emboldened the Fed to be more relaxed about keeping rates high for longer," said Dec Mullarkey, a managing director at SLC Management in Boston. "So, the Fed is signaling it will be patient and use that runway to let more data roll in and cement the evidence that the economy is well balanced before they adjust rates," Mullarkey said. Fed funds futures show a 52.6% chance of a cut in June, with a 35.5% probability of no cut, a sharp reversal from bets on Feb. 1 of a 62% chance of a cut in March, according to CME Group's FedWatch Tool. The pan-European STOXX 600 index (.STOXX) , opens new tab rose 0.43% to post its fifth straight week of gains and a new closing high. The French CAC40 (.FCHI) , opens new tab and German DAX (.GDAXI) , opens new tab indices also closed at record highs. On Wall Street, the Dow Jones Industrial Average (.DJI) , opens new tab rose 0.16% and the S&P 500 (.SPX) , opens new tab eked out a 0.03% gain as both posted new closing highs. The Nasdaq Composite (.IXIC) , opens new tab dropped 0.28% but all three indices rose for the week, with the Dow up 1.3%, S&P 500 1.7% and the Nasdaq 1.4%. The dollar was poised to record a weekly fall for the first time in 2024 as investors consolidated positions and sought further guidance on global economies. The dollar index rose 0.029%, with the euro down 0.03% to $1.082. On the data front in Europe, German business morale fell unexpectedly in Europe's biggest economy in December, an Ifo institute survey showed. German bond yields were on track for their third straight weekly increase as the economic data and central bank officials continued to chip away at investors' hopes for rapid rate cuts by the European Central Bank this year. Japan's stock market was closed for a public holiday on Friday, but Nikkei futures rose nearly 1%, suggesting Japanese stocks will extend their record run next week. Chinese shares wobbled between gains and losses. The Shanghai Composite index (.SSEC) , opens new tab rose above the psychologically key 3,000-point mark. It is up 4.6% for the week and has bounced about 10% from five-year lows set more than two weeks ago. Hong Kong's Hang Seng index (.HIS) , opens new tab slipped 0.1%. Data showed on Friday that China's new home prices fell for the seventh month in January, leaving sentiment fragile as policymakers' efforts to restore confidence in the debt-ridden sector struggled for traction. A Reuters poll showed that the recent rally in global stocks had a little further to go but they were divided on whether there would be a correction in the next three months. The two-year Treasury yield, which reflects interest rate expectations, fell 2.2 basis points to 4.692%, while the yield on the benchmark 10-year note was down 7.5 basis points at 4.252%. The 10-year hit a three-month high of 4.3540% overnight. U.S. crude futures settled down $2.12 to $76.49 a barrel and Brent fell $2.05 to settle at $81.62. Gold prices were set for a weekly gain, buoyed by a softer dollar. U.S. gold futures settled 0.9% higher at $2,049.40 an ounce. https://www.reuters.com/markets/global-markets-wrapup-1pix-2024-02-23/

2024-02-23 06:00

Fed governor sees 'no rush' to cut interest rates Gaza ceasefire talks underway in Paris US oil rig count up six in biggest weekly hike since November NEW YORK, Feb 23 (Reuters) - Oil prices fell nearly 3% lower on Friday and posted a weekly decline after a U.S. central bank policymaker indicated interest rate cuts could be delayed by at least two more months. Brent crude futures settled down $2.05, or 2.5%, at $81.62 a barrel, while U.S. West Texas Intermediate crude futures (WTI) were down $2.12, or 2.7%, to $76.49. For the week, Brent declined about 2% and WTI fell more than 3%. However, indications of healthy fuel demand and supply concerns could revive prices in the coming days. Federal Reserve policymakers should delay U.S. interest rate cuts by at least another couple of months, Fed Governor Christopher Waller said on Thursday, which could slow economic growth and curb oil demand. The Fed has held its policy rate steady in a 5.25% to 5.5% range since last July. Minutes of its meeting last month show most central bankers were worried about moving too quickly to ease policy. "The entire energy complex is reacting, because if inflation begins to come back it will slow demand for energy products," said Tim Snyder, economist at Matador Economics. "That is not something the market wants to digest right now, especially as it is trying to figure out a direction," he added. Some analysts, however, say demand has remained largely healthy despite the impact of high interest rates, including in the United States. JPMorgan's demand indicators are showing oil demand rising by 1.7 million barrels per day (bpd) month over month through Feb. 21, its analysts said in a note. "This compares to a 1.6 million bpd increase observed during the prior week, likely benefiting from increased travel demand in China and Europe," the analysts said. Meanwhile, Gaza truce talks were underway in Paris in what appears to be the most serious push in weeks to halt the conflict in Palestine and see Israeli and foreign hostages released. Ceasefire talks could prompt the market to anticipate an easing of geopolitical tensions, Tim Evans, an independent oil market analyst, said in a note. Still, tensions in the Red Sea continued, with attacks by Iran-backed Houthi militants near Yemen on Thursday forcing more shipping vessels to divert from the trade route. U.S. energy firms this week added the most oil rigs since November, and the most in a month since October 2022, energy services firm Baker Hughes (BKR.O) , opens new tab said. The oil rig count, an early indicator of future output, rose by six to 503 this week, and increased by four this month. https://www.reuters.com/markets/commodities/oil-falls-after-us-fed-governor-says-no-rush-cut-interest-rates-2024-02-23/

2024-02-23 05:40

NEW YORK, Feb 23 (Reuters) - The U.S. dollar index was on track for its first weekly fall in 2024 on Friday as investors took a breather from buying the currency following an almost two-month rally built on expectations that the Federal Reserve will begin cutting rates later than previously expected. Investors have pushed back expectations for the first Fed rate cut to June, from May, and dramatically reduced how far they see the U.S. central bank cutting its benchmark rate. Fed officials have projected three 25 basis point cuts this year, while markets had priced for as many as seven. "The dollar's rally this year has been predicated on the markets converging back to the Fed," said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York. Traders may also be pricing for the likelihood that economic data will begin to slow. "I think starting with the February jobs data, which is due March 8, we're going to begin seeing a series of weaker U.S. economic data," Chandler said. Personal Consumption Expenditures (PCE) due next week may also provide clues for Fed policy. New York Fed President John Williams sees the U.S. central bank on track for interest-rate cuts "later this year," despite stronger-than-expected readings on inflation and the labor market in January, according to an interview published Friday by Axios. The dollar index was little changed on the day on Friday at 103.93 and on track for a weekly loss of 0.34%. It has bounced from a five-month low of 100.61 on Dec. 28 and is holding below a three-month high of 104.97 reached on Feb. 14. The greenback has risen this year on enduring economic strength and as Fed officials caution against cutting rates too soon as they seek to bring inflation back closer to their 2% annual target. Now, however, investors are waiting on further economic indicators for fresh clues on monetary policy. "It's not the time yet to sell the dollar, but we think it will start to weaken in the second quarter, assuming that the Fed will cut in June and continue cutting rates once a quarter," said Athanasios Vamvakidis, global head of G10 forex strategy at BofA Global Research. BofA expects the euro to strengthen to 1.15 versus the greenback by the end of the year. "If the U.S. economy remains so strong, we have to change our view, as the Fed might not be able to cut in June or not even this year," Vamvakidis added. Improved risk appetite that has seen stock markets set records in several countries this week may have also reduced demand for the U.S. currency, which is seen as a safe haven. The euro was little changed on the day at $1.0822 . It has dropped from $1.11395 on Dec. 28, but is up from $1.0695 on Feb. 14. German business morale improved in February, a survey showed on Friday, though probably not enough to prevent Europe's biggest economy from slipping into another recession. ECB President Christine Lagarde on Friday called the relatively benign fourth quarter wage growth data encouraging but not yet enough to give the European Central Bank confidence that inflation has been defeated. YEN WORST PERFORMER The yen is the worst-performing G10 currency this year, with the greenback gaining 6.7% against the Japanese currency. The dollar fell 0.04% to 150.45 yen on Friday. The Japanese currency is headed for a fourth weekly drop as investors chased better yields just about everywhere else, wagering Japan's rates would stay near zero for some time. With the Fed expected to hold rates higher for longer, investors are staying in carry trades in which they sell or borrow the yen and invest in higher yielding currencies. "For the dollar/yen to weaken, we need the Fed to start cutting rates," said BofA's Vamvakidis. In cryptocurrencies, bitcoin fell 1.01% to $51,122. https://www.reuters.com/markets/currencies/yen-sinks-currency-traders-keep-short-carry-2024-02-23/