2024-02-23 05:37

A look at the day ahead in European and global markets from Ankur Banerjee Investors head to the weekend holding on to their risk-on hats as bourses across the world swell to all-time highs after AI darling Nvidia's (NVDA.O) , opens new tab blockbuster earnings revived a fiery rally in tech shares that may still rage on. They will have a sprinkle of economic data from Germany to ponder on Friday, with European bourses due for a higher open, futures indicate. Nvidia added an eye-watering $277 billion, or half a TSMC (2330.TW) , opens new tab, to its market value on Thursday, with the optimism around AI taking the Nikkei (.N225) , opens new tab, the STOXX 600 (.STOXX) , opens new tab and the S&P 500 (.SPX) , opens new tab to record peaks on the same day. Friday is turning into more of the same, with Asian stocks (.MIAPJ0000PUS) , opens new tab at more than a six-month high, led by technology shares. Japan markets are closed for a holiday. Technology shares in Europe (.SX8P) , opens new tab have been on a tear, climbing 12.5% so far this year but with technical indicators flashing warnings of overheating, we may yet see some profit taking by investors in the near term. The pan-European STOXX 600's relative strength index sits just below the 70 threshold that signals an overbought market. In the currency market, the yen hogs the spotlight, sliding to fresh lows on the euro, sterling and other crosses this week. The yen is the worst-performing G10 currency this year, with a 6.4% slide on the dollar. The dollar index , which measures the U.S. currency against six rivals, is up 2.5% as traders come to the realisation that the Fed was perhaps not bluffing when it pushed back against early and steep expectations of interest rate cuts. Goldman Sachs was the latest to push back its starting point of the Fed's easing cycle to June from May. Markets are also now pricing in June as the point at which the U.S. central bank will first cut rates. Traders have also priced in 78 basis points of cuts in the year, down from 150 bps of easing at the start of the year and closer to the Fed's own projection of 75 bps of cuts. In company news, Standard Chartered (STAN.L) , opens new tab will be in focus at the open after the Asia-focused bank announced a $1 billion share buyback and a jump in dividend, while reporting an 18% rise in 2023 pre-tax profit. Key developments that could influence markets on Friday: Economic events: Germany Q4 detailed GDP data; Germany Feb IFO data Earnings: BASF (BASFn.DE) , opens new tab https://www.reuters.com/markets/europe/global-markets-view-europe-2024-02-23/

2024-02-23 05:23

BEIJING, Feb 23 (Reuters) - Several people were injured after more than 100 cars collided into each other on an icy stretch of an expressway in the Chinese city of Suzhou, state media reported on Friday, the latest accident caused by extreme weather conditions. Dramatic footage from state television CCTV and social media showed numerous cars clumped together haphazardly on the highway with one jack-knifed at a severe angle in the air. Glass and debris could be seen scattered everywhere. Three people were injured and hospitalised, while six suffered minor scratches, Suzhou Industrial Park traffic police reported on its WeChat social media account. Road traffic has been restored and the cause of the accident is being investigated, the police said. Over the past few weeks, large parts of China have been hit by cold waves, blizzards and icy rain, impacting transport at a time millions of people are rushing home for the Lunar New Year holiday celebrations. During this week, the government raised its emergency response for freezing temperatures and also started several plans for transportation flow, supplies and electricity in provinces and cities including Beijing, Hebei, Shanxi, Anhui and Hubei, Xinhua news reported. The China Meteorological Administration maintained a heightened warning for freezing and low temperatures in several central and southern areas. According to weather warning data on VariFlight, 34 of the more than 260 airports in the country have issued fog and snow warnings, CCTV reported. https://www.reuters.com/world/china/several-injured-100-car-pile-icy-china-expressway-2024-02-23/

2024-02-23 05:09

MUMBAI, Feb 23 (Reuters) - The Indian rupee struggled to build on its upward momentum on Friday, on dollar demand from oil companies and other importers, and the Federal Reserve's wariness over cutting interest rates early. The rupee was at 82.8675 to the U.S. dollar at 10:22 a.m. IST compared with 82.84 in the previous session. The local currency on Thursday had its best day this year, thanks to inflows. Persistent comments from Fed officials about keeping the policy rate higher are likely to cap any substantial upside in the rupee, Arnob Biswas, head of foreign exchange research at SMC Securities, said. He pointed out that the first Fed cut is now likely only in June, according to Fed funds futures. A March U.S. rate cut has been fully priced out while odds of a reduction in May are less than 25%. Policymakers should delay interest rate cuts by at least another couple more months to see if a recent uptick in inflation signals stalling progress toward price stability or is just a bump in the road, Fed Governor Christopher Waller said on Thursday. The two-year U.S. Treasury yield climbed to the highest level since mid-December. Besides higher U.S. yields, the "other impediment" for the rupee to move higher from here are oil companies and the Reserve Bank of India (RBI), a FX trader at a bank said. Oil companies "always seem to come in" when USD/INR "has a decent dip" and the RBI "anyway will most likely step in", he said. https://www.reuters.com/markets/currencies/rupees-upward-momentum-runs-into-fed-dollar-buying-by-oil-companies-2024-02-23/

2024-02-23 04:01

SINGAPORE, Feb 23 (Reuters) - Goldman Sachs' analysts no longer expect a U.S. interest rate cut in May and see four 25 basis point cuts this year, as policymakers' rhetoric suggests they are in no rush. Federal Reserve Governor Christopher Waller said on Thursday he needed to see a few more months of inflation data to check the economy was on track toward price stability. "Because there are only two rounds of inflation data and a little over two months until the May (Fed) meeting, his comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely," Goldman Sachs analysts said in a note. They now forecast an extra cut next year instead, with an unchanged terminal rate forecast of 3.25-3.5%. https://www.reuters.com/markets/us/goldman-sachs-no-longer-expects-us-interest-rate-cut-may-2024-02-23/

2024-02-23 04:01

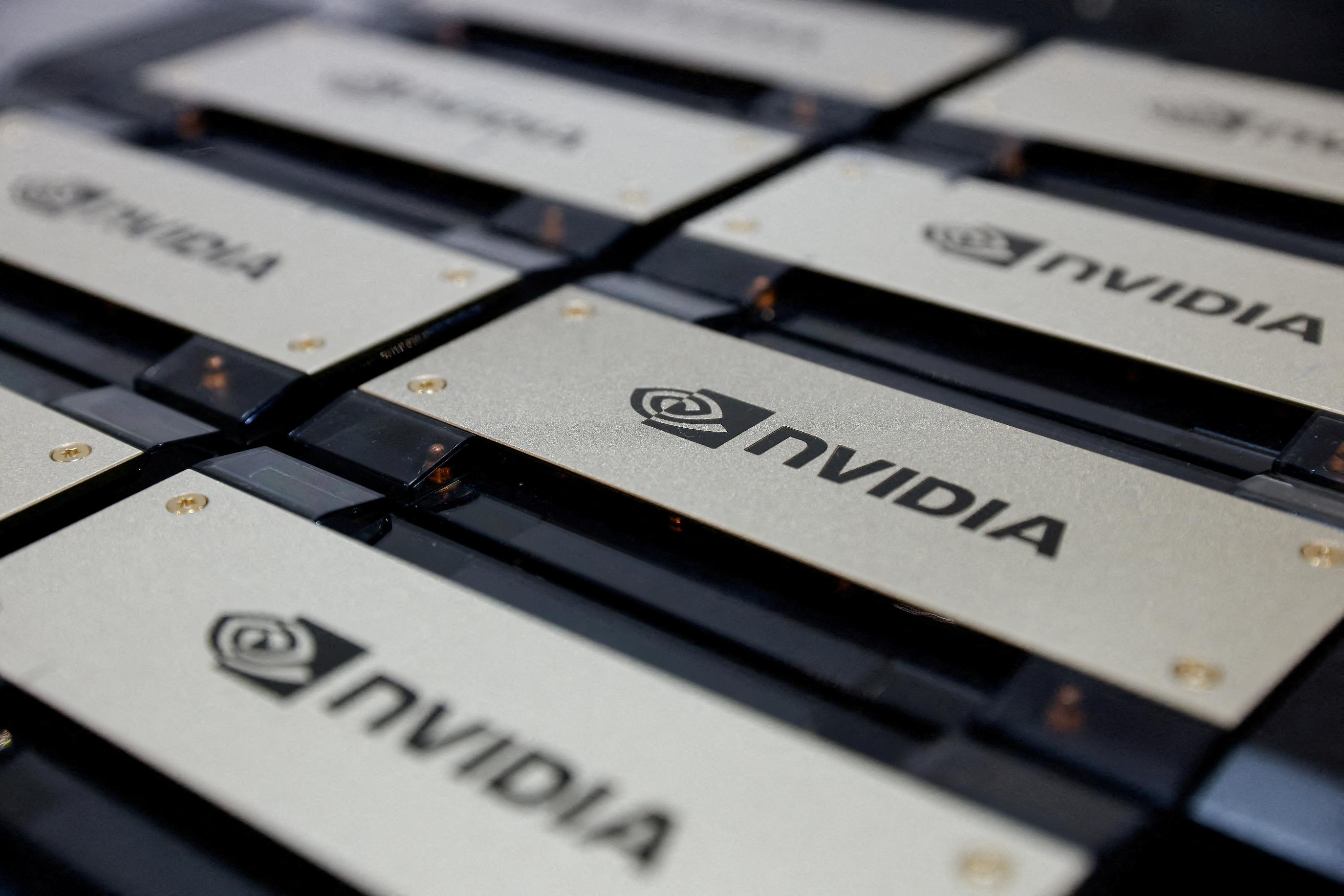

Nvidia jumps as revenue forecast tops estimates, lifts AI peers Nvidia's market cap gains $277 bln in one day - a record Rivian and Lucid fall as 2024 production targets disappoint S&P 500, Dow Jones close at record highs Indexes up: Dow 1.18%, S&P 2.11%, Nasdaq 2.96% Feb 22 (Reuters) - The S&P 500 and Dow Jones Industrial Average both surged to record closing highs on Thursday, powered by investors piling into growth and technology stocks the day after artificial intelligence poster child Nvidia's bumper earnings and outlook. For the S&P 500 (.SPX) , opens new tab benchmark, it was also the largest daily gain in 13 months. The Nasdaq Composite notched its biggest single-session advance in a year and just missed a record finish. Investors eagerly bought stocks as Nvidia shares jumped 16.4% after the chip designer forecast a roughly three-fold surge in first-quarter revenue on strong demand for its AI chips and beat expectations for fourth-quarter revenue. The company's earnings were a major test for the AI-fueled rally on Wall Street that first pushed the S&P 500 (.SPX) , opens new tab above the 5,000 point mark earlier this month. Some analysts had cautioned that disappointing results could spark a steep selloff among technology stocks. Instead, the S&P 500 (.SPX) , opens new tab ended at a record high, gaining 105.23 points, or 2.11%, to 5,087.03, as did the Dow Jones Industrials (.DJI) , opens new tab, which closed at 39,069.11 after rising 456.87 points, or 1.18%. It was the first time the Dow has ever finished above 39,000 points. The Nasdaq Composite (.IXIC) , opens new tab added 460.75 points, or 2.96%, to 16,041.62. "As Nvidia goes, so goes the world," joked Jack Janasiewicz, lead portfolio strategist at Natixis Investment Managers Solutions. He noted how Nvidia's earnings performance trounced high market expectations, showing doubters that plenty of juice was left in the AI trade after the recent rally. "When do you sell - maybe you don't. Maybe there's still room, and I'm happy to sit and ride it out," Janasiewicz added. Nvidia added $277 billion to its market capitalization, beating Meta Platform's $196 billion surge earlier this month as the biggest one-day gain by any company in Wall Street history. Those shorting Nvidia stock were left nursing more than $2.9 billion of paper losses, per data from Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners. The benchmark index will finish this year above the 5,000 mark, according to strategists in a Reuters poll. All but one of the 11 major S&P 500 sectors rose, with technology stocks (.SPLRCT) , opens new tab leading gains with a 4.4% increase. The outlier was utilities (.SPLRCU) , opens new tab, which slipped 0.8% The S&P 500 growth index (.IGX) , opens new tab advanced 3.3%, its biggest daily percentage gain since November 2022. Shares of other companies, seen as beneficiaries of the AI boost, also got a shot in the arm. Nvidia's rival Advanced Micro Devices (AMD.O) , opens new tab, server component supplier Super Micro Computer (SMCI.O) , opens new tab and Arm Holdings jumped between 4.2% and 32.9%. Synopsys (SNPS.O) , opens new tab soared 6.9%, to a record finish, after the software maker for chip designers reported estimate-beating earnings and outlook. Also posting a record close was the Philadelphia Semiconductor index (.SOX) , opens new tab, with its 5% increase its largest one-day gain since October. Big Tech and growth stocks such as Alphabet (GOOGL.O) , opens new tab, Microsoft (MSFT.O) , opens new tab and Meta Platforms (META.O) , opens new tab climbed between 1.1% and 3.9%. Elsewhere, vaccine maker Moderna (MRNA.O) , opens new tab jumped 13.5% after surprising investors with a fourth-quarter profit. The stock's technicals also pointed to a bullish outlook. However, Rivian (RIVN.O) , opens new tab and Lucid (LCID.O) , opens new tab tumbled 25.6% and 16.8%, respectively, after the electric vehicle startups forecast 2024 production well below analyst estimates on slowdown in demand. The volume on U.S. exchanges was 11.93 billion shares, compared with the 11.64 billion average over the last 20 trading days. https://www.reuters.com/markets/us/nasdaq-futures-jump-nearly-2-after-nvidia-trounces-expectations-2024-02-22/

2024-02-23 02:55

MUMBAI, Feb 23 (Reuters) - The Indian rupee will attempt to move past an important level on the back of dollar inflows on Friday, while investors keep an eye out for possible intervention by the central bank. Non-deliverable forwards indicate the rupee will open barely changed to the U.S. dollar from 82.84 in the previous session. There are "plentiful inflows", largely on the capital side and to an extent on the portfolio front, a FX trader said. "What matters now is whether you see a drop (on USD/INR) below 82.75-82.80 and we have a new lower range," he said. "Like it has been for several months, all depends on what RBI (Reserve Bank of India) wants." The RBI on Thursday did not intervene to buy dollars late in the session, like it had in the previous two days, helping rupee to its best level since September on a closing basis. To strengthen past 82.75-82.80, the rupee will have to contend with a rise in near-maturity U.S. Treasury yields and a further easing in odds of an imminent Federal Reserve rate cut. The rally in U.S. equities and data that indicated that the labor market continues to hold up well pushed U.S. yields higher. The number of Americans filing new claims for unemployment benefits unexpectedly fell last week. "If claims surprise in the next couple of weeks, they could reverse the expectations for February’s U.S. nonfarm payrolls to fall below 200,000 a fortnight from today," DBS Research said in a note. Further underscoring the view that the Fed can afford to be patient on rate cuts, U.S. existing home sales rose the highest level since last August. The 2-year U.S. bond yield rose to the highest since mid-December. It is now up 60 basis points from the year-to-date low. KEY INDICATORS: ** One-month non-deliverable rupee forward at 82.92; onshore one-month forward premium at 7.50 paisa ** Dollar index inches down to 103.88 ** Brent crude futures at $83.36 ** Ten-year U.S. note yield at 4.33% ** As per NSDL data, foreign investors bought $47.5 million of Indian shares on Feb. 21 ** NSDL data shows foreign investors sold $59.9 million of Indian bonds on Feb. 21 https://www.reuters.com/markets/currencies/rupee-boosted-by-inflows-takes-aim-key-resistance-2024-02-23/