2024-02-22 05:32

A look at the day ahead in European and global markets from Kevin Buckland If Nvidia's (NVDA.O) , opens new tab eye-popping revenue forecasts were meant to keep the AI fervour pumping money into already-heated tech shares, it was hard to see it anywhere but in Japan on Thursday. The Nikkei (.N225) , opens new tab overcame some early nerves to finally surge as much as 2% to a record high above 39,000, putting it in blue sky territory after a 34-year gap from its previous "bubble" era peak. But Chinese stocks struggled (.HSI) , opens new tab, (.CSI300) , opens new tab, with some exhaustion likely setting in after a seven-day winning stretch inspired by Beijing's stimulus measures. A subindex of Hang Seng tech shares (.HSTECH) , opens new tab has notably spent the day so far in the red. Chinese hedge funds have been scrambling to soothe investor nerves after the slump in shares to five-year lows at the start of the month. Nvidia's impact on the Wall Street reopen isn't in question though, with Nasdaq futures pointing 1.5% higher, after a lacklustre day of trading on Wednesday. European traders also have a fairly lengthy list of macro indicators to look forward to, with PMIs from Germany, France and the euro zone as a whole, as well as from Britain. The euro area also has final readings for consumer inflation in January. The euro and sterling have outperformed the dollar and yen over the past week, with traders betting the ECB and Bank of England will be later than the Fed in cutting rates, while the Bank of Japan moves with extreme caution on rate hikes. The 10-year Treasury yield remains elevated at above 4.3%, but below the 4.4% level that some analysts flag as the threshold for a flare-up in equity market jitters. A smaller pool of earnings today, but Nestle's (NESN.S) , opens new tab could shed light on how tight consumers' purse strings are. In Britain, Lloyds (LLOY.L) , opens new tab and Anglo American (AAL.L) , opens new tab are due to report. Key developments that could influence markets on Thursday: -Flash PMIs for Germany, France, euro zone and UK (all Feb) -Final HICP for euro zone (Jan) -Earnings from Nestle, Lloyds, Anglo American -US initial jobless claims, flash PMIs (Feb), existing home sales (Jan) https://www.reuters.com/world/europe/global-markets-view-europe-2024-02-22/

2024-02-22 04:55

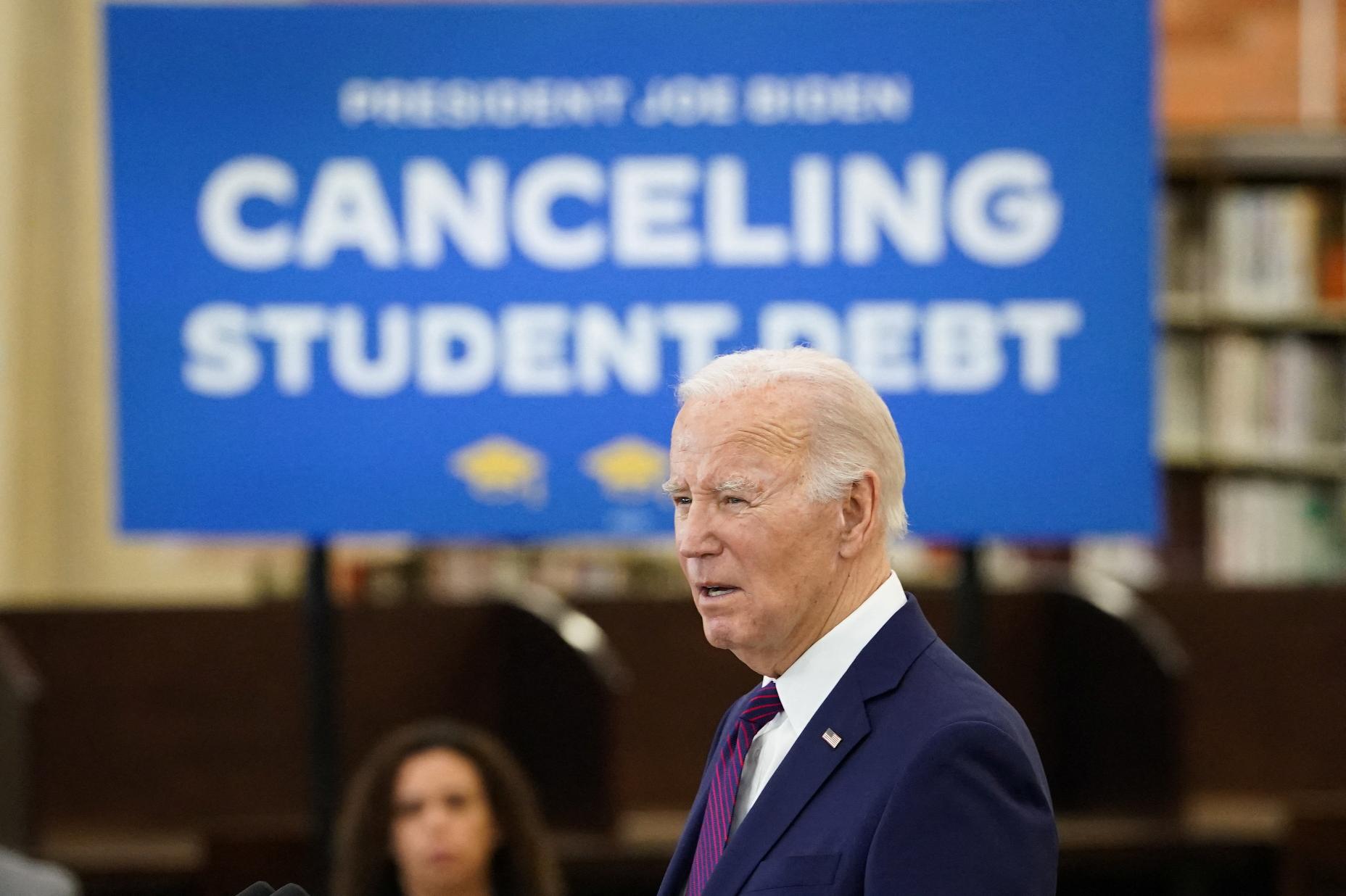

CULVER CITY, California/WASHINGTON, Feb 21 (Reuters) - President Joe Biden said on Wednesday his administration is cancelling $1.2 billion worth of student loans for nearly 153,000 people who are eligible under a program used to make good on his promises to increase loan forgiveness. Biden, a Democrat, last year pledged to find other avenues for tackling debt relief after the Supreme Court in June blocked his broader plan to cancel $430 billion in student loan debt. Left-leaning progressive and young voters, whose support Biden needs to win re-election in November, have been vocal in advocating for student loan forgiveness on a wide scale. Republicans largely oppose such actions. "While a college degree is a ticket to a better life, that ticket is too expensive," Biden said during a trip to California that has been focused primarily on fundraising for his re-election campaign. Biden said the latest round of debt relief would be "a huge help to graduates of community college and borrowers with smaller loans, putting them back on track faster for debt forgiveness than ever before." The administration has now canceled some $138 billion in student debt for nearly 3.9 million people through executive actions, the White House said. The latest announcement applies to people enrolled in a repayment program known as Saving on a Valuable Education (SAVE) and covers those who borrowed $12,000 or less who have been repaying the money for at least 10 years. The SAVE plan, according to the White House, takes into account a debt holder's income and family size when setting monthly payments and makes sure balances cannot grow from unpaid interest if the borrowers are making regular payments. Recipients of the relief will receive an e-mail from Biden. "I hope this relief gives you a little more breathing room," Biden writes in the note, provided by the White House. "I've heard from countless people who have told me that relieving the burden of their student loan debt will allow them to support themselves and their families, buy their first home, start a small business, and move forward with life plans they've put on hold." https://www.reuters.com/world/us/biden-administration-cancel-another-12-bln-student-loans-2024-02-21/

2024-02-22 04:19

TOKYO, Feb 22 (Reuters) - The Bank of Japan will pull the plug on its eight-year negative interest rate policy in April, according to more than 80% of economists polled by Reuters, marking a long-awaited major shift from a global outlier central bank. Nearly the same proportion of economists, 76%, also expect the BOJ to scrap yield curve control at that meeting, with almost all saying ultra-loose monetary conditions will end then, just months before many major central banks are expected to start cutting rates. The BOJ is on track to end negative interest rates in coming months despite Japan's economy slipping into a recession, sources have previously told Reuters. In the Feb. 15-20 Reuters poll, 25 of 30 economists, or 83%, said the central bank will in April ditch its minus 0.1% short-term deposit rate, which has been in place since January 2016. "(The BOJ) can make a decision at April's meeting based on the preliminary results of the annual labour-management wage talks for big firms and the hearings from BOJ branch managers on wage trends in small and mid-sized firms," said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities. Two entities, Daiwa Securities and T&D Asset Management, chose March. Another said June and two others selected 2025 or later. "The longer (BOJ) waits, the more likely it is to miss the right moment as the uncertainty of foreign factors increase," said Mari Iwashita, Daiwa Securities' chief market economist, referring to an impending policy shift by the BOJ's peers. Nearly every economist, 91% providing end-quarter rate forecasts, expects negative rate policy to be abandoned by end-year, up from 82% in January's poll. BOJ Governor Kazuo Ueda, however, has repeatedly stressed Japan's monetary conditions will likely remain accommodative even after the central bank scraps negative rates. YCC ON ITS LAST LEG, EYES ON WAGE TALKS The poll also showed 25 of 29 economists - or 86% - expecting BOJ to end YCC, far surpassing four who said it would be modified. That was roughly in line with January's poll. Of those 25 economists, 19 expected the central bank to dismantle YCC in April. All but one of the 19 respondents said an end to negative rates would happen simultaneously. Almost every economist, 97% of those polled, predicted average wage growth and base salary increases in the next fiscal year starting in April would exceed this year's 3.58% at big Japanese firms, up from 90% when asked in January. For Japanese firms, including small and mid-sized firms, the poll increase was sharper, with 90% of economists anticipating a bigger increase, up from 77% in January and 65% in November. The range of pay increases will fall between 3.6% and 4.36% in mid-March for big companies and between 1.5% and about 4.0% for overall businesses, economists said. (For other stories from the Reuters global economic poll:) https://www.reuters.com/markets/asia/boj-scrap-negative-interest-rates-april-say-over-80-economists-2024-02-22/

2024-02-22 04:10

SAN FRANCISCO, Feb 21 (Reuters) - Social media platform Reddit has struck a deal with Google (GOOGL.O) , opens new tab to make its content available for training the search engine giant's artificial intelligence models, three people familiar with the matter said. The contract with Alphabet-owned Google is worth about $60 million per year, according to one of the sources. The deal underscores how Reddit, which is preparing for a high-profile stock market launch, is seeking to generate new revenue amid fierce competition for advertising dollars from the likes of TikTok and Meta Platform's (META.O) , opens new tab Facebook. The sources were not authorized to speak to media and declined to be identified. Reddit and Google declined to comment. Bloomberg previously reported Reddit's content deal without naming the buyer. Last year, Reddit said it would charge companies for access to its application programming interface (API) - the means by which it distributes its content. The agreement with Google is its first reported deal with a big AI company. San Francisco-based Reddit, which has been looking at a stock float for more than three years, is preparing to make its initial public offering filing this week, which would detail its financials for the first time to potential IPO investors. The filing could be available as early as Thursday, two of the sources said. The company, which was valued at about $10 billion in a funding round in 2021, is seeking to sell about 10% of its shares in the offering, Reuters has previously reported. Reddit's stock market launch would mark the first IPO of a major social media company since Pinterest floated its shares in 2019. Makers of AI models have been busy clinching deals with content owners in recent months, aiming to diversify their training data beyond large scrapes of the internet. That practice is rife with potential copyright issues as many content creators have alleged that their content was used without permission. Founded in 2005 by web developer Steve Huffman and entrepreneur Alexis Ohanian, Reddit is known for its manifold niche discussion groups, some of which boast tens of millions of members. https://www.reuters.com/technology/reddit-ai-content-licensing-deal-with-google-sources-say-2024-02-22/

2024-02-22 01:47

NEW YORK, Feb 22 (Reuters) - The dollar index dipped on Thursday but came off of a three-week low as investors waited on new data catalysts for clues on when the U.S. Federal Reserve is likely to begin cutting interest rates. The greenback has bounced this year as strong growth and sticky inflation lead traders to push back expectations on when the U.S. central bank will begin easing. But after hitting a three-month high last week, the U.S. currency has been largely consolidating. The dollar is likely to benefit from divergences with other countries as the U.S. economy looks relatively stronger, said Noel Dixon, senior macro strategist at State Street Global Markets in Boston. However, after the recent strength “there’s clearly some fatigue with some of the dollar bulls,” he said. “For the dollar to break out one way or another we would need to see more data.” The dollar index was last down 0.03% at 103.95. It fell to 103.43 earlier on Thursday, the lowest since Feb. 2, and is holding below the 104.97 level reached on Feb. 14, which was the highest since Nov. 14. Personal Consumption Expenditures (PCE) due next week may be the next major release to provide clues for Fed policy. Minutes from the Fed’s January meeting released on Wednesday showed that the bulk of policymakers were concerned about the risks of cutting interest rates too soon as they seek to bring inflation closer to the 2% annual target. Fed Vice Chair Philip Jefferson said on Thursday he will be looking across a broad set of economic indicators to convince him it is time to cut interest rates, rather than focusing on a single metric. U.S. data on Thursday showed that jobless claims unexpectedly fell last week, while U.S. business activity cooled in February, with a measure of prices paid for inputs falling to the lowest level in nearly 3-1/2 years. Existing home sales also increased 3.1% in January to a seasonally adjusted annual rate of 4.00 million units, the highest level since last August. The U.S. dollar may also be supported by weakness in other regions, including Canada and Australia, which could lead their central banks to cut rates before the Fed, said Dixon. Data on Tuesday showed that Canada’s annual inflation rate slowed significantly more than expected in January. Australian unemployment was also surprisingly weak in January, while the jobless rate climbed to a two-year high, data showed last week. The euro edged up 0.03% to $1.0820 and earlier reached $1.0889, the highest since Feb. 2. The downturn in euro zone business activity eased in February, suggesting signs of recovery, according to a survey on Thursday. Sterling gained 0.17% to $1.2656 after data from a British business activity survey came in stronger than expected and showed robust growth for services firms. The pound earlier reached $1.2710, also the highest since Feb. 2. The greenback rose 0.17% to 150.53 yen . It is holding just below a three-month high of 150.88 reached against the Japanese currency on Feb. 13. Traders will be watching for any signs of intervention by the Bank of Japan and Ministry of Finance if the yen continues to weaken. Japanese Finance Minister Shunichi Suzuki said on Thursday that the government had "no defence line" for foreign exchange rates, but it was necessary to monitor volatility in the market as the yen has weakened against the dollar in recent days. In cryptocurrencies, bitcoin increased 0.13% to $51,467. https://www.reuters.com/markets/currencies/dollar-rangebound-an-array-pmi-data-awaited-2024-02-22/

2024-02-22 00:09

LONDON, Feb 22 (Reuters) - Britain is set to miss its decarbonisation targets for 2030 and its goal of reducing greenhouse gas emissions to net zero by the middle of the century, Norwegian risk manager DNV said. Under the Paris Agreement, Britain has committed to reduce emissions by 68% by 2030 compared with 1990 levels, but a DNV report forecast the reduction to be 55% by then. "Without immediate action the UK will fail to deliver on its climate commitments, fall behind in the global race to decarbonize," said Hari Vamadevan, executive vice president and regional director, UK & Ireland, energy systems at DNV. In addition to the Paris global climate pact, Britain has its own legally binding target of bringing all emissions to net zero by 2050 from 1990 levels. However, the country's annual emissions are expected to be 125 million metric tons of carbon dioxide equivalent in 2050, equivalent to an 85% cut from 1990 levels, not the 100% reduction the government is aiming for, DNV's report said. DNV said transport and buildings are two sectors which will be the largest contributors to total annual emissions in 2050. Last year, the British government pushed back a ban on new petrol and diesel cars and vans to 2035 from 2030. DNV said a large proportion of vehicles, particularly commercial ones, will continue to be fossil-fuelled and aviation will continue to be a large emitter due to the slow roll-out of low carbon fuels. Around 80% of Britain's primary energy supply comes from fossil fuels, with 13% from renewables and 7% from nuclear. Heavy reliance on fossil fuels looks set to continue, only reducing to 71% by 2031 under current policies, and a third of all primary energy supply still coming from fossil fuels by mid century, the DNV report forecast. With the right incentives, decarbonisation can be accelerated by swifter deployment of technologies such as wind, solar PV, smart grids and electric vehicles, along with carbon capture and storage and hydrogen, it added. The government aims for 10 gigawatts (GW) of low-carbon hydrogen production by 2030, which can help to decarbonise industrial sectors but also potentially ultimately replace some gas in Britain's domestic and commercial heating systems. However, hydrogen production will reach 1 million tons a year, only 60% of which will be low-carbon, equivalent to roughly 5 GW of capacity, DNV said. https://www.reuters.com/world/uk/uk-set-miss-near-long-term-emissions-targets-dnv-predicts-2024-02-22/